Deck 15: International Trade Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/187

Play

Full screen (f)

Deck 15: International Trade Policy

1

Based on the table below, at what world price would the country export?

A) at only $8

B) all prices below $8

C) it is impossible to say

D) all prices above $8

A) at only $8

B) all prices below $8

C) it is impossible to say

D) all prices above $8

all prices above $8

2

The fundamental force that generates international trade is

A) comparative advantage.

B) law of increasing costs.

C) law of diminishing returns.

D) absolute advantage.

A) comparative advantage.

B) law of increasing costs.

C) law of diminishing returns.

D) absolute advantage.

A

3

Based on the table below, at what world price would the country import?

A) all prices below $8

B) all prices above $8

C) at exactly $8

D) it is impossible to say

A) all prices below $8

B) all prices above $8

C) at exactly $8

D) it is impossible to say

all prices below $8

4

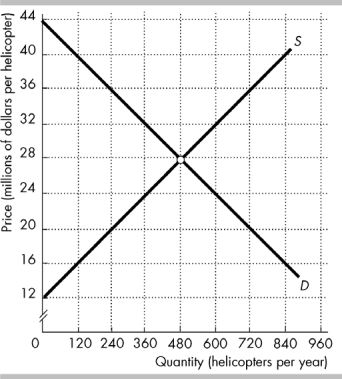

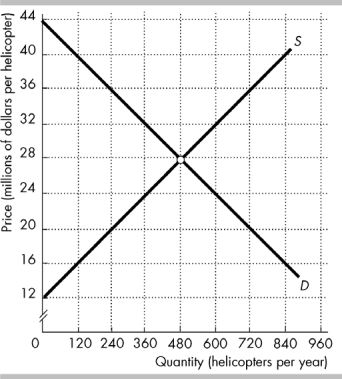

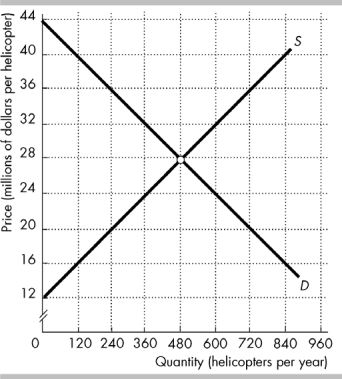

The figure shows the market for helicopters in the United States, where D is the domestic demand curve and S is the domestic supply curve. The United States trades helicopters with the rest of the world at a price of $36 million per helicopter.

In the figure above, with international trade U.S. companies buy helicopters per year.

A) 240

B) 360

C) 480

D) 720

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

5

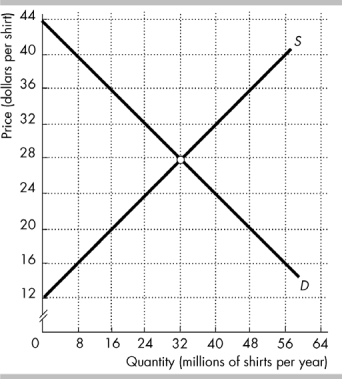

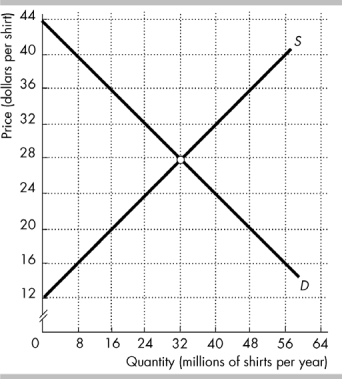

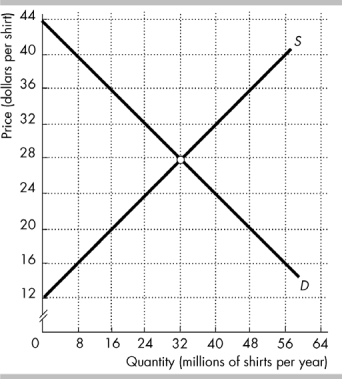

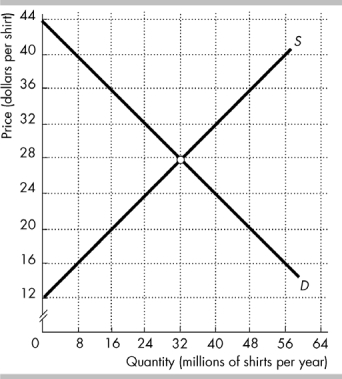

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt.

In the figure above, with international trade the United States million shirts per year.

A) imports 48

B) exports 16

C) exports 32

D) imports 32

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose the world price of a good is $4. Based on the table below, the country willould

A) import 10 units

B) import 20 units

C) export 20 units

D) export 10 units

A) import 10 units

B) import 20 units

C) export 20 units

D) export 10 units

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

7

Who benefits from imports?

A) foreign consumers

B) domestic consumers

C) domestic workers in the industry

D) domestic producers

A) foreign consumers

B) domestic consumers

C) domestic workers in the industry

D) domestic producers

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

8

The figure shows the market for helicopters in the United States, where D is the domestic demand curve and S is the domestic supply curve. The United States trades helicopters with the rest of the world at a price of $36 million per helicopter.

In the figure above, with international trade helicopters per year are produced in the United States.

A) 240

B) 360

C) 720

D) 480

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

9

Consider a market that, with no international trade, is initially in equilibrium with quantity demanded equal to quantity supplied at a price of $20. If the world price of the good is $10 and the country opens up to international trade then in this market

A) imports will increase, price will fall, and quantity supplied will fall

B) imports will increase, price will decrease, and the supply curve will shift to the left

C) quantity demanded will decrease, quantity supplied will decrease, and price will decrease

D) exports will increase, price will be unchanged, and quantity supplied will increase

A) imports will increase, price will fall, and quantity supplied will fall

B) imports will increase, price will decrease, and the supply curve will shift to the left

C) quantity demanded will decrease, quantity supplied will decrease, and price will decrease

D) exports will increase, price will be unchanged, and quantity supplied will increase

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

10

The United States decides to follow its comparative advantage and specialize in the production of airplanes. Which of the following will occur?

A) the quantity of airplanes demanded in the United States will increase

B) the world price of airplanes will increase

C) there will be no change in the price of airplanes in the United States

D) more airplanes will be produced in the United States

A) the quantity of airplanes demanded in the United States will increase

B) the world price of airplanes will increase

C) there will be no change in the price of airplanes in the United States

D) more airplanes will be produced in the United States

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

11

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt.

In the figure above, with international trade Americans buy million shirts per year.

A) 48

B) 16

C) 24

D) 32

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

12

When the principle of comparative advantage is used to guide trade, then a country will specialize by producing only

A) goods for which production costs are more than average total costs.

B) goods with the highest opportunity cost.

C) goods for which production takes fewer worker-hour than another country.

D) goods with the lowest opportunity costs.

A) goods for which production costs are more than average total costs.

B) goods with the highest opportunity cost.

C) goods for which production takes fewer worker-hour than another country.

D) goods with the lowest opportunity costs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

13

In a market open to international trade, at the world price the quantity demanded is 150 and quantity supplied is 200. This country will

A) export 50 units.

B) export 200 units.

C) import 50 units.

D) import 150 units.

A) export 50 units.

B) export 200 units.

C) import 50 units.

D) import 150 units.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

14

Comparative advantage implies that a country will

A) export goods produced by domestic industries with low wages relative to its trading partners.

B) import those goods in which the country has a comparative advantage.

C) find it difficult to conclude free trade agreements with other nations.

D) export those goods in which the country has a comparative advantage.

A) export goods produced by domestic industries with low wages relative to its trading partners.

B) import those goods in which the country has a comparative advantage.

C) find it difficult to conclude free trade agreements with other nations.

D) export those goods in which the country has a comparative advantage.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

15

The fundamental force that drives international trade is:

A) Countriesʹ desire to increase their trade surplus

B) Absolute advantage

C) Cheap labor in countries like China or India

D) Comparative advantage

A) Countriesʹ desire to increase their trade surplus

B) Absolute advantage

C) Cheap labor in countries like China or India

D) Comparative advantage

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

16

A country specializes in the production of goods for which it has a comparative advantage. We find that

A) producers win, consumers lose, but overall the gains exceed the losses

B) all producers win

C) all consumers win

D) some producers and consumers win, some lose, but overall the gains exceed the losses

A) producers win, consumers lose, but overall the gains exceed the losses

B) all producers win

C) all consumers win

D) some producers and consumers win, some lose, but overall the gains exceed the losses

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

17

Consider a market that sells some of its goods as exports. Who does NOT benefit?

A) foreign consumers

B) workers in the industry

C) domestic consumers

D) domestic producers

A) foreign consumers

B) workers in the industry

C) domestic consumers

D) domestic producers

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

18

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt.

In the figure above, with international trade million shirts per year are produced in the United States.

A) 32

B) 48

C) 20

D) 16

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

19

Prior to international trade, if country A has a lower price of good X than does country B, then we know definitely that

A) country B has a comparative advantage in the production of good X.

B) country A has a comparative advantage in the production of good X.

C) country A has an absolute advantage in the production of good X.

D) country B has an absolute advantage in the production of good X.

A) country B has a comparative advantage in the production of good X.

B) country A has a comparative advantage in the production of good X.

C) country A has an absolute advantage in the production of good X.

D) country B has an absolute advantage in the production of good X.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

20

The figure shows the market for helicopters in the United States, where D is the domestic demand curve and S is the domestic supply curve. The United States trades helicopters with the rest of the world at a price of $36 million per helicopter.

In the figure above, the United States helicopters per year.

A) exports 480

B) imports 240

C) exports 720

D) imports 480

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

21

A tariff is

A) a licensing regulation that limits imports.

B) a tax on an exported good.

C) an agreement to restrict the volume of exports.

D) a tax on an imported good.

A) a licensing regulation that limits imports.

B) a tax on an exported good.

C) an agreement to restrict the volume of exports.

D) a tax on an imported good.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

22

A tariff the quantity of the good imported and the domestic price of the imported good.

A) increases; lowers

B) decreases; decreases

C) decreases; increases

D) does not change; increases

A) increases; lowers

B) decreases; decreases

C) decreases; increases

D) does not change; increases

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

23

Tariffs and import quotas differ in that

A) one is imposed by the government, while the other is imposed by the private sector.

B) one is a form of trade restriction, while the other is not.

C) one is legal, while the other is not.

D) one is a tax, while the other is a limit.

A) one is imposed by the government, while the other is imposed by the private sector.

B) one is a form of trade restriction, while the other is not.

C) one is legal, while the other is not.

D) one is a tax, while the other is a limit.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements concerning tariffs is NOT true?

A) A tariff creates revenue for the government.

B) A tariff leaves the price of imports unchanged.

C) A tariff decreases international trade.

D) A tariff results in a loss for for domestic consumers of the good.

A) A tariff creates revenue for the government.

B) A tariff leaves the price of imports unchanged.

C) A tariff decreases international trade.

D) A tariff results in a loss for for domestic consumers of the good.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

25

If the United States imposes a tariff on imported cars, the

A) U.S. demand curve shifts leftward.

B) U.S. supply curve shifts rightward.

C) price in the United States rises but neither the U.S. demand curve nor the U.S. supply curve shift..

D) U.S. demand curve shifts rightward.

A) U.S. demand curve shifts leftward.

B) U.S. supply curve shifts rightward.

C) price in the United States rises but neither the U.S. demand curve nor the U.S. supply curve shift..

D) U.S. demand curve shifts rightward.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

26

A tariff imposed by the United States on Japanese cars the price of cars in the United States and the quantity of Japanese cars imported into the United States.

A) lowers; decreases

B) raises; decreases

C) raises; increases

D) lowers; increases

A) lowers; decreases

B) raises; decreases

C) raises; increases

D) lowers; increases

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

27

Compared to the situation before international trade, after the United States exports a good production in the United States and consumption in the United States .

A) decreases; increases

B) increases; decreases

C) decreases; decreases

D) increases; increases

A) decreases; increases

B) increases; decreases

C) decreases; decreases

D) increases; increases

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

28

If a country imposes a tariff on an imported good, the tariff the price in the importing country and the quantity of imports.

A) raises; decreases

B) raises; does not change

C) raises; increases

D) lowers; does not change

A) raises; decreases

B) raises; does not change

C) raises; increases

D) lowers; does not change

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements about U.S. international trade in 2009 is correct?

A) The value of U.S. exports was about 33 percent of the value of total U.S. production

B) The value of U.S. exports exceeded the value of U.S. imports

C) The United States was the worldʹs largest trader.

D) The United States imported only goods.

A) The value of U.S. exports was about 33 percent of the value of total U.S. production

B) The value of U.S. exports exceeded the value of U.S. imports

C) The United States was the worldʹs largest trader.

D) The United States imported only goods.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

30

If the United States imposes a tariff on imported steel, the tariff will

A) decrease employment in the U.S. steel industry.

B) raise the U.S. price of imported steel.

C) decrease the U.S. production of steel.

D) increase the total U.S. consumption of steel.

A) decrease employment in the U.S. steel industry.

B) raise the U.S. price of imported steel.

C) decrease the U.S. production of steel.

D) increase the total U.S. consumption of steel.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

31

If the United States imposes a tariff of $1 per imported shirt, the higher tariff

A) raises the price of a shirt to U.S. consumers.

B) increases imports of shirts into the United States.

C) benefits U.S. shirt consumers.

D) None of the above

A) raises the price of a shirt to U.S. consumers.

B) increases imports of shirts into the United States.

C) benefits U.S. shirt consumers.

D) None of the above

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

32

Tariffs and import quotas both result in

A) lower levels of imports.

B) the domestic government gaining revenue.

C) higher levels of domestic consumption.

D) lower levels of domestic production.

A) lower levels of imports.

B) the domestic government gaining revenue.

C) higher levels of domestic consumption.

D) lower levels of domestic production.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

33

A tax that is imposed by the importing country when an imported good crosses its international boundary is called

A) dumping.

B) a tariff.

C) a voluntary export restraint.

D) an import quota.

A) dumping.

B) a tariff.

C) a voluntary export restraint.

D) an import quota.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

34

A tariff is a

A) tax on an exported good or service.

B) subsidy on an imported good.

C) tax on an imported good or service.

D) subsidy on an exported good.

A) tax on an exported good or service.

B) subsidy on an imported good.

C) tax on an imported good or service.

D) subsidy on an exported good.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

35

A major purpose of tariffs is to

A) discourage imports.

B) encourage imports.

C) encourage exports.

D) discourage exports.

A) discourage imports.

B) encourage imports.

C) encourage exports.

D) discourage exports.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

36

The United States has a comparative advantage in producing cotton if the U.S. price of cotton before international trade is the world price

A) greater than

B) less than

C) not comparable to

D) equal to

A) greater than

B) less than

C) not comparable to

D) equal to

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

37

A tariff

A) is a tax imposed on exported goods.

B) has no effect on prices paid by domestic consumers even though it increases the revenue collected by domestic producers.

C) is a tax imposed on imported goods.

D) encourages worldwide specialization according to the principle of comparative advantage.

A) is a tax imposed on exported goods.

B) has no effect on prices paid by domestic consumers even though it increases the revenue collected by domestic producers.

C) is a tax imposed on imported goods.

D) encourages worldwide specialization according to the principle of comparative advantage.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

38

Compared to the situation before international trade, after the United States imports a good production in the United States and consumption in the United States .

A) increases; increases

B) decreases; increases

C) increases; decreases

D) decreases; decreases

A) increases; increases

B) decreases; increases

C) increases; decreases

D) decreases; decreases

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

39

If a tariff is imposed, the price paid by domestic consumers will and the amount imported will .

A) not change; increase

B) increase; increase

C) increase; decrease

D) increase; not change

A) not change; increase

B) increase; increase

C) increase; decrease

D) increase; not change

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

40

Suppose the country of Atlantica imposes a tariff on foreign-produced cars. As a result of the tariff,

A) there is an increase in the number of imported cars.

B) tariff revenue collected by the government in the Atlantica increases.

C) there are more efficient trade agreements between Atlantica and its trade partners.

D) the gains from trade rise.

A) there is an increase in the number of imported cars.

B) tariff revenue collected by the government in the Atlantica increases.

C) there are more efficient trade agreements between Atlantica and its trade partners.

D) the gains from trade rise.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

41

Lowering the tariff on good X will

A) increase the domestic imports of good X.

B) have no effect unless the nationʹs trading partner also lowers its tariff on good X.

C) increase domestic employment in industry X.

D) increase the domestic price of good X.

A) increase the domestic imports of good X.

B) have no effect unless the nationʹs trading partner also lowers its tariff on good X.

C) increase domestic employment in industry X.

D) increase the domestic price of good X.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

42

During the Great Depression in the 1930s, the average tariff level in the United States peaked at about

A) 6 percent.

B) 100 percent.

C) zero.

D) 20 percent.

A) 6 percent.

B) 100 percent.

C) zero.

D) 20 percent.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

43

Reducing a tariff will the domestic production of the good and the total domestic consumption of the good.

A) decrease; increase

B) increase; decrease

C) decrease; decrease

D) increase; increase

A) decrease; increase

B) increase; decrease

C) decrease; decrease

D) increase; increase

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

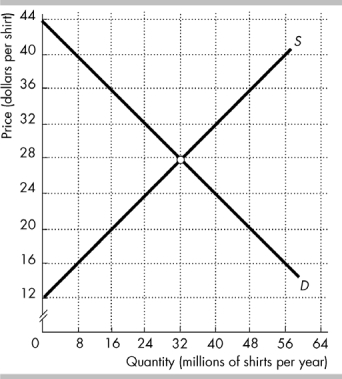

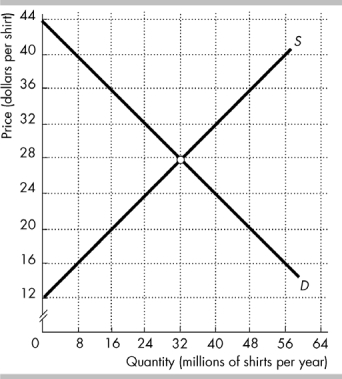

44

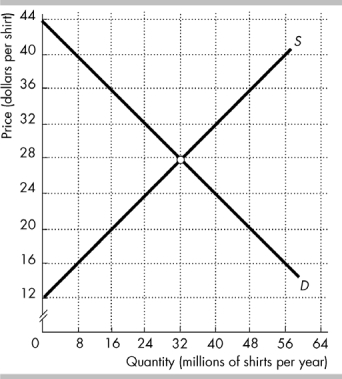

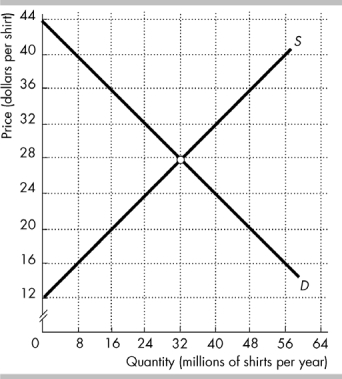

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt. The United States imposes a tariff on imported shirts, $4 per shirt.

In the figure above, the U.S. governmentʹs revenue from the tariff is .

A) $64 million

B) $32 million

C) $48 million

D) $128 million

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

45

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt. The United States imposes a tariff on imported shirts, $4 per shirt.

In the figure above, the tariff the domestic production of shirts in the United States by

Per year.

A) increases; 4 million

B) decreases; 8 million

C) decreases; 16 million

D) increases; 8 million

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

46

Average tariff levels in the United States in the last decade are

A) about equal to the average since 1930.

B) zero, as there are no longer any tariffs in the United States.

C) positive, but below the average since 1930.

D) above the average since 1930.

A) about equal to the average since 1930.

B) zero, as there are no longer any tariffs in the United States.

C) positive, but below the average since 1930.

D) above the average since 1930.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

47

A U.S. tariff on textiles would U.S. clothing prices and jobs in the U.S. textile industry.

A) reduce; increase

B) raise; increase

C) raise; decrease

D) reduce; decrease

A) reduce; increase

B) raise; increase

C) raise; decrease

D) reduce; decrease

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

48

The Smoot-Hawley Act

A) made most tariffs illegal.

B) recognized Congressʹs right to deny trade authorization powers to the President.

C) gave the President the right to broker trade deals with other nations.

D) greatly raised tariffs.

A) made most tariffs illegal.

B) recognized Congressʹs right to deny trade authorization powers to the President.

C) gave the President the right to broker trade deals with other nations.

D) greatly raised tariffs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

49

U.S. tariffs in the peaked in

A) 1940.

B) 1961.

C) 1992.

D) 1933.

A) 1940.

B) 1961.

C) 1992.

D) 1933.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

50

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt. The United States imposes a tariff on imported shirts, $4 per shirt.

In the figure above, with the tariff the United States imports million shirts per year.

A) 24

B) 8

C) 16

D) 32

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

51

A tariff is imposed on a good. The tariff will quantity supplied, quantity demanded, and price in the home country.

A) increase; decrease; decrease

B) increase; remain unchanged; remain unchanged

C) increase; increase; increase

D) increase; decrease; increase

A) increase; decrease; decrease

B) increase; remain unchanged; remain unchanged

C) increase; increase; increase

D) increase; decrease; increase

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

52

Increasing a tariff will the domestic quantity consumed of the good, while the domestic production of the good.

A) decrease; decreasing

B) decrease; increasing

C) increase; increasing

D) increase; decreasing

A) decrease; decreasing

B) decrease; increasing

C) increase; increasing

D) increase; decreasing

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

53

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt. The United States imposes a tariff on imported shirts, $4 per shirt.

In the figure above, the tariff U.S. imports of shirts by million shirts per year.

A) increases; 4

B) decreases; 8

C) decreases; 16

D) increases; 8

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

54

The United States imports cars from Japan. If the United States imposes a tariff on cars imported from Japan, American

A) consumers will lose and American producers will gain.

B) tariff revenue will equal the loss inflicted on American consumers.

C) car manufacturers will gain revenue equal to the revenue lost by Japanese car manufacturers.

D) consumers will lose and Japanese producers will gain.

A) consumers will lose and American producers will gain.

B) tariff revenue will equal the loss inflicted on American consumers.

C) car manufacturers will gain revenue equal to the revenue lost by Japanese car manufacturers.

D) consumers will lose and Japanese producers will gain.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

55

The Smoot-Hawley Act introduced

A) opportunities for expanding U.S. foreign trade.

B) a framework promoting international free trade.

C) revenue tariffs as a major source of U.S. government revenues.

D) the highest tariffs set by the United States in the last 80 years.

A) opportunities for expanding U.S. foreign trade.

B) a framework promoting international free trade.

C) revenue tariffs as a major source of U.S. government revenues.

D) the highest tariffs set by the United States in the last 80 years.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

56

Suppose the country of Mooland imposes tariffs on imported beef from the country of Aqualand. As a result of the tariffs, the

A) price of beef in Mooland falls.

B) quantity of beef imported by Mooland decreases.

C) quantity of beef exported by Mooland increases.

D) quantity of beef imported by Mooland increases.

A) price of beef in Mooland falls.

B) quantity of beef imported by Mooland decreases.

C) quantity of beef exported by Mooland increases.

D) quantity of beef imported by Mooland increases.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

57

The winners from a tariff on imports are

A) producers

B) producers and government

C) consumers, producers, and government

D) consumers

A) producers

B) producers and government

C) consumers, producers, and government

D) consumers

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

58

The Smoot-Hawley Act was enacted in

A) 1980.

B) 1930.

C) 1950.

D) 2000.

A) 1980.

B) 1930.

C) 1950.

D) 2000.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

59

The figure shows the market for shirts in the United States, where D is the domestic demand curve and S is the domestic supply curve. The world price is $20 per shirt. The United States imposes a tariff on imported shirts, $4 per shirt.

In the figure above, with the tariff Americans buy million shirts per year.

A) 16

B) 40

C) 32

D) 48

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

60

Tariffs

A) generate revenue for the government.

B) generate revenue for consumers.

C) encourage domestic consumers to buy more imports.

D) encourage domestic producers to produce less.

A) generate revenue for the government.

B) generate revenue for consumers.

C) encourage domestic consumers to buy more imports.

D) encourage domestic producers to produce less.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

61

A difference between a quota and a tariff is that with a quota the

A) exporting government collects an extra gain in the form of revenue.

B) domestic consumers are not harmed.

C) importing government collects an extra gain in the form of revenue.

D) person who has the right to import the good captures an extra gain.

A) exporting government collects an extra gain in the form of revenue.

B) domestic consumers are not harmed.

C) importing government collects an extra gain in the form of revenue.

D) person who has the right to import the good captures an extra gain.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

62

An import quota is

A) a tariff that is a fixed dollar amount per unit of a good.

B) a tariff that is a fixed percentage of the price of a good.

C) a restriction that specifies the maximum amount of a good that may be imported.

D) an agreed upon price for a good to be imported at a specified future date.

A) a tariff that is a fixed dollar amount per unit of a good.

B) a tariff that is a fixed percentage of the price of a good.

C) a restriction that specifies the maximum amount of a good that may be imported.

D) an agreed upon price for a good to be imported at a specified future date.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following best describes the history of tariffs in the United States over the past 70 years?

A) Average tariff rates have not changed much since the early 1930s and are less than 5 percent.

B) Tariffs have declined overall since the early 1930s and now average just over 10 percent.

C) Tariffs were at their highest level in the 1970s and now average just over 10 percent.

D) Tariffs reached a maximum in the early 1930s and now average less than 5 percent

A) Average tariff rates have not changed much since the early 1930s and are less than 5 percent.

B) Tariffs have declined overall since the early 1930s and now average just over 10 percent.

C) Tariffs were at their highest level in the 1970s and now average just over 10 percent.

D) Tariffs reached a maximum in the early 1930s and now average less than 5 percent

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

64

An import quota directly restricts and are designed to protect domestic .

A) imports; producers

B) exports; consumers

C) imports; consumers

D) exports; producers

A) imports; producers

B) exports; consumers

C) imports; consumers

D) exports; producers

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

65

The effect of an import quota is to

A) increase the supply of the good and lower its price.

B) decrease the supply of the good and raise its price.

C) increase the demand for the good and increase its price.

D) increase the supply of the good and increase its price.

A) increase the supply of the good and lower its price.

B) decrease the supply of the good and raise its price.

C) increase the demand for the good and increase its price.

D) increase the supply of the good and increase its price.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

66

A tariff is

A) a government imposed limit on the amount of a good that can be exported from a nation.

B) an agreement between governments to limit exports from a nation.

C) a tax on a good imported into a nation.

D) a government imposed barrier that sets a fixed limit on the amount of a good that can be imported into a nation.

A) a government imposed limit on the amount of a good that can be exported from a nation.

B) an agreement between governments to limit exports from a nation.

C) a tax on a good imported into a nation.

D) a government imposed barrier that sets a fixed limit on the amount of a good that can be imported into a nation.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

67

Of the following, in which decade were U.S. tariffs at their lowest level?

A) 2000s

B) 1930s

C) 1970s

D) 1950s

A) 2000s

B) 1930s

C) 1970s

D) 1950s

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

68

A difference between a quota and a tariff is that

A) a tariff generates a higher price than does a quota.

B) a quota increases profits of domestic producers more than does a tariff.

C) a tariff generates a greater reduction in exports than does a quota.

D) the government collects revenues from a tariff but does not collect revenues from a quota.

A) a tariff generates a higher price than does a quota.

B) a quota increases profits of domestic producers more than does a tariff.

C) a tariff generates a greater reduction in exports than does a quota.

D) the government collects revenues from a tariff but does not collect revenues from a quota.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

69

A key difference between tariffs and quotas is that

A) consumers are hurt with tariffs but not with quotas.

B) the government receives revenue with tariffs, but the importer receives the added revenue with quotas.

C) the government receives revenue with quotas, but the importer receives the added revenue with tariffs.

D) consumers are hurt with quotas but not with tariffs.

A) consumers are hurt with tariffs but not with quotas.

B) the government receives revenue with tariffs, but the importer receives the added revenue with quotas.

C) the government receives revenue with quotas, but the importer receives the added revenue with tariffs.

D) consumers are hurt with quotas but not with tariffs.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

70

Import quotas

A) set the number of units of a good that can be imported.

B) set the minimum percentage of the value of a good that can consist of imported components.

C) are a tax on an imported good.

D) encourage freer trade.

A) set the number of units of a good that can be imported.

B) set the minimum percentage of the value of a good that can consist of imported components.

C) are a tax on an imported good.

D) encourage freer trade.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

71

Import quotas

A) are the same as tariffs.

B) are not used by the United States.

C) set the maximum number of units of a good that can be imported.

D) set the minimum percentage of the value of a product that must consist of imported components.

A) are the same as tariffs.

B) are not used by the United States.

C) set the maximum number of units of a good that can be imported.

D) set the minimum percentage of the value of a product that must consist of imported components.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

72

Voluntary export restraints VERs)

A) raise the prices paid by domestic consumers.

B) do not protect domestic producers.

C) raise revenue for the governments involved.

D) Both answers B and C are correct.

A) raise the prices paid by domestic consumers.

B) do not protect domestic producers.

C) raise revenue for the governments involved.

D) Both answers B and C are correct.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

73

Import quotas the price of imported goods and the quantity consumed in the nation imposing the quota.

A) lower; decrease

B) lower; increase

C) raise; increase

D) raise; decrease

A) lower; decrease

B) lower; increase

C) raise; increase

D) raise; decrease

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

74

An import quota is a

A) government-imposed restriction on the quantity of a specific good that can be imported.

B) market-imposed balancing factor that keeps prices of imports and exports in equilibrium.

C) tariff imposed on goods that are dumped in the country.

D) law that prevents ecologically damaging goods from being imported into a country.

A) government-imposed restriction on the quantity of a specific good that can be imported.

B) market-imposed balancing factor that keeps prices of imports and exports in equilibrium.

C) tariff imposed on goods that are dumped in the country.

D) law that prevents ecologically damaging goods from being imported into a country.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

75

An import quota protects domestic producers by

A) increasing the total supply of the product.

B) setting a limit on the amount of imports.

C) placing a prohibitive tax on imports.

D) encouraging competition among domestic producers.

A) increasing the total supply of the product.

B) setting a limit on the amount of imports.

C) placing a prohibitive tax on imports.

D) encouraging competition among domestic producers.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

76

A key difference between a quota and a tariff is that

A) a quota has a larger effect on quantity than on price.

B) the government of the importing country gains revenue from a tariff, but the price gap caused by a quota benefits domestic importers.

C) a tariff has a larger effect on quantity than on price.

D) All of the above answers are correct.

A) a quota has a larger effect on quantity than on price.

B) the government of the importing country gains revenue from a tariff, but the price gap caused by a quota benefits domestic importers.

C) a tariff has a larger effect on quantity than on price.

D) All of the above answers are correct.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

77

Since 1930, tariff levels in the United States have

A) increased during expansions.

B) decreased during recessions.

C) generally declined.

D) steadily risen.

A) increased during expansions.

B) decreased during recessions.

C) generally declined.

D) steadily risen.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

78

The current U.S. average tariff rate

A) greater than 10 percent.

B) approximately 20 percent.

C) less than 5 percent.

D) over 50 percent.

A) greater than 10 percent.

B) approximately 20 percent.

C) less than 5 percent.

D) over 50 percent.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

79

An import quota specifies the

A) minimum quantity of a good that must be exported during a specified time period.

B) maximum quantity of a good that may be imported during a specified time period.

C) highest price that can be charged for an imported good.

D) per unit tax that must be paid on an imported good.

A) minimum quantity of a good that must be exported during a specified time period.

B) maximum quantity of a good that may be imported during a specified time period.

C) highest price that can be charged for an imported good.

D) per unit tax that must be paid on an imported good.

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck

80

If a government imposes a quota on imports of a popular doll, the price of the doll in the country will and the quantity purchased in the country will .

A) rise; decrease

B) fall; decrease

C) rise; increase

D) fall; increase

A) rise; decrease

B) fall; decrease

C) rise; increase

D) fall; increase

Unlock Deck

Unlock for access to all 187 flashcards in this deck.

Unlock Deck

k this deck