Deck 7: Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/152

Play

Full screen (f)

Deck 7: Inflation

1

If the price of iPods rises 10 percent during a year when the level of average prices rises 3 percent,the relative price of iPods compared with other goods

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

B

2

When there is no deflation or inflation,

A)Prices of all goods change by the same percentage.

B)Relative prices remain unchanged.

C)Average prices do not change.

D)Full employment is achieved.

A)Prices of all goods change by the same percentage.

B)Relative prices remain unchanged.

C)Average prices do not change.

D)Full employment is achieved.

C

3

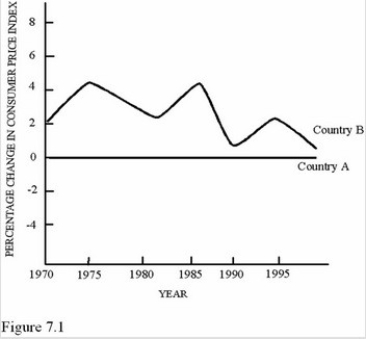

According to Figure 7.1,which of the following statements was definitely true about Country B?

According to Figure 7.1,which of the following statements was definitely true about Country B?A)Relative prices were changing.

B)The average price in general increased over the time period 1970 to 1995.

C)Real incomes were increasing.

D)The price level was about the same in 1970 and 1995.

B

4

Inflation is

A)A rise in the price of every good but not any service.

B)An increase in relative prices of all goods and services.

C)A situation in which purchasing power increases.

D)An increase in the average level of prices of goods and services.

A)A rise in the price of every good but not any service.

B)An increase in relative prices of all goods and services.

C)A situation in which purchasing power increases.

D)An increase in the average level of prices of goods and services.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

5

Deflation is a/an ________ in the average level of prices of goods and services.

A)increase

B)decrease

C)stagnation

D)increase followed by a decrease

A)increase

B)decrease

C)stagnation

D)increase followed by a decrease

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

6

Changes in the relative prices of two goods indicate

A)Inflation.

B)Nominal price changes adjusted for the inflation in the price of the goods.

C)That average prices for the period must not be stable.

D)Changes in the desired mix of output.

A)Inflation.

B)Nominal price changes adjusted for the inflation in the price of the goods.

C)That average prices for the period must not be stable.

D)Changes in the desired mix of output.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

7

Inflation means

A)Specific prices are rising,and relative prices are falling.

B)Both relative prices and average prices are rising.

C)Relative prices are rising,but it is not certain what is happening to average prices.

D)Average prices are rising,but it is not certain what is happening to relative prices.

A)Specific prices are rising,and relative prices are falling.

B)Both relative prices and average prices are rising.

C)Relative prices are rising,but it is not certain what is happening to average prices.

D)Average prices are rising,but it is not certain what is happening to relative prices.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

8

Relative price is

A)The price of one good in comparison with the price of other goods.

B)A decrease in purchasing power because of rising prices.

C)The amount of income a particular good requires.

D)The current price paid for a good or service.

A)The price of one good in comparison with the price of other goods.

B)A decrease in purchasing power because of rising prices.

C)The amount of income a particular good requires.

D)The current price paid for a good or service.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

9

A decrease in the average level of prices of goods and services is

A)Deflation.

B)Recession.

C)Depression.

D)Inflation.

A)Deflation.

B)Recession.

C)Depression.

D)Inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

10

During the time period represented in Figure 7.1,Country A

During the time period represented in Figure 7.1,Country AA)Experienced periods of both inflation and deflation.

B)Never achieved the inflation goal set by the Full Employment and Balanced Growth Act of 1978.

C)Had no need for COLAs.

D)Experienced only inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

11

Comparing changes in relative prices is more useful than examining average prices in

A)Determining the redistribution of income.

B)Determining the inflation rate.

C)Deflating nominal income.

D)Determining if there is deflation.

A)Determining the redistribution of income.

B)Determining the inflation rate.

C)Deflating nominal income.

D)Determining if there is deflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

12

Changes in relative prices may occur in a period of

A)Stable prices only.

B)Inflation only.

C)Deflation only.

D)Stable prices,inflation,or deflation.

A)Stable prices only.

B)Inflation only.

C)Deflation only.

D)Stable prices,inflation,or deflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

13

If the price of Bluetooth headsets rises 12 percent during a year when the level of average prices rises 13 percent,the relative price of Bluetooth headsets

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

14

Inflation rates above 10 percent occur

A)In most countries today.

B)Rarely in the United States.

C)During wartime periods.

D)None of the other choices.

A)In most countries today.

B)Rarely in the United States.

C)During wartime periods.

D)None of the other choices.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

15

According to Figure 7.1 in Country A,

According to Figure 7.1 in Country A,A)Relative prices may have been changing,but average prices were constant.

B)Relative prices were definitely constant.

C)Average prices and relative prices were definitely changing.

D)Average prices were constant,and unemployment was increasing.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following explains why redistribution occurs during inflation?

A)Rising prices fail to signal desirable changes in the mix of output.

B)Because all prices do not change at the same rate,people buy different combinations of goods and services and own different combinations of wealth.

C)Relative prices remain unchanged.

D)All loans are indexed to inflation.

A)Rising prices fail to signal desirable changes in the mix of output.

B)Because all prices do not change at the same rate,people buy different combinations of goods and services and own different combinations of wealth.

C)Relative prices remain unchanged.

D)All loans are indexed to inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

17

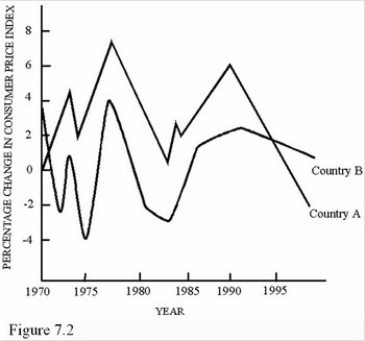

In the year 1995,which of the following statements is true about the two countries represented in Figure 7.2?

In the year 1995,which of the following statements is true about the two countries represented in Figure 7.2?A)The countries had approximately the same rate of inflation.

B)The CPI was virtually equal in the two countries.

C)The market basket cost approximately the same in both countries.

D)Real incomes were rising at the same rate in both countries.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

18

When the price of a good decreases more slowly than an index of average prices decreases,the good's relative price

A)Has risen while its actual price has fallen.

B)And its actual price has risen.

C)And its actual price has fallen.

D)Has fallen while its actual price has risen.

A)Has risen while its actual price has fallen.

B)And its actual price has risen.

C)And its actual price has fallen.

D)Has fallen while its actual price has risen.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following results from unexpected increases in the rate of inflation?

A)Decreased uncertainty.

B)Increased windfall profits to creditors who have lent large amounts of money.

C)Redistributions of income and wealth between different groups.

D)Creditors are made better off.

A)Decreased uncertainty.

B)Increased windfall profits to creditors who have lent large amounts of money.

C)Redistributions of income and wealth between different groups.

D)Creditors are made better off.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following functions are performed by changes in relative prices but not by changes in average prices?

A)Computing real income from nominal income.

B)Indicating an overheating economy.

C)Signaling changes in the desired mix of output.

D)Measuring the rates of inflation.

A)Computing real income from nominal income.

B)Indicating an overheating economy.

C)Signaling changes in the desired mix of output.

D)Measuring the rates of inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

21

Real income is

A)Nominal income adjusted for inflation.

B)The amount of money income received in a given time period,measured in current dollars.

C)The use of nominal dollars to gauge changes in income.

D)None of the other choices.

A)Nominal income adjusted for inflation.

B)The amount of money income received in a given time period,measured in current dollars.

C)The use of nominal dollars to gauge changes in income.

D)None of the other choices.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

22

If the price of your cell phone service increases from $70 to $105 over a period of one year and your income rises from $1,500 to $1,525,your nominal income has

A)Increased,and your real income has increased.

B)Increased,but your real income has decreased.

C)Decreased,and your real income has decreased.

D)Increased,but your real income has remained the same.

A)Increased,and your real income has increased.

B)Increased,but your real income has decreased.

C)Decreased,and your real income has decreased.

D)Increased,but your real income has remained the same.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

23

Inflation ________ the purchasing power of money.

A)increases

B)decreases

C)does not affect

D)stabilizes

A)increases

B)decreases

C)does not affect

D)stabilizes

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a microeconomic consequence of inflation?

A)Greater unemployment.

B)Greater real income.

C)Wealth effects.

D)None of the other choices.

A)Greater unemployment.

B)Greater real income.

C)Wealth effects.

D)None of the other choices.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

25

Income in constant dollars is

A)Nominal income.

B)Real income.

C)Bracket creep.

D)Income effect.

A)Nominal income.

B)Real income.

C)Bracket creep.

D)Income effect.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

26

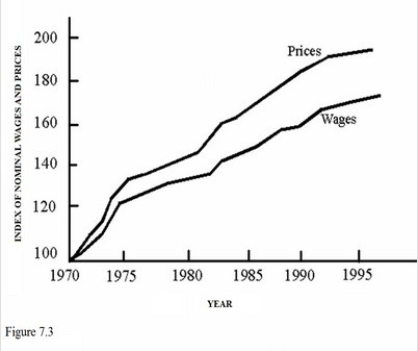

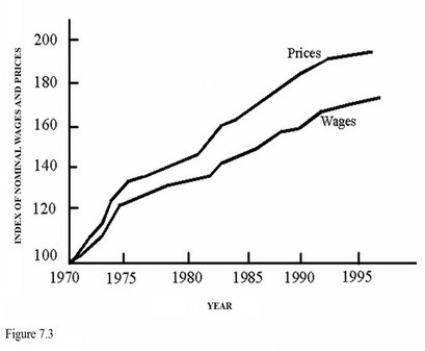

According to Figure 7.3,prices and wages were rising,so

According to Figure 7.3,prices and wages were rising,soA)Sellers of output were better off than wage earners.

B)Everyone must have been worse off since the price level rose faster than incomes.

C)There were no redistributive effects of inflation.

D)The economy was experiencing stagflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

27

All of the following are microeconomic consequences of inflation except

A)A price effect.

B)An income effect.

C)A wealth effect.

D)A profit effect.

A)A price effect.

B)An income effect.

C)A wealth effect.

D)A profit effect.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

28

The redistributive mechanics of inflation include all of the following except

A)Price effects.

B)Income effects.

C)Wealth effects.

D)Output effects.

A)Price effects.

B)Income effects.

C)Wealth effects.

D)Output effects.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

29

The term "nominal income" refers to

A)Money income adjusted for any change in the price level.

B)Real purchasing power.

C)Real purchasing power deflated for rising prices.

D)Money income measured in current dollars.

A)Money income adjusted for any change in the price level.

B)Real purchasing power.

C)Real purchasing power deflated for rising prices.

D)Money income measured in current dollars.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following groups is protected from a sudden increase in inflation?

A)Borrowers who have loans at fixed interest rates.

B)Fixed-income groups.

C)Workers who receive fixed wages under multiyear contracts.

D)People who rent their homes under short-term leases in comparison with those who own their homes.

A)Borrowers who have loans at fixed interest rates.

B)Fixed-income groups.

C)Workers who receive fixed wages under multiyear contracts.

D)People who rent their homes under short-term leases in comparison with those who own their homes.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

31

When the price of a product rises faster than the inflation rate,

A)Nominal incomes of the consumers of that product fall.

B)Users of that product have higher real incomes than people who do not consume the product.

C)Nominal incomes of the consumers of that product rise.

D)Real incomes of the consumers of that product fall.

A)Nominal incomes of the consumers of that product fall.

B)Users of that product have higher real incomes than people who do not consume the product.

C)Nominal incomes of the consumers of that product rise.

D)Real incomes of the consumers of that product fall.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

32

Generally speaking,which of the following groups would tend to gain real income from the wealth effects of inflation?

A)People with fixed income.

B)People who have savings accounts at fixed rates of interest.

C)People who own assets that are appreciating faster than the inflation rate.

D)People who hold all of their assets in the form of cash.

A)People with fixed income.

B)People who have savings accounts at fixed rates of interest.

C)People who own assets that are appreciating faster than the inflation rate.

D)People who hold all of their assets in the form of cash.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

33

The amount of income received in a given time period,measured in current dollars,is

A)Nominal income.

B)Real income.

C)Relative income.

D)The Consumer Price Index.

A)Nominal income.

B)Real income.

C)Relative income.

D)The Consumer Price Index.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not true about your nominal income?

A)It is the amount of money you receive during a given time period.

B)It is measured in current dollars.

C)It is not an accurate measure of purchasing power.

D)It is the same as your real income in times of high inflation.

A)It is the amount of money you receive during a given time period.

B)It is measured in current dollars.

C)It is not an accurate measure of purchasing power.

D)It is the same as your real income in times of high inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

35

If deflation is 0.5 percent per year and you receive a 1 percent decrease in your salary,then your

A)Real income falls,but your nominal income remains unchanged.

B)Real and nominal income both fall.

C)Real income remains unchanged,but your nominal income rises.

D)Real and nominal income both rise.

A)Real income falls,but your nominal income remains unchanged.

B)Real and nominal income both fall.

C)Real income remains unchanged,but your nominal income rises.

D)Real and nominal income both rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

36

Your real income is

A)The amount of money you receive during a given time period.

B)Measured in current dollars.

C)The purchasing power of the money you receive.

D)The same as your nominal income in times of high inflation.

A)The amount of money you receive during a given time period.

B)Measured in current dollars.

C)The purchasing power of the money you receive.

D)The same as your nominal income in times of high inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

37

If a bank has already lent money at fixed interest rates,then during a period of higher-than-expected inflation,it experiences

A)Negative real income effects.

B)Hyperinflation.

C)Rising real interest rates.

D)Deflation.

A)Negative real income effects.

B)Hyperinflation.

C)Rising real interest rates.

D)Deflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

38

During a period of unanticipated inflation,

A)Debtors are better off and creditors are worse off.

B)Debtors and creditors are both better off because of lower real interest rates.

C)Individuals on fixed incomes are better off.

D)All individuals are worse off because of the level of uncertainty.

A)Debtors are better off and creditors are worse off.

B)Debtors and creditors are both better off because of lower real interest rates.

C)Individuals on fixed incomes are better off.

D)All individuals are worse off because of the level of uncertainty.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

39

If the cost of your gasoline purchases decrease from $150 per month to $80 over a period of one year due to lower prices and your income decreases from $1,600 per month to $1,500 per month,your nominal income has

A)Increased,but your real income has decreased.

B)Decreased,but your real income has increased.

C)Increased,and your real income has increased.

D)Increased,but your real income has remained the same.

A)Increased,but your real income has decreased.

B)Decreased,but your real income has increased.

C)Increased,and your real income has increased.

D)Increased,but your real income has remained the same.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

40

If your rent increases from $1,000 to $1,100 over a period of one year and your income rises from $6,000 to $7,000,your nominal income has

A)Increased,but your real income has decreased.

B)Increased,and your real income has increased.

C)Decreased,and your real income has decreased.

D)Increased,but your real income has remained the same.

A)Increased,but your real income has decreased.

B)Increased,and your real income has increased.

C)Decreased,and your real income has decreased.

D)Increased,but your real income has remained the same.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

41

When people make decisions on the basis of the face value of currency rather than the real value,their decisions reflect

A)The price effect of inflation.

B)The income effect of inflation.

C)The wealth effect of inflation.

D)Money illusion.

A)The price effect of inflation.

B)The income effect of inflation.

C)The wealth effect of inflation.

D)Money illusion.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is a likely macroeconomic consequence of inflation?

A)Focus on long-term planning.

B)Speculation.

C)Antitrust issues.

D)None of the other choices.

A)Focus on long-term planning.

B)Speculation.

C)Antitrust issues.

D)None of the other choices.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

43

The uncertainty that results from inflation causes changes in

A)Consumption,saving,and investment behavior.

B)Saving and investment behavior,but not consumption.

C)Consumption,but not saving and investment behavior.

D)Income,but not consumption.

A)Consumption,saving,and investment behavior.

B)Saving and investment behavior,but not consumption.

C)Consumption,but not saving and investment behavior.

D)Income,but not consumption.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

44

A friend tells you that his income has risen every year by 5 percent.At the same time,prices,on average,have risen by 5 percent.Your friend claims he is better off.Your friend

A)Is experiencing money illusion.

B)Really is better off as he suggests.

C)Has experienced an increase in nominal and real income.

D)Has experienced an increase in real income only.

A)Is experiencing money illusion.

B)Really is better off as he suggests.

C)Has experienced an increase in nominal and real income.

D)Has experienced an increase in real income only.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

45

Hyperinflation is

A)An inflation rate in excess of 200 percent,lasting at least one year.

B)An inflation rate in excess of 20 percent,lasting at least one year.

C)A common problem in the United States.

D)The movement of taxpayers to higher tax brackets because of rising prices.

A)An inflation rate in excess of 200 percent,lasting at least one year.

B)An inflation rate in excess of 20 percent,lasting at least one year.

C)A common problem in the United States.

D)The movement of taxpayers to higher tax brackets because of rising prices.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

46

During a period of deflation,

A)The price level rises.

B)People on fixed incomes are better off.

C)People who hold cash are worse off.

D)Lenders are worse off.

A)The price level rises.

B)People on fixed incomes are better off.

C)People who hold cash are worse off.

D)Lenders are worse off.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

47

Last year you earned $20,000 and paid taxes in the second tax bracket at 15 percent.This year you earned $25,000,the extra $5,000 just compensating you for inflation.However,this year you paid taxes in the third bracket at 20 percent.This illustrates the concept of

A)Stagflation.

B)Speculation.

C)Deflation.

D)Bracket creep.

A)Stagflation.

B)Speculation.

C)Deflation.

D)Bracket creep.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

48

Money illusion is the

A)Use of nominal dollars rather than real dollars to gauge changes in one's income or wealth.

B)Movement of taxpayers into higher tax brackets as nominal income increases.

C)Focus on real dollars rather than nominal dollars to determine purchasing power over time.

D)Uncertainty that occurs because of inflation.

A)Use of nominal dollars rather than real dollars to gauge changes in one's income or wealth.

B)Movement of taxpayers into higher tax brackets as nominal income increases.

C)Focus on real dollars rather than nominal dollars to determine purchasing power over time.

D)Uncertainty that occurs because of inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is a macro consequence of a sudden increase in the average level of prices?

A)People on fixed incomes benefit.

B)Uncertainty is greater.

C)Nominal income falls by a smaller percentage than real income.

D)People lengthen their time horizons.

A)People on fixed incomes benefit.

B)Uncertainty is greater.

C)Nominal income falls by a smaller percentage than real income.

D)People lengthen their time horizons.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

50

During a period of deflation,

A)Time horizons are longer.

B)Consumer confidence increases.

C)Lenders are better off.

D)Borrowers are better off.

A)Time horizons are longer.

B)Consumer confidence increases.

C)Lenders are better off.

D)Borrowers are better off.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

51

All of the following are macroeconomic effects of inflation except

A)Uncertainty.

B)Speculation.

C)Bracket creep.

D)Lower taxes.

A)Uncertainty.

B)Speculation.

C)Bracket creep.

D)Lower taxes.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

52

To construct the Consumer Price Index,the Bureau of Labor Statistics must

A)Find out what people buy with their incomes and how the prices of what they buy change.

B)Find out why people buy,what they buy,and how the prices of what they buy change.

C)Find out what is in the typical consumer market basket on the basis of what producers produce.

D)Conduct producer surveys to determine how much prices rise.

A)Find out what people buy with their incomes and how the prices of what they buy change.

B)Find out why people buy,what they buy,and how the prices of what they buy change.

C)Find out what is in the typical consumer market basket on the basis of what producers produce.

D)Conduct producer surveys to determine how much prices rise.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

53

Inflation affects production decisions because it

A)Decreases input costs.

B)Reduces speculation.

C)Causes businesses to focus more on the future.

D)Causes businesses to be more cautious since the future appears more uncertain.

A)Decreases input costs.

B)Reduces speculation.

C)Causes businesses to focus more on the future.

D)Causes businesses to be more cautious since the future appears more uncertain.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

54

Speculation during periods of inflation can result in all of the following except

A)People buying resources for resale later,rather than using the resources for current production.

B)A movement inward from the production possibilities curve.

C)People buying gold,silver,jewelry,and the like instead of capital for production.

D)More resources going into the production process.

A)People buying resources for resale later,rather than using the resources for current production.

B)A movement inward from the production possibilities curve.

C)People buying gold,silver,jewelry,and the like instead of capital for production.

D)More resources going into the production process.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

55

If the price level is falling,all of the following are true except

A)Lenders are better off.

B)Businesses are reluctant to borrow money.

C)Purchasing power increases.

D)Borrowers are not affected.

A)Lenders are better off.

B)Businesses are reluctant to borrow money.

C)Purchasing power increases.

D)Borrowers are not affected.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following measures changes in the average price of consumer goods and services?

A)Inflation rate.

B)CPI.

C)Deflation rate.

D)Market basket.

A)Inflation rate.

B)CPI.

C)Deflation rate.

D)Market basket.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

57

The movement of taxpayers into higher tax brackets as nominal incomes grow is

A)Bracket leap.

B)Bracket hike.

C)Bracket creep.

D)Inflation hike.

A)Bracket leap.

B)Bracket hike.

C)Bracket creep.

D)Inflation hike.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

58

During the time period represented in Figure 7.3,the purchasing power of the average worker

During the time period represented in Figure 7.3,the purchasing power of the average workerA)Increased because nominal wages increased.

B)Decreased because real income decreased.

C)Stay the same because COLAs reduced purchasing power.

D)Decreased because nominal income decreased.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

59

The Consumer Price Index is

A)A measure of changes in the average price of all goods and services.

B)A measure of changes in the average price of consumer goods and services.

C)Used to measure the impact of business speculation on consumers.

D)The impact felt by consumers who move into a higher tax bracket because of inflation.

A)A measure of changes in the average price of all goods and services.

B)A measure of changes in the average price of consumer goods and services.

C)Used to measure the impact of business speculation on consumers.

D)The impact felt by consumers who move into a higher tax bracket because of inflation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

60

All of the following push a country inside its production possibilities curve except

A)A sudden burst of inflation that has not been anticipated.

B)A sudden burst of deflation that has not been anticipated.

C)The withholding of resources from the production process because of speculation.

D)An increase in labor force participation.

A)A sudden burst of inflation that has not been anticipated.

B)A sudden burst of deflation that has not been anticipated.

C)The withholding of resources from the production process because of speculation.

D)An increase in labor force participation.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

61

To compute the real income of a household,the index that should be used is the

A)Producer Price Index (PPI).

B)Consumer Price Index (CPI).

C)GDP deflator.

D)Cost of Living Adjustment (COLA).

A)Producer Price Index (PPI).

B)Consumer Price Index (CPI).

C)GDP deflator.

D)Cost of Living Adjustment (COLA).

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

62

If the Consumer Price Index rose from 180.9 in 2005 to 418.5 in 2015,what is the total percentage change in prices over this 10-year period?

A)131.34 percent.

B)18.5 percent.

C)80.9 percent.

D)127.21 percent.

A)131.34 percent.

B)18.5 percent.

C)80.9 percent.

D)127.21 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

63

The percentage of total expenditure spent on a specific product is called

A)Core inflation.

B)A market basket.

C)A budget.

D)The item weight.

A)Core inflation.

B)A market basket.

C)A budget.

D)The item weight.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

64

If the CPI increases from 110 to 125 for one year,the rate of inflation for that year is

A)15 percent.

B)13.6 percent.

C)1.13 percent.

D)50 percent.

A)15 percent.

B)13.6 percent.

C)1.13 percent.

D)50 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

65

Assume the CPI increases from 110 to 121,and Manny's nominal income increases from $100,000 to $120,000 over the same period.Manny's real income has

A)Increased by approximately 12 percent.

B)Increased by approximately 9 percent.

C)Decreased by approximately 8 percent.

D)Remained the same.

A)Increased by approximately 12 percent.

B)Increased by approximately 9 percent.

C)Decreased by approximately 8 percent.

D)Remained the same.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

66

The price index that refers to all final goods and services produced in a country is the

A)GDP deflator.

B)PPI.

C)CPI.

D)GDP inflator.

A)GDP deflator.

B)PPI.

C)CPI.

D)GDP inflator.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

67

The GDP deflator

A)Is the price index based on a fixed basket of goods and services for the government.

B)Is the best measure of inflation for consumers.

C)Reflects the price changes felt by producers but not consumers.

D)Is the broadest price index,covering all output.

A)Is the price index based on a fixed basket of goods and services for the government.

B)Is the best measure of inflation for consumers.

C)Reflects the price changes felt by producers but not consumers.

D)Is the broadest price index,covering all output.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

68

For the CPI,the market basket is expressed in terms of what the goods cost in

A)1929.

B)2000.

C)The base period.

D)The optimal period.

A)1929.

B)2000.

C)The base period.

D)The optimal period.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

69

If the CPI increases from 250 to 275 for one year,the rate of inflation for that year is

A)13 percent.

B)10 percent.

C)25 percent.

D)15 percent.

A)13 percent.

B)10 percent.

C)25 percent.

D)15 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

70

At the beginning of 2000,the CPI was 159.3.At the beginning of 2001,it was 177.6.What was the approximate rate of inflation in 2000?

A)7.6 percent.

B)18.3 percent.

C)10.0 percent.

D)11.5 percent.

A)7.6 percent.

B)18.3 percent.

C)10.0 percent.

D)11.5 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

71

The Producer Price Index (PPI)is the best index to measure average price changes faced by

A)Consumers.

B)Producers.

C)Importers.

D)Labor unions negotiating COLAs.

A)Consumers.

B)Producers.

C)Importers.

D)Labor unions negotiating COLAs.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

72

The base period is the

A)Time period used for comparative analysis.

B)Absence of significant changes in the average price level.

C)Time period when full employment is reached.

D)First year in which inflation figures were calculated.

A)Time period used for comparative analysis.

B)Absence of significant changes in the average price level.

C)Time period when full employment is reached.

D)First year in which inflation figures were calculated.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

73

Item weight is the

A)Measure of how much consumers demand a particular item.

B)Percentage of total expenditure spent on a particular product.

C)Significance placed on a particular item by the wealthiest households.

D)Physical weight of a good or service.

A)Measure of how much consumers demand a particular item.

B)Percentage of total expenditure spent on a particular product.

C)Significance placed on a particular item by the wealthiest households.

D)Physical weight of a good or service.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

74

At the beginning of 2006 the CPI was 216.2.At the beginning of 2007,it was 225.1.What was the rate of inflation in 2006?

A)4.9 percent.

B)4.1 percent.

C)3.6 percent.

D)8.9 percent.

A)4.9 percent.

B)4.1 percent.

C)3.6 percent.

D)8.9 percent.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

75

If you were interested in charting prices of resources used by producers of energy,which of the following would you use?

A)The Producer Price Index (PPI).

B)The Consumer Price Index (CPI).

C)The GDP deflator.

D)The Cost of Living Adjustment (COLA).

A)The Producer Price Index (PPI).

B)The Consumer Price Index (CPI).

C)The GDP deflator.

D)The Cost of Living Adjustment (COLA).

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is often watched closely as a clue to potential changes in consumer prices in the future?

A)The CPI.

B)The PPI.

C)The GDP deflator.

D)The COLAs.

A)The CPI.

B)The PPI.

C)The GDP deflator.

D)The COLAs.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

77

The inflation rate is the

A)Monthly percentage rate increase in the price of all goods and services.

B)Annual percentage rate increase in tax brackets.

C)Annual percentage rate increase in the average price level.

D)Monthly adjustment of wages to the cost of living.

A)Monthly percentage rate increase in the price of all goods and services.

B)Annual percentage rate increase in tax brackets.

C)Annual percentage rate increase in the average price level.

D)Monthly adjustment of wages to the cost of living.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

78

If a price index changed from 150 in 2008 to 148.5 in 2009,while Jim Bob's nominal wage fell from $25 to $24,then Jim Bob is

A)Better off like everyone else in the economy since prices are lower for consumers.

B)Neither better nor worse off since his real wage remained constant.

C)Better off since his nominal wage fell slower than the price level did.

D)Worse off since his nominal wage fell faster than the price level did.

A)Better off like everyone else in the economy since prices are lower for consumers.

B)Neither better nor worse off since his real wage remained constant.

C)Better off since his nominal wage fell slower than the price level did.

D)Worse off since his nominal wage fell faster than the price level did.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

79

A sudden increase in inflation,ceteris paribus,

A)Raises the real income of lenders relative to borrowers.

B)Raises the CPI and reduces real income.

C)Reduces the nominal income of those who have constant real incomes.

D)Makes everyone worse off.

A)Raises the real income of lenders relative to borrowers.

B)Raises the CPI and reduces real income.

C)Reduces the nominal income of those who have constant real incomes.

D)Makes everyone worse off.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck

80

The base period used in computing a price index is

A)The year in which prices were at their lowest level.

B)The year in which prices were at their average level.

C)A fixed reference year from which meaningful comparisons can be made.

D)The earliest year for which data are available.

A)The year in which prices were at their lowest level.

B)The year in which prices were at their average level.

C)A fixed reference year from which meaningful comparisons can be made.

D)The earliest year for which data are available.

Unlock Deck

Unlock for access to all 152 flashcards in this deck.

Unlock Deck

k this deck