Deck 7: Taxation and Government Intervention

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/32

Play

Full screen (f)

Deck 7: Taxation and Government Intervention

1

What are the three costs of taxation? What is the deadweight loss of taxation? What causes deadweight loss?

The costs of taxation to society include the direct cost to taxpayers of the revenue they pay to government. It also includes the loss of consumer and producer surplus caused by the tax. Finally, it includes the cost of administering the tax codes. A tax raises the equilibrium price and reduces the equilibrium quantity. The higher price to consumer reduces the consumer surplus by more than the amount transferred to government. The lower price received by producers reduces producer surplus by more than the amount of revenue transferred to the government. The excess is called the deadweight loss. It arises because a misallocation of resources was caused by a deviation from supply/demand equilibrium.

2

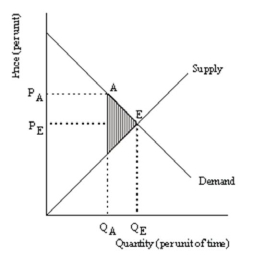

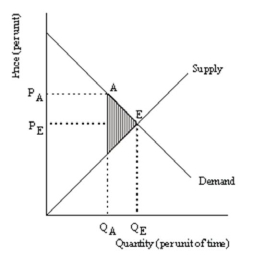

Demonstrate graphically and explain verbally why the equilibrium values of price and quantity in a supply and demand model lead to the maximum combination of consumer and producer surplus.

To demonstrate that the maximum combination of consumer and producer surplus occurs at the equilibrium of the supply and demand model, we show that a point away from the free market equilibrium results in less surplus than does the equilibrium point. This is illustrated in the diagram below. Compare point A to the equilibrium point E. At point A price is above the equilibrium price (PA > PE) and quantity is below the equilibrium quantity (QA < QE). The difference between QA and QE represents a loss of trades that would have benefited consumers and producers. This creates a loss of surplus (when compared to the surplus of point E) equal to the shaded triangle.

3

Define consumer surplus and producer surplus.

Consumer surplus is the value the consumer gets from buying a product less its price. Producer surplus is the price the producer sells a product for less the cost of producing it.

4

Demonstrate graphically and explain verbally the cost to producers of a tax of t per carton imposed on the sellers of cigarettes. Where does the lost producer surplus go?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

5

How are price ceilings similar to taxes on producers? How are price floors similar to taxes on consumers? How are both price ceilings and price floors different from taxes?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

6

Define rent-seeking activities and give an example. Use agricultural price supports to demonstrate that the value of rent seeking is linked to elasticity.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

7

Demonstrate graphically and explain verbally the cost to consumers of a tax of t per carton imposed on the sellers of cigarettes. Where does the lost producer surplus go?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

8

How are price ceilings similar to taxes? How are they different?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

9

Explain why the person who physically pays the tax is not necessarily the person who bears the tax. Who is most likely to bear the greater proportion of the tax burden? How does this apply to Social Security taxes?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

10

Demonstrate graphically and explain verbally the cost to society of a tax of t per carton imposed on the sellers of cigarettes.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

11

Demonstrate graphically and explain verbally the concept of consumer surplus.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

12

What is the deadweight loss of taxation? What causes deadweight loss?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

13

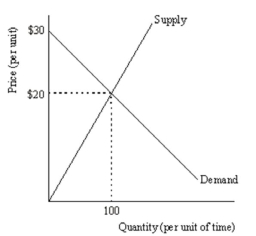

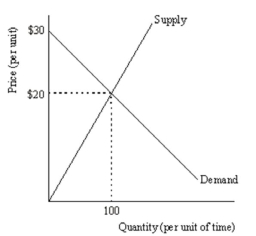

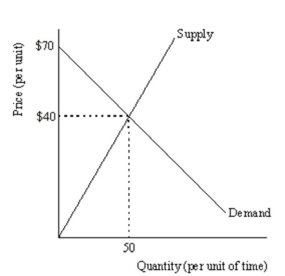

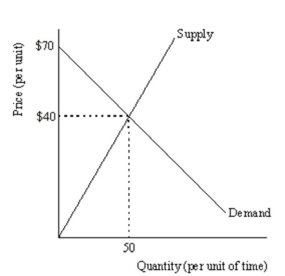

Use the diagram below to compute the dollar value of the consumer and producer surplus.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

14

Use the diagram below to compute the dollar value of the consumer and producer surplus.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

15

There are far more consumers of agricultural commodities than there are producers; but agricultural producers have consistently been able to get Congress to vote them subsidies at taxpayer expense and supply restrictions at the consumer's expense. How can the success of the agricultural lobby be explained by "the general rule of political economy"?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

16

Compute the dollar amount of the welfare loss from the imposition of the tax t in the diagram below.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

17

What are rent-seeking activities? Give an example.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

18

Define consumer surplus and producer surplus. Explain why the equilibrium price and quantity maximizes the sum of producer plus consumer surplus (the total surplus).

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

19

Demonstrate graphically and explain verbally the concept of producer surplus.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

20

Demonstrate graphically and explain verbally that the welfare loss of a tax on suppliers will be smaller the less elastic is demand.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

21

Demonstrate graphically and explain verbally how the problem of price controls differs in the short-run and the long run.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

22

Demonstrate graphically and explain verbally how a price ceiling may be viewed as essentially a tax and subsidy scheme.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

23

Demonstrate graphically and explain verbally how the size of a shortage created by a price ceiling is related to the elasticity of the supply and demand curves.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose the price elasticity of demand is 1.5 and the price elasticity of supply is 0.5, what is the percentage of a tax borne by the consumer, and what is the percentage of the same tax borne by the producer?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

25

When the Federal government reinstated a 10% excise tax on airline tickets, the industry wanted to pass on the full 10% ticket tax but was only able to boost fares by 4%.

(a) What can you conclude regarding the elasticity of demand for airline tickets?

(b) If you know that elasticity of demand is 2 and the elasticity of supply is 1, who bears the larger burden of the tax?

(c) Show the incidence of the tax graphically.

(a) What can you conclude regarding the elasticity of demand for airline tickets?

(b) If you know that elasticity of demand is 2 and the elasticity of supply is 1, who bears the larger burden of the tax?

(c) Show the incidence of the tax graphically.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

26

Demonstrate graphically and explain verbally how the size of a surplus created by a price floor is related to the elasticity of the supply and demand curves.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose the current equilibrium price of a good is $10, the elasticity of demand is 0, and the elasticity of supply is 2. If the government levies a $1 tax on the supplier, calculate the new equilibrium price and the percentage of the tax borne by both the demander and the supplier of the good.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose you are a seller of an item that is about to have a tax imposed upon it. Would you rather have the demand for your product be elastic or inelastic? Explain verbally and demonstrate graphically.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

29

Demonstrate graphically and explain verbally how the incentive to restrict supply (and rent-seeking activities) by suppliers is stronger the less elastic the demand.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

30

The United States currently imposes a tariff on imported sugar. How does the burden imposed on suppliers and consumers by this tariff relate to the relative elasticities for sugar? Explain. NOTE: Be sure to include supply and demand diagrams as part of your explanation and vary the elasticity of demand, keeping elasticity of supply constant.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

31

Demonstrate graphically and explain verbally how a price floor may be viewed as essentially a tax and subsidy scheme.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

32

Demonstrate graphically and explain verbally that the buyers bear the entire burden of a tax when demand is perfectly inelastic.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck