Deck 6: Internal Control, Cash, and Merchandise Sales

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/144

Play

Full screen (f)

Deck 6: Internal Control, Cash, and Merchandise Sales

1

Sales discounts,sales returns & allowances,and cost of goods sold are all temporary accounts which are closed to retained earnings at the end of the accounting period.

True

2

Most companies report their sales revenue and contra-revenue accounts,as well as net sales,on their externally reported income statements.

False

3

Inventory shrinkage is the difference between inventory recorded and inventory counted.

True

4

A good voucher system includes procedures and approvals designed to control cash payments.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

5

Cash equivalents are short-term,highly liquid investments purchased within one year of maturity.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

6

A highly effective internal control should not be implemented if the cost is greater than the benefit.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

7

In a perpetual inventory system,only one journal entry is required to record the sale of merchandise.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

8

Internal controls include the policies and procedures a company implements to protect against theft of assets,to promote efficiency,and to ensure compliance with laws and regulations.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

9

Gross profit is not a ledger account name.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

10

Sales discounts are discounts that consumers get from buying clearance items at a reduced price.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

11

On a bank statement,deposits are listed as debits and cleared checks are listed as credits.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

12

The sales returns and allowances account balance should be reported as a deduction from the sales account balance because it is an expense account.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

13

A retailer is a company that buys products from manufacturers and sells them to wholesalers.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

14

A company is either a service company,a merchandising company,or a manufacturer,but cannot be more than one of these.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

15

FOB shipping point means that ownership of goods passes to the buyer when the goods reach the buyer.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

16

A merchandising company's operating cycle begins with the sale of merchandise and ends with the cash collection from sales.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

17

If a merchandiser offers a sales discount of 2/10,net/30 on a sale of $1,000,the amount due in 30 days is the net amount of $980.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

18

The gross profit percentage is computed by dividing operating income by net sales.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

19

A physical count of inventory is performed annually in both a perpetual inventory system and a periodic inventory system.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

20

The use of internal controls guarantees protection against losses due to fraud,errors,and inefficiencies.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

21

Segregation of duties means that a company assigns responsibilities so that:

A)sufficient workers are available to cover all necessary jobs.

B)responsibilities for related activities are assigned to two or more people.

C)employees are restricted to jobs for which they have adequate training.

D)workers are divided into those who do the same tasks but on different days.

A)sufficient workers are available to cover all necessary jobs.

B)responsibilities for related activities are assigned to two or more people.

C)employees are restricted to jobs for which they have adequate training.

D)workers are divided into those who do the same tasks but on different days.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

22

Intel makes microchips from raw materials acquired from suppliers.Intel is a:

A)service company.

B)retail company.

C)manufacturer.

D)merchandising company.

A)service company.

B)retail company.

C)manufacturer.

D)merchandising company.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

23

When a customer returns for credit a defective product it had purchased,the seller would record the transaction using which of the following accounts?

A)Purchase Returns and Allowances

B)Sales Returns and Allowances

C)Sales

D)Sales Discounts

A)Purchase Returns and Allowances

B)Sales Returns and Allowances

C)Sales

D)Sales Discounts

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of the following statements regarding sales discounts is true?

A)If a company offers a discount to encourage prompt payment and the discount is taken,the discount reduces the amount of Net Sales.

B)Credit terms of "2/10,n/30" mean that if payment is made in two days,a 10% discount may be taken;if not paid within two days,the full invoice price will be due in thirty days.

C)The terms "sales discounts" and "sales credits" are used interchangeably by a company.

D)Sales discounts is an expense account.

A)If a company offers a discount to encourage prompt payment and the discount is taken,the discount reduces the amount of Net Sales.

B)Credit terms of "2/10,n/30" mean that if payment is made in two days,a 10% discount may be taken;if not paid within two days,the full invoice price will be due in thirty days.

C)The terms "sales discounts" and "sales credits" are used interchangeably by a company.

D)Sales discounts is an expense account.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements regarding journal entries under a perpetual inventory system is true?

A)"Freight-out" or delivery costs associated with sales should be included in the cost of goods sold amount.

B)When a company receives payment from a customer for a sale,cash is debited and accounts payable is credited.

C)When a company grants an allowance to a customer,inventory is credited when using a perpetual inventory system.

D)When a customer returns inventory,the seller debits sales returns and allowances under a perpetual inventory system.

A)"Freight-out" or delivery costs associated with sales should be included in the cost of goods sold amount.

B)When a company receives payment from a customer for a sale,cash is debited and accounts payable is credited.

C)When a company grants an allowance to a customer,inventory is credited when using a perpetual inventory system.

D)When a customer returns inventory,the seller debits sales returns and allowances under a perpetual inventory system.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

26

BetterBuy purchases computers from companies like Hewlett Packard and IBM and sells them to consumers.BetterBuy is a:

A)merchandising company at the retail level.

B)service company.

C)merchandising company at the wholesale level.

D)manufacturer.

A)merchandising company at the retail level.

B)service company.

C)merchandising company at the wholesale level.

D)manufacturer.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements regarding inventory counts is not true?

A)Companies need to perform a physical count of their inventory at least yearly regardless of which inventory system is being used.

B)A perpetual inventory system does not require a physical count during the accounting period to determine cost of goods sold.

C)In a perpetual inventory system,the inventory count is compared to the inventory account balance to reveal shrinkage.

D)If a company uses a perpetual inventory system and the inventory count at the end of the accounting period is greater than the balance in the inventory ledger account,there must have been shrinkage.

A)Companies need to perform a physical count of their inventory at least yearly regardless of which inventory system is being used.

B)A perpetual inventory system does not require a physical count during the accounting period to determine cost of goods sold.

C)In a perpetual inventory system,the inventory count is compared to the inventory account balance to reveal shrinkage.

D)If a company uses a perpetual inventory system and the inventory count at the end of the accounting period is greater than the balance in the inventory ledger account,there must have been shrinkage.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements regarding sales returns and allowances is true?

A)Recording sales returns and allowances in a separate account is an important internal control that allows management to evaluate the volume of returns and allowances as a potential indicator of the quality of their products.

B)The Sales Returns and Allowances account balance should be added to the Sales account balance when computing net sales.

C)Sales Returns and Allowances account is an example of a contra-asset account.

D)Recording a sales allowance requires two entries.

A)Recording sales returns and allowances in a separate account is an important internal control that allows management to evaluate the volume of returns and allowances as a potential indicator of the quality of their products.

B)The Sales Returns and Allowances account balance should be added to the Sales account balance when computing net sales.

C)Sales Returns and Allowances account is an example of a contra-asset account.

D)Recording a sales allowance requires two entries.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not a reason why it is especially important for companies to have internal controls over cash?

A)Most businesses have a large amount of cash on hand.

B)There are a lot of transactions that affect cash.

C)Cash is portable.

D)Most theft of assets involve cash.

A)Most businesses have a large amount of cash on hand.

B)There are a lot of transactions that affect cash.

C)Cash is portable.

D)Most theft of assets involve cash.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements regarding gross profit percentage is not true?

A)It is possible for a company to increase both its gross profit percentage and net income without increasing the dollar amount of sales.

B)A rising gross profit percentage indicates management's inability to control production and inventory costs.

C)The gross profit percentage can be used to determine if a company is making enough on each sale to cover its operating expenses.

D)Gross profit percentages vary across industries.

A)It is possible for a company to increase both its gross profit percentage and net income without increasing the dollar amount of sales.

B)A rising gross profit percentage indicates management's inability to control production and inventory costs.

C)The gross profit percentage can be used to determine if a company is making enough on each sale to cover its operating expenses.

D)Gross profit percentages vary across industries.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not stated as a primary objective of a company's internal control policies and procedures?

A)The proper recording and authorization of transactions.

B)The maintenance of adequate records.

C)The prevention or detection of unauthorized activities involving a company's records.

D)The provision of current information for outside investors and analysts.

A)The proper recording and authorization of transactions.

B)The maintenance of adequate records.

C)The prevention or detection of unauthorized activities involving a company's records.

D)The provision of current information for outside investors and analysts.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

32

The internal control principle related to separating employees' duties so that the work of one person can be used to check the work of another person is called:

A)duplication of responsibility.

B)mandatory vacations.

C)segregation of duties.

D)rotation of duties.

A)duplication of responsibility.

B)mandatory vacations.

C)segregation of duties.

D)rotation of duties.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

33

The main purposes of internal controls do not include:

A)prevention of error,theft,and fraud.

B)promotion of operational efficiency.

C)ensuring compliance with laws and regulations.

D)providing more favorable financial information.

A)prevention of error,theft,and fraud.

B)promotion of operational efficiency.

C)ensuring compliance with laws and regulations.

D)providing more favorable financial information.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

34

Internal controls are concerned with:

A)only manual systems of accounting.

B)the extent of government regulations.

C)protecting against theft of assets and enhancing the reliability of accounting information.

D)preparing income tax returns.

A)only manual systems of accounting.

B)the extent of government regulations.

C)protecting against theft of assets and enhancing the reliability of accounting information.

D)preparing income tax returns.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is an activity common to the operations of merchandising,manufacturing,and service companies?

A)Producing the product.

B)Incurring operating expenses.

C)Buying goods or raw materials.

D)Selling a physical product.

A)Producing the product.

B)Incurring operating expenses.

C)Buying goods or raw materials.

D)Selling a physical product.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

36

A store holding a "25% off" sale will probably experience ______________ gross profit than usual and _______________ sales volume.

A)higher;higher

B)lower;lower

C)higher;lower

D)lower;higher

A)higher;higher

B)lower;lower

C)higher;lower

D)lower;higher

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements regarding the recording of merchandising journal entries in a perpetual inventory system is true?

A)When a customer pays within the discount period,accounts receivable is credited for the full amount.

B)If a customer pays within the discount period,sales discounts is credited.

C)A sales return is recorded with entries that include a credit to sales returns and allowances.

D)Sales of merchandise are recorded by entries that include a credit to cost of goods sold.

A)When a customer pays within the discount period,accounts receivable is credited for the full amount.

B)If a customer pays within the discount period,sales discounts is credited.

C)A sales return is recorded with entries that include a credit to sales returns and allowances.

D)Sales of merchandise are recorded by entries that include a credit to cost of goods sold.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the statements appearing below is true regarding bank reconciliations?

A)A bank reconciliation is an external report prepared to report the cash balance to investors and creditors.

B)After preparing a bank reconciliation,no adjusting journal entries need to be made for outstanding checks or deposits in transit.

C)If a company's records show a different cash balance from that shown on the company's bank statement,either the company or the bank has made an error.

D)The up-to-date ending cash balance on the bank statement side should not equal the up-to-date ending cash balance on the book side.

A)A bank reconciliation is an external report prepared to report the cash balance to investors and creditors.

B)After preparing a bank reconciliation,no adjusting journal entries need to be made for outstanding checks or deposits in transit.

C)If a company's records show a different cash balance from that shown on the company's bank statement,either the company or the bank has made an error.

D)The up-to-date ending cash balance on the bank statement side should not equal the up-to-date ending cash balance on the book side.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements regarding shrinkage is not true?

A)Perpetual inventory systems can help managers detect shrinkage.

B)Shrinkage is another term for inventory loss due to theft,error,or fraud.

C)Shrinkage is detected by comparing the balance in the inventory ledger account and the results of the physical inventory count.

D)It is easier to detect shrinkage in a periodic inventory system than in a perpetual inventory system.

A)Perpetual inventory systems can help managers detect shrinkage.

B)Shrinkage is another term for inventory loss due to theft,error,or fraud.

C)Shrinkage is detected by comparing the balance in the inventory ledger account and the results of the physical inventory count.

D)It is easier to detect shrinkage in a periodic inventory system than in a perpetual inventory system.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding gross profit is true?

A)Gross profit is net sales minus cost of goods sold.

B)A company sells $10,000 of goods.If the gross profit percentage is 32%,net income would be $3,200.

C)Gross profit is recorded by a credit to the gross profit account.

D)If net sales are $100 and cost of goods sold is $50 then the gross profit percentage is 100%.

A)Gross profit is net sales minus cost of goods sold.

B)A company sells $10,000 of goods.If the gross profit percentage is 32%,net income would be $3,200.

C)Gross profit is recorded by a credit to the gross profit account.

D)If net sales are $100 and cost of goods sold is $50 then the gross profit percentage is 100%.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

41

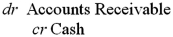

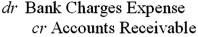

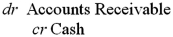

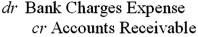

Notification by the bank that a customer's deposited check was returned NSF requires that the company make the following adjusting journal entry:

A)

B)

C)

D)No adjusting entry is necessary.

A)

B)

C)

D)No adjusting entry is necessary.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

42

Use of a cash register or point of sale terminal addresses all of the following internal control principles,except which one?

A)Restrict access.

B)Document transactions.

C)Independently verify.

D)Segregate duties.

A)Restrict access.

B)Document transactions.

C)Independently verify.

D)Segregate duties.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

43

The receipt of cash is one of the operating activities of:

A)companies that sell goods but not companies that sell services.

B)companies that sell to consumers but do not sell to other companies.

C)merchandising,manufacturing,and service companies.

D)companies that sell goods they bought from others but not of companies that make the goods they sell.

A)companies that sell goods but not companies that sell services.

B)companies that sell to consumers but do not sell to other companies.

C)merchandising,manufacturing,and service companies.

D)companies that sell goods they bought from others but not of companies that make the goods they sell.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

44

When preparing this month's bank reconciliation,you find that you failed to record a $95 deposit for a payment you received from a customer.You immediately prepare a journal entry to record the deposit.Which of the following describes the actions to be taken when preparing next month's bank reconciliation?

A)You must decrease the balance per bank by $95.

B)You must increase the balance per bank by $95.

C)You must increase the balance per books by $95.

D)No further action is necessary.

A)You must decrease the balance per bank by $95.

B)You must increase the balance per bank by $95.

C)You must increase the balance per books by $95.

D)No further action is necessary.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following items on a bank reconciliation would require an adjusting journal entry on the company's books?

A)An error by the bank.

B)Outstanding checks.

C)A bank service charge.

D)A deposit in transit.

A)An error by the bank.

B)Outstanding checks.

C)A bank service charge.

D)A deposit in transit.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

46

All of the following bank reconciliation items would result in an adjusting journal entry on the company's books except:

A)interest earned.

B)deposits in transit.

C)service charge.

D)a customer's check returned NSF.

A)interest earned.

B)deposits in transit.

C)service charge.

D)a customer's check returned NSF.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

47

On October 31,2013,your company's records say that the company has $16,451.03 in its checking account.A review of the bank statement shows you have three outstanding checks totaling $5,643.01,and the bank has paid you interest of $12.19 and charged you $9.00 in fees.The bank statement dated October 31,2013 would report a balance of:

A)$22,090.85.

B)$16,454.22.

C)$22,097.23.

D)$10,804.83.

A)$22,090.85.

B)$16,454.22.

C)$22,097.23.

D)$10,804.83.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

48

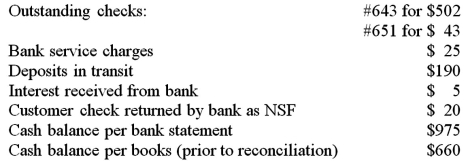

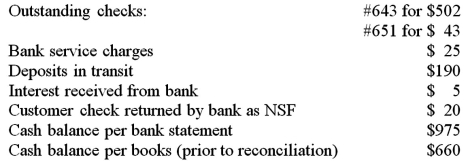

The following information was available to the accountant of Horton Company when preparing the monthly bank reconciliation:  The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:

The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:

A)$660.

B)$640.

C)$620.

D)$305.

The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:

The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:A)$660.

B)$640.

C)$620.

D)$305.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

49

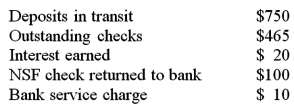

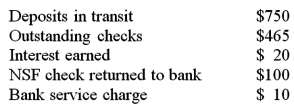

Before reconciling to its bank statement,Lauren Cosmetics Corporation's general ledger had a month-end balance in the cash account of $5,250.The bank reconciliation for the month contained the following items:  Given the above information,what adjusted cash balance should Lauren report at month-end?

Given the above information,what adjusted cash balance should Lauren report at month-end?

A)$4,500.

B)$4,820.

C)$5,160.

D)$5,590.

Given the above information,what adjusted cash balance should Lauren report at month-end?

Given the above information,what adjusted cash balance should Lauren report at month-end?A)$4,500.

B)$4,820.

C)$5,160.

D)$5,590.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is an activity in the operations of a manufacturer,but not in the operations of a merchandising or service company?

A)Selling the good to consumers.

B)Receiving cash.

C)Selling the good to other firms.

D)Buying raw materials.

A)Selling the good to consumers.

B)Receiving cash.

C)Selling the good to other firms.

D)Buying raw materials.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following situations would cause the balance per bank to be more than the balance per books?

A)Deposits in transit.

B)Service charges.

C)Outstanding checks.

D)Checks from customers returned as NSF.

A)Deposits in transit.

B)Service charges.

C)Outstanding checks.

D)Checks from customers returned as NSF.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is not a purpose of a cash count sheet?

A)To determine any cash shortage or overage.

B)To determine the amount of cash available for deposit in the bank.

C)To determine the amount of cash to be reported on the balance sheet.

D)To document cash received.

A)To determine any cash shortage or overage.

B)To determine the amount of cash available for deposit in the bank.

C)To determine the amount of cash to be reported on the balance sheet.

D)To document cash received.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

53

A company buys footwear and clothing from manufacturers,which it resells to discount stores in a large urban area.This company is an example of a:

A)wholesale merchandising company.

B)service company.

C)retail merchandising company.

D)secondary service company.

A)wholesale merchandising company.

B)service company.

C)retail merchandising company.

D)secondary service company.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

54

DigDug Corporation had outstanding checks totaling $5,400 on its June bank reconciliation.In July,DigDug issued checks totaling $38,900.The July bank statement shows that $26,300 in checks cleared the bank in July.The amount of outstanding checks on DigDug's July bank reconciliation should be:

A)$12,600.

B)$18,000.

C)$5,400.

D)$7,200.

A)$12,600.

B)$18,000.

C)$5,400.

D)$7,200.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not a reason why businesses need an effective internal control system?

A)To help ensure that sales are not lost because desired goods are not in stock.

B)To help ensure that money is not tied up in excessive inventory.

C)To help ensure the loss of inventory and cash to theft is minimized.

D)To identify ways to circumvent applicable laws and regulations.

A)To help ensure that sales are not lost because desired goods are not in stock.

B)To help ensure that money is not tied up in excessive inventory.

C)To help ensure the loss of inventory and cash to theft is minimized.

D)To identify ways to circumvent applicable laws and regulations.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

56

On October 31,2013,the bank's records say that your company has $12,956.73 in its checking account.You are aware of three outstanding checks for a total of $2,112.19.During October,2013,the bank rejected two deposited checks from customers totaling $654.19 because of insufficient funds and charged you $12.00 in service fees.You had not yet received notice about the bad checks,but you were aware of and have recorded the $12.00 of service fees.Prior to adjustment on October 31,2013,your Cash account would have a balance of:

A)$14,402.73.

B)$15,711.11.

C)$11,498.73.

D)$10,202.35.

A)$14,402.73.

B)$15,711.11.

C)$11,498.73.

D)$10,202.35.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following items appearing on a bank reconciliation would require journal entries to bring the cash account up to date?

A)Deposits in transit.

B)Checks from customers returned as NSF.

C)Outstanding checks.

D)An error made by the bank in recording a deposit.

A)Deposits in transit.

B)Checks from customers returned as NSF.

C)Outstanding checks.

D)An error made by the bank in recording a deposit.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

58

Deposits in transit:

A)have been recorded by the company but not yet by the bank.

B)have been recorded by the bank but not yet by the company.

C)have not been recorded by the bank or the company.

D)have been recorded by both the bank and the company.

A)have been recorded by the company but not yet by the bank.

B)have been recorded by the bank but not yet by the company.

C)have not been recorded by the bank or the company.

D)have been recorded by both the bank and the company.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following bank reconciliation items would not result in an adjusting journal entry in the company's books?

A)Service charge.

B)Outstanding checks.

C)A customer's check returned NSF.

D)Interest earned on deposits.

A)Service charge.

B)Outstanding checks.

C)A customer's check returned NSF.

D)Interest earned on deposits.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

60

When you identify outstanding checks in performing a bank reconciliation,you must:

A)deduct the amount of the outstanding checks from the balance per books.

B)deduct the amount of the outstanding checks from the balance per bank.

C)add the amount of the outstanding checks to the balance per books.

D)add the amount of the outstanding checks to the balance per bank.

A)deduct the amount of the outstanding checks from the balance per books.

B)deduct the amount of the outstanding checks from the balance per bank.

C)add the amount of the outstanding checks to the balance per books.

D)add the amount of the outstanding checks to the balance per bank.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

61

In a retail business that uses a perpetual inventory system,scanning a bar code does not:

A)calculate the amount owed by the customer.

B)identify the item sold to be removed from the Inventory account.

C)identify the item sold to be recorded in the Cost of Goods Sold account.

D)calculate the gross margin.

A)calculate the amount owed by the customer.

B)identify the item sold to be removed from the Inventory account.

C)identify the item sold to be recorded in the Cost of Goods Sold account.

D)calculate the gross margin.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

62

On June 15,Oakley Inc.sells merchandise on account to Sunglass Hut (SH)for $1,000,terms 2/10,n/30.On June 20,SH returns to Oakley merchandise that SH had purchased for $300.On June 24,SH completely fulfills its obligation to Oakley by making a cash payment.What is the amount of cash paid by SH to Oakley?

A)$680.

B)$686.

C)$700.

D)$1,000.

A)$680.

B)$686.

C)$700.

D)$1,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

63

Central Company sold goods for $5,000 to Western Company on March 12 on credit.Terms of the sale were 2/10,n/30.At the time of the sale,Central recorded the transaction by debiting accounts receivable for $5,000 and crediting sales revenue for $5,000.Western paid the balance due,less the discount,on March 21.To record the March 21 transaction,Central would debit:

A)Cash for $4,900.

B)Accounts Receivable for $4,900.

C)Cash for $5,000.

D)Accounts Receivable for $5,000.

A)Cash for $4,900.

B)Accounts Receivable for $4,900.

C)Cash for $5,000.

D)Accounts Receivable for $5,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements regarding periodic versus perpetual inventory systems is true?

A)Perpetual inventory systems are inferior for determining optimal times to reorder merchandise.

B)Periodic inventory systems require a greater investment in technology to implement them.

C)Perpetual inventory systems may assist in determining inventory lost due to shrinkage.

D)Periodic inventory systems allow sales personnel to provide more immediate information regarding availability of inventory.

A)Perpetual inventory systems are inferior for determining optimal times to reorder merchandise.

B)Periodic inventory systems require a greater investment in technology to implement them.

C)Perpetual inventory systems may assist in determining inventory lost due to shrinkage.

D)Periodic inventory systems allow sales personnel to provide more immediate information regarding availability of inventory.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

65

The Tuck Shop began the current month with inventory costing $10,000,then purchased inventory at a cost of $35,000.The perpetual inventory system indicates that inventory costing $30,000 was sold during the month for $40,000.If an inventory count shows that inventory costing $14,500 is actually on hand at month-end,what amount of shrinkage occurred during the month?

A)$500.

B)$5,000.

C)$14,495.

D)$15,000.

A)$500.

B)$5,000.

C)$14,495.

D)$15,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

66

In order to calculate shrinkage:

A)both periodic and perpetual inventory systems are needed.

B)a periodic inventory system is more effective.

C)a perpetual inventory system requires an occasional count of actual inventory.

D)it does not matter which system one uses.

A)both periodic and perpetual inventory systems are needed.

B)a periodic inventory system is more effective.

C)a perpetual inventory system requires an occasional count of actual inventory.

D)it does not matter which system one uses.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

67

If a company returns an item to a supplier,the supplier will record the return as:

A)sales returns and allowances.

B)shrinkage.

C)sales discounts.

D)purchase returns and allowances.

A)sales returns and allowances.

B)shrinkage.

C)sales discounts.

D)purchase returns and allowances.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

68

A company sells goods on account at a selling price of $20,000.The cost of the goods is $15,000.Under a perpetual inventory system the journal entries to record the sale will include:

A)$20,000 will be debited to Inventory and $20,000 will be credited to Accounts Receivable.

B)$20,000 will be debited to Cost of goods sold and $20,000 will be credited to Inventory.

C)$15,000 will be credited to Inventory and $15,000 will be credited to Sales.

D)$20,000 will be debited to Accounts receivable and $20,000 will be credited to Sales.

A)$20,000 will be debited to Inventory and $20,000 will be credited to Accounts Receivable.

B)$20,000 will be debited to Cost of goods sold and $20,000 will be credited to Inventory.

C)$15,000 will be credited to Inventory and $15,000 will be credited to Sales.

D)$20,000 will be debited to Accounts receivable and $20,000 will be credited to Sales.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

69

BetterBuy sells a computer from inventory for $599 on credit.BetterBuy originally bought the computer from IBM for $395 and uses the perpetual inventory system.How is the sale recorded in BetterBuy's journal entries?

A)Debit Cash for $599,credit Sales for $599;debit Cost of goods sold for $395 and credit Inventory for $395.

B)Debit Accounts Receivable for $599,credit Inventory for $395,and credit gross profit for $204.

C)Debit Accounts Receivable for $599,credit Sales for $599;debit Cost of Goods Sold for $395 and credit Inventory for $395.

D)Debit Inventory for $395,debit Cost of Goods Sold for $204,and credit Accounts Receivable for $599.

A)Debit Cash for $599,credit Sales for $599;debit Cost of goods sold for $395 and credit Inventory for $395.

B)Debit Accounts Receivable for $599,credit Inventory for $395,and credit gross profit for $204.

C)Debit Accounts Receivable for $599,credit Sales for $599;debit Cost of Goods Sold for $395 and credit Inventory for $395.

D)Debit Inventory for $395,debit Cost of Goods Sold for $204,and credit Accounts Receivable for $599.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

70

When a company collects from a customer who pays within the discount period,the company:

A)debits a contra-revenue account.

B)debits a liability account.

C)credits a liability account.

D)debits a revenue account.

A)debits a contra-revenue account.

B)debits a liability account.

C)credits a liability account.

D)debits a revenue account.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

71

On December 31,2014,you count 300 tie clips in inventory.During the next quarter,you carefully record the effect of each purchase and sale transaction on inventory.You buy 128 tie clips during the next quarter.On March 31,2015,you count 288 tie clips in inventory.Which of the following is not true?

A)Ending inventory on March 31,2015 should be 288 tie clips.

B)Your company uses the perpetual inventory method.

C)Your company's records would show that 140 tie clips were sold during the quarter.

D)The amount of shrinkage cannot be determined with this type of inventory system.

A)Ending inventory on March 31,2015 should be 288 tie clips.

B)Your company uses the perpetual inventory method.

C)Your company's records would show that 140 tie clips were sold during the quarter.

D)The amount of shrinkage cannot be determined with this type of inventory system.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

72

Thirty years ago,most companies relied mainly upon periodic inventory systems.Why?

A)Theft was an insignificant source of loss compared to today.

B)The tax code required physical inventory counts until tax regulations were changed in the 1980s.

C)New technology,allowing perpetual inventory systems to be installed more easily and inexpensively,was not available thirty years ago.

D)Before the advent of computers,perpetual systems were less accurate than periodic systems.

A)Theft was an insignificant source of loss compared to today.

B)The tax code required physical inventory counts until tax regulations were changed in the 1980s.

C)New technology,allowing perpetual inventory systems to be installed more easily and inexpensively,was not available thirty years ago.

D)Before the advent of computers,perpetual systems were less accurate than periodic systems.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

73

The perpetual inventory method of tracking inventory is considered superior to the periodic method because the perpetual method:

A)makes calculations easier and less technology can be deployed.

B)tells what inventory a company should have at any point in time.

C)saves a company from ever having to count the goods in inventory.

D)is more consistent with how companies calculated inventory in the past.

A)makes calculations easier and less technology can be deployed.

B)tells what inventory a company should have at any point in time.

C)saves a company from ever having to count the goods in inventory.

D)is more consistent with how companies calculated inventory in the past.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

74

Companies using a perpetual inventory system:

A)never physically count their inventory.

B)must count their inventory at least once a week.

C)still need to count the inventory at the end of the period.

D)always know the actual amount in inventory from their accounting records.

A)never physically count their inventory.

B)must count their inventory at least once a week.

C)still need to count the inventory at the end of the period.

D)always know the actual amount in inventory from their accounting records.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

75

When you identify interest received from the bank in performing a bank reconciliation,you must:

A)add the amount of interest to the balance per bank.

B)deduct the amount of interest from the balance per books.

C)add the amount of interest to the balance per books.

D)deduct the amount of interest from the balance per bank.

A)add the amount of interest to the balance per bank.

B)deduct the amount of interest from the balance per books.

C)add the amount of interest to the balance per books.

D)deduct the amount of interest from the balance per bank.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

76

A company sells goods at a selling price of $20,000.The cost of the goods is $15,000.Under a perpetual inventory system the journal entries to record the sale will include:

A)$15,000 will be debited to Inventory and $15,000 will be credited to Sales.

B)$15,000 will be debited to Cost of goods sold and $15,000 will be credited to Inventory.

C)$15,000 will be credited to Inventory and $15,000 will be credited to Sales.

D)$15,000 will be debited to Cost of goods sold and $15,000 will be credited to Sales.

A)$15,000 will be debited to Inventory and $15,000 will be credited to Sales.

B)$15,000 will be debited to Cost of goods sold and $15,000 will be credited to Inventory.

C)$15,000 will be credited to Inventory and $15,000 will be credited to Sales.

D)$15,000 will be debited to Cost of goods sold and $15,000 will be credited to Sales.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

77

Merchandise was sold on credit for $3,000,terms 1/10,n/30.How should the seller record the cash collection?

A)Debit Cash,$3,000,and credit Accounts Receivable,$3,000,if collected within the discount period.

B)Debit Cash,$3,000,credit Accounts Receivable,$2,970,and credit Sales Discounts,$30,if collected within the discount period.

C)Debit Cash,$3,000,credit Accounts Receivable,$2,970,and credit Sales Discounts,$30,if collected after the discount period.

D)Debit Cash,$3,000,and credit Accounts Receivable,$3,000,if collected after the discount perioD.

A)Debit Cash,$3,000,and credit Accounts Receivable,$3,000,if collected within the discount period.

B)Debit Cash,$3,000,credit Accounts Receivable,$2,970,and credit Sales Discounts,$30,if collected within the discount period.

C)Debit Cash,$3,000,credit Accounts Receivable,$2,970,and credit Sales Discounts,$30,if collected after the discount period.

D)Debit Cash,$3,000,and credit Accounts Receivable,$3,000,if collected after the discount perioD.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

78

Your company purchases $50,000 of inventory from a wholesaler who allows you 45 days to pay.In addition,the wholesaler offers a 3% discount if payment is made within 12 days.These payment terms would be expressed as:

A).03/12,n/45.

B)n/45,3/12.

C)n/45,.03/12.

D)3/12,n/45.

A).03/12,n/45.

B)n/45,3/12.

C)n/45,.03/12.

D)3/12,n/45.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

79

BetterBuy sells $50,000 of TVs to a customer.The credit terms state a 2% discount if paid in 7 days and a 1% discount if paid in 8-14 days.The customer pays in 12 days.How would BetterBuy record the customer's payment?

A)Debit Cash for $50,000 and credit Accounts Receivable for $50,000.

B)Debit Accounts Receivable for $50,000,credit Cash for $49,500,and credit Inventory for $500.

C)Debit Cash for $49,500,credit Accounts Receivable for $50,000,and debit Sales Discounts for $500.

D)Debit Cash for $49,500,credit Accounts Receivable for $49,000,and credit Sales Returns & Allowances for $500.

A)Debit Cash for $50,000 and credit Accounts Receivable for $50,000.

B)Debit Accounts Receivable for $50,000,credit Cash for $49,500,and credit Inventory for $500.

C)Debit Cash for $49,500,credit Accounts Receivable for $50,000,and debit Sales Discounts for $500.

D)Debit Cash for $49,500,credit Accounts Receivable for $49,000,and credit Sales Returns & Allowances for $500.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

80

B-Mart sells $5,000 of blue jeans.The customer later tells B-Mart that $200 of them are defective.The sale of the $5,000 of blue jeans on account has already been recorded.The customer agrees to keep the blue jeans and B-Mart agrees to a $200 allowance.Assuming a perpetual inventory system is used,B-Mart will:

A)debit Accounts receivable for $200 and credit Inventory for $200.

B)debit Inventory for $200 and credit Accounts receivable for $200.

C)debit Accounts receivable for $200 and credit Sales Returns & Allowances for $200.

D)debit Sales Returns & Allowances for $200 and credit Accounts Receivable for $200.

A)debit Accounts receivable for $200 and credit Inventory for $200.

B)debit Inventory for $200 and credit Accounts receivable for $200.

C)debit Accounts receivable for $200 and credit Sales Returns & Allowances for $200.

D)debit Sales Returns & Allowances for $200 and credit Accounts Receivable for $200.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck