Deck 7: Corporate Nonliquidating Distributions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 7: Corporate Nonliquidating Distributions

1

Oreo Corporation has accumulated E&P of $8,000 at the beginning of the current year.During the year (a nonleap year),the corporation incurs a current E&P deficit of $18,250.The corporation distributes $11,000 on March 20th to Morris,its sole shareholder,who has a $9,000 basis for his stock.If the exact loss cannot be determined as of the date of distribution,the treatment of the distribution will be

A)$4,100 dividend and a $6,900 capital gain.

B)$11,000 return of capital.

C)$4,100 dividend and a $6,900 tax free return of capital.

D)$8,000 dividend and a $3,000 return of capital.

A)$4,100 dividend and a $6,900 capital gain.

B)$11,000 return of capital.

C)$4,100 dividend and a $6,900 tax free return of capital.

D)$8,000 dividend and a $3,000 return of capital.

C

2

Tomika Corporation has current and accumulated earnings and profits of $0.Tomika distributes $10,000 to its sole shareholder,Alana.What are Tomika's earnings and profits after the distribution?

A)$0

B)($10,000)

C)$10,000

D)none of the above

A)$0

B)($10,000)

C)$10,000

D)none of the above

A

3

When computing E & P,Section 179 property must be expensed ratably over a five-year period,starting with the month in which it is expensed for Sec.179 purposes.

True

4

Identify which of the following statements is true.

A)Section 179 property must be expensed ratably over a five-year period when computing E&P.

B)Losses on property sales to related parties are not deductible when computing E&P.

C)Distributions made out of accumulated E&P are allocated ratably between multiple distributions made during the tax year.

D)All of the above are false.

A)Section 179 property must be expensed ratably over a five-year period when computing E&P.

B)Losses on property sales to related parties are not deductible when computing E&P.

C)Distributions made out of accumulated E&P are allocated ratably between multiple distributions made during the tax year.

D)All of the above are false.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

For purposes of determining current E&P,which of the following items cannot be deducted in the year incurred?

A)charitable contribution in excess of the 10% limitation

B)capital losses in excess of capital gains

C)life insurance premiums (in excess of the increase in cash surrender value for the policy)paid on the lives of key employees

D)dividends-received deduction

A)charitable contribution in excess of the 10% limitation

B)capital losses in excess of capital gains

C)life insurance premiums (in excess of the increase in cash surrender value for the policy)paid on the lives of key employees

D)dividends-received deduction

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

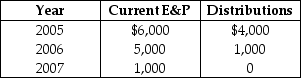

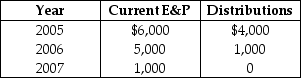

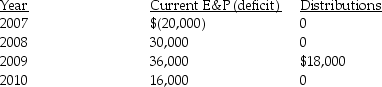

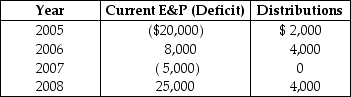

Poppy Corporation was formed three years ago.Poppy's E&P history is as follows:  Poppy Corporation's accumulated E&P on January 1 will be

Poppy Corporation's accumulated E&P on January 1 will be

A)$0.

B)$7,000.

C)$5,000.

D)$12,000.

Poppy Corporation's accumulated E&P on January 1 will be

Poppy Corporation's accumulated E&P on January 1 will beA)$0.

B)$7,000.

C)$5,000.

D)$12,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

Corporate distributions that exceed earnings and profits are always capital gains.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

How does a shareholder classify a distribution for tax purposes?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

On April 1,Delta Corporation distributes $120,000 in cash to each of its two equal shareholders,Sarah and Matt.At the time of the distribution,Delta's E&P is $160,000.Sarah's basis in her stock is $50,000 and Matt's basis in his stock is $20,000.How are the distributions characterized to Sarah and Matt? Be specific.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

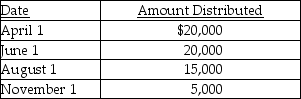

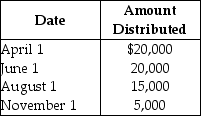

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A)$15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B)$15,000 is taxable as a dividend from accumulated E&P.

C)$4,000 is taxable as a dividend from accumulated E&P,and $11,000 is tax-free as a return of capital.

D)$5,000 is taxable as a dividend from current E&P,and $10,000 is tax-free as a return of capital.

The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would beA)$15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B)$15,000 is taxable as a dividend from accumulated E&P.

C)$4,000 is taxable as a dividend from accumulated E&P,and $11,000 is tax-free as a return of capital.

D)$5,000 is taxable as a dividend from current E&P,and $10,000 is tax-free as a return of capital.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Identify which of the following increases Earnings & Profits.

A)a capital contribution

B)life insurance proceeds payable to the spouse

C)tax-exempt interest income

D)All of the above increase E&P of a corporation.

A)a capital contribution

B)life insurance proceeds payable to the spouse

C)tax-exempt interest income

D)All of the above increase E&P of a corporation.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

Boxer Corporation buys equipment in January of the current year with a seven-year class life for $15,000.The corporation expensed the $15,000 under Sec.179.The deduction in the year of purchase for E&P purposes due to the acquisition and expensing of the equipment is

A)$1,500.

B)$3,000.

C)$14,000.

D)$15,000.

A)$1,500.

B)$3,000.

C)$14,000.

D)$15,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

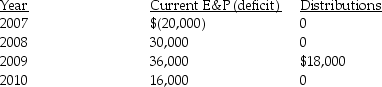

Omega Corporation is formed in 2006.Its current E&P and distributions for each year through 2010 are as follows:  Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

In 2010,Tru Corporation deducted $5,000 of bad debts.It received no tax benefit from the deduction because it had an NOL in 2010 that it was unable to carry back or forward.In 2011,Tru recovered $4,000 of the amount due.

a)What amount must Tru include in income in 2011?

b)What effect does the $4,000 have on E&P in 2011,if any?

a)What amount must Tru include in income in 2011?

b)What effect does the $4,000 have on E&P in 2011,if any?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

In the current year,Ho Corporation sells land that has a $6,000 basis and a $10,000 FMV to Henry,an unrelated individual.Henry makes a $25,000 down payment this year and will pay Ho $25,000 per year for the next three years,plus interest on the unpaid balance at a rate acceptable to the IRS.Ho's realized gain is $4,000.Since Ho is not in the business of selling land,it will use the installment method of accounting.How does this transaction affect Ho's E&P in the current year and the three subsequent years?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

Corporations may always use retained earnings as a substitute for earnings and profits.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Identify which of the following statements is false.

A)For E&P dividend distribution purposes,property as defined in Sec.317(a)includes money.

B)The function of E&P is to provide a measure of a corporation's economic ability to pay dividends.

C)At formation,a corporation's E&P depends on the amount of capital contributed by the shareholders.

D)Adjustments to taxable income when computing E&P do not include tax-exempt interest.

A)For E&P dividend distribution purposes,property as defined in Sec.317(a)includes money.

B)The function of E&P is to provide a measure of a corporation's economic ability to pay dividends.

C)At formation,a corporation's E&P depends on the amount of capital contributed by the shareholders.

D)Adjustments to taxable income when computing E&P do not include tax-exempt interest.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

Current E&P does not include

A)tax-exempt interest income.

B)life insurance proceeds where the corporation is the beneficiary.

C)federal income tax refunds from prior years.

D)All of the above are included.

A)tax-exempt interest income.

B)life insurance proceeds where the corporation is the beneficiary.

C)federal income tax refunds from prior years.

D)All of the above are included.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

Grant Corporation sells land (a noninventory item)with a basis of $57,000 for $100,000.Nichole will be paid on an installment basis in five equal annual payments,starting in the current year.The E&P for the year of sale will be increased as a result of the sale (excluding federal income taxes)by

A)$0.

B)$8,600.

C)$43,000.

D)$100,000.

A)$0.

B)$8,600.

C)$43,000.

D)$100,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

Crossroads Corporation distributes $60,000 to its sole shareholder Harley.Crossroads has earnings and profits of $55,000 and Harley's basis in her stock is $20,000.After the distribution,Harley's basis is

A)$5,000.

B)$15,000.

C)$20,000.

D)$60,000.

A)$5,000.

B)$15,000.

C)$20,000.

D)$60,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

When is E&P measured for purposes of determining whether a distribution is a dividend?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

Identify which of the following statements is true.

A)The holding period for property received by a shareholder in a nonliquidating distribution begins on the day after the distribution.

B)When making a nonliquidating distribution,a corporation recognizes gains and losses.

C)When making a nonliquidating distribution,the corporation's E&P is reduced by the property's FMV even though the property's basis is greater than its FMV.

D)All of the above are false.

A)The holding period for property received by a shareholder in a nonliquidating distribution begins on the day after the distribution.

B)When making a nonliquidating distribution,a corporation recognizes gains and losses.

C)When making a nonliquidating distribution,the corporation's E&P is reduced by the property's FMV even though the property's basis is greater than its FMV.

D)All of the above are false.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

Wills Corporation,which has accumulated a current E&P totaling $70,000,distributes land to its sole shareholder,an individual.The land has an FMV of $75,000 and an adjusted basis of $60,000.The shareholder assumes a $15,000 liability associated with the land.The transaction will have the following tax consequences.

A)The corporation will recognize a $15,000 gain; the shareholder will recognize dividend income of $75,000.

B)The corporation will recognize no gain; the shareholder will recognize dividend income of $75,000.

C)The corporation will recognize a $15,000 gain; the shareholder will recognize dividend income of $60,000.

D)The corporation will recognize no gain; the shareholder will recognize dividend income of $60,000.

A)The corporation will recognize a $15,000 gain; the shareholder will recognize dividend income of $75,000.

B)The corporation will recognize no gain; the shareholder will recognize dividend income of $75,000.

C)The corporation will recognize a $15,000 gain; the shareholder will recognize dividend income of $60,000.

D)The corporation will recognize no gain; the shareholder will recognize dividend income of $60,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

River Corporation's taxable income is $25,000,after deducting a $5,000 NOL carryover from last year and after claiming a $10,000 dividends-received deduction.What is the current E&P?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

When appreciated property is distributed in a nonliquidating distribution,the net effect on the distributing corporation's E&P is that it is reduced by the FMV of the property distributed and increased by the gain (net of federal income taxes)recognized due to the property distribution.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

Splash Corporation has $50,000 of taxable income before any charitable contribution deduction.Splash contributed $20,000 to a qualified charitable organization.Due to the 10% of taxable income limitation on charitable contribution deductions,Splash's contribution deduction is limited to $5,000.What effect does the charitable contribution have on current and future E&P?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

When computing E&P and taxable income,different depreciation methods are often used.What happens when the taxpayer sells such assets?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

Green Corporation is a calendar-year taxpayer.All of the stock is owned by Evan.His basis for the stock is $35,000.On March 1 (of a non-leap year),Green Corporation distributes $120,000 to Evan.Determine the tax consequences of the cash distribution to Evan in each of the following independent situations:

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

Dixie Corporation distributes $31,000 to its sole shareholder,Sally.At the time of the distribution,Dixie's E&P is $25,000 and Sally's basis in her Dixie stock is $10,000.Sally's basis in her Dixie stock after the distribution is

A)$4,000.

B)$10,000.

C)$25,000.

D)$31,000.

A)$4,000.

B)$10,000.

C)$25,000.

D)$31,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

One consequence of a property distribution by a corporation to a shareholder is that

A)the amount of the distribution is increased by any liability assumed by the shareholder.

B)the holding period of the distributed property includes the holding period of the distributing corporation.

C)the shareholder's basis in the distributed property is the same as the distributing corporation's basis.

D)any liabilities assumed by the shareholder do not reduce the shareholder's basis.

A)the amount of the distribution is increased by any liability assumed by the shareholder.

B)the holding period of the distributed property includes the holding period of the distributing corporation.

C)the shareholder's basis in the distributed property is the same as the distributing corporation's basis.

D)any liabilities assumed by the shareholder do not reduce the shareholder's basis.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

Corporations recognize gains and losses on the distribution of property to shareholders if the property's fair market value differs from its basis.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Tia receives a $15,000 cash distribution from Main Corporation in March of the current year.Main has $6,000 of accumulated E&P at the beginning of the year and $12,000 of current E&P.Main also distributed $15,000 in cash to Betty,who purchased all 300 shares of Main stock from Tia in June of the current year.What tax issues should be considered with respect to the distributions paid to Tia and Betty?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Hogg Corporation distributes $30,000 to its sole shareholder,Ima.At the time of the distribution,Hogg's E&P is $14,000 and Ima's basis in her stock is $10,000.Ima's gain from this transaction is a

A)$6,000 capital gain.

B)$14,000 capital gain.

C)$20,000 capital gain.

D)$30,000 capital gain.

A)$6,000 capital gain.

B)$14,000 capital gain.

C)$20,000 capital gain.

D)$30,000 capital gain.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

Wills Corporation,which has accumulated a current E&P totaling $65,000,distributes land to its sole shareholder,an individual.The land has an FMV of $75,000 and an adjusted basis of $55,000.The shareholder assumes a $15,000 liability associated with the land.The shareholder will recognize

A)$60,000 of dividend income and have a $60,000 basis in the land.

B)$65,000 of dividend income and have a $75,000 basis in the land.

C)$60,000 of dividend income and have a $75,000 basis in the land.

D)$65,000 of dividend income and have a $65,000 basis in the land.

A)$60,000 of dividend income and have a $60,000 basis in the land.

B)$65,000 of dividend income and have a $75,000 basis in the land.

C)$60,000 of dividend income and have a $75,000 basis in the land.

D)$65,000 of dividend income and have a $65,000 basis in the land.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

Outline the computation of current E&P,including two examples for each adjustment.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

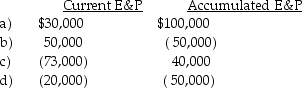

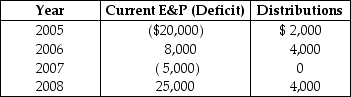

Peach Corporation was formed four years ago.Its current E&P (or E&P deficit)and distributions for the most recent four years are as follows:  What is Peach's accumulated E&P at the beginning of 2006,2007,2008,and 2009?

What is Peach's accumulated E&P at the beginning of 2006,2007,2008,and 2009?

What is Peach's accumulated E&P at the beginning of 2006,2007,2008,and 2009?

What is Peach's accumulated E&P at the beginning of 2006,2007,2008,and 2009?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

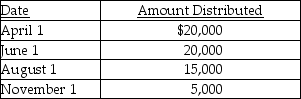

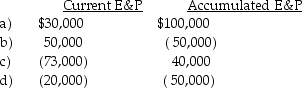

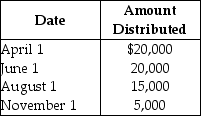

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year,the corporation makes the following distributions to its sole shareholder:  The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

Identify which of the following statements is true.

A)If both the current and accumulated E&P have deficit balances,a corporate distribution cannot be characterized as a dividend.

B)The shareholder's basis in property received in a nonliquidating distribution is the property's FMV reduced by liabilities assumed by the shareholder.

C)A corporation recognizes gain when distributing money as a dividend to its shareholders.

D)All of the above are false.

A)If both the current and accumulated E&P have deficit balances,a corporate distribution cannot be characterized as a dividend.

B)The shareholder's basis in property received in a nonliquidating distribution is the property's FMV reduced by liabilities assumed by the shareholder.

C)A corporation recognizes gain when distributing money as a dividend to its shareholders.

D)All of the above are false.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

A shareholder's basis in property distributed as a dividend is its fair market value.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

Kiara owns 100% of the shares of Lion Corporation.Kiara's basis is $70,000 and the FMV of the shares is $200,000.Kiara is willing to sell all of the stock to Tia,but Tia is unwilling to pay more than $150,000 for the stock because the Corporation has excess cash balances.They have agreed that Kiara can withdraw $50,000 in cash from Lion before the stock sale.What tax issues should be considered with respect to Kiara and Tia's agreement?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

What is a constructive dividend? Under what circumstances are constructive dividends most likely to arise?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following transactions does not have the potential of creating a constructive dividend?

A)compensation paid by a corporation to a shareholder-employee

B)purchase of corporate property by the shareholder

C)shareholder's rental of corporate property

D)All of the above can result in a constructive dividend.

A)compensation paid by a corporation to a shareholder-employee

B)purchase of corporate property by the shareholder

C)shareholder's rental of corporate property

D)All of the above can result in a constructive dividend.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

In the current year,Red Corporation has $100,000 of current and accumulated E&P.On March 2,Red Corporation distributes to Randy,a shareholder,a parcel of land (a capital asset)having a $60,000 FMV.The land has a $30,000 adjusted basis (for both tax and E&P purposes)to Red Corporation and is subject to an $8,000 mortgage,which Randy assumes.Assume a 34% marginal corporate tax rate.

a)What is the amount and character of the income Randy recognizes as a result of the distribution?

b)What is Randy's basis for the land?

c)What is the amount and character of Red Corporation's gain or loss as a result of the distribution?

d)What effect does the distribution have on Red Corporation's E&P?

a)What is the amount and character of the income Randy recognizes as a result of the distribution?

b)What is Randy's basis for the land?

c)What is the amount and character of Red Corporation's gain or loss as a result of the distribution?

d)What effect does the distribution have on Red Corporation's E&P?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

Bat Corporation distributes stock rights with a $20,000 FMV to its common stock shareholders.The $20,000 value of the stock rights at the time of distribution is less than 15% of the value of the underlying stock.Which of the following statements is true?

A)A shareholder must allocate basis to the rights based on the relative FMVs of the stock and the rights.

B)A shareholder cannot allocate any basis to the rights.

C)The basis in the rights is zero unless a shareholder makes a valid election to allocate basis to the rights.

D)The holding period for the rights begins on the day the rights are distributed in all cases.

A)A shareholder must allocate basis to the rights based on the relative FMVs of the stock and the rights.

B)A shareholder cannot allocate any basis to the rights.

C)The basis in the rights is zero unless a shareholder makes a valid election to allocate basis to the rights.

D)The holding period for the rights begins on the day the rights are distributed in all cases.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

In the current year,Pearl Corporation has $300,000 of current and accumulated E&P.On June 3,Pearl Corporation distributes a parcel of land (a capital asset)worth $120,000 to Betty,a shareholder.The land has a $60,000 adjusted basis to Pearl Corporation and is subject to a $16,000 mortgage,which Betty assumes.Assume a 34% marginal corporate tax rate.

a)What is the amount and character of the income recognized by Betty as a result of the distribution?

b)What is Betty's basis for the land?

c)What is the amount and character of Pearl's gain or loss as a result of the distribution?

d)What effect does the distribution have on Pearl's E&P?

a)What is the amount and character of the income recognized by Betty as a result of the distribution?

b)What is Betty's basis for the land?

c)What is the amount and character of Pearl's gain or loss as a result of the distribution?

d)What effect does the distribution have on Pearl's E&P?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Jerry purchased land from Winter Harbor Corporation,his 100%-owned corporation,for $275,000.The corporation purchased the land three years ago for $300,000.Similar tracts of land located nearby have sold for $400,000 in recent months.What tax issues should be considered with respect to the corporation's sale of the land?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

Tia owns 2,000 shares of Bass Corporation common stock with an $80,000 basis.Bass distributes a nontaxable preferred stock dividend.When the preferred stock is distributed,it has an FMV of $60,000 and the FMV of the 2,000 common stock shares is $180,000.The basis of the preferred stock is

A)$0.

B)$20,000.

C)$60,000.

D)$80,000.

A)$0.

B)$20,000.

C)$60,000.

D)$80,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

John,the sole shareholder of Photo Specialty Corporation has had an exceptional year.He is considering issuing himself a large bonus in lieu of a dividend.You are concerned about unreasonable compensation.What issues must be considered?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

Gould Corporation distributes land (a capital asset)worth $90,000 to Gerry,a shareholder.The land has a $30,000 basis to Gould.What is the amount and character of the gain or loss recognized by Gould?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

Identify which of the following statements is true.

A)Loans made to shareholders in proportion to their stock ownership in the corporation is evidence that the loans are disguised dividends.

B)Corporate payments for the shareholder's benefit may be a taxable dividend.

C)If the shareholder can elect to receive distributing corporation stock or money,the receipt of distributing corporation stock will be a taxable dividend.

D)All of the above are true.

A)Loans made to shareholders in proportion to their stock ownership in the corporation is evidence that the loans are disguised dividends.

B)Corporate payments for the shareholder's benefit may be a taxable dividend.

C)If the shareholder can elect to receive distributing corporation stock or money,the receipt of distributing corporation stock will be a taxable dividend.

D)All of the above are true.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Identify which of the following statements is true.

A)The FMV of an obligation is used to determine the E&P reduction when a corporation distributes the obligation to its shareholders.

B)When appreciated property is distributed to shareholders,E&P must be increased by any gain (net of taxes)recognized due to the property distribution.

C)When appreciated property is distributed in a nonliquidating distribution,the net effect on the distributing corporation's E&P is that it is reduced by the net of the FMV of the property distributed minus the gain (net of federal income taxes)recognized due to the property distribution.

D)Only B and C above are true.

A)The FMV of an obligation is used to determine the E&P reduction when a corporation distributes the obligation to its shareholders.

B)When appreciated property is distributed to shareholders,E&P must be increased by any gain (net of taxes)recognized due to the property distribution.

C)When appreciated property is distributed in a nonliquidating distribution,the net effect on the distributing corporation's E&P is that it is reduced by the net of the FMV of the property distributed minus the gain (net of federal income taxes)recognized due to the property distribution.

D)Only B and C above are true.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

White Corporation is a calendar-year taxpayer.Wilhelmina owns all of its stock.Her basis for the stock is $25,000.On March 1 of the current year (not a leap year),White Corporation distributes $60,000 to Wilhelmina.Determine the tax consequences of the cash distribution to Wilhelmina in each of the following independent situations:

a)Current E&P $15,000,accumulated E&P $50,000.

b)Current E&P $25,000,accumulated E&P $(25,000).

c)Current E&P ($36,500),accumulated E&P $65,000.

d)Current E&P ($10,000),accumulated E&P $(25,000.

a)Current E&P $15,000,accumulated E&P $50,000.

b)Current E&P $25,000,accumulated E&P $(25,000).

c)Current E&P ($36,500),accumulated E&P $65,000.

d)Current E&P ($10,000),accumulated E&P $(25,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

In a nontaxable distribution of stock rights,when the value of the rights is less than 15% of the value of the stock with respect to which the rights were distributed,the basis of the rights is zero unless the shareholder elects to allocate stock basis to the rights.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

Digger Corporation has $50,000 of current and accumulated E&P.On March 1,Digger distributes land with a $30,000 FMV and a $17,500 adjusted basis to Dave,its sole shareholder.The land is subject to a $5,000 liability which Dave assumes.

a)What are the amount and character of the distribution?

b)What is Dave's basis in the property?

c)When does his holding period for the property begin?

a)What are the amount and character of the distribution?

b)What is Dave's basis in the property?

c)When does his holding period for the property begin?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

In a taxable distribution of stock,the recipient shareholder takes a basis equal to the FMV of the stock received.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

A corporation distributes land and the related liability in a nonliquidating distribution to a shareholder.The land (a capital asset)has an adjusted basis of $70,000,an FMV of $100,000 and is subject to a mortgage of $120,000.The corporation must recognize

A)a $20,000 capital loss.

B)a $50,000 capital gain.

C)a $70,000 capital gain.

D)no gain or loss.

A)a $20,000 capital loss.

B)a $50,000 capital gain.

C)a $70,000 capital gain.

D)no gain or loss.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

Maple Corporation distributes land to a noncorporate shareholder.Explain how the following items are computed:

a)The amount of the distribution.

b)The amount of the dividend.

c)The basis of the land to the shareholder.

d)The start of the holding period for the land.

How would your answers change if the distribution was made to a corporate shareholder?

a)The amount of the distribution.

b)The amount of the dividend.

c)The basis of the land to the shareholder.

d)The start of the holding period for the land.

How would your answers change if the distribution was made to a corporate shareholder?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

A corporation distributes land and the related liability to Meg,its sole shareholder.The land has an FMV of $60,000 and is subject to a liability of $70,000.The corporation has current and accumulated E&P of $80,000.The corporation's adjusted basis for the property is $70,000.What effect does the transaction have on the corporation?

A)A recognized loss of $10,000; its E&P is reduced by $70,000.

B)A recognized loss of $10,000; its E&P is unchanged.

C)No recognized gain or loss; its E&P is reduced by $60,000.

D)No recognized gain or loss; its E&P is unchanged by the distribution.

A)A recognized loss of $10,000; its E&P is reduced by $70,000.

B)A recognized loss of $10,000; its E&P is unchanged.

C)No recognized gain or loss; its E&P is reduced by $60,000.

D)No recognized gain or loss; its E&P is unchanged by the distribution.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

An individual shareholder owns 3,000 shares of Baxter Corporation common stock with a basis of $10 per share.She receives a nontaxable 5% stock dividend.The basis per share of the common stock after the stock dividend is

A)$9.00.

B)$9.50.

C)$9.52.

D)$10.00.

A)$9.00.

B)$9.50.

C)$9.52.

D)$10.00.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Strong Corporation is owned by a group of 20 shareholders.During the current year,Strong Corporation pays $225,000 in salary and bonuses to Stedman,its president and controlling shareholder.The IRS audits Strong's tax return and determines that reasonable compensation for Stedman would be $125,000.Strong Corporation agrees to the adjustment.

a)What effect does the disallowance of part of the deduction for Stedman's salary and bonuses have on Strong Corporation and Stedman?

b)What tax savings could have been obtained by Strong Corporation and Stedman if an agreement had been in effect that required Stedman to repay Strong Corporation any amounts determined by the IRS to be unreasonable?

a)What effect does the disallowance of part of the deduction for Stedman's salary and bonuses have on Strong Corporation and Stedman?

b)What tax savings could have been obtained by Strong Corporation and Stedman if an agreement had been in effect that required Stedman to repay Strong Corporation any amounts determined by the IRS to be unreasonable?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

Joshua owns 100% of Steeler Corporation's stock.Joshua's basis in the stock is $8,000.Steeler Corporation has E&P of $40,000.If Steeler Corporation redeems 60% of Joshua's stock for $50,000,Joshua must report dividend income of

A)$0.

B)$8,000.

C)$40,000.

D)$50,000.

A)$0.

B)$8,000.

C)$40,000.

D)$50,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

Family Corporation,a corporation controlled by Buddy's family,redeems all of Buddy's stock.For the redemption to be treated as a sale,which one of the following conditions must be met?

A)Buddy cannot be a creditor of the corporation after the redemption.

B)Buddy cannot be an officer of the corporation after the redemption.

C)Buddy cannot acquire an interest,even by inheritance,for 10 years unless the bequest was made prior to the redemption.

D)Buddy must have purchased the redeemed stock from a person whose stock ownership would be attributed to Buddy.

A)Buddy cannot be a creditor of the corporation after the redemption.

B)Buddy cannot be an officer of the corporation after the redemption.

C)Buddy cannot acquire an interest,even by inheritance,for 10 years unless the bequest was made prior to the redemption.

D)Buddy must have purchased the redeemed stock from a person whose stock ownership would be attributed to Buddy.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

Identify which of the following statements is true.

A)Generally in a stock redemption,if the shareholder's ownership percentage is substantially reduced,the redemption is treated as a sale.

B)The family attribution rules of Sec.318 are as inclusive as the family attribution rules of Sec.267.

C)A 10% shareholder of a corporation is considered to own 10% of any stock that is owned by the corporation under the Sec.318 attribution rules.

D)All of the above are false.

A)Generally in a stock redemption,if the shareholder's ownership percentage is substantially reduced,the redemption is treated as a sale.

B)The family attribution rules of Sec.318 are as inclusive as the family attribution rules of Sec.267.

C)A 10% shareholder of a corporation is considered to own 10% of any stock that is owned by the corporation under the Sec.318 attribution rules.

D)All of the above are false.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

Bruce receives 20 stock rights in a nontaxable distribution.The stock rights have an FMV of $5,000.The common stock with respect to which the rights are issued has a basis of $4,000 and an FMV of $120,000.Bruce allows the stock rights to lapse.He can deduct a loss of

A)$0.

B)$1,000.

C)$5,000.

D)none of the above

A)$0.

B)$1,000.

C)$5,000.

D)none of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following requirements must be met for a redemption to be treated as substantially disproportionate?

A)The shareholder must own less than 50% of the outstanding stock (in terms of voting power)after the redemption.

B)After the redemption,the shareholder must own less than 80% of his percentage ownership of voting stock prior to the redemption.

C)After the redemption,the shareholder must own less than 80% of his percentage ownership of common stock (voting and nonvoting)prior to the redemption.

D)All of the above must be met.

A)The shareholder must own less than 50% of the outstanding stock (in terms of voting power)after the redemption.

B)After the redemption,the shareholder must own less than 80% of his percentage ownership of voting stock prior to the redemption.

C)After the redemption,the shareholder must own less than 80% of his percentage ownership of common stock (voting and nonvoting)prior to the redemption.

D)All of the above must be met.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

Identify which of the following statements is true.

A)Stock ownership attributed to a corporation from one of its shareholders cannot be attributed to another of the corporation's shareholders under the Sec.318 attribution rules.

B)Under the attribution rules relating to stock redemptions,a person who has an option to purchase stock is considered to own the stock.

C)A stock redemption that qualifies as substantially disproportionate is a safe harbor for capital gain treatment.

D)All of the above are true.

A)Stock ownership attributed to a corporation from one of its shareholders cannot be attributed to another of the corporation's shareholders under the Sec.318 attribution rules.

B)Under the attribution rules relating to stock redemptions,a person who has an option to purchase stock is considered to own the stock.

C)A stock redemption that qualifies as substantially disproportionate is a safe harbor for capital gain treatment.

D)All of the above are true.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

The Sec.318 family attribution rules can be waived for purposes of the Sec.302(b)(3)complete termination rules even though the redeeming shareholder is a creditor of the corporation.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

Why are stock dividends generally nontaxable? Under what circumstances are stock dividends taxable?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not a condition that permits a stock redemption to be treated as a sale?

A)It provides funds for payment of income taxes.

B)It is not essentially equivalent to a dividend.

C)The redemption is substantially disproportionate.

D)The redemption completely terminates the shareholder's interest.

A)It provides funds for payment of income taxes.

B)It is not essentially equivalent to a dividend.

C)The redemption is substantially disproportionate.

D)The redemption completely terminates the shareholder's interest.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

Identify which of the following statements is false.

A)The distribution of stock rights will be taxable if the value of the stock rights is more than 15% of the value of the underlying stock.

B)The distribution of stock rights is generally tax free under Sec.305.

C)If the value of stock rights is less than 15% of the value of the underlying stock,the basis of the rights is zero unless the shareholder elects to allocate basis to the rights.

D)The holding period for stock rights includes the holding period for the underlying stock.

A)The distribution of stock rights will be taxable if the value of the stock rights is more than 15% of the value of the underlying stock.

B)The distribution of stock rights is generally tax free under Sec.305.

C)If the value of stock rights is less than 15% of the value of the underlying stock,the basis of the rights is zero unless the shareholder elects to allocate basis to the rights.

D)The holding period for stock rights includes the holding period for the underlying stock.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

Identify which of the following statements is true.

A)The distributing corporation's E&P must be reduced by the FMV of nontaxable stock rights distributed to shareholders.

B)A stock redemption can be used to withdraw some assets from a corporation prior to a sale of the business.

C)A shareholder can redeem part of his stock and recognize a capital gain if the corporation has only one shareholder.

D)All of the above are false.

A)The distributing corporation's E&P must be reduced by the FMV of nontaxable stock rights distributed to shareholders.

B)A stock redemption can be used to withdraw some assets from a corporation prior to a sale of the business.

C)A shareholder can redeem part of his stock and recognize a capital gain if the corporation has only one shareholder.

D)All of the above are false.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

Identify which of the following statements is false.

A)A stock redemption is treated as a sale or exchange only if the shareholder's ownership of one particular class of stock is terminated.

B)An individual is not considered to own stock owned by a brother under the family attribution rules of Sec.318.

C)An individual is considered to own the stock owned by his parents,children,spouse,and grandchildren under the family attribution rules of Sec.318.

D)A person who has an option to purchase stock is considered to own the stock.

A)A stock redemption is treated as a sale or exchange only if the shareholder's ownership of one particular class of stock is terminated.

B)An individual is not considered to own stock owned by a brother under the family attribution rules of Sec.318.

C)An individual is considered to own the stock owned by his parents,children,spouse,and grandchildren under the family attribution rules of Sec.318.

D)A person who has an option to purchase stock is considered to own the stock.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

A partial liquidation of a corporation is treated as a dividend in the case of a corporate shareholder.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Identify which of the following statements is true.

A)The Sec.318 family attribution rules can be waived for purposes of the Sec.302(b)(3)complete termination rules even though the redeeming shareholder is a creditor of the corporation.

B)Waiver of the Sec.318 family attribution rules is permitted for all related party stock transactions.

C)For a redemption to be essentially equivalent to a dividend,the shareholder must not have control of the corporation immediately following the redemption.

D)All of the above are false.

A)The Sec.318 family attribution rules can be waived for purposes of the Sec.302(b)(3)complete termination rules even though the redeeming shareholder is a creditor of the corporation.

B)Waiver of the Sec.318 family attribution rules is permitted for all related party stock transactions.

C)For a redemption to be essentially equivalent to a dividend,the shareholder must not have control of the corporation immediately following the redemption.

D)All of the above are false.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

Elijah owns 20% of Park Corporation's single class of stock.Elijah's basis in the stock is $8,000.Park's E&P is $28,000.If Park redeems all of Elijah's stock for $48,000,Elijah must report dividend income of

A)$0.

B)$28,000.

C)$40,000.

D)$48,000.

A)$0.

B)$28,000.

C)$40,000.

D)$48,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

Checkers Corporation has a single class of common stock outstanding.Bert owns 100 shares,which he purchased five years ago for $200,000.In the current year,when the stock is worth $2,500 per share,Checkers Corporation declares a 10% stock dividend payable in common stock.Bert receives ten additional shares on December 10 of the current year.On January 25 of next year he sells all ten shares for $30,000.

a)How much income must Bert recognize when he receives the stock dividend?

b)How much gain or loss must Bert recognize when he sells the ten shares he received as a stock dividend?

a)How much income must Bert recognize when he receives the stock dividend?

b)How much gain or loss must Bert recognize when he sells the ten shares he received as a stock dividend?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

A stock redemption is always treated as if the shareholder sold his stock to the corporation.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

What are the consequences of a stock redemption to the distributing corporation?

A)The corporation recognizes a gain or loss as if it had sold the distributed property for its FMV immediately before the redemption.

B)If the redemption is treated as a dividend,E&P is reduced in the same manner as for a regular dividend.

C)If the redemption is treated as a sale,only accumulated earnings and profits is reduced.

D)All of the above are correct.

A)The corporation recognizes a gain or loss as if it had sold the distributed property for its FMV immediately before the redemption.

B)If the redemption is treated as a dividend,E&P is reduced in the same manner as for a regular dividend.

C)If the redemption is treated as a sale,only accumulated earnings and profits is reduced.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

Ace Corporation has a single class of stock outstanding.Alan owns 200 shares of the common stock,which he purchased for $50 per share two years ago.On April 10,of the current year,Ace Corporation distributes to its shareholders one right to purchase a share of common stock at $60 per share for each share of common stock held.At the time of the distribution,the common stock is worth $75 per share,and the rights are worth $15 per right.On September 10,Alan sells 100 rights for $2,000 and exercises the remaining 100 rights.He sells 60 of the shares acquired with the rights for $80 each on November 10.

a)What is the amount and character of income Alan recognizes when he receives the rights?

b)What is the amount and character of gain or loss Alan recognizes when he sells the rights?

c)What is the amount and character of gain or loss Alan recognizes when he exercises the rights?

d)What is the amount and character of gain or loss Alan recognizes when he sells the new common stock?

e)What basis does Alan have in his remaining shares?

a)What is the amount and character of income Alan recognizes when he receives the rights?

b)What is the amount and character of gain or loss Alan recognizes when he sells the rights?

c)What is the amount and character of gain or loss Alan recognizes when he exercises the rights?

d)What is the amount and character of gain or loss Alan recognizes when he sells the new common stock?

e)What basis does Alan have in his remaining shares?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is not a reason for a stock redemption?

A)desire by remaining shareholders to retain control

B)desire by shareholders to reduce the corporate tax liability

C)Redemption of shares is a good corporate investment.

D)No outside market exists for the stock.

A)desire by remaining shareholders to retain control

B)desire by shareholders to reduce the corporate tax liability

C)Redemption of shares is a good corporate investment.

D)No outside market exists for the stock.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck