Deck 18: Income Inequality and Poverty

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 18: Income Inequality and Poverty

1

If permanent income were utilized to measure the income distribution instead of current annual income, the income distribution would appear to be wider.

False

2

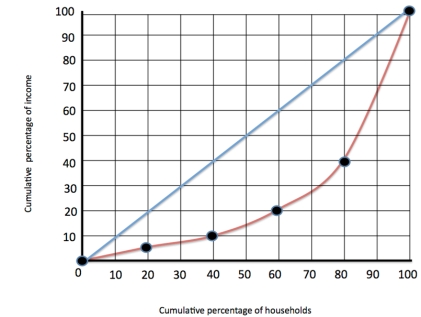

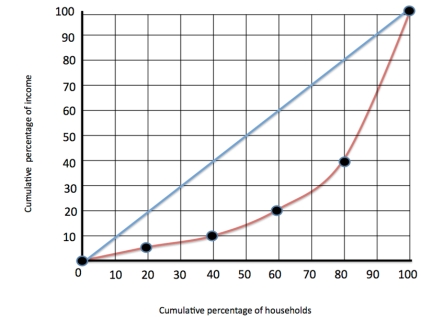

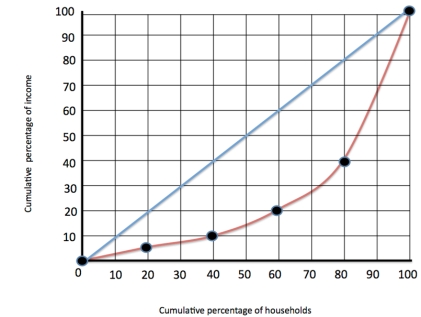

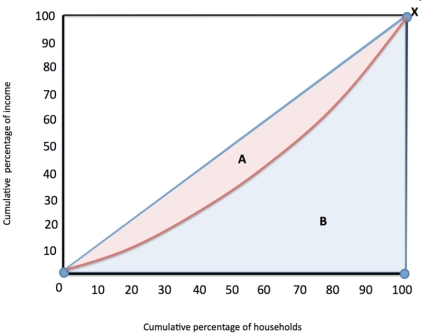

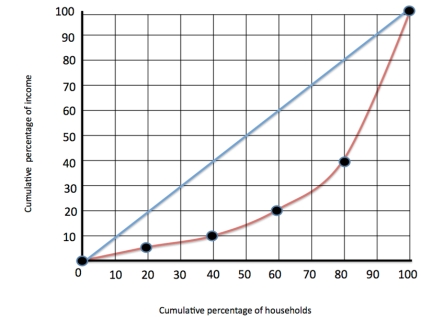

Figure 1  Refer to figure 1. The top 20% of the population have what % of the income

Refer to figure 1. The top 20% of the population have what % of the income

A) 5%

B) 40%

C) 60%

D) 50%

Refer to figure 1. The top 20% of the population have what % of the income

Refer to figure 1. The top 20% of the population have what % of the incomeA) 5%

B) 40%

C) 60%

D) 50%

C

3

The distribution of income in the UK became more equal between 1979 and 2000.

False

4

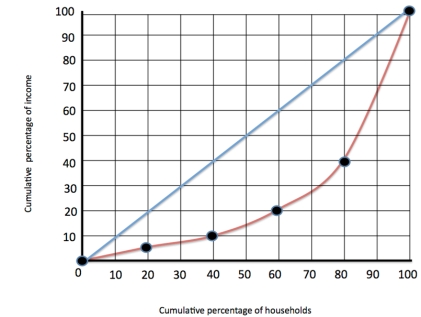

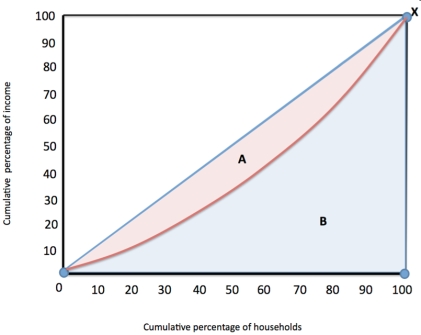

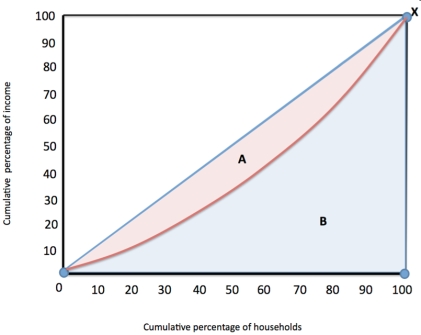

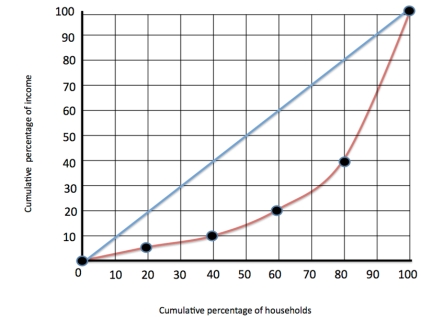

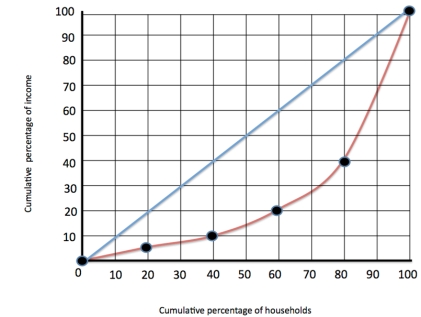

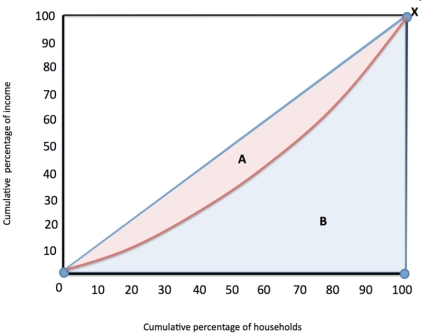

Figure 2  Refer to figure 2. The Gini coefficient is calculated by

Refer to figure 2. The Gini coefficient is calculated by

A) Taking area B from area A

B) Dividing area B by area A

C) Dividing area A + B by area A

D) Dividing A by B

Refer to figure 2. The Gini coefficient is calculated by

Refer to figure 2. The Gini coefficient is calculated byA) Taking area B from area A

B) Dividing area B by area A

C) Dividing area A + B by area A

D) Dividing A by B

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

There is an easy and perfectly acceptable solution to the problem of poverty traps: recipients' benefit income should be reduced more gradually as they increase their earnings.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

It is more efficient for the government to provide in-kind transfers instead of cash payments.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Figure 1  Refer to figure 1. The red line refers to

Refer to figure 1. The red line refers to

A) The Gini coefficient

B) The Lorenz curve

C) The line of perfect inequality

D) The line of perfect equality

Refer to figure 1. The red line refers to

Refer to figure 1. The red line refers toA) The Gini coefficient

B) The Lorenz curve

C) The line of perfect inequality

D) The line of perfect equality

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

A Gini coefficient of .7 suggests a country has a very unequal distribution of income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

When households are divided into deciles, each group covers what percentage of the population?

A) 5%

B) 10%

C) 15%

D) 20%

A) 5%

B) 10%

C) 15%

D) 20%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

Utilitarianism is based on the assumption of diminishing marginal product.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

The political philosophies of utilitarianism and liberalism both suggest that income should be equalized across the population.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Libertarians are more concerned with equal opportunity than with equal outcome.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Figure 1  Refer to figure 1. The middle quintile group earn

Refer to figure 1. The middle quintile group earn

A) 10%

B) 20%

C) 30%

D) 7%

Refer to figure 1. The middle quintile group earn

Refer to figure 1. The middle quintile group earnA) 10%

B) 20%

C) 30%

D) 7%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

The UK Gini coefficient suggests that

A) the UK's inequality levels have change in the last 30 years

B) the UK's income distribution has become more equable.

C) the UK's income distribution has become more unequal.

D) the UK has a very equal distribution of income.

A) the UK's inequality levels have change in the last 30 years

B) the UK's income distribution has become more equable.

C) the UK's income distribution has become more unequal.

D) the UK has a very equal distribution of income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

Figure 2  Refer to figure 2. The Gini coefficient is

Refer to figure 2. The Gini coefficient is

A) zero

B) one

C) Less than 0.3 but higher than 0

D) Over 0.7 but less than 1

Refer to figure 2. The Gini coefficient is

Refer to figure 2. The Gini coefficient isA) zero

B) one

C) Less than 0.3 but higher than 0

D) Over 0.7 but less than 1

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Because of in-kind transfers to the poor and because people's incomes vary from year to year and across their lifetimes, standard measures of income distribution exaggerate the degree of inequality in standards of living.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

Permanent income is

A) Social Security income of the elderly and disabled.

B) the maximum earned during a worker's lifetime.

C) wages fixed by a union or other labour contract.

D) equal to the minimum wage.

E) a person's normal, or average, income.

A) Social Security income of the elderly and disabled.

B) the maximum earned during a worker's lifetime.

C) wages fixed by a union or other labour contract.

D) equal to the minimum wage.

E) a person's normal, or average, income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Figure 1  Refer to figure 1. The blue 45 degree line refers to

Refer to figure 1. The blue 45 degree line refers to

A) The Gini coefficient

B) The Lorenz curve

C) The line of perfect inequality

D) The line of perfect equality

Refer to figure 1. The blue 45 degree line refers to

Refer to figure 1. The blue 45 degree line refers toA) The Gini coefficient

B) The Lorenz curve

C) The line of perfect inequality

D) The line of perfect equality

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

John Rawls argues that economic justice would result if society chose a set of rules for the redistribution of income from behind a "veil of ignorance" and he argues that the set of rules would be the maximin criterion.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

Because in-kind transfers are not accounted for in standard measures of income distribution, the standard measures of income distribution

A) accurately represent the true inequality of living standards.

B) understate the inequality of living standards.

C) exaggerate the inequality of living standards.

D) could exaggerate or understate the inequality of living standards depending on whether the transfers are goods or services.

A) accurately represent the true inequality of living standards.

B) understate the inequality of living standards.

C) exaggerate the inequality of living standards.

D) could exaggerate or understate the inequality of living standards depending on whether the transfers are goods or services.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

If people can borrow and lend to perfectly smooth out their lifetime living standards, then

A) transitory income is a good measure of the distribution of living standards.

B) none of these answers.

C) permanent income is a good measure of the distribution of living standards.

D) life-cycle income is a good measure of the distribution of living standards.

E) current annual income is a good measure of the distribution of living standards.

A) transitory income is a good measure of the distribution of living standards.

B) none of these answers.

C) permanent income is a good measure of the distribution of living standards.

D) life-cycle income is a good measure of the distribution of living standards.

E) current annual income is a good measure of the distribution of living standards.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Current anti-poverty programs discourage work because

A) benefits are reduced at such a high rate when recipients earn more income that there is little or no incentive to work once one is receiving benefits.

B) in order to be eligible for benefits, a recipient cannot have a job.

C) they make recipients more comfortable than most middle-class citizens.

D) anti-poverty programs attract naturally lazy people to begin with.

A) benefits are reduced at such a high rate when recipients earn more income that there is little or no incentive to work once one is receiving benefits.

B) in order to be eligible for benefits, a recipient cannot have a job.

C) they make recipients more comfortable than most middle-class citizens.

D) anti-poverty programs attract naturally lazy people to begin with.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Someone said to live in relative poverty is

A) poor and single, with no relatives.

B) poor relative to their neighbours.

C) unable to access the standard of living considered to be the minimum acceptable standard in their society.

D) unable to access the necessities of life: food, shelter and clothing.

A) poor and single, with no relatives.

B) poor relative to their neighbours.

C) unable to access the standard of living considered to be the minimum acceptable standard in their society.

D) unable to access the necessities of life: food, shelter and clothing.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

John Rawls's suggestion that policy should be directed at maximizing the welfare of the least well off person in society is derived from

A) the idea that people should consider policy as if behind a veil of ignorance as to what their circumstances might be in society, and the idea that as long as there is no theft then there is no need for governments to intervene and redistribute income.

B) the idea that people should consider policy as if behind a veil of ignorance as to what their circumstances might be in society, and the idea that people will then be particularly concerned about the possibility that they might find themselves at the bottom of the income distribution.

C) the idea that people should consider policy as if behind a veil of ignorance as to what their circumstances might be in society, and the ignorant people should be looked after.

D) the idea that everyone in society should have an equal income.

A) the idea that people should consider policy as if behind a veil of ignorance as to what their circumstances might be in society, and the idea that as long as there is no theft then there is no need for governments to intervene and redistribute income.

B) the idea that people should consider policy as if behind a veil of ignorance as to what their circumstances might be in society, and the idea that people will then be particularly concerned about the possibility that they might find themselves at the bottom of the income distribution.

C) the idea that people should consider policy as if behind a veil of ignorance as to what their circumstances might be in society, and the ignorant people should be looked after.

D) the idea that everyone in society should have an equal income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

In-kind transfers are:

A) cash payments made to poor people so that they can buy medical treatment.

B) cash payments made to poor people in excess of what they need.

C) transfers to the poor given in the form of goods and services rather than cash.

D) transfers to the poor given by charities rather than the government.

A) cash payments made to poor people so that they can buy medical treatment.

B) cash payments made to poor people in excess of what they need.

C) transfers to the poor given in the form of goods and services rather than cash.

D) transfers to the poor given by charities rather than the government.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

The philosopher John Rawls argued that

A) people would choose income equality if they had to determine an economic distribution system before knowing their place in it.

B) people would choose income inequality to allow the maximum use of their individual talents.

C) government has a role to ensure income equality to prevent social unrest.

D) people would choose income equality because it is morally right.

A) people would choose income equality if they had to determine an economic distribution system before knowing their place in it.

B) people would choose income inequality to allow the maximum use of their individual talents.

C) government has a role to ensure income equality to prevent social unrest.

D) people would choose income equality because it is morally right.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

The distribution of income in a country is:

According to the table, what percentage of households have income levels above €60,000?

A) 80 per cent

B) 60 per cent

C) 50 per cent

D) 40 per cent

According to the table, what percentage of households have income levels above €60,000?

A) 80 per cent

B) 60 per cent

C) 50 per cent

D) 40 per cent

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

A libertarian would be likely to argue that

A) equality of outcomes in a society does not matter; it's the fairness of the processes that lead to those outcomes that matters.

B) equality of opportunities is more important than equality of incomes.

C) the government should not redistribute resources from some individuals to others.

D) all of the above.

A) equality of outcomes in a society does not matter; it's the fairness of the processes that lead to those outcomes that matters.

B) equality of opportunities is more important than equality of incomes.

C) the government should not redistribute resources from some individuals to others.

D) all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Because people's incomes vary over the life cycle and because there are transitory shocks to people's incomes, the standard measures of income distribution

A) exaggerate the inequality of living standards.

B) could exaggerate or understate the inequality of living standards depending on whether the transitory shocks are positive or negative.

C) understate the inequality of living standards.

D) accurately represent the true inequality of living standards.

A) exaggerate the inequality of living standards.

B) could exaggerate or understate the inequality of living standards depending on whether the transitory shocks are positive or negative.

C) understate the inequality of living standards.

D) accurately represent the true inequality of living standards.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

An increase in the minimum wage will cause a relatively large increase in unemployment among

A) unskilled workers if the demand for labour is relatively inelastic.

B) unskilled workers if the demand for labour is relatively elastic.

C) skilled workers if the demand for labour is relatively elastic.

D) skilled workers if the demand for labour is relatively inelastic.

A) unskilled workers if the demand for labour is relatively inelastic.

B) unskilled workers if the demand for labour is relatively elastic.

C) skilled workers if the demand for labour is relatively elastic.

D) skilled workers if the demand for labour is relatively inelastic.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

The maximin criterion suggested by John Rawls's theory of justice means that the government should aim to

A) maximize the total utility of society.

B) maximize the well-being of the worst-off person in society.

C) minimize the difference between the rich and poor.

D) maximize the economic freedom of individuals by minimizing government interference in private decision making.

E) minimize the well-being of the best-off person in society.

A) maximize the total utility of society.

B) maximize the well-being of the worst-off person in society.

C) minimize the difference between the rich and poor.

D) maximize the economic freedom of individuals by minimizing government interference in private decision making.

E) minimize the well-being of the best-off person in society.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Raising the welfare of the worst-off person in society is an important goal of which political philosophy?

A) utilitarianism

B) liberalism

C) libertarianism

D) secularism

A) utilitarianism

B) liberalism

C) libertarianism

D) secularism

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Marie earns more than Seamus and she came by her income fairly and honestly. Which of the following political philosophies would argue against the redistribution of income from Marie to Seamus?

A) all of these answers

B) libertarianism

C) liberalism

D) utilitarianism

E) communism

A) all of these answers

B) libertarianism

C) liberalism

D) utilitarianism

E) communism

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

John Rawls's maximin criterion does not mean that there should be redistribution so as to equalize everyone's incomes in society because

A) such redistribution would mean that those who worked hard were no better off than those who were lazy and this would be unfair.

B) such redistribution would not maximize the total income of all members of society.

C) such redistribution would remove the incentive to work hard, so society's total income would fall, and so the least well off person would be worse off than they could be under a system in which there was some inequality in income.

D) such redistribution would amount to confiscation of honestly earned income from higher earners and so would be unjust.

A) such redistribution would mean that those who worked hard were no better off than those who were lazy and this would be unfair.

B) such redistribution would not maximize the total income of all members of society.

C) such redistribution would remove the incentive to work hard, so society's total income would fall, and so the least well off person would be worse off than they could be under a system in which there was some inequality in income.

D) such redistribution would amount to confiscation of honestly earned income from higher earners and so would be unjust.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Rank utilitarianism, liberalism, and libertarianism in sequence from the political philosophy that would redistribute income the greatest to the one that would redistribute income the least.

A) utilitarianism, liberalism, libertarianism

B) liberalism, libertarianism, utilitarianism

C) libertarianism, liberalism, utilitarianism

D) liberalism, utilitarianism, libertarianism

A) utilitarianism, liberalism, libertarianism

B) liberalism, libertarianism, utilitarianism

C) libertarianism, liberalism, utilitarianism

D) liberalism, utilitarianism, libertarianism

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

Susan had a big win at the casino on her birthday. The money she won is considered to be

A) permanent income.

B) life-cycle income.

C) transitory income.

D) an in-kind transfer.

A) permanent income.

B) life-cycle income.

C) transitory income.

D) an in-kind transfer.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Which political philosophy believes that the government should equalize the incomes of all members of society?

A) Utilitarianism.

B) Liberalism.

C) Libertarianism.

D) None of the above is correct.

A) Utilitarianism.

B) Liberalism.

C) Libertarianism.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

A period of unemployment due to recession will:

A) increase a worker's current income and permanent income.

B) reduce a worker's current income but not necessarily their permanent income

C) affect neither the current nor the permanent income of a worker.

D) reduce a worker's permanent income but not their current income.

A) increase a worker's current income and permanent income.

B) reduce a worker's current income but not necessarily their permanent income

C) affect neither the current nor the permanent income of a worker.

D) reduce a worker's permanent income but not their current income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Permanent income is more equally distributed than is current income because:

A) permanent income includes income from social security benefits.

B) permanent income includes winnings from gambling.

C) current income is usually lower than permanent income.

D) current income is subject to transitory changes which sometimes raise a person's income and sometimes reduce it.

A) permanent income includes income from social security benefits.

B) permanent income includes winnings from gambling.

C) current income is usually lower than permanent income.

D) current income is subject to transitory changes which sometimes raise a person's income and sometimes reduce it.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Utilitarianism suggests that the government should choose policies that maximize the total utility of everyone in society by

A) redistributing income from rich to poor because this is what the members of society would choose to do if they were behind a "veil of ignorance."

B) redistributing income from rich to poor because, due to the diminishing marginal utility of income, taking a pound from the rich reduces their utility by less than the gain in utility generated by giving a pound to the poor.

C) allowing individuals to maximize their own utility without interference from the government.

D) redistributing income from rich to poor because this would maximize the well-being of the worst-off person in society.

A) redistributing income from rich to poor because this is what the members of society would choose to do if they were behind a "veil of ignorance."

B) redistributing income from rich to poor because, due to the diminishing marginal utility of income, taking a pound from the rich reduces their utility by less than the gain in utility generated by giving a pound to the poor.

C) allowing individuals to maximize their own utility without interference from the government.

D) redistributing income from rich to poor because this would maximize the well-being of the worst-off person in society.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Assume that the government proposes a negative income tax that calculates taxes owed by the formula, Taxes Owed = (a Income) -

a. What is the value for "a"?

b. A family with an income of €40,000 pays €5,000 in taxes, and a family with an income of €12,000 receives an income subsidy of €2,000.

b. What is the value for "b"?

c. What is the tax liability of a family with an income of €50,000?

d. At what level of income will a family neither pay taxes, nor receive an income subsidy?

a. What is the value for "a"?

b. A family with an income of €40,000 pays €5,000 in taxes, and a family with an income of €12,000 receives an income subsidy of €2,000.

b. What is the value for "b"?

c. What is the tax liability of a family with an income of €50,000?

d. At what level of income will a family neither pay taxes, nor receive an income subsidy?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

A key economic argument against complete equalization of incomes is that

A) it would be unfair.

B) it would remove incentives for people to work harder and to invest in human capital.

C) we don't really know what choices people would make if they were behind a veil of ignorance.

D) people would never vote for such a measure.

A) it would be unfair.

B) it would remove incentives for people to work harder and to invest in human capital.

C) we don't really know what choices people would make if they were behind a veil of ignorance.

D) people would never vote for such a measure.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Explain what is meant by "in-kind transfer" programs. Briefly outline the advantages and disadvantages of an in-kind transfer program.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Assume that the government proposes a negative income tax that calculates taxes owed by the following formula,

Taxes Owed = (1/3 x Income) - €10,000.

Compute the tax that would be owed given each level of income.

a. €120,000

b. €90,000

c. €60,000

d. €30,000

e. €0

Taxes Owed = (1/3 x Income) - €10,000.

Compute the tax that would be owed given each level of income.

a. €120,000

b. €90,000

c. €60,000

d. €30,000

e. €0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Using the same assumption as above about a negative income tax system, if a person who was earning no income takes a job paying an annual salary of €15,000, how much better off will that person be after taking income tax into account?

A) No better off.

B) €3,750 better off.

C) €11,250 better off.

D) €15,000 better off.

A) No better off.

B) €3,750 better off.

C) €11,250 better off.

D) €15,000 better off.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Using the same assumption as above about a negative income tax system complete this sentence:

A person who is earning an annual salary of €20,000 will receive __________ of income from work and __________ of income from the government.

A) €20,000; €15,000

B) €20,000; €10,000

C) €20,000; €5,000

D) €20,000; €0

A person who is earning an annual salary of €20,000 will receive __________ of income from work and __________ of income from the government.

A) €20,000; €15,000

B) €20,000; €10,000

C) €20,000; €5,000

D) €20,000; €0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

A problem with a negative income tax system is that it

A) guarantees every household a minimum level of income.

B) causes excessive government meddling in people's lives.

C) is too complex to administer fairly.

D) supports people who are simply lazy.

A) guarantees every household a minimum level of income.

B) causes excessive government meddling in people's lives.

C) is too complex to administer fairly.

D) supports people who are simply lazy.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Given the table shown, which country has a more equal income distribution? Explain your answer.

Country

Bottom Fifth

Second Fifth

Middle Fifth

Fourth Fifth

Top Fifth

Country A

9.0%

13.5%

17.5%

22.9%

37.1%

Country B

4.8%

10.5%

16.0%

23.5%

45.2%

Country

Bottom Fifth

Second Fifth

Middle Fifth

Fourth Fifth

Top Fifth

Country A

9.0%

13.5%

17.5%

22.9%

37.1%

Country B

4.8%

10.5%

16.0%

23.5%

45.2%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Social security benefits are examples of

A) transfer payments.

B) negative income payments.

C) property income.

D) compensating differentials.

A) transfer payments.

B) negative income payments.

C) property income.

D) compensating differentials.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

What is meant by a perfectly equal distribution of income? Use a graph to depict such a situation.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Explain how a "leaky bucket" can be used to illustrate the utilitarian argument that governments should not attempt to completely equalize individual incomes.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

The greatest advantage of a negative income tax is that it

A) generates a smaller disincentive to work than most alternative anti-poverty policies.

B) reduces the cost to the government of fighting poverty.

C) would not provide benefits to lazy people.

D) ensures that the poor actually receive what the government thinks they need.

E) means no-one is taxed unfairly

A) generates a smaller disincentive to work than most alternative anti-poverty policies.

B) reduces the cost to the government of fighting poverty.

C) would not provide benefits to lazy people.

D) ensures that the poor actually receive what the government thinks they need.

E) means no-one is taxed unfairly

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose a negative income tax system is established and the formula to compute a person's annual tax liability is: tax due = (25% of income) - €15,000.

If a person earns no income then he would receive a negative income tax payment of

A) €3,750.

B) €15,000.

C) €18,750.

D) €60,000.

If a person earns no income then he would receive a negative income tax payment of

A) €3,750.

B) €15,000.

C) €18,750.

D) €60,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Explain the relationship between labour earnings and the distribution of income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Briefly describe the three prominent schools of thought in political philosophy. Identify one of the most well-known philosophers in each school.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

Social security benefit payments may increase poverty in the long run because they tend to

A) decrease the incentive to work among the poor.

B) increase the level of saving among the rich.

C) increase productivity of labour among the rich and poor.

D) promote investment activity by the rich.

A) decrease the incentive to work among the poor.

B) increase the level of saving among the rich.

C) increase productivity of labour among the rich and poor.

D) promote investment activity by the rich.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Explain the concept of diminishing marginal utility, and describe the role that it plays in the utilitarian argument for the redistribution of income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Compare and contrast the "life cycle" hypothesis and the "permanent income" hypothesis. What are their respective implications for inequality in the income distribution?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is most likely to occur when the government enacts policies to make the distribution of income more equal?

A) a more efficient allocation of resources

B) a distortion of incentives

C) unchanged behavior

D) All of the above are correct.

A) a more efficient allocation of resources

B) a distortion of incentives

C) unchanged behavior

D) All of the above are correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

The poverty trap refers to

A) a situation in which those receiving state benefits may be almost no better off if they choose to work more to earn more income for themselves and their families because doing so will mean they have to pay back the benefits they have previously received.

B) a situation in which workers are unable to find jobs.

C) a situation in which those receiving state benefits may be almost no better off if they choose to work more to earn more income for themselves and their families because doing so will reduce the amount of benefit income to which they are entitled and increase the amount of tax they must pay.

D) a situation in which those receiving state benefits are discriminated against by employers and so find it more difficult to find jobs.

A) a situation in which those receiving state benefits may be almost no better off if they choose to work more to earn more income for themselves and their families because doing so will mean they have to pay back the benefits they have previously received.

B) a situation in which workers are unable to find jobs.

C) a situation in which those receiving state benefits may be almost no better off if they choose to work more to earn more income for themselves and their families because doing so will reduce the amount of benefit income to which they are entitled and increase the amount of tax they must pay.

D) a situation in which those receiving state benefits are discriminated against by employers and so find it more difficult to find jobs.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck