Deck 8: Capital Gains and Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 8: Capital Gains and Losses

1

In December of 2011,Betty and James (married,filing jointly)have a long-term capital gain of $45,000 on the sale of stock.They have no other capital gains and losses for the year.Their ordinary income for the year after the standard deduction and exemptions is $69,000,making their total taxable income for the year $114,000 ($69,000 + $45,000).In 2011,married taxpayers pay tax of $9,500 (from the tax table)on the first $69,000 of taxable ordinary income and 25 percent on the next taxable income up to $139,350.What is their total tax liability?

A)$22,100

B)$20,750

C)$16,250

D)$9,500

A)$22,100

B)$20,750

C)$16,250

D)$9,500

C

2

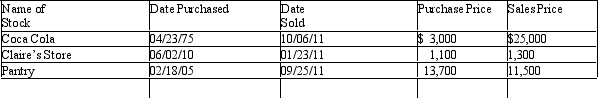

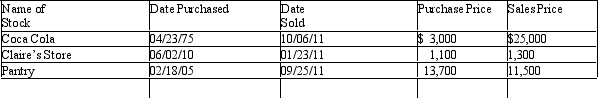

Henry sold the following stock during the year.He is in the 33 percent tax bracket for his ordinary income.How are the stocks reported on Henry's tax return?

A)$19,800 of net long-term gain taxed at zero percent and $200 short-term gain taxed at the 33 percent rate.

B)$19,800 of net long-term gain taxed at 15 percent and $200 short-term gain taxed at the 33 percent rate.

C)Net $20,000 of long-term gain taxed at 15 percent

D)Net $20,000 of long-term gain taxed at 33 percent

A)$19,800 of net long-term gain taxed at zero percent and $200 short-term gain taxed at the 33 percent rate.

B)$19,800 of net long-term gain taxed at 15 percent and $200 short-term gain taxed at the 33 percent rate.

C)Net $20,000 of long-term gain taxed at 15 percent

D)Net $20,000 of long-term gain taxed at 33 percent

B

3

Which of the following is considered a capital asset?

A)Disney stock owned by a taxpayer as an investment.

B)A widget held for resale by the Widget Factory.

C)A cooking grill used by a restaurant.

D)An office building owned and used by IBM.

A)Disney stock owned by a taxpayer as an investment.

B)A widget held for resale by the Widget Factory.

C)A cooking grill used by a restaurant.

D)An office building owned and used by IBM.

A

4

On December 31,2011,Harold,a sole proprietor,sold for $85,000 a machine that was used in his business.The machine had been purchased in 2006 for $60,000,and when it was sold it had an adjusted basis of $45,000.For the year 2011,how should this gain be treated?

A)Ordinary income of $40,000

B)Section 1231 gain of $40,000

C)Section 1231 gain of $15,000 and ordinary income of $25,000

D)Section 1231 gain of $25,000 and ordinary income of $15,000

E)None of the above.

A)Ordinary income of $40,000

B)Section 1231 gain of $40,000

C)Section 1231 gain of $15,000 and ordinary income of $25,000

D)Section 1231 gain of $25,000 and ordinary income of $15,000

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Ponce acquired raw land costing $60,000 as an investment in 1998.In 2011,the land is sold for a total sales price of $150,000,consisting of $30,000 cash and the buyer's note for $120,000.Assume that Ponce uses the installment method to recognize the gain and receives only the $30,000 down payment in the year of sale.How much gain should Ponce recognize in 2011?

A)$90,000

B)$30,000

C)$18,000

D)$12,000

E)$0

A)$90,000

B)$30,000

C)$18,000

D)$12,000

E)$0

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Choose the true statement regarding like-kind exchanges..

A)A taxpayer is not required to file any forms if there is no gain recognized in a like-kind exchange.

B)In a like-kind exchange,the holding period for the new asset starts when the exchange is completed.

C)Personal residences are a type of property which can be exchanged tax-free under the like-kind exchange rules.

D)Gain is recognized in the amount equal to the lesser of the gain realized or to the extent that "boot" was received.

A)A taxpayer is not required to file any forms if there is no gain recognized in a like-kind exchange.

B)In a like-kind exchange,the holding period for the new asset starts when the exchange is completed.

C)Personal residences are a type of property which can be exchanged tax-free under the like-kind exchange rules.

D)Gain is recognized in the amount equal to the lesser of the gain realized or to the extent that "boot" was received.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

The adjusted basis of an asset may be determined by the:

A)Selling price + gain realized

B)Selling price + gain recognized

C)Selling price + capital improvements - accumulated depreciation + cost.

D)Original basis + capital improvements - selling price

E)Selling price - gain realized

A)Selling price + gain realized

B)Selling price + gain recognized

C)Selling price + capital improvements - accumulated depreciation + cost.

D)Original basis + capital improvements - selling price

E)Selling price - gain realized

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Patrick inherited his mother's house.The house cost his mother $45,000 and was valued at the date of her death at $325,000.Patrick spent $20,000 adding new carpet and improvements to the house.He rented the house for several years and deducted $35,000 for depreciation.Patrick then sold the house for $355,000.He paid $22,000 in selling costs.What is the gain or the loss on the sale of the home?

A)A $12,000 loss.

B)A $23,000 gain.

C)A $45,000 gain.

D)A $303,000 gain.

A)A $12,000 loss.

B)A $23,000 gain.

C)A $45,000 gain.

D)A $303,000 gain.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is true about capital assets?

A)Real property used in a trade or business is a capital asset.

B)Capital losses may be carried back 3 years to offset capital gains in those years.

C)For 2011,net long-term capital losses are granted preferential tax rates.

D)Individual taxpayers may deduct net capital gains of up to $3,000 per year.

E)Shares of stock held for investment are capital assets.

A)Real property used in a trade or business is a capital asset.

B)Capital losses may be carried back 3 years to offset capital gains in those years.

C)For 2011,net long-term capital losses are granted preferential tax rates.

D)Individual taxpayers may deduct net capital gains of up to $3,000 per year.

E)Shares of stock held for investment are capital assets.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

The provisions for involuntary conversion:

A)Apply to gains only,not losses.

B)Require taxpayers to always defer gains.

C)State that the property must be replaced within the year following the conversion.

D)Require that gain is recognized in an amount equal to the lesser of the gain realized or to the extent that "boot" was received.

A)Apply to gains only,not losses.

B)Require taxpayers to always defer gains.

C)State that the property must be replaced within the year following the conversion.

D)Require that gain is recognized in an amount equal to the lesser of the gain realized or to the extent that "boot" was received.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

During 2007,Cody purchased an automobile for $35,000 which he has used 100 percent for business.On May 27,2011,he sells the car for $30,000.He has claimed $6,000 of depreciation.Cody:

A)Has a $5,000 loss which he can deduct on his tax return.

B)Has a $5,000 loss,but since it is a loss,he can not recognize it on his tax return.

C)Has a $1,000 gain which will be taxed at capital gains rates.

D)Must recognize a $1,000 gain which will be taxed at ordinary tax rates.

A)Has a $5,000 loss which he can deduct on his tax return.

B)Has a $5,000 loss,but since it is a loss,he can not recognize it on his tax return.

C)Has a $1,000 gain which will be taxed at capital gains rates.

D)Must recognize a $1,000 gain which will be taxed at ordinary tax rates.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is a rule related to the exclusion of gain on the sale of a personal residence?

A)In general,to exclude the gain from the sale of a personal residence,the home must be used as a personal residence within the last 3 years.

B)The gain exclusion is either $250,000 ($500,000 if married)or nothing.

C)If the taxpayer has not used and owned the house for the designated time,then the taxpayer may still qualify if he/she had unforeseen circumstances.Unforeseen circumstances include divorce,multiple births,and inability to pay the mortgage due to a change in employment.

D)After May 6,1997,a taxpayer may exclude $125,000 of the gain if they are over the age of 55.

A)In general,to exclude the gain from the sale of a personal residence,the home must be used as a personal residence within the last 3 years.

B)The gain exclusion is either $250,000 ($500,000 if married)or nothing.

C)If the taxpayer has not used and owned the house for the designated time,then the taxpayer may still qualify if he/she had unforeseen circumstances.Unforeseen circumstances include divorce,multiple births,and inability to pay the mortgage due to a change in employment.

D)After May 6,1997,a taxpayer may exclude $125,000 of the gain if they are over the age of 55.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Kay,a single taxpayer,bought her home in Montecito 30 years ago for $45,000.She has lived continuously in the home since she purchased it.In December,2011,she sells her home for $550,000.What is Kay's taxable gain on the sale?

A)$5,000

B)$505,000

C)$300,000

D)$255,000

A)$5,000

B)$505,000

C)$300,000

D)$255,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

If a capital asset were purchased on May 9,2010 and sold on February 24,2011 for a gain and this were the only capital asset sold during the year,then the capital asset is treated as:

A)A long-term asset and will be taxed using capital gains rate.

B)A long-term asset and will be taxed using ordinary income tax rate.

C)A short-term asset and will be taxed using capital gains rate.

D)A short-term asset and will be taxed using ordinary income tax rate.

A)A long-term asset and will be taxed using capital gains rate.

B)A long-term asset and will be taxed using ordinary income tax rate.

C)A short-term asset and will be taxed using capital gains rate.

D)A short-term asset and will be taxed using ordinary income tax rate.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

On August 15,2010,Susie sold a piece of property for $250,000 which she originally purchased for $50,000.She was paid $50,000 in cash and received an 8 percent note.The note is payable at $10,000 per year for 20 years starting on August 15,2011 plus interest.Assuming that Susie uses the installment method,how much is her capital gain for 2011,the second year of the installment sale?

A)None.Susie recognized all the gain in 2010.

B)$2,000

C)$8,000

D)$10,000

A)None.Susie recognized all the gain in 2010.

B)$2,000

C)$8,000

D)$10,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Thomas has a casualty gain of $3,000 and a casualty loss of $8,400,before the $100 floor and before the adjusted gross income limitation.The gain and loss were the result of two separate casualties occurring during 2011 and both properties were personal-use assets.If Thomas itemizes deductions on his 2011 return,and has adjusted gross income of $30,000,what is Thomas's gain or loss (deduction)as a result of these casualties?

A)$8,300 itemized deduction,$3,000 capital gain

B)$5,300 itemized deduction

C)$2,300 itemized deduction

D)$2,300 itemized deduction,$3,000 capital gain

E)$700 capital gain

A)$8,300 itemized deduction,$3,000 capital gain

B)$5,300 itemized deduction

C)$2,300 itemized deduction

D)$2,300 itemized deduction,$3,000 capital gain

E)$700 capital gain

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

In January 2011,Keystone Trucking Company exchanged an old truck,which cost $74,000 and had accumulated depreciation of $38,000,for a new truck having a fair market value of $82,000.In connection with the exchange,Keystone paid $40,000 in cash.What is the tax basis of the new truck?

A)$74,000

B)$82,000

C)$76,000

D)$78,000

E)$40,000

A)$74,000

B)$82,000

C)$76,000

D)$78,000

E)$40,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

In 2011,Philippe,a single taxpayer,has taxable income of $40,000 exclusive of capital gains and losses.Philippe incurred a $2,000 short-term capital loss and a $6,000 long-term capital loss in 2011.What is the amount of his long-term capital loss carryover to 2012?

A)$0

B)$2,000

C)$3,000

D)$5,000

E)$6,000

A)$0

B)$2,000

C)$3,000

D)$5,000

E)$6,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

The U.S.government decides to build a freeway.Unfortunately,Jim's office building lies directly in the path of the new freeway.The government acquires the property from Jim for $175,000.Jim originally purchased the building 3 years ago for $125,000.If Jim purchases a new building in the following year for $165,000:

A)Jim must recognize $50,000 of the gain.

B)Jim's basis in the new property is $125,000.

C)Jim does not qualify for involuntary conversion.

D)Jim will be able to defer all of the gain.

A)Jim must recognize $50,000 of the gain.

B)Jim's basis in the new property is $125,000.

C)Jim does not qualify for involuntary conversion.

D)Jim will be able to defer all of the gain.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Burt purchased an apartment building on January 1,1998,for $345,000.The building has been depreciated over the appropriate recovery period using the straight-line method.On December 31,2011,the building was sold for $420,000,when the accumulated depreciation was $126,500.On his 2011 tax return,Burt should report:

A)Section 1231 gain of $75,000 and ordinary income of $126,500

B)Section 1231 gain of $126,500 and ordinary income of $75,000

C)Ordinary income of $201,500

D)Section 1231 gain of $75,000 and unrecaptured depreciation of $126,500

E)None of the above.

A)Section 1231 gain of $75,000 and ordinary income of $126,500

B)Section 1231 gain of $126,500 and ordinary income of $75,000

C)Ordinary income of $201,500

D)Section 1231 gain of $75,000 and unrecaptured depreciation of $126,500

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck