Deck 6: Credits and Special Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 6: Credits and Special Taxes

1

Courtney and Ralph are married,file a joint return,and have two dependent children,ages 10 and 12.Their combined income is $114,000.By how much is their child credit reduced in 2011?

A)$1,000

B)$500

C)$-0-

D)$2,000

E)$200

A)$1,000

B)$500

C)$-0-

D)$2,000

E)$200

E

2

Which of the following statements is not correct?

A)The American Opportunity credit and the lifetime learning credit are both phased out at different levels of adjusted gross income.

B)Expenses paid for room and board do not qualify.

C)Taxpayers can take both the American Opportunity credit and the lifetime learning credit for the same student in the same year.

D)The persons who claim the students as dependents can claim the educational credit.

E)All the statements are correct.

A)The American Opportunity credit and the lifetime learning credit are both phased out at different levels of adjusted gross income.

B)Expenses paid for room and board do not qualify.

C)Taxpayers can take both the American Opportunity credit and the lifetime learning credit for the same student in the same year.

D)The persons who claim the students as dependents can claim the educational credit.

E)All the statements are correct.

C

3

In regards to the alternative minimum tax (AMT):

A)State income tax refunds are not considered income since state income taxes are not allowed as a deduction for AMT.

B)To calculate AMT,a taxpayer can only use the standard deduction.

C)The alternative minimum tax uses the same tax rates as the regular income taxes.

D)A taxpayer may choose to calculate AMT instead of using the regular tax rates.

A)State income tax refunds are not considered income since state income taxes are not allowed as a deduction for AMT.

B)To calculate AMT,a taxpayer can only use the standard deduction.

C)The alternative minimum tax uses the same tax rates as the regular income taxes.

D)A taxpayer may choose to calculate AMT instead of using the regular tax rates.

A

4

Mr.and Mrs.Darling are in the process of adopting two children.Their adjusted gross income for 2011 is $135,000. During 2011,their adoption of a baby girl from Florida became finalized.They paid adoption expenses of $5,000 during 2010 and $7,000 during 2011.

The Darlings also paid $2,500 during 2010 and $4,000 during 2011 for the adoption of a boy from South Carolina.This adoption is not finalized until 2012.

On their 2011 tax return,how much may the Darlings take as an adoption credit?

A)$7,500

B)$13,360

C)$14,500

D)$20,500

The Darlings also paid $2,500 during 2010 and $4,000 during 2011 for the adoption of a boy from South Carolina.This adoption is not finalized until 2012.

On their 2011 tax return,how much may the Darlings take as an adoption credit?

A)$7,500

B)$13,360

C)$14,500

D)$20,500

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

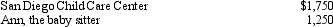

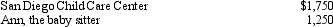

Marge and Lester file a joint tax return for 2011,with adjusted gross income of $33,000.Marge and Lester earned income of $20,000 and $12,000 respectively,during 2011.In order for Marge to be gainfully employed,they pay the following child care expenses for their 4-year-old son,Kevin:  Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

A)$0

B)$780

C)$1,250

D)$1,750

E)$3,000

Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?A)$0

B)$780

C)$1,250

D)$1,750

E)$3,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following lists only community property states?

A)Arizona,Nevada,Texas

B)California,Oregon,Washington

C)Massachusetts,New Mexico,Washington

D)Idaho,Louisiana,North Carolina

A)Arizona,Nevada,Texas

B)California,Oregon,Washington

C)Massachusetts,New Mexico,Washington

D)Idaho,Louisiana,North Carolina

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

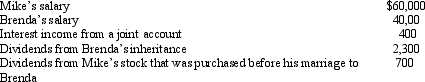

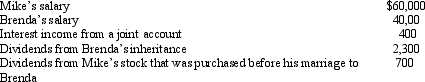

Brenda and Mike are married and live in Washington.They have the following income:  If Mike and Brenda file separate returns,how much income would Brenda report on her federal tax return?

If Mike and Brenda file separate returns,how much income would Brenda report on her federal tax return?

A)$41,700

B)$42,500

C)$51,700

D)$52,500

If Mike and Brenda file separate returns,how much income would Brenda report on her federal tax return?

If Mike and Brenda file separate returns,how much income would Brenda report on her federal tax return?A)$41,700

B)$42,500

C)$51,700

D)$52,500

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

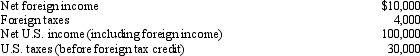

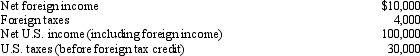

Mr.French had the following income and taxes:  Calculate the amount of the foreign tax credit.

Calculate the amount of the foreign tax credit.

A)The current year foreign tax credit is $400.

B)The current year foreign tax credit is $10,000.

C)The current year foreign tax credit is $3,000.

D)The current year foreign tax credit is $4,000.

Calculate the amount of the foreign tax credit.

Calculate the amount of the foreign tax credit.A)The current year foreign tax credit is $400.

B)The current year foreign tax credit is $10,000.

C)The current year foreign tax credit is $3,000.

D)The current year foreign tax credit is $4,000.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

In order to qualify for the child tax credit of $1,000 per child (before any phase-out),

A)The child must be under age 14.

B)The child can be a citizen of Mexico.

C)The child must be a "qualifying child".

D)The child may claim his/her own personal exemption on his/her own tax return.

A)The child must be under age 14.

B)The child can be a citizen of Mexico.

C)The child must be a "qualifying child".

D)The child may claim his/her own personal exemption on his/her own tax return.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Which of these statements concerning the alternative minimum tax (AMT)is correct?

A)The alternative minimum tax rate for capital gains and dividends is 26 percent.

B)Married taxpayers are allowed an exemption allowance,regardless of their level of alternative minimum taxable income.

C)The alternative minimum tax credit rate is 26 percent.

D)For married taxpayers,the alternative minimum tax rate is 26 percent of the first $175,000.

E)If the tentative minimum tax is smaller than the regular tax,he or she must pay the alternative minimum tax.

A)The alternative minimum tax rate for capital gains and dividends is 26 percent.

B)Married taxpayers are allowed an exemption allowance,regardless of their level of alternative minimum taxable income.

C)The alternative minimum tax credit rate is 26 percent.

D)For married taxpayers,the alternative minimum tax rate is 26 percent of the first $175,000.

E)If the tentative minimum tax is smaller than the regular tax,he or she must pay the alternative minimum tax.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

In the case of the adoption of a child who is a U.S.citizen or resident of the U.S. ,the credit for qualified adoption expenses incurred over several years is available:

A)In the first year the expenses are paid.

B)Each year expenses are paid.

C)In the last year expenses are paid although the adoption is not yet final.

D)In the year the adoption becomes final for expenses incurred in that year and the prior year.

A)In the first year the expenses are paid.

B)Each year expenses are paid.

C)In the last year expenses are paid although the adoption is not yet final.

D)In the year the adoption becomes final for expenses incurred in that year and the prior year.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Leonard is a junior at ESU and his parents have a 2011 tax liability of $6,000 before taking into account the American Opportunity credit.Leonard's parents paid $2,500 in qualifying expenses.Leonard was a full-time student,and was claimed as a dependent by his parents.What is the amount of the American Opportunity credit allowed on the parents' 2011 tax return? Assume there is no income limitation.

A)$2,125

B)$2,500

C)$625

D)$2,000

E)$-0-

A)$2,125

B)$2,500

C)$625

D)$2,000

E)$-0-

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Mr.and Mrs.Brown adopted a child in 2011.During 2011,Mrs.Brown's employer pays $3,000 of her adoption expenses.The Browns also pay $12,300 out of their pocket during 2011.Their AGI is $100,000.Which of the following are accurate?

A)The $3,000 of adoption expenses will not be included as wages on Mrs.Brown's W-2 and the Browns will also be able to claim a $12,300 adoption credit on their 2011 tax return.

B)The Browns are entitled only to a $12,300 adoption credit.The $3,000 of adoption expenses will be reflected on Mrs.Brown's W-2 as wages.

C)The Browns may choose between excluding the $3,000 from Mrs.Brown's income and claiming an adoption credit.

D)The Browns will receive a $3,000 exclusion from income and a credit of $10,360.

A)The $3,000 of adoption expenses will not be included as wages on Mrs.Brown's W-2 and the Browns will also be able to claim a $12,300 adoption credit on their 2011 tax return.

B)The Browns are entitled only to a $12,300 adoption credit.The $3,000 of adoption expenses will be reflected on Mrs.Brown's W-2 as wages.

C)The Browns may choose between excluding the $3,000 from Mrs.Brown's income and claiming an adoption credit.

D)The Browns will receive a $3,000 exclusion from income and a credit of $10,360.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

Rick has net taxable income of $20,000 from Country Z which imposes a 40 percent income tax.Rick also has net taxable income from U.S.sources of $80,000,and U.S.tax liability,before the foreign tax credit,of $22,000.What is the amount of Rick's foreign tax credit?

A)$8,000

B)$8,800

C)$5,000

D)$4,400

E)$32,000

A)$8,000

B)$8,800

C)$5,000

D)$4,400

E)$32,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

In 2011,Alexis has income from wages of $17,000,adjusted gross income of $19,000,and tax liability of $200 before the earned income credit.She has one qualifying child.What is the amount of Alexis' earned income credit for 2011?

A)$0

B)$1,000

C)$200

D)$2,721

E)$3,040

A)$0

B)$1,000

C)$200

D)$2,721

E)$3,040

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Nine states have a community property system of marital law.Which of the following statements is correct?

A)Federal law determines how income will be allocated to husband and wife in community property states.

B)Separate property acquired before marriage becomes community property after marriage in community property states.

C)In some states,separate property can give rise to community income.

D)Married couples in community property states filing joint tax returns allocate their income according to state community property laws.

E)Even though the spouses have been living apart for an entire year,personal earnings will generally be treated as having been earned one-half by each spouse.

A)Federal law determines how income will be allocated to husband and wife in community property states.

B)Separate property acquired before marriage becomes community property after marriage in community property states.

C)In some states,separate property can give rise to community income.

D)Married couples in community property states filing joint tax returns allocate their income according to state community property laws.

E)Even though the spouses have been living apart for an entire year,personal earnings will generally be treated as having been earned one-half by each spouse.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Mike and Mindy have two children,Sarah and Jake.Sarah has interest and dividend income of $2,200.Jake has interest and dividend income of $750.For 2011,Mike and Mindy have taxable income of $76,000 which puts them in the 25 percent federal tax bracket.If each child files his/her own tax return,what is Sarah and Jake's tax liability?

A)Sarah's tax liability is $100;Jake's tax liability is $0.

B)Sarah's tax liability is $170;Jake's tax liability is $0.

C)Sarah's tax liability is $170;Jake's tax liability is $95.

D)Sarah's tax liability is $550;Jake's tax liability is $188.

A)Sarah's tax liability is $100;Jake's tax liability is $0.

B)Sarah's tax liability is $170;Jake's tax liability is $0.

C)Sarah's tax liability is $170;Jake's tax liability is $95.

D)Sarah's tax liability is $550;Jake's tax liability is $188.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

The earned income credit:

A)Is a non-refundable credit.

B)Is based upon the adjusted gross income,the number of qualifying children,and the filing status of the taxpayer.

C)Is available no matter what the taxpayer's age.

D)Is available no matter what the source of income as long as the income is below a certain amount.

A)Is a non-refundable credit.

B)Is based upon the adjusted gross income,the number of qualifying children,and the filing status of the taxpayer.

C)Is available no matter what the taxpayer's age.

D)Is available no matter what the source of income as long as the income is below a certain amount.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

In order to claim the child and dependent care credit:

A)The child of divorced parents must be a dependent of the person claiming the credit.

B)The amount of the credit depends upon the taxable income of the taxpayer.

C)Overnight camps count as child care expenses.

D)The dependent must be under age 13 or any age if incapable of self-care.

A)The child of divorced parents must be a dependent of the person claiming the credit.

B)The amount of the credit depends upon the taxable income of the taxpayer.

C)Overnight camps count as child care expenses.

D)The dependent must be under age 13 or any age if incapable of self-care.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Sally and Jack have two children,Thornton (age 13)and Sirah (age 8).For 2011,there is a total parental tax of $5,500 related to the children's income.Thornton's net unearned income is $14,000,while Sirah's net unearned income is $6,000.How much of the parental tax would be allocated to Thornton on his 2011 tax return?

A)$0

B)$1,650

C)$2,750

D)$3,850

E)$5,500

A)$0

B)$1,650

C)$2,750

D)$3,850

E)$5,500

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck