Deck 7: Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 7: Inflation

1

Comparing changes in relative prices is more useful than examining average prices in

A)Determining the redistribution of income.

B)Determining the inflation rate.

C)Deflating nominal income.

D)Determining if there is deflation.

A)Determining the redistribution of income.

B)Determining the inflation rate.

C)Deflating nominal income.

D)Determining if there is deflation.

Determining the redistribution of income.

2

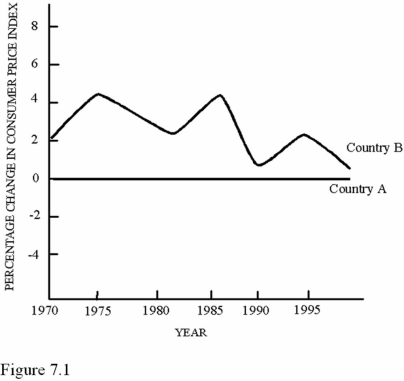

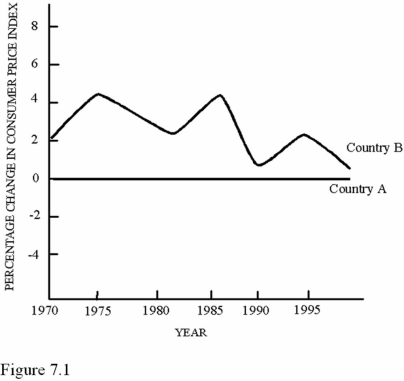

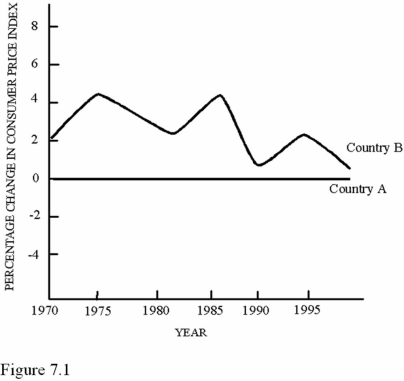

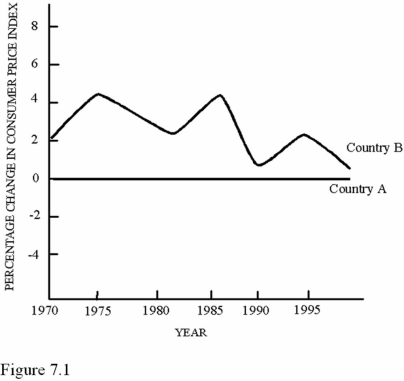

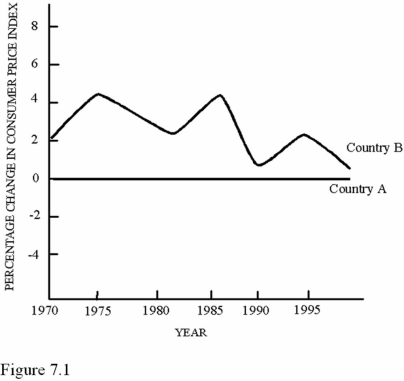

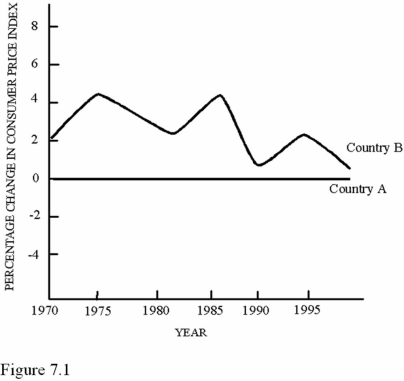

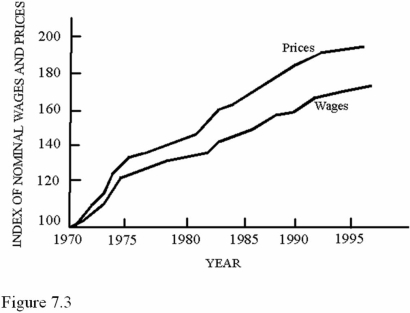

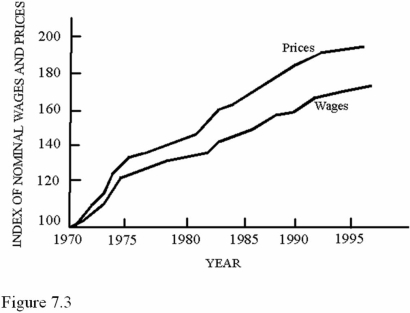

Use the following figure to answer the questions : Figure 7.1:

According to Figure 7.1 in Country A,

A)Relative prices may have been changing,but average prices were constant.

B)Relative prices were definitely constant.

C)Average prices and relative prices were definitely changing.

D)Average prices were constant, and unemployment was increasing.

According to Figure 7.1 in Country A,

A)Relative prices may have been changing,but average prices were constant.

B)Relative prices were definitely constant.

C)Average prices and relative prices were definitely changing.

D)Average prices were constant, and unemployment was increasing.

Relative prices may have been changing,but average prices were constant.

3

Real income is

A)Nominal income adjusted for inflation.

B)The amount of money income received in a given time period,measured in current dollars.

C)The use of nominal dollars to gauge changes in income.

D)None of the other choices.

A)Nominal income adjusted for inflation.

B)The amount of money income received in a given time period,measured in current dollars.

C)The use of nominal dollars to gauge changes in income.

D)None of the other choices.

Nominal income adjusted for inflation.

4

Relative price is

A)The price of one good in comparison with the price of other goods.

B)A decrease in purchasing power because of rising prices.

C)The amount of income a particular good requires.

D)The current price paid for a good or service.

A)The price of one good in comparison with the price of other goods.

B)A decrease in purchasing power because of rising prices.

C)The amount of income a particular good requires.

D)The current price paid for a good or service.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

A decrease in the average level of prices of goods and services is

A)Deflation.

B)Recession.

C)Depression.

D)Inflation

A)Deflation.

B)Recession.

C)Depression.

D)Inflation

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

If the price of Bluetooth headsets rises 12 percent during a year when the level of average prices rises 13 percent,the relative price of Bluetooth headsets

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

Your real income is

A)The amount of money you receive during a given time period.

B)Measured in current dollars.

C)The purchasing power of the money you receive.

D)The same as your nominal income in times of high inflation.

A)The amount of money you receive during a given time period.

B)Measured in current dollars.

C)The purchasing power of the money you receive.

D)The same as your nominal income in times of high inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

Deflation is a/an ____________ in the average level of prices of goods and services.

A)increase

B)decrease

C)stagnation

D)increase followed by a decrease

A)increase

B)decrease

C)stagnation

D)increase followed by a decrease

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

When the price of a good decreases more slowly than an index of average prices decreases,the good's relative price

A)Has risen while its absolute price has fallen.

B)And its absolute price have risen.

C)And its absolute price have fallen.

D)Has fallen while its absolute price has risen.

A)Has risen while its absolute price has fallen.

B)And its absolute price have risen.

C)And its absolute price have fallen.

D)Has fallen while its absolute price has risen.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

Income in constant prices is

A)Nominal income.

B)Real income.

C)Bracket creep.

D)Income effect.

A)Nominal income.

B)Real income.

C)Bracket creep.

D)Income effect.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following results from unexpected increases in the rate of inflation?

A)Decreased uncertainty.

B)Increased windfall profits to creditors who have lent large amounts of money.

C)Redistributions of income and wealth between different groups.

D)Creditors are made better off.

A)Decreased uncertainty.

B)Increased windfall profits to creditors who have lent large amounts of money.

C)Redistributions of income and wealth between different groups.

D)Creditors are made better off.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

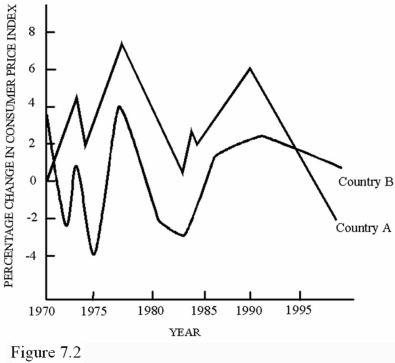

In the year 1995,which of the following statements is true about the two countries represented in Figure 7.2?

In the year 1995,which of the following statements is true about the two countries represented in Figure 7.2?A)The countries had approximately the same rate of inflation.

B)The CPI was virtually equal in the two countries.

C)The market basket cost approximately the same in both countries.

D)Real incomes were rising at the same rate in both countries.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

When there is no deflation or inflation,

A)Prices of all goods change by the same percentage.

B)Relative prices remain unchanged.

C)Average prices do not change.

D)Full employment is achieved.

A)Prices of all goods change by the same percentage.

B)Relative prices remain unchanged.

C)Average prices do not change.

D)Full employment is achieved.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following figure to answer the questions : Figure 7.1:

According to Figure 7.1,which of the following statements was definitely true about Country B?

A)Relative prices were changing.

B)The price level in general increased over the time period 1970 to 1995.

C)Real incomes were increasing.

D)The price level was about the same in 1970 and 1995.

According to Figure 7.1,which of the following statements was definitely true about Country B?

A)Relative prices were changing.

B)The price level in general increased over the time period 1970 to 1995.

C)Real incomes were increasing.

D)The price level was about the same in 1970 and 1995.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following functions are performed by changes in relative prices but not by changes in average prices?

A)Computing real income from nominal income.

B)Indicating an overheating economy.

C)Signaling changes in the desired mix of output.

D)Measuring the rates of inflation.

A)Computing real income from nominal income.

B)Indicating an overheating economy.

C)Signaling changes in the desired mix of output.

D)Measuring the rates of inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following explains why redistribution occurs during inflation?

A)Rising prices fail to signal desirable changes in the mix of output.

B)Because all prices do not change at the same rate,people buy different combinations of goods and services and own different combinations of wealth.

C)Relative prices remain unchanged.

D)All loans are indexed to inflation.

A)Rising prices fail to signal desirable changes in the mix of output.

B)Because all prices do not change at the same rate,people buy different combinations of goods and services and own different combinations of wealth.

C)Relative prices remain unchanged.

D)All loans are indexed to inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

If the price of iPods rises 10 percent during a year when the level of average prices rises 3 percent,the relative price of iPods compared with other goods

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

A)Remains constant.

B)Increases.

C)Decreases.

D)More information is required to answer this question.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following figure to answer the questions : Figure 7.1:

During the time period represented in Figure 7.1,Country A

A)Experienced periods of both inflation and deflation.

B)Never achieved the inflation goal set by the Full Employment and Balanced Growth Act of 1978.

C)Had no need for COLAs.

D)Experienced only inflation.

During the time period represented in Figure 7.1,Country A

A)Experienced periods of both inflation and deflation.

B)Never achieved the inflation goal set by the Full Employment and Balanced Growth Act of 1978.

C)Had no need for COLAs.

D)Experienced only inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

The amount of money income received in a given time period,measured in current dollars,is

A)Nominal income.

B)Real income.

C)Relative income.

D)The Consumer Price Index.

A)Nominal income.

B)Real income.

C)Relative income.

D)The Consumer Price Index.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

Inflation rates above 10 percent rarely occur

A)In most countries today.

B)In the United States.

C)During wartime periods.

D)None of the other choices.

A)In most countries today.

B)In the United States.

C)During wartime periods.

D)None of the other choices.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

A friend tells you that his income has risen every year by 5 percent.At the same time,prices,on average,have risen by 5 percent.Your friend claims he is better off.Your friend

A)Is experiencing money illusion.

B)Really is better off as he suggests.

C)Has experienced an increase in nominal and real income.

D)Has experienced an increase in real income only.

A)Is experiencing money illusion.

B)Really is better off as he suggests.

C)Has experienced an increase in nominal and real income.

D)Has experienced an increase in real income only.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

The movement of taxpayers into higher tax brackets as nominal incomes grow is

A)Bracket leap.

B)Bracket hike.

C)Bracket creep.

D)Inflation hike.

A)Bracket leap.

B)Bracket hike.

C)Bracket creep.

D)Inflation hike.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

During a period of deflation,

A)The price level rises.

B)People on fixed incomes are better off.

C)People who hold cash are worse off.

D)Lenders are worse off.

A)The price level rises.

B)People on fixed incomes are better off.

C)People who hold cash are worse off.

D)Lenders are worse off.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a macro consequence of a sudden increase in the average level of prices?

A)People on fixed incomes suffer.

B)Uncertainty is greater.

C)Nominal income falls by a smaller percentage than real income.

D)People lengthen their time horizons.

A)People on fixed incomes suffer.

B)Uncertainty is greater.

C)Nominal income falls by a smaller percentage than real income.

D)People lengthen their time horizons.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

Generally speaking,which of the following groups would tend to gain real income from the wealth effects of inflation?

A)People with fixed income.

B)People who have passbook savings accounts at fixed rates of interest.

C)People who own assets that are appreciating faster than the inflation rate.

D)People who hold all of their assets in the form of cash.

A)People with fixed income.

B)People who have passbook savings accounts at fixed rates of interest.

C)People who own assets that are appreciating faster than the inflation rate.

D)People who hold all of their assets in the form of cash.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is a microeconomic consequence of inflation?

A)Greater unemployment.

B)Greater real income.

C)The wealth effect.

D)None of the other choices.

A)Greater unemployment.

B)Greater real income.

C)The wealth effect.

D)None of the other choices.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following groups is protected from a sudden increase in inflation?

A)Borrowers who have loans at fixed interest rates.

B)Fixed-income groups.

C)Workers who receive fixed wages under multiyear contracts.

D)People who rent their homes under short-term leases in comparison with those who own their homes.

A)Borrowers who have loans at fixed interest rates.

B)Fixed-income groups.

C)Workers who receive fixed wages under multiyear contracts.

D)People who rent their homes under short-term leases in comparison with those who own their homes.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

During a period of unanticipated inflation,

A)Debtors are better off and creditors are worse off.

B)Debtors and creditors are both better off because of lower real interest rates.

C)Individuals on fixed incomes are better off.

D)All individuals are worse off because of the level of uncertainty.

A)Debtors are better off and creditors are worse off.

B)Debtors and creditors are both better off because of lower real interest rates.

C)Individuals on fixed incomes are better off.

D)All individuals are worse off because of the level of uncertainty.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

The uncertainty that results from inflation causes changes in

A)Consumption,saving,and investment behavior.

B)Saving and investment behavior,but not consumption.

C)Consumption,but not saving and investment behavior.

D)Income, but not consumption.

A)Consumption,saving,and investment behavior.

B)Saving and investment behavior,but not consumption.

C)Consumption,but not saving and investment behavior.

D)Income, but not consumption.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

Inflation ________________ the purchasing power of money.

A)increases

B)decreases

C)does not affect

D)stabilizes

A)increases

B)decreases

C)does not affect

D)stabilizes

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

Hyperinflation is

A)An inflation rate in excess of 200 percent,lasting at least one year.

B)An inflation rate in excess of 20 percent,lasting at least one year.

C)A common problem in the United States.

D)The movement of taxpayers to higher tax brackets because of rising prices.

A)An inflation rate in excess of 200 percent,lasting at least one year.

B)An inflation rate in excess of 20 percent,lasting at least one year.

C)A common problem in the United States.

D)The movement of taxpayers to higher tax brackets because of rising prices.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

If your rent increases from $1,000 to $1,100 over a period of one year and your income rises from $6,000 to $7,000,your nominal income has

A)Increased,but your real income has decreased.

B)Increased,and your real income has increased.

C)Decreased,and your real income has decreased.

D)Increased, but your real income has remained the same.

A)Increased,but your real income has decreased.

B)Increased,and your real income has increased.

C)Decreased,and your real income has decreased.

D)Increased, but your real income has remained the same.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is a likely macroeconomic consequence of inflation?

A)Focus on long-term planning.

B)Speculation.

C)Antitrust issues.

D)None of the other choices.

A)Focus on long-term planning.

B)Speculation.

C)Antitrust issues.

D)None of the other choices.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

If a bank has already lent money at fixed interest rates,then during a period of higher-than-expected inflation,it experiences

A)Negative real income effects.

B)Hyperinflation.

C)Rising real interest rates.

D)Deflation.

A)Negative real income effects.

B)Hyperinflation.

C)Rising real interest rates.

D)Deflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

If deflation is 0.5 percent per year and you receive a 1 percent decrease in your salary,then your

A)Real income falls,but your nominal income remains unchanged.

B)Real and nominal income both fall.

C)Real income remains unchanged,but your nominal income rises.

D)Real and nominal income both rise.

A)Real income falls,but your nominal income remains unchanged.

B)Real and nominal income both fall.

C)Real income remains unchanged,but your nominal income rises.

D)Real and nominal income both rise.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

Money illusion is the

A)Use of nominal dollars rather than real dollars to gauge income or wealth.

B)Movement of taxpayers into higher tax brackets as nominal income increases.

C)Focus on real dollars rather than nominal dollars to determine purchasing power.

D)Uncertainty that occurs because of inflation.

A)Use of nominal dollars rather than real dollars to gauge income or wealth.

B)Movement of taxpayers into higher tax brackets as nominal income increases.

C)Focus on real dollars rather than nominal dollars to determine purchasing power.

D)Uncertainty that occurs because of inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

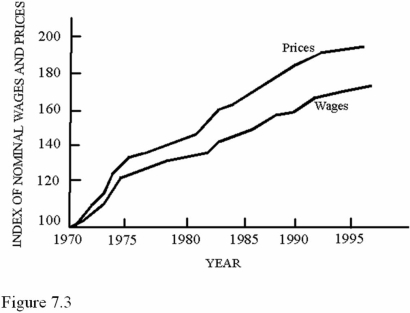

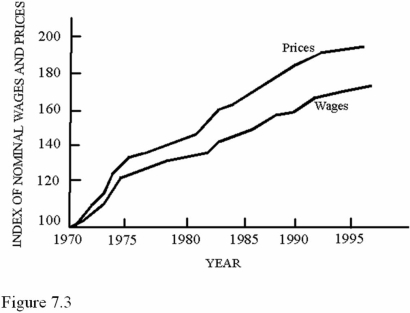

Use the following figure to answer the questions : Figure 7.3 :

According to Figure 7.3,prices and wages were rising,so

A)Sellers of output were better off than wage earners.

B)Everyone must have been worse off since the price level rose faster than incomes.

C)There were no redistributive effects of inflation.

D)The economy was experiencing stagflation.

According to Figure 7.3,prices and wages were rising,so

A)Sellers of output were better off than wage earners.

B)Everyone must have been worse off since the price level rose faster than incomes.

C)There were no redistributive effects of inflation.

D)The economy was experiencing stagflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following figure to answer the questions : Figure 7.3 :

During the time period represented in Figure 7.3,the purchasing power of the average worker

A)Increased because nominal wages increased.

B)Decreased because real income decreased.

C)Stay the same because COLAs probably kept purchasing power approximately constant.

D)Decreased because nominal income decreased.

During the time period represented in Figure 7.3,the purchasing power of the average worker

A)Increased because nominal wages increased.

B)Decreased because real income decreased.

C)Stay the same because COLAs probably kept purchasing power approximately constant.

D)Decreased because nominal income decreased.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

If your gasoline purchases decrease from $150 per month to $80 over a period of one year due to lower prices and your income decreases from $1,600 per month to $1,500 per month,your nominal income has

A)Increased,but your real income has decreased.

B)Decreased,but your real income has increased.

C)Increased,and your real income has increased.

D)Increased, but your real income has remained the same.

A)Increased,but your real income has decreased.

B)Decreased,but your real income has increased.

C)Increased,and your real income has increased.

D)Increased, but your real income has remained the same.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

If the price of your cell phone service increases from $70 to $105 over a period of one year and your income rises from $1,500 to $1,525,your nominal income has

A)Increased,and your real income has increased.

B)Increased,but your real income has decreased.

C)Decreased,and your real income has decreased.

D)Increased, but your real income has remained the same.

A)Increased,and your real income has increased.

B)Increased,but your real income has decreased.

C)Decreased,and your real income has decreased.

D)Increased, but your real income has remained the same.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

The inflation rate is the

A)Monthly percentage rate increase in the price of all goods and services.

B)Annual percentage rate increase in tax brackets.

C)Annual percentage rate increase in the average price level.

D)Monthly adjustment of wages to the cost of living.

A)Monthly percentage rate increase in the price of all goods and services.

B)Annual percentage rate increase in tax brackets.

C)Annual percentage rate increase in the average price level.

D)Monthly adjustment of wages to the cost of living.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

A sudden increase in inflation,ceteris paribus,

A)Raises the real income of lenders relative to borrowers.

B)Raises the CPI and reduces real income.

C)Reduces the nominal income of those who have constant real incomes.

D)Makes everyone worse off.

A)Raises the real income of lenders relative to borrowers.

B)Raises the CPI and reduces real income.

C)Reduces the nominal income of those who have constant real incomes.

D)Makes everyone worse off.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

Nominal GDP is the

A)Price index that refers to all goods and services included in GDP.

B)Value of final output produced using American-owned factors of production.

C)Value of final output produced,measured in current prices.

D)Value of final output produced, adjusted for changing prices.

A)Price index that refers to all goods and services included in GDP.

B)Value of final output produced using American-owned factors of production.

C)Value of final output produced,measured in current prices.

D)Value of final output produced, adjusted for changing prices.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

The price index that refers to all final goods and services produced in a country is the

A)GDP deflator.

B)PPI.

C)CPI.

D)GDP inflator.

A)GDP deflator.

B)PPI.

C)CPI.

D)GDP inflator.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

Item weight is the

A)Measure of how much consumers demand a particular item.

B)Percentage of the typical consumer budget spent on the item.

C)Significance placed on a particular item by the wealthiest households.

D)Physical weight of a good or service.

A)Measure of how much consumers demand a particular item.

B)Percentage of the typical consumer budget spent on the item.

C)Significance placed on a particular item by the wealthiest households.

D)Physical weight of a good or service.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

Real GDP is the

A)Value of final output produced,adjusted for changing prices.

B)Value of final output produced,measured in current prices.

C)Income earned by current factors of production.

D)GDP minus depreciation.

A)Value of final output produced,adjusted for changing prices.

B)Value of final output produced,measured in current prices.

C)Income earned by current factors of production.

D)GDP minus depreciation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following measures changes in the average price of consumer goods and services?

A)Inflation rate.

B)CPI.

C)Deflation rate.

D)Market basket.

A)Inflation rate.

B)CPI.

C)Deflation rate.

D)Market basket.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

If you were interested in charting prices of resources used by producers of energy,which of the following would you use?

A)The Producer Price Index (PPI).

B)The Consumer Price Index (CPI).

C)The GDP deflator.

D)The Cost of Living Adjustment (COLA).

A)The Producer Price Index (PPI).

B)The Consumer Price Index (CPI).

C)The GDP deflator.

D)The Cost of Living Adjustment (COLA).

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

If the CPI increases from 250 to 275 for one year,the rate of inflation for that year is

A)13 percent.

B)10 percent.

C)25 percent.

D)50 percent.

A)13 percent.

B)10 percent.

C)25 percent.

D)50 percent.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

The base period used in computing a price index is

A)The year in which prices were at their lowest level.

B)The year in which prices were at their average level.

C)A fixed reference year from which meaningful comparisons can be made.

D)The earliest year for which data are available.

A)The year in which prices were at their lowest level.

B)The year in which prices were at their average level.

C)A fixed reference year from which meaningful comparisons can be made.

D)The earliest year for which data are available.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Assume the CPI increases from 110 to 121,and Manny's nominal income increases from $100,000 to $120,000 over the same period.Manny's real income has

A)Increased by approximately 12 percent.

B)Increased by approximately 9 percent.

C)Decreased by approximately 8 percent.

D)Remained the same.

A)Increased by approximately 12 percent.

B)Increased by approximately 9 percent.

C)Decreased by approximately 8 percent.

D)Remained the same.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

To construct the Consumer Price Index,the Bureau of Labor Statistics must

A)Find out what people buy with their incomes and how the prices of what they buy change.

B)Find out why people buy,what they buy,and how the prices of what they buy change.

C)Find out what is in the typical consumer market basket on the basis of what producers produce.

D)Conduct producer surveys to determine how much prices rise.

A)Find out what people buy with their incomes and how the prices of what they buy change.

B)Find out why people buy,what they buy,and how the prices of what they buy change.

C)Find out what is in the typical consumer market basket on the basis of what producers produce.

D)Conduct producer surveys to determine how much prices rise.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

The Consumer Price Index is

A)A measure of changes in the average price of all goods and services.

B)A measure of changes in the average price of consumer goods and services.

C)Used to measure the impact of business speculation on consumers.

D)The impact felt by consumers who move into a higher tax bracket because of inflation.

A)A measure of changes in the average price of all goods and services.

B)A measure of changes in the average price of consumer goods and services.

C)Used to measure the impact of business speculation on consumers.

D)The impact felt by consumers who move into a higher tax bracket because of inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

To compute the real income of a household,the index that should be used is the

A)Producer Price Index (PPI).

B)Consumer Price Index (CPI).

C)GDP deflator.

D)Cost of Living Adjustment (COLA).

A)Producer Price Index (PPI).

B)Consumer Price Index (CPI).

C)GDP deflator.

D)Cost of Living Adjustment (COLA).

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following reflects changes in expenditure patterns as well as price changes?

A)The CPI.

B)The PPI.

C)The GDP deflator.

D)The COLA.

A)The CPI.

B)The PPI.

C)The GDP deflator.

D)The COLA.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

The Producer Price Index (PPI)is the best index to measure average price changes faced by

A)Consumers.

B)Producers.

C)Importers.

D)Labor unions negotiating COLAs.

A)Consumers.

B)Producers.

C)Importers.

D)Labor unions negotiating COLAs.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is often watched closely as a clue to potential changes in consumer prices in the future?

A)The CPI.

B)The PPI.

C)The GDP deflator.

D)The COLAs.

A)The CPI.

B)The PPI.

C)The GDP deflator.

D)The COLAs.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not true for the GDP deflator?

A)It is based on a fixed basket of goods and services.

B)It refers to all goods and services produced in GDP.

C)It typically reveals a lower inflation rate than the CPI.

D)It reflects both price changes and market responses.

A)It is based on a fixed basket of goods and services.

B)It refers to all goods and services produced in GDP.

C)It typically reveals a lower inflation rate than the CPI.

D)It reflects both price changes and market responses.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

During a period of deflation,

A)Time horizons are longer.

B)Consumer confidence increases.

C)Lenders are better off.

D)Borrowers are better off.

A)Time horizons are longer.

B)Consumer confidence increases.

C)Lenders are better off.

D)Borrowers are better off.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

The base period is the

A)Time period used for comparative analysis.

B)Absence of significant changes in the average price level.

C)Time period when full employment is reached.

D)First year in which inflation figures were calculated.

A)Time period used for comparative analysis.

B)Absence of significant changes in the average price level.

C)Time period when full employment is reached.

D)First year in which inflation figures were calculated.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

Cost-of-living adjustments

A)Reduce the price effect of inflation.

B)Allow individuals to maintain their purchasing power during inflation.

C)Cause individuals to shorten their time horizons.

D)Maintain constant real interest rates.r.

A)Reduce the price effect of inflation.

B)Allow individuals to maintain their purchasing power during inflation.

C)Cause individuals to shorten their time horizons.

D)Maintain constant real interest rates.r.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

A mortgage that adjusts the nominal interest rate to changing rates of inflation is

A)An ARM.

B)A PPI.

C)A GDM.

D)A COLA.

A)An ARM.

B)A PPI.

C)A GDM.

D)A COLA.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

The real interest rate is

A)The difference between the prime rate and the rate charged by the government (the Federal Reserve)on loans.

B)The nominal interest rate minus the anticipated rate of inflation.

C)The inflation rate minus the percentage increase in average wages.

D)The sum of inflation rates and unemployment rates.

A)The difference between the prime rate and the rate charged by the government (the Federal Reserve)on loans.

B)The nominal interest rate minus the anticipated rate of inflation.

C)The inflation rate minus the percentage increase in average wages.

D)The sum of inflation rates and unemployment rates.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

If some specific prices fall,some relative prices rise,and average prices remain unchanged,there has been a period of

A)Stable price levels.

B)Inflation.

C)Deflation.

D)Disinflation.

A)Stable price levels.

B)Inflation.

C)Deflation.

D)Disinflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

If nominal GDP is constant,then the GDP deflator varies inversely with

A)The unemployment rate.

B)Real GDP.

C)COLAs.

D)The CPI.

A)The unemployment rate.

B)Real GDP.

C)COLAs.

D)The CPI.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

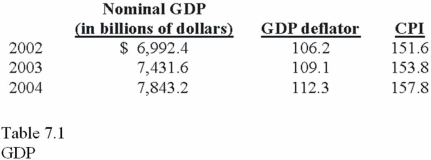

Based on Table 7.1,the real GDP for 2003 was

Based on Table 7.1,the real GDP for 2003 wasA)$4,832.0 billion.

B)$6,811.7 billion.

C)$6,584.2 billion.

D)$6,984.1 billion.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

When production costs increase and producers raise output prices,the result is

A)The price effect.

B)Unemployment.

C)Cost-push inflation.

D)Demand-pull inflation.

A)The price effect.

B)Unemployment.

C)Cost-push inflation.

D)Demand-pull inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

If the nominal interest rate is 10 percent and the real interest rate is 6 percent,

A)The expected rate of inflation is 4 percent.

B)The expected rate of inflation is 6 percent.

C)Real GDP must exceed nominal GDP.

D)Nominal GDP equals real GDP.

A)The expected rate of inflation is 4 percent.

B)The expected rate of inflation is 6 percent.

C)Real GDP must exceed nominal GDP.

D)Nominal GDP equals real GDP.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

If the economy is producing at capacity and consumers are willing and able to buy more,this may cause

A)Demand-pull inflation.

B)Cost-push inflation.

C)Supply-side inflation.

D)The price effect.

A)Demand-pull inflation.

B)Cost-push inflation.

C)Supply-side inflation.

D)The price effect.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

The most fundamental function of prices in a market economy is to provide

A)The data necessary to calculate rates of inflation.

B)The basis for the calculation of sales tax.

C)Information about the relative scarcities of resources and goods and services.

D)Maximum profits to producers.

A)The data necessary to calculate rates of inflation.

B)The basis for the calculation of sales tax.

C)Information about the relative scarcities of resources and goods and services.

D)Maximum profits to producers.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

Which one of the following statements about the United States is true?

A)Prior to World War II,the United States experienced periods of both deflation and inflation.

B)The United States has experienced inflation virtually every year since 1800.

C)Since World War II,the United States has experienced deflation.

D)Prior to World War II, the United States experienced deflation virtually every year; since World War II, the United States has consistently experienced inflation.

A)Prior to World War II,the United States experienced periods of both deflation and inflation.

B)The United States has experienced inflation virtually every year since 1800.

C)Since World War II,the United States has experienced deflation.

D)Prior to World War II, the United States experienced deflation virtually every year; since World War II, the United States has consistently experienced inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

In the Full Employment and Balanced Growth Act of 1978,

A)Congress set an inflation goal of no more than 3 percent.

B)The president set an inflation goal of 0 percent.

C)Alan Greenspan set an inflation goal of 0 percent.

D)An unemployment goal of 4 percent was set, but no inflation goal could be set.

A)Congress set an inflation goal of no more than 3 percent.

B)The president set an inflation goal of 0 percent.

C)Alan Greenspan set an inflation goal of 0 percent.

D)An unemployment goal of 4 percent was set, but no inflation goal could be set.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

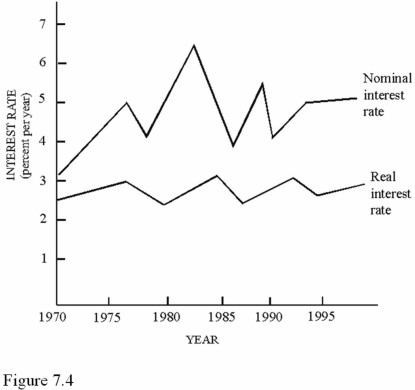

Consider the economy represented in Figure 7.4.If actual inflation was greater than anticipated inflation,

Consider the economy represented in Figure 7.4.If actual inflation was greater than anticipated inflation,A)Borrowers would experience a decrease in real income.

B)Lenders would experience a decrease in real income.

C)Lenders would experience an increase in real income.

D)The Federal Reserve would be forced to step in to increase lending.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

If consumers attempt to buy more goods than the economy can produce,the result is

A)Unemployment.

B)Demand-pull inflation.

C)Cost-push inflation.

D)The wealth effect.

A)Unemployment.

B)Demand-pull inflation.

C)Cost-push inflation.

D)The wealth effect.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

If the CPI doesn't measure product quality improvements,the CPI tends to

A)Understate the inflation rate.

B)Overstate the inflation rate.

C)Understate economic growth.

D)Be artificially low.

A)Understate the inflation rate.

B)Overstate the inflation rate.

C)Understate economic growth.

D)Be artificially low.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

Price stability

A)Is defined as a 0 percent rate of inflation in the Full Employment and Balanced Growth Act of 1978.

B)Is targeted at a 3 percent rate of inflation by Alan Greenspan,the head of the Federal Reserve.

C)Has been officially set by Congress at 3 percent or less.

D)Has been achieved consistently in the 20th century in the United States.

A)Is defined as a 0 percent rate of inflation in the Full Employment and Balanced Growth Act of 1978.

B)Is targeted at a 3 percent rate of inflation by Alan Greenspan,the head of the Federal Reserve.

C)Has been officially set by Congress at 3 percent or less.

D)Has been achieved consistently in the 20th century in the United States.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

The most desirable inflation rate is the rate that

A)Equals the official goal of 3 percent.

B)Has the least effect on the behavior of companies,investors,consumers,and workers.

C)Maximizes the "wealth effect" of inflation.

D)Coincides with an unemployment rate of 0 percent.

A)Equals the official goal of 3 percent.

B)Has the least effect on the behavior of companies,investors,consumers,and workers.

C)Maximizes the "wealth effect" of inflation.

D)Coincides with an unemployment rate of 0 percent.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

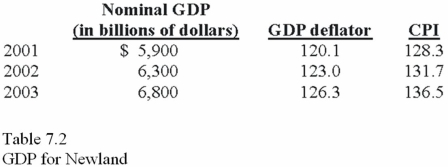

Based on Table 7.2,the real GDP for 2002 was

Based on Table 7.2,the real GDP for 2002 wasA)$7,749.0 billion.

B)$4,783.6 billion.

C)$5,122.0 billion.

D)$8,297.1 billion.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

If OPEC raises the price of oil and production costs increase,this may cause

A)Cost-push inflation.

B)Demand-pull inflation.

C)Hyperinflation.

D)Super-pull inflation.

A)Cost-push inflation.

B)Demand-pull inflation.

C)Hyperinflation.

D)Super-pull inflation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

If the nominal interest rate is 13 percent and the anticipated rate of inflation is 8 percent,the real interest rate is

A)13 percent.

B)21 percent.

C)5 percent.

D)-5 percent.

A)13 percent.

B)21 percent.

C)5 percent.

D)-5 percent.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck