Deck 13: Property Transactions: Section 1231 and Recapture

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 13: Property Transactions: Section 1231 and Recapture

1

Sec. 1245 can increase the amount of gain recognized on an asset.

False

2

Section 1250 could convert a portion of Sec. 1231 gain into ordinary income if the real property was placed in service prior to 1987 and accelerated depreciation was used.

True

3

If the recognized losses resulting from involuntary conversions arising from casualty or theft exceed the recognized gains from such events (i.e. a net loss from the casualty), all of the involuntary conversions are treated as ordinary gains and losses.

True

4

If a taxpayer has gains on Sec. 1231 assets, Secs. 1245 and 1250 must be applied first to determine any amounts recaptured as ordinary income, and any excess gain may then be netted with Sec. 1231 losses for possible long-term capital gain treatment.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

In 2014, Thomas, who has a marginal tax rate of 15%, sells land that is Sec. 1231 property at a gain of $4,000. If he has no other 1231 transactions or capital asset transactions and has no nonrecaptured 1231 gain, Thomas will pay no tax on the $4,000 gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

The sale of inventory results in ordinary gain or loss.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

Sec. 1245 applies to gains on the sale of depreciable personal property, but it generally does not apply to depreciable real property.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Any gain or loss resulting from the sale or disposition of depreciable property used in trade or business and held one year or less is considered ordinary.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

Gains and losses resulting from condemnations of Sec. 1231 property and capital assets held more than one year are classified as ordinary gains and losses.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

For noncorporate taxpayers, depreciation recapture is not required on real property placed in service after 1986.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

If realized gain from disposition of business equipment exceeds total depreciation or cost recovery, a portion of the gain will receive Sec. 1231 treatment if the equipment's holding period is more than one year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Depreciable property used in a trade or business for one year or less is considered Sec. 1231 property.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

When corporate and noncorporate taxpayers sell real property placed in service after 1986, all depreciation taken will be taxed at a maximum rate of 25%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

Sec. 1245 ordinary income recapture can apply to buildings placed in service prior to 1987.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

Unrecaptured 1250 gain is the amount of long-term capital gain which would be taxed as ordinary income if Sec. 1250 provided for the recapture of all depreciation and not just additional depreciation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

Sec. 1231 property must satisfy a holding period of more than one year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

A net Sec. 1231 gain is treated as ordinary income to the extent of any nonrecaptured net Sec. 1231 losses for the preceding five years.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Gains and losses from involuntary conversions of property used in a trade or business generally are classified as capital gains and losses.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

The purpose of Sec. 1245 is to eliminate the advantage taxpayers would have if they were able to reduce ordinary income by depreciation deductions and also receive favorable Sec. 1231 treatment when the asset was sold.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

Mark owns an unincorporated business and has $20,000 of Section 1231 gains and $22,000 of Section 1231 losses. He must report a capital loss of $2,000 on his tax return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

Daniel recognizes $35,000 of Sec. 1231 gains and $25,000 of Sec. 1231 losses during the current year. The only other Sec. 1231 item was a $4,000 loss three years ago. This year, Daniel must report

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

The amount recaptured as ordinary income under either Sec. 1245 or Sec. 1250 can never exceed the realized gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

When gain is recognized on an involuntary conversion, gain is subject to recapture under Sec. 1245 or Sec.1250.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Costs of tangible personal business property which are expensed under Sec. 179 are subject to recapture if the property is converted to nonbusiness use before the end of the MACRS recovery period.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

The additional recapture under Sec. 291 is 25% of the difference between the amount that would have been recaptured if the property was Sec. 1245 property and the actual recapture under Sec. 1250.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses. The gains and losses are characterized as

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

Pierce has a $16,000 Section 1231 loss, a $12,000 Section 1231 gain, and a salary of $50,000. What is the treatment of these items in Pierce's AGI?

A)Pierce has a LTCG of $12,000 and a net ordinary income of $34,000.

B)The 1231 gains and losses are treated as ordinary gains and losses making Pierce's AGI for the year $46,000.

C)Pierce has a $3,000 LTCL which is deductible for AGI making AGI $47,000. He also has a $1,000 LTCL carryover.

D)Pierce has net LTCG of $9,000 and $37,000 of net ordinary income.

A)Pierce has a LTCG of $12,000 and a net ordinary income of $34,000.

B)The 1231 gains and losses are treated as ordinary gains and losses making Pierce's AGI for the year $46,000.

C)Pierce has a $3,000 LTCL which is deductible for AGI making AGI $47,000. He also has a $1,000 LTCL carryover.

D)Pierce has net LTCG of $9,000 and $37,000 of net ordinary income.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

When appreciated property is transferred at death, the recapture potential carries over to the person who receives the property from the decedent.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

If no gain is recognized in a nontaxable like-kind exchange involving Sec. 1245 or Sec. 1250 property, the recapture potential carries over to the replacement property.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

When a donee disposes of appreciated gift property, the recapture amount for the donee is computed by including the recapture amount attributable to the donor.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

During the current year, Danika recognizes a $30,000 Section 1231 gain and a $22,000 Section 1231 loss. Prior to this, Danika's only Section 1231 item was a $15,000 loss two years ago. Danika must report a(n)

A)$8,000 net LTCG.

B)$8,000 ordinary income.

C)$15,000 ordinary income.

D)$8,000 ordinary income and $7,000 net LTCG.

A)$8,000 net LTCG.

B)$8,000 ordinary income.

C)$15,000 ordinary income.

D)$8,000 ordinary income and $7,000 net LTCG.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

During the current year, George recognizes a $30,000 Section 1231 gain on sale of land and a $18,000 Section 1231 loss on the sale of land. Prior to this, George's only Section 1231 item was a $14,000 loss six years ago. George must report a

A)$12,000 net LTCG.

B)$12,000 ordinary income.

C)$14,000 ordinary income.

D)$10,000 ordinary income and $2,000 net LTCG.

A)$12,000 net LTCG.

B)$12,000 ordinary income.

C)$14,000 ordinary income.

D)$10,000 ordinary income and $2,000 net LTCG.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

Section 1250 does not apply to assets sold or exchanged at a loss.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

During the current year, Kayla recognizes a $40,000 Section 1231 gain on sale of land and a $22,000 Section 1231 loss on the sale of land. Prior to this, Kayla's only Section 1231 item was a $10,000 loss six years ago. Kayla is in the 28% marginal tax bracket. The amount of tax resulting from these transactions is

A)$2,700.

B)$3,600.

C)$4,000.

D)$5,040.

A)$2,700.

B)$3,600.

C)$4,000.

D)$5,040.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

Why did Congress establish favorable treatment for 1231 assets?

A)to encourage the mobility of capital

B)to allow a larger deduction for losses

C)to help business owners replace assets which had declined in value

D)All of the above

A)to encourage the mobility of capital

B)to allow a larger deduction for losses

C)to help business owners replace assets which had declined in value

D)All of the above

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

In addition to the normal recapture rules of Sec. 1250, corporations which sell depreciable real estate are subject to additional recapture rules of Sec. 291.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Frisco Inc., a C corporation, placed a building in service in 2002 and deducted straight-line depreciation under the MACRS system in the normal manner. It sold the building this year for a substantial gain. Because straight-line depreciation was used, Frisco will not need to recognize any ordinary gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

Gain recognized on the sale or exchange of property between related parties is capital if the property is subject to depreciation in the hands of the transferee.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

Installment sales of depreciable property which result in recaptured income under Secs. 1245 or 1250 require that the recaptured income be recognized in the year of sale.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Gifts of appreciated depreciable property may trigger recapture of depreciation or cost-recovery deductions to the donor.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

During the current year, a corporation sells equipment for $300,000. The equipment cost $270,000 when purchased and placed in service two years ago and $60,000 of depreciation deductions were allowed. The results of the sale are

A)ordinary income of $90,000.

B)Sec. 1231 gain of $90,000.

C)ordinary income of $60,000 and LTCG of $30,000.

D)ordinary income of $60,000 and Sec. 1231 gain of $30,000.

A)ordinary income of $90,000.

B)Sec. 1231 gain of $90,000.

C)ordinary income of $60,000 and LTCG of $30,000.

D)ordinary income of $60,000 and Sec. 1231 gain of $30,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

Terry has sold equipment used in her business. She acquired the equipment three years ago for $50,000 and has recognized $30,000 of depreciation across the years in use. In order to recognize any Sec. 1231 gain, she must sell the equipment for more than

A)$0.

B)$20,000.

C)$30,000.

D)$50,000.

A)$0.

B)$20,000.

C)$30,000.

D)$50,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

Harry owns equipment ($50,000 basis and $38,000 FMV)and a building ($140,000 basis and $156,000 FMV), which are used in his business. Harry uses straight-line depreciation for both assets, which were acquired several years ago. Both the equipment and the building are destroyed in a fire, and Harry collects insurance proceeds equal to the assets' FMV. The tax result to Harry for this transaction is

A)the involuntary conversions are treated as ordinary gains and losses.

B)the involuntary conversions are treated as Sec. 1231 gains and losses.

C)the loss on involuntary conversion is treated as a Sec. 1231 loss while the gain is treated as an ordinary gain.

D)the loss on involuntary conversion is treated as an ordinary loss while the gain is treated as a Sec. 1231 gain.

A)the involuntary conversions are treated as ordinary gains and losses.

B)the involuntary conversions are treated as Sec. 1231 gains and losses.

C)the loss on involuntary conversion is treated as a Sec. 1231 loss while the gain is treated as an ordinary gain.

D)the loss on involuntary conversion is treated as an ordinary loss while the gain is treated as a Sec. 1231 gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

Section 1245 recapture applies to all the following except

A)depreciable personal property.

B)assets sold or exchanged at a loss.

C)total depreciation or amortization allowed or allowable.

D)amortizable intangible personal property.

A)depreciable personal property.

B)assets sold or exchanged at a loss.

C)total depreciation or amortization allowed or allowable.

D)amortizable intangible personal property.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

For a business, Sec. 1231 property does not include

A)timber, coal, or domestic iron ore.

B)inventory purchased 24 months ago.

C)an office building purchased five years ago.

D)land used in the business that was purchased two years ago.

A)timber, coal, or domestic iron ore.

B)inventory purchased 24 months ago.

C)an office building purchased five years ago.

D)land used in the business that was purchased two years ago.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Cassie owns equipment ($45,000 basis and $30,000 FMV)and a building ($152,000 basis and $158,000 FMV), which are used in Cassie's business. Cassie has used straight-line depreciation for both assets, which were acquired two years ago. Both the equipment and the building are destroyed in a fire, and Cassie collects insurance proceeds equal to the assets' FMV. The tax result to Cassie for this transaction is a

A)$15,000 Sec. 1231 loss and a $6,000 ordinary gain.

B)$15,000 ordinary loss and a $6,000 ordinary gain.

C)$15,000 ordinary loss and a $6,000 Sec. 1231 gain.

D)$15,000 Sec. 1231 loss and a $6,000 Sec. 1231 gain.

A)$15,000 Sec. 1231 loss and a $6,000 ordinary gain.

B)$15,000 ordinary loss and a $6,000 ordinary gain.

C)$15,000 ordinary loss and a $6,000 Sec. 1231 gain.

D)$15,000 Sec. 1231 loss and a $6,000 Sec. 1231 gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Section 1231 property will generally have all the following characteristics except

A)real or depreciable property.

B)used in trade or business.

C)held for sale to customers.

D)held for more than one year.

A)real or depreciable property.

B)used in trade or business.

C)held for sale to customers.

D)held for more than one year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

A building used in a business for more than a year is sold. Sec. 1250 will not cause depreciation recapture if

A)the building is fully depreciated.

B)the building was placed in service after 1986.

C)straight-line depreciation was used.

D)all of the above.

A)the building is fully depreciated.

B)the building was placed in service after 1986.

C)straight-line depreciation was used.

D)all of the above.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Emma owns a small building ($120,000 basis and $123,000 FMV)and equipment ($35,000 basis and $22,000 FMV). Both assets were acquired three years ago, are used in Emma's business, and are depreciated using straight-line depreciation. Both are destroyed by fire. Insurance proceeds were equal to their FMVs. Only one other transfer of an asset occurs during the year, and a $3,000 LTCL is recognized. After considering all transactions, the tax result to Emma is a

A)$13,000 NLTCL.

B)$13,000 ordinary loss.

C)$3,000 LTCG; $3,000 LTCL; and $13,000 ordinary loss.

D)$10,000 net ordinary loss and a $3,000 NLTCL.

A)$13,000 NLTCL.

B)$13,000 ordinary loss.

C)$3,000 LTCG; $3,000 LTCL; and $13,000 ordinary loss.

D)$10,000 net ordinary loss and a $3,000 NLTCL.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

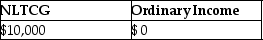

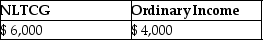

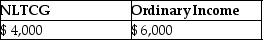

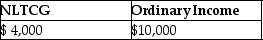

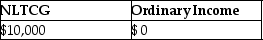

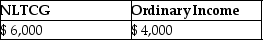

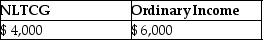

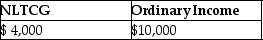

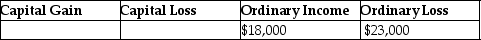

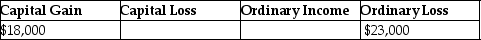

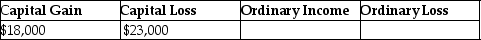

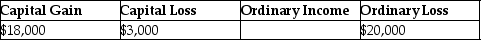

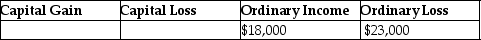

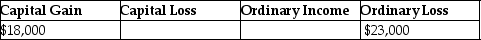

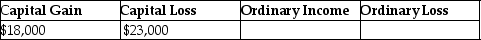

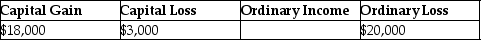

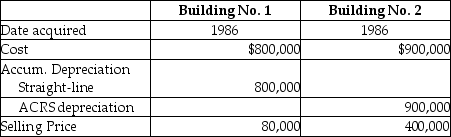

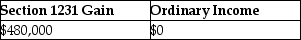

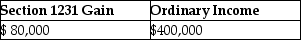

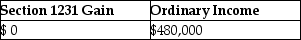

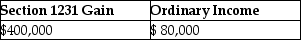

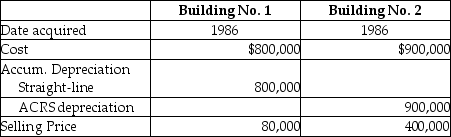

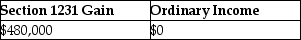

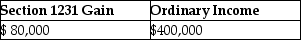

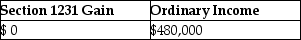

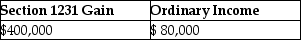

An unincorporated business sold two warehouses during the current year. The straight-line depreciation method was used for the first building and the accelerated method (ACRS)was used for the second building. Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

A)

B)

C)

D)

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?A)

B)

C)

D)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

During the current year, Hugo sells equipment for $150,000. The equipment cost $175,000 when placed in service two years ago, and $55,000 of depreciation deductions were allowed. The results of the sale are

A)LTCG of $30,000.

B)Sec. 1231 gain of $30,000.

C)Sec. 1245 ordinary income $30,000.

D)Sec. 1250 ordinary income of $30,000.

A)LTCG of $30,000.

B)Sec. 1231 gain of $30,000.

C)Sec. 1245 ordinary income $30,000.

D)Sec. 1250 ordinary income of $30,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

A corporation owns many acres of timber, which it acquired three years ago, and which has a $150,000 basis for depletion. The timber is cut during the current year for use in the corporation's business. The FMV of the timber on the first day of the current year is $280,000. If the corporation makes the appropriate election, the tax result is

A)recognition of a Sec. 1231 gain of $130,000.

B)no recognition of gain or loss since the timber is used in the business.

C)recognition of a gain at the time of sale if the timber is later sold with the gain equal to the sales price less the basis in the timber.

D)recognition of a gain if the timber is later sold with the gain equal to the sales price less $280,000 (FMV on the first day of the year of the cutting).

A)recognition of a Sec. 1231 gain of $130,000.

B)no recognition of gain or loss since the timber is used in the business.

C)recognition of a gain at the time of sale if the timber is later sold with the gain equal to the sales price less the basis in the timber.

D)recognition of a gain if the timber is later sold with the gain equal to the sales price less $280,000 (FMV on the first day of the year of the cutting).

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following assets is 1231 property?

A)a machine used in the company's manufacturing operations

B)an investment in corporate stock

C)land held for investment

D)items held for resale by a retailer

A)a machine used in the company's manufacturing operations

B)an investment in corporate stock

C)land held for investment

D)items held for resale by a retailer

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

If Section 1231 applies to the sale or exchange of an unharvested crop sold with land, the costs of producing the crop are

A)capitalized.

B)deducted as an expense of operations when incurred and also deducted from the sales price at the time of the sale.

C)deducted when incurred if the land is sold but capitalized if the land is exchanged.

D)deducted as an expense of operations when incurred.

A)capitalized.

B)deducted as an expense of operations when incurred and also deducted from the sales price at the time of the sale.

C)deducted when incurred if the land is sold but capitalized if the land is exchanged.

D)deducted as an expense of operations when incurred.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

Blair, whose tax rate is 28%, sells one tract of land at a gain of $29,000 and another tract of land at a gain of $11,000. Both tracts of land are Sec. 1231 property. She has never had any other Sec. 1231 transactions. How are the gains taxed?

A)ordinary income of $40,000 taxed at 28%

B)a net capital gain of $40,000 which is not taxed

C)a net capital gain of $40,000 taxed at 15%

D)ordinary income of $40,000 taxed at 25%

A)ordinary income of $40,000 taxed at 28%

B)a net capital gain of $40,000 which is not taxed

C)a net capital gain of $40,000 taxed at 15%

D)ordinary income of $40,000 taxed at 25%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

In order to be considered Sec. 1231 property, all of the following livestock must be held for 12 months or more from date of acquisition except

A)goats.

B)hogs.

C)sheep.

D)cattle.

A)goats.

B)hogs.

C)sheep.

D)cattle.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

A corporation owns many acres of timber, which it acquired three years ago, and which has a $120,000 basis. The timber was cut last year for use in the corporation's business. The FMV of the timber on the first day of last year was $270,000. The corporation made the appropriate election to treat the cutting as a sale or exchange. The timber is sold for $300,000 this year. The tax result this year is

A)recognition of capital gain of $30,000.

B)recognition of Sec. 1231 gain of $30,000.

C)recognition of ordinary income of $30,000.

D)no income recognized since all recognition occurs in the year of the cutting of the timber.

A)recognition of capital gain of $30,000.

B)recognition of Sec. 1231 gain of $30,000.

C)recognition of ordinary income of $30,000.

D)no income recognized since all recognition occurs in the year of the cutting of the timber.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

For livestock to be considered Section 1231 property,

A)the livestock must be held for draft, breeding or dairy purposes, but not for sport.

B)cattle and horses must be held for at least 12 months from the date of acquisition.

C)cattle and horses must be held for at least 24 months from the date of acquisition.

D)livestock other than cattle and horses must be held for at least 24 months from the date of acquisition.

A)the livestock must be held for draft, breeding or dairy purposes, but not for sport.

B)cattle and horses must be held for at least 12 months from the date of acquisition.

C)cattle and horses must be held for at least 24 months from the date of acquisition.

D)livestock other than cattle and horses must be held for at least 24 months from the date of acquisition.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

All of the following statements are true regarding Sec. 1245 are true except

A)Sec. 1245 does not apply to any buildings placed in service after 1986.

B)Sec. 1245 applies to assets sold or exchanged at a gain or at a loss.

C)Sec. 1245 property includes nonresidential real estate that qualified as recovery property under the ACRS rules unless the taxpayer elected to use the straight-line method of cost recovery.

D)Sec. 1245 ordinary applies to total depreciation or amortization allowed or allowable but not more than the realized gain.

A)Sec. 1245 does not apply to any buildings placed in service after 1986.

B)Sec. 1245 applies to assets sold or exchanged at a gain or at a loss.

C)Sec. 1245 property includes nonresidential real estate that qualified as recovery property under the ACRS rules unless the taxpayer elected to use the straight-line method of cost recovery.

D)Sec. 1245 ordinary applies to total depreciation or amortization allowed or allowable but not more than the realized gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Dinah owned land with a FMV of $130,000 (adjusted basis $120,000)which is investment property (a capital asset). Dinah owned a second tract of land, a 1231 asset, with a FMV of $46,000 (adjusted basis $50,000). Both tracts were acquired in 2001 and condemned by the state this year. The state paid an amount equal to FMV. If there are no other transactions involving capital assets or 1231 assets, Dinah must report on her current year return

A)$6,000 net ordinary income.

B)$6,000 net section 1231 gain treated as a net capital gain.

C)a LTCG of $10,000 and a 1231 loss of $4,000.

D)a LTCG of $10,000 and a nondeductible loss of $4,000.

A)$6,000 net ordinary income.

B)$6,000 net section 1231 gain treated as a net capital gain.

C)a LTCG of $10,000 and a 1231 loss of $4,000.

D)a LTCG of $10,000 and a nondeductible loss of $4,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

Ross purchased a building in 1985, which he uses in his manufacturing business. Ross uses the ACRS statutory rates to determine the cost-recovery deduction for the building. Ross's original cost for the building is $500,000 and cost-recovery deductions allowed are $500,000. If the building is sold for $340,000, the tax results to Ross are

A)$340,000 LTCG.

B)$340,000 Sec. 1231 gain.

C)$340,000 Sec. 1245 ordinary income.

D)$340,000 Sec. 1250 ordinary income.

A)$340,000 LTCG.

B)$340,000 Sec. 1231 gain.

C)$340,000 Sec. 1245 ordinary income.

D)$340,000 Sec. 1250 ordinary income.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Maura makes a gift of a van to a local food bank run by a charity. Maura had used the van in her trade or business. The van has a FMV of $6,500; a cost of $31,000; and $27,000 depreciation claimed. What is the amount of Maura's charitable contribution deduction?

A)$6,500

B)$31,000

C)$4,000

D)$2,500

A)$6,500

B)$31,000

C)$4,000

D)$2,500

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

A taxpayer purchased a factory building in 1985 for $800,000. After claiming ACRS-accelerated depreciation of $800,000, she sells the asset for $1,000,000 during the current year. No payment is received during the current year, and the $1,000,000 balance to be paid with interest at the interest rate in four annual payments beginning one year from date of sale. The installment sales method is adopted. How much ordinary income is recognized in the current year?

A)$ 0

B)$200,000

C)$800,000

D)$1,000,000

A)$ 0

B)$200,000

C)$800,000

D)$1,000,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

Indicate whether each of the following assets are capital assets, Sec. 1231 assets, or ordinary income property (property which, if sold, results in ordinary income). Assume that all of the property is held for more than one year.

a. XYZ Corporation owns land used as an employee parking lot. How is the parking lot classified for tax purposes?

b. Montana Corporation owns land held as an investment. How is the land classified for tax purposes?

c. John, a self-employed electrician, owns an automobile he uses strictly for personal use. How is the automobile classified for tax purposes?

d. Jan, a self-employed contractor, owns a truck she uses exclusively in her trade or business. How is the truck classified for tax purposes?

e. Leslie owns an office building where her accounting practice is located. What is the classification of the building?

f. Yvonne owns a computer for use in her job as a sales representative. She does not use the computer for personal purposes. How is the computer classified for tax purposes?

a. XYZ Corporation owns land used as an employee parking lot. How is the parking lot classified for tax purposes?

b. Montana Corporation owns land held as an investment. How is the land classified for tax purposes?

c. John, a self-employed electrician, owns an automobile he uses strictly for personal use. How is the automobile classified for tax purposes?

d. Jan, a self-employed contractor, owns a truck she uses exclusively in her trade or business. How is the truck classified for tax purposes?

e. Leslie owns an office building where her accounting practice is located. What is the classification of the building?

f. Yvonne owns a computer for use in her job as a sales representative. She does not use the computer for personal purposes. How is the computer classified for tax purposes?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

In 1980, Artima Corporation purchased an office building for $400,000 for use in its business. The building is sold during the current year for $550,000. Total depreciation allowed for the building was $350,000; straight-line would have been $320,000. As result of the sale, how much section 1231 gain will Artima Corporation report?

A)$350,000

B)$406,000

C)$320,000

D)$500,000

A)$350,000

B)$406,000

C)$320,000

D)$500,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

Emily, whose tax rate is 28%, owns an office building which she purchased for $900,000 on March 18 of last year. The building is sold for $950,000 on February 20 of this year when the adjusted basis of the building was $876,000. The tax results to Emily are

A)$74,000 1231 gain taxed at 15%.

B)$74,000 ordinary income taxed at 28%.

C)$24,000 1250 unrecaptured gain taxed at 25% and $50,000 1231 gain taxed at 15%.

D)$24,000 1231 gain taxed at 15% and $50,000 ordinary income taxed at 28%.

A)$74,000 1231 gain taxed at 15%.

B)$74,000 ordinary income taxed at 28%.

C)$24,000 1250 unrecaptured gain taxed at 25% and $50,000 1231 gain taxed at 15%.

D)$24,000 1231 gain taxed at 15% and $50,000 ordinary income taxed at 28%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Jillian, whose tax rate is 39.6%, had the following sales of Section 1231 property this year:

Sale of land at a gain of $15,000

Sale of land at a gain of $12,000

Sale of land at a loss of $8,000

a. What is the amount of her resulting tax liability?

b. Assume instead that Jillian has a 15% marginal tax rate. What is the amount of her resulting tax liability?

c. Assume instead that Jillian has a 28% marginal tax rate. What is the amount of her resulting tax liability?

Sale of land at a gain of $15,000

Sale of land at a gain of $12,000

Sale of land at a loss of $8,000

a. What is the amount of her resulting tax liability?

b. Assume instead that Jillian has a 15% marginal tax rate. What is the amount of her resulting tax liability?

c. Assume instead that Jillian has a 28% marginal tax rate. What is the amount of her resulting tax liability?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

With respect to residential rental property

A)80% or more of the gross rental income from the building or structure must be rental income from dwelling units in order for it to be classified as residential rental property.

B)hotels are not included in this category if less than half of the units are used on a transient basis.

C)80% or more of the net rental income from the building or structure must be rental income from dwelling units in order for it to be classified as residential rental property.

D)gain is not subject to the depreciation recapture provisions if the property is held more than one year.

A)80% or more of the gross rental income from the building or structure must be rental income from dwelling units in order for it to be classified as residential rental property.

B)hotels are not included in this category if less than half of the units are used on a transient basis.

C)80% or more of the net rental income from the building or structure must be rental income from dwelling units in order for it to be classified as residential rental property.

D)gain is not subject to the depreciation recapture provisions if the property is held more than one year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

Eric purchased a building in 2003 that he uses in his business. Eric uses the straight-line method for the building. Eric's original cost for the building is $420,000 and cost-recovery deductions are $120,000. Eric is in the top tax bracket and has never sold any other business assets. If the building is sold for $560,000, the tax results are

A)$260,000 Sec. 1231 gain, all taxable at 20%.

B)$260,000 unrecaptured Sec. 1250 gain, all taxable at 25%.

C)$260,000 Sec. 1231 gain, of which $120,000 is unrecaptured Sec. 1250 gain taxable at 25% and the $140,000 balance is taxable at 20%.

D)$120,000 Sec. 1245 ordinary income, $140,000 Sec. 1231 gain taxable at 20%.

A)$260,000 Sec. 1231 gain, all taxable at 20%.

B)$260,000 unrecaptured Sec. 1250 gain, all taxable at 25%.

C)$260,000 Sec. 1231 gain, of which $120,000 is unrecaptured Sec. 1250 gain taxable at 25% and the $140,000 balance is taxable at 20%.

D)$120,000 Sec. 1245 ordinary income, $140,000 Sec. 1231 gain taxable at 20%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

All of the following are considered related parties for purposes of Sec. 1239 recapture with the exception of

A)an individual and a partnership where the individual has a one-fourth interest in the partnership.

B)an individual and a corporation where the individual owns more than 50% of the value of the outstanding stock of the corporation.

C)an individual and a corporation where the individual's spouse owns more than 50% of the value of the outstanding stock of the corporation.

D)an individual and a partnership where the individual owns more than 50% of the capital of the partnership.

A)an individual and a partnership where the individual has a one-fourth interest in the partnership.

B)an individual and a corporation where the individual owns more than 50% of the value of the outstanding stock of the corporation.

C)an individual and a corporation where the individual's spouse owns more than 50% of the value of the outstanding stock of the corporation.

D)an individual and a partnership where the individual owns more than 50% of the capital of the partnership.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

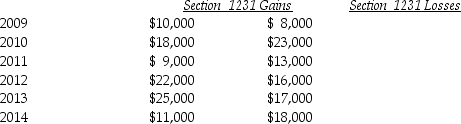

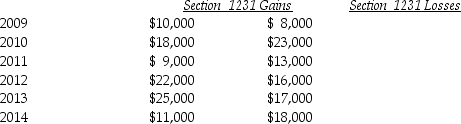

Lucy, a noncorporate taxpayer, experienced the following Section 1231 gains and losses during the years 2009 through 2014. Her first disposition of a Sec. 1231 asset occurred in 2009. Assuming Lucy had no capital gains and losses during that time period, what is the tax treatment in each of the years listed?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

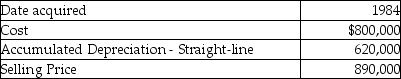

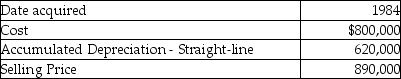

A corporation sold a warehouse during the current year. The straight-line depreciation method was used. Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A)$124,000

B)$620,000

C)$586,000

D)$710,000

How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?A)$124,000

B)$620,000

C)$586,000

D)$710,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

Clarise bought a building three years ago for $180,000 to use in her business. The straight-line method of depreciation was used and $15,000 of depreciation deductions were allowed. During the current year, Clarise sells the building to her wholly-owned corporation for $235,000. The tax results to Clarise are

A)$70,000 ordinary income.

B)$70,000 of Sec. 1231 gain.

C)$55,000 ordinary income and $15,000 Sec. 1231 gain.

D)$15,000 of ordinary income and $55,000 Sec. 1231 gain.

A)$70,000 ordinary income.

B)$70,000 of Sec. 1231 gain.

C)$55,000 ordinary income and $15,000 Sec. 1231 gain.

D)$15,000 of ordinary income and $55,000 Sec. 1231 gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

Octet Corporation placed a small storage building in service in 1999. Octet's original cost for the building is $800,000 and the cost recovery deductions are $300,000. This year the building is sold for $1,100,000. The amount and character of the gain are

A)Ordinary gain of $60,000 and Sec. 1231 gain of $540,000.

B)Ordinary gain of $300,000 and Sec. 1231 gain of $300,000.

C)Ordinary gain of $600,000.

D)Sec. 1231 gain of $600,000.

A)Ordinary gain of $60,000 and Sec. 1231 gain of $540,000.

B)Ordinary gain of $300,000 and Sec. 1231 gain of $300,000.

C)Ordinary gain of $600,000.

D)Sec. 1231 gain of $600,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

Cobra Inc. sold stock for a $25,000 loss five years ago. It has been carrying over the capital loss for five years, and the loss will expire at the end of this year because Cobra has not had any capital gains. Earlier this year Cobra sold a parcel of land held four years for business use and will recognize a $30,000 gain. Cobra is thinking about selling some machinery used in its business for the past three years. During this time technology has dramatically changed so Cobra will recognize a $32,000 loss on the sale of the machinery. Cobra is trying to decide whether to sell the machinery at year-end or early next year. Cobra is profitable and has a consistent marginal tax rate of 35%. When should Cobra sell the equipment?

A)current year

B)early next year

C)current year, but arrange an installment sale to spread the loss recognition over the two years

D)either the current year or next year

A)current year

B)early next year

C)current year, but arrange an installment sale to spread the loss recognition over the two years

D)either the current year or next year

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

Hilton, a single taxpayer in the 28% marginal tax bracket, has $16,000 of nonrecaptured net Sec. 1231 losses, at the beginning of a year in which he had the following transactions:

-Sale of Asset A at a $10,000 1231 gain, all of which is unrecaptured Sec. 1250 gain

-Sale of Asset B at a $13,000 1231 gain

How are the items reported this year and at which rate(s)are the amounts taxed?

-Sale of Asset A at a $10,000 1231 gain, all of which is unrecaptured Sec. 1250 gain

-Sale of Asset B at a $13,000 1231 gain

How are the items reported this year and at which rate(s)are the amounts taxed?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Douglas bought office furniture two years and four months ago for $25,000 to use in his business and elected to expense all of it under Sec. 179. Depreciation of $3,500 would have been taken under the MACRS rules. If Douglas converts the furniture to nonbusiness use today, Douglas must

A)amend the prior two years tax returns.

B)include $3,500 in gross income in year of conversion.

C)include $21,500 in gross income in year of conversion.

D)include $25,000 in gross income in year of conversion.

A)amend the prior two years tax returns.

B)include $3,500 in gross income in year of conversion.

C)include $21,500 in gross income in year of conversion.

D)include $25,000 in gross income in year of conversion.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Marta purchased residential rental property for $600,000 on January 1, 1985. Total ACRS deductions for 1985 through the date of sale amounted to $600,000. If the straight-line method of depreciation had been used, depreciation would have been $600,000. The property is sold for $750,000 on January 1 of the current year. The amount and character of the gain is

A)$750,000 Sec. 1231 gain.

B)$150,000 Sec. 1231 gain and $600,000 ordinary income.

C)$750,000 ordinary gain due to Sec 1245.

D)$750,000 ordinary gain due to Sec. 1250.

A)$750,000 Sec. 1231 gain.

B)$150,000 Sec. 1231 gain and $600,000 ordinary income.

C)$750,000 ordinary gain due to Sec 1245.

D)$750,000 ordinary gain due to Sec. 1250.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

With regard to noncorporate taxpayers, all of the following statements are true regarding Sec. 1250 recapture except

A)Sec. 1250 affects the character of the gain, not the amount of the gain.

B)Sec. 1250 applies to assets sold or exchanged at either a gain or a loss.

C)Sec. 1250 ordinary income does not exist if the straight-line method of depreciation is used.

D)Sec. 1250 ordinary income is never more than the additional depreciation allowed.

A)Sec. 1250 affects the character of the gain, not the amount of the gain.

B)Sec. 1250 applies to assets sold or exchanged at either a gain or a loss.

C)Sec. 1250 ordinary income does not exist if the straight-line method of depreciation is used.

D)Sec. 1250 ordinary income is never more than the additional depreciation allowed.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

In 1980, Mr. Lyle purchased a factory building to use in business for $480,000. When Mr. Lyle sells the building for $580,000, he has taken depreciation of $470,000. Straight-line depreciation would have been $400,000. Mr. Lyle must report

A)$570,000 of ordinary gain.

B)$570,000 of Sec. 1231 gain.

C)$70,000 of ordinary income and $500,000 of Sec. 1231 gain.

D)$470,000 of ordinary gain and $100,000 of Sec. 1231 gain.

A)$570,000 of ordinary gain.

B)$570,000 of Sec. 1231 gain.

C)$70,000 of ordinary income and $500,000 of Sec. 1231 gain.

D)$470,000 of ordinary gain and $100,000 of Sec. 1231 gain.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck