Deck 25: Long-Run Economic Growth

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/132

Play

Full screen (f)

Deck 25: Long-Run Economic Growth

1

A common measure of a countryʹs level of productivity is

A) the average efficiency of capital.

B) the capital-output ratio.

C) output per capita.

D) output per unit of labour input.

E) per capita GDP.

A) the average efficiency of capital.

B) the capital-output ratio.

C) output per capita.

D) output per unit of labour input.

E) per capita GDP.

D

2

Over the long term, by far the most potent force for raising average material living standards is

A) economic growth.

B) reducing inefficiencies.

C) redistributing income.

D) increasing the money supply.

E) appropriate fiscal policies.

A) economic growth.

B) reducing inefficiencies.

C) redistributing income.

D) increasing the money supply.

E) appropriate fiscal policies.

A

3

Of the variables listed below, the best measure of a nationʹs average material standard of living is

A) nominal GDP.

B) percent change in nominal GDP.

C) per capita real GDP.

D) per capita nominal GDP.

E) real GDP.

A) nominal GDP.

B) percent change in nominal GDP.

C) per capita real GDP.

D) per capita nominal GDP.

E) real GDP.

C

4

In the long run, changes in average material living standards are best shown by

A) growth in real GDP.

B) population growth.

C) growth in real per capita GDP.

D) improvements in fiscal policy.

E) improvements in monetary policy.

A) growth in real GDP.

B) population growth.

C) growth in real per capita GDP.

D) improvements in fiscal policy.

E) improvements in monetary policy.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

5

Answer: D

Diff: 3

Topic: 25.1a. The Nature of Economic Growth Skill: Applied

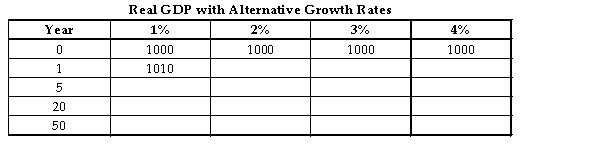

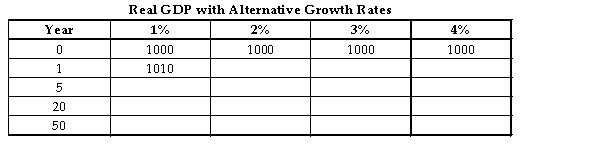

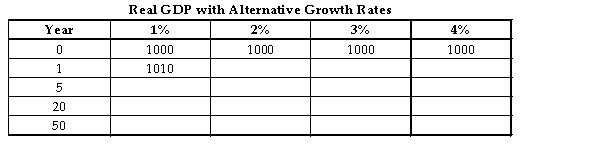

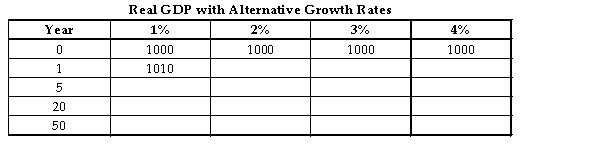

Learning Obj.: 25-2 List four important determinants of growth in potential GDP User1: Table

User2: Quantitative

Note: This question requires a calculator with an exponent feature.

Refer to Table 25-1. What is real GDP in this economy in Year 20 if the annual growth rate is 1%?

A) 200

B) 1020

C) 1220

D) 6727

E) 20 200

Diff: 3

Topic: 25.1a. The Nature of Economic Growth Skill: Applied

Learning Obj.: 25-2 List four important determinants of growth in potential GDP User1: Table

User2: Quantitative

Note: This question requires a calculator with an exponent feature.

Refer to Table 25-1. What is real GDP in this economy in Year 20 if the annual growth rate is 1%?

A) 200

B) 1020

C) 1220

D) 6727

E) 20 200

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

6

A common measure of a countryʹs rate of economic growth is

A) the marginal efficiency of capital.

B) the capital-output ratio.

C) the level of output per capita.

D) the change in output per capita.

E) the level of real gross domestic product.

A) the marginal efficiency of capital.

B) the capital-output ratio.

C) the level of output per capita.

D) the change in output per capita.

E) the level of real gross domestic product.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

7

If per capita GDP in a richer country grows at a faster annual rate than in a poorer country,

A) the gap between their standards of living will widen over time.

B) the gap between their standards of living will close over time.

C) the gap between their standards of living will close over time as long as the rate of population growth is higher in the poorer country.

D) whether the gap in living standards widens or closes over time depends on the absolute size of the relative growth rates.

E) the difference in their living standards will not change over time.

A) the gap between their standards of living will widen over time.

B) the gap between their standards of living will close over time.

C) the gap between their standards of living will close over time as long as the rate of population growth is higher in the poorer country.

D) whether the gap in living standards widens or closes over time depends on the absolute size of the relative growth rates.

E) the difference in their living standards will not change over time.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

8

The theory of economic growth concentrates on the over the long run, not on .

A) growth of investment in capital goods; short-run fluctuations of investment

B) growth of real GDP; growth of potential GDP

C) factor utilization rates; growth of the supplies of factors

D) factor utilization rates; growth of real GDP

E) growth of potential output; fluctuations of output around potential

A) growth of investment in capital goods; short-run fluctuations of investment

B) growth of real GDP; growth of potential GDP

C) factor utilization rates; growth of the supplies of factors

D) factor utilization rates; growth of real GDP

E) growth of potential output; fluctuations of output around potential

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

9

If GDP in a richer country grows at the same annual rate as in a poorer country, the

A) gap between their standards of living will widen over time.

B) gap between their standards of living will close over time.

C) gap between their standards of living will close over time as long as the rate of population growth is lower in the poorer country.

D) gap between their standards of living will close over time as long as the rate of population growth is lower in the richer country.

E) difference in their living standards will not change over time.

A) gap between their standards of living will widen over time.

B) gap between their standards of living will close over time.

C) gap between their standards of living will close over time as long as the rate of population growth is lower in the poorer country.

D) gap between their standards of living will close over time as long as the rate of population growth is lower in the richer country.

E) difference in their living standards will not change over time.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

10

The diagram below shows alternate paths for two hypothetical economies, each starting with GDP of $1 billion. Assume that Area 1 is equal to Area 2.

FIGURE 25-1

FIGURE 25-1

Refer to Figure 25-1. Which of the following statements best describes what we know about the difference between the two economies at Year 0?

A) Economy A has a higher level of real GDP at Year 0 than Economy B.

B) Economy Bʹs households are consuming a larger percentage of GDP than Economy Aʹs households.

C) There is no opportunity cost for economic growth for Economy B at Year 0.

D) There is no opportunity cost of economic growth for Economy A at Year 0.

E) Economy Aʹs households are consuming a larger percentage of GDP than Economy Bʹs households.

FIGURE 25-1

FIGURE 25-1Refer to Figure 25-1. Which of the following statements best describes what we know about the difference between the two economies at Year 0?

A) Economy A has a higher level of real GDP at Year 0 than Economy B.

B) Economy Bʹs households are consuming a larger percentage of GDP than Economy Aʹs households.

C) There is no opportunity cost for economic growth for Economy B at Year 0.

D) There is no opportunity cost of economic growth for Economy A at Year 0.

E) Economy Aʹs households are consuming a larger percentage of GDP than Economy Bʹs households.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

11

If real income grows at approximately 2% per year, the number of years it will take for real income to double is approximately

A) 5.

B) 12.

C) 24.

D) 36.

E) 72.

A) 5.

B) 12.

C) 24.

D) 36.

E) 72.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

12

If real income grows at approximately 4% per year, the number of years it will take for real income to double is approximately

A) 5.

B) 12.

C) 18.

D) 36.

E) 72.

A) 5.

B) 12.

C) 18.

D) 36.

E) 72.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

13

Over a long period of time, perhaps many years, changes in real GDP come primarily from

A) upward shifts of the AS curve.

B) upward shifts of the AE curve.

C) rightward shifts of the AD curve.

D) continuous increases in potential GDP.

E) leftward shifts of the AD curve.

A) upward shifts of the AS curve.

B) upward shifts of the AE curve.

C) rightward shifts of the AD curve.

D) continuous increases in potential GDP.

E) leftward shifts of the AD curve.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

14

Consider the following table for a hypothetical economy in which the initial level of GDP Y0) in all cases is 1000. Assume that real GDP grows according to the equation Y01 + growth rate)N, where N is the number of years in the future. Numbers are rounded to the nearest whole number.  TABLE 25-1

TABLE 25-1

Note: This question requires a calculator with an exponent function.

Refer to Table 25-1. If this economy is growing at an annual rate of 4%, then real GDP in Year 50 will be A) 2000.

B) 1268.

C) 2255.

D) 7107.

E) 51 000.

TABLE 25-1

TABLE 25-1Note: This question requires a calculator with an exponent function.

Refer to Table 25-1. If this economy is growing at an annual rate of 4%, then real GDP in Year 50 will be A) 2000.

B) 1268.

C) 2255.

D) 7107.

E) 51 000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

15

Diff: 3

Topic: 25.1a. The Nature of Economic Growth Skill: Applied

Learning Obj.: 25-2 List four important determinants of growth in potential GDP User1: Table

User2: Quantitative

Note: This question requires a calculator with an exponent function.

Refer to Table 25-1. What is real GDP in this economy in Year 20 if the annual growth rate is 4%?

A) 2191

B) 8000

C) 20 800

D) 80 000

E) 836 683

Topic: 25.1a. The Nature of Economic Growth Skill: Applied

Learning Obj.: 25-2 List four important determinants of growth in potential GDP User1: Table

User2: Quantitative

Note: This question requires a calculator with an exponent function.

Refer to Table 25-1. What is real GDP in this economy in Year 20 if the annual growth rate is 4%?

A) 2191

B) 8000

C) 20 800

D) 80 000

E) 836 683

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is the best example of the acquisition of human capital?

A) A worker takes a training course that increases his/her productivity.

B) A worker receives new machinery enabling him/her to do the amount of work that was formerly done by two workers.

C) A worker communicates more quickly and accurately with suppliers because of upgrades to communications software.

D) A government-sponsored program increases the amount of investment available per worker.

E) A computer chip manufacturer introduces a faster processor for micro-computing.

A) A worker takes a training course that increases his/her productivity.

B) A worker receives new machinery enabling him/her to do the amount of work that was formerly done by two workers.

C) A worker communicates more quickly and accurately with suppliers because of upgrades to communications software.

D) A government-sponsored program increases the amount of investment available per worker.

E) A computer chip manufacturer introduces a faster processor for micro-computing.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

17

Between the years 1960 and 2014, the Canadian economy experienced growth in real GDP at an average annual rate of %.

A) 0.7

B) 1.2

C) 1.9

D) 3.3

E) 6.3

A) 0.7

B) 1.2

C) 1.9

D) 3.3

E) 6.3

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

18

Consider the following table for a hypothetical economy in which the initial level of GDP Y0) in all cases is 1000. Assume that real GDP grows according to the equation Y01 + growth rate)N, where N is the number of years in the future. Numbers are rounded to the nearest whole number.  TABLE 25-1

TABLE 25-1

Note: This question requires a calculator with an exponent function.

Refer to Table 25-1. If this economy is growing at an annual rate of 2%, then real GDP in Year 50 will be

A) 1645.

B) 1126.

C) 2692.

D) 500.

E) 51 000.

TABLE 25-1

TABLE 25-1Note: This question requires a calculator with an exponent function.

Refer to Table 25-1. If this economy is growing at an annual rate of 2%, then real GDP in Year 50 will be

A) 1645.

B) 1126.

C) 2692.

D) 500.

E) 51 000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

19

The compounding of economic growth rates means that

A) a large increase in investment today has little effect on national income over the long run.

B) small changes in sustained growth rates can have a significant impact on national income over several decades.

C) consumers should not save, given the low real returns that compounding produces.

D) a 10% annual rate of return will double an investment in less than 6 years.

E) a 2% annual growth rate of GDP will double national income in 27 years.

A) a large increase in investment today has little effect on national income over the long run.

B) small changes in sustained growth rates can have a significant impact on national income over several decades.

C) consumers should not save, given the low real returns that compounding produces.

D) a 10% annual rate of return will double an investment in less than 6 years.

E) a 2% annual growth rate of GDP will double national income in 27 years.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

20

The four major determinants of economic growth include all of the following EXCEPT

A) technological improvement.

B) growth in physical capital.

C) growth in human capital.

D) growth in financial capital.

E) growth in the labour force.

A) technological improvement.

B) growth in physical capital.

C) growth in human capital.

D) growth in financial capital.

E) growth in the labour force.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

21

Consider a closed economy with real GDP in the long run of $400, consumption expenditures of $250, government purchases of $75, and net tax revenue of $20. What is the level of national saving?

A) $55

B) $75

C) $95

D) $225

E) $230

A) $55

B) $75

C) $95

D) $225

E) $230

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

22

An important social cost of economic growth is

A) the increasing inequality of income that usually accompanies sustained growth.

B) the sacrifice of current consumption required for a higher level of future consumption.

C) the associated inflation.

D) the associated frictional unemployment.

E) the destruction of jobs due to labour skills of certain workers becoming obsolete.

A) the increasing inequality of income that usually accompanies sustained growth.

B) the sacrifice of current consumption required for a higher level of future consumption.

C) the associated inflation.

D) the associated frictional unemployment.

E) the destruction of jobs due to labour skills of certain workers becoming obsolete.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

23

The diagram below shows alternate paths for two hypothetical economies, each starting with GDP of $1 billion. Assume that Area 1 is equal to Area 2.

FIGURE 25-1

FIGURE 25-1

Refer to Figure 25-1. Which of the following statements about Economies A and B is correct?

A) Economy A will sustain higher material living standards than Economy B in the long run.

B) Economies A and B will have equal material living standards beginning at Year 0.

C) Economy B will sustain higher material living standards than Economy A in the long run.

D) Economies A and B will have equal material living standards beginning at Year X.

E) Economies A and B will have equal material living standards beginning at Year Y.

FIGURE 25-1

FIGURE 25-1Refer to Figure 25-1. Which of the following statements about Economies A and B is correct?

A) Economy A will sustain higher material living standards than Economy B in the long run.

B) Economies A and B will have equal material living standards beginning at Year 0.

C) Economy B will sustain higher material living standards than Economy A in the long run.

D) Economies A and B will have equal material living standards beginning at Year X.

E) Economies A and B will have equal material living standards beginning at Year Y.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

24

Alleviation of poverty is more achievable in a growing economy mainly because

A) individuals are more likely to object to the redistribution of income when they earn more.

B) everyone, including the poor, benefits equally from growth.

C) poor individuals are relatively easier to be identified in a growing economy.

D) nobody has to be made worse off when the increment to income caused by growth is redistributed.

E) wage rates for low-income people are naturally rising.

A) individuals are more likely to object to the redistribution of income when they earn more.

B) everyone, including the poor, benefits equally from growth.

C) poor individuals are relatively easier to be identified in a growing economy.

D) nobody has to be made worse off when the increment to income caused by growth is redistributed.

E) wage rates for low-income people are naturally rising.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

25

The diagram below shows alternate paths for two hypothetical economies, each starting with GDP of $1 billion. Assume that Area 1 is equal to Area 2.

FIGURE 25-1

FIGURE 25-1

Refer to Figure 25-1. Suppose Economy A jumps to the path of Economy B at Year 0 by increasing the share of GDP that is saved. In that case, which of the following statements about Economy A is true?

A) Economy A will not be able to regain the losses in consumption it incurs by jumping to the path of Economy B.

B) By Year Y, the increase in consumption made possible by the economyʹs higher growth rate equals the consumption sacrificed in earlier years.

C) By Year X, Economy A is better off in terms of material living standards for having jumped to the path of Economy B.

D) By jumping to a new growth path at Year 0, Economy A has increased the share of national income that is consumed.

E) By Year X, Economy A is saving and investing the same share of its national income as it would have been had it stayed on its original path.

FIGURE 25-1

FIGURE 25-1Refer to Figure 25-1. Suppose Economy A jumps to the path of Economy B at Year 0 by increasing the share of GDP that is saved. In that case, which of the following statements about Economy A is true?

A) Economy A will not be able to regain the losses in consumption it incurs by jumping to the path of Economy B.

B) By Year Y, the increase in consumption made possible by the economyʹs higher growth rate equals the consumption sacrificed in earlier years.

C) By Year X, Economy A is better off in terms of material living standards for having jumped to the path of Economy B.

D) By jumping to a new growth path at Year 0, Economy A has increased the share of national income that is consumed.

E) By Year X, Economy A is saving and investing the same share of its national income as it would have been had it stayed on its original path.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

26

The costs of economic growth include

A) declining future living standards.

B) current saving must be sacrificed to increase investment in capital goods.

C) improvements in technology.

D) the effects on workers whose skills are made obsolete by technical change.

E) reduced interest rates.

A) declining future living standards.

B) current saving must be sacrificed to increase investment in capital goods.

C) improvements in technology.

D) the effects on workers whose skills are made obsolete by technical change.

E) reduced interest rates.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

27

Long-term economic growth

A) is achieved only by changes in factor-utilization rates.

B) alleviates all poverty.

C) can improve average material living standards.

D) is the result of expansionary fiscal policy.

E) leads to equal income distribution.

A) is achieved only by changes in factor-utilization rates.

B) alleviates all poverty.

C) can improve average material living standards.

D) is the result of expansionary fiscal policy.

E) leads to equal income distribution.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

28

Consuming fewer goods today in order to invest resources in capital goods can be considered the of economic growth.

A) opportunity cost

B) social cost

C) investment cost

D) external cost

E) total cost

A) opportunity cost

B) social cost

C) investment cost

D) external cost

E) total cost

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

29

The costs of long-run economic growth include:

1) declining future average living standards;

2) that current consumption must be sacrificed to increase investment in capital goods;

3) current increases in investment may only generate greater consumption in the distant future.

A) 1 and 2

B) 2 and 3

C) 1 only

D) 2 only

E) 3 only

1) declining future average living standards;

2) that current consumption must be sacrificed to increase investment in capital goods;

3) current increases in investment may only generate greater consumption in the distant future.

A) 1 and 2

B) 2 and 3

C) 1 only

D) 2 only

E) 3 only

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

30

Economic growth is often associated with structural change in the economy, and this change can present difficult policy challenges to governments. Which of the following government policies would be most useful at addressing the social costs of economic growth?

A) expansionary monetary policy

B) the imposition of trade restrictions to protect Canadian jobs

C) subsidies directed at Canadian manufacturing firms

D) worker re-training and education programs

E) reducing income taxes

A) expansionary monetary policy

B) the imposition of trade restrictions to protect Canadian jobs

C) subsidies directed at Canadian manufacturing firms

D) worker re-training and education programs

E) reducing income taxes

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

31

If a country transfers resources from the production of consumption goods to the production of capital goods, the result will be to

A) raise future consumption.

B) raise current living standards.

C) decrease the long-run growth rate.

D) lower future living standards.

E) raise current consumption.

A) raise future consumption.

B) raise current living standards.

C) decrease the long-run growth rate.

D) lower future living standards.

E) raise current consumption.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

32

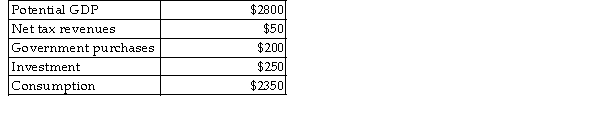

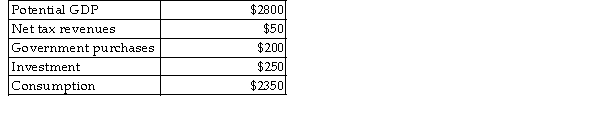

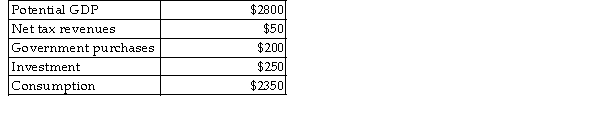

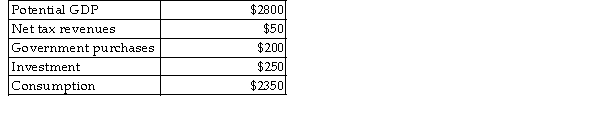

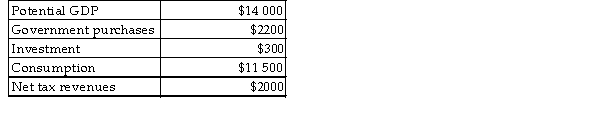

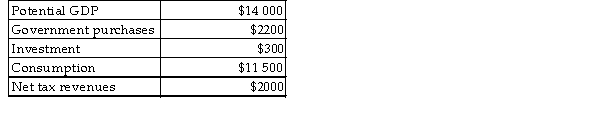

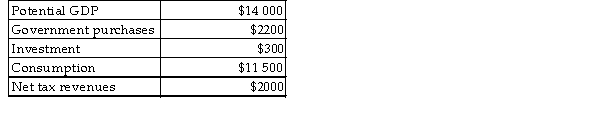

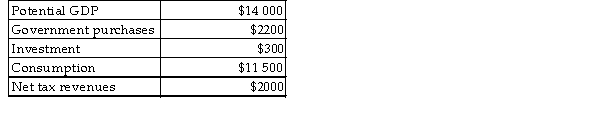

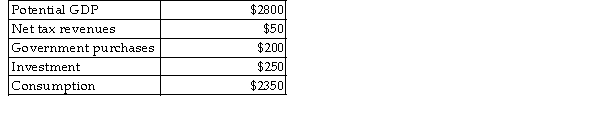

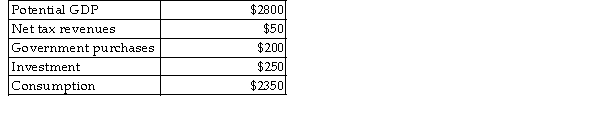

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-2

TABLE 25-2

Refer to Table 25-2. What is the level of private saving for this economy?

A) $50

B) $100

C) $150

D) $400

E) $450

TABLE 25-2

TABLE 25-2Refer to Table 25-2. What is the level of private saving for this economy?

A) $50

B) $100

C) $150

D) $400

E) $450

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

33

Consider the long-run theory of investment, saving and growth. In the long-run version of our macro model with real GDP equal to Y*), the equilibrium interest rate is determined where

A) aggregate demand equals aggregate expenditure.

B) desired national saving equals desired investment.

C) the nominal price level equals the real price level.

D) desired consumption equals desired investment.

E) desired saving equals desired consumption.

A) aggregate demand equals aggregate expenditure.

B) desired national saving equals desired investment.

C) the nominal price level equals the real price level.

D) desired consumption equals desired investment.

E) desired saving equals desired consumption.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

34

For a given level of technology, a more rapid rate of economic growth can probably be achieved only if a countryʹs citizens are prepared to

A) redistribute income.

B) sacrifice some present consumption.

C) increase their demand for goods and services.

D) increase exports.

E) decrease interest rates.

A) redistribute income.

B) sacrifice some present consumption.

C) increase their demand for goods and services.

D) increase exports.

E) decrease interest rates.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following equations is a correct expression for national saving in the long run when real GDP equals potential output?

A) NS = Y* - C - G

B) NS = Y* - C + T - G

C) NS = Y* - T - C

D) NS = T - G

E) NS = T - G - C

A) NS = Y* - C - G

B) NS = Y* - C + T - G

C) NS = Y* - T - C

D) NS = T - G

E) NS = T - G - C

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

36

The diagram below shows alternate paths for two hypothetical economies, each starting with GDP of $1 billion. Assume that Area 1 is equal to Area 2.

FIGURE 25-1

FIGURE 25-1

Refer to Figure 25-1. Which of the following costs of economic growth are reflected in this diagram?

A) the sacrifice of current consumption

B) lower real interest rate

C) environmental degradation

D) resource exhaustion

E) national saving

FIGURE 25-1

FIGURE 25-1Refer to Figure 25-1. Which of the following costs of economic growth are reflected in this diagram?

A) the sacrifice of current consumption

B) lower real interest rate

C) environmental degradation

D) resource exhaustion

E) national saving

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

37

The diagram below shows alternate paths for two hypothetical economies, each starting with GDP of $1 billion. Assume that Area 1 is equal to Area 2.

FIGURE 25-1

FIGURE 25-1

Refer to Figure 25-1. The area marked Area 1 represents

A) the value of consumption from Year 0 to Year X in Economy A.

B) the value of the investment in capital goods undertaken by Economy B.

C) the value of the investment in capital goods undertaken by Economy A.

D) the sacrifice of current consumption by Economy B, as compared to Economy A.

E) the sacrifice of current consumption by Economy A, as compared to Economy B.

FIGURE 25-1

FIGURE 25-1Refer to Figure 25-1. The area marked Area 1 represents

A) the value of consumption from Year 0 to Year X in Economy A.

B) the value of the investment in capital goods undertaken by Economy B.

C) the value of the investment in capital goods undertaken by Economy A.

D) the sacrifice of current consumption by Economy B, as compared to Economy A.

E) the sacrifice of current consumption by Economy A, as compared to Economy B.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

38

If government policies are to be successful in enhancing a countryʹs long -run growth rate, they likely work through generating

A) higher levels of current consumption.

B) greater private investment in physical and human capital.

C) an increase in current consumption and a reduction in saving.

D) a leftward shift in the AS curve.

E) fiscal policies that shift the AD curve to the right.

A) higher levels of current consumption.

B) greater private investment in physical and human capital.

C) an increase in current consumption and a reduction in saving.

D) a leftward shift in the AS curve.

E) fiscal policies that shift the AD curve to the right.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

39

Long-run economic growth can help alleviate the problems of poverty by

A) creating new low-paying jobs for the unemployed.

B) generating more resources that can be used to reduce income inequality.

C) reallocating income away from low-value production to increase the incentives for high-value production.

D) requiring increased saving on the part of most of the population.

E) increasing future consumption for the middle class.

A) creating new low-paying jobs for the unemployed.

B) generating more resources that can be used to reduce income inequality.

C) reallocating income away from low-value production to increase the incentives for high-value production.

D) requiring increased saving on the part of most of the population.

E) increasing future consumption for the middle class.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

40

One of the benefits of long-run economic growth is

A) growth in nominal GDP greater than real GDP.

B) decreased productive capacity.

C) a greater ability to reduce inequality.

D) increased future interest rates.

E) decreased current saving and increased current consumption.

A) growth in nominal GDP greater than real GDP.

B) decreased productive capacity.

C) a greater ability to reduce inequality.

D) increased future interest rates.

E) decreased current saving and increased current consumption.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

41

For a given level of national income, a decrease in government tax revenues will cause

A) a decrease in national saving.

B) an increase in national saving.

C) an increase in the growth rate.

D) no effect on national saving.

E) a decrease in consumption.

A) a decrease in national saving.

B) an increase in national saving.

C) an increase in the growth rate.

D) no effect on national saving.

E) a decrease in consumption.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose the government has a budget deficit of $400. If the countryʹs level of national saving is $200, then private saving must be

A) -$400.

B) $200.

C) $400.

D) $600.

E) $800.

A) -$400.

B) $200.

C) $400.

D) $600.

E) $800.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

43

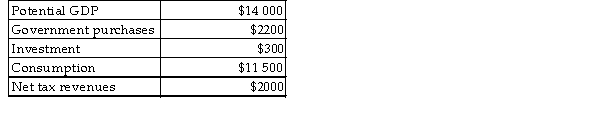

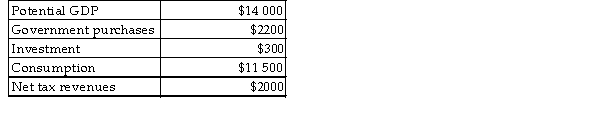

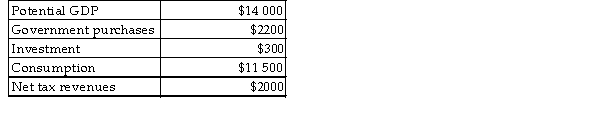

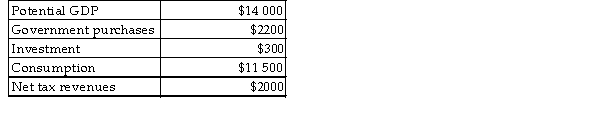

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-3

TABLE 25-3

Refer to Table 25-3. What is the level of private saving for this economy?

A) $50

B) $100

C) $500

D) $2000

E) $3000

TABLE 25-3

TABLE 25-3Refer to Table 25-3. What is the level of private saving for this economy?

A) $50

B) $100

C) $500

D) $2000

E) $3000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

44

For a given level of private saving, a decrease in the governmentʹs budget deficit the long -run rate of economic growth.

A) will reduce

B) will leave unchanged

C) will increase

D) will diminish

E) none of the above

A) will reduce

B) will leave unchanged

C) will increase

D) will diminish

E) none of the above

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

45

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-2

TABLE 25-2

Refer to Table 25-2. What is the level of national saving for this economy?

A) -$200

B) -$150

C) -$50

D) $150

E) $250

TABLE 25-2

TABLE 25-2Refer to Table 25-2. What is the level of national saving for this economy?

A) -$200

B) -$150

C) -$50

D) $150

E) $250

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

46

Consider a closed economy in the long run. A country with a low national saving rate as a fraction of real GDP) is likely to have

A) a high growth rate because aggregate expenditure will be high out of any given income.

B) either a high or low growth rate depending on the investment schedule.

C) an AS curve moving continually to the right.

D) trouble achieving potential real national income in the short run.

E) a low growth rate because sustained high investment is not possible with low saving.

A) a high growth rate because aggregate expenditure will be high out of any given income.

B) either a high or low growth rate depending on the investment schedule.

C) an AS curve moving continually to the right.

D) trouble achieving potential real national income in the short run.

E) a low growth rate because sustained high investment is not possible with low saving.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

47

Consider the long-run theory of investment, saving and growth. For a given level of national income, a decrease in private consumption or government purchases will cause the equilibrium interest rate to

A) increase and the flow of national saving to fall.

B) increase and the flow of investment to increase.

C) increase and the flow of investment to decrease.

D) decrease and the flow of investment to decrease.

E) decrease and the flow of investment to increase.

A) increase and the flow of national saving to fall.

B) increase and the flow of investment to increase.

C) increase and the flow of investment to decrease.

D) decrease and the flow of investment to decrease.

E) decrease and the flow of investment to increase.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

48

For a given level of national income, an increase in private consumption or government purchases will cause national saving to

A) increase.

B) grow at a constant rate.

C) remain unchanged from its initial level.

D) exceed investment.

E) decrease.

A) increase.

B) grow at a constant rate.

C) remain unchanged from its initial level.

D) exceed investment.

E) decrease.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

49

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-3

TABLE 25-3

Refer to Table 25-3. What is the level of combined budget surpluses of all levels of government in this economy?

A) $50

B) $100

C) $500

D) -$200

E) -$500

TABLE 25-3

TABLE 25-3Refer to Table 25-3. What is the level of combined budget surpluses of all levels of government in this economy?

A) $50

B) $100

C) $500

D) -$200

E) -$500

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

50

Suppose the government has a budget surplus of $2 billion. If the countryʹs level of private saving is $1.2 billion, then national saving must be

A) -$1.2 billion.

B) -$800 million.

C) $0.

D) $800 million

E) $3.2 billion

A) -$1.2 billion.

B) -$800 million.

C) $0.

D) $800 million

E) $3.2 billion

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

51

Consider the long-run theory of investment, saving, and growth. For a given level of private saving, an increase in government purchases will likely the economyʹs long-run growth rate.

A) slow down

B) accelerate

C) not affect

D) increase

E) Not enough information to know

A) slow down

B) accelerate

C) not affect

D) increase

E) Not enough information to know

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

52

Consider the long-run theory of investment, saving, and growth. For a given level of national income, a decrease in private consumption or government purchases will cause the equilibrium interest rate to

A) increase and the flow of national saving to decrease.

B) increase and the flow of investment to increase.

C) increase and the flow of investment to decrease.

D) decrease and the flow of national saving to increase.

E) decrease and the flow of national saving to decrease.

A) increase and the flow of national saving to decrease.

B) increase and the flow of investment to increase.

C) increase and the flow of investment to decrease.

D) decrease and the flow of national saving to increase.

E) decrease and the flow of national saving to decrease.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

53

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-3

TABLE 25-3

Refer to Table 25-3. What is the level of national saving for this economy?

A) $50

B) $100

C) $200

D) $250

E) $300

TABLE 25-3

TABLE 25-3Refer to Table 25-3. What is the level of national saving for this economy?

A) $50

B) $100

C) $200

D) $250

E) $300

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

54

An increase in the government budget surplus, everything else constant, will cause an)

A) decrease in national saving.

B) increase in national saving.

C) decrease in the growth rate.

D) equal increase in private consumption.

E) equal decrease in private investment.

A) decrease in national saving.

B) increase in national saving.

C) decrease in the growth rate.

D) equal increase in private consumption.

E) equal decrease in private investment.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

55

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-3

TABLE 25-3

Refer to Table 25-3. What is the level of public saving for this economy?

A) -$200

B) -$100

C) $200

D) $300

E) $500

TABLE 25-3

TABLE 25-3Refer to Table 25-3. What is the level of public saving for this economy?

A) -$200

B) -$100

C) $200

D) $300

E) $500

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

56

Consider the market for financial capital in the long run. The national saving curve is upward sloping because an increase in the real interest rate

A) leads households to increase their current consumption.

B) leads to an increase in investment demand.

C) decreases the supply of public saving.

D) leads households to reduce their current consumption.

E) decreases the supply of private saving.

A) leads households to increase their current consumption.

B) leads to an increase in investment demand.

C) decreases the supply of public saving.

D) leads households to reduce their current consumption.

E) decreases the supply of private saving.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

57

The table below shows aggregate values for a hypothetical economy. Suppose that this economy has real GDP equal to potential output.  TABLE 25-2

TABLE 25-2

Refer to Table 25-2. What is the level of public saving for this economy?

A) -$200

B) -$150

C) -$50

D) $150

E) $200

TABLE 25-2

TABLE 25-2Refer to Table 25-2. What is the level of public saving for this economy?

A) -$200

B) -$150

C) -$50

D) $150

E) $200

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements concerning national saving is true?

A) A countryʹs saving rate is unrelated to its growth rate.

B) An increase in the rate of saving will lead to a reduction in consumption and therefore to both a short-run and a long-run decrease in national income.

C) An increase in the rate of saving will cause an immediate increase in national income, but may cause a drop in national income in the long-run.

D) An increase in the rate of saving will always be offset by a reduction in private investment.

E) An increase in the rate of saving will lead to a short-run reduction in national income, but to higher economic growth in the long run.

A) A countryʹs saving rate is unrelated to its growth rate.

B) An increase in the rate of saving will lead to a reduction in consumption and therefore to both a short-run and a long-run decrease in national income.

C) An increase in the rate of saving will cause an immediate increase in national income, but may cause a drop in national income in the long-run.

D) An increase in the rate of saving will always be offset by a reduction in private investment.

E) An increase in the rate of saving will lead to a short-run reduction in national income, but to higher economic growth in the long run.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

59

Consider the market for financial capital in the long run. The investment demand curve is downward sloping because

A) an increase in the real interest rate leads to an increase in investment demand.

B) all components of desired investment are negatively related to the real interest rate.

C) all components of desired investment are positively related to the real interest rate.

D) a decrease in the real interest rate reflects a higher opportunity cost to firms of using financial capital.

E) an increase in the real interest rate reflects a lower opportunity cost to firms of using financial capital.

A) an increase in the real interest rate leads to an increase in investment demand.

B) all components of desired investment are negatively related to the real interest rate.

C) all components of desired investment are positively related to the real interest rate.

D) a decrease in the real interest rate reflects a higher opportunity cost to firms of using financial capital.

E) an increase in the real interest rate reflects a lower opportunity cost to firms of using financial capital.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

60

Consider the market for financial capital for a closed economy in the long run. Other things being equal, a country with a high national saving rate will tend to have

A) a high growth rate because aggregate expenditure will be high out of any given income.

B) a high growth rate because sustained high investment is possible with high saving.

C) an AS curve moving continually to the left.

D) trouble achieving potential real national income in the short run.

E) either a high or low growth rate depending on the investment demand schedule.

A) a high growth rate because aggregate expenditure will be high out of any given income.

B) a high growth rate because sustained high investment is possible with high saving.

C) an AS curve moving continually to the left.

D) trouble achieving potential real national income in the short run.

E) either a high or low growth rate depending on the investment demand schedule.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

61

The Neoclassical growth model assumes that, with a given state of technology, increases in the use of a single factor eventually cause the

A) average product of the factor to increase.

B) marginal product of the factor to fall.

C) marginal product of the factor to increase at an increasing rate.

D) marginal product of the factor to increase but at a decreasing rate.

E) material standard of living to increase.

A) average product of the factor to increase.

B) marginal product of the factor to fall.

C) marginal product of the factor to increase at an increasing rate.

D) marginal product of the factor to increase but at a decreasing rate.

E) material standard of living to increase.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

62

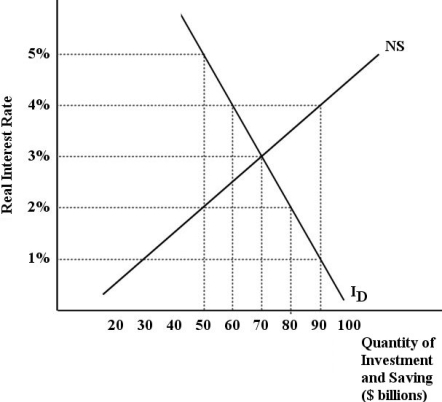

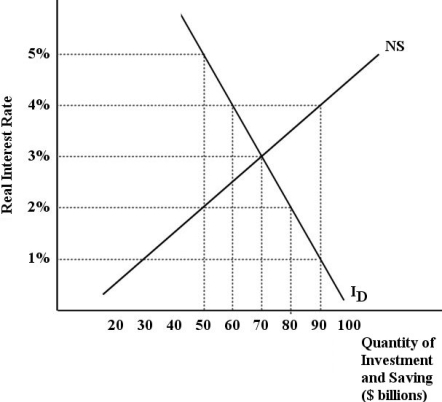

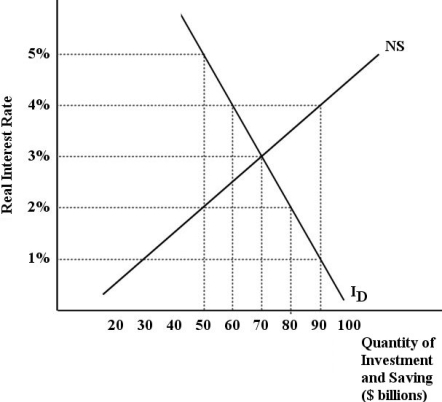

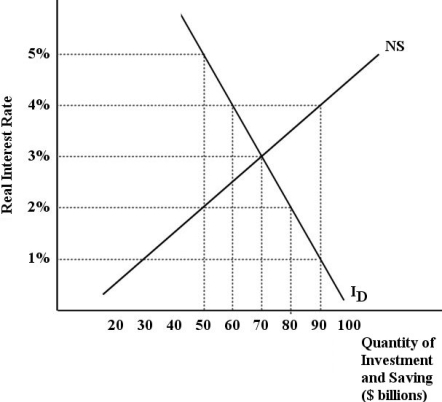

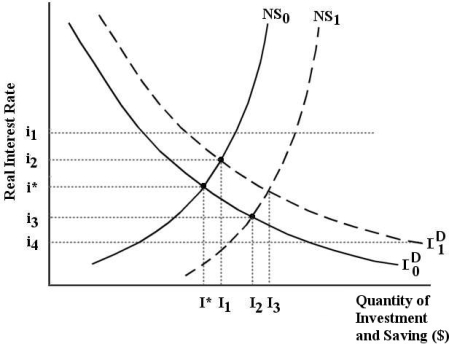

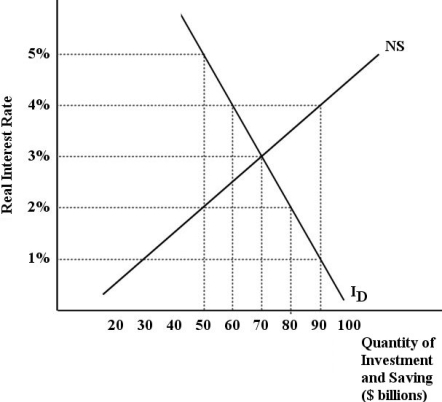

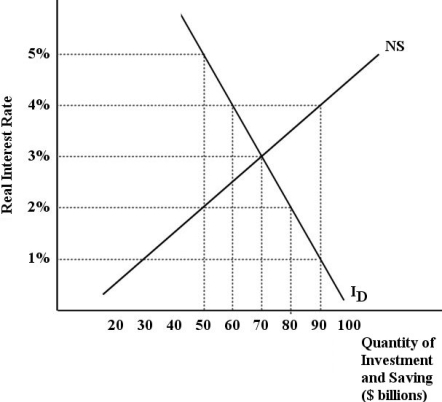

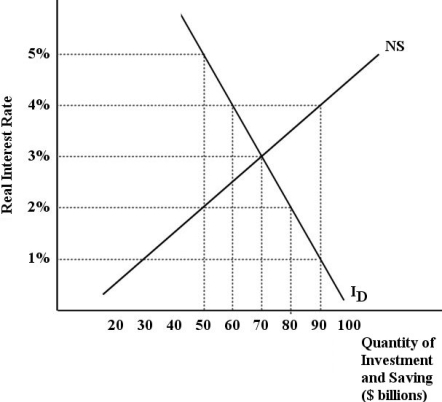

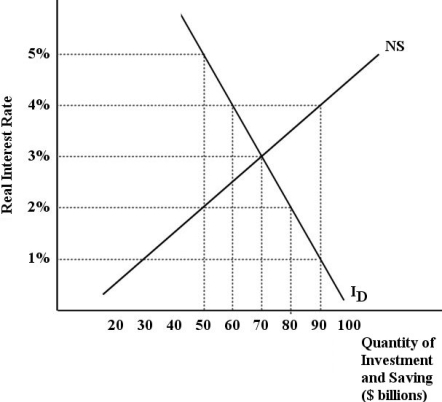

The diagram below shows the market for financial capital in the long run when real GDP is equal to potential output, Y*.

FIGURE 25-3

FIGURE 25-3

Refer to Figure 25-3. Suppose the interest rate in this market for financial capital is 2%. Which of the following statements correctly describes the adjustment that will occur in this market?

A) The excess supply of saving will push up the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

B) The excess demand for investment will push up the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

C) The excess supply of saving will push down the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

D) The excess demand for investment will push down the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

E) The excess demand for investment will push up the real interest rate, which will increase the quantity demanded of investment and decrease the quantity supplied of saving.

FIGURE 25-3

FIGURE 25-3Refer to Figure 25-3. Suppose the interest rate in this market for financial capital is 2%. Which of the following statements correctly describes the adjustment that will occur in this market?

A) The excess supply of saving will push up the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

B) The excess demand for investment will push up the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

C) The excess supply of saving will push down the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

D) The excess demand for investment will push down the real interest rate, which will decrease the quantity demanded of investment and increase the quantity supplied of saving.

E) The excess demand for investment will push up the real interest rate, which will increase the quantity demanded of investment and decrease the quantity supplied of saving.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

63

The diagram below shows the market for financial capital in the long run when real GDP is equal to potential output, Y*.

FIGURE 25-3

FIGURE 25-3

Refer to Figure 25-3. The equilibrium interest rate in this market is % and the equilibrium flow of investment and saving is billion dollars.

A) 1; 50

B) 2; 60

C) 3; 70

D) 4; 80

E) 5; 90

FIGURE 25-3

FIGURE 25-3Refer to Figure 25-3. The equilibrium interest rate in this market is % and the equilibrium flow of investment and saving is billion dollars.

A) 1; 50

B) 2; 60

C) 3; 70

D) 4; 80

E) 5; 90

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

64

One important assumption of the Neoclassical growth model is that, with a given state of technology,

A) increases in the use of a single factor bring increasing returns.

B) increases in the use of a single factor result in constant returns.

C) increases in the use of single factor bring diminishing returns.

D) the return from successive units of a single factor increases over time.

E) increases in GDP are possible only if all factors are increased at an equal rate.

A) increases in the use of a single factor bring increasing returns.

B) increases in the use of a single factor result in constant returns.

C) increases in the use of single factor bring diminishing returns.

D) the return from successive units of a single factor increases over time.

E) increases in GDP are possible only if all factors are increased at an equal rate.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

65

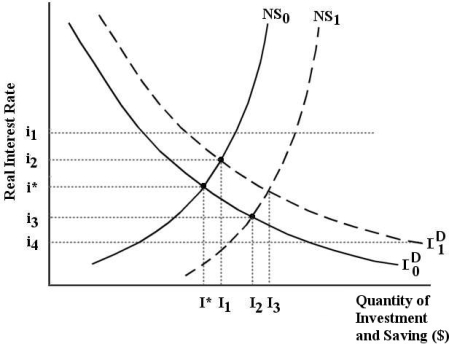

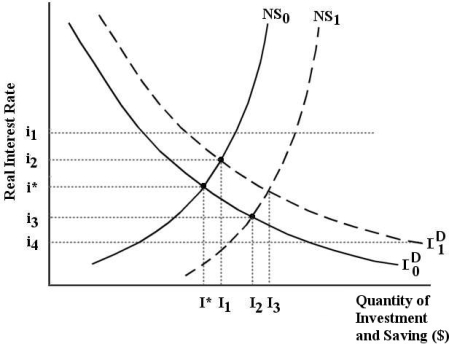

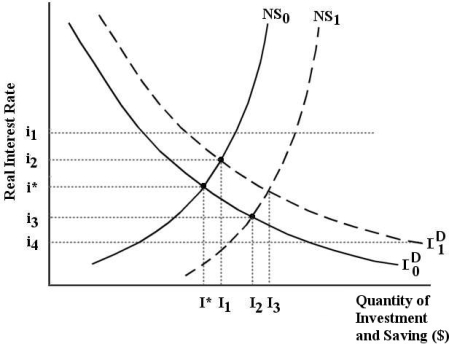

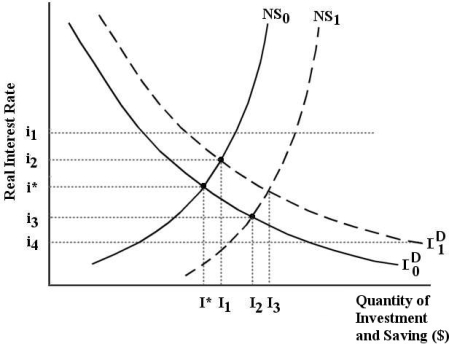

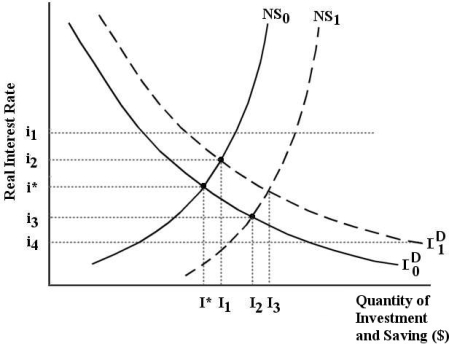

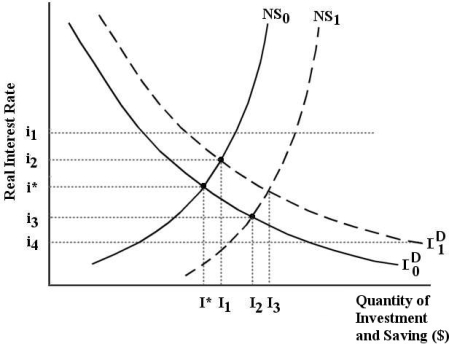

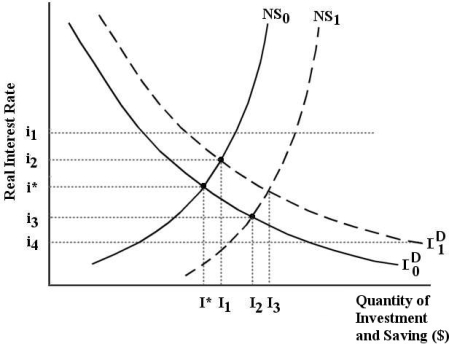

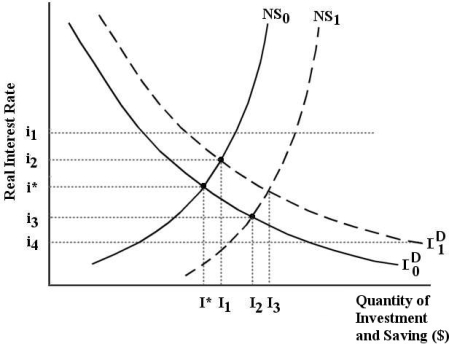

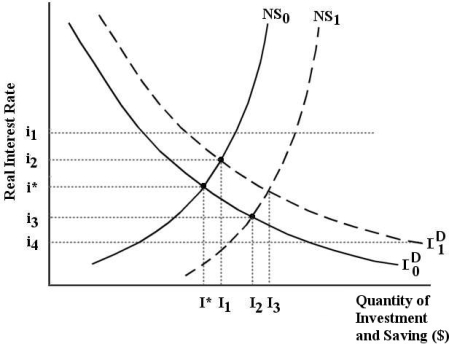

The diagram below show the market for financial capital assuming that national income is constant at potential GDP, Y*.

FIGURE 25-2

FIGURE 25-2

Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. Now suppose the government implements a revenue-neutral tax policy that encourages investment. What is the effect on the quantity of national saving?

A) There is no effect on NS or ID and the quantity of national saving supplied remains at I*.

B) National saving shifts to NS1, and the quantity of national saving supplied rises to I 2.

C) Investment demand shifts to I1D and the quantity of national saving supplied rises to I1.

D) Investment demand shifts to I1D, national saving shifts to NS1, and the quantity of national saving rises to I3.

E) National saving shifts to NS1, investment demand shifts to I1D, and the quantity of national saving rises to I1.

FIGURE 25-2

FIGURE 25-2Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. Now suppose the government implements a revenue-neutral tax policy that encourages investment. What is the effect on the quantity of national saving?

A) There is no effect on NS or ID and the quantity of national saving supplied remains at I*.

B) National saving shifts to NS1, and the quantity of national saving supplied rises to I 2.

C) Investment demand shifts to I1D and the quantity of national saving supplied rises to I1.

D) Investment demand shifts to I1D, national saving shifts to NS1, and the quantity of national saving rises to I3.

E) National saving shifts to NS1, investment demand shifts to I1D, and the quantity of national saving rises to I1.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

66

A central assumption of the Neoclassical growth model is that

A) long-run growth arises from correcting market failures.

B) long-run growth arises only from technological innovation.

C) there are diminishing marginal returns to a single factor.

D) there are constant marginal returns to investment.

E) there are increasing marginal returns to capital investment.

A) long-run growth arises from correcting market failures.

B) long-run growth arises only from technological innovation.

C) there are diminishing marginal returns to a single factor.

D) there are constant marginal returns to investment.

E) there are increasing marginal returns to capital investment.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

67

The diagram below show the market for financial capital assuming that national income is constant at potential GDP, Y*.

FIGURE 25-2

FIGURE 25-2

Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. Now suppose the government implements a revenue-neutral tax policy that encourages investment. What is the effect on the real interest rate?

A) There is no effect on NS or ID, and the interest rate remains at i*.

B) National saving shifts to NS1, and the real interest rate falls to i3.

C) The real interest rate rises because of the decrease in the budget surplus.

D) The real interest rate falls because of the decrease in the budget surplus.

E) Investment demand shifts to I1D, and the real interest rate rises to i2.

FIGURE 25-2

FIGURE 25-2Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. Now suppose the government implements a revenue-neutral tax policy that encourages investment. What is the effect on the real interest rate?

A) There is no effect on NS or ID, and the interest rate remains at i*.

B) National saving shifts to NS1, and the real interest rate falls to i3.

C) The real interest rate rises because of the decrease in the budget surplus.

D) The real interest rate falls because of the decrease in the budget surplus.

E) Investment demand shifts to I1D, and the real interest rate rises to i2.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

68

Consider the Neoclassical growth model. The effect of an increase in population or the labour force) in an economy, with everything else held constant, is

A) an increase in per capita national income.

B) an increasingly aging population.

C) a decrease in per capita output.

D) a decrease in the capital-output ratio.

E) an inward shift of the production possibilities boundary.

A) an increase in per capita national income.

B) an increasingly aging population.

C) a decrease in per capita output.

D) a decrease in the capital-output ratio.

E) an inward shift of the production possibilities boundary.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

69

The diagram below show the market for financial capital assuming that national income is constant at potential GDP, Y*.

FIGURE 25-2

FIGURE 25-2

Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. Now suppose there is a reduction in government purchases. What is the effect on investment demand?

A) National saving shifts to NS1, causing an increase in the quantity of investment demanded from I* to I 2.

B) There is no effect on NS or ID, and the quantity of investment demanded remains at I*.

C) Investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I1.

D) Investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I3.

E) National saving shifts to NS1, and investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I3.

FIGURE 25-2

FIGURE 25-2Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. Now suppose there is a reduction in government purchases. What is the effect on investment demand?

A) National saving shifts to NS1, causing an increase in the quantity of investment demanded from I* to I 2.

B) There is no effect on NS or ID, and the quantity of investment demanded remains at I*.

C) Investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I1.

D) Investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I3.

E) National saving shifts to NS1, and investment demand shifts to I1D, causing an increase in the quantity of investment demanded from I* to I3.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

70

The diagram below shows the market for financial capital in the long run when real GDP is equal to potential output, Y*.

FIGURE 25-3

FIGURE 25-3

Refer to Figure 25-3. Suppose the interest rate in this market for financial capital is 2%. In this case there is an excess financial capital of billion dollars.

A) supply of; 30

B) demand for; -30

C) supply of; 50

D) demand for; 30

E) demand for; 80

FIGURE 25-3

FIGURE 25-3Refer to Figure 25-3. Suppose the interest rate in this market for financial capital is 2%. In this case there is an excess financial capital of billion dollars.

A) supply of; 30

B) demand for; -30

C) supply of; 50

D) demand for; 30

E) demand for; 80

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

71

The diagram below show the market for financial capital assuming that national income is constant at potential GDP, Y*.

FIGURE 25-2

FIGURE 25-2

Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. If the real interest rate is i1, there is which will drive the interest rate down until it reaches i*.

A) an excess demand for financial capital

B) an excess demand for investment

C) an excess supply of financial capital

D) an excess supply of public saving

FIGURE 25-2

FIGURE 25-2Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. If the real interest rate is i1, there is which will drive the interest rate down until it reaches i*.

A) an excess demand for financial capital

B) an excess demand for investment

C) an excess supply of financial capital

D) an excess supply of public saving

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

72

Data from most industrialized countries show that countries with high investment rates as a percentage of GDP) tend to be countries

A) with the highest levels of per capita GDP.

B) with the highest levels of GDP.

C) with high rates of economic growth.

D) with the lowest rate of national saving.

E) with a negative relationship between investment and the rate of economic growth.

A) with the highest levels of per capita GDP.

B) with the highest levels of GDP.

C) with high rates of economic growth.

D) with the lowest rate of national saving.

E) with a negative relationship between investment and the rate of economic growth.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

73

The diagram below show the market for financial capital assuming that national income is constant at potential GDP, Y*.

FIGURE 25-2

FIGURE 25-2

Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. If the real interest rate is i4, there is , which will drive the real interest rate up to i*.

A) an excess demand for financial capital

B) an excess supply of financial capital

C) an excess supply of saving

D) an excess demand for public saving

FIGURE 25-2

FIGURE 25-2Refer to Figure 25-2. Suppose national saving is reflected by NS 0 and investment demand is reflected by I0D. If the real interest rate is i4, there is , which will drive the real interest rate up to i*.

A) an excess demand for financial capital

B) an excess supply of financial capital

C) an excess supply of saving

D) an excess demand for public saving

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

74

In the Neoclassical growth model, decreases in the population, other things being equal, would eventually result in

A) decreasing GDP and falling living standards.

B) decreasing GDP and increasing living standards.

C) increasing GDP and falling living standards.

D) increasing GDP and increasing living standards.

E) increasing savings and increasing living standards.

A) decreasing GDP and falling living standards.

B) decreasing GDP and increasing living standards.

C) increasing GDP and falling living standards.

D) increasing GDP and increasing living standards.

E) increasing savings and increasing living standards.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

75

The main properties of a Neoclassical aggregate production function are when all factors are increased proportionally and when any one factor is increased on its own.

A) increasing returns to scale; diminishing marginal returns

B) constant returns to scale; diminishing marginal returns

C) constant returns to scale; constant marginal returns

D) decreasing returns to scale; diminishing marginal returns

E) increasing returns to scale; increasing marginal returns

A) increasing returns to scale; diminishing marginal returns

B) constant returns to scale; diminishing marginal returns

C) constant returns to scale; constant marginal returns

D) decreasing returns to scale; diminishing marginal returns

E) increasing returns to scale; increasing marginal returns

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

76

In the Neoclassical growth model, increases in the stock of physical capital, other things being equal, will lead to

A) decreasing GDP and falling living standards.

B) decreasing GDP and increasing living standards.

C) increasing GDP and falling living standards.

D) increasing GDP and increasing living standards.

E) increasing GDP and decreased national wealth.

A) decreasing GDP and falling living standards.

B) decreasing GDP and increasing living standards.

C) increasing GDP and falling living standards.

D) increasing GDP and increasing living standards.

E) increasing GDP and decreased national wealth.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

77

The diagram below shows the market for financial capital in the long run when real GDP is equal to potential output, Y*.

FIGURE 25-3

FIGURE 25-3

Refer to Figure 25-3. Suppose the interest rate in this market for financial capital is 4%. In this case there is an excess financial capital of billion dollars.

A) supply of; 30

B) demand for; -60

C) supply of; 90

D) demand for; 30

E) demand for; 60

FIGURE 25-3

FIGURE 25-3Refer to Figure 25-3. Suppose the interest rate in this market for financial capital is 4%. In this case there is an excess financial capital of billion dollars.

A) supply of; 30

B) demand for; -60

C) supply of; 90

D) demand for; 30

E) demand for; 60

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

78

In the Neoclassical growth model, whenever diminishing returns applies, increases in the population, other things being equal, are accompanied by

A) decreasing GDP and falling living standards.

B) decreasing GDP and increasing living standards.

C) increasing GDP and falling living standards.

D) increasing GDP and constant living standards.

E) increasing GDP and increasing living standards.

A) decreasing GDP and falling living standards.

B) decreasing GDP and increasing living standards.

C) increasing GDP and falling living standards.

D) increasing GDP and constant living standards.

E) increasing GDP and increasing living standards.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

79

The Neoclassical growth model assumes that, with a given state of technology, increases in the use of a single factor will eventually

A) increase the average product of the factor.

B) decrease the average product of the factor.

C) lead to an increase in the marginal output of the factor.

D) lead to a decrease in total output by the factor.

E) lead to an increase in the material standard of living.

A) increase the average product of the factor.

B) decrease the average product of the factor.

C) lead to an increase in the marginal output of the factor.

D) lead to a decrease in total output by the factor.

E) lead to an increase in the material standard of living.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

80

In the long run, an increase in the demand for investment pushes the real interest rate, encourages

Saving by households, and leads to a future growth rate of potential output.

A) down; less; lower

B) up; less; lower

C) down; less; higher

D) up; more; higher

E) up; more; lower

Saving by households, and leads to a future growth rate of potential output.

A) down; less; lower

B) up; less; lower

C) down; less; higher

D) up; more; higher

E) up; more; lower

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck