Deck 3: The Balance Sheet and Notes to the Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 3: The Balance Sheet and Notes to the Financial Statements

1

A contingent liability should be recorded when

A) any lawsuit is actually filed against a company.

B) it is certain that funds are available to pay the amount of the claim.

C) it is probable that a liability has been incurred even though the amount of the loss cannot be reasonably estimated.

D) the amount of the loss can be reasonably estimated and it is probable prior to issuance of financial statements that a liability has been incurred.

A) any lawsuit is actually filed against a company.

B) it is certain that funds are available to pay the amount of the claim.

C) it is probable that a liability has been incurred even though the amount of the loss cannot be reasonably estimated.

D) the amount of the loss can be reasonably estimated and it is probable prior to issuance of financial statements that a liability has been incurred.

D

2

Investment securities held for the purpose of retiring bonds should be classified on a balance sheet as

A) current assets.

B) investments.

C) deferred bond liability.

D) intangible assets.

A) current assets.

B) investments.

C) deferred bond liability.

D) intangible assets.

B

3

How should a contingent liability be reported in the financial statements when it is "reasonably possible" the company will have to pay the liability at a future date?

A) As a deferred liability

B) As an accrued liability

C) As a disclosure only

D) As an account payable with an additional disclosure explaining the nature of the transaction

A) As a deferred liability

B) As an accrued liability

C) As a disclosure only

D) As an account payable with an additional disclosure explaining the nature of the transaction

C

4

Which of the following would not be reported in the stockholders' equity section of the balance sheet?

A) Retained earnings appropriated for future plant expansion

B) Dividends declared on preferred stock

C) Paid-in capital in excess of par value

D) Deficit in retained earnings

A) Retained earnings appropriated for future plant expansion

B) Dividends declared on preferred stock

C) Paid-in capital in excess of par value

D) Deficit in retained earnings

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following would not be classified as a current liability on a classified balance sheet?

A) Unearned revenue

B) Mandatorily redeemable preferred stock

C) The currently maturing portion of long-term debt

D) Accrued salaries payable to management

A) Unearned revenue

B) Mandatorily redeemable preferred stock

C) The currently maturing portion of long-term debt

D) Accrued salaries payable to management

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

Pending litigation would generally be considered a(n)

A) nonmonetary liability.

B) contingent liability.

C) estimated liability.

D) current liability.

A) nonmonetary liability.

B) contingent liability.

C) estimated liability.

D) current liability.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following characteristics may result in the classification of a liability being changed from current to noncurrent?

A) Violation of a subjective acceleration clause

B) Violation of an objective acceleration clause

C) A demand provision for payment

D) Refinancing after the balance sheet date

A) Violation of a subjective acceleration clause

B) Violation of an objective acceleration clause

C) A demand provision for payment

D) Refinancing after the balance sheet date

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

For a liability to exist,

A) there must be a past transaction or event.

B) the exact amount must be known.

C) the identity of the party to whom the liability is owed must be known.

D) there must be an obligation to pay cash in the future.

A) there must be a past transaction or event.

B) the exact amount must be known.

C) the identity of the party to whom the liability is owed must be known.

D) there must be an obligation to pay cash in the future.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following would not be considered an element of working capital?

A) Investment securities (current)

B) Organization costs

C) Accrued interest on notes payable

D) Work in process inventories

A) Investment securities (current)

B) Organization costs

C) Accrued interest on notes payable

D) Work in process inventories

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

The correct order to present current assets is

A) cash, inventories, prepaid items, accounts receivable.

B) cash, inventories, accounts receivable, prepaid items.

C) cash, accounts receivable, prepaid items, inventories.

D) cash, accounts receivable, inventories, prepaid items.

A) cash, inventories, prepaid items, accounts receivable.

B) cash, inventories, accounts receivable, prepaid items.

C) cash, accounts receivable, prepaid items, inventories.

D) cash, accounts receivable, inventories, prepaid items.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following would not be classified as a current asset on a classified balance sheet?

A) Investment securities (trading)

B) Short-term investments

C) Prepaid expenses

D) Intangible assets

A) Investment securities (trading)

B) Short-term investments

C) Prepaid expenses

D) Intangible assets

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following best describes contributed capital?

A) The amount that would be distributed to the stockholders in a liquidation of the corporation

B) The amount of capital provided by stockholders' investments

C) The amount of capital provided by stockholders' investments and undistributed earnings

D) The value of the common and preferred stock

A) The amount that would be distributed to the stockholders in a liquidation of the corporation

B) The amount of capital provided by stockholders' investments

C) The amount of capital provided by stockholders' investments and undistributed earnings

D) The value of the common and preferred stock

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

Balance sheet analysis is useful in assessing a firm's liquidity, which is the ability to

A) satisfy short-term obligations.

B) main profitable operations.

C) maintain past levels of preferred and common dividends.

D) survive a major economic downturn.

A) satisfy short-term obligations.

B) main profitable operations.

C) maintain past levels of preferred and common dividends.

D) survive a major economic downturn.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not a long-term investment?

A) Stock held to exert influence on another company

B) Land held for speculation

C) Trademarks

D) Cash surrender value of life insurance

A) Stock held to exert influence on another company

B) Land held for speculation

C) Trademarks

D) Cash surrender value of life insurance

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements regarding assets is not true?

A) An asset represents a probable future economic benefit.

B) Assets are obtained or controlled as a result of past or probable future transactions or events.

C) Assets reported on the balance sheet include both monetary and nonmonetary resources.

D) Assets include costs that have not yet been matched with revenues.

A) An asset represents a probable future economic benefit.

B) Assets are obtained or controlled as a result of past or probable future transactions or events.

C) Assets reported on the balance sheet include both monetary and nonmonetary resources.

D) Assets include costs that have not yet been matched with revenues.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following circumstances would require recording an accrual for a loss contingency under current generally accepted accounting principles?

A) Event is unusual in nature and occurrence of event is probable

B) Event is unusual in nature and event occurs infrequently

C) Amount of loss is reasonably estimable and occurrence of event is probable

D) Amount of loss is reasonably estimable and event occurs infrequently

A) Event is unusual in nature and occurrence of event is probable

B) Event is unusual in nature and event occurs infrequently

C) Amount of loss is reasonably estimable and occurrence of event is probable

D) Amount of loss is reasonably estimable and event occurs infrequently

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

Accrued revenues would normally appear on the balance sheet as

A) plant assets.

B) current liabilities.

C) long-term liabilities.

D) current assets.

A) plant assets.

B) current liabilities.

C) long-term liabilities.

D) current assets.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following would not be reported for capital stock in the contributed capital section of a classified balance sheet?

A) Dividends per share

B) Shares authorized

C) Shares issued

D) Shares outstanding

A) Dividends per share

B) Shares authorized

C) Shares issued

D) Shares outstanding

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following characteristics may result in the classification of a liability as current?

A) Short-term obligations expected to be refinanced with long-term debt

B) Debts to be liquidated from funds that have been accumulated and are reported as noncurrent assets

C) Violation of provisions of a debt agreement

D) Obligations for advance collections that involve long-term deferment of the delivery of goods or services

A) Short-term obligations expected to be refinanced with long-term debt

B) Debts to be liquidated from funds that have been accumulated and are reported as noncurrent assets

C) Violation of provisions of a debt agreement

D) Obligations for advance collections that involve long-term deferment of the delivery of goods or services

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

Unearned rent would normally appear on the balance sheet as a

A) plant asset.

B) current liability.

C) long-term liability.

D) current asset.

A) plant asset.

B) current liability.

C) long-term liability.

D) current asset.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

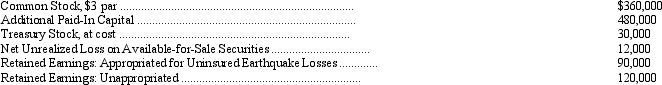

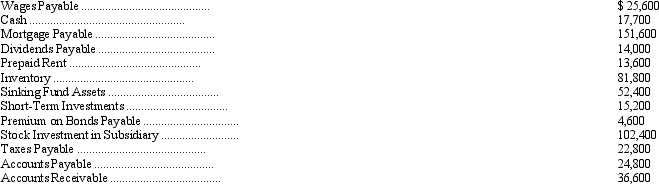

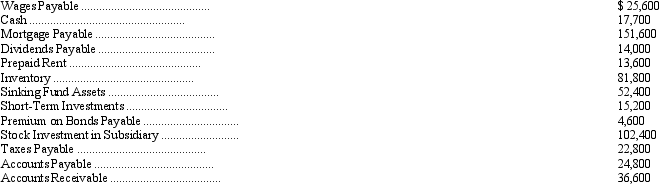

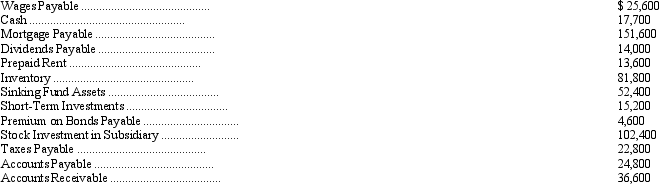

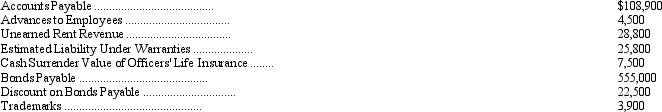

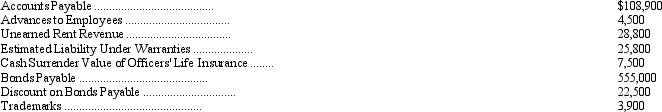

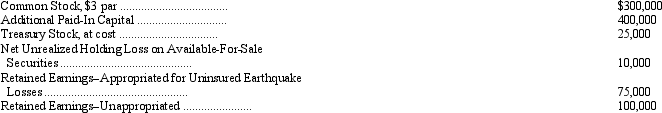

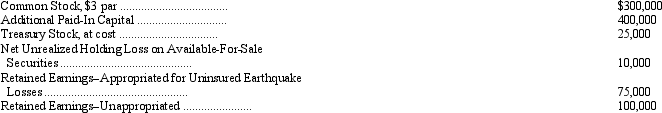

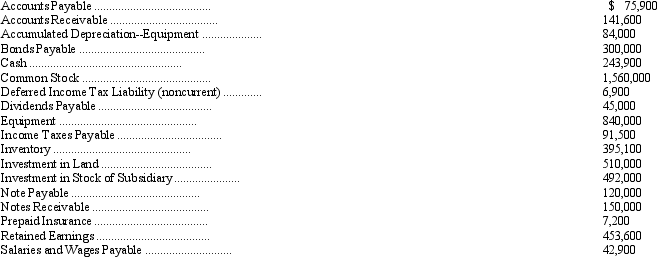

Mejarus Co.'s adjusted trial balance at December 31, 2011, includes the following account balances:

What amount should Mejarus report as total stockholders' equity in its December 31, 2011, balance sheet?

A) $1,008,000

B) $1,032,000

C) $1,068,000

D) $1,092,000

What amount should Mejarus report as total stockholders' equity in its December 31, 2011, balance sheet?

A) $1,008,000

B) $1,032,000

C) $1,068,000

D) $1,092,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

The operating cycle

A) measures the time elapsed between cash disbursement for inventory and cash collection of the sales price.

B) refers to the seasonal variations experienced by business enterprises.

C) should be used to classify assets and liabilities as current if it is less than one year.

D) cannot exceed one year.

A) measures the time elapsed between cash disbursement for inventory and cash collection of the sales price.

B) refers to the seasonal variations experienced by business enterprises.

C) should be used to classify assets and liabilities as current if it is less than one year.

D) cannot exceed one year.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

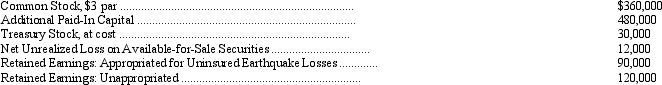

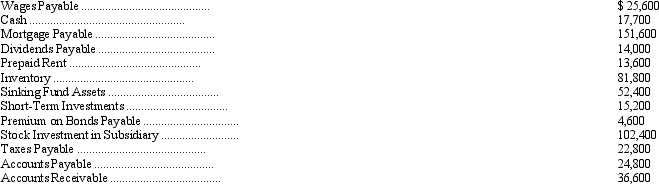

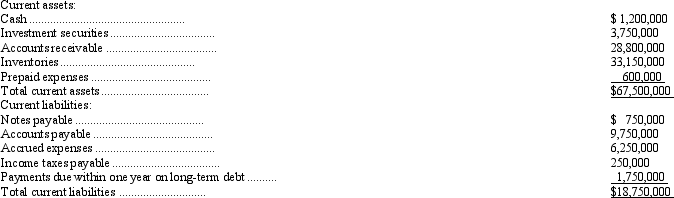

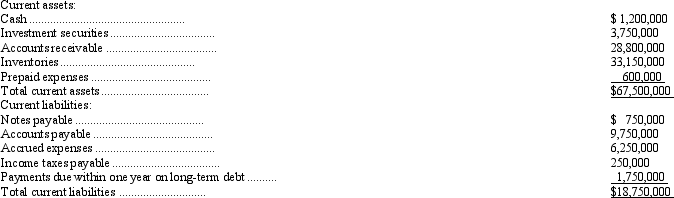

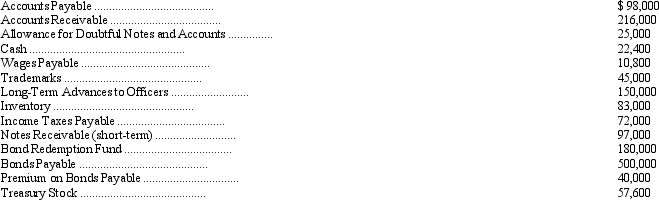

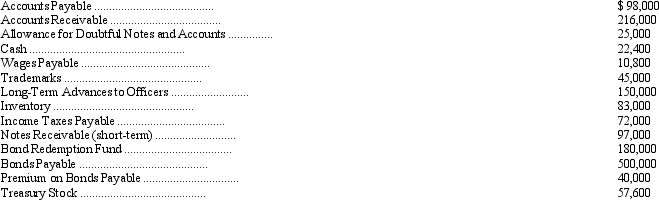

The accounts and balances shown below were gathered from Paynter Corporation's trial balance on December 31, 2011. All adjusting entries have been made.

See information for Paynter Corporation above. Paynter Corporation's working capital is

A) $62,500.

B) $73,100.

C) $77,700.

D) $125,700.

See information for Paynter Corporation above. Paynter Corporation's working capital is

A) $62,500.

B) $73,100.

C) $77,700.

D) $125,700.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

Hogi-Yogi Co. has total debt of $252,000 and stockholders' equity of $420,000. Hogi-Yogi is seeking capital to fund an expansion. Hogi-Yogi is planning to issue an additional $180,000 in common stock, and is negotiating with a bank to borrow additional funds. The bank requires a maximum debt ratio of .75. What is the maximum additional amount Hogi-Yogi will be able to borrow after the common stock is issued?

A) $639,000

B) $852,000

C) $1,236,000

D) $1,548,000

A) $639,000

B) $852,000

C) $1,236,000

D) $1,548,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

Barney Co.'s current ratio is 2:1. Which of the following transactions would normally increase Barney's current ratio?

A) Purchasing inventory on account

B) Borrowing money by signing a long-term note

C) Collecting an account receivable

D) Purchasing land for cash

A) Purchasing inventory on account

B) Borrowing money by signing a long-term note

C) Collecting an account receivable

D) Purchasing land for cash

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

The accounts and balances shown below were gathered from Paynter Corporation's trial balance on December 31, 2011. All adjusting entries have been made.

See information for Paynter Corporation above. The amount that should be reported as current liabilities on Paynter Corporation's balance sheet is

A) $87,200.

B) $91,800.

C) $73,200.

D) $238,800.

See information for Paynter Corporation above. The amount that should be reported as current liabilities on Paynter Corporation's balance sheet is

A) $87,200.

B) $91,800.

C) $73,200.

D) $238,800.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

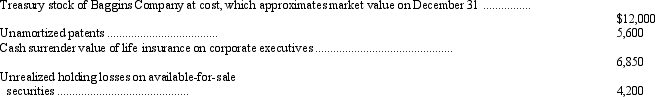

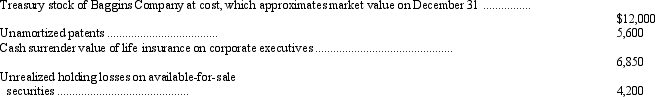

Baggins Company prepared a draft of its 2011 balance sheet. The draft statement reported total assets of $437,500. Included in this total assets figure were the following items:

At which amount should Baggins' total assets be correctly reported in the December 31, 2011, balance sheet?

A) $420,850

B) $421,300

C) $425,050

D) $425,500

At which amount should Baggins' total assets be correctly reported in the December 31, 2011, balance sheet?

A) $420,850

B) $421,300

C) $425,050

D) $425,500

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

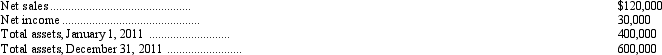

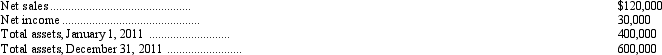

The following data were taken from the financial statements of Jensen Corporation for the year ended December 31, 2011:

What was Jensen's rate of return on assets for 2011?

A) 5 percent

B) 6 percent

C) 20 percent

D) 24 percent

What was Jensen's rate of return on assets for 2011?

A) 5 percent

B) 6 percent

C) 20 percent

D) 24 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

The accounts and balances shown below were gathered from Paynter Corporation's trial balance on December 31, 2011. All adjusting entries have been made.

The amount that should be reported as current assets on Paynter Corporation's balance sheet is

A) $151,300.

B) $164,900.

C) $217,300.

D) $267,300.

The amount that should be reported as current assets on Paynter Corporation's balance sheet is

A) $151,300.

B) $164,900.

C) $217,300.

D) $267,300.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following generally is considered a limitation of the balance sheet?

A) The balance sheet reflects the current value of a business.

B) The balance sheet reflects the instability of the dollar.

C) Balance sheet formats and classifications do not vary to reflect industry differences.

D) Due to measurement problems, some enterprise resources and obligations are not reported on the balance sheet.

A) The balance sheet reflects the current value of a business.

B) The balance sheet reflects the instability of the dollar.

C) Balance sheet formats and classifications do not vary to reflect industry differences.

D) Due to measurement problems, some enterprise resources and obligations are not reported on the balance sheet.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

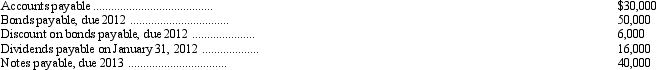

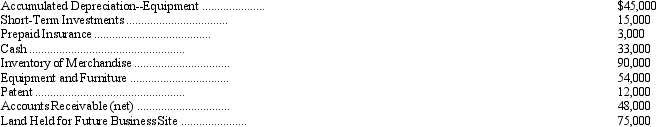

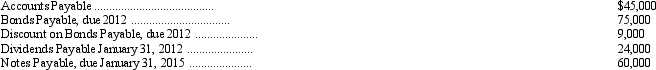

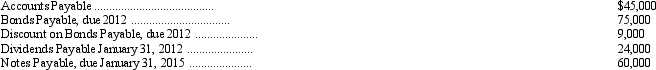

Eagle Co. prepared a draft of its 2011 balance sheet. The draft statement reported current liabilities totaling $200,000. However, none of the following items were included in this preliminary total at December 31, 2011:

At which amount should Eagle's current liabilities be correctly reported in the December 31, 2011, balance sheet?

A) $230,000

B) $290,000

C) $296,000

D) $302,000

At which amount should Eagle's current liabilities be correctly reported in the December 31, 2011, balance sheet?

A) $230,000

B) $290,000

C) $296,000

D) $302,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

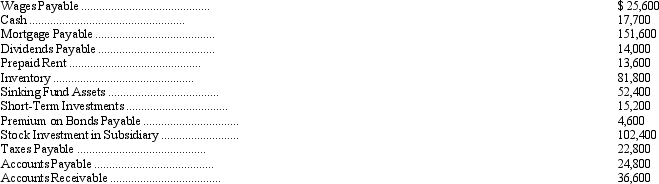

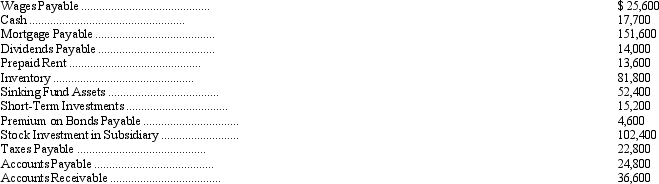

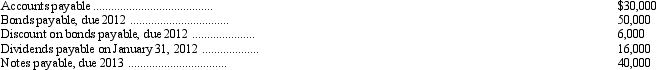

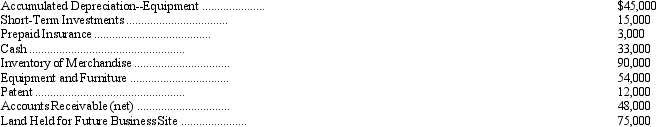

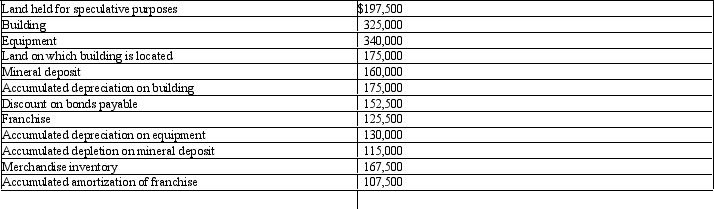

Neptune Corporation's trial balance contained the following account balances at December 31, 2011:

On Neptune's December 31, 2011, balance sheet, the current assets total should be

A) $189,000.

B) $201,000.

C) $219,000.

D) $243,000.

On Neptune's December 31, 2011, balance sheet, the current assets total should be

A) $189,000.

B) $201,000.

C) $219,000.

D) $243,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

Maryk Electronics Inc. reported the following items on its December 31, 2011, trial balance:

The amount that should be recorded on Maryk's balance sheet as total liabilities is

A) $696,000.

B) $700,500.

C) $703,500.

D) $741,000.

The amount that should be recorded on Maryk's balance sheet as total liabilities is

A) $696,000.

B) $700,500.

C) $703,500.

D) $741,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

Lobo Co. was incorporated on July 1, 2011, with $200,000 from the issuance of stock and borrowed funds of $30,000. During the first year of operations, net income was $10,000. On December 15, Lobo paid an $800 cash dividend. No additional activities affected owners' equity in 2011. At December 31, 2011, Lobo's liabilities had increased to $37,600. In Lobo's December 31, 2011, balance sheet, total assets should be reported at

A) $239,200.

B) $240,000.

C) $246,800.

D) $276,800.

A) $239,200.

B) $240,000.

C) $246,800.

D) $276,800.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

Troy Co. began operations on January 1, 2011, with $100,000 from the issuance of stock and borrowed funds of $15,000. Net income for 2011 was $5,000 and Troy paid a $400 cash dividend on December 15. No additional activities affected owners' equity in 2011. At December 31, 2011, Troy's liabilities had increased to $18,800. In Troy's December 31, 2011, balance sheet, total assets should be reported at

A) $119,600.

B) $120,000.

C) $123,400.

D) $138,400.

A) $119,600.

B) $120,000.

C) $123,400.

D) $138,400.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

Information from Blain Company's balance sheet is as follows:

What is Blain's quick (acid-test) ratio?

A) 0.26 to 1

B) 0.30 to 1

C) 1.80 to 1

D) 3.60 to 1

What is Blain's quick (acid-test) ratio?

A) 0.26 to 1

B) 0.30 to 1

C) 1.80 to 1

D) 3.60 to 1

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

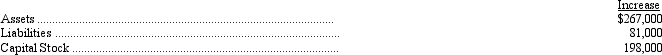

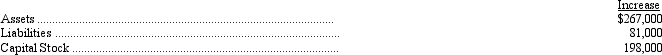

The following changes in Patriot Corporation's account balances occurred during 2011:

Patriot paid dividends of $39,000 during the year. There were no changes in Retained Earnings for 2011 except dividends and net income. What was Patriot's net income for 2011?

A) $12,000

B) $27,000

C) $39,000

D) $51,000

Patriot paid dividends of $39,000 during the year. There were no changes in Retained Earnings for 2011 except dividends and net income. What was Patriot's net income for 2011?

A) $12,000

B) $27,000

C) $39,000

D) $51,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements best describes a subsequent event?

A) A subsequent event affects only subsequent reporting periods.

B) A subsequent event may occur any time after financial statements are issued.

C) A subsequent event is, in some cases, reflected in the statements of the preceding period.

D) A subsequent event is not covered by the independent auditor's report.

A) A subsequent event affects only subsequent reporting periods.

B) A subsequent event may occur any time after financial statements are issued.

C) A subsequent event is, in some cases, reflected in the statements of the preceding period.

D) A subsequent event is not covered by the independent auditor's report.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

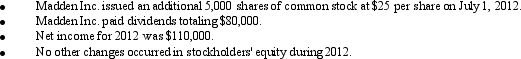

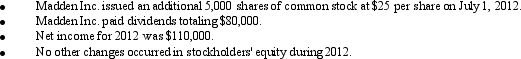

The December 31, 2011, balance sheet of Madden Inc., reported total assets of $1,050,000 and total liabilities of $680,000. The following information relates to the year 2012:

The stockholders' equity section of the December 31, 2012, balance sheet would report a balance of

A) $400,000.

B) $525,000.

C) $685,000.

D) $835,000.

The stockholders' equity section of the December 31, 2012, balance sheet would report a balance of

A) $400,000.

B) $525,000.

C) $685,000.

D) $835,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

Blues Corporation's trial balance included the following account balances at December 31, 2011:

What amount should be included in the current liability section of Blues' December 31, 2011, balance sheet?

A) $135,000

B) $153,000

C) $195,000

D) $234,000

What amount should be included in the current liability section of Blues' December 31, 2011, balance sheet?

A) $135,000

B) $153,000

C) $195,000

D) $234,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

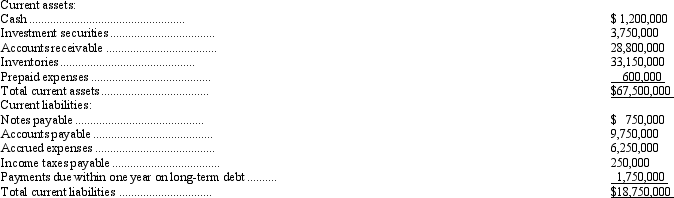

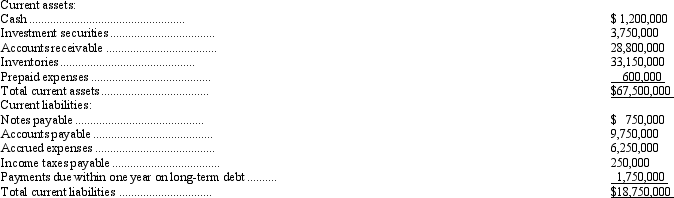

41

Information from Blain Company's balance sheet is as follows: Current assets:

What is Blain's current ratio?

A) 0.26 to 1

B) 0.30 to 1

C) 1.80 to 1

D) 3.60 to 1

What is Blain's current ratio?

A) 0.26 to 1

B) 0.30 to 1

C) 1.80 to 1

D) 3.60 to 1

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

Martin Corporation was organized on January 3, 2012. Martin was authorized to issue 50,000 shares of common stock with a par value of $10 per share. On January 4, Martin issued 30,000 shares of common stock at $25 per share. On July 15, Martin issued an additional 10,000 shares at $20 per share. Martin reported income of $33,000 during 2012. In addition, Martin declared a dividend of $.50 per share on December 31, 2012.

See Martin Corporation information above. The amount reported on Martin Corporation's December 31, 2012, balance sheet as additional paid-in capital was

A) $400,000.

B) $550,000.

C) $563,000.

D) $950,000.

See Martin Corporation information above. The amount reported on Martin Corporation's December 31, 2012, balance sheet as additional paid-in capital was

A) $400,000.

B) $550,000.

C) $563,000.

D) $950,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

The disclosure of accounting policies

A) may describe policies that are peculiar to the reporting company's industry.

B) should not appear in the notes to the financial statements.

C) should not describe unusual or innovative applications of GAAP.

D) is encouraged but not required.

A) may describe policies that are peculiar to the reporting company's industry.

B) should not appear in the notes to the financial statements.

C) should not describe unusual or innovative applications of GAAP.

D) is encouraged but not required.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

Seahawk Company's adjusted trial balance at December 31, 2012, includes the following account balances:

What amount should Seahawk report as total owners' equity in its December 31, 2012, balance sheet?

A) $840,000

B) $860,000

C) $890,000

D) $910,000

What amount should Seahawk report as total owners' equity in its December 31, 2012, balance sheet?

A) $840,000

B) $860,000

C) $890,000

D) $910,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

Below are selected accounts and their balances for the Stonefly Company as of December 31, 2012:

Based on the above information, determine the amount of working capital at December 31, 2012.

Based on the above information, determine the amount of working capital at December 31, 2012.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

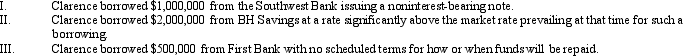

A general principle of disclosure is that material related-party transactions should be disclosed. As the auditor of the Clarence Company, you have noted the following transactions entered into by Clarence during the past fiscal year:

Assuming all of the above transactions are material, which transaction or transactions above most likely would be a related party transaction requiring disclosure in Clarence's financial statements?

A) Only I above.

B) Only III above.

C) Both I and III above.

D) Both II and III above.

Assuming all of the above transactions are material, which transaction or transactions above most likely would be a related party transaction requiring disclosure in Clarence's financial statements?

A) Only I above.

B) Only III above.

C) Both I and III above.

D) Both II and III above.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

The balance sheet category receivables represents claims to cash. Accounts receivable typically constitutes the largest dollar value of receivables. An estimated allowance for doubtful accounts should be deducted from the gross amount of accounts receivable to arrive at the estimated amount collectible. Plant assets are reported on the balance sheet at their historical cost less any accumulated depreciation. The allowance for doubtful accounts and accumulated depreciation are both termed contra-asset accounts. Which of the following statements regarding these two contra-asset accounts is true?

A) Both result in the valuation of their related asset account at net realizable value.

B) Accumulated depreciation deducted from the related asset account shows the unallocated portion of the historical cost of the related asset.

C) Accumulated depreciation deducted from the related asset account shows the net realizable value of the related asset.

D) Accumulated depreciation deducted from the related asset account shows the current replacement cost of the related asset.

A) Both result in the valuation of their related asset account at net realizable value.

B) Accumulated depreciation deducted from the related asset account shows the unallocated portion of the historical cost of the related asset.

C) Accumulated depreciation deducted from the related asset account shows the net realizable value of the related asset.

D) Accumulated depreciation deducted from the related asset account shows the current replacement cost of the related asset.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

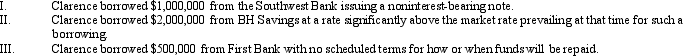

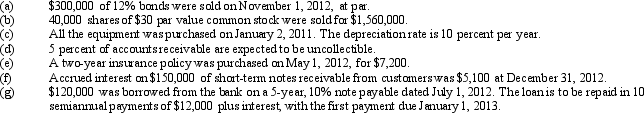

Account balances and supplemental information for the Bighorn Corporation as of December 31, 2012, are given below:

Prepare a properly classified balance sheet in report form for Bighorn Corporation as of December 31, 2012.

Prepare a properly classified balance sheet in report form for Bighorn Corporation as of December 31, 2012.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

In a consolidated balance sheet, the minority interest is reported

A) as part of long-term liabilities.

B) between liabilities and stockholders' equity

C) as part of stockholders' equity.

D) as part of long-term assets.

A) as part of long-term liabilities.

B) between liabilities and stockholders' equity

C) as part of stockholders' equity.

D) as part of long-term assets.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following items is usually classified as a noncurrent asset?

A) Plant expansion fund

B) Prepaid rent

C) Supplies

D) Goods that are in the process of being completed for another company

A) Plant expansion fund

B) Prepaid rent

C) Supplies

D) Goods that are in the process of being completed for another company

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

Treasury stock should be reported

A) as a current asset only if it will be sold within the next year or the operating cycle, whichever is longer.

B) as a current asset only if it will be sold within the next year or the operating cycle, whichever is shorter.

C) in the Investments and Funds section of the balance sheet.

D) as a deduction from total stockholders' equity on the balance sheet.

A) as a current asset only if it will be sold within the next year or the operating cycle, whichever is longer.

B) as a current asset only if it will be sold within the next year or the operating cycle, whichever is shorter.

C) in the Investments and Funds section of the balance sheet.

D) as a deduction from total stockholders' equity on the balance sheet.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

Martin Corporation was organized on January 3, 2012. Martin was authorized to issue 50,000 shares of common stock with a par value of $10 per share. On January 4, Martin issued 30,000 shares of common stock at $25 per share. On July 15, Martin issued an additional 10,000 shares at $20 per share. Martin reported income of $33,000 during 2012. In addition, Martin declared a dividend of $.50 per share on December 31, 2012.

See Martin Corporation information above. The amount reported on Martin Corporation's December 31, 2012, balance sheet as stockholders' equity was

A) $400,000.

B) $550,000.

C) $950,000.

D) $963,000.

See Martin Corporation information above. The amount reported on Martin Corporation's December 31, 2012, balance sheet as stockholders' equity was

A) $400,000.

B) $550,000.

C) $950,000.

D) $963,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

In relation to a set of 2012 basic financial statements, a subsequent event is one that

A) occurs before the 2012 financial statements are issued.

B) involves uncertainty as to possible gain or loss that will ultimately be resolved in 2013 or later.

C) occurs after the 2012 financial statements are issued.

D) requires an appropriate adjusting entry to be made as of the end of 2012.

A) occurs before the 2012 financial statements are issued.

B) involves uncertainty as to possible gain or loss that will ultimately be resolved in 2013 or later.

C) occurs after the 2012 financial statements are issued.

D) requires an appropriate adjusting entry to be made as of the end of 2012.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following items would normally be excluded from the computation of working capital?

A) Advances from customers for goods that will be shipped three months after the balance sheet date

B) The portion of long-term debt that matures six months after the balance sheet date and will be paid from the regular cash account

C) Prepaid insurance

D) Cash surrender value of life insurance

A) Advances from customers for goods that will be shipped three months after the balance sheet date

B) The portion of long-term debt that matures six months after the balance sheet date and will be paid from the regular cash account

C) Prepaid insurance

D) Cash surrender value of life insurance

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not true regarding reserves that appear in the equity section of the balance sheet of foreign companies?

A) Reserves represent cash set aside to fund capital projects.

B) Reserves are different categories found in the equity section of the balance sheet.

C) The balances in reserve accounts can affect an entity's legal ability to pay cash dividends.

D) An extensive description of each reserve shown on the balance sheet is provided.

A) Reserves represent cash set aside to fund capital projects.

B) Reserves are different categories found in the equity section of the balance sheet.

C) The balances in reserve accounts can affect an entity's legal ability to pay cash dividends.

D) An extensive description of each reserve shown on the balance sheet is provided.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements regarding intangible assets is not correct?

A) Intangible assets represent long-term rights and privileges of a nonphysical nature.

B) A trademark is an example of an intangible asset.

C) Intangible assets must be tested regularly to determine if their value has been impaired.

D) Intangible assets should be amortized over a period not exceed 40 years.

A) Intangible assets represent long-term rights and privileges of a nonphysical nature.

B) A trademark is an example of an intangible asset.

C) Intangible assets must be tested regularly to determine if their value has been impaired.

D) Intangible assets should be amortized over a period not exceed 40 years.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

The term "deficit" refers to

A) an excess of current assets over current liabilities.

B) an excess of current liabilities over current assets.

C) a debit balance in Retained Earnings.

D) a loss that is reported as a prior period adjustment.

A) an excess of current assets over current liabilities.

B) an excess of current liabilities over current assets.

C) a debit balance in Retained Earnings.

D) a loss that is reported as a prior period adjustment.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

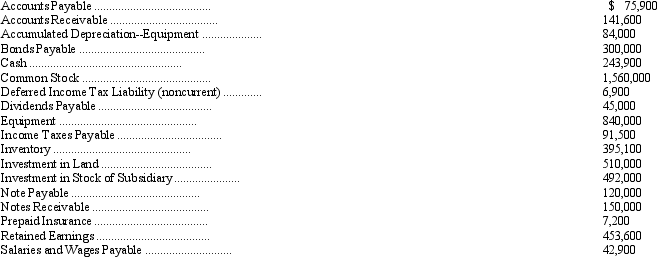

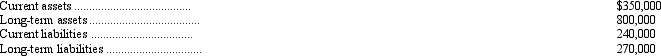

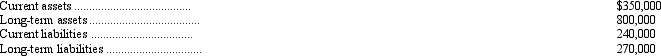

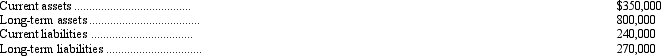

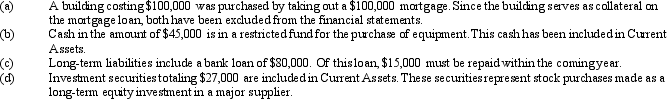

The following totals are taken from the December 31, 2012, balance sheet of Streamer Company:

Additional information:

After making any necessary changes, what are the totals for Streamer's current assets and current liabilities?

Additional information:

After making any necessary changes, what are the totals for Streamer's current assets and current liabilities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is an appropriate computation for return on investment?

A) Net income divided by total assets

B) Net income divided by sales

C) Sales divided by total assets

D) Sales divided by stockholders' equity

A) Net income divided by total assets

B) Net income divided by sales

C) Sales divided by total assets

D) Sales divided by stockholders' equity

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

An operating cycle

A) is twelve months or less in length.

B) is the average time required for a company to collect its receivables.

C) is used to determine current assets when the operating cycle is longer than one year.

D) starts with inventory and ends with cash.

A) is twelve months or less in length.

B) is the average time required for a company to collect its receivables.

C) is used to determine current assets when the operating cycle is longer than one year.

D) starts with inventory and ends with cash.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

The balance sheet provides information concerning liquidity, financial flexibility, and information for calculating various financial ratios. The balance sheet serves as a major indicator of an enterprise's ability to survive. Nevertheless, the analysis of the balance sheet should be approached with a clear understanding of the limitations of the statement.

What are the major limitations of the balance sheet that should be recognized in analyzing the statement?

What are the major limitations of the balance sheet that should be recognized in analyzing the statement?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

You have just joined the public accounting firm of Jensen, Barnes, and Summers upon graduating from State University. You are assigned to the audit of the Hansen Company, a manufacturer of electronic musical instruments. Part of your responsibility on the audit will be the examination of the property, plant, and equipment of the client.

Required:

Use your knowledge of financial statements plus your experience in your principles of accounting course to develop a list of questions regarding property, plant, and equipment you feel you should answer as an independent auditor in order to ensure that the statements provide relevant and reliable information to the users of Hansen Company's financial statements.

Required:

Use your knowledge of financial statements plus your experience in your principles of accounting course to develop a list of questions regarding property, plant, and equipment you feel you should answer as an independent auditor in order to ensure that the statements provide relevant and reliable information to the users of Hansen Company's financial statements.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

Knowledgeable users of financial statements recognize that the numbers reported in a company's financial statements depend on the accounting policies used to generate the numbers. Various choices of accounting policies exist, such as LIFO vs. FIFO for inventory costing and straight-line vs. double-declining balance for depreciation. APB Opinion No. 22 requires that a company disclose the accounting policies used to ensure that statement users have the information they need to make sound decisions.

What problems arise from the large variety of accounting choices available?

What problems arise from the large variety of accounting choices available?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

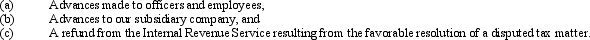

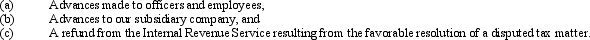

As a member of the audit staff of Brown & Co., CPAs, you have been assigned to the audit of a new client, Black Corporation. Upon arriving at the client's offices, the controller provides you with copies of the company's annual financial statements. You quickly observe that the balance of accounts receivable has increased materially over the amount reported on the prior year's balance sheet. Your inquiry of the controller produces the following response:

"This year we have included several other items with our trade receivables. All of these items represent receivables and include:

I have included a description of the tax item in the note to the financial statements. Since the other two items represent internal matters, I saw no reason to disclose them or present them as separate items on the balance sheet."

Do you concur with the controller's treatment of these items? Explain.

"This year we have included several other items with our trade receivables. All of these items represent receivables and include:

I have included a description of the tax item in the note to the financial statements. Since the other two items represent internal matters, I saw no reason to disclose them or present them as separate items on the balance sheet."

Do you concur with the controller's treatment of these items? Explain.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

The following information pertains to Heiner Company on December 31, 2011:

Required:

Prepare the property, plant, and equipment section of Heiner Company's balance sheet on December 31, 2011.

Required:

Prepare the property, plant, and equipment section of Heiner Company's balance sheet on December 31, 2011.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

Your friend has just purchased one hundred shares of the common stock of the Ryan Corporation. Your friend notices that the company shows an amount of $5,000,000 labeled as bond payable in the balance sheet. You have just recently received your license as a CPA and your friend has come to you for advice. She begins by asking: "What are bonds payable and what should I know about them in terms of my investment in Ryan Corporation?"

Required:

How would you respond to the question posed by your friend?

Required:

How would you respond to the question posed by your friend?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

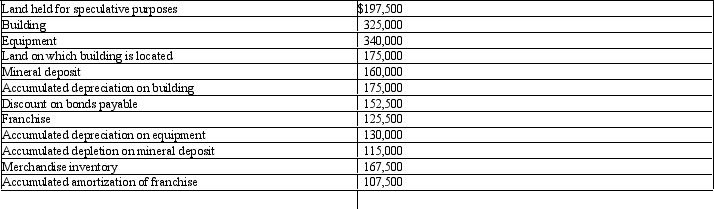

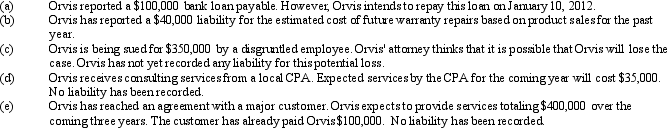

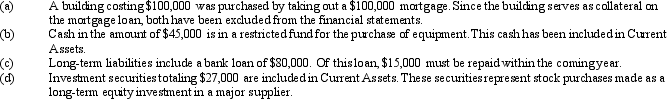

Orvis Company reported liabilities totaling $1,230,000 as of December 31, 2011. The following information relates to those liabilities:

After considering these items, what should be the total of Orvis' reported liabilities?

After considering these items, what should be the total of Orvis' reported liabilities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

The president of the Howard Company is upset! The president has just received the first draft of the company's annual financial statements for the year ended December 31, 2011, prepared by the company's controller. The statements show an overdraft in one of the company's bank accounts as an item in the current liabilities section of the balance sheet. The company experienced a very difficult year during 2011, although the first month of 2012 has shown some improvement. The Howard Company is a public company and may wish to issue additional common shares in the near future. The proceeds of the stock issuance would be used to acquire new equipment that could prove vital in reversing the company's decline.

Required:

Has the controller properly reported the bank overdraft? What factors should be considered in reporting this item?

Required:

Has the controller properly reported the bank overdraft? What factors should be considered in reporting this item?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

Certain assets currently are omitted from the balance sheet. For example, the value of the human resources of the firm are not reported. Nevertheless, investors and others might greatly benefit from a knowledge of the extent to which human assets have increased or decreased during a given period. Values certainly may be attributed to individuals or groups based on their ability to render future economic services. A major issue is the method that should be employed in measuring human assets.

Identify some possible ways of measuring human resources.

Identify some possible ways of measuring human resources.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

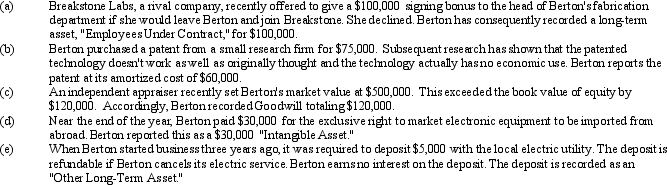

Berton Company reported assets totaling $870,000 as of December 31, 2011. The following information relates to those assets:

After considering the items above, what should be the total of Berton's reported assets?

After considering the items above, what should be the total of Berton's reported assets?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

Trimble and Co., CPAs, has just been retained by the Peterson Company to audit Peterson's financial statement for the last fiscal year. Peterson Company shows substantial amounts of inventory on its balance sheet.

Karen Page has just joined the staff of Trimble and Co. and has been assigned to assist in the audit of Peterson's inventory.

Required:

Identify the major issues regarding the inventory of Peterson Company that Karen needs to consider in determining if Peterson has properly accounted for and reported its inventory.

Karen Page has just joined the staff of Trimble and Co. and has been assigned to assist in the audit of Peterson's inventory.

Required:

Identify the major issues regarding the inventory of Peterson Company that Karen needs to consider in determining if Peterson has properly accounted for and reported its inventory.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

72

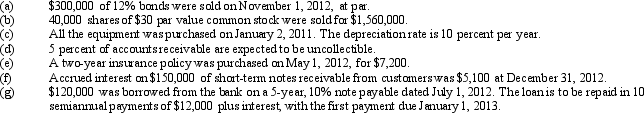

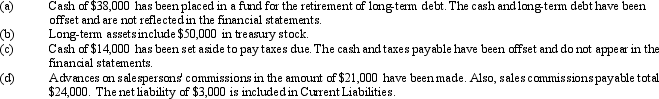

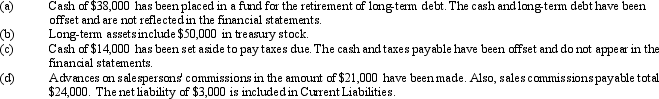

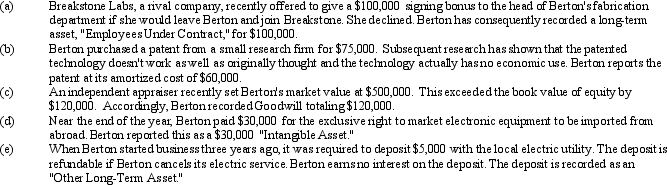

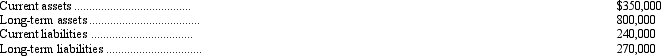

The following totals are taken from the December 31, 2011, balance sheet of Bartholomew Company:

Additional information:

After making any necessary changes, what are the totals for Bartholomew's long-term assets and long-term liabilities?

Additional information:

After making any necessary changes, what are the totals for Bartholomew's long-term assets and long-term liabilities?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck