Deck 21: Debt Restructuring, Corporate Reorganizations, and Liquidations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/44

Play

Full screen (f)

Deck 21: Debt Restructuring, Corporate Reorganizations, and Liquidations

1

In a quasi-reorganization, a debit balance in Retained Earnings (a deficit) is eliminated by

A) reducing paid-in capital or reorganization capital.

B) reducing future depreciation charges.

C) issuing more capital stock.

D) writing down assets to lower, but fair, values.

A) reducing paid-in capital or reorganization capital.

B) reducing future depreciation charges.

C) issuing more capital stock.

D) writing down assets to lower, but fair, values.

A

2

Which of the following statements is true about Chapter 7 of the Bankruptcy Code?

A) Only voluntary petitions are allowed.

B) A debtor with at least 12 creditors may be subject to involuntary proceedings if 3 or more of those creditors hold noncontingent, unsecured claims of $12,000 or more.

C) A debtor with fewer than 12 creditors may be subject to involuntary proceedings if 1 or more of those creditors holds noncontingent, unsecured claims of $10,000 or more.

D) The requirements for involuntary proceedings are identical to those for Chapter 13.

A) Only voluntary petitions are allowed.

B) A debtor with at least 12 creditors may be subject to involuntary proceedings if 3 or more of those creditors hold noncontingent, unsecured claims of $12,000 or more.

C) A debtor with fewer than 12 creditors may be subject to involuntary proceedings if 1 or more of those creditors holds noncontingent, unsecured claims of $10,000 or more.

D) The requirements for involuntary proceedings are identical to those for Chapter 13.

C

3

In a troubled debt restructuring where the debtor elects to transfer an equity interest to a creditor in exchange for the satisfaction of an outstanding debt:

A) the debtor may recognize a gain on restructure when the market value of the equity interest is greater than the book value of the debt plus any accrued interest

B) the debtor may recognize a gain on restructure when the market value of the equity interest is less than the book value of the debt plus any accrued interest

C) any difference between market value of equity interest and book value of the debt plus accrued interest must be recorded in Retained Earnings.

D) any difference between market value of equity interest and book value of the debt plus accrued interest must be recorded in Additional Paid in Capital in Excess of Par.

A) the debtor may recognize a gain on restructure when the market value of the equity interest is greater than the book value of the debt plus any accrued interest

B) the debtor may recognize a gain on restructure when the market value of the equity interest is less than the book value of the debt plus any accrued interest

C) any difference between market value of equity interest and book value of the debt plus accrued interest must be recorded in Retained Earnings.

D) any difference between market value of equity interest and book value of the debt plus accrued interest must be recorded in Additional Paid in Capital in Excess of Par.

B

4

Put the following classes in the order allowed by the Bankruptcy Act, starting with the highest priority to the lowest: 1)

Expenses to administer estate

2)

Tax claims of governmental units

3)

Wages (including salaries and commissions) up to $4,000 earned within 90 days

4)

Deposits up to $1,800 each for goods or services never received from the debtor

A) 1,3,4,2

B) 3,1,2,4

C) 4,2,1,3

D) 2,1,3,4

Expenses to administer estate

2)

Tax claims of governmental units

3)

Wages (including salaries and commissions) up to $4,000 earned within 90 days

4)

Deposits up to $1,800 each for goods or services never received from the debtor

A) 1,3,4,2

B) 3,1,2,4

C) 4,2,1,3

D) 2,1,3,4

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

5

A corporation's accounting statement of affairs shows a dividend of 40%. The dividend means that

A) all creditors and stockholders will receive approximately 40% of the book value of their respective interests.

B) all creditors will receive an amount approximately equal to 40% of the book value of their claims, but stockholders will receive nothing.

C) Class 1-6 unsecured claims will receive 40% of the book value of their respective claims.

D) Class 7 unsecured claims will receive 40% of the book value of their respective claims.

A) all creditors and stockholders will receive approximately 40% of the book value of their respective interests.

B) all creditors will receive an amount approximately equal to 40% of the book value of their claims, but stockholders will receive nothing.

C) Class 1-6 unsecured claims will receive 40% of the book value of their respective claims.

D) Class 7 unsecured claims will receive 40% of the book value of their respective claims.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

6

After eliminating the deficit in a reorganization plan, a balance may remain in Reorganization Capital. On the balance sheet, where would this account appear?

A) part of the Paid-In Capital

B) part of the dated balance in Retained Earnings

C) an Intangible Asset if the balance is a debit

D) a deferred credit amortized over a period not to exceed 40 years

A) part of the Paid-In Capital

B) part of the dated balance in Retained Earnings

C) an Intangible Asset if the balance is a debit

D) a deferred credit amortized over a period not to exceed 40 years

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following does not describe the accounting statement of affairs?

A) the emphasis is on asset net realizable value, not historical cost

B) the statement of affairs is concerned only with the assets of the debtor organization, not the claims

C) the statement can also be used in a reorganization

D) the statement of affairs is based on estimated values; actual realized values may be different

A) the emphasis is on asset net realizable value, not historical cost

B) the statement of affairs is concerned only with the assets of the debtor organization, not the claims

C) the statement can also be used in a reorganization

D) the statement of affairs is based on estimated values; actual realized values may be different

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

8

The document used to estimate amounts available to each class of claims is called a(n)

A) Statement of Assets and Liabilities.

B) Legal Statement of Affairs.

C) Accounting Statement of Affairs.

D) Statement of Realization and Liquidation.

A) Statement of Assets and Liabilities.

B) Legal Statement of Affairs.

C) Accounting Statement of Affairs.

D) Statement of Realization and Liquidation.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

9

The document used by a trustee to report periodically on the status of fiduciary activities is called a(n)

A) Statement of Assets and Liabilities.

B) Legal Statement of Affairs.

C) Accounting Statement of Affairs.

D) Statement of Realization and Liquidation.

A) Statement of Assets and Liabilities.

B) Legal Statement of Affairs.

C) Accounting Statement of Affairs.

D) Statement of Realization and Liquidation.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

10

A voluntary bankruptcy petition can be filed under

A) Chapter 7.

B) Chapter 11.

C) Chapter 13.

D) All of the above chapters.

A) Chapter 7.

B) Chapter 11.

C) Chapter 13.

D) All of the above chapters.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

11

In a quasi-reorganization, which of the following may occur?

A) Excess plant capacity may be sold

B) Assets may be revalued to reflect impaired values

C) Retained Earnings deficits are eliminated by changes made to the capital structure

D) All of the above may occur

A) Excess plant capacity may be sold

B) Assets may be revalued to reflect impaired values

C) Retained Earnings deficits are eliminated by changes made to the capital structure

D) All of the above may occur

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

12

In the accounting statement of affairs, the gains or losses upon liquidation would equal

A) net book value of assets minus book value of liabilities.

B) the book value of assets minus their realizable value.

C) total estimated realizable value of assets minus the amount assigned to secured creditors.

D) total estimated realizable value of assets minus the amount remaining for Class 7 unsecured creditors.

A) net book value of assets minus book value of liabilities.

B) the book value of assets minus their realizable value.

C) total estimated realizable value of assets minus the amount assigned to secured creditors.

D) total estimated realizable value of assets minus the amount remaining for Class 7 unsecured creditors.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

13

A plan of reorganization may include all EXCEPT which of the following?

A) arrangements involving elimination of some debt

B) identification of various classes of claims

C) identification of a trustee in liquidations

D) differentiation of impaired versus non-impaired interests

A) arrangements involving elimination of some debt

B) identification of various classes of claims

C) identification of a trustee in liquidations

D) differentiation of impaired versus non-impaired interests

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is true?

A) Certain debts are not dischargeable.

B) The goal of liquidation is to give the company a new start.

C) All secured claims are paid in full.

D) The expenses to administer the estate are paid last because they are unsecured.

A) Certain debts are not dischargeable.

B) The goal of liquidation is to give the company a new start.

C) All secured claims are paid in full.

D) The expenses to administer the estate are paid last because they are unsecured.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is NOT a general objective of bankruptcy procedures?

A) assurance that all obligations of the debtor will be satisfied completely

B) attempt to give the debtor a fresh start

C) assurance of an equitable distribution of the debtor's property among creditors

D) None of the above is a general objective.

A) assurance that all obligations of the debtor will be satisfied completely

B) attempt to give the debtor a fresh start

C) assurance of an equitable distribution of the debtor's property among creditors

D) None of the above is a general objective.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is an illustration of an action that can be taken to help a troubled firm without using the court system?

A) asset transfers to settle debt

B) equity interest granted in exchange for debt

C) modifications of interest rates more favorable to the firm

D) All or a combination can be used.

A) asset transfers to settle debt

B) equity interest granted in exchange for debt

C) modifications of interest rates more favorable to the firm

D) All or a combination can be used.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

17

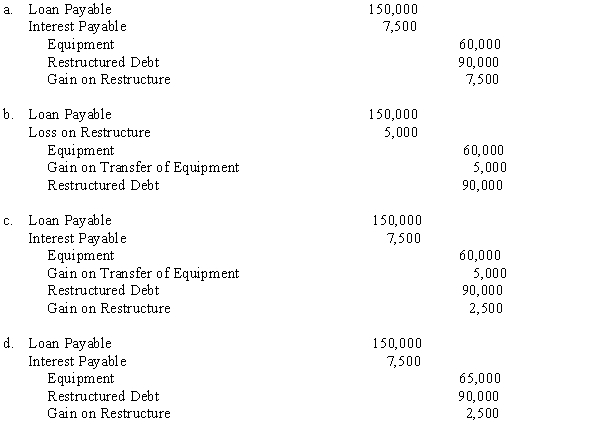

Equipment with a fair value of $65,000 and a cost basis of $60,000 is transferred to a creditor in partial settlement of a debt of $150,000 plus accrued interest of $7,500. The balance of the debt will be satisfied by 3 equal payments of $30,000 over the next three years. Which of the following journal entries best records the restructure?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

18

The ratio called "dividend to general unsecured creditors" is calculated by which of the following formulas?

A) Estimated amount available for unsecured creditors with/without priority divided by Total claims of all unsecured creditors with/without priority

B) Estimated realizable value of all debtor assets divided by Book value of debtor assets

C) Estimated gain/loss on liquidation divided by Total estimated net realizable value of debtor assets

D) Net estimated proceeds available to class 7 unsecured creditors divided by Total claims of unsecured creditors

A) Estimated amount available for unsecured creditors with/without priority divided by Total claims of all unsecured creditors with/without priority

B) Estimated realizable value of all debtor assets divided by Book value of debtor assets

C) Estimated gain/loss on liquidation divided by Total estimated net realizable value of debtor assets

D) Net estimated proceeds available to class 7 unsecured creditors divided by Total claims of unsecured creditors

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

19

To assist the trustee, a debtor must

A) collect and reduce to money any non-exempt property

B) file progress reports with the court

C) file a statement of affairs, consisting of answers to a series of questions regarding debtor's financial condition

D) pay dividends to creditors with regards to priorities

A) collect and reduce to money any non-exempt property

B) file progress reports with the court

C) file a statement of affairs, consisting of answers to a series of questions regarding debtor's financial condition

D) pay dividends to creditors with regards to priorities

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

20

Lakeside Bank holds a $100,000 note secured by a building owned by Fly-By-Night Manufacturing, which has filed for bankruptcy under Chapter 7 of the Bankruptcy Code. If the property has a book value of $120,000 and a fair market value of $90,000, what is the best way to describe the note held by Second City Bank? The bank has a(n)

A) secured claim of $100,000.

B) unsecured claim of $100,000.

C) secured claim of $90,000 and an unsecured claim of $10,000.

D) secured claim of $100,000 and an unsecured claim of $20,000.

A) secured claim of $100,000.

B) unsecured claim of $100,000.

C) secured claim of $90,000 and an unsecured claim of $10,000.

D) secured claim of $100,000 and an unsecured claim of $20,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

21

Kentucky Blue, Inc., a lawn care service corporation, is in serious financial difficulty with a deficit of $2,100,000. The company's plant and equipment were designed for highly specialized products and activities. Therefore, they would yield only a small fraction of their book value upon sale. Creditors realize that they will receive little if the corporation is dissolved. In view of the renewed interest in professional lawn care, a plan of reorganization under Chapter 11 was adopted and received the necessary approvals.

Required:

Prepare journal entries to record the following stipulations of the plan:

a.

Replace the 14% first mortgage bonds with face value of $300,000, on which there is $13,000 of unamortized premium, with 10% interest bonds, with a face value of $250,000. To cover the accrued interest of $42,000 on the 14% bonds, bondholders will receive 20,000 shares of new $1 par common stock.

b.

Unsecured accounts and notes payable total $200,000. Creditors have agreed to accept $0.55 on the dollar.

c.

Replace the 10%, $100 par, cumulative participating preferred stock (of which 10,000 shares are outstanding, having a related paid-in capital in excess of par of $170,000) with an equal number of shares of 8%, $40 par, noncumulative nonparticipating preferred stock. The corporation will no longer be liable for the $100,000 of undeclared dividends in arrears on the 10% preferred stock.

d.

Replace the 200,000 shares of $10 par common stock, having a discount of $80,000, with an equal number of $1 par common shares.

e.

Eliminate the deficit.

Required:

Prepare journal entries to record the following stipulations of the plan:

a.

Replace the 14% first mortgage bonds with face value of $300,000, on which there is $13,000 of unamortized premium, with 10% interest bonds, with a face value of $250,000. To cover the accrued interest of $42,000 on the 14% bonds, bondholders will receive 20,000 shares of new $1 par common stock.

b.

Unsecured accounts and notes payable total $200,000. Creditors have agreed to accept $0.55 on the dollar.

c.

Replace the 10%, $100 par, cumulative participating preferred stock (of which 10,000 shares are outstanding, having a related paid-in capital in excess of par of $170,000) with an equal number of shares of 8%, $40 par, noncumulative nonparticipating preferred stock. The corporation will no longer be liable for the $100,000 of undeclared dividends in arrears on the 10% preferred stock.

d.

Replace the 200,000 shares of $10 par common stock, having a discount of $80,000, with an equal number of $1 par common shares.

e.

Eliminate the deficit.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

22

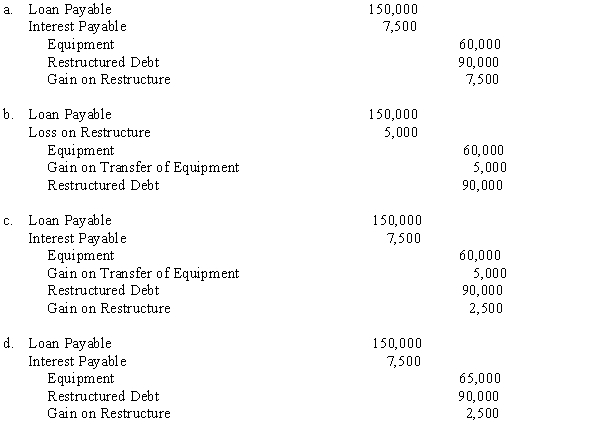

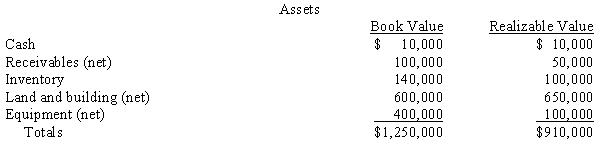

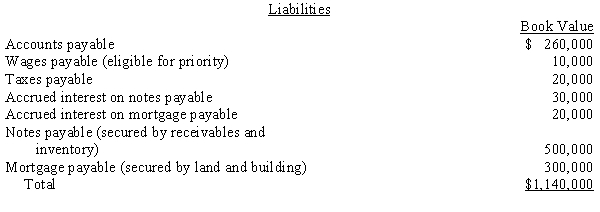

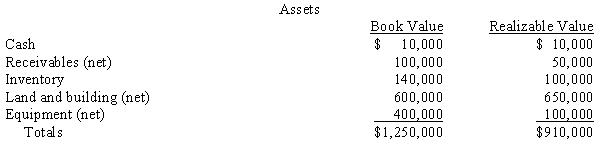

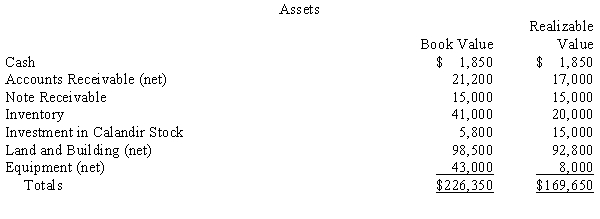

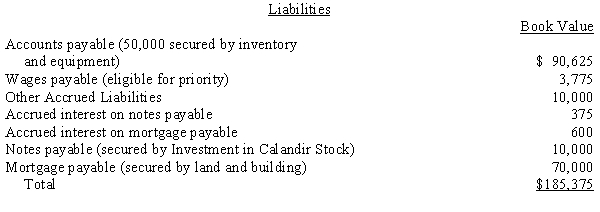

On June 1, 20X5, the books of Hallow Corporation show assets with book values and realizable values as follows:

Hallow's books show the following liabilities:

Hallow's books show the following liabilities:

Required:

Required:

a.

Prepare a schedule to determine the amount available for Class 7 unsecured claims.

b.

Determine the dividend to Class 7 unsecured claims.

c.

What amount are the note holders likely to receive? What is their dividend?

Hallow's books show the following liabilities:

Hallow's books show the following liabilities: Required:

Required: a.

Prepare a schedule to determine the amount available for Class 7 unsecured claims.

b.

Determine the dividend to Class 7 unsecured claims.

c.

What amount are the note holders likely to receive? What is their dividend?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

23

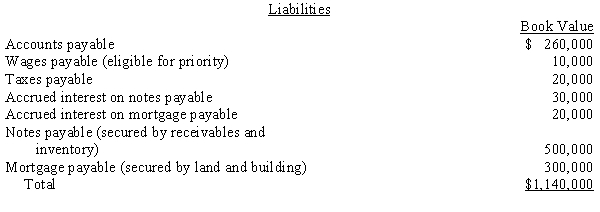

As of June 30, 20X4, the Lillie Corporation has the following assets, liabilities, and owners' equity:

The following is provided:

The following is provided:

Marketable securities have a market value of $24,000. Accounts receivable are estimated to produce $30,000. The sale of inventories should yield $120,000, $20,000 of which must be assigned to a creditor (account payable) who is owed $24,000. The land and buildings can be sold for $222,000 with the buyer assuming the mortgage and its unpaid interest. The machinery will realize $50,000. All salaries qualify for priority.

Required:

Prepare a statement of affairs including the calculation of the dividend to Class 7 unsecured claims.

The following is provided:

The following is provided:Marketable securities have a market value of $24,000. Accounts receivable are estimated to produce $30,000. The sale of inventories should yield $120,000, $20,000 of which must be assigned to a creditor (account payable) who is owed $24,000. The land and buildings can be sold for $222,000 with the buyer assuming the mortgage and its unpaid interest. The machinery will realize $50,000. All salaries qualify for priority.

Required:

Prepare a statement of affairs including the calculation of the dividend to Class 7 unsecured claims.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

24

Dremer Corporation: On June 1, 20X5, the books of Dremer Corporation show assets with book values and realizable values as follows:

Dremer's books show the following liabilities:

Dremer's books show the following liabilities:

refer to Dremer Corporation Prepare an accounting Statement of Affairs including the computation of the dividend to Class 7 unsecured creditors.

Dremer's books show the following liabilities:

Dremer's books show the following liabilities:

refer to Dremer Corporation Prepare an accounting Statement of Affairs including the computation of the dividend to Class 7 unsecured creditors.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

25

John Shark has been appointed trustee under a Chapter 11 reorganization of Fishe Corporation. The trustee has decided to open a new set of records for the period of trusteeship. Which of the following accounts would Shark credit when the assets transferred are recorded on the trustee's books?

A) Fishe Corporation in Trusteeship

B) Assets Transferred for Lyon Corporation

C) Assets to Be Realized

D) John Shark, Trustee

A) Fishe Corporation in Trusteeship

B) Assets Transferred for Lyon Corporation

C) Assets to Be Realized

D) John Shark, Trustee

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

26

The Statement of Realization and Liquidation differs from the Statement of Affairs because

A) The Statement of Realization and Affairs reports estimated realizable values rather than actual liquidation results

B) The Statement of Realization and Affairs is a summary of secured debt activity only

C) The Statement of Realization and Affairs is prepared only at final completion of the liquidation process

D) The Statement of Realization and Affairs reports actual liquidation results rather than estimated realizable values

A) The Statement of Realization and Affairs reports estimated realizable values rather than actual liquidation results

B) The Statement of Realization and Affairs is a summary of secured debt activity only

C) The Statement of Realization and Affairs is prepared only at final completion of the liquidation process

D) The Statement of Realization and Affairs reports actual liquidation results rather than estimated realizable values

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

27

Using the information from Dremer Corporation and the following information, prepare a Statement of Realization and Liquidation for Dremer Inc. for the period of 6/1/X5 to 6/30/X5.

No subsequent discoveries

Sale of Calandir Securities at a market value of $16,000

Collection of Note Receivable into cash $15,000

Sale of Equipment at $7,000

Sale of Inventory at $22,000

Partial Payment of Accounts Payable $29,000

Payment of Note Payable $10,375

No subsequent discoveries

Sale of Calandir Securities at a market value of $16,000

Collection of Note Receivable into cash $15,000

Sale of Equipment at $7,000

Sale of Inventory at $22,000

Partial Payment of Accounts Payable $29,000

Payment of Note Payable $10,375

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

28

Zenato's Corporation is a chain of sandwich shops that has recently had difficulty meeting its long-term debt requirements. In order to avoid court proceedings, the firm's creditors agreed to the following debt restructuring in December, 20X1:

a.

A $50,000 note would be fully satisfied with a single $40,000 payment on March 1, 20X2. The note had accrued interest of $2,000 on December 1, 20X1.

b.

A $75,000 note with accrued interest of $3,000 will be fully satisfied with $35,000 payments on December 1, 20X2 and December 1, 20X3. The original interest rate on the note was 12%.

c.

A $40,000 note with no accrued interest will be satisfied with payments of $23,048 on December 1, 20X2 and December 1, 20X3. The old note carried a 15% interest rate. The effective rate on the restructured note is 10%.

Required:

Prepare the journal entries to record the restructuring and payments of the notes.

a.

A $50,000 note would be fully satisfied with a single $40,000 payment on March 1, 20X2. The note had accrued interest of $2,000 on December 1, 20X1.

b.

A $75,000 note with accrued interest of $3,000 will be fully satisfied with $35,000 payments on December 1, 20X2 and December 1, 20X3. The original interest rate on the note was 12%.

c.

A $40,000 note with no accrued interest will be satisfied with payments of $23,048 on December 1, 20X2 and December 1, 20X3. The old note carried a 15% interest rate. The effective rate on the restructured note is 10%.

Required:

Prepare the journal entries to record the restructuring and payments of the notes.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

29

The following post-closing trial balance has been prepared for Harper Corporation as of September 30, 20X4:

Notes receivable and accrued interest on these notes are expected to realize their book values.

Notes receivable and accrued interest on these notes are expected to realize their book values.

Accounts receivable are expected to realize $45,000. The accounts receivable have been pledged to secure a note payable for $30,000 and accrued interest expense of $2,400.

Inventories will realize approximately 60% of their book value.

A real estate agent believes that the land and building and equipment could be sold for $150,000. The holder of a note payable of $69,000, with accrued interest thereon of $3,600, has a lien against the property for the full amount due.

All salaries qualify for priority.

Required:

a.

Prepare an accounting statement of affairs, for which the accountant's fee will be $2,000.

b.

Compute the dividend for the Class 7 unsecured creditors.

Notes receivable and accrued interest on these notes are expected to realize their book values.

Notes receivable and accrued interest on these notes are expected to realize their book values.Accounts receivable are expected to realize $45,000. The accounts receivable have been pledged to secure a note payable for $30,000 and accrued interest expense of $2,400.

Inventories will realize approximately 60% of their book value.

A real estate agent believes that the land and building and equipment could be sold for $150,000. The holder of a note payable of $69,000, with accrued interest thereon of $3,600, has a lien against the property for the full amount due.

All salaries qualify for priority.

Required:

a.

Prepare an accounting statement of affairs, for which the accountant's fee will be $2,000.

b.

Compute the dividend for the Class 7 unsecured creditors.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

30

Rockee Corporation, a bio-tech firm, has found itself in financial difficulty and may file for bankruptcy. Rockee's Statement of Affairs reflects the following summary information:

Required:

Required:

Compute the following:

a.

The deficiency traceable to unsecured creditors in Class 7.

b.

The dividend to general unsecured creditors.

c.

Rockee owes Flint Corporation $9,000 secured by inventory that is expected to realize $7,000. How much can Flint expect to receive on this claim?

Required:

Required:Compute the following:

a.

The deficiency traceable to unsecured creditors in Class 7.

b.

The dividend to general unsecured creditors.

c.

Rockee owes Flint Corporation $9,000 secured by inventory that is expected to realize $7,000. How much can Flint expect to receive on this claim?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

31

A corporation's accounting statement of affairs shows a dividend of 115%. The dividend means that

A) secured creditors will receive an amount in excess of the book value of their claims.

B) unsecured creditors will receive an amount in excess of the book value of their claims.

C) stockholders may expect some return on their interests.

D) an error was made in the preparation of the statement.

A) secured creditors will receive an amount in excess of the book value of their claims.

B) unsecured creditors will receive an amount in excess of the book value of their claims.

C) stockholders may expect some return on their interests.

D) an error was made in the preparation of the statement.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

32

Hogan, Inc. is a telecommunications company. Currently, Hogan is experiencing difficulty in servicing its long-term debt. The corporation has obtained permission from its creditors to restructure outside of the court system with the following transactions:

a.

A piece of equipment that had cost Hogan $95,000 and had $19,000 of accumulated depreciation was transferred to a creditor in full settlement of a $45,000 note with $2,250 of accrued interest.

b.

2,000 shares of $2 par value common stock were issued to a creditor in full payment of a $80,000 loan, plus accrued interest of $800. The stock was selling for $30 per share on the date of exchange.

c.

A loan with a book value of $50,000 and accrued interest of $1,000 was restructured so that three annual installments of $12,000 will satisfy both the principal and interest in full.

Required:

Prepare the necessary journal entries to record these transactions in the journal of Hogan.

a.

A piece of equipment that had cost Hogan $95,000 and had $19,000 of accumulated depreciation was transferred to a creditor in full settlement of a $45,000 note with $2,250 of accrued interest.

b.

2,000 shares of $2 par value common stock were issued to a creditor in full payment of a $80,000 loan, plus accrued interest of $800. The stock was selling for $30 per share on the date of exchange.

c.

A loan with a book value of $50,000 and accrued interest of $1,000 was restructured so that three annual installments of $12,000 will satisfy both the principal and interest in full.

Required:

Prepare the necessary journal entries to record these transactions in the journal of Hogan.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

33

Wayne Corporation, a manufacturer of farm machinery, had poor financial results last year because of a drought. Back orders indicate complete recovery this year. To eliminate a deficit that increased when the books were closed at the end of last year, the corporation has received stockholders' and state approval to conduct a quasi-reorganization on January 2.

Required:

Prepare journal entries as of January 2 to record the quasi-reorganization and the stockholders' equity section of its balance sheet immediately thereafter. The following data are pertinent:

Required:

Prepare journal entries as of January 2 to record the quasi-reorganization and the stockholders' equity section of its balance sheet immediately thereafter. The following data are pertinent:

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

34

Tonya Fox has been appointed trustee under a Chapter 11 reorganization of Hen Corporation. The trustee has decided to open a new set of records for the period of trusteeship. Which of the following is true?

A) Fox will transfer all assets and all liabilities at market values

B) Fox will transfer all assets and all liabilities at book values

C) Fox will transfer all assets at market values, but all liabilities at book values.

D) Fox will transfer only those assets accepted at their book values, but will transfer no liabilities.

A) Fox will transfer all assets and all liabilities at market values

B) Fox will transfer all assets and all liabilities at book values

C) Fox will transfer all assets at market values, but all liabilities at book values.

D) Fox will transfer only those assets accepted at their book values, but will transfer no liabilities.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

35

A.B. Case has been appointed trustee under a Chapter 11 reorganization of Dee Corporation. The trustee has decided to open a new set of records for the period of trusteeship. The trustee pays the balance of an account payable that was recorded prior to the date of stewardship. Which of the following accounts would be credited on the corporation's books to record payment of the account payable mentioned?

A) Cash

B) Liabilities Liquidated

C) A.B. Case, Trustee

D) Retained Earnings

A) Cash

B) Liabilities Liquidated

C) A.B. Case, Trustee

D) Retained Earnings

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

36

T. P. Varnum has been appointed trustee under a Chapter 11 reorganization of Lyon Corporation. The trustee has decided to open a new set of records for the period of trusteeship. The trustee pays the balance of an account payable that was recorded prior to the date of stewardship. When payment is recorded on the trustee's books, the account debited is

A) Accounts Payable.

B) Accounts Payable-Lyon Corporation.

C) Retained Earnings.

D) an appropriate expense account.

A) Accounts Payable.

B) Accounts Payable-Lyon Corporation.

C) Retained Earnings.

D) an appropriate expense account.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

37

Equipment with a book values of $120,000 is sold in a liquidation process for cash of $110,000. This equipment was security for a $150,000 bank loan. Any remainder is consider unsecured, class 7. How would this transaction be reported on the Statement of Realization and Liquidation?

A) A reduction in non-cash assets of $120,000

B) A loss reported to owner's equity of $10,000

C) A disbursement of cash to the bank of $110,000, a reduction in partially secured liability of $150,000, and an increase in unsecured without priority liability of $40,000

D) all of the above would occur

A) A reduction in non-cash assets of $120,000

B) A loss reported to owner's equity of $10,000

C) A disbursement of cash to the bank of $110,000, a reduction in partially secured liability of $150,000, and an increase in unsecured without priority liability of $40,000

D) all of the above would occur

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

38

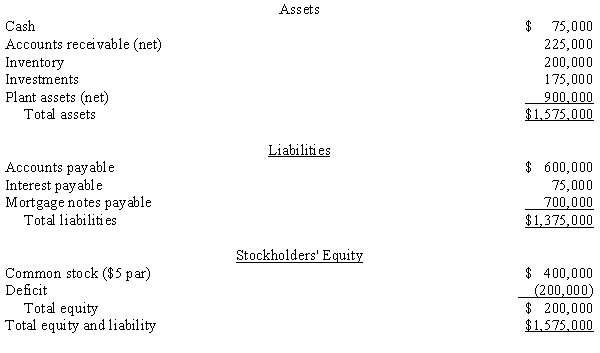

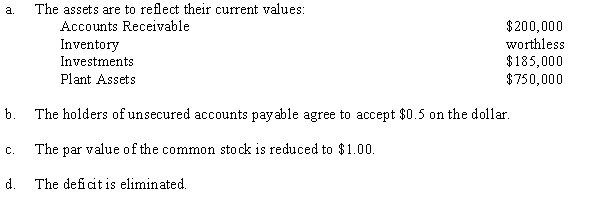

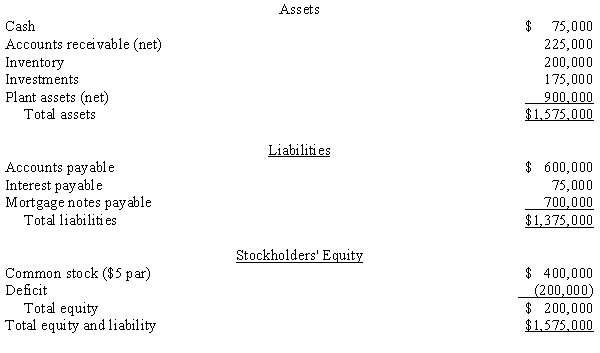

Morton Corporation has received permission to reorganize under Chapter 11. Just prior to recording the reorganization, the balance sheet appears as follows:

Required:

Required:

Record in journal form the following elements of the reorganization agreement. Assume that the adjustments to the assets and liabilities impact directly on reorganization capital.

Required:

Required:Record in journal form the following elements of the reorganization agreement. Assume that the adjustments to the assets and liabilities impact directly on reorganization capital.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

39

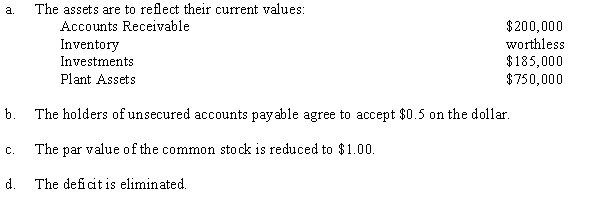

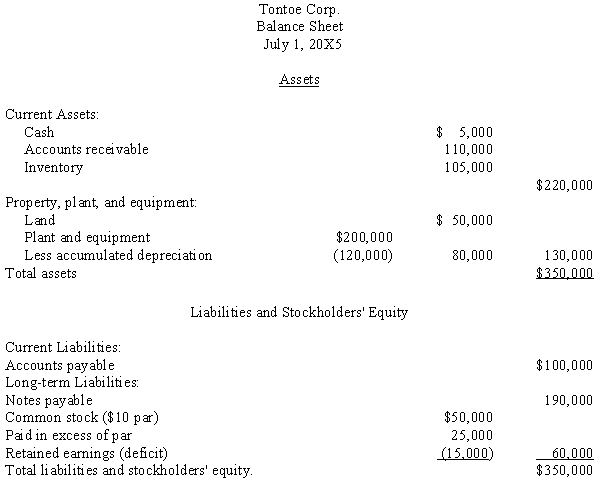

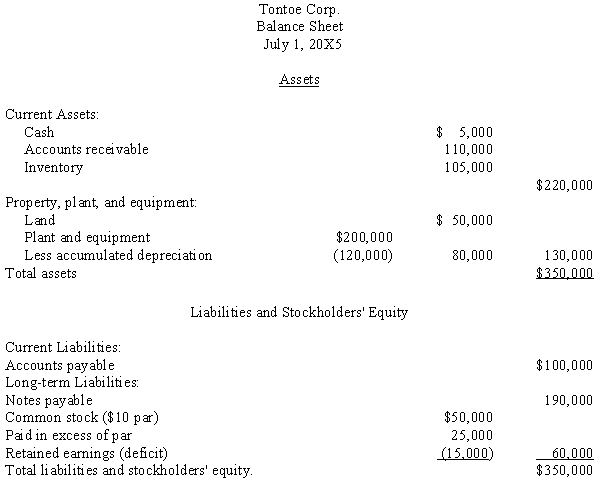

Following is the balance sheet of Tontoe Corporation on July 1, 20X5, just prior to obtaining the required stockholder approval to undergo a quasi-reorganization:

Required:

Required:

Prepare the journal entries necessary to record the following items that were part of the quasi-reorganization:

a.

Inventory is to be reduced to its fair market value of $90,000.

b.

The plant and equipment is to be revalued to $70,000 through the Accumulated Depreciation account.

c.

Par value of the stock is reduced to $1 per share and the deficit is eliminated.

Required:

Required:Prepare the journal entries necessary to record the following items that were part of the quasi-reorganization:

a.

Inventory is to be reduced to its fair market value of $90,000.

b.

The plant and equipment is to be revalued to $70,000 through the Accumulated Depreciation account.

c.

Par value of the stock is reduced to $1 per share and the deficit is eliminated.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

40

Port Corporation is a parent, having purchased 80% of Sand Company's common stock at par value for $800,000. Sand Company is in financial difficulty. The parent granted an unsecured loan of $400,000 to the subsidiary. An accounting statement of affairs for Sand Company shows a dividend of 40%. Port Corporation can expect to receive payment for its investment in Sand Company of approximately ____.

A) $640,000

B) $320,000

C) $160,000

D) $0

A) $640,000

B) $320,000

C) $160,000

D) $0

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

41

Describe the options that are available to a corporation that is unable to service its debts on a timely basis but that does NOT require court action.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

42

Describe the duties of the trustee in a Chapter 7 liquidation.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

43

Differentiate by function the Accounting Statement of Affairs and the Statement of Realization and Liquidation.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

44

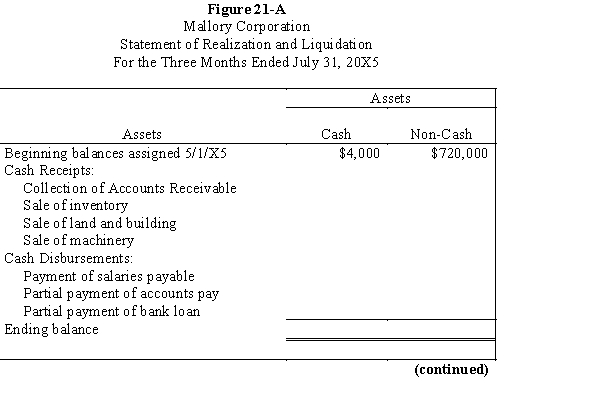

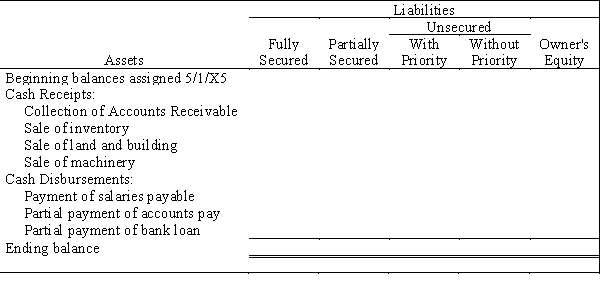

Mallory Corporation is being liquidated under Chapter 7 of the Bankruptcy Act. On May 1, 20X5, you are appointed the court's trustee for the liquidation. The book values for assets and liabilities, on May 1, 20X5, were as follows:

During May through July of 20X5, the following occurred:

During May through July of 20X5, the following occurred:

The mortgage is secured by the land and building and the bank loan is secured by the machinery. The accounts payable are secured by the inventories.

Three-fourths of the accounts receivable were collected. Of the remaining accounts, $10,000 are believed to be uncollectible.

The inventories were sold for $170,000.

The land and building were sold for $20,000 and assumption of the mortgage. The machinery sold for $70,000 and the proceeds were remitted to the bank.

Salaries payable and $170,000 of the accounts payable were paid.

Required:

Complete Figure 21-A: Statement of Realization and Liquidation for May, June, and July of 20X5.

During May through July of 20X5, the following occurred:

During May through July of 20X5, the following occurred:The mortgage is secured by the land and building and the bank loan is secured by the machinery. The accounts payable are secured by the inventories.

Three-fourths of the accounts receivable were collected. Of the remaining accounts, $10,000 are believed to be uncollectible.

The inventories were sold for $170,000.

The land and building were sold for $20,000 and assumption of the mortgage. The machinery sold for $70,000 and the proceeds were remitted to the bank.

Salaries payable and $170,000 of the accounts payable were paid.

Required:

Complete Figure 21-A: Statement of Realization and Liquidation for May, June, and July of 20X5.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck