Deck 7: Capital Asset Pricing Model

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 7: Capital Asset Pricing Model

1

The characteristic line shows the relationship between:

A)Risk- free returns and market returns

B)A single asset and risk- free returns

C)A single asset and market returns

D)All of the above

A)Risk- free returns and market returns

B)A single asset and risk- free returns

C)A single asset and market returns

D)All of the above

A single asset and market returns

2

Which of the following is the graphical representation of the capital asset pricing model?

A)The equity market line

B)The capital market line

C)The index market line

D)The security market line

A)The equity market line

B)The capital market line

C)The index market line

D)The security market line

The security market line

3

The return on treasury notes is expected to be 7.5%.The expected return on the market is 12%.What is the expected return on a stock with a beta of 1.4?

A)19.2%

B)12.6%

C)6.6%

D)13.8%

A)19.2%

B)12.6%

C)6.6%

D)13.8%

13.8%

4

The return on treasury notes is expected to be 7.5%.The market risk premium is 8%.What is the expected return on a stock with a beta of 1.3?

A)12.95%

B)12.35%

C)7.25%

D)17.90%

A)12.95%

B)12.35%

C)7.25%

D)17.90%

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is the set of feasible portfolios formed from all of the stocks listed upon the stock exchange?

A)The market portfolio

B)The opportunity set of risk- free portfolios

C)The risk- free portfolio

D)The opportunity set of risky portfolios

A)The market portfolio

B)The opportunity set of risk- free portfolios

C)The risk- free portfolio

D)The opportunity set of risky portfolios

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

An investor will choose to invest in a portfolio on the right portion of the efficient frontier if .

A)They are risk neutral

B)They are risk averse

C)They are irrational

D)They are risk seeking

A)They are risk neutral

B)They are risk averse

C)They are irrational

D)They are risk seeking

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

The efficient frontier is sometimes used to refer to _ .

A)The bottom half of the minimum variance set

B)The line on a chart mapping risk and return which maps out the efficient portfolios

C)The top half of the minimum variance set

D)Both B and C

A)The bottom half of the minimum variance set

B)The line on a chart mapping risk and return which maps out the efficient portfolios

C)The top half of the minimum variance set

D)Both B and C

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

What is the name given to the portfolio formed from the point of tangency of the security market line and the efficient frontier?

A)The market portfolio

B)The equity portfolio

C)The capital portfolio

D)The risk- free portfolio

A)The market portfolio

B)The equity portfolio

C)The capital portfolio

D)The risk- free portfolio

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

How much should a security with a high variance of return and fi of 1 be expected to return?

A)The market rate of return

B)The risk- free rate of return

C)Nothing

D)None of the above

A)The market rate of return

B)The risk- free rate of return

C)Nothing

D)None of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

Which of these represents the line drawn between the point of tangency of the efficient frontier and the risk free rate?

A)The capital market line

B)The equity return line

C)The equity market line

D)The security market line

A)The capital market line

B)The equity return line

C)The equity market line

D)The security market line

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

The capital market line plots the expected return on _______ against its _______ .

A)a portfolio,systematic risk

B)an individual asset,standard deviation

C)an individual asset,systematic risk

D)a portfolio,standard deviation

A)a portfolio,systematic risk

B)an individual asset,standard deviation

C)an individual asset,systematic risk

D)a portfolio,standard deviation

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

An investor will choose to invest in a portfolio on the left portion of the efficient frontier if .

A)They are risk seeking

B)They are risk neutral

C)They are irrational

D)They are risk averse

A)They are risk seeking

B)They are risk neutral

C)They are irrational

D)They are risk averse

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

The minimum variance portfolios are .

A)A subset of feasible portfolios offering the lowest return for each level of risk

B)A subset of feasible portfolios offering the highest return for each level of risk

C)A subset of feasible portfolios offering the highest level of risk for each level of return

D)A subset of feasible portfolios offering the lowest level of risk for each level of return

A)A subset of feasible portfolios offering the lowest return for each level of risk

B)A subset of feasible portfolios offering the highest return for each level of risk

C)A subset of feasible portfolios offering the highest level of risk for each level of return

D)A subset of feasible portfolios offering the lowest level of risk for each level of return

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

The beta of a stock A is 1.32.If the standard deviation of the market is 0.0443,and stock A's covariance with the market is 0.0054.What is Stock A's standard deviation?

A)0.0543

B)0.0765

C)1.0037

D)0.0924

A)0.0543

B)0.0765

C)1.0037

D)0.0924

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

According to finance theory a rational investor is assumed to focus on when making investment decisions?

A)Expected return and mean returns

B)Expected risk and standard deviation of returns

C)Expected risk and total risk

D)Expected return and standard deviation of returns

A)Expected return and mean returns

B)Expected risk and standard deviation of returns

C)Expected risk and total risk

D)Expected return and standard deviation of returns

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

A security with a fi of 0 should be expected to return ________________.

A)The risk- free rate of return

B)Nothing

C)The market rate of return

D)None of the above

A)The risk- free rate of return

B)Nothing

C)The market rate of return

D)None of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

An increase in systematic risk would cause a(n)in beta and a(n)in the required rate of return

A)increase,increase

B)decrease,increase

C)increase,decrease

D)decrese,decrease

A)increase,increase

B)decrease,increase

C)increase,decrease

D)decrese,decrease

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

What is the beta of the market portfolio?

A)1

B)- 1

C)0

D)It is impossible to determine.

A)1

B)- 1

C)0

D)It is impossible to determine.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

The security market line plots the expected return on against its .

A)a portfolio,standard deviation

B)a portfolio,systematic risk

C)an individual asset,standard deviation

D)an individual asset,systematic risk

A)a portfolio,standard deviation

B)a portfolio,systematic risk

C)an individual asset,standard deviation

D)an individual asset,systematic risk

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements best describes the beta term used in the CAPM?

A)It is the ratio of the covariance between excess market returns to the variance between excess share returns and excess market returns.

B)It is the ratio of the covariance between excess share returns and excess market returns to the variance of excess market returns.

C)It is the ratio of the variance between excess share returns and excess market returns to the variance of excess market returns.

D)It is the ratio of the variance between excess share returns and excess market returns to the covariance of excess market returns.

A)It is the ratio of the covariance between excess market returns to the variance between excess share returns and excess market returns.

B)It is the ratio of the covariance between excess share returns and excess market returns to the variance of excess market returns.

C)It is the ratio of the variance between excess share returns and excess market returns to the variance of excess market returns.

D)It is the ratio of the variance between excess share returns and excess market returns to the covariance of excess market returns.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

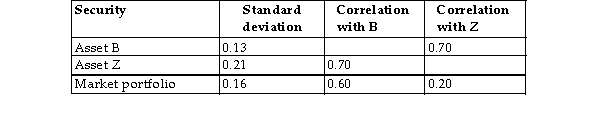

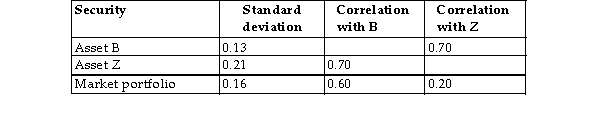

The following table provides standard deviations and correlation coefficients relating to two risky securities,B and Z,and the market portfolio.Use this information to estimate the beta and expected returns on securities B and Z,assuming an expected return on the market portfolio of 12%,and a risk- free return of 5.5%.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

In general,individual stock returns appear to be normally distributed.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

The efficient set of portfolios is .

A)A subset of minimum variance portfolios offering the highest return for each level of risk

B)A subset of minimum variance portfolios offering the lowest level of risk for each level of return

C)A subset of minimum variance portfolios offering the lowest return for each level of risk

D)A subset of minimum variance portfolios offering the highest level of risk for each level of return

A)A subset of minimum variance portfolios offering the highest return for each level of risk

B)A subset of minimum variance portfolios offering the lowest level of risk for each level of return

C)A subset of minimum variance portfolios offering the lowest return for each level of risk

D)A subset of minimum variance portfolios offering the highest level of risk for each level of return

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements best describes feasible portfolios?

A)All the possible portfolios with identical risk and return outcomes that can be constructed from a given set of securities

B)All the possible portfolios with different risk and return outcomes that can be constructed from a given set of securities

C)All the possible portfolios with different risk and identical return outcomes that can be constructed from a given set of securities

D)All the possible portfolios with identical risk and different return outcomes that can be constructed from a given set of securities

A)All the possible portfolios with identical risk and return outcomes that can be constructed from a given set of securities

B)All the possible portfolios with different risk and return outcomes that can be constructed from a given set of securities

C)All the possible portfolios with different risk and identical return outcomes that can be constructed from a given set of securities

D)All the possible portfolios with identical risk and different return outcomes that can be constructed from a given set of securities

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

According to the CAPM equation,which of the following represents the risk premium for security 'i'?

A)fii (rm)

B)fii (rm - rf)

C)fii (rm - rf)am2 D)fii

A)fii (rm)

B)fii (rm - rf)

C)fii (rm - rf)am2 D)fii

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

What is the beta of a stock A,given it has the covariance with the market of 0.0045,a standard deviation of 0.0657? The standard deviation of the market is 0.0469.

A)1.36

B)1.52

C)1.46

D)1.40

A)1.36

B)1.52

C)1.46

D)1.40

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

The global minimum variance portfolio is .

A)The portfolio with the lowest level of return obtainable on the efficient frontier

B)The portfolio with the highest level of return obtainable on the efficient frontier

C)The portfolio with the lowest level of risk obtainable on the efficient frontier

D)The portfolio with the highest level of risk obtainable on the efficient frontier

A)The portfolio with the lowest level of return obtainable on the efficient frontier

B)The portfolio with the highest level of return obtainable on the efficient frontier

C)The portfolio with the lowest level of risk obtainable on the efficient frontier

D)The portfolio with the highest level of risk obtainable on the efficient frontier

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

The capital asset pricing model implies that the only factors that determine the required rate of return on a stock are the amount of market risk the stock is exposed to and the expected return in the market.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

The return on treasury notes is expected to be 10%.The expected return on the market is 14%.What is the expected return on a stock with a beta of - 0.5?

A)8%

B)- 7%

C)0%

D)No stock can have a negative beta.

A)8%

B)- 7%

C)0%

D)No stock can have a negative beta.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

According to finance theory returns for stocks are distributed.

A)Asymmetrically

B)Normally

C)Fundamentally

D)None of the above

A)Asymmetrically

B)Normally

C)Fundamentally

D)None of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is not true regarding the CAPM?

A)If a share's expected return is 2% and the expected return on the market portfolio is 11%,the share's beta must be negative.

B)In equilibrium,all risky assets are priced such that their expected return lies on the security market line.

C)Investors do not differ in their attitudes towards risk.

D)A and B

E)A and C

A)If a share's expected return is 2% and the expected return on the market portfolio is 11%,the share's beta must be negative.

B)In equilibrium,all risky assets are priced such that their expected return lies on the security market line.

C)Investors do not differ in their attitudes towards risk.

D)A and B

E)A and C

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

(a)What are feasible portfolios?

(b)How would you construct one containing a mixture of shares from companies A and G?

(b)How would you construct one containing a mixture of shares from companies A and G?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

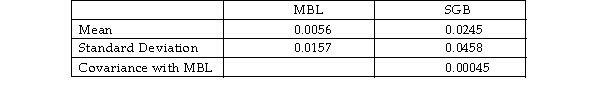

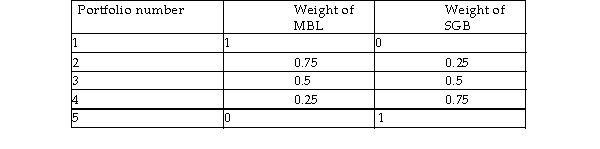

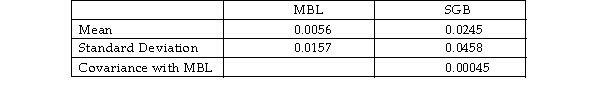

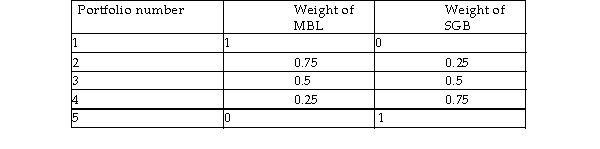

Examine the following data on MBL and SGB:  Calculate the expected return and standard deviation of the following portfolio combinations of stocks MBL and SGB:

Calculate the expected return and standard deviation of the following portfolio combinations of stocks MBL and SGB:

Calculate the expected return and standard deviation of the following portfolio combinations of stocks MBL and SGB:

Calculate the expected return and standard deviation of the following portfolio combinations of stocks MBL and SGB:

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

The beta of a share cannot be calculated from historical data.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following does not affect the capital asset pricing model in respect of an individual security?

A)The expected return on the market

B)The market risk of the security

C)The expected return on the security

D)The beta of the security

A)The expected return on the market

B)The market risk of the security

C)The expected return on the security

D)The beta of the security

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

Two securities with different expected returns will have the same beta.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

The risk free asset can be expected to have a beta of .

A)1

B)- 1

C)0

D)The expected return on the market minus the risk free rate

A)1

B)- 1

C)0

D)The expected return on the market minus the risk free rate

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

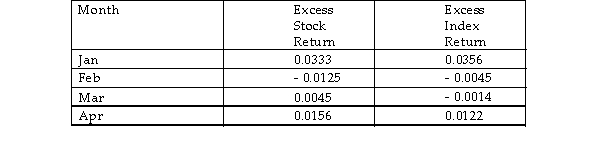

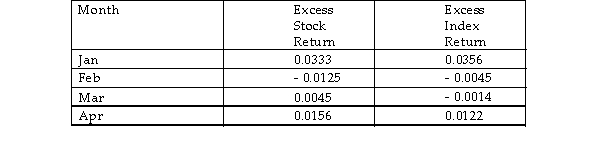

Use the following data to calculate the beta of Southeast Wineries Ltd:

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

CAPM can be used to price risky debt securities as well as risky equity securities.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

The beta of a stock A is 1.52 and its standard deviation is 0.0765.If the standard deviation of the market is 0.0543,what is stock A's covariance with the market?

A)0.0089

B)0.0063

C)0.0078

D)0.0045

A)0.0089

B)0.0063

C)0.0078

D)0.0045

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

For portfolio theory to hold stock returns must be normally distributed.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

Portfolio theory is based on the assumption that all investors hold some proportion of their investment in the market portfolio.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

Beta is a measure of a securities systematic risk.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

Markowitz's portfolio theory only holds for portfolios comprised of different combinations of two stocks.Therefore investors who create portfolios comprised of three or more stocks must disregard the theory.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

The most reliable method to calculate beta is to use 'raw' return data rather than 'excess' return data because the choice of risk- free rate makes the 'excess return' data too subjective in nature.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

Investors have different attitudes towards risk.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

Investors must choose between stocks that are either part of the minimum variance portfolio or are part of the efficient portfolio.They cannot have both.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

A security lying below the security market line (SML)is under- priced.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

Using a shorter estimation period will tend to improve the accuracy of a beta calculation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

One of the key strengths of the CAPM is that it represents historical returns very well.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck