Deck 13: Financial Statement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/145

Play

Full screen (f)

Deck 13: Financial Statement Analysis

1

Trend data can be measured in dollar amounts or percentages

True

2

Vertical analysis is the comparison of a company's financial information over time

False

3

The going-concern assumption is also known as the continuity assumption

True

4

According to the full disclosure principle, financial reports should present detailed information about every transaction

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following analysis techniques does not pertain to changes over time?

A) Trend analysis

B) Horizontal analysis

C) Time-series analysis

D) Vertical analysis

A) Trend analysis

B) Horizontal analysis

C) Time-series analysis

D) Vertical analysis

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

6

The higher the receivables turnover, the slower accounts receivable are being collected

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is not true?

A) Horizontal analyses help financial statement users recognize changes that unfold over time.

B) Vertical analyses focus on relationships between items on the same financial statement.

C) Ratio analyses focus on relationships between items on one or more of the financial statements.

D) Horizontal analyses help financial statement users recognize changes that occur between companies.

A) Horizontal analyses help financial statement users recognize changes that unfold over time.

B) Vertical analyses focus on relationships between items on the same financial statement.

C) Ratio analyses focus on relationships between items on one or more of the financial statements.

D) Horizontal analyses help financial statement users recognize changes that occur between companies.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

8

If the debt-to-assets ratio is 0.63, it means that 37% of the company's financing has been provided by stockholders' equity

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

9

Liquidity measures the ability of a company to meet its current financial obligations

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

10

Horizontal analysis involves:

A) Comparing individual financial statement line items with each other to understand the relationships between line items.

B) Comparing individual financial statement line items to some benchmark, typically similar competitors' financial statement line items.

C) Comparing individual financial statement line items over time.

D) Comparing individual financial statement line items that have been arranged horizontally from highest to lowest dollar amounts.

A) Comparing individual financial statement line items with each other to understand the relationships between line items.

B) Comparing individual financial statement line items to some benchmark, typically similar competitors' financial statement line items.

C) Comparing individual financial statement line items over time.

D) Comparing individual financial statement line items that have been arranged horizontally from highest to lowest dollar amounts.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

11

The fixed asset turnover ratio is a profitability ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

12

Benchmarks are required to evaluate a company's performance

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

13

A company with a high inventory turnover requires a larger investment in inventory than another company of similar sales with a lower inventory turnover

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

14

The higher the times interest earned ratio, the greater the risk of nonpayment of interest

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

15

The general goal of horizontal analyses is to identify significant trends

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

16

The primary objective of external financial reporting is to:

A) enhance the ability of the company to acquire financial capital from external sources.

B) accurately provide financial results for tax purposes.

C) comply with external regulations and requirements of government and professional associations.

D) provide useful information to decision makers, especially investors and creditors.

A) enhance the ability of the company to acquire financial capital from external sources.

B) accurately provide financial results for tax purposes.

C) comply with external regulations and requirements of government and professional associations.

D) provide useful information to decision makers, especially investors and creditors.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

17

Financial statement analysis is useful for:

A) evaluating a company's success in meeting the challenges that it faces.

B) selecting the most appropriate accounting rules to follow.

C) determining the market price of a company's stock.

D) comparing US companies with foreign companies.

A) evaluating a company's success in meeting the challenges that it faces.

B) selecting the most appropriate accounting rules to follow.

C) determining the market price of a company's stock.

D) comparing US companies with foreign companies.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

18

Often loan agreements require the borrower to comply with certain requirements, such as maintaining a particular current ratio or limiting future borrowing. To decide if a company has complied with its loan covenants, a creditor would look at the company's:

A) financial statements.

B) chart of accounts.

C) bank statements.

D) charter.

A) financial statements.

B) chart of accounts.

C) bank statements.

D) charter.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

19

If earnings per share (EPS) decreases, it must mean that the company's net income has fallen

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

20

Horizontal analysis is the comparison of each financial statement amount to another amount on the same financial statement

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

21

Horizontal analysis:

A) is used to identify trends over time.

B) identifies the relative contribution made by each financial statement line item.

C) provides an understanding of the relationships among various items on financial statements.

D) involves comparing amounts across different financial statements.

A) is used to identify trends over time.

B) identifies the relative contribution made by each financial statement line item.

C) provides an understanding of the relationships among various items on financial statements.

D) involves comparing amounts across different financial statements.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

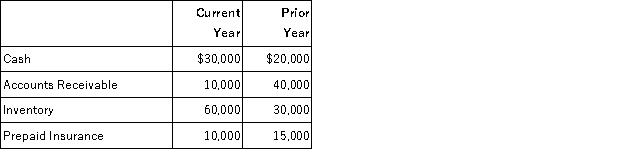

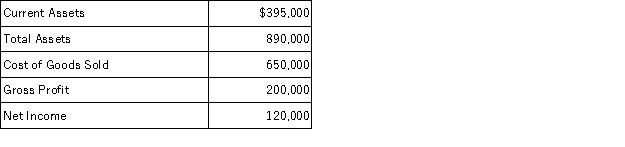

22

Which balance sheet line item has the highest percentage increase from the prior year to the current year?

A) Inventory

B) Cash

C) Accounts receivable

D) Prepaid insurance

A) Inventory

B) Cash

C) Accounts receivable

D) Prepaid insurance

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

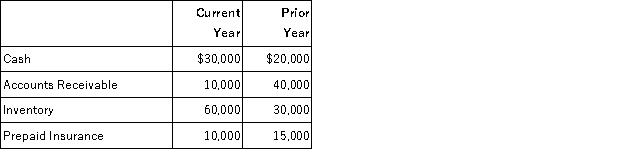

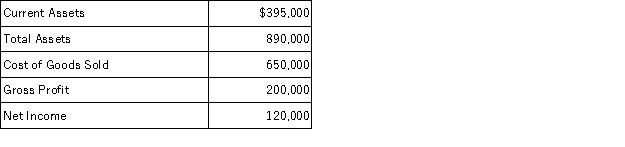

23

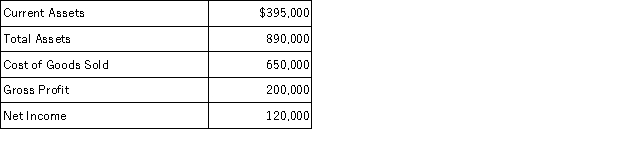

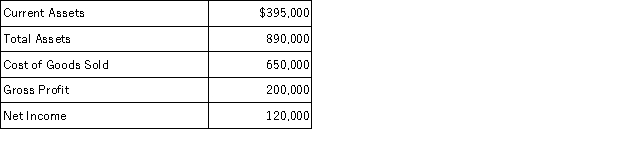

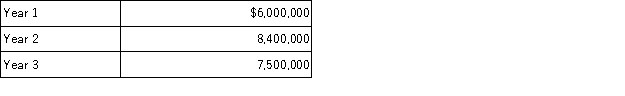

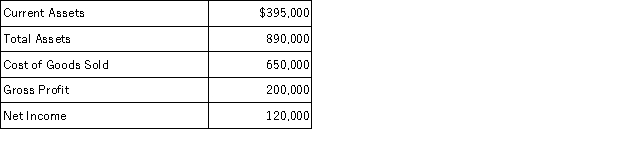

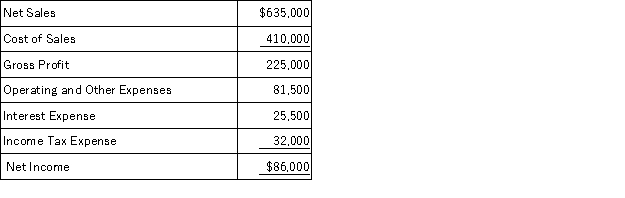

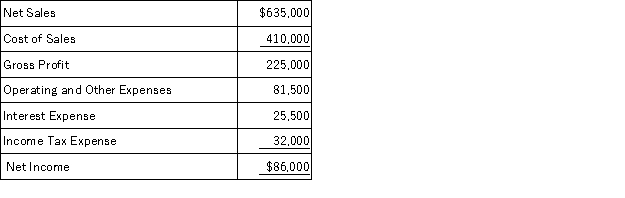

The following information is taken from the financial statements of a company for the current year:  On a common size income statement for this year, what is the percentage that would be shown next to the dollar amount of cost of goods sold?

On a common size income statement for this year, what is the percentage that would be shown next to the dollar amount of cost of goods sold?

A) 76%

B) 24%

C) 31%

D) 18%

On a common size income statement for this year, what is the percentage that would be shown next to the dollar amount of cost of goods sold?

On a common size income statement for this year, what is the percentage that would be shown next to the dollar amount of cost of goods sold?A) 76%

B) 24%

C) 31%

D) 18%

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

24

The following information is taken from the financial statements of a company for the current year:  The gross profit percentage for the current year rounded to the nearest whole percent is closest to:

The gross profit percentage for the current year rounded to the nearest whole percent is closest to:

A) 24%.

B) 76%.

C) 60%.

D) 31%.

The gross profit percentage for the current year rounded to the nearest whole percent is closest to:

The gross profit percentage for the current year rounded to the nearest whole percent is closest to:A) 24%.

B) 76%.

C) 60%.

D) 31%.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

25

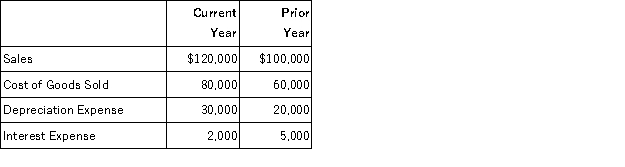

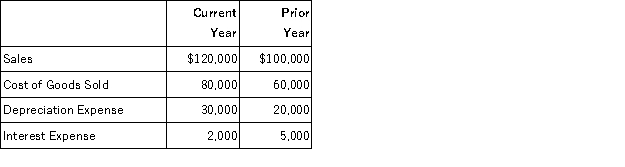

Which income statement line item had the largest percentage increase from the prior year to the current year?

A) Depreciation Expense

B) Cost of Goods Sold

C) Interest Expense

D) Sales

A) Depreciation Expense

B) Cost of Goods Sold

C) Interest Expense

D) Sales

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

26

A company's sales are $285,000 and $200,000 during the current and prior years, respectively. The percentage change is:

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

27

Net income was $418,600 in the current year and $364,000 in the prior year. The year-to-year percentage change in net income is closest to:

A) 15%.

B) 55%.

C) 87%.

D) 13%.

A) 15%.

B) 55%.

C) 87%.

D) 13%.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

28

A trend analysis to determine a year-to-year dollar amount change is calculated by subtracting the:

A) previous period amount from the current amount.

B) current period amount from the previous period amount.

C) current period amount from the previous period amount and then dividing the result by the previous period amount.

D) previous period amount from the current period amount and then dividing the result by the current period amount.

A) previous period amount from the current amount.

B) current period amount from the previous period amount.

C) current period amount from the previous period amount and then dividing the result by the previous period amount.

D) previous period amount from the current period amount and then dividing the result by the current period amount.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

29

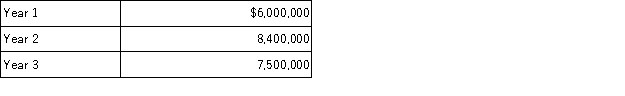

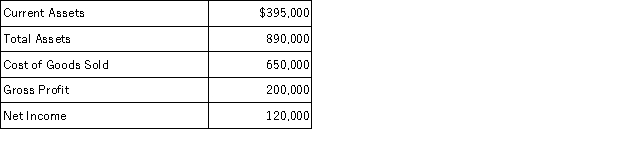

Assume the following sales data for a company:  By what percentage did sales differ between Years 1 and 2 and Years 2 and 3, respectively?

By what percentage did sales differ between Years 1 and 2 and Years 2 and 3, respectively?

A) 40.0% and (10.7%)

B) 28.6% and (12.0%)

C) 40.0% and (15.0%)

D) 32.0% and (10.7%)

By what percentage did sales differ between Years 1 and 2 and Years 2 and 3, respectively?

By what percentage did sales differ between Years 1 and 2 and Years 2 and 3, respectively?A) 40.0% and (10.7%)

B) 28.6% and (12.0%)

C) 40.0% and (15.0%)

D) 32.0% and (10.7%)

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

30

On a common size balance sheet what is the percentage that would be shown next to the dollar amount of current assets?

A) 100%

B) 44%

C) 30%

D) 33%

A) 100%

B) 44%

C) 30%

D) 33%

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

31

A company's comparative balance sheet show total assets of $990,000 and $900,000, for the current and prior years, respectively. The percentage change to be reported in the horizontal analysis is an increase of:

A) 10%.

B) 9%.

C) 5%.

D) 4%.

A) 10%.

B) 9%.

C) 5%.

D) 4%.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

32

In a common size income statement, each item on the income statement is expressed as a percentage of:

A) net income.

B) gross profit.

C) total expenses.

D) sales revenue.

A) net income.

B) gross profit.

C) total expenses.

D) sales revenue.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

33

Vertical analysis:

A) identifies the relative contribution made by each financial statement line item.

B) identifies trends over time.

C) provides an understanding of the relationships among various items on financial statements by expressing the differences in terms of dollars.

D) involves comparing amounts across different financial statements.

A) identifies the relative contribution made by each financial statement line item.

B) identifies trends over time.

C) provides an understanding of the relationships among various items on financial statements by expressing the differences in terms of dollars.

D) involves comparing amounts across different financial statements.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

34

Ratio analysis:

A) is required by GAAP as part of every company's income statement and balance sheet.

B) will always identify the best investment decision.

C) will tell you how a company will perform in the future.

D) allows you to evaluate how well a company has performed relative to other different-sized companies within the same industry.

A) is required by GAAP as part of every company's income statement and balance sheet.

B) will always identify the best investment decision.

C) will tell you how a company will perform in the future.

D) allows you to evaluate how well a company has performed relative to other different-sized companies within the same industry.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements about trend analysis is correct?

A) Time-series analysis is an example of trend analysis.

B) Trend data are always in dollars.

C) Trend analysis is also known as vertical analysis.

D) Common-size analysis is an example of trend analysis.

A) Time-series analysis is an example of trend analysis.

B) Trend data are always in dollars.

C) Trend analysis is also known as vertical analysis.

D) Common-size analysis is an example of trend analysis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

36

The following information pertains to the CJ Company:

A. 12.7%

B. 1.7%

C. 0.6%

D. 0.9%

A. 12.7%

B. 1.7%

C. 0.6%

D. 0.9%

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

37

The following information is taken from the financial statements of a company for the current year:  On a common size income statement for the year, what is the percentage that would be shown next to the dollar amount of sales revenue?

On a common size income statement for the year, what is the percentage that would be shown next to the dollar amount of sales revenue?

A) 100%

B) 14%

C) 60%

D) Cannot be determined

On a common size income statement for the year, what is the percentage that would be shown next to the dollar amount of sales revenue?

On a common size income statement for the year, what is the percentage that would be shown next to the dollar amount of sales revenue?A) 100%

B) 14%

C) 60%

D) Cannot be determined

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

38

In a common size balance sheet, each item on the balance sheet is expressed as a percentage of:

A) total assets.

B) total liabilities.

C) net income.

D) total stockholders' equity.

A) total assets.

B) total liabilities.

C) net income.

D) total stockholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

39

To analyze changes in a company's sales over the last five years, you should perform:

A) vertical analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

A) vertical analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

40

To analyze changes in a company's net income over the last ten years, you should perform:

A) horizontal analysis.

B) vertical analysis.

C) cross-section analysis.

D) ratio analysis.

A) horizontal analysis.

B) vertical analysis.

C) cross-section analysis.

D) ratio analysis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following ratios is used to evaluate solvency?

A) Earnings per share (EPS)

B) Fixed asset turnover

C) Debt-to-assets

D) Current ratio

A) Earnings per share (EPS)

B) Fixed asset turnover

C) Debt-to-assets

D) Current ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following ratios is used to evaluate a company's liquidity?

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Return on equity ratio

D) Current ratio

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Return on equity ratio

D) Current ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

43

If an analyst wanted to assess a company's long-run survival, which of the following categories of ratios would most likely be used?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

A) Liquidity

B) Market share

C) Profitability

D) Solvency

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

44

If an analyst wants to examine a company's short-run ability to survive, which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

A) Liquidity

B) Market share

C) Profitability

D) Solvency

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

45

If you wish to examine how one aspect of a business is doing relative to other aspects of the business at the current time, you are most likely to use:

A) time-series analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

A) time-series analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following ratios is a solvency ratio?

A) Net profit margin ratio

B) Current ratio

C) Fixed asset turnover ratio

D) Debt-to-assets ratio

A) Net profit margin ratio

B) Current ratio

C) Fixed asset turnover ratio

D) Debt-to-assets ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following ratios is used to evaluate solvency?

A) Fixed asset turnover ratio

B) Days to sell ratio

C) Current ratio

D) Times interest earned

A) Fixed asset turnover ratio

B) Days to sell ratio

C) Current ratio

D) Times interest earned

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is not a profitability ratio?

A) Return on equity (ROE)

B) Earnings per share

C) Fixed asset turnover

D) Days to sell

A) Return on equity (ROE)

B) Earnings per share

C) Fixed asset turnover

D) Days to sell

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

49

If an analyst wants to examine a company's current ability to generate income, which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

A) Liquidity

B) Market share

C) Profitability

D) Solvency

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following measures would assist in assessing the profitability of a company?

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Current ratio

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Current ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following measures would assist in assessing the profitability of a company?

A) Fixed asset turnover

B) Times interest earned ratio

C) Inventory turnover ratio

D) Debt-to-assets ratio

A) Fixed asset turnover

B) Times interest earned ratio

C) Inventory turnover ratio

D) Debt-to-assets ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

52

Solvency ratio data are primarily concerned with the ability of a company to:

A) produce profits.

B) maintain long-term survival and repay its debt.

C) manage its cash flow.

D) provide income for stockholders.

A) produce profits.

B) maintain long-term survival and repay its debt.

C) manage its cash flow.

D) provide income for stockholders.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements about liquidity and solvency ratios is correct?

A) Unlike solvency ratios, liquidity ratios relate to the company's long-run survival.

B) Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C) Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D) Solvency ratios include the current ratio and the net profit margin ratio.

A) Unlike solvency ratios, liquidity ratios relate to the company's long-run survival.

B) Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C) Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D) Solvency ratios include the current ratio and the net profit margin ratio.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is a profitability measure?

A) Net income ÷ Revenues

B) Total assets ÷ Total stockholders' equity

C) Total liabilities ÷ Total stockholders' equity

D) Cost of goods sold ÷ Average inventory

A) Net income ÷ Revenues

B) Total assets ÷ Total stockholders' equity

C) Total liabilities ÷ Total stockholders' equity

D) Cost of goods sold ÷ Average inventory

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

55

To perform a vertical analysis of an income statement, you would divide each line item on the statement by:

A) sales.

B) cost of goods sold.

C) operating expenses.

D) net income.

A) sales.

B) cost of goods sold.

C) operating expenses.

D) net income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is a liquidity ratio?

A) Inventory turnover

B) Price/Earnings ratio

C) Net profit margin

D) Times interest earned

A) Inventory turnover

B) Price/Earnings ratio

C) Net profit margin

D) Times interest earned

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following measures would assist in assessing the liquidity of a company?

A) Return on equity

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Times interest earned

A) Return on equity

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Times interest earned

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the measures below is used to assess profitability?

A) Current ratio

B) Debt-to-assets ratio

C) Asset turnover

D) Receivables turnover

A) Current ratio

B) Debt-to-assets ratio

C) Asset turnover

D) Receivables turnover

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

59

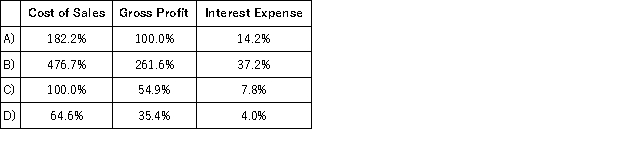

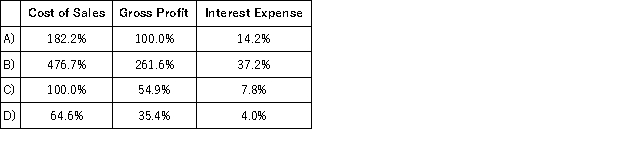

Cotton Products, Inc. prepared its income statement containing the information below. Using vertical analysis, what percentages would apply to cost of sales, gross profit, and interest expense, respectively?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following measures would assist in assessing the solvency of a company?

A) Debt-to-assets

B) Fixed asset turnover

C) Return on equity

D) Current ratio

A) Debt-to-assets

B) Fixed asset turnover

C) Return on equity

D) Current ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

61

Company X has net sales revenue of $1,250,000, cost of goods sold of $760,000, and all other expenses of $290,000. The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets is $361,000. The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000. The fixed asset turnover ratio is closest to:

A) 0.53.

B) 2.50.

C) 3.33.

D) 0.80.

A) 0.53.

B) 2.50.

C) 3.33.

D) 0.80.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

62

In which of the following company attributes would a long-term bond holder be most interested?

A) Quality of earnings

B) Solvency

C) Profitability

D) Liquidity

A) Quality of earnings

B) Solvency

C) Profitability

D) Liquidity

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following actions would likely increase the Return on Equity (ROE)?

A) An increase in the cost of goods sold

B) The purchase of treasury stock

C) Issuing shares of preferred stock

D) An increase in the income tax rate

A) An increase in the cost of goods sold

B) The purchase of treasury stock

C) Issuing shares of preferred stock

D) An increase in the income tax rate

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following ratios is calculated by dividing net income by revenues?

A) Return on equity ratio

B) Net profit margin ratio

C) Current ratio

D) Fixed asset turnover ratio

A) Return on equity ratio

B) Net profit margin ratio

C) Current ratio

D) Fixed asset turnover ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is calculated by dividing net revenue by average net fixed assets?

A) Net profit margin

B) Fixed asset turnover

C) Total asset turnover

D) Current ratio

A) Net profit margin

B) Fixed asset turnover

C) Total asset turnover

D) Current ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

66

A company has a debt-to-assets ratio of 0.45. If the company then borrows cash from the bank to finance a building acquisition, which of the following is a correct statement?

A) The debt-to-assets ratio will be unchanged.

B) The debt-to-assets ratio will increase.

C) The debt-to-assets ratio will decrease.

D) The debt-to-assets ratio will increase as a result of the cash received and then decrease as a result of the building acquisition.

A) The debt-to-assets ratio will be unchanged.

B) The debt-to-assets ratio will increase.

C) The debt-to-assets ratio will decrease.

D) The debt-to-assets ratio will increase as a result of the cash received and then decrease as a result of the building acquisition.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

67

Net revenue divided by average net fixed assets is the calculation for which of the following ratios?

A) Net profit margin

B) Fixed asset turnover

C) Current ratio

D) Return on assets

A) Net profit margin

B) Fixed asset turnover

C) Current ratio

D) Return on assets

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following ratios is calculated by dividing current assets by current liabilities?

A) Quick ratio

B) Solvency ratio

C) Debt ratio

D) Current ratio

A) Quick ratio

B) Solvency ratio

C) Debt ratio

D) Current ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is calculated by dividing net income by revenues?

A) Gross profit margin

B) Current ratio

C) Net profit margin

D) Asset turnover

A) Gross profit margin

B) Current ratio

C) Net profit margin

D) Asset turnover

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

70

Cost of goods sold divided by average inventory is the calculation for which of the following ratios?

A) Net profit margin ratio

B) Current ratio

C) Inventory turnover ratio

D) Fixed asset turnover ratio

A) Net profit margin ratio

B) Current ratio

C) Inventory turnover ratio

D) Fixed asset turnover ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following will increase earnings per share?

A) A ten percent increase in net income and a ten percent increase in the average number of shares of common stock outstanding

B) A ten percent decrease in net income and a ten percent increase in the average number of shares of common stock outstanding

C) A ten percent increase in net income and a ten percent decrease in the average number of shares of common stock outstanding

D) A ten percent decrease in net income and a ten percent decrease in the average number of shares of common stock outstanding

A) A ten percent increase in net income and a ten percent increase in the average number of shares of common stock outstanding

B) A ten percent decrease in net income and a ten percent increase in the average number of shares of common stock outstanding

C) A ten percent increase in net income and a ten percent decrease in the average number of shares of common stock outstanding

D) A ten percent decrease in net income and a ten percent decrease in the average number of shares of common stock outstanding

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is calculated by dividing net sales revenue by average net receivables?

A) Days to sell ratio

B) Current ratio

C) Profit margin

D) Receivables turnover ratio

A) Days to sell ratio

B) Current ratio

C) Profit margin

D) Receivables turnover ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

73

Vesuvius Company has net sales revenue of $780,000, cost of goods sold of $343,200, net income of $119,200, and preferred dividends of $10,000 during the current year. At the beginning of the year, 503,000 shares of common stock were outstanding, and, at the end of the year, 537,000 shares of common stock were outstanding. A total of 1,000 preferred shares were outstanding throughout the year. The company's earnings per share for the current year is closest to:

A) $1.50.

B) $0.84.

C) $0.21.

D) $0.87.

A) $1.50.

B) $0.84.

C) $0.21.

D) $0.87.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

74

During the current accounting period, revenue from credit sales is $671,000. The Accounts Receivable balance is $51,480 at the beginning of the period and $52,200 at the end of the period. Which of the following statements is correct?

A) The receivables turnover ratio is 12.9.

B) On average, it takes 12.9 days to collect payment from credit customers.

C) The receivables turnover ratio is 28.3.

D) On average, the company sells its inventory every 28.3 days.

A) The receivables turnover ratio is 12.9.

B) On average, it takes 12.9 days to collect payment from credit customers.

C) The receivables turnover ratio is 28.3.

D) On average, the company sells its inventory every 28.3 days.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

75

Which ratio is a test of liquidity?

A) Net profit margin

B) Inventory turnover

C) Times interest earned

D) Debt-to-assets

A) Net profit margin

B) Inventory turnover

C) Times interest earned

D) Debt-to-assets

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is calculated by dividing cost of goods sold by average inventory and then dividing this result into 365 days?

A) Inventory turnover

B) Current ratio

C) Days to collect ratio

D) Days to sell ratio

A) Inventory turnover

B) Current ratio

C) Days to collect ratio

D) Days to sell ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

77

Company X has net sales revenue of $780,000, cost of goods sold of $343,200, and all other expenses of $327,600. The gross profit percentage is closest to:

A) 32%.

B) 56%.

C) 86%.

D) 14%.

A) 32%.

B) 56%.

C) 86%.

D) 14%.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is calculated by dividing (net income less preferred dividends) by average common stockholders' equity?

A) Return on assets ratio

B) Return on equity ratio

C) Earnings per share

D) Net profit margin ratio

A) Return on assets ratio

B) Return on equity ratio

C) Earnings per share

D) Net profit margin ratio

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

79

Company X has net sales revenue of $780,000, cost of goods sold of $343,200, and all other expenses of $327,600. The net profit margin is closest to:

A) 0.32.

B) 0.56.

C) 0.86.

D) 0.14.

A) 0.32.

B) 0.56.

C) 0.86.

D) 0.14.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the measures below is used to measure liquidity?

A) Current ratio

B) Debt-to-assets ratio

C) Price ÷ Earnings ratio

D) Times interest earned

A) Current ratio

B) Debt-to-assets ratio

C) Price ÷ Earnings ratio

D) Times interest earned

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck