Deck 3: The Corporate Income Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/128

Play

Full screen (f)

Deck 3: The Corporate Income Tax

1

Corporations are permitted to deduct $3,000 in net capital losses annually.

False

2

A new corporation may generally select one of the following accounting methods with the exception of

A) cash method.

B) accrual method.

C) retail method.

D) hybrid method.

A) cash method.

B) accrual method.

C) retail method.

D) hybrid method.

C

3

Identify which of the following statements is true.

A) A corporation is a separate taxpaying entity that must file a tax return annually.

B) A newly formed corporation must select its basic accounting method.

C) The terms "regular corporation" and "C corporation" are synonymous.

D) All of the above are true.

A) A corporation is a separate taxpaying entity that must file a tax return annually.

B) A newly formed corporation must select its basic accounting method.

C) The terms "regular corporation" and "C corporation" are synonymous.

D) All of the above are true.

D

4

Identify which of the following is false.

A) Corporations that sell real property at a gain must report an additional 20% of the entire gain as ordinary income.

B) Corporations selling real property that previously had been depreciated using an accelerated method are subject to Sec. 291.

C) Section 291 reduces the amount of net Sec. 1231 gains that can be offset by corporate capital losses.

D) Section 291 recapture applies to Sec. 1250 property.

A) Corporations that sell real property at a gain must report an additional 20% of the entire gain as ordinary income.

B) Corporations selling real property that previously had been depreciated using an accelerated method are subject to Sec. 291.

C) Section 291 reduces the amount of net Sec. 1231 gains that can be offset by corporate capital losses.

D) Section 291 recapture applies to Sec. 1250 property.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

5

Identify which of the following statements is true.

A) A corporation that is a member of an affiliated group filing a consolidated tax return may be allowed a tax year which is different from the group's parent.

B) An S corporation must generally use a calendar year.

C) A corporation's first year must cover a twelve-month period.

D) All of the above are false.

A) A corporation that is a member of an affiliated group filing a consolidated tax return may be allowed a tax year which is different from the group's parent.

B) An S corporation must generally use a calendar year.

C) A corporation's first year must cover a twelve-month period.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

6

Identify which of the following statements is false.

A) A corporation's fiscal year generally must end on the last day of the month.

B) A fiscal year may not end on December 31.

C) A new corporation can elect a fiscal year that runs from February 16 to February 15 of the following year.

D) A corporation's first tax year may not cover a full 12-month period.

A) A corporation's fiscal year generally must end on the last day of the month.

B) A fiscal year may not end on December 31.

C) A new corporation can elect a fiscal year that runs from February 16 to February 15 of the following year.

D) A corporation's first tax year may not cover a full 12-month period.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

7

Corporations may carry charitable contributions in excess of the income limitation forward for five years.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

8

Trail Corporation has gross profits on sales of $140,000 and deductible expenses of $180,000. In addition, Trail has a net capital gain of $60,000. Trail's taxable income is

A) a $20,000 loss.

B) a $40,000 loss.

C) $60,000.

D) $20,000.

A) a $20,000 loss.

B) a $40,000 loss.

C) $60,000.

D) $20,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

9

Newco Corporation has asked you to help determine whether it should use the accrual method or the cash method of accounting. What are the tax issues involved in making this determination?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

10

Organizational expenses incurred after 2004 are amortized over five years.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

11

Identify which of the following statements is false.

A) A corporation with annual gross receipts of $5,000,000 or less can use the accrual method to account for sales, cost of goods sold, inventories, accounts receivable and payable, and the cash method for other income and expenses.

B) Casualty losses incurred by a corporation are deductible subject to a nondeductible floor similar to those applicable to individuals.

C) The passive loss rules do not apply to widely held C corporations.

D) Corporations may receive a deduction for dividends received from other corporations.

A) A corporation with annual gross receipts of $5,000,000 or less can use the accrual method to account for sales, cost of goods sold, inventories, accounts receivable and payable, and the cash method for other income and expenses.

B) Casualty losses incurred by a corporation are deductible subject to a nondeductible floor similar to those applicable to individuals.

C) The passive loss rules do not apply to widely held C corporations.

D) Corporations may receive a deduction for dividends received from other corporations.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

12

Dallas Corporation, not a dealer in securities, realizes taxable income of $60,000 from the operation of its business. Additionally, in the same year, Dallas realizes a long-term capital loss of $10,000 from the sale of marketable securities. If the corporation realizes no other capital gains or losses, what is the proper treatment for the $10,000 long-term capital loss on the tax return?

A) Use $3,000 of the loss to reduce taxable income and carry $7,000 of the long-term capital loss forward for five years.

B) Use $6,000 of the loss to reduce taxable income and carry $4,000 of the long-term capital loss forward for five years.

C) Use $10,000 of the long-term capital loss to reduce taxable income.

D) Carry the $10,000 long-term capital loss back three years as a short-term capital loss, then forward five years.

A) Use $3,000 of the loss to reduce taxable income and carry $7,000 of the long-term capital loss forward for five years.

B) Use $6,000 of the loss to reduce taxable income and carry $4,000 of the long-term capital loss forward for five years.

C) Use $10,000 of the long-term capital loss to reduce taxable income.

D) Carry the $10,000 long-term capital loss back three years as a short-term capital loss, then forward five years.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

13

If a controlling shareholder sells depreciable property to a controlled corporation and the property is depreciable by the purchaser, any gain on the sale is a 1231 gain.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

14

Corporations may deduct the adjusted basis of inventory plus one-half of the excess of the property's FMV over its adjusted basis if the inventory is used for the care of the ill, needy, or infants.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

15

Once a corporation has elected a taxable year, it can change the taxable year without IRS permission if

A) the resulting short period has a net operating loss of $100,000 that the corporation wants to carry forward.

B) the corporation changed its taxable year seven years ago.

C) the corporation is not an S Corporation.

D) A corporation can change its taxable year without IRS permission in all of the above situations.

A) the resulting short period has a net operating loss of $100,000 that the corporation wants to carry forward.

B) the corporation changed its taxable year seven years ago.

C) the corporation is not an S Corporation.

D) A corporation can change its taxable year without IRS permission in all of the above situations.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

16

Sparks Corporation receives a dividend of $100,000 from Jill Corporation, a C Corporation. Sparks owns 70% of Jill Corporation stock. Sparks' dividends-received deduction is $80,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

17

An election to forgo an NOL carryback must be made on or before the return due date (including extensions) for the year in which the NOL is incurred.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

18

Identify which of the following statements is true.

A) A corporate capital loss can be carried back three years, and then can be carried forward five years.

B) Corporate capital loss carrybacks can offset corporate ordinary income earned in previous years.

C) At the election of a corporation, a net capital loss carryback can be forgone and carried forward only.

D) All of the above are false.

A) A corporate capital loss can be carried back three years, and then can be carried forward five years.

B) Corporate capital loss carrybacks can offset corporate ordinary income earned in previous years.

C) At the election of a corporation, a net capital loss carryback can be forgone and carried forward only.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

19

The dividends-received deduction is designed to reduce double taxation of corporate dividends payable to individual shareholders.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

20

A C corporation must use a calendar year as its tax year unless it has a substantial business purpose to use a fiscal year.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

21

Edison Corporation is organized on July 31. The corporation starts business on August 10. The corporation adopts a November 30 fiscal year end. The following expenses are incurred during the year: What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending November 30?

A) $16,000

B) $12,000

C) $5,156

D) $800

A) $16,000

B) $12,000

C) $5,156

D) $800

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

22

Booth Corporation sells a building classified as a residential rental property for $200,000. The MACRS straight-line depreciation taken is $20,000 and the adjusted basis of the building is $170,000. Booth Corporation must recognize ordinary income of

A) $30,000.

B) $20,000.

C) $4,000.

D) $0.

A) $30,000.

B) $20,000.

C) $4,000.

D) $0.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

23

Island Corporation has the following income and expense items for the year: The taxable income of Island Corporation is

A) $100,000.

B) $70,000.

C) $47,000.

D) $42,000.

A) $100,000.

B) $70,000.

C) $47,000.

D) $42,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

24

In February of the current year, Brent Corporation donates computer equipment that it purchased six months ago to Eastside High School for use in its educational program. The donated property had a $20,000 adjusted basis to Brent and a $40,000 FMV. What is the amount of the gift?

A) $20,000

B) $30,000

C) $35,000

D) $50,000

A) $20,000

B) $30,000

C) $35,000

D) $50,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

25

Blueboy Inc. contributes inventory to a qualified charity for use in feeding the needy. The inventory has a $70,000 FMV and a $30,000 adjusted basis. Blueboy Inc. can take a charitable contribution deduction of

A) $20,000.

B) $30,000.

C) $50,000.

D) $60,000.

A) $20,000.

B) $30,000.

C) $50,000.

D) $60,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

26

Richards Corporation has taxable income of $280,000 calculated before the charitable contribution deduction and before its dividends-received deduction of $34,000. Richards makes cash contributions of $35,000 to charitable organizations. What is Richards Corporation's charitable contribution deduction for the current year?

A) $24,600

B) $28,000

C) $31,400

D) $35,000

A) $24,600

B) $28,000

C) $31,400

D) $35,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

27

In 2011, Summer Corporation earns domestic gross receipts of $2 million and incurs allocable expenses of $800,000. It has $400,000 of income from other sources, resulting in taxable income of $1.6 million before the U.S. production activities deduction. What is its U.S. production activities deduction?

A) $120,000

B) $108,000

C) $60,000

D) $36,000

A) $120,000

B) $108,000

C) $60,000

D) $36,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

28

Evans Corporation has a $15,000 net capital loss in 2011. The corporation reported the following capital gain net income during the past three years. Identify which of the following statements is true.

A) The loss is used to offset the gains from 2010 and then carried back to offset $10,000 of the gains in 2008.

B) The loss is used to offset the $11,000 of the 2009 gains and then carried back to offset $4,000 of the year 2008 net gain.

C) The loss is used to offset $3,000 of the current year ordinary income, all of the year 2008 capital gains, and $7,000 of the year 2009 net gain.

D) The loss is used to offset the year 2008 net gains, then $5,000 of the year 2009 net gains.

A) The loss is used to offset the gains from 2010 and then carried back to offset $10,000 of the gains in 2008.

B) The loss is used to offset the $11,000 of the 2009 gains and then carried back to offset $4,000 of the year 2008 net gain.

C) The loss is used to offset $3,000 of the current year ordinary income, all of the year 2008 capital gains, and $7,000 of the year 2009 net gain.

D) The loss is used to offset the year 2008 net gains, then $5,000 of the year 2009 net gains.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

29

Identify which of the following statements is true.

A) Organizational expenditures incurred by a corporation do not include the cost of accounting services necessary to create the corporation.

B) Organizational expenditures incurred by a corporation do not include the cost of printing stock.

C) Unamortized organizational expenses cannot be deducted when the corporation is liquidated.

D) All of the above are false.

A) Organizational expenditures incurred by a corporation do not include the cost of accounting services necessary to create the corporation.

B) Organizational expenditures incurred by a corporation do not include the cost of printing stock.

C) Unamortized organizational expenses cannot be deducted when the corporation is liquidated.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

30

Green Corporation is incorporated on March 1 and begins business on June 1. Green's first tax year ends on October 31, i.e., a short year. Green incurs the following expenses during the year: What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as possible?

A) $36,000

B) $5,028

C) $667

D) $500

A) $36,000

B) $5,028

C) $667

D) $500

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

31

JLA is a U.S. shoe manufacturer. Its domestic production income is $1,000,000 and U.S. W-2 wages are $600,000. Taxable income before the domestic production deduction is $500,000. What is the amount of the production activities deduction?

A) $15,000

B) $20,000

C) $45,000

D) $50,000

A) $15,000

B) $20,000

C) $45,000

D) $50,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

32

The U.S. production activities deduction is based on a percentage of which of the following?

A) taxable income before the production activities deduction

B) 50% of W-2 wages.

C) qualified production activities income

D) both A and C above

A) taxable income before the production activities deduction

B) 50% of W-2 wages.

C) qualified production activities income

D) both A and C above

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

33

Identify which of the following statements is true.

A) "Ordinary income property" with regard to the charitable contribution deduction does not include property whose sale would have produced a short-term capital gain.

B) The Twilight Corporation purchases inventory for $5,000. Its FMV on the date it is donated to the Blue-Gray Hospital for the care of the needy is $14,000. The maximum charitable contribution deduction available for the donation is $9,000.

C) Corporations' charitable deductions are limited to 20% of their adjusted taxable income.

D) All of the above are false.

A) "Ordinary income property" with regard to the charitable contribution deduction does not include property whose sale would have produced a short-term capital gain.

B) The Twilight Corporation purchases inventory for $5,000. Its FMV on the date it is donated to the Blue-Gray Hospital for the care of the needy is $14,000. The maximum charitable contribution deduction available for the donation is $9,000.

C) Corporations' charitable deductions are limited to 20% of their adjusted taxable income.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

34

Identify which of the following statements is true.

A) A corporation that accrues compensation payable to an employee must pay the amount within two and one-half months after the close of the taxable year to deduct the amount in the year of the accrual.

B) Accrued compensation that is deductible in the year of accrual is considered to be part of an IRS deferred compensation plan.

C) Accrued compensation not paid within three and one-half months after the close of the corporation tax year is deducted in the year following the accrual.

D) All of the above are false.

A) A corporation that accrues compensation payable to an employee must pay the amount within two and one-half months after the close of the taxable year to deduct the amount in the year of the accrual.

B) Accrued compensation that is deductible in the year of accrual is considered to be part of an IRS deferred compensation plan.

C) Accrued compensation not paid within three and one-half months after the close of the corporation tax year is deducted in the year following the accrual.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

35

Garth Corporation donates inventory having an adjusted basis of $40,000 and an FMV of $150,000 to a qualified public charity. The inventory will be used by the charity to care for the ill. The maximum charitable contribution deduction before consideration of the 10% limitation is

A) $40,000.

B) $55,000.

C) $80,000.

D) $95,000.

A) $40,000.

B) $55,000.

C) $80,000.

D) $95,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

36

If a corporation's charitable contributions exceed the deduction limitation in a particular year, the excess

A) is not deductible in any future year.

B) becomes a carryover to a maximum of five succeeding years.

C) may be carried back to the third preceding year.

D) is carried over indefinitely.

A) is not deductible in any future year.

B) becomes a carryover to a maximum of five succeeding years.

C) may be carried back to the third preceding year.

D) is carried over indefinitely.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

37

Super Corporation gives a painting to a museum for public display on August 6. The painting was purchased on April 3 of the same year for $20,000 and is worth $30,000 at the date of gift. Also, Super accrues a charitable contribution on December 30 and pays the $12,000 contribution on February 1 of the next year. Super Corporation is a calendar-year corporation that uses the accrual method of accounting. Before considering the 10% limitation rule, the maximum deduction for the current year is

A) $12,000.

B) $20,000.

C) $30,000.

D) $32,000.

A) $12,000.

B) $20,000.

C) $30,000.

D) $32,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

38

Identify which of the following statements is true.

A) When a corporation donates appreciated capital gain property to a charity, the amount of the contribution deduction generally equals the property's FMV.

B) When a corporation donates appreciated capital gain property to a private nonoperating foundation, the corporation's contribution is limited to the property's FMV minus the ordinary gain that would have resulted from the property's sale.

C) When a corporation contributes appreciated property to a charity, the charitable contribution deduction is the property's FMV or adjusted basis, depending on the election made by the taxpayer.

D) All of the above are false.

A) When a corporation donates appreciated capital gain property to a charity, the amount of the contribution deduction generally equals the property's FMV.

B) When a corporation donates appreciated capital gain property to a private nonoperating foundation, the corporation's contribution is limited to the property's FMV minus the ordinary gain that would have resulted from the property's sale.

C) When a corporation contributes appreciated property to a charity, the charitable contribution deduction is the property's FMV or adjusted basis, depending on the election made by the taxpayer.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

39

For purposes of the production activities deduction, domestic production gross receipts do not include which of the following?

A) construction performed in the United States

B) engineering or architectural services performed in the United States for construction projects in the United States

C) lease, rental, license, sale, or other disposition of qualified production property manufactured, produced, grown, or extracted in whole or in significant part within the United States

D) sale of food and beverages prepared at a retail establishment

A) construction performed in the United States

B) engineering or architectural services performed in the United States for construction projects in the United States

C) lease, rental, license, sale, or other disposition of qualified production property manufactured, produced, grown, or extracted in whole or in significant part within the United States

D) sale of food and beverages prepared at a retail establishment

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

40

Organizational expenditures include all of the following except for

A) costs incurred when issuing stock.

B) legal costs incident to the creation of the corporation.

C) expenses of organizational meetings.

D) fees paid to the state of incorporation.

A) costs incurred when issuing stock.

B) legal costs incident to the creation of the corporation.

C) expenses of organizational meetings.

D) fees paid to the state of incorporation.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

41

Identify which of the following statements is false.

A) The 70% dividends-received deduction is limited to 70% of the taxable income of the corporation without regard to any NOL deduction, any capital loss carryback, and the dividends-received deduction itself unless the dividends-received deduction produces an NOL.

B) Members of an affiliated group can claim a 90% dividends-received deduction for dividends received from other group members that is not subject to a taxable income limitation.

C) A corporate dividends-received deduction is not allowed for dividends received on stock held for 40 days.

D) All of the above are false.

A) The 70% dividends-received deduction is limited to 70% of the taxable income of the corporation without regard to any NOL deduction, any capital loss carryback, and the dividends-received deduction itself unless the dividends-received deduction produces an NOL.

B) Members of an affiliated group can claim a 90% dividends-received deduction for dividends received from other group members that is not subject to a taxable income limitation.

C) A corporate dividends-received deduction is not allowed for dividends received on stock held for 40 days.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

42

Bright Corporation purchased residential real estate five years ago for $450,000, of which $50,000 was allocated to the land and $400,000 was allocated to the building. Bright booked straight-line MACRS deductions of $55,000 during the past five years. This year, Bright sells the property for $550,000, of which $100,000 is allocated to the land and $450,000 is allocated to the building. What is the amount and character of Bright's recognized gain or loss on the sale?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

43

Maxwell Corporation reports the following results: Maxwell's dividends-received deduction is

A) $42,000.

B) $49,000.

C) $56,000.

D) $70,000.

A) $42,000.

B) $49,000.

C) $56,000.

D) $70,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

44

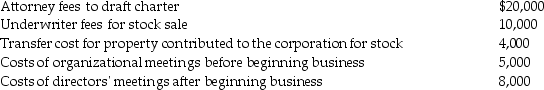

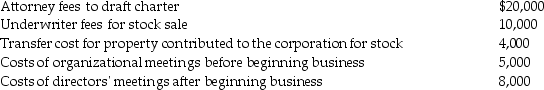

The following expenses are incurred by Salter Corporation when it is organized on July 1:

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

45

Identify which of the following statements is true.

A) The charitable contribution deduction is computed after the deduction for an NOL.

B) The charitable contribution deduction is computed after the dividends-received deduction.

C) The NOL deduction claimed by a corporation must be taken after the dividends-received deduction.

D) All of the above are false.

A) The charitable contribution deduction is computed after the deduction for an NOL.

B) The charitable contribution deduction is computed after the dividends-received deduction.

C) The NOL deduction claimed by a corporation must be taken after the dividends-received deduction.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

46

Webster, who owns all the Bear Corporation stock, purchases a dump truck from Bear Corporation in January. The truck cost $12,000 and has a $10,000 adjusted basis at the time of the sale. Webster pays Bear the truck's $8,000 FMV. Later in the same year, Webster sells the dump truck to an unrelated party for $6,000. Webster can recognize a loss of

A) $4,000.

B) $2,000.

C) $3,000.

D) $5,000.

A) $4,000.

B) $2,000.

C) $3,000.

D) $5,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

47

Walter, who owns all of the Ajax Corporation stock, purchases a truck from Ajax Corporation in January. The truck cost $12,000 and has a $10,000 adjusted basis. Walter pays the truck's $8,000 FMV. Later in the same year, Walter sells the truck to an unrelated party for $13,000. With respect to these transactions,

A) Ajax Corporation reports a loss of $2,000 and Walter reports a gain of $5,000.

B) Ajax Corporation reports no loss and Walter reports a gain of $3,000.

C) Ajax Corporation reports a loss of $4,000 and Walter reports a gain of $5,000.

D) Ajax Corporation reports no loss and Walter reports a gain of $5,000.

A) Ajax Corporation reports a loss of $2,000 and Walter reports a gain of $5,000.

B) Ajax Corporation reports no loss and Walter reports a gain of $3,000.

C) Ajax Corporation reports a loss of $4,000 and Walter reports a gain of $5,000.

D) Ajax Corporation reports no loss and Walter reports a gain of $5,000.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

48

Chambers Corporation is a calendar year taxpayer using the accrual method of accounting. In 2011, its board of directors authorizes a $20,000 contribution to the Boy Scouts. Chambers pays the contribution on March 12, 2012. What is the maximum contribution allowed in 2011? What is the maximum contribution allowed in 2012?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

49

Identify which of the following statements is true.

A) The dividends-received deduction is designed to reduce double taxation of corporate dividends.

B) The full 80% dividends-received deduction is available without restriction.

C) If a corporation receives dividends eligible for the 80% dividends-received deduction and the 70% dividends-received deduction, the 70% dividends-received deduction reduces taxable income prior to the 80% deduction.

D) All of the above are false.

A) The dividends-received deduction is designed to reduce double taxation of corporate dividends.

B) The full 80% dividends-received deduction is available without restriction.

C) If a corporation receives dividends eligible for the 80% dividends-received deduction and the 70% dividends-received deduction, the 70% dividends-received deduction reduces taxable income prior to the 80% deduction.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

50

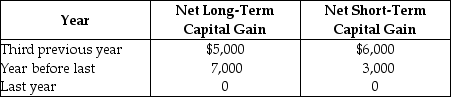

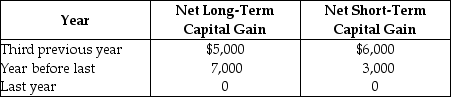

Lass Corporation reports a $25,000 net capital loss this year. The corporation reports the following net capital gains during the past three years.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, if any, available as a carryforward.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

51

Identify which of the following statements is true.

A) A corporate NOL can be carried back two years and forward 15 years.

B) An election to forgo an NOL carryback must be made on or before the return due date (including extensions) for the year in which the NOL is incurred.

C) In computing an NOL for the current year, a deduction is allowed for NOLs from previous years.

D) All of the above are false.

A) A corporate NOL can be carried back two years and forward 15 years.

B) An election to forgo an NOL carryback must be made on or before the return due date (including extensions) for the year in which the NOL is incurred.

C) In computing an NOL for the current year, a deduction is allowed for NOLs from previous years.

D) All of the above are false.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

52

Ryan Corporation sells a commercial building and land. The sales proceeds attributable to the building is $145,000. When purchased, the building is allocated $75,000 of the purchase price. The firm has depreciated the building using the MACRS rules. The MACRS deductions taken total $60,000. What is the amount and character of Ryan's recognized gain?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

53

Jackson Corporation, not a dealer in securities, realizes taxable income of $80,000 from the operation of its business. Additionally, Jackson Corporation realizes a $10,000 long-term capital loss from the sale of marketable securities. Explain the treatment of the loss on the corporate return for this and any other years.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

54

On December 10, 2011, Dell Corporation (a calendar-year taxpayer) accrues an obligation for a $100,000 bonus to Muriel, a sales representative who had had an outstanding year. Muriel owns no Dell Corporation stock. The bonus is paid on May 5, 2012. What is Dell's deduction for 2011? What is Dell's deduction for 2012?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

55

West Corporation purchases 50 shares (less than 1%) of Perch Corporation common stock on April 3. The ex-dividend date is April 4. West Corporation pays $50,000 for the stock and receives a dividend of $5,000 on the Perch stock. On May 1, West Corporation sells the Perch stock for $45,000. West's taxable income before the dividends-received deduction is $4,000. West's dividends-received deduction is

A) $3,500.

B) $3,200.

C) $2,800.

D) $0.

A) $3,500.

B) $3,200.

C) $2,800.

D) $0.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

56

Two days before the ex-dividend date, Drexel Corporation buys 100 shares of Zebra Corporation stock (less than 1%) for $200,000. Drexel Corporation receives $10,000 of dividends from Zebra Corporation. Two weeks after the ex-dividend date, Drexel Corporation sells the Zebra Corporation stock for $190,000. Which of the following statements is correct?

A) Drexel Corporation cannot recognize a capital loss.

B) Drexel Corporation cannot take a dividends-received deduction on the Zebra Corporation dividend.

C) Drexel Corporation will be allowed a 70% dividends-received deduction when reporting the Zebra Corporation dividend.

D) Drexel Corporation will receive no dividends-received deduction because the stock was purchased ex-dividend.

A) Drexel Corporation cannot recognize a capital loss.

B) Drexel Corporation cannot take a dividends-received deduction on the Zebra Corporation dividend.

C) Drexel Corporation will be allowed a 70% dividends-received deduction when reporting the Zebra Corporation dividend.

D) Drexel Corporation will receive no dividends-received deduction because the stock was purchased ex-dividend.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

57

During the year, Soup Corporation contributes some of its inventory to a qualified charity for use in feeding the needy. The inventory has an FMV of $85,000 and an adjusted basis of $25,000. What is the amount of Soup Corporation's charitable contribution deduction for the donation of the inventory as determined without regard to the overall charitable contribution limitation?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

58

Money Corporation has the following income and expenses for the tax year: Gross profit on sales:

Expenses:

Dividends received from less-than-20\%-owned domestic

corporations: What is Money's net operating loss?

A) $494,000

B) $480,000

C) $520,000

D) $220,000

Expenses:

Dividends received from less-than-20\%-owned domestic

corporations: What is Money's net operating loss?

A) $494,000

B) $480,000

C) $520,000

D) $220,000

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

59

Prince Corporation donates inventory having an adjusted basis of $26,000 and an FMV of $40,000 to County Hospital, which is a qualified public charity. What is the amount of Prince's deduction?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

60

Miller Corporation has gross income of $100,000, which includes $40,000 of dividends from a 10%-owned corporation. In addition, Miller has $80,000 of expenses. Miller's taxable income or loss is

A) $20,000.

B) $6,000.

C) $0.

D) ($8,000).

A) $20,000.

B) $6,000.

C) $0.

D) ($8,000).

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

61

James Corporation purchased residential real estate in 2007 for $225,000, of which $25,000 was allocated to land and $200,000 was allocated to the building. James Corporation took straight-line MACRS deductions of $30,000 during the years 2005-2009. In 2012, James corporation sold the property for $285,000, of which $60,000 is allocated to the land and $225,000 is allocated to the building. What are the amounts and character of James Corporation's recognized gain or loss on the sale?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

62

Describe the domestic production activities deduction.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

63

When computing corporate taxable income. what is the proper sequencing of deductions?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

64

What are start-up expenditures?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

65

Chase Corporation reports the following results in the current year:

What is Chase's taxable income?

What is Chase's taxable income?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

66

Bebop Corporation reports the following results in the current year:

What is Bebop's taxable income?

What is Bebop's taxable income?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

67

Jackel, Inc. has the following information for the current tax year:

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

68

Dumont Corporation reports the following results in the current year:

What is Dumont's taxable income?

What is Dumont's taxable income?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

69

How does the use of a net capital loss differ for individual and corporate taxpayers?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

70

How does the use of an NOL differ for individual and corporate taxpayers?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

71

Paul, who owns all the stock in Rodgers Corporation, purchases a truck from the corporation in January. The truck cost $11,000 and has an adjusted basis of $9,000. Paul pays Rodgers the truck's $7,000 FMV. Paul sells the truck later in the tax year to an unrelated party for $12,000. What is the amount and character of the income that Paul will report on this year's tax return?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

72

For corporations, what happens to excess charitable contributions?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

73

Courtney Corporation had the following income and expenses for the tax year:

Dividends received from less-than-20%-

owned domestic corporations Courtney had taxable income for the past three years of:

a) Determine the corporation's NOL for the current year.

b) Determine the amount of NOL carried back to each preceding tax year and the amount of NOL, if any, available as a carryforward.

Dividends received from less-than-20%-

owned domestic corporations Courtney had taxable income for the past three years of:

a) Determine the corporation's NOL for the current year.

b) Determine the amount of NOL carried back to each preceding tax year and the amount of NOL, if any, available as a carryforward.

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

74

Little Corporation uses the accrual method of accounting. Little's sole shareholder, Renee, uses the cash method of accounting. Both taxpayers use the calendar year as their tax year. The corporation accrues a $25,000 interest payment to Renee on December 25, 2011 and makes the payment on March 10, 2012. What are the tax consequences of the transactions to both taxpayers in 2011 and 2012?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

75

Dexter Corporation reports the following results for the current year:

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income for the current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income for the current year?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

76

What are the various levels of stock ownership by corporate shareholders for the dividends-received deduction (DRD)? What is the DRD% for each level of ownership?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

77

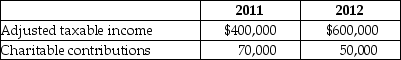

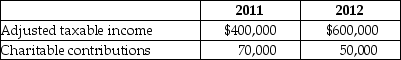

Bermuda Corporation reports the following results in 2009 and 2010:

What is Bermuda's contribution deduction in 2011 and 2012? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2011 and 2012? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2011 and 2012? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2011 and 2012? What is the disposition of any remaining amount?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

78

Zerotech Corporation donates the following property to an elementary school:

• Computer printer purchased three years ago for $1,000. The printer has a $500 FMV and $0 adjusted basis on contribution date.

• Computer equipment acquired one year ago at a cost of $5,000. The equipment has an $8,000 FMV and $0 adjusted basis on contribution date.

• Computer software acquired two months ago at a cost of $10,000. The software will be used in a prekindergarten program. Its FMV on the contribution date is $10,000 and it has an adjusted basis of $0.

a) Identify any donation qualifying for special treatment.

b) What is Zerotech's charitable contribution deduction?

• Computer printer purchased three years ago for $1,000. The printer has a $500 FMV and $0 adjusted basis on contribution date.

• Computer equipment acquired one year ago at a cost of $5,000. The equipment has an $8,000 FMV and $0 adjusted basis on contribution date.

• Computer software acquired two months ago at a cost of $10,000. The software will be used in a prekindergarten program. Its FMV on the contribution date is $10,000 and it has an adjusted basis of $0.

a) Identify any donation qualifying for special treatment.

b) What is Zerotech's charitable contribution deduction?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

79

Francine Corporation reports the following income and expense items for the tax year ending December 31:

What is Francine Corporation's taxable income?

What is Francine Corporation's taxable income?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck

80

Carter Corporation reports the following results for the current year:

a) What is Carter Corporation's taxable income for the current year?

b) How would your answer to Part (a) change if Carter's operating expenses are instead $700,000?

c) How would your answer to Part (a) change if Carter's operating expenses are instead $760,000?

a) What is Carter Corporation's taxable income for the current year?

b) How would your answer to Part (a) change if Carter's operating expenses are instead $700,000?

c) How would your answer to Part (a) change if Carter's operating expenses are instead $760,000?

Unlock Deck

Unlock for access to all 128 flashcards in this deck.

Unlock Deck

k this deck