Deck 33: Taxes: Equity Versus Efficiency

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

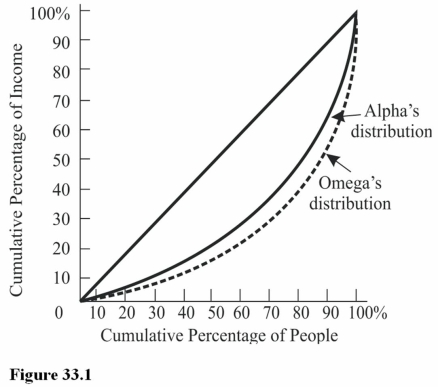

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/117

Play

Full screen (f)

Deck 33: Taxes: Equity Versus Efficiency

1

When the Census Bureau counts the number of poor Americans,it counts

A)Only in-kind income.

B)Both in-kind and money income.

C)Only money income.

A)Only in-kind income.

B)Both in-kind and money income.

C)Only money income.

Only money income.

2

How income is distributed is typically measured using

A)In-kind income.

B)Personal income.

C)Wealth.

A)In-kind income.

B)Personal income.

C)Wealth.

Personal income.

3

According to the Census Bureau,in 2010 nearly _____________ Americans were counted as poor.

A)1 million

B)9 million

C)20 million

A)1 million

B)9 million

C)20 million

9 million

4

If the area between the diagonal line of absolute equality and the Lorenz curve is greater for the United States than for Japan,we can conclude that the

A)Distribution of income in Japan is closer to being equal than in the United States.

B)Distribution of income in Japan is as equal as in the United States.

C)Distribution of income in Japan is less equal than in the United States.

A)Distribution of income in Japan is closer to being equal than in the United States.

B)Distribution of income in Japan is as equal as in the United States.

C)Distribution of income in Japan is less equal than in the United States.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

5

The federal income tax is designed to

A)Shift the Lorenz curve inward.

B)Shift the Lorenz curve outward.

C)Raise the Gini coefficient.

A)Shift the Lorenz curve inward.

B)Shift the Lorenz curve outward.

C)Raise the Gini coefficient.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

6

Income is measured as

A)A flow only.

B)A stock only.

C)Both a flow and a stock.

A)A flow only.

B)A stock only.

C)Both a flow and a stock.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

7

If income is distributed equally,the

A)Lorenz curve is a straight line.

B)Line of equality sags below the Lorenz curve.

C)Lorenz curve sags below the line of equality.

A)Lorenz curve is a straight line.

B)Line of equality sags below the Lorenz curve.

C)Lorenz curve sags below the line of equality.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

8

Medicare is an example of

A)Free goods.

B)Personal income.

C)In-kind income.

A)Free goods.

B)Personal income.

C)In-kind income.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

9

A mathematical summary of inequality based on the Lorenz curve is known as the

A)Okun coefficient.

B)Income distribution share.

C)Gini coefficient.

A)Okun coefficient.

B)Income distribution share.

C)Gini coefficient.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

10

As the ________ becomes larger,the distance between the line of absolute equality and the ________ becomes greater.

A)Gini coefficient;Lorenz curve

B)Gini coefficient;production possibilities curve

C)Lorenz curve;Gini curve

A)Gini coefficient;Lorenz curve

B)Gini coefficient;production possibilities curve

C)Lorenz curve;Gini curve

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

11

Market failure exists whenever

A)Income distribution is unequal.

B)The market generates a suboptimal outcome of income distribution.

C)The government intervenes in the market.

A)Income distribution is unequal.

B)The market generates a suboptimal outcome of income distribution.

C)The government intervenes in the market.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

12

If the Gini coefficient is greater for the United Kingdom than for Japan,we can conclude that the

A)Relative distributions of income in the two countries are the same.

B)Distribution of income in the United Kingdom is less equal than in Japan.

C)Distribution of income in the United Kingdom is as equal as it is in Japan.

A)Relative distributions of income in the two countries are the same.

B)Distribution of income in the United Kingdom is less equal than in Japan.

C)Distribution of income in the United Kingdom is as equal as it is in Japan.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

13

If the area between the diagonal line of absolute equality and the Lorenz curve is greater for China than for the United States,we can conclude that the

A)Distribution of income in China is closer to being equal than in the United States.

B)Distribution of income in China is as equal as in the United States.

C)Distribution of income in China is less equal than in the United States.

A)Distribution of income in China is closer to being equal than in the United States.

B)Distribution of income in China is as equal as in the United States.

C)Distribution of income in China is less equal than in the United States.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

14

The size distribution of income

A)Is the same thing as the functional distribution of income.

B)Tells how personal income is divided up among households or income classes.

C)Focuses on the distribution of income to different factors of production.

A)Is the same thing as the functional distribution of income.

B)Tells how personal income is divided up among households or income classes.

C)Focuses on the distribution of income to different factors of production.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

15

In the United States between 1980 and 2009,the Gini coefficient

A)Increased,indicating greater income inequality.

B)Increased,indicating less income inequality.

C)Decreased,indicating greater income inequality.

A)Increased,indicating greater income inequality.

B)Increased,indicating less income inequality.

C)Decreased,indicating greater income inequality.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

16

Public housing is an example of

A)In-kind income.

B)Free goods.

C)Money income.

A)In-kind income.

B)Free goods.

C)Money income.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

17

If a greater portion of income is distributed to those in the highest income quintile,the

A)Lorenz curve is a straight line.

B)Line of equality sags below the Lorenz curve.

C)Lorenz curve sags below the diagonal line of absolute equality.

A)Lorenz curve is a straight line.

B)Line of equality sags below the Lorenz curve.

C)Lorenz curve sags below the diagonal line of absolute equality.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

18

Wealth is measured as

A)A flow only.

B)A stock only.

C)Both a flow and a stock.

A)A flow only.

B)A stock only.

C)Both a flow and a stock.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

19

The proportion of total income received by a particular group is called the group's

A)Market share.

B)Income share.

C)Gini coefficient.

A)Market share.

B)Income share.

C)Gini coefficient.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

20

A graphic illustration of the cumulative size distribution of income is known as the

A)Size distribution of income.

B)Okun curve.

C)Lorenz curve.

A)Size distribution of income.

B)Okun curve.

C)Lorenz curve.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

21

If an individual is taxed at a 17 percent rate for each extra dollar earned,the reference is to the

A)Marginal tax rate.

B)Nominal tax rate.

C)Average tax rate.

A)Marginal tax rate.

B)Nominal tax rate.

C)Average tax rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

22

A tax elasticity of supply equal to zero indicates that

A)Employers will not hire any workers if tax rates increase.

B)Employers will hire more workers if tax rates increase.

C)Workers will not cut back on the number of hours worked if tax rates increase.

A)Employers will not hire any workers if tax rates increase.

B)Employers will hire more workers if tax rates increase.

C)Workers will not cut back on the number of hours worked if tax rates increase.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

23

The U.S.federal income tax is classified as a

A)Regressive tax only.

B)Flat tax only.

C)Progressive tax only.

A)Regressive tax only.

B)Flat tax only.

C)Progressive tax only.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

24

The tax elasticity of supply measures the

A)Response of workers to a change in the tax rate.

B)Response of workers to a change in prices.

C)Change in the amount of taxes workers must pay when tax rates change.

A)Response of workers to a change in the tax rate.

B)Response of workers to a change in prices.

C)Change in the amount of taxes workers must pay when tax rates change.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

25

In general,lower marginal tax rates provide incentives to

A)Work less.

B)Produce more output.

C)Invest less.

A)Work less.

B)Produce more output.

C)Invest less.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

26

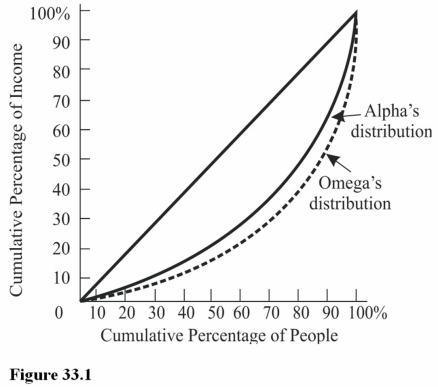

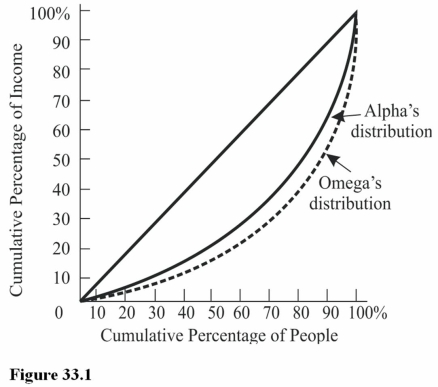

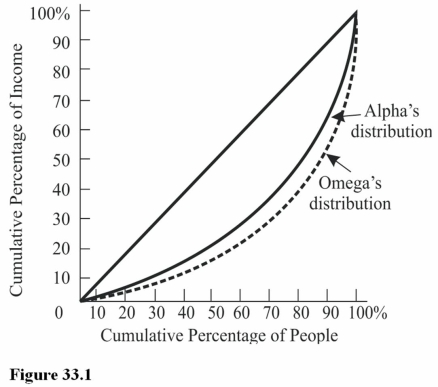

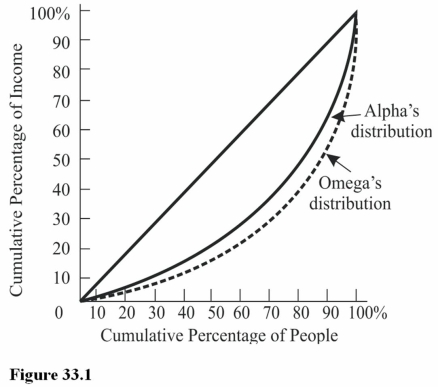

In Omega the lowest 40 percent of families receive approximately what percentage of income? (See Figure 33.1)

A)20 percent.

B)40 percent.

C)10 percent.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

27

In Figure 33.1,suppose that the Gini coefficient for Omega is 0.55.The Gini coefficient for Alpha must be

A)Less than 0.55.

B)Equal to 0.55.

C)Greater than 0.55.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

28

Additional loopholes in the personal income tax law tend to

A)Make the system less progressive.

B)Increase horizontal equity.

C)Increase the tax base.

A)Make the system less progressive.

B)Increase horizontal equity.

C)Increase the tax base.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

29

The size distribution of income in Figure 33.1 reveals that

A)Incomes are more equally distributed in Alpha than in Omega.

B)Incomes are more equally distributed in Omega than in Alpha.

C)The Gini coefficient for Alpha is larger than for Omega.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following taxes is most likely to reduce inequity?

A)A local property tax.

B)The federal income tax.

C)A gasoline tax.

A)A local property tax.

B)The federal income tax.

C)A gasoline tax.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

31

To make a tax system more progressive,policy makers could

A)Raise marginal tax rates for higher incomes.

B)Narrow the tax base.

C)Allow all interest expenses to be deductible,not just interest on mortgages.

A)Raise marginal tax rates for higher incomes.

B)Narrow the tax base.

C)Allow all interest expenses to be deductible,not just interest on mortgages.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

32

Assume the marginal tax rate is 10 percent for the first $30,000 of income,15 percent for income between $30,000 and $70,000,and 20 percent for any income over $70,000.If Emily has taxable income equal to $80,000 for the year,what is her tax bill?

A)$16,000.

B)$11,000.

C)$8,000.

A)$16,000.

B)$11,000.

C)$8,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

33

A tax is progressive if it takes a

A)Larger number of dollars as income rises.

B)Larger number of dollars as income falls.

C)Smaller fraction of income as income falls.

A)Larger number of dollars as income rises.

B)Larger number of dollars as income falls.

C)Smaller fraction of income as income falls.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

34

If the percentage of income paid in taxes increases as income rises,then the tax system is

A)Regressive.

B)Progressive.

C)Marginal.

A)Regressive.

B)Progressive.

C)Marginal.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

35

The bottom 80 percent of families in Alpha receive approximately what percentage of total income? (See Figure 33.1. )

A)80 percent.

B)60 percent.

C)50 percent.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

36

If the marginal tax rate is too high,it can cause all of the following except

A)Businesses to produce more.

B)Government tax receipts to decline.

C)The rate of saving to decline.

A)Businesses to produce more.

B)Government tax receipts to decline.

C)The rate of saving to decline.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

37

In Alpha the lowest 20 percent of families receive approximately what percentage of income? (See Figure 33.1)

A)10 percent.

B)5 percent.

C)20 percent.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is a progressive tax?

A)The federal income tax.

B)The Social Security tax.

C)Local sales taxes.

A)The federal income tax.

B)The Social Security tax.

C)Local sales taxes.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

39

Assume the marginal tax rate is 12 percent for the first $40,000 of income,28 percent for income between $40,000 and $100,000,and 30 percent for any income over $100,000.If Sarah has taxable income equal to $120,000 for the year,what is her tax bill?

A)$27,600.

B)$33,600.

C)$34,000.

A)$27,600.

B)$33,600.

C)$34,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

40

Assume that the marginal tax rate is 10 percent for the first $10,000 of income,20 percent for income between $10,000 and $40,000,and 30 percent for any income over $40,000.If Aaron has taxable income equal to $60,000 for the year,what is his tax bill?

A)$6,000.

B)$13,000.

C)$15,000.

A)$6,000.

B)$13,000.

C)$15,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose a taxpayer has an income of $70,000 and a taxable income of $60,000,and pays $9,000 in taxes.If the taxpayer says she is taxed at a 15 percent tax rate,she is referring to the

A)Marginal tax rate.

B)Nominal tax rate.

C)Effective tax rate.

A)Marginal tax rate.

B)Nominal tax rate.

C)Effective tax rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose a taxpayer has an income of $50,000 and a taxable income of $45,000,and pays $5,000 in taxes.If the taxpayer talks of being taxed at a 10 percent tax rate,she is referring to the

A)Effective tax rate.

B)Marginal tax rate.

C)Nominal tax rate.

A)Effective tax rate.

B)Marginal tax rate.

C)Nominal tax rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

43

To determine horizontal equity,two taxpayers with

A)The same taxable incomes should be compared for their effective tax rates.

B)The same gross incomes should be compared for their effective tax rates.

C)Different gross incomes should be compared for their effective tax rates.

A)The same taxable incomes should be compared for their effective tax rates.

B)The same gross incomes should be compared for their effective tax rates.

C)Different gross incomes should be compared for their effective tax rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

44

Suppose a taxpayer has an income of $120,000 and a taxable income of $80,000,and pays $20,000 in taxes.If the taxpayer says she is taxed at a 25 percent tax rate,she is referring to the

A)Nominal tax rate.

B)Marginal tax rate.

C)Effective tax rate.

A)Nominal tax rate.

B)Marginal tax rate.

C)Effective tax rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

45

If an accountant makes $80,000 and after deductions pays $8,000 in taxes while a secretary makes $35,000 and after deductions pays $4,000 in taxes,this is an example of

A)Marginal inequity.

B)Horizontal equity.

C)Vertical equity.

A)Marginal inequity.

B)Horizontal equity.

C)Vertical equity.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

46

The taxation principle that says people with higher incomes should pay more in taxes than those with lower incomes is called

A)A flat tax system.

B)A regressive tax system.

C)Vertical equity.

A)A flat tax system.

B)A regressive tax system.

C)Vertical equity.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

47

Vertical equity can be determined by comparing the

A)Effective tax rate of the taxpayer with the highest nominal income to the effective tax rates of taxpayers with lower nominal incomes.

B)Marginal tax rate of the taxpayer with the highest nominal income to the marginal tax rates of taxpayers with lower nominal incomes.

C)Marginal tax rates for two taxpayers with the same nominal incomes.

A)Effective tax rate of the taxpayer with the highest nominal income to the effective tax rates of taxpayers with lower nominal incomes.

B)Marginal tax rate of the taxpayer with the highest nominal income to the marginal tax rates of taxpayers with lower nominal incomes.

C)Marginal tax rates for two taxpayers with the same nominal incomes.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

48

Suppose Mr.Lee has total income of $120,000,has taxable income of $90,000,and pays $30,000 in taxes.Considering the information,what is Mr.Lee's nominal tax rate?

A)25 percent.

B)75 percent.

C)33.33 percent

A)25 percent.

B)75 percent.

C)33.33 percent

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

49

The taxation principle that says people with equal incomes should pay equal taxes is called

A)Horizontal equity.

B)A progressive tax system.

C)A regressive tax system.

A)Horizontal equity.

B)A progressive tax system.

C)A regressive tax system.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

50

If a tax system has no deductions,exemptions,or other loopholes,then the effective tax rate will be

A)Greater than the nominal tax rate.

B)Equal to the nominal tax rate.

C)Less than the nominal tax rate.

A)Greater than the nominal tax rate.

B)Equal to the nominal tax rate.

C)Less than the nominal tax rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

51

The many loopholes present in the federal income tax system prior to the 1986 tax reform caused all of the following except

A)Greater vertical inequity by making the income tax more regressive.

B)Greater horizontal inequity since the loopholes were more accessible to some taxpayers than others.

C)The system to be more progressive since loopholes favored those at lower income levels.

A)Greater vertical inequity by making the income tax more regressive.

B)Greater horizontal inequity since the loopholes were more accessible to some taxpayers than others.

C)The system to be more progressive since loopholes favored those at lower income levels.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

52

If Luis makes $50,000 per year as a computer programmer and pays $6,000 in taxes while Hector makes $50,000 per year as a roofing contractor and pays $7,000 in taxes,this is an example of

A)A regressive tax system.

B)Horizontal inequity.

C)A flat tax.

A)A regressive tax system.

B)Horizontal inequity.

C)A flat tax.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

53

The effective tax rate is

A)Equal to the taxes paid divided by taxable income.

B)The percentage of tax payable on the last dollar of income received.

C)Never higher than the nominal tax rate.

A)Equal to the taxes paid divided by taxable income.

B)The percentage of tax payable on the last dollar of income received.

C)Never higher than the nominal tax rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

54

As exemptions are raised and allowable deductions are increased,there is

A)A smaller gap between effective and nominal tax rates.

B)Greater vertical inequity.

C)A smaller gap between gross income and taxable income.

A)A smaller gap between effective and nominal tax rates.

B)Greater vertical inequity.

C)A smaller gap between gross income and taxable income.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

55

Exemptions and deductions included in the tax laws

A)Are designed to encourage specific economic activities.

B)Reduce vertical inequities.

C)Make the tax structure more progressive.

A)Are designed to encourage specific economic activities.

B)Reduce vertical inequities.

C)Make the tax structure more progressive.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

56

If Alejandra makes $46,000 per year as a nurse and pays $7,000 in taxes while Emily makes $46,000 per year as a high school teacher and pays $6,500 in taxes,this is an example of

A)Horizontal inequity.

B)Marginal inequity.

C)A flat tax.

A)Horizontal inequity.

B)Marginal inequity.

C)A flat tax.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

57

A tax that is designed to be progressive will improve

A)Efficiency.

B)Vertical equity.

C)Horizontal equity.

A)Efficiency.

B)Vertical equity.

C)Horizontal equity.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

58

An increase in deductions,exemptions,and credits in the tax code will

A)Reduce the tax base.

B)Allow lower rates to raise the same tax revenues.

C)Induce economic activity to go underground.

A)Reduce the tax base.

B)Allow lower rates to raise the same tax revenues.

C)Induce economic activity to go underground.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

59

An economy with nominal tax rates significantly higher than effective tax rates has

A)Loopholes in the tax code.

B)A regressive tax system.

C)A progressive tax system.

A)Loopholes in the tax code.

B)A regressive tax system.

C)A progressive tax system.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

60

The nominal tax rate is

A)Lower than the effective tax rate.

B)Taxes paid divided by total economic income.

C)Taxes paid divided by taxable income.

A)Lower than the effective tax rate.

B)Taxes paid divided by total economic income.

C)Taxes paid divided by taxable income.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

61

A 7.25 percent sales tax

A)Is a proportional tax because the rate is the same for all income groups.

B)Is a progressive tax because high-income individuals buy more goods and services than low-income individuals.

C)Is a regressive tax because poor individuals consume a higher percentage of their income than high-income individuals.

A)Is a proportional tax because the rate is the same for all income groups.

B)Is a progressive tax because high-income individuals buy more goods and services than low-income individuals.

C)Is a regressive tax because poor individuals consume a higher percentage of their income than high-income individuals.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

62

The argument against greater equality in the distribution of income in the United States hinges basically on

A)Loss of incentives.

B)Greater productivity.

C)The loss of horizontal equity.

A)Loss of incentives.

B)Greater productivity.

C)The loss of horizontal equity.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

63

Government failure

A)Occurs whenever the government intervenes in the market.

B)Does not occur;only market failure occurs.

C)Results when government intervention fails to improve market outcomes.

A)Occurs whenever the government intervenes in the market.

B)Does not occur;only market failure occurs.

C)Results when government intervention fails to improve market outcomes.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

64

A tax system in which tax rates fall as incomes rise is

A)Regressive.

B)Proportional.

C)Flat.

A)Regressive.

B)Proportional.

C)Flat.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is an example of an indirect income transfer?

A)Public schools.

B)Social Security payments.

C)Unemployment benefits.

A)Public schools.

B)Social Security payments.

C)Unemployment benefits.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

66

The changes contained in the 1990 and 1993 tax increases

A)Increased the variation in the effective tax rates.

B)Left a lot of variation in the effective tax rates.

C)Reduced the variation in the nominal tax rates.

A)Increased the variation in the effective tax rates.

B)Left a lot of variation in the effective tax rates.

C)Reduced the variation in the nominal tax rates.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

67

The changes contained in the Tax Reform Act (TRA)of 1986 included

A)Narrowing the tax base.

B)Lowering marginal tax rates.

C)A partial shift from corporate to personal taxes.

A)Narrowing the tax base.

B)Lowering marginal tax rates.

C)A partial shift from corporate to personal taxes.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following was a basic feature of the Tax Reform Act of 1986?

A)A shift from corporate to personal taxes.

B)Tax relief for the rich.

C)Loophole closing.

A)A shift from corporate to personal taxes.

B)Tax relief for the rich.

C)Loophole closing.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

69

The Bush tax cuts of 2001-2010 reduced

A)The top marginal tax rate from 39.6 percent to 35 percent.

B)The marginal tax rate for the highest income class to 10 percent.

C)Incentives for education.

A)The top marginal tax rate from 39.6 percent to 35 percent.

B)The marginal tax rate for the highest income class to 10 percent.

C)Incentives for education.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

70

The U.S.tax system as a whole is basically

A)Progressive.

B)Regressive.

C)Proportional.

A)Progressive.

B)Regressive.

C)Proportional.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

71

The fact that landlords are able to pass the majority,but not all,of the burden of property taxes on to renters suggests that the price elasticity of demand for apartments is

A)Elastic.

B)Inelastic.

C)Perfectly elastic.

A)Elastic.

B)Inelastic.

C)Perfectly elastic.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is a payroll tax?

A)The Social Security tax.

B)A sales tax.

C)The federal income tax.

A)The Social Security tax.

B)A sales tax.

C)The federal income tax.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

73

Greater equality in income is supported by the argument that it

A)Increases horizontal equity.

B)Stimulates consumption.

C)Increases incentives to work for low-income earners.

A)Increases horizontal equity.

B)Stimulates consumption.

C)Increases incentives to work for low-income earners.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

74

The marginal revenue product (MRP)establishes

A)An upper limit to the productivity of a worker.

B)An upper limit to the wage rate an employer is willing to pay.

C)A lower limit to the wage rate demands of laborers.

A)An upper limit to the productivity of a worker.

B)An upper limit to the wage rate an employer is willing to pay.

C)A lower limit to the wage rate demands of laborers.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is an example of an explicit income transfer?

A)The check received by a person currently employed by the postal service.

B)A Social Security pension paid to a retired factory worker.

C)A payment to a member of the U.S.Army who has recently been transferred to Germany.

A)The check received by a person currently employed by the postal service.

B)A Social Security pension paid to a retired factory worker.

C)A payment to a member of the U.S.Army who has recently been transferred to Germany.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is true about a payroll tax?

A)It shifts the labor supply curve to the right.

B)It reduces the net wage to employees.

C)It results in more workers being employed.

A)It shifts the labor supply curve to the right.

B)It reduces the net wage to employees.

C)It results in more workers being employed.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

77

State and local governments generate most of their revenues through

A)Income taxes.

B)Sales and property taxes.

C)Corporate profit taxes.

A)Income taxes.

B)Sales and property taxes.

C)Corporate profit taxes.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

78

The Bush tax cuts of 2001-2010 increased education incentives,and as a result,

A)New vertical inequities were introduced into the tax system.

B)Low-income households benefited more than all other households.

C)College enrollments were expected to increase significantly.

A)New vertical inequities were introduced into the tax system.

B)Low-income households benefited more than all other households.

C)College enrollments were expected to increase significantly.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

79

Since the current tax system is fairly ineffective at redistributing income,some people think this indicates

A)Government failure.

B)A problem with externalities.

C)Market failure.

A)Government failure.

B)A problem with externalities.

C)Market failure.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

80

Tax incidence most accurately refers to

A)Those from whom a tax is collected.

B)The distribution of the real burden of a tax.

C)The relative tax burdens of state and local governments.

A)Those from whom a tax is collected.

B)The distribution of the real burden of a tax.

C)The relative tax burdens of state and local governments.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck