Deck 5: Project Appraisal: Capital Rationing, Taxation and Inflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 5: Project Appraisal: Capital Rationing, Taxation and Inflation

1

If a firm has a limited capital budget and too many good capital projects to fund them all, it is said to be facing the problem of

A) profitability.

B) wealth optimization.

C) capital rationing.

D) constrained capital.

A) profitability.

B) wealth optimization.

C) capital rationing.

D) constrained capital.

C

2

The objective of is to select the group of projects that provides the highest overall net present value and does not require more dollars than are budgeted.

A) certainty equivalents

B) capital rationing

C) sensitivity analysis

D) scenario analysis

A) certainty equivalents

B) capital rationing

C) sensitivity analysis

D) scenario analysis

B

3

When calculating the profitability index, which ratio would you use (using the definitions in Arnold's textbook)?

A) Initial outlay/Gross present value

B) Initial outlay/Gross present value

C) Gross present value/Initial outlay

D) Gross present value/Net present value

A) Initial outlay/Gross present value

B) Initial outlay/Gross present value

C) Gross present value/Initial outlay

D) Gross present value/Net present value

C

4

In which type of cash flow are all future cash flows expressed in the prices expected to rule when the cash flow occurs?

A) Inflation- linked cash flow

B) Money cash flow

C) Real cash flow

D) Money rate of cash flow

A) Inflation- linked cash flow

B) Money cash flow

C) Real cash flow

D) Money rate of cash flow

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

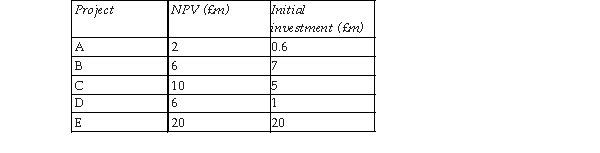

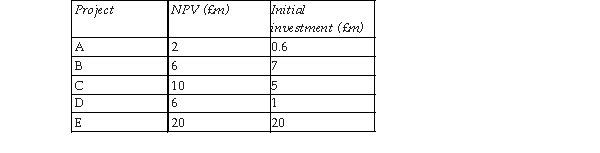

Consider the following projects:  A capital constraint of £32m has been imposed on the total initial investment. The projects are divisible and each may be undertaken only once. What is the maximum NPV available from the projects?

A capital constraint of £32m has been imposed on the total initial investment. The projects are divisible and each may be undertaken only once. What is the maximum NPV available from the projects?

A) £37.4m

B) £34.8m

C) B £32.6m

D) £40.6m

A capital constraint of £32m has been imposed on the total initial investment. The projects are divisible and each may be undertaken only once. What is the maximum NPV available from the projects?

A capital constraint of £32m has been imposed on the total initial investment. The projects are divisible and each may be undertaken only once. What is the maximum NPV available from the projects?A) £37.4m

B) £34.8m

C) B £32.6m

D) £40.6m

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

When calculating the benefit- cost ratio, which ratio would you use (using the definitions in Arnold 's textbook)?

A) Net present value/Initial outlay

B) Initial outlay/Net initial value

C) Initial outlay/Net present value

D) Net initial value/Present outlay

A) Net present value/Initial outlay

B) Initial outlay/Net initial value

C) Initial outlay/Net present value

D) Net initial value/Present outlay

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

Which option correctly show Fisher's equation?

A) (1+m) = (1+h) x (1+ i)

B) (1+m) x (1+h) = (1+ i)

C) (1+h) = (1+i) x (1+ m)

D) (1+h) = (1+i) x (1- m)

A) (1+m) = (1+h) x (1+ i)

B) (1+m) x (1+h) = (1+ i)

C) (1+h) = (1+i) x (1+ m)

D) (1+h) = (1+i) x (1- m)

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

Which three of the following accurately describe a post- completion audit?

A) It is the monitoring and evaluation of the progress of a capital investment project.

B) It focuses primarily on the differences between predicted and actual profits.

C) It involves analysis of cash flows and other costs and benefits that were forecast at the time of authorization.

D) It involves analysis of actual cash flows and other costs and benefits.

A) It is the monitoring and evaluation of the progress of a capital investment project.

B) It focuses primarily on the differences between predicted and actual profits.

C) It involves analysis of cash flows and other costs and benefits that were forecast at the time of authorization.

D) It involves analysis of actual cash flows and other costs and benefits.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Which two of the following are possible approaches to adjusting for inflation in project appraisal?

A) Estimate the cash flow in money terms and use a real discount rate

B) Estimate the cash flow in real terms and use a real discount rate

C) Estimate the cash flow in real terms and use a money discount rate

D) Estimate the cash flow in money terms and use a money discount rate

A) Estimate the cash flow in money terms and use a real discount rate

B) Estimate the cash flow in real terms and use a real discount rate

C) Estimate the cash flow in real terms and use a money discount rate

D) Estimate the cash flow in money terms and use a money discount rate

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

How is benefit- cost ratio calculated?

A) Net present value divided by Total outlay

B) Net present value divided by Initial outlay

C) Gross present value divided by Total outlay

D) Gross present value divided by Initial outlay

A) Net present value divided by Total outlay

B) Net present value divided by Initial outlay

C) Gross present value divided by Total outlay

D) Gross present value divided by Initial outlay

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

Which approach should be taken to adjust for inflation when calculating net present value?

A) Estimate the future cash flows by multiplying by the specific inflation of each cash inflow and outflow item, and then discount using the real rate of return

B) Estimate the cash flows in money terms and use a real discount rate

C) Estimate the cash flows in real terms and use a real discount rate

D) Estimate the cash flows in real terms and use a money discount rate

A) Estimate the future cash flows by multiplying by the specific inflation of each cash inflow and outflow item, and then discount using the real rate of return

B) Estimate the cash flows in money terms and use a real discount rate

C) Estimate the cash flows in real terms and use a real discount rate

D) Estimate the cash flows in real terms and use a money discount rate

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following best describes a divisible project?

A) One where it is impossible to undertake a fraction of the project

B) One which may be identified with a particular division

C) One where the initial investment funds have to be divided into very small amounts

D) One where it is possible to undertake a fraction of the project

A) One where it is impossible to undertake a fraction of the project

B) One which may be identified with a particular division

C) One where the initial investment funds have to be divided into very small amounts

D) One where it is possible to undertake a fraction of the project

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

Which statement best describes the relationship between the two types of profits?

A) Taxable profits are smaller than accounting profits.

B) Taxable profits are larger than accounting profits.

C) Taxable profits are the same as accounting profits.

D) Taxable profits are not the same as accounting profits.

A) Taxable profits are smaller than accounting profits.

B) Taxable profits are larger than accounting profits.

C) Taxable profits are the same as accounting profits.

D) Taxable profits are not the same as accounting profits.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

Which two of the following are rules that should be followed when taking taxation into account?

A) Include incremental tax effects of a project as a cash outflow

B) Focus primarily on incremental cash flows

C) Get the timing right

D) Focus on maintaining present value

A) Include incremental tax effects of a project as a cash outflow

B) Focus primarily on incremental cash flows

C) Get the timing right

D) Focus on maintaining present value

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

What term is used to describe price changes in an individual good or service over time?

A) Specific inflation

B) General inflation

C) Value inflation

D) Future value

A) Specific inflation

B) General inflation

C) Value inflation

D) Future value

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

Which option best describes the calculation of money cash flows?

A) Future cash flows are expressed in the prices expected to rule when the cash flow occurs.

B) All present cash flows are expressed in the prices expected to rule when the cash flow occurs.

C) Future cash flows are expressed in constant purchasing power.

D) Present cash flows are expressed in constant purchasing power.

A) Future cash flows are expressed in the prices expected to rule when the cash flow occurs.

B) All present cash flows are expressed in the prices expected to rule when the cash flow occurs.

C) Future cash flows are expressed in constant purchasing power.

D) Present cash flows are expressed in constant purchasing power.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Management may impose internal limits on investment expenditure despite the availability of positive NPV projects. What term is used for these limits?

A) Soft capital rationing

B) Divisible one- period rationing

C) Indivisible one- period rationing

D) Hard capital rationing

A) Soft capital rationing

B) Divisible one- period rationing

C) Indivisible one- period rationing

D) Hard capital rationing

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Which three of the following may be reasons for soft capital rationing?

A) Senior managers are aware that to undertake all positive NPV projects may place a strain on available managerial talent or other resources.

B) Senior management retains control over divisions by placing limits on the amount any particular division can spend on a set of projects.

C) Managerial unwillingness to borrow.

D) Agencies external to the firm will not supply finance for all positive NPV projects.

A) Senior managers are aware that to undertake all positive NPV projects may place a strain on available managerial talent or other resources.

B) Senior management retains control over divisions by placing limits on the amount any particular division can spend on a set of projects.

C) Managerial unwillingness to borrow.

D) Agencies external to the firm will not supply finance for all positive NPV projects.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

Which three of the following factors appear in Fisher's equation?

A) Internal rate of return

B) Anticipated rate of inflation

C) Real rate of return

D) Money rate of return

A) Internal rate of return

B) Anticipated rate of inflation

C) Real rate of return

D) Money rate of return

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is a key rule for analysing indivisible one- period capital rationing problems?

A) Examine all the feasible alternative combinations

B) Make tax reduction a primary aim

C) Focus on initial outlay

D) Focus on maintaining present value

A) Examine all the feasible alternative combinations

B) Make tax reduction a primary aim

C) Focus on initial outlay

D) Focus on maintaining present value

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following best describes capital rationing?

A) When the financial markets are told by government not to lend beyond imposed limits

B) When wealth is destroyed because capital repayments on loans have to be made earlier than anticipated

C) When funds are not available to undertake all the projects put forward by divisional management teams

D) When funds are not available to finance all wealth- enhancing projects

A) When the financial markets are told by government not to lend beyond imposed limits

B) When wealth is destroyed because capital repayments on loans have to be made earlier than anticipated

C) When funds are not available to undertake all the projects put forward by divisional management teams

D) When funds are not available to finance all wealth- enhancing projects

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

The objective of capital rationing is to select the group of projects that provides the quickest overall payback and does not require more euros than are budgeted.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

The objective of capital rationing is to select the group of projects that provides the highest overall net present value and does not require more euros than are budgeted.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

If a firm has unlimited funds to invest in capital assets, all independent projects that meet its minimum investment criteria should be implemented.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

If a firm is subject to capital rationing, it is able to accept all independent projects that provide an acceptable return.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

The ranking approach involves the ranking of capital expenditure projects on the basis of some predetermined measure such as the profitability index or rate of return.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

A firm with limited funds for investment in capital assets must ration those funds by allocating them to projects that will maximize share value.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Mutually exclusive projects are projects whose cash flows are unrelated to one another; the acceptance of one does not eliminate the others from further consideration.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

Which option best describes the use of real cash flows?

A) All future cash flows are expressed in the prices expected to rule when the cash flow occurs.

B) Present cash flows are expressed in constant purchasing power.

C) All present cash flows are expressed in the prices expected to rule when the cash flow occurs.

D) Future cash flows are expressed in constant purchasing power.

A) All future cash flows are expressed in the prices expected to rule when the cash flow occurs.

B) Present cash flows are expressed in constant purchasing power.

C) All present cash flows are expressed in the prices expected to rule when the cash flow occurs.

D) Future cash flows are expressed in constant purchasing power.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck