Deck 7: Finance, Saving, and Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

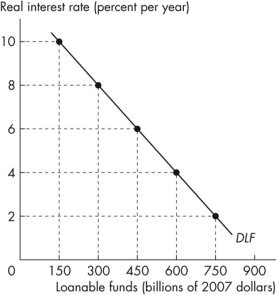

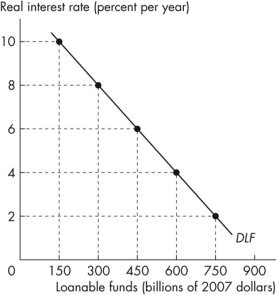

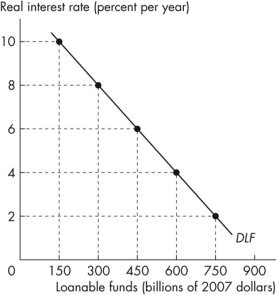

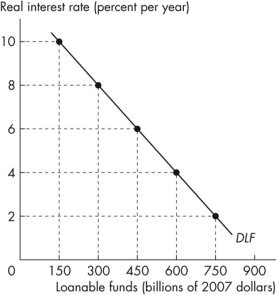

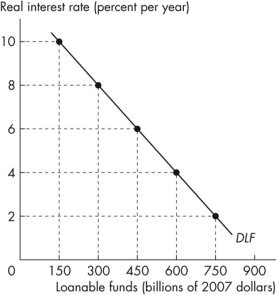

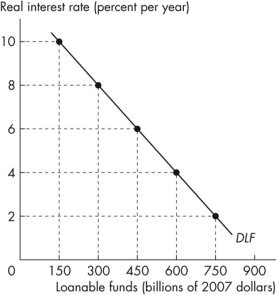

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/138

Play

Full screen (f)

Deck 7: Finance, Saving, and Investment

1

Physical capital is

A)the tools, instruments, machines, buildings, and other items that have been produced in the past and that are used today to produce goods and services.

B)the sum of investment and government expenditure on goods.

C)greater than financial wealth.

D)net investment.

E)gross investment.

A)the tools, instruments, machines, buildings, and other items that have been produced in the past and that are used today to produce goods and services.

B)the sum of investment and government expenditure on goods.

C)greater than financial wealth.

D)net investment.

E)gross investment.

the tools, instruments, machines, buildings, and other items that have been produced in the past and that are used today to produce goods and services.

2

Net investment equals

A)gross investment minus depreciation.

B)wealth minus saving.

C)gross investment divided by depreciation.

D)gross investment plus depreciation.

E)capital minus depreciation.

A)gross investment minus depreciation.

B)wealth minus saving.

C)gross investment divided by depreciation.

D)gross investment plus depreciation.

E)capital minus depreciation.

gross investment minus depreciation.

3

In January 2017, Tim's Gyms, Inc.owned machines valued at $1 million.During the year, the market value of the machines fell by 30 percent.During 2017, Tim spent $200,000 on new machines.During 2017, Tim's gross investment was

A)$1 million.

B)$900,000.

C)$100,000.

D)$200,000

E)$300,000.

A)$1 million.

B)$900,000.

C)$100,000.

D)$200,000

E)$300,000.

$200,000

4

At the beginning of the year, Tom's Tubes has capital of 5 tube- inflating machines.During the year, Tom scraps 2 old machines and purchases 3 new machines.Tom's gross investment for the year is

A)1 machine.

B)3 machines.

C)2 machines.

D)8 machines.

E)6 machines.

A)1 machine.

B)3 machines.

C)2 machines.

D)8 machines.

E)6 machines.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

5

The change in the value of capital is

A)saving.

B)net investment.

C)depreciation.

D)wealth.

E)gross investment.

A)saving.

B)net investment.

C)depreciation.

D)wealth.

E)gross investment.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

6

The funds used to buy physical capital are

A)net investment.

B)investment.

C)wealth.

D)financial capital.

E)saving.

A)net investment.

B)investment.

C)wealth.

D)financial capital.

E)saving.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

7

If the economy's capital increases over time,

A)gross investment equals depreciation.

B)net investment is positive.

C)depreciation exceeds gross investment.

D)depreciation is less than zero.

E)gross investment is zero.

A)gross investment equals depreciation.

B)net investment is positive.

C)depreciation exceeds gross investment.

D)depreciation is less than zero.

E)gross investment is zero.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

8

At the beginning of the year, Tom's Tubes has capital of 5 tube- inflating machines.During the year, Tom scraps 2 old machines and purchases 3 new machines.Tom's net investment for the year is

A)1 machine.

B)3 machines.

C)2 machines.

D)6 machines.

E)5 machines

A)1 machine.

B)3 machines.

C)2 machines.

D)6 machines.

E)5 machines

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

9

In January 2017, Tim's Gyms, Inc.owned machines valued at $1 million.During the year, the market value of the machines fell by 30 percent.During 2017, Tim spent $200,000 on new machines.During 2017, Tim's net investment was

A)$500,000.

B)$100,000.

C)- $100,000.

D)$200,000.

E)$300,000.

A)$500,000.

B)$100,000.

C)- $100,000.

D)$200,000.

E)$300,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

10

The total amount spent on new capital is

A)depreciation.

B)net investment.

C)saving.

D)gross investment.

E)wealth.

A)depreciation.

B)net investment.

C)saving.

D)gross investment.

E)wealth.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

11

In 2017, Tim's Gyms finances the building of a new gym.Tim secures this financing from a bank, and the bank receives ownership if Tim fails to make payments.This source of funds is

A)a bond issued in the bond market.

B)a stock issued in the bond market.

C)a mortgage obtained in the loan market.

D)a mortgage obtained in the stock market.

E)a stock issued in the loan market.

A)a bond issued in the bond market.

B)a stock issued in the bond market.

C)a mortgage obtained in the loan market.

D)a mortgage obtained in the stock market.

E)a stock issued in the loan market.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

12

At the beginning of the year, your wealth is $10,000.During the year, you have an income of $80,000 and you spend $90,000 on consumption goods and services.You pay no taxes.Your wealth at the end of the year is

A)$10,000.

B)$20,000.

C)$0.

D)$90,000.

E)$100,000.

A)$10,000.

B)$20,000.

C)$0.

D)$90,000.

E)$100,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

13

At the beginning of the year, Tom's Tubes has capital of 5 tube- inflating machines.During the year, Tom scraps 2 old machines and purchases 3 new machines.Tom's capital at the end of year is

A)8 machines.

B)6 machines.

C)2 machines.

D)1 machine.

E)3 machines.

A)8 machines.

B)6 machines.

C)2 machines.

D)1 machine.

E)3 machines.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is false?

A)Saving equals wealth minus consumption expenditure.

B)Saving is the source of funds used to finance investment.

C)Saving adds to wealth.

D)Income left after paying taxes can either be consumed or saved.

E)Saving supplies funds in loan markets, bond markets, and stock markets.

A)Saving equals wealth minus consumption expenditure.

B)Saving is the source of funds used to finance investment.

C)Saving adds to wealth.

D)Income left after paying taxes can either be consumed or saved.

E)Saving supplies funds in loan markets, bond markets, and stock markets.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

15

Capital increases when

A)net investment exceeds gross investment.

B)net investment is positive.

C)net investment is zero.

D)gross investment exceeds net investment.

E)gross investment is negative.

A)net investment exceeds gross investment.

B)net investment is positive.

C)net investment is zero.

D)gross investment exceeds net investment.

E)gross investment is negative.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

16

In January 2017, Tim's Gyms, Inc.owned machines valued at $1 million.During the year, the market value of the machines fell by 10 percent.During 2017, Tim spent $200,000 on new machines.During 2017, Tim's net investment was

A)$1.1 million.

B)$300,000.

C)$1 million.

D)$200,000.

E)$100,000.

A)$1.1 million.

B)$300,000.

C)$1 million.

D)$200,000.

E)$100,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

17

The Acme Stereo Company has capital of $24 million at the beginning of the year.At the end of the year, the firm has capital of $20 million.Its

A)net investment is $4 million.

B)net investment is unknown.

C)gross investment is zero.

D)depreciation is $4 million.

E)net investment is - $4 million.

A)net investment is $4 million.

B)net investment is unknown.

C)gross investment is zero.

D)depreciation is $4 million.

E)net investment is - $4 million.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

18

If the economy's capital decreases over time,

A)depreciation exceeds gross investment.

B)depreciation is less than zero.

C)net investment is positive.

D)gross investment equals net investment.

E)gross investment is zero.

A)depreciation exceeds gross investment.

B)depreciation is less than zero.

C)net investment is positive.

D)gross investment equals net investment.

E)gross investment is zero.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

19

Gross investment

A)equals real GDP minus consumption expenditure.

B)equals wealth minus saving.

C)is the total amount spent on new capital.

D)decreases when depreciation increases.

E)is the change in the value of capital

A)equals real GDP minus consumption expenditure.

B)equals wealth minus saving.

C)is the total amount spent on new capital.

D)decreases when depreciation increases.

E)is the change in the value of capital

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

20

At the beginning of the year, your wealth is $10,000.During the year, you have an income of $90,000 and you spend $80,000 on consumption goods and services.You pay no taxes.Your wealth at the end of the year is

A)$90,000.

B)$10,000.

C)$20,000.

D)$0.

E)$100,000.

A)$90,000.

B)$10,000.

C)$20,000.

D)$0.

E)$100,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

21

Investment is financed by which of the following? I.Government spending

II.Household saving

III.Borrowing from the rest of the world

A)I and III only

B)I and II only

C)I, II, and III

D)II and III only

E)II only

II.Household saving

III.Borrowing from the rest of the world

A)I and III only

B)I and II only

C)I, II, and III

D)II and III only

E)II only

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

22

The real interest rate

A)increases when the inflation rate increases.

B)is approximately equal to the nominal interest rate plus the inflation rate.

C)is approximately equal to the nominal interest rate minus the inflation rate.

D)can never be negative.

E)is determined in the market for money.

A)increases when the inflation rate increases.

B)is approximately equal to the nominal interest rate plus the inflation rate.

C)is approximately equal to the nominal interest rate minus the inflation rate.

D)can never be negative.

E)is determined in the market for money.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

23

If a bank's net worth is negative, then the bank is

A)liquid.

B)solvent.

C)illiquid.

D)insolvent.

E)destitute.

A)liquid.

B)solvent.

C)illiquid.

D)insolvent.

E)destitute.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

24

The key Canadian financial institutions include all of the following except

A)credit unions and caisses populaires.

B)ATMs.

C)banks.

D)payday loan firms.

E)trust and loan companies.

A)credit unions and caisses populaires.

B)ATMs.

C)banks.

D)payday loan firms.

E)trust and loan companies.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

25

A stock is

A)a promise to make specified payments on specified dates.

B)a certificate of ownership and claim to the firm's profits.

C)a financial market.

D)available from a bank in the form of a loan.

E)a document which entitles its holder to the income from a package of mortgages.

A)a promise to make specified payments on specified dates.

B)a certificate of ownership and claim to the firm's profits.

C)a financial market.

D)available from a bank in the form of a loan.

E)a document which entitles its holder to the income from a package of mortgages.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose that a bond promises to pay its holder $100 a year forever.If the price of the bond increases from $1,000 to $1,250, then the interest rate on the bond

A)rises from 8 percent a year to 10 percent a year.

B)rises because the bond becomes a better investment.

C)falls from 10 percent a year to 8 percent a year.

D)falls from 10 percent a year to 6 percent a year.

E)does not change because the purchaser buys the bond knowing that interest rates will be adjusted.

A)rises from 8 percent a year to 10 percent a year.

B)rises because the bond becomes a better investment.

C)falls from 10 percent a year to 8 percent a year.

D)falls from 10 percent a year to 6 percent a year.

E)does not change because the purchaser buys the bond knowing that interest rates will be adjusted.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose a bond promises to pay its holder $100 a year forever.The interest rate on the bond rises from 4 percent to 5 percent.The price of the bond

A)rises from $20,000 to $25,000.

B)falls from $2,500 to $2,000.

C)rises from $2,000 to $2,500.

D)falls from $25,000 to $20,000.

E)does not change.Bond prices are constant.

A)rises from $20,000 to $25,000.

B)falls from $2,500 to $2,000.

C)rises from $2,000 to $2,500.

D)falls from $25,000 to $20,000.

E)does not change.Bond prices are constant.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

28

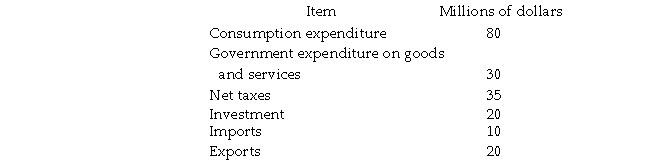

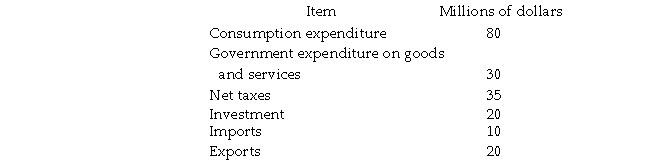

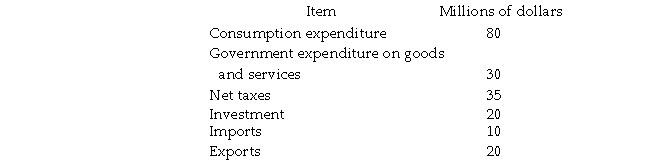

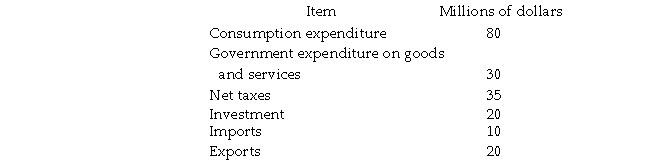

Refer to the table below to answer the following questions.

Table 7.1.1

Refer to Table 7.1.1.Government saving is

A)$15 million.

B)$45 million.

C)- $5 million.

D)$5 million.

E)$20 million.

Table 7.1.1

Refer to Table 7.1.1.Government saving is

A)$15 million.

B)$45 million.

C)- $5 million.

D)$5 million.

E)$20 million.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

29

National saving equals

A)private saving - net taxes.

B)government saving.

C)private saving + private wealth.

D)investment.

E)private saving + government saving.

A)private saving - net taxes.

B)government saving.

C)private saving + private wealth.

D)investment.

E)private saving + government saving.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

30

Approximately, the real interest rate _______ the inflation rate _______ the nominal interest rate.

A)times; divided by 100 equals

B)minus; equals

C)equals; minus

D)plus; equals

E)equals; plus

A)times; divided by 100 equals

B)minus; equals

C)equals; minus

D)plus; equals

E)equals; plus

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

31

Choose the statement that is incorrect about trust and loan companies.

A)Trust and loan companies accept deposits and make personal loans and mortgage loans.

B)Trust and loan companies administer estates.

C)The largest trust and loan companies are owned by banks.

D)Trust and loan companies hold more than 70 percent of the total assets of the Canadian financial services sector.

E)Trust and loan companies administer trusts and pension plans.

A)Trust and loan companies accept deposits and make personal loans and mortgage loans.

B)Trust and loan companies administer estates.

C)The largest trust and loan companies are owned by banks.

D)Trust and loan companies hold more than 70 percent of the total assets of the Canadian financial services sector.

E)Trust and loan companies administer trusts and pension plans.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

32

In 2017, Country A has net taxes of $30 million and government expenditures of $35 million.Private saving in Country A is $5 million and consumption expenditure is $80 million.The government of Country A is running a budget _______ and national saving is _______.

A)surplus; $25 million

B)deficit; $5 million

C)surplus; $5 million

D)deficit; zero

E)deficit; - $5 million

A)surplus; $25 million

B)deficit; $5 million

C)surplus; $5 million

D)deficit; zero

E)deficit; - $5 million

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

33

Choose the statement that is incorrect.

A)A financial institution's net worth is the market value of what it has lent minus the market value of what it has borrowed.

B)Insolvency and illiquidity were at the core of a global financial meltdown in 2007- 2008.

C)A financial institution can be solvent but illiquid.

D)If a financial institution's net worth is negative, the institution is solvent.

E)A firm is illiquid if it has made long- term loans with borrowed funds and is faced with a sudden demand to repay more of what is has borrowed than its available cash.

A)A financial institution's net worth is the market value of what it has lent minus the market value of what it has borrowed.

B)Insolvency and illiquidity were at the core of a global financial meltdown in 2007- 2008.

C)A financial institution can be solvent but illiquid.

D)If a financial institution's net worth is negative, the institution is solvent.

E)A firm is illiquid if it has made long- term loans with borrowed funds and is faced with a sudden demand to repay more of what is has borrowed than its available cash.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

34

Elena owns a bond with a price of $5,000, which pays $500 per year.The price of the bond rises in the bond market to $7,500.What is the new interest rate on the bond?

A)500 percent

B)10 percent

C)5 percent

D)6.67 percent

E)20 percent

A)500 percent

B)10 percent

C)5 percent

D)6.67 percent

E)20 percent

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

35

This year Pizza House spent $1.3 billion on new capital in its stores.Depreciation during the year was $300 million.Pizza House's gross investment was _______ and its net investment was _______.

A)$1.0 billion; $1.3 billion

B)$1.3 billion; $1.0 billion

C)$1.3 billion; $1.6 billion

D)$1.3 billion; $0.3 billion

E)$1.0 billion; $0.7 billion

A)$1.0 billion; $1.3 billion

B)$1.3 billion; $1.0 billion

C)$1.3 billion; $1.6 billion

D)$1.3 billion; $0.3 billion

E)$1.0 billion; $0.7 billion

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

36

Refer to the table below to answer the following questions.

Table 7.1.1

Refer to Table 7.1.1.Private saving is

A)- $15 million.

B)$40 million.

C)$80 million.

D)$20 million.

E)$25 million.

Table 7.1.1

Refer to Table 7.1.1.Private saving is

A)- $15 million.

B)$40 million.

C)$80 million.

D)$20 million.

E)$25 million.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

37

Choose the statement that is incorrect.

A)A bond that you buy for $50 and pays you $5 a year has an interest rate of 10 percent a year.

B)Stocks, bonds, short- term securities, and loans are financial assets.

C)If the asset price rises, other things remaining the same, the interest rate falls.

D)The price of an asset is determined first, then the interest rate is determined.

E)The interest rate on a financial asset is the interest received expressed as a percentage of the price of the asset.

A)A bond that you buy for $50 and pays you $5 a year has an interest rate of 10 percent a year.

B)Stocks, bonds, short- term securities, and loans are financial assets.

C)If the asset price rises, other things remaining the same, the interest rate falls.

D)The price of an asset is determined first, then the interest rate is determined.

E)The interest rate on a financial asset is the interest received expressed as a percentage of the price of the asset.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose Canada spends more on foreign goods and services than foreigners spend on our goods and services.Then

A)Canada must borrow an amount equal to imports minus exports.

B)the rest of the world may or may not finance Canada's trade deficit.

C)the Bank of Canada will raise the foreign exchange rate of the Canadian dollar.

D)Canada must borrow an amount equal to consumption expenditure plus investment.

E)Canada must borrow an amount equal to national saving.

A)Canada must borrow an amount equal to imports minus exports.

B)the rest of the world may or may not finance Canada's trade deficit.

C)the Bank of Canada will raise the foreign exchange rate of the Canadian dollar.

D)Canada must borrow an amount equal to consumption expenditure plus investment.

E)Canada must borrow an amount equal to national saving.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

39

In which market would you find mortgage- backed securities?

A)bond market

B)housing market

C)capital market

D)stock market

E)loan market

A)bond market

B)housing market

C)capital market

D)stock market

E)loan market

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

40

If national saving equals $100,000, net taxes equal $100,000 and government expenditure equals $25,000, what is private saving?

A)$25,000

B)$175,000

C)- $25,000

D)$225,000

E)zero

A)$25,000

B)$175,000

C)- $25,000

D)$225,000

E)zero

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

41

A fall in the real interest rate

A)shifts the demand for loanable funds curve rightward.

B)decreases the inflation rate.

C)creates a movement down along the demand for loanable funds curve.

D)creates a movement up along the demand for loanable funds curve.

E)shifts the demand for loanable funds curve leftward.

A)shifts the demand for loanable funds curve rightward.

B)decreases the inflation rate.

C)creates a movement down along the demand for loanable funds curve.

D)creates a movement up along the demand for loanable funds curve.

E)shifts the demand for loanable funds curve leftward.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

42

The quantity of loanable funds demanded increases when

A)the supply of loanable funds decreases.

B)the real interest rate rises.

C)expected profit decreases.

D)wealth increases.

E)the real interest rate falls.

A)the supply of loanable funds decreases.

B)the real interest rate rises.

C)expected profit decreases.

D)wealth increases.

E)the real interest rate falls.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

43

Investment will be higher if

A)the government deficit is higher.

B)national saving is higher.

C)net exports are higher.

D)government spending is higher.

E)the real interest rate is higher.

A)the government deficit is higher.

B)national saving is higher.

C)net exports are higher.

D)government spending is higher.

E)the real interest rate is higher.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

44

A firm's decision to invest in a project is based on the

A)nominal interest rate and the expected profit.

B)real interest rate and expected total revenue.

C)real interest rate and the expected profit.

D)expected future income, wealth, and default risk.

E)nominal interest rate and expected total revenue.

A)nominal interest rate and the expected profit.

B)real interest rate and expected total revenue.

C)real interest rate and the expected profit.

D)expected future income, wealth, and default risk.

E)nominal interest rate and expected total revenue.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

45

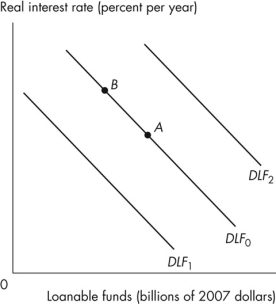

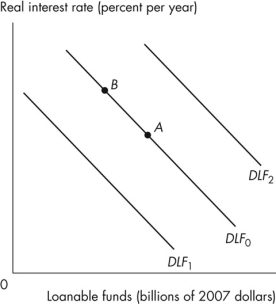

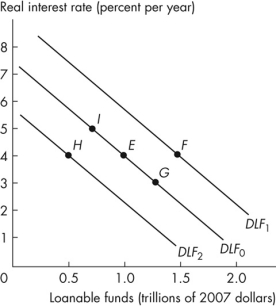

Refer to the figure below to answer the following question.

Figure 7.2.1

Figure 7.2.1

In Figure 7.2.1, the economy is at point A.What happens if the real interest rate rises?

A)There is a movement to a point such as B.

B)The demand for loanable funds curve shifts rightward to curve DLF2.

C)The demand for loanable funds curve shifts leftward to curve DLF1.

D)Either A or B can occur.

E)Either A or C can occur.

Figure 7.2.1

Figure 7.2.1In Figure 7.2.1, the economy is at point A.What happens if the real interest rate rises?

A)There is a movement to a point such as B.

B)The demand for loanable funds curve shifts rightward to curve DLF2.

C)The demand for loanable funds curve shifts leftward to curve DLF1.

D)Either A or B can occur.

E)Either A or C can occur.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

46

The demand for loanable funds is the relationship between the quantity of loanable funds demanded and the _______ when all other influences on borrowing plans remain the same.

A)nominal interest rate

B)inflation rate

C)quantity of loanable funds supplied

D)real interest rate

E)price level

A)nominal interest rate

B)inflation rate

C)quantity of loanable funds supplied

D)real interest rate

E)price level

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

47

Suppose that you took out a $1,000 loan in January and were required to pay $75 in annual interest.During the year, inflation was 6 percent.Which of the following statements is correct?

A)The real interest rate is 6 percent and the nominal interest rate is - 1.5 percent.

B)The real interest rate is 7.5 percent and the nominal interest rate is 1.5 percent.

C)The nominal interest rate is 7.5 percent and the real interest rate is 1.5 percent.

D)The nominal interest rate is 7.5 percent and the real interest rate is 13.5 percent.

E)The real interest rate is 6 percent and the nominal interest rate is 7.5 percent.

A)The real interest rate is 6 percent and the nominal interest rate is - 1.5 percent.

B)The real interest rate is 7.5 percent and the nominal interest rate is 1.5 percent.

C)The nominal interest rate is 7.5 percent and the real interest rate is 1.5 percent.

D)The nominal interest rate is 7.5 percent and the real interest rate is 13.5 percent.

E)The real interest rate is 6 percent and the nominal interest rate is 7.5 percent.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

48

A rise in the real interest rate

A)shifts the demand for loanable funds curve rightward.

B)shifts the demand for loanable funds curve leftward.

C)creates a movement down along the demand for loanable funds curve.

D)creates a movement up along the demand for loanable funds curve.

E)increases the inflation rate.

A)shifts the demand for loanable funds curve rightward.

B)shifts the demand for loanable funds curve leftward.

C)creates a movement down along the demand for loanable funds curve.

D)creates a movement up along the demand for loanable funds curve.

E)increases the inflation rate.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

49

A decrease in the demand for loanable funds occurs when

A)the government cuts taxes.

B)government expenditure increases.

C)expected profit decreases.

D)expected profit increases.

E)the real interest rate rises.

A)the government cuts taxes.

B)government expenditure increases.

C)expected profit decreases.

D)expected profit increases.

E)the real interest rate rises.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

50

A decrease in the real interest rate leads to a _______ the demand for loanable funds curve, and a decrease in expected profit leads to a _______ the demand for loanable funds curve.

A)rightward shift of; movement up along

B)movement down along; movement up along

C)movement down along; leftward shift of

D)rightward shift of; leftward shift of

E)movement down along; rightward shift of

A)rightward shift of; movement up along

B)movement down along; movement up along

C)movement down along; leftward shift of

D)rightward shift of; leftward shift of

E)movement down along; rightward shift of

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

51

As the _______ interest rate rises _______.

A)real; a movement occurs up along the demand for loanable funds curve

B)nominal; the demand for loanable funds curve shifts leftward

C)real; the demand for loanable funds curve shifts rightward

D)nominal; the demand for loanable funds curve shifts rightward

E)real; a movement occurs down along the demand for loanable funds curve

A)real; a movement occurs up along the demand for loanable funds curve

B)nominal; the demand for loanable funds curve shifts leftward

C)real; the demand for loanable funds curve shifts rightward

D)nominal; the demand for loanable funds curve shifts rightward

E)real; a movement occurs down along the demand for loanable funds curve

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

52

When the inflation rate is zero, the

A)real interest rate is negative.

B)nominal interest rate is zero.

C)demand for loanable funds increases.

D)supply of loanable funds decreases.

E)real interest rate equals the nominal interest rate.

A)real interest rate is negative.

B)nominal interest rate is zero.

C)demand for loanable funds increases.

D)supply of loanable funds decreases.

E)real interest rate equals the nominal interest rate.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose a firm has an investment project which will cost $200,000 and result in $30,000 annual profit.The firm will not undertake the project if the real interest rate is

A)greater than 5 percent a year.

B)greater than 10 percent a year.

C)positive.

D)greater than 15 percent a year.

E)greater than 7.5 percent a year.

A)greater than 5 percent a year.

B)greater than 10 percent a year.

C)positive.

D)greater than 15 percent a year.

E)greater than 7.5 percent a year.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

54

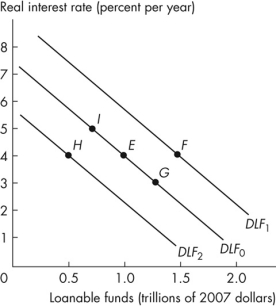

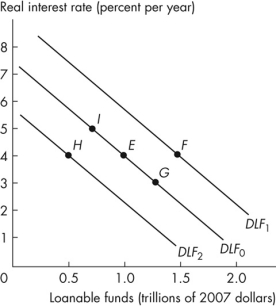

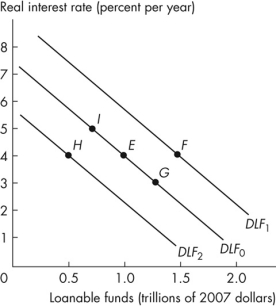

Refer to the figure below to answer the following questions.

Figure 7.2.2

Figure 7.2.2

In Figure 7.2.2, a decrease in the real interest rate will result in a movement from point E to

A)point F.

B)point G.

C)point H.

D)point I.

E)either point G or point F.

Figure 7.2.2

Figure 7.2.2In Figure 7.2.2, a decrease in the real interest rate will result in a movement from point E to

A)point F.

B)point G.

C)point H.

D)point I.

E)either point G or point F.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

55

During a recession, firms decrease their profit expectations.As a result, there is a _______ shift of the _______ loanable funds curve.

A)leftward; demand for

B)leftward; demand for loanable funds curve and supply of

C)rightward; demand for

D)rightward, supply of

E)rightward; supply of

A)leftward; demand for

B)leftward; demand for loanable funds curve and supply of

C)rightward; demand for

D)rightward, supply of

E)rightward; supply of

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

56

The demand for loanable funds curve

A)is vertical.

B)is horizontal.

C)has a positive slope.

D)slopes downward at high real interest rates and slopes upward at low real interest rates.

E)has a negative slope.

A)is vertical.

B)is horizontal.

C)has a positive slope.

D)slopes downward at high real interest rates and slopes upward at low real interest rates.

E)has a negative slope.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

57

Southton has investment of $100, private saving of $90, net taxes of $25, government expenditure of $30, exports of $25 and imports of $10.What is national saving?

A)$105

B)$90

C)$95

D)$85

E)$100

A)$105

B)$90

C)$95

D)$85

E)$100

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

58

As the _______ interest rate increases, the quantity of loanable funds demanded _______.

A)nominal; increases

B)nominal; decreases

C)real; does not change

D)real; decreases

E)real; increases

A)nominal; increases

B)nominal; decreases

C)real; does not change

D)real; decreases

E)real; increases

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

59

If the real interest rate rises from 3 percent a year to 5 percent a year,

A)there is a movement down along the supply of loanable funds curve.

B)the supply of loanable funds curve shifts rightward.

C)the nominal interest rate falls.

D)the demand for loanable funds curve shifts rightward.

E)there is a movement up along the demand for loanable funds curve.

A)there is a movement down along the supply of loanable funds curve.

B)the supply of loanable funds curve shifts rightward.

C)the nominal interest rate falls.

D)the demand for loanable funds curve shifts rightward.

E)there is a movement up along the demand for loanable funds curve.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

60

If the nominal interest rate is 11 percent and the inflation rate is 9 percent, then the real interest rate is approximately

A)- 2 percent.

B)4 percent.

C)2 percent.

D)20 percent.

E)18 percent.

A)- 2 percent.

B)4 percent.

C)2 percent.

D)20 percent.

E)18 percent.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

61

All of the following are sources of loanable funds except

A)business investment.

B)private saving.

C)international borrowing.

D)government budget surplus.

E)none of the above are souces of loanable funds.

A)business investment.

B)private saving.

C)international borrowing.

D)government budget surplus.

E)none of the above are souces of loanable funds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

62

_______ increases households' saving.

A)A decrease in the real interest rate

B)Higher expected future income

C)An increase in wealth

D)A tax cut that increases disposable income

E)An increase in default risk

A)A decrease in the real interest rate

B)Higher expected future income

C)An increase in wealth

D)A tax cut that increases disposable income

E)An increase in default risk

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

63

Changes in all of the following shift the supply curve of loanable funds except

A)disposable income.

B)the real interest rate.

C)wealth.

D)default risk.

E)expected future income.

A)disposable income.

B)the real interest rate.

C)wealth.

D)default risk.

E)expected future income.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

64

When the real interest rate increases,

A)the demand for loanable funds curve shifts leftward.

B)the supply of loanable funds curve shifts rightward.

C)there is a movement up along the supply of loanable funds curve.

D)the supply of loanable funds curve shifts leftward.

E)there is a movement down along the supply of loanable funds curve.

A)the demand for loanable funds curve shifts leftward.

B)the supply of loanable funds curve shifts rightward.

C)there is a movement up along the supply of loanable funds curve.

D)the supply of loanable funds curve shifts leftward.

E)there is a movement down along the supply of loanable funds curve.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

65

The greater a household's _______ the less is its saving.

A)expected future profit

B)disposable income

C)taxes

D)wealth

E)return from saving

A)expected future profit

B)disposable income

C)taxes

D)wealth

E)return from saving

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

66

As the _______ rises, the quantity of loanable funds supplied _______ , other things remaining the same.

A)nominal interest rate; increases

B)real interest rate; increases

C)inflation rate; increases

D)inflation rate; decreases

E)real interest rate; decreases

A)nominal interest rate; increases

B)real interest rate; increases

C)inflation rate; increases

D)inflation rate; decreases

E)real interest rate; decreases

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

67

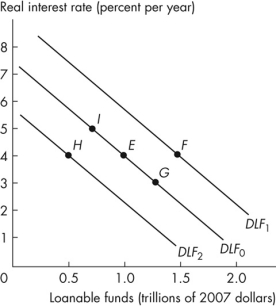

Refer to the figure below to answer the following questions.

Figure 7.2.2

Figure 7.2.2

In Figure 7.2.2, an increase in expected profit will result in a movement from point E to

A)point F.

B)point G.

C)point H.

D)point I.

E)either point I or point F.

Figure 7.2.2

Figure 7.2.2In Figure 7.2.2, an increase in expected profit will result in a movement from point E to

A)point F.

B)point G.

C)point H.

D)point I.

E)either point I or point F.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is correct?

A)As disposable income increases, the real interest rate rises.

B)As disposable income decreases, saving decreases.

C)The higher a household's wealth the greater is its saving.

D)Both B and C are correct.

E)Both A and C are correct.

A)As disposable income increases, the real interest rate rises.

B)As disposable income decreases, saving decreases.

C)The higher a household's wealth the greater is its saving.

D)Both B and C are correct.

E)Both A and C are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

69

As a result of a recession, the default risk increases.How does this change affect the loanable funds market?

A)There is a rightward shift of the supply of loanable funds curve.

B)There is a rightward shift of the demand for loanable funds curve.

C)There is a movement up along the supply of loanable funds curve.

D)There is a leftward shift of the supply of loanable funds curve.

E)There is a movement down along the demand for loanable funds curve.

A)There is a rightward shift of the supply of loanable funds curve.

B)There is a rightward shift of the demand for loanable funds curve.

C)There is a movement up along the supply of loanable funds curve.

D)There is a leftward shift of the supply of loanable funds curve.

E)There is a movement down along the demand for loanable funds curve.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

70

The supply of loanable funds is the relationship between the quantity of loanable funds supplied and _______ when all other influences on lending plans remain the same.

A)the price level

B)the nominal interest rate

C)the inflation rate

D)real GDP

E)the real interest rate

A)the price level

B)the nominal interest rate

C)the inflation rate

D)real GDP

E)the real interest rate

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

71

An increase in _______ will shift the supply of loanable funds curve _______.

A)disposable income; leftward

B)wealth; leftward

C)default risk; rightward

D)the real interest rate; rightward

E)expected future income; rightward

A)disposable income; leftward

B)wealth; leftward

C)default risk; rightward

D)the real interest rate; rightward

E)expected future income; rightward

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following influences household saving? I.The real interest rate

II.Disposable income

III.Expected future income

A)I only

B)I and III only

C)I and II only

D)I, II, and III

E)II and III only

II.Disposable income

III.Expected future income

A)I only

B)I and III only

C)I and II only

D)I, II, and III

E)II and III only

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

73

Refer to the figure below to answer the following questions.

Figure 7.2.2

Figure 7.2.2

In Figure 7.2.2, a decrease in expected profit will result in a movement from point E to

A)point F.

B)point G.

C)point H.

D)point I.

E)either point G or point H.

Figure 7.2.2

Figure 7.2.2In Figure 7.2.2, a decrease in expected profit will result in a movement from point E to

A)point F.

B)point G.

C)point H.

D)point I.

E)either point G or point H.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

74

If households' disposable income decreases, then

A)the supply of loanable funds increases.

B)the demand for loanable funds decreases.

C)households' saving decreases.

D)a movement occurs down along the supply of loanable funds curve.

E)households' saving increases.

A)the supply of loanable funds increases.

B)the demand for loanable funds decreases.

C)households' saving decreases.

D)a movement occurs down along the supply of loanable funds curve.

E)households' saving increases.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

75

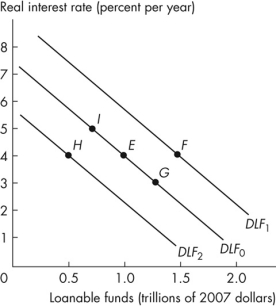

Refer to the figure below to answer the following questions.

Figure 7.2.3

Figure 7.2.3

In Figure 7.2.3, the real interest rate is 6 percent a year and the economy is on curve DLF.The expected profit rises.With no change in the real interest rate, the new quantity of loanable funds demanded is

A)zero.

B)less than $450 billion.

C)greater than $450 billion.

D)$450 billion.

E)between $300 billion and $450 billion.

Figure 7.2.3

Figure 7.2.3In Figure 7.2.3, the real interest rate is 6 percent a year and the economy is on curve DLF.The expected profit rises.With no change in the real interest rate, the new quantity of loanable funds demanded is

A)zero.

B)less than $450 billion.

C)greater than $450 billion.

D)$450 billion.

E)between $300 billion and $450 billion.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

76

Households will choose to save more if

A)expected future income decreases.

B)current disposable income increases.

C)current disposable income decreases.

D)Both A and B are correct.

E)Both A and C are correct.

A)expected future income decreases.

B)current disposable income increases.

C)current disposable income decreases.

D)Both A and B are correct.

E)Both A and C are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

77

The supply of loanable funds curve

A)is vertical.

B)has a negative slope.

C)is upward sloping at low real interest rates and downward sloping at high real interest rates.

D)has a positive slope.

E)is horizontal.

A)is vertical.

B)has a negative slope.

C)is upward sloping at low real interest rates and downward sloping at high real interest rates.

D)has a positive slope.

E)is horizontal.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

78

Refer to the figure below to answer the following questions.

Figure 7.2.3

Figure 7.2.3

In Figure 7.2.3, when the real interest rate is 6 percent, the quantity of loanable funds demanded is

A)$300 billion.

B)$450 billion.

C)$150 billion.

D)any amount less than $450 billion.

E)$600 billion.

Figure 7.2.3

Figure 7.2.3In Figure 7.2.3, when the real interest rate is 6 percent, the quantity of loanable funds demanded is

A)$300 billion.

B)$450 billion.

C)$150 billion.

D)any amount less than $450 billion.

E)$600 billion.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

79

Refer to the figure below to answer the following questions.

Figure 7.2.3

Figure 7.2.3

In Figure 7.2.3, the real interest rate is 6 percent a year and the economy is on curve DLF.The expected profit falls.With no change in the real interest rate, the new quantity of loanable funds demanded is

A)zero.

B)between $450 billion and $600 billion.

C)greater than $600 billion.

D)less than $450 billion.

E)$450 billion.

Figure 7.2.3

Figure 7.2.3In Figure 7.2.3, the real interest rate is 6 percent a year and the economy is on curve DLF.The expected profit falls.With no change in the real interest rate, the new quantity of loanable funds demanded is

A)zero.

B)between $450 billion and $600 billion.

C)greater than $600 billion.

D)less than $450 billion.

E)$450 billion.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following will shift the supply of loanable funds curve leftward?

A)a decrease in disposable income

B)a decrease in the real interest rate

C)a decrease in real wealth

D)a decrease in expected future income

E)a decrease in default risk

A)a decrease in disposable income

B)a decrease in the real interest rate

C)a decrease in real wealth

D)a decrease in expected future income

E)a decrease in default risk

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck