Deck 6: Accounting for Income Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

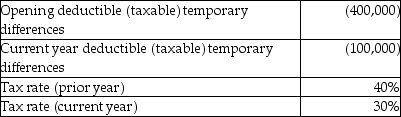

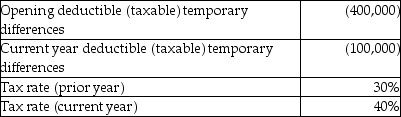

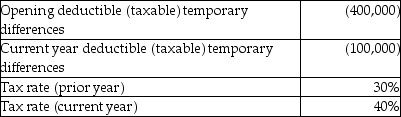

Question

Question

Question

Question

Question

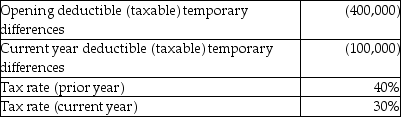

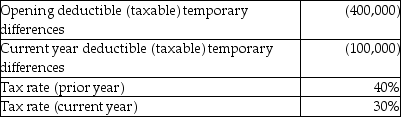

Question

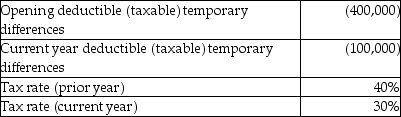

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

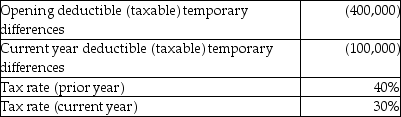

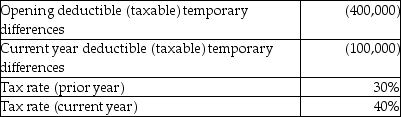

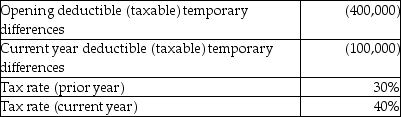

Question

Question

Question

Question

Question

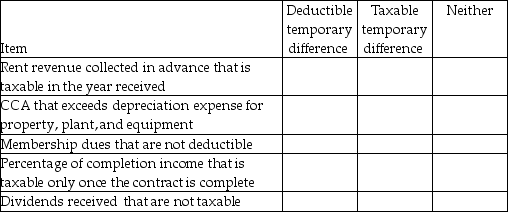

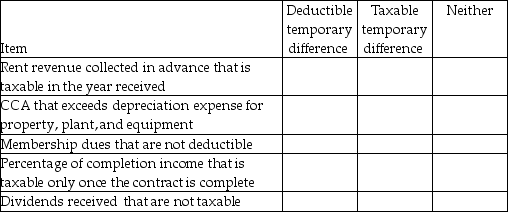

Question

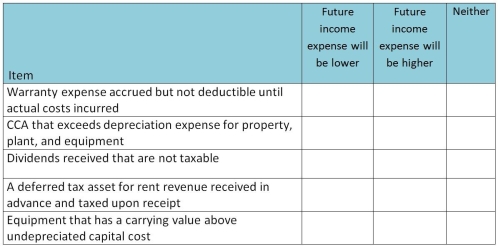

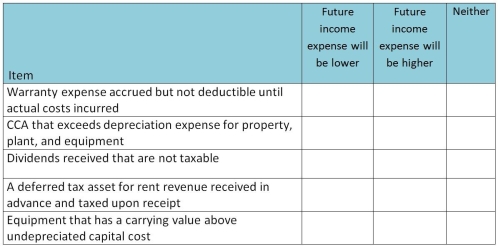

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

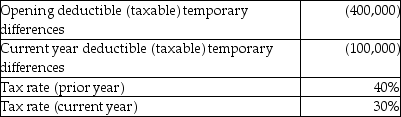

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 6: Accounting for Income Taxes

1

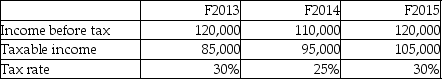

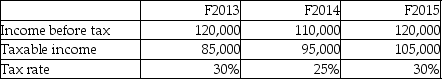

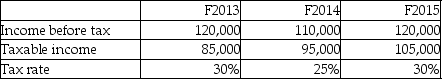

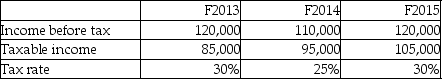

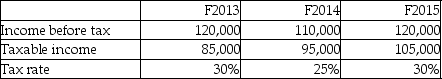

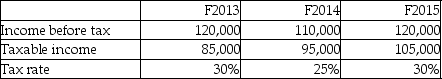

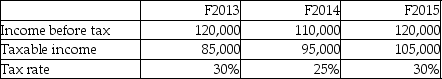

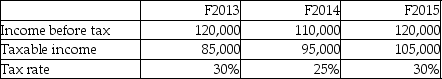

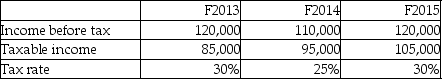

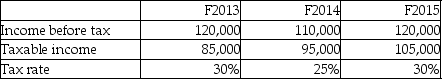

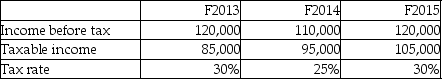

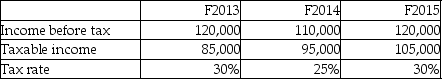

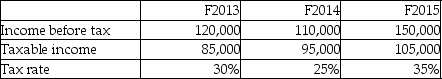

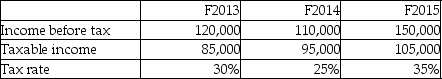

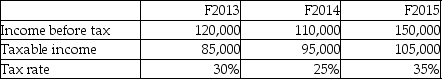

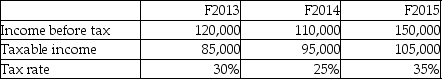

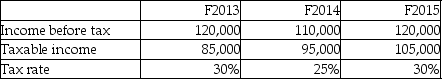

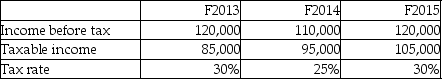

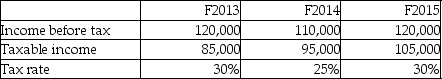

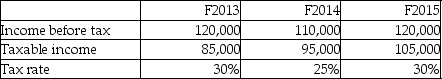

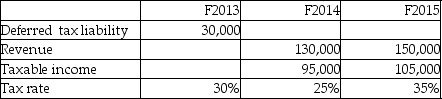

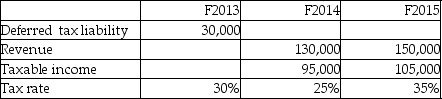

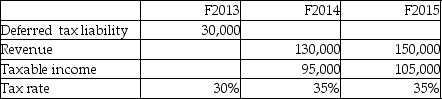

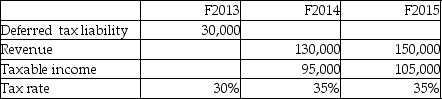

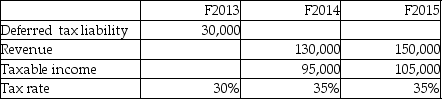

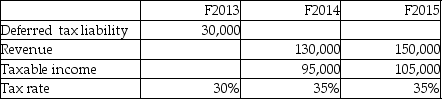

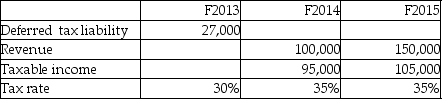

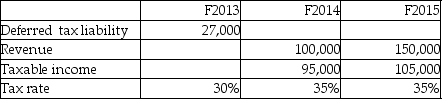

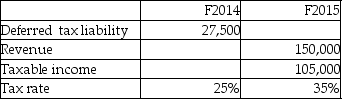

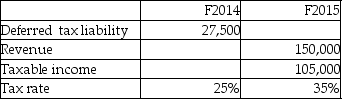

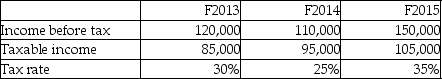

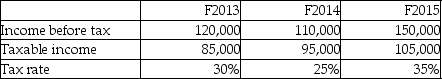

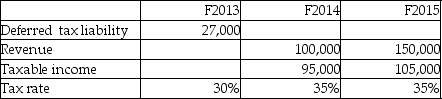

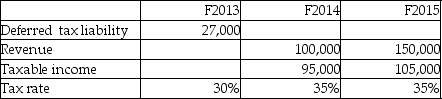

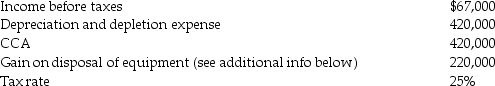

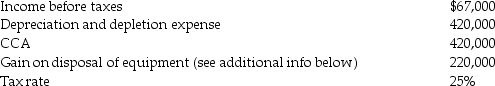

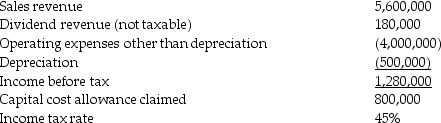

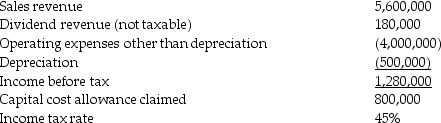

What is the income tax payable under the deferral method for F2014?

A)$23,750

B)$25,500

C)$27,500

D)$36,000

A)$23,750

B)$25,500

C)$27,500

D)$36,000

A

2

Which statement is accurate?

A)The taxes payable method is also known as the "deferral method."

B)The deferral method and the accrual method are "tax allocation" approaches.

C)The income statement approach is also known as the "accrual method."

D)The balance sheet approach is also known as the "deferral method."

A)The taxes payable method is also known as the "deferral method."

B)The deferral method and the accrual method are "tax allocation" approaches.

C)The income statement approach is also known as the "accrual method."

D)The balance sheet approach is also known as the "deferral method."

B

3

Which accurately describes the purpose of the taxes payable method?

A)It represents the amount of income recognized for accounting purposes.

B)It represents the amount of income recognized for tax purposes.

C)It calculates tax expense based on the accounting income before tax.

D)It calculates tax expense based on the amount payable to tax authorities.

A)It represents the amount of income recognized for accounting purposes.

B)It represents the amount of income recognized for tax purposes.

C)It calculates tax expense based on the accounting income before tax.

D)It calculates tax expense based on the amount payable to tax authorities.

D

4

Which statement is correct?

A)Financial reporting rules are generally consistent with tax reporting rules.

B)Tax rules are generally consistent the principles used in accrual accounting.

C)Tax rules generally require a higher degree of reliability than financial reporting.

D)Accounting income is generally similar to taxable income.

A)Financial reporting rules are generally consistent with tax reporting rules.

B)Tax rules are generally consistent the principles used in accrual accounting.

C)Tax rules generally require a higher degree of reliability than financial reporting.

D)Accounting income is generally similar to taxable income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

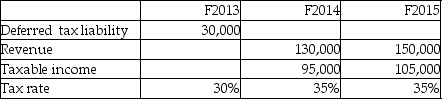

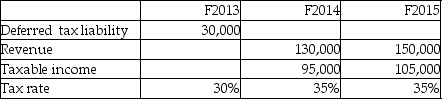

What is the deferred tax liability under the deferral method for F2013?

A)$10,500

B)$25,500

C)$30,750

D)$36,000

A)$10,500

B)$25,500

C)$30,750

D)$36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

How much tax would be reported under the taxes payable method for F2014?

A)23,750

B)25,500

C)27,500

D)36,000

A)23,750

B)25,500

C)27,500

D)36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

Which statement is correct about the "taxes payable method"?

A)It is the accounting method used under both ASPE and IFRS.

B)It records an amount for income tax equal to the tax payments required.

C)It matches income with the associated income tax expense.

D)It records an amount for income tax equal to the net income before tax.

A)It is the accounting method used under both ASPE and IFRS.

B)It records an amount for income tax equal to the tax payments required.

C)It matches income with the associated income tax expense.

D)It records an amount for income tax equal to the net income before tax.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

How much tax would be reported under the taxes payable method for F2015?

A)25,500

B)31,500

C)33,750

D)36,000

A)25,500

B)31,500

C)33,750

D)36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

What is the tax expense under the deferral method for F2014?

A)$23,750

B)$25,500

C)$27,500

D)$36,000

A)$23,750

B)$25,500

C)$27,500

D)$36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

What is the deferred tax liability under the deferral method for F2014?

A)$3,750

B)$23,750

C)$27,500

D)$36,000

A)$3,750

B)$23,750

C)$27,500

D)$36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

What is one reason to use the taxes payable method?

A)It is a complicated method,but results in the least tax expense.

B)A company only pays tax once a year under this method.

C)It results in the best matching for the balance sheet.

D)It is the least costly method for tax accounting.

A)It is a complicated method,but results in the least tax expense.

B)A company only pays tax once a year under this method.

C)It results in the best matching for the balance sheet.

D)It is the least costly method for tax accounting.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

What is the income tax payable under the deferral method for F2015?

A)$27,500

B)$36,000

C)$36,750

D)$52,500

A)$27,500

B)$36,000

C)$36,750

D)$52,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

What is the tax expense under the deferral method for F2015?

A)$27,500

B)$36,000

C)$36,750

D)$52,500

A)$27,500

B)$36,000

C)$36,750

D)$52,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

Which statement best describes the "deferral method"?

A)This method focuses on the balance sheet.

B)This method is an example of a "tax allocation" approach.

C)This is the same as the "accrual method" of tax accounting.

D)This method is used by companies reporting using IFRS.

A)This method focuses on the balance sheet.

B)This method is an example of a "tax allocation" approach.

C)This is the same as the "accrual method" of tax accounting.

D)This method is used by companies reporting using IFRS.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

Which method reflects the tax effect in the period that tax is payable?

A)Accrual method.

B)Taxes payable method.

C)Deferral method.

D)Tax allocation method.

A)Accrual method.

B)Taxes payable method.

C)Deferral method.

D)Tax allocation method.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

What is the income tax payable under the deferral method for F2013?

A)$25,500

B)$30,000

C)$30,750

D)$36,000

A)$25,500

B)$30,000

C)$30,750

D)$36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

Which method does not use "temporary differences" to account for income tax expense?

A)The taxes payable method.

B)The deferral method.

C)The accrual method.

D)The tax allocation method.

A)The taxes payable method.

B)The deferral method.

C)The accrual method.

D)The tax allocation method.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

Which statement is accurate?

A)Accounting income is generally higher than taxable income.

B)Accounting income is determined by financial reporting.

C)The balance sheet is unaffected by the tax accounting method.

D)The taxes payable method is a "tax allocation" approach.

A)Accounting income is generally higher than taxable income.

B)Accounting income is determined by financial reporting.

C)The balance sheet is unaffected by the tax accounting method.

D)The taxes payable method is a "tax allocation" approach.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement is not correct?

A)The accrual method focuses on the balance sheet.

B)The deferral method focuses on the income statement.

C)The deferral methods matches tax expense to the balance sheet.

D)The accrual and deferral methods are both tax allocation methods.

A)The accrual method focuses on the balance sheet.

B)The deferral method focuses on the income statement.

C)The deferral methods matches tax expense to the balance sheet.

D)The accrual and deferral methods are both tax allocation methods.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

What is the tax expense under the deferral method for F2013?

A)$25,500

B)$30,000

C)$30,750

D)$36,000

A)$25,500

B)$30,000

C)$30,750

D)$36,000

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

A company facing a 45% tax rate has calculated its taxable income for the year to be $2,100,000. It made installment payments during the year totalling $995,000; this amount has been recorded in an asset account as "income tax installments"

Requirement:

Prepare the journal entry to record the adjusting entry for income taxes at the end of the year under the taxes payable method.

Requirement:

Prepare the journal entry to record the adjusting entry for income taxes at the end of the year under the taxes payable method.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

SEG Company reported $490,000 in income tax expense for the year under the accrual method. Its balance sheet reported an overall increase in deferred income tax liability of $20,000 and a decrease in income tax payable of $25,000. How much would SEG report as income tax expense had it used the taxes payable method?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

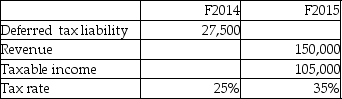

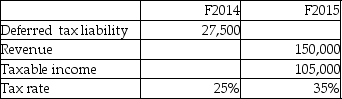

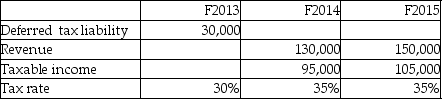

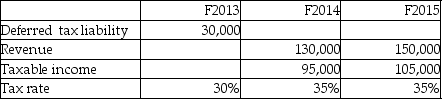

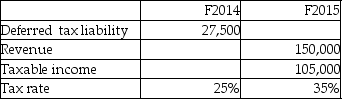

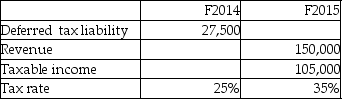

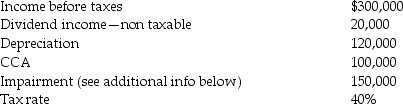

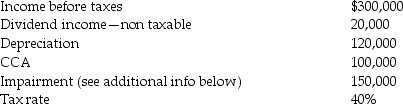

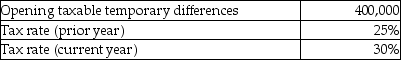

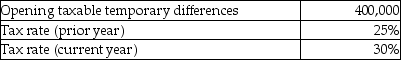

How much tax expense would be recorded under the accrual method for F2014?

A)5,000

B)27,500

C)32,500

D)37,500

A)5,000

B)27,500

C)32,500

D)37,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

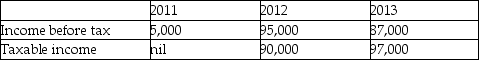

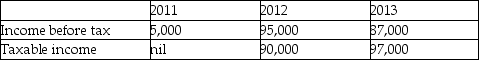

Withering Inc. began operations in 2011. Due to the untimely death of its founder,Edwin Delaney,the company was wound up in 2013. The following table provides information on Withering's income over the three years.

The statutory income tax rate remained at 45% throughout the three years.

The statutory income tax rate remained at 45% throughout the three years.

Requirement:

a. For each year and for the three years combined,compute the following:

- income tax expense under the taxes payable method;

- the effective tax rate (= tax expense -;- pre-tax income)under the taxes payable method;

- income tax expense under the accrual method;

- effective tax rate under the accrual method.

b. Briefly comment on any differences between the effective tax rates and the statutory rate of 45%.

The statutory income tax rate remained at 45% throughout the three years.

The statutory income tax rate remained at 45% throughout the three years.Requirement:

a. For each year and for the three years combined,compute the following:

- income tax expense under the taxes payable method;

- the effective tax rate (= tax expense -;- pre-tax income)under the taxes payable method;

- income tax expense under the accrual method;

- effective tax rate under the accrual method.

b. Briefly comment on any differences between the effective tax rates and the statutory rate of 45%.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not an example of a "temporary difference"?

A)Membership fees that are not deductible.

B)Advances received on rent revenue.

C)Percentage of completion method.

D)Fair value decrease on biological assets.

A)Membership fees that are not deductible.

B)Advances received on rent revenue.

C)Percentage of completion method.

D)Fair value decrease on biological assets.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

Under the accrual method,what is the effect of the tax rate change in F2014?

A)Increase of 5,000.

B)Decrease of 5,000.

C)Increase of 32,500.

D)Decrease of 32,500.

A)Increase of 5,000.

B)Decrease of 5,000.

C)Increase of 32,500.

D)Decrease of 32,500.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

How much tax expense would be recorded under the accrual method for F2014?

A)5,000

B)27,500

C)32,500

D)37,500

A)5,000

B)27,500

C)32,500

D)37,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

28

Under the accrual method,what is the tax expense in F2014?

A)4,500

B)30,500

C)35,000

D)39,500

A)4,500

B)30,500

C)35,000

D)39,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

Under the accrual method,what is the effect of the tax rate change in F2015?

A)Increase of 11,000.

B)Decrease of 11,000.

C)Decrease of 62,500.

D)Increase of 63,500.

A)Increase of 11,000.

B)Decrease of 11,000.

C)Decrease of 62,500.

D)Increase of 63,500.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

A company earns $390,000 in pre-tax income,while its tax return shows taxable income of $280,000. At a tax rate of 35%,how much is the income tax expense under the taxes payable method permitted under ASPE?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

Under the accrual method,what is the effect of the current year temporary difference in F2015?

A)11,000

B)42,500

C)52,500

D)63,500

A)11,000

B)42,500

C)52,500

D)63,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

A company earns $490,000 in pre-tax income,while its tax return shows taxable income of $380,000. At a tax rate of 35%,how much is the income tax expense under the taxes payable method permitted under ASPE?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

What is a "taxable" temporary difference?

A)Results in future taxable income being higher than accounting income.

B)Results in future taxable income being less than accounting income.

C)The amount of income tax payable in the current and future periods.

D)Result of an event affecting accounting and taxable income in different periods.

A)Results in future taxable income being higher than accounting income.

B)Results in future taxable income being less than accounting income.

C)The amount of income tax payable in the current and future periods.

D)Result of an event affecting accounting and taxable income in different periods.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

Under the accrual method,what is the effect of the current year temporary difference in F2014?

A)5,000

B)27,500

C)32,500

D)37,500

A)5,000

B)27,500

C)32,500

D)37,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

Which statement is correct?

A)The deferral and accrual methods produce the same tax expense when tax rates are constant.

B)The deferral method applies new tax rates to accumulated tax balances.

C)The accrual method applies new tax rates to only to current year's income.

D)The deferral and accrual methods produce the same tax expense when tax rates are falling.

A)The deferral and accrual methods produce the same tax expense when tax rates are constant.

B)The deferral method applies new tax rates to accumulated tax balances.

C)The accrual method applies new tax rates to only to current year's income.

D)The deferral and accrual methods produce the same tax expense when tax rates are falling.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

What is the deferred tax liability under the deferral method for F2015?

A)$52,500

B)$36,750

C)$27,500

D)$15,750

A)$52,500

B)$36,750

C)$27,500

D)$15,750

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

Under the accrual method,what is the effect of the tax rate change in F2014?

A)Increase of 5,000.

B)Decrease of 5,000.

C)Increase of 27,500.

D)Decrease of 27,500.

A)Increase of 5,000.

B)Decrease of 5,000.

C)Increase of 27,500.

D)Decrease of 27,500.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

38

Under the accrual method,what is the effect of the current year temporary difference in F2014?

A)4,500

B)30,500

C)35,000

D)39,500

A)4,500

B)30,500

C)35,000

D)39,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

How much tax expense would be recorded under the accrual method for F2015?

A)11,000

B)42,500

C)52,500

D)63,500

A)11,000

B)42,500

C)52,500

D)63,500

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is an example of a "permanent difference"?

A)Warranty provisions.

B)Dividends on corporations.

C)Depreciation on capital assets.

D)Completed contract method.

A)Warranty provisions.

B)Dividends on corporations.

C)Depreciation on capital assets.

D)Completed contract method.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

The following data represent the differences between accounting and tax income for Seafood Imports Inc.,whose pre-tax accounting income is $650,000 for the year ended December 31. The company's income tax rate is 45%. Additional information relevant to income taxes includes the following.

a. Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b. Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

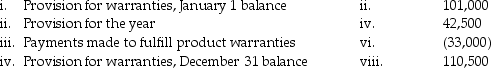

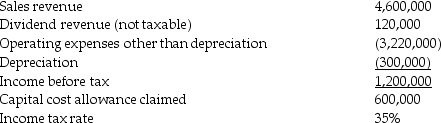

c. In a previous year,the company established a provision for product warranty expense. A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.

d. Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Requirement:

Prepare the journal entries to record income taxes for Seafood Imports.

a. Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b. Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

c. In a previous year,the company established a provision for product warranty expense. A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.d. Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Requirement:

Prepare the journal entries to record income taxes for Seafood Imports.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet. Treat each item independently of the others. Assume a tax rate of 30%.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

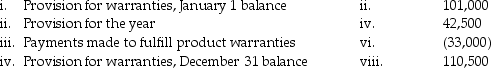

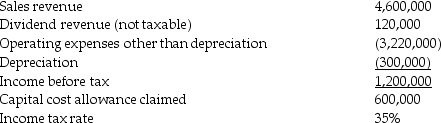

The following summarizes information relating to Gonzalez Corporation's operations for the current year.

Requirement:

Requirement:

Compute the amount of taxes payable and income tax expense for Gonzalez Corporation.

Requirement:

Requirement:Compute the amount of taxes payable and income tax expense for Gonzalez Corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

What is a deferred tax asset?

A)A deductible temporary difference that results in future taxable income being less than accounting income.

B)The amount of income tax recoverable in future periods as a result of deductible temporary differences.

C)A deductible temporary difference that results in future taxable income being higher than accounting income.

D)The amount of income tax payable in future periods as a result of taxable temporary differences.

A)A deductible temporary difference that results in future taxable income being less than accounting income.

B)The amount of income tax recoverable in future periods as a result of deductible temporary differences.

C)A deductible temporary difference that results in future taxable income being higher than accounting income.

D)The amount of income tax payable in future periods as a result of taxable temporary differences.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

At the beginning of the current fiscal year,Withering Corporation had a deferred income tax liability balance of $20,000,which relates to depreciable assets. During the year,Withering reported the following information:

• Income before income taxes for the year was $300,000 and the tax rate was 45%.

• Depreciation expense was $150,000 and CCA was $130,000.

• Unearned rent revenue was reported at $120,000. Rent revenue is taxable when the cash is received. There was no opening balance in the unearned rent revenue account at the beginning of the year.

• No other items affected deferred tax amounts other than these transactions.

Requirement:

Prepare the journal entry or entries to record income taxes for the year.

• Income before income taxes for the year was $300,000 and the tax rate was 45%.

• Depreciation expense was $150,000 and CCA was $130,000.

• Unearned rent revenue was reported at $120,000. Rent revenue is taxable when the cash is received. There was no opening balance in the unearned rent revenue account at the beginning of the year.

• No other items affected deferred tax amounts other than these transactions.

Requirement:

Prepare the journal entry or entries to record income taxes for the year.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

What is an "originating difference"?

A)The net carrying amount of a capital asset or capital asset class for tax purposes in Canada.

B)A temporary item that narrows that gap between accounting and tax values of an asset or liability.

C)A temporary item that widens the gap between accounting and tax values of an asset or liability.

D)The terminology used for depreciation of capital assets under for tax purposes in Canada.

A)The net carrying amount of a capital asset or capital asset class for tax purposes in Canada.

B)A temporary item that narrows that gap between accounting and tax values of an asset or liability.

C)A temporary item that widens the gap between accounting and tax values of an asset or liability.

D)The terminology used for depreciation of capital assets under for tax purposes in Canada.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

The following information relates to the accounting income for Saskatchewan Real Estate Company (SREC)for the current year ended December 31.

During the year,the company sold one of its buildings with carrying value of $780,000 for proceeds of $1,000,000,resulting in an accounting gain of $220,000. This gain has been included in the pre-tax income figure of $670,000 shown above. For tax purposes,the acquisition cost of the building was $870,000. For purposes of CCA,it is a Class 1 Asset,which treats each building as a separate class. The undepreciated capital cost (VCC)on the building at the time of disposal was $660,000.

During the year,the company sold one of its buildings with carrying value of $780,000 for proceeds of $1,000,000,resulting in an accounting gain of $220,000. This gain has been included in the pre-tax income figure of $670,000 shown above. For tax purposes,the acquisition cost of the building was $870,000. For purposes of CCA,it is a Class 1 Asset,which treats each building as a separate class. The undepreciated capital cost (VCC)on the building at the time of disposal was $660,000.

Requirement:

Prepare the journal entries to record income taxes for SREC.

During the year,the company sold one of its buildings with carrying value of $780,000 for proceeds of $1,000,000,resulting in an accounting gain of $220,000. This gain has been included in the pre-tax income figure of $670,000 shown above. For tax purposes,the acquisition cost of the building was $870,000. For purposes of CCA,it is a Class 1 Asset,which treats each building as a separate class. The undepreciated capital cost (VCC)on the building at the time of disposal was $660,000.

During the year,the company sold one of its buildings with carrying value of $780,000 for proceeds of $1,000,000,resulting in an accounting gain of $220,000. This gain has been included in the pre-tax income figure of $670,000 shown above. For tax purposes,the acquisition cost of the building was $870,000. For purposes of CCA,it is a Class 1 Asset,which treats each building as a separate class. The undepreciated capital cost (VCC)on the building at the time of disposal was $660,000.Requirement:

Prepare the journal entries to record income taxes for SREC.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet. Treat each item independently of the others. Assume a tax rate of 25%.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

The following information relates to the accounting income for Withering Press Company (WPC)for the current year ended December 31.

The company had purchased land some years ago for $600,000. Recently,it was discovered that this land is contaminated by industrial pollution. Because of the soil remediation costs required,the value of the land has decreased. For tax purposes,the impairment loss is not currently deductible. In the future when the land is sold,half of any losses is deductible against taxable capital gains (ie.,the other half that is not taxable or deductible is a permanent difference).

The company had purchased land some years ago for $600,000. Recently,it was discovered that this land is contaminated by industrial pollution. Because of the soil remediation costs required,the value of the land has decreased. For tax purposes,the impairment loss is not currently deductible. In the future when the land is sold,half of any losses is deductible against taxable capital gains (ie.,the other half that is not taxable or deductible is a permanent difference).

The deferred income tax liability account on January 1 had a credit balance of $45,000. This balance is entirely related to property,plant,and equipment (PPE).

Requirement:

Prepare the journal entries to record income taxes for WPC.

The company had purchased land some years ago for $600,000. Recently,it was discovered that this land is contaminated by industrial pollution. Because of the soil remediation costs required,the value of the land has decreased. For tax purposes,the impairment loss is not currently deductible. In the future when the land is sold,half of any losses is deductible against taxable capital gains (ie.,the other half that is not taxable or deductible is a permanent difference).

The company had purchased land some years ago for $600,000. Recently,it was discovered that this land is contaminated by industrial pollution. Because of the soil remediation costs required,the value of the land has decreased. For tax purposes,the impairment loss is not currently deductible. In the future when the land is sold,half of any losses is deductible against taxable capital gains (ie.,the other half that is not taxable or deductible is a permanent difference).The deferred income tax liability account on January 1 had a credit balance of $45,000. This balance is entirely related to property,plant,and equipment (PPE).

Requirement:

Prepare the journal entries to record income taxes for WPC.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

The following summarizes information relating to Gonzalez Corporation's operations for the current year.

Requirement:

Requirement:

Compute the amount of taxes payable and income tax expense for Gonzalez Corporation.

Requirement:

Requirement:Compute the amount of taxes payable and income tax expense for Gonzalez Corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

A company has income before tax of $350,000,which includes a permanent difference of $65,000 relating to non-taxable dividend income. There are no other permanent or temporary differences. The income tax rate is 45%.

Requirement:

Compute the amount of taxes payable and income tax expense.

Requirement:

Compute the amount of taxes payable and income tax expense.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

What is the balance of the deferred tax liability due to the rate change?

A)100,000 debit

B)100,000 credit

C)120,000 debit

D)120,000 credit

A)100,000 debit

B)100,000 credit

C)120,000 debit

D)120,000 credit

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

When will there be recapture and a capital gain?

A)When proceeds of disposal are less than undepreciated capital cost.

B)When proceeds of disposal are between undepreciated capital cost and original cost.

C)When proceeds of disposal are more than undepreciated capital cost.

D)When proceeds of disposal are more than original cost.

A)When proceeds of disposal are less than undepreciated capital cost.

B)When proceeds of disposal are between undepreciated capital cost and original cost.

C)When proceeds of disposal are more than undepreciated capital cost.

D)When proceeds of disposal are more than original cost.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

The following information relates to the accounting income for Ontario Uranium Enterprises (QUE)for the current year ended December 31.

During the year,the company sold one of its machines with carrying value of $85,000 for proceeds of $10,000,resulting in an accounting loss of $75,000. This loss has been included in the pre-tax income figure of $850,000 shown above. For tax purposes,the proceeds from the disposal were removed from the undepreciated capital cost (VCC)of Class 8 assets.

During the year,the company sold one of its machines with carrying value of $85,000 for proceeds of $10,000,resulting in an accounting loss of $75,000. This loss has been included in the pre-tax income figure of $850,000 shown above. For tax purposes,the proceeds from the disposal were removed from the undepreciated capital cost (VCC)of Class 8 assets.

The deferred income tax liability account on January 1 had a credit balance of $230,000. This balance is entirely related to property,plant,and equipment (PPE).

Requirement:

Prepare the journal entries to record income taxes for QUE.

During the year,the company sold one of its machines with carrying value of $85,000 for proceeds of $10,000,resulting in an accounting loss of $75,000. This loss has been included in the pre-tax income figure of $850,000 shown above. For tax purposes,the proceeds from the disposal were removed from the undepreciated capital cost (VCC)of Class 8 assets.

During the year,the company sold one of its machines with carrying value of $85,000 for proceeds of $10,000,resulting in an accounting loss of $75,000. This loss has been included in the pre-tax income figure of $850,000 shown above. For tax purposes,the proceeds from the disposal were removed from the undepreciated capital cost (VCC)of Class 8 assets.The deferred income tax liability account on January 1 had a credit balance of $230,000. This balance is entirely related to property,plant,and equipment (PPE).

Requirement:

Prepare the journal entries to record income taxes for QUE.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

When will a terminal loss occur?

A)When proceeds of disposal are less than undepreciated capital cost.

B)When proceeds of disposal are between undepreciated capital cost and original cost.

C)When proceeds of disposal are more than undepreciated capital cost.

D)When proceeds of disposal are less than original cost.

A)When proceeds of disposal are less than undepreciated capital cost.

B)When proceeds of disposal are between undepreciated capital cost and original cost.

C)When proceeds of disposal are more than undepreciated capital cost.

D)When proceeds of disposal are less than original cost.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

When will there be a recapture of depreciation?

A)When proceeds of disposal are less than undepreciated capital cost.

B)When proceeds of disposal are between undepreciated capital cost and original cost.

C)When proceeds of disposal are more than undepreciated capital cost.

D)When proceeds of disposal are less than original cost.

A)When proceeds of disposal are less than undepreciated capital cost.

B)When proceeds of disposal are between undepreciated capital cost and original cost.

C)When proceeds of disposal are more than undepreciated capital cost.

D)When proceeds of disposal are less than original cost.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

Indicate whether the item will result in a deductible temporary difference,taxable temporary difference or neither.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

Indicate whether the item would result in future income taxes being higher,future income taxes being lower or neither:

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

Which statement is correct?

A)A deductible temporary difference results in future taxable income being higher than accounting income.

B)A deductible temporary difference results in future taxable income being less than accounting income.

C)A deductible temporary difference refers to the amount of income tax payable in the current

D)A deductible temporary difference results from an event affecting accounting and taxable income in the same periods.

A)A deductible temporary difference results in future taxable income being higher than accounting income.

B)A deductible temporary difference results in future taxable income being less than accounting income.

C)A deductible temporary difference refers to the amount of income tax payable in the current

D)A deductible temporary difference results from an event affecting accounting and taxable income in the same periods.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

A company has income before tax of $200,000. The company also has a temporary difference of $80,000 relating to capital cost allowance (CCA)in excess of depreciation expense recorded for the year. There are no other permanent or temporary differences. The income tax rate is 40%.

Requirement:

Compute the amount of taxes payable and income tax expense.

Requirement:

Compute the amount of taxes payable and income tax expense.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

In the first two years of operations,a company reports taxable income of $115,000 and $165,000,respectively. In the first two years,the tax rates were 38% and 32% respectively. It is now the end of the third year,and the company has a loss of$160,000 for tax purposes. The company carries losses to the earliest year possible. The tax rate is currently 25%.

Requirement:

a. How much tax was paid in year 1 and year 2?

b. Compute the amount of income tax payable or receivable in the current (third)year.

Requirement:

a. How much tax was paid in year 1 and year 2?

b. Compute the amount of income tax payable or receivable in the current (third)year.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

A company has a deferred tax liability of $120,000 at the beginning of the fiscal year relating to a taxable temporary difference of $300,000. The current year tax rate is 20%.

Requirement:

Provide the journal entry to reflect the tax rate change.

Requirement:

Provide the journal entry to reflect the tax rate change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

A company has a deferred tax liability of $20,000 at the beginning of the fiscal year relating to a taxable temporary difference of $80,000. The current year tax rate is 20%.

Requirement:

Provide the journal entry to reflect the tax rate change.

Requirement:

Provide the journal entry to reflect the tax rate change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

64

A company has a deferred tax liability of $60,000 at the beginning of the fiscal year relating to a taxable temporary difference of $300,000. The tax rate for the year increased from 20% to 25%.

Requirement:

Provide the journal entry to reflect the tax rate change.

Requirement:

Provide the journal entry to reflect the tax rate change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

A company had taxable income of $12 million in fiscal 2013 and paid taxes of 4.8 million; the company incurred a loss of $7 million in fiscal 2015 when the tax rate is 50%. How much refund is the company entitled to?

A)Nil

B)$2.8 million

C)$3.5 million

D)$4.8 million

A)Nil

B)$2.8 million

C)$3.5 million

D)$4.8 million

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

What adjustment is required to the opening deferred taxes as a result of the rate change?

A)30,000 credit

B)90,000 credit

C)120,000 credit

D)150,000 credit

A)30,000 credit

B)90,000 credit

C)120,000 credit

D)150,000 credit

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

A company has a deferred tax liability of $120,000 at the beginning of the fiscal year relating to a taxable temporary difference of $300,000. The current year tax rate is 50%.

Requirement:

Provide the journal entry to reflect the tax rate change.

Requirement:

Provide the journal entry to reflect the tax rate change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

A company has a deferred tax liability of $20,000 at the beginning of the fiscal year relating to a taxable temporary difference of $80,000. The current year tax rate is 30%.

Requirement:

Provide the journal entry to reflect the tax rate change.

Requirement:

Provide the journal entry to reflect the tax rate change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

What is the ending balance of deferred taxes?

A)30,000 debit

B)30,000 credit

C)130,000 credit

D)190,000 credit

A)30,000 debit

B)30,000 credit

C)130,000 credit

D)190,000 credit

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

70

What adjustment is required to the opening deferred taxes as a result of the rate change?

A)30,000 debit

B)30,000 credit

C)130,000 credit

D)190,000 credit

A)30,000 debit

B)30,000 credit

C)130,000 credit

D)190,000 credit

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

A company has a deferred tax liability of $112,500 at the beginning of the fiscal year relating to a taxable temporary difference of $450,000. The tax rate for the year increased from 25% to 35%.

Requirement:

Provide the journal entry to reflect the tax rate change.

Requirement:

Provide the journal entry to reflect the tax rate change.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

72

In the first two years of operations,a company reports taxable income of $125,000 and $65,000,respectively. In the first two years,the tax rates were 44% and 48% respectively. It is now the end of the third year,and the company has a loss of $260,000 for tax purposes. The company carries losses to the earliest year possible. The tax rate is currently 25%.

Requirement:

a. How much tax was paid in year 1 and year 2?

b. Compute the amount of income tax payable or receivable in the current (third)year.

Requirement:

a. How much tax was paid in year 1 and year 2?

b. Compute the amount of income tax payable or receivable in the current (third)year.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

A company had taxable income of $2 million in fiscal 2013 and paid taxes of 7.7 million; the company incurred a loss of $8 million in fiscal 2015 when the tax rate is 50%. How much refund is the company entitled to?

A)Nil

B)$0.7 million

C)$3.85 million

D)$4 million

A)Nil

B)$0.7 million

C)$3.85 million

D)$4 million

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

A company had taxable income of $2 million in fiscal 2013 and paid taxes of 0.6 million; the company incurred a loss of $7 million in fiscal 2015 when the tax rate is 50%. How much refund is the company entitled to?

A)Nil

B)$0.6 million

C)$1.0 million

D)$3.5 million

A)Nil

B)$0.6 million

C)$1.0 million

D)$3.5 million

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

Which statement is not correct?

A)Loss carryback result in definite cash inflow.

B)Loss carryback result in immediate cash inflow.

C)Loss carryforward result in definite cash inflow.

D)Loss carryforward result in uncertain cash inflow.

A)Loss carryback result in definite cash inflow.

B)Loss carryback result in immediate cash inflow.

C)Loss carryforward result in definite cash inflow.

D)Loss carryforward result in uncertain cash inflow.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

What adjustment is required to the opening deferred taxes as a result of the rate change?

A)30,000 debit

B)90,000 debit

C)120,000 debit

D)150,000 debit

A)30,000 debit

B)90,000 debit

C)120,000 debit

D)150,000 debit

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

77

In the first two years of operations,a company reports taxable income of $125,000 and $65,000,respectively. In the first two years,the company paid $50,000 and $13,000. It is now the end of the third year,and the company has a loss of $160,000 for tax purposes. The company carries losses to the earliest year possible. The tax rate is currently 25%.

Requirement:

Compute the amount of income tax payable or receivable in the current (third)year.

Requirement:

Compute the amount of income tax payable or receivable in the current (third)year.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

A company had taxable income of $2 million in fiscal 2013 and paid taxes of 0.4 million; the company incurred a loss of $0.5 million in fiscal 2015 when the tax rate is 30%. How much refund is the company entitled to?

A)Nil

B)$0.2 million

C)$0.4 million

D)$0.6 million

A)Nil

B)$0.2 million

C)$0.4 million

D)$0.6 million

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

Which statement is correct?

A)Income tax system treats income and losses symmetrically.

B)Income tax system treats income and losses asymmetrically.

C)When a company has a loss,a refund is received equal to the loss multiplied by the tax rate.

D)A loss carryforward has immediate cash flow benefits to a company.

A)Income tax system treats income and losses symmetrically.

B)Income tax system treats income and losses asymmetrically.

C)When a company has a loss,a refund is received equal to the loss multiplied by the tax rate.

D)A loss carryforward has immediate cash flow benefits to a company.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

What is the effect on the deferred tax balance as a result of the rate change?

A)100,000 credit

B)160,000 credit

C)120,000 credit

D)200,000 credit

A)100,000 credit

B)160,000 credit

C)120,000 credit

D)200,000 credit

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck