Deck 7: Accounting Periods and Methods and Depreciation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 7: Accounting Periods and Methods and Depreciation

1

If a loss from sale or exchange of property between related parties is disallowed and the property is subsequently sold to an unrelated party,

A)An amended return may be filed to claim the loss previously disallowed.

B)The original seller may claim the loss previously disallowed.

C)The disallowed loss may be used to offset a gain on the subsequent sale.

D)The disallowed loss may be used if there is a further loss on the subsequent sale.

E)The disallowed loss is lost forever.

A)An amended return may be filed to claim the loss previously disallowed.

B)The original seller may claim the loss previously disallowed.

C)The disallowed loss may be used to offset a gain on the subsequent sale.

D)The disallowed loss may be used if there is a further loss on the subsequent sale.

E)The disallowed loss is lost forever.

C

2

During 2011,Don purchases $2,100,000 of construction equipment (7-year property)for use in his business.Don has taxable income from his business of $600,000.What is the maximum amount that Don may deduct under the election to expense?

A)$600,000

B)$500,000

C)$100,000

D)$400,000

E)$242,930

A)$600,000

B)$500,000

C)$100,000

D)$400,000

E)$242,930

D

3

G&M Enterprises purchased a 6,500 pound SUV (not considered a passenger automobile for purposes of the listed property and luxury automobile limitations)on June 1,2011 for use in its business.The SUV,with a cost basis of $29,000,has a 5-year estimated life.It also is 5-year recovery property.How much depreciation and Section 179 expense should be taken on the SUV for the 2011 calendar tax year,assuming G&M Enterprises wishes to maximize its deduction? Do not consider bonus depreciation.

A)$25,000

B)$4,000

C)$5,800

D)$2,917

E)$25,800

A)$25,000

B)$4,000

C)$5,800

D)$2,917

E)$25,800

E

4

In regards to accounting methods:

A)The accrual method requires income to be recognized when money is received.

B)The business must make an election for its overall method of accounting when filing its first tax return.

C)The business may change accounting methods on its tax return anytime.

D)The cash method requires the deduction of expenses when all activities related to the expense have been performed.

A)The accrual method requires income to be recognized when money is received.

B)The business must make an election for its overall method of accounting when filing its first tax return.

C)The business may change accounting methods on its tax return anytime.

D)The cash method requires the deduction of expenses when all activities related to the expense have been performed.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not a true statement about "listed" property?

A)An ambulance is "listed" property.

B)A taxpayer can elect to expense an asset if its business use is greater than 50 percent.

C)If business use drops below 50 percent,then the prior years' excess depreciation must be added to income.

D)A taxpayer must use straight- line depreciation if the business use is below 50 percent.

A)An ambulance is "listed" property.

B)A taxpayer can elect to expense an asset if its business use is greater than 50 percent.

C)If business use drops below 50 percent,then the prior years' excess depreciation must be added to income.

D)A taxpayer must use straight- line depreciation if the business use is below 50 percent.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Section 197 intangibles:

A)Are amortized over 5 years.

B)Include computer software available for purchase by the general public.

C)Are not subject to accelerated depreciation.

D)May be amortized using the mid-quarter convention.

A)Are amortized over 5 years.

B)Include computer software available for purchase by the general public.

C)Are not subject to accelerated depreciation.

D)May be amortized using the mid-quarter convention.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Coral purchased a personal auto for $35,000 during 2011.She uses it for 90 percent business use.How much depreciation may she take for 2011? Assume she elects out of the bonus depreciation provisions.

A)$2,754

B)$3,060

C)$6,300

D)$7,000

A)$2,754

B)$3,060

C)$6,300

D)$7,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Wonton Foods is a partnership owned 40 percent by Sze-Ern,25 percent by Quinquang,and 35 percent by Zhaou.Sze-Ern and Zhaou each have an October 31 tax year-end,while Quinquang has a February 28 tax year-end.Under the general rule,what tax year-end should the partnership adopt?

A)December 31

B)February 28

C)November 30

D)October 31 or January 31

E)October 31

A)December 31

B)February 28

C)November 30

D)October 31 or January 31

E)October 31

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

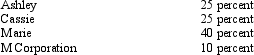

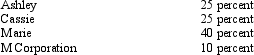

The shareholders of the Cat Corporation are:  Ashley and Cassie are sisters.Marie is not related to Ashley and Cassie.The M Corporation is owned 50 percent by Ashley and 50 percent by Tim,an unrelated party.

Ashley and Cassie are sisters.Marie is not related to Ashley and Cassie.The M Corporation is owned 50 percent by Ashley and 50 percent by Tim,an unrelated party.

What is Ashley's deemed ownership percentage in the Cat Corporation?

A)25 percent

B)30 percent

C)50 percent

D)55 percent

Ashley and Cassie are sisters.Marie is not related to Ashley and Cassie.The M Corporation is owned 50 percent by Ashley and 50 percent by Tim,an unrelated party.

Ashley and Cassie are sisters.Marie is not related to Ashley and Cassie.The M Corporation is owned 50 percent by Ashley and 50 percent by Tim,an unrelated party.What is Ashley's deemed ownership percentage in the Cat Corporation?

A)25 percent

B)30 percent

C)50 percent

D)55 percent

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Rickie purchased a house for $300,000.$250,000 of the $300,000 is for the building and $50,000 is for the land.He rents it out on April 1,2011 to the Wilson family.How much depreciation can he take for 2011?

A)$4,548

B)$6,410

C)$6,440

D)$9,090

A)$4,548

B)$6,410

C)$6,440

D)$9,090

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

In 2011,Walter purchased a $75,000 milling machine during the year,planning to write off $40,000 as a Section 179 expense.He had taxable income before depreciation of $40,000,and will depreciate the remaining $35,000 over a 5-year period.

A)The total amount of the $75,000 Walter can write off in 2011 is $47,000.

B)He can write off $40,000 as a Section 179 expense,but cannot take additional depreciation as his taxable income before depreciation is only $40,000.

C)He can take depreciation of $7,000 and $40,000 of Section 179 write-off,creating a $7,000 loss after depreciation.

D)He can take $7,000 in depreciation and $33,000 of Section 179 write-off,but the remaining $7,000 of Section 179 write-off must be allocated over the remaining life of the asset.

E)In 2012,if his taxable income before depreciation is sufficient,he can take the second year-depreciation on the $35,000 not immediately written off plus $7,000 of Section 179 write-off that could not be used in the prior year.

A)The total amount of the $75,000 Walter can write off in 2011 is $47,000.

B)He can write off $40,000 as a Section 179 expense,but cannot take additional depreciation as his taxable income before depreciation is only $40,000.

C)He can take depreciation of $7,000 and $40,000 of Section 179 write-off,creating a $7,000 loss after depreciation.

D)He can take $7,000 in depreciation and $33,000 of Section 179 write-off,but the remaining $7,000 of Section 179 write-off must be allocated over the remaining life of the asset.

E)In 2012,if his taxable income before depreciation is sufficient,he can take the second year-depreciation on the $35,000 not immediately written off plus $7,000 of Section 179 write-off that could not be used in the prior year.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following assets is considered "listed" property?

A)A computer used only at Nintendo's headquarters.

B)A U-Haul truck.

C)An office desk at the local Ford dealer.

D)Al Spitzer's personal BMW which he uses to drive to and from client meetings.

A)A computer used only at Nintendo's headquarters.

B)A U-Haul truck.

C)An office desk at the local Ford dealer.

D)Al Spitzer's personal BMW which he uses to drive to and from client meetings.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

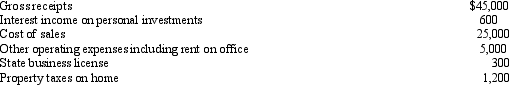

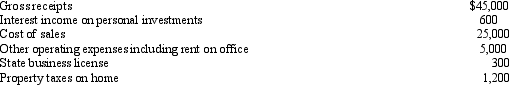

From the records of Ted,a cash basis sole proprietor,the following information was available:  What amount should Ted report as net earnings from self-employment?

What amount should Ted report as net earnings from self-employment?

A)$15,000

B)$13,500

C)$14,100

D)$14,700

E)$12,900

What amount should Ted report as net earnings from self-employment?

What amount should Ted report as net earnings from self-employment?A)$15,000

B)$13,500

C)$14,100

D)$14,700

E)$12,900

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

Depreciation

A)Should only be used if the asset will depreciate in value.

B)Is used instead of tracking maintenance expense.

C)Is calculated on all assets,even land.

D)Is the accounting process of allocating and deducting the cost of an asset over a period of years.

A)Should only be used if the asset will depreciate in value.

B)Is used instead of tracking maintenance expense.

C)Is calculated on all assets,even land.

D)Is the accounting process of allocating and deducting the cost of an asset over a period of years.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

The Exclusive Uniform partnership has a natural business cycle which corresponds with the school year of July through June.The owners of the shop file their tax return on a calendar year basis.What tax year end can the partnership adopt?

A)The partnership must adopt a calendar year tax year.

B)The partners may adopt either a tax year that ends in June or in December.

C)The partners must adopt a tax year ending in June.

D)The partners may choose to end the tax year in any month they want.

A)The partnership must adopt a calendar year tax year.

B)The partners may adopt either a tax year that ends in June or in December.

C)The partners must adopt a tax year ending in June.

D)The partners may choose to end the tax year in any month they want.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Computers are depreciated over the following number of years under MACRS:

A)3 years

B)5 years

C)7 years

D)10 years

A)3 years

B)5 years

C)7 years

D)10 years

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

On January 1,2011,Ted purchased a small software company for $155,000.He paid $95,000 for the fixed assets of the company and $60,000 for goodwill.How much amortization may Ted deduct on his 2011 tax return for the purchased goodwill?

A)$155,000

B)$60,000

C)$95,000

D)$2,000

E)$4,000

A)$155,000

B)$60,000

C)$95,000

D)$2,000

E)$4,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

An asset other than an SUV or a passenger automobile is placed in service on June 1,2011,and has a depreciable basis of $506,000.The asset is in the 7-year recovery class and the business has an $800,000 profit for the year.What is the maximum depreciation deduction that may be claimed for 2011,including the election to expense? Do not consider bonus depreciation.

A)$500,000

B)$500,500

C)$21,333

D)$500,857

E)$500,429

A)$500,000

B)$500,500

C)$21,333

D)$500,857

E)$500,429

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

On January 1,2011,Rusty,a sole proprietor,purchased for use in his business a new production machine (7-year property)at a cost of $60,000.Rusty did not purchase any other property during 2011 and has net income from his business of $80,000.The standard double-declining balance recovery period table would allow $8,574 of depreciation expense on the $60,000 of equipment purchased in 2011.What is Rusty's maximum depreciation deduction for 2011 if he elects to use a double-declining balance recovery period table,including the amount that could be deducted under the election to expense (Section 179)?

A)$500,000

B)$80,000

C)$68,574

D)$60,000

E)None of the above.

A)$500,000

B)$80,000

C)$68,574

D)$60,000

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Gonzo Inc.is an S corporation that has chosen a fiscal year ending November 30.For the fiscal year ended November 30,2011 Gonzo Inc.had taxable income of $192,000 and the prior year made a required payment of $3,000.What is the amount of the required tax payment that should be made in 2012?

A)$5,760

B)$4,844

C)$2,760

D)$2,400

E)$1,844

A)$5,760

B)$4,844

C)$2,760

D)$2,400

E)$1,844

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck