Deck 13: The Budget: the Politics of Taxing and Spending

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 13: The Budget: the Politics of Taxing and Spending

1

Questions 14 and 15 refer to the following image.

The U.S.Air Force unveiled its new stealth bomber in 1989. Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air Force

Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air Force

Financially,who benefits the most from the military-industrial complex?

A)Congress

B)the president

C)defense contractors

D)taxpayers -Consider This: Taxpayers may benefit from savings in some contracts,but they also may suffer a decrease in service quality.

The U.S.Air Force unveiled its new stealth bomber in 1989.

Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air Force

Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air ForceFinancially,who benefits the most from the military-industrial complex?

A)Congress

B)the president

C)defense contractors

D)taxpayers -Consider This: Taxpayers may benefit from savings in some contracts,but they also may suffer a decrease in service quality.

C

2

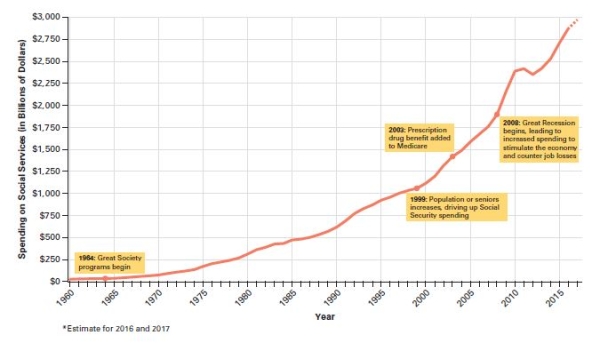

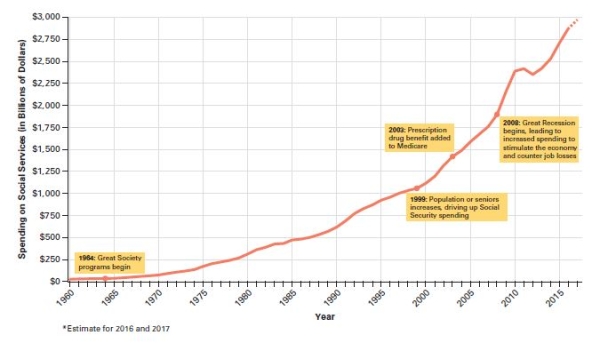

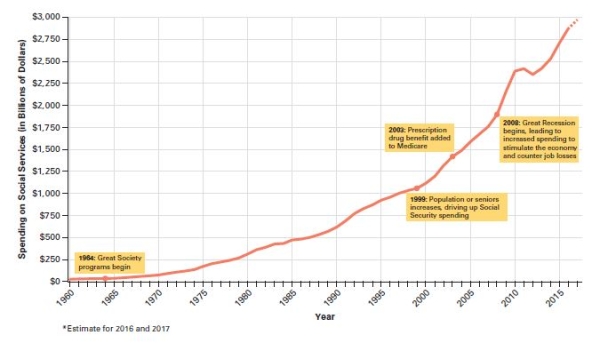

Trends in social service spending

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Table 3.1.

-In what sense is Social Security spending "uncontrollable"?

A)Congress determines how much it will spend for Social Security each year.

B)Social Security spending varies according to how much money is available in the Social Security Trust Fund.-Consider This: Social Security payments are automatic for anyone who qualifies,regardless of funding available.

C)Congress has enacted laws that make Social Security payments automatic for all those who are eligible.

D)Social Security requires funding from excise taxes that are unpredictable from year to year.

Congress has enacted laws that make Social Security payments automatic for all those who are eligible.

3

Questions 12 and 13 refer to the following image.  Credit: Perry van Munster/Alamy Stock Photo

Credit: Perry van Munster/Alamy Stock Photo

Why does Congress hold significant power over the federal budget?

A)It has 535 members representing each state.-Consider This: Congress does represent the people more closely than the president,but it is the power given Congress by the Constitution that makes it the most important factor in the government's financial decisions.

B)It has the power of the purse.

C)It receives reports from the Office of Management and Budget.

D)It considers all interest groups request for financing.

Credit: Perry van Munster/Alamy Stock Photo

Credit: Perry van Munster/Alamy Stock PhotoWhy does Congress hold significant power over the federal budget?

A)It has 535 members representing each state.-Consider This: Congress does represent the people more closely than the president,but it is the power given Congress by the Constitution that makes it the most important factor in the government's financial decisions.

B)It has the power of the purse.

C)It receives reports from the Office of Management and Budget.

D)It considers all interest groups request for financing.

D

4

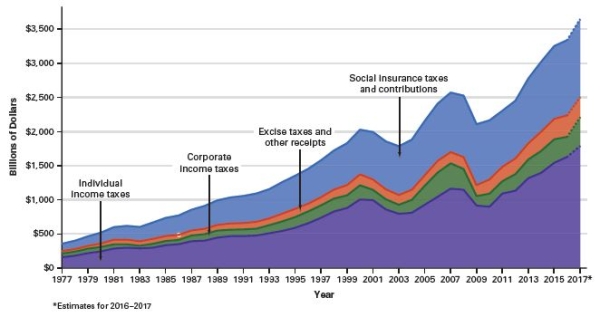

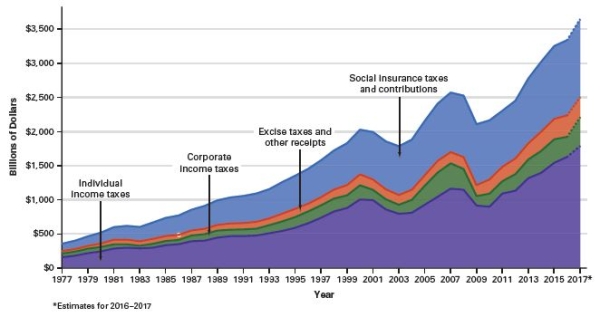

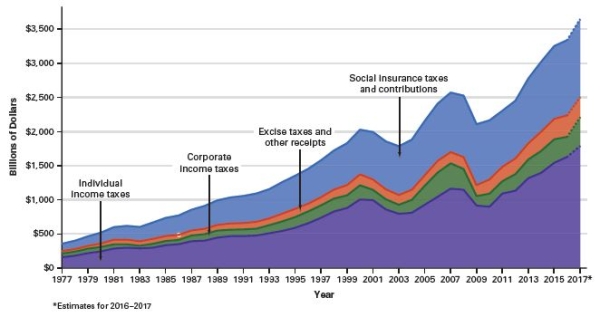

Questions 3 and 4 refer to the following graph.

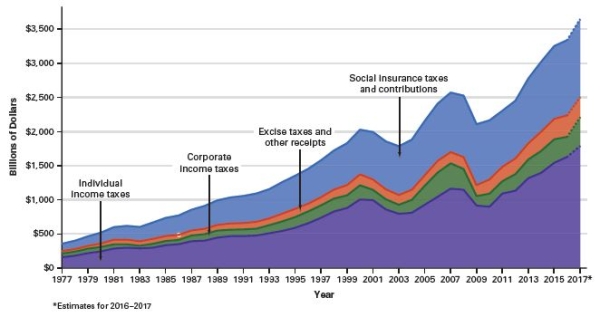

Federal Revenues

This is a stacked graph in which the difference between the lines indicates the revenues

raised by each tax. Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Government Printing Office,2016),Table 2.1.

Based on the graph,what was the largest source of federal revenue in 2017?

A)social insurance taxes -Consider This: These taxes are significant,but do not approach the amount brought in by individual income taxes.

B)excise taxes

C)corporate income taxes

D)individual income taxes

Federal Revenues

This is a stacked graph in which the difference between the lines indicates the revenues

raised by each tax.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Table 2.1.

Based on the graph,what was the largest source of federal revenue in 2017?

A)social insurance taxes -Consider This: These taxes are significant,but do not approach the amount brought in by individual income taxes.

B)excise taxes

C)corporate income taxes

D)individual income taxes

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

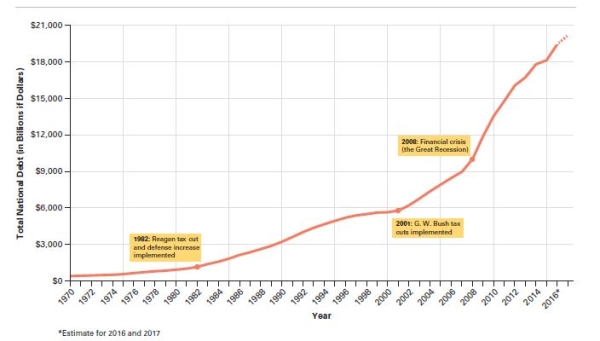

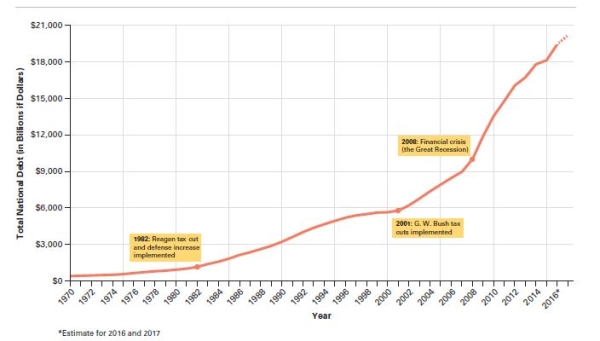

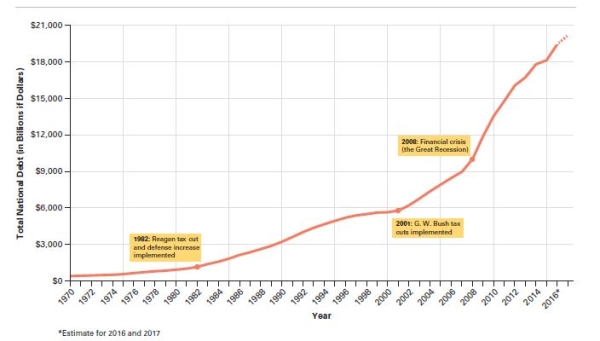

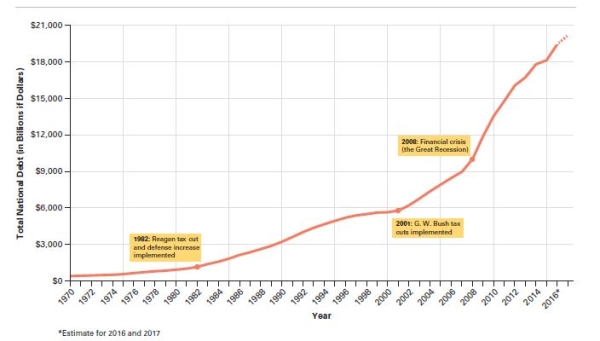

Total National Debt  Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,

D.C.: U.S.Government Printing Office,2016),Table 7.1.

-Which of the following statements about the national debt is true?

A)The national debt has grown steadily over the course of time.-Consider This: The national debt was steadier in the twentieth century than in the twenty first century.

B)The bulk of the national debt accumulated in the 1980s.

C)The national debt grew at a faster pace after the 2008 economic crisis.

D)Increased military spending is always associated with increased national debt.

Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Table 7.1.

-Which of the following statements about the national debt is true?

A)The national debt has grown steadily over the course of time.-Consider This: The national debt was steadier in the twentieth century than in the twenty first century.

B)The bulk of the national debt accumulated in the 1980s.

C)The national debt grew at a faster pace after the 2008 economic crisis.

D)Increased military spending is always associated with increased national debt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

Questions 14 and 15 refer to the following image.

The U.S.Air Force unveiled its new stealth bomber in 1989. Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air Force

Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air Force

What effect might the creation of planes such as the one pictured have on federal spending?

A)New technology led to large increases in the defense budget.

B)Federal spending decreased when the nation was better protected.

C)The government lowers social spending to make up for higher defense spending.-Consider This: Overall spending increases when one category increases; accommodations are not often made.

D)Salaries at the Pentagon decrease as technological costs rise.

The U.S.Air Force unveiled its new stealth bomber in 1989.

Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air Force

Credit: Staff Sgt.Jeremy M.Wilson/U.S.Air ForceWhat effect might the creation of planes such as the one pictured have on federal spending?

A)New technology led to large increases in the defense budget.

B)Federal spending decreased when the nation was better protected.

C)The government lowers social spending to make up for higher defense spending.-Consider This: Overall spending increases when one category increases; accommodations are not often made.

D)Salaries at the Pentagon decrease as technological costs rise.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

In which of the following years was Medicare added to the Social Security system?

A)1935

B)1965

C)1998 -Consider This: Medicare was added during the Johnson Presidency-not three decades later under President Clinton.

D)2001

A)1935

B)1965

C)1998 -Consider This: Medicare was added during the Johnson Presidency-not three decades later under President Clinton.

D)2001

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

Questions 5 and 6 refer to the following graph.

Total National Debt Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,

D.C.: U.S.Government Printing Office,2016),Table 7.1.

According to the graph,what was the approximate amount of the national debt in 2015?

A)$18 trillion

B)$3.7 trillion -Consider This: While this number is high,the actual national debt in 2015 was even higher.

C)$800 billion

D)$500 billion

Total National Debt

Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017 Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Table 7.1.

According to the graph,what was the approximate amount of the national debt in 2015?

A)$18 trillion

B)$3.7 trillion -Consider This: While this number is high,the actual national debt in 2015 was even higher.

C)$800 billion

D)$500 billion

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

In which of the following years were prescription drug benefits added to Medicare?

A)1965 -Consider This: While Medicare came into existence in 1965,prescription drugs were not added until the 21st Century.

B)1974

C)2003

D)2012

A)1965 -Consider This: While Medicare came into existence in 1965,prescription drugs were not added until the 21st Century.

B)1974

C)2003

D)2012

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

Questions 12 and 13 refer to the following image.  Credit: Perry van Munster/Alamy Stock Photo

Credit: Perry van Munster/Alamy Stock Photo

Which of the following situations might have contributed to the situation pictured?

A)The rising national debt led to severe cuts in government spending.-Consider This: Though the government might make cuts when the national debt is high,it would not shut down major agencies like the Parks Service.

B)The federal government shut down parks to preserve the environment.

C)The Office of Management and Budget neglected to give money to the parks.

D)Congress and the president could not compromise,leading to a shutdown.

Credit: Perry van Munster/Alamy Stock Photo

Credit: Perry van Munster/Alamy Stock PhotoWhich of the following situations might have contributed to the situation pictured?

A)The rising national debt led to severe cuts in government spending.-Consider This: Though the government might make cuts when the national debt is high,it would not shut down major agencies like the Parks Service.

B)The federal government shut down parks to preserve the environment.

C)The Office of Management and Budget neglected to give money to the parks.

D)Congress and the president could not compromise,leading to a shutdown.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

Federal Revenues

This is a stacked graph in which the difference between the lines indicates the revenues

raised by each tax. Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Government Printing Office,2016),Table 2.1.

-Income taxes are a major source of revenue for the U.S.government despite the fact that 43 percent of people filing income tax returns in 2013 paid no income tax at all because the income tax is __________.

A)regressive -Consider This: If the income tax was regressive,poor individuals would actually carry a greater burden than those with higher incomes.

B)progressive

C)proportional

D)flat

This is a stacked graph in which the difference between the lines indicates the revenues

raised by each tax.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Table 2.1.

-Income taxes are a major source of revenue for the U.S.government despite the fact that 43 percent of people filing income tax returns in 2013 paid no income tax at all because the income tax is __________.

A)regressive -Consider This: If the income tax was regressive,poor individuals would actually carry a greater burden than those with higher incomes.

B)progressive

C)proportional

D)flat

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

Which is the largest social policy of the federal government?

A)Social Security

B)drug rehabilitation

C)assistance for the poor -Consider This: Significant resources are devoted to assisting those in need,but another area is the largest social policy for the federal government.

D)food subsidies

A)Social Security

B)drug rehabilitation

C)assistance for the poor -Consider This: Significant resources are devoted to assisting those in need,but another area is the largest social policy for the federal government.

D)food subsidies

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

When must the president submit a budget by law?

A)the first Monday in February

B)the first Monday in September

C)the first Monday October -Consider This: The budget cycle ends in October,but begins during the winter.

D)the first Monday in November

A)the first Monday in February

B)the first Monday in September

C)the first Monday October -Consider This: The budget cycle ends in October,but begins during the winter.

D)the first Monday in November

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following budgetary process actors does the president oversee?

A)House and Ways Committee

B)Joint Committee on Taxation

C)Congressional Budget Office -Consider This: Rather than being overseen by the president,the CBO reports and responds to members of Congress and their committees.

D)Office of Management and Budget

A)House and Ways Committee

B)Joint Committee on Taxation

C)Congressional Budget Office -Consider This: Rather than being overseen by the president,the CBO reports and responds to members of Congress and their committees.

D)Office of Management and Budget

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

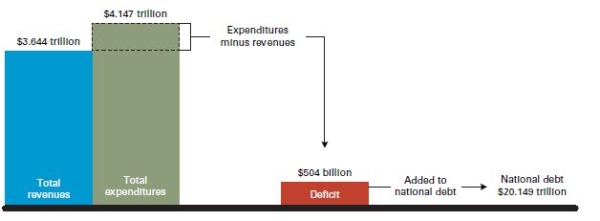

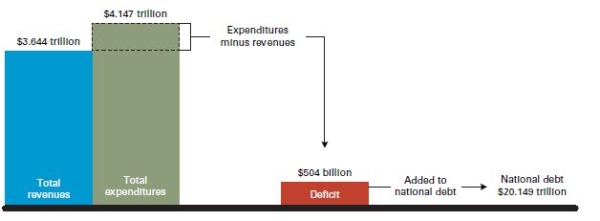

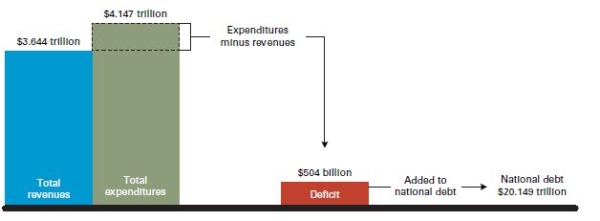

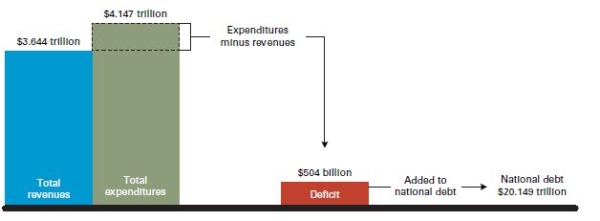

Questions 1 and 2 refer to the following graph.

The federal budget: An overview Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,

D.C.: U.S.Government Printing Office,2016),Tables 1.1 and 7.1.

Note: Data are estimates for fiscal year 2017.

Based on the graph,what is a budget deficit?

A)the amount the nation owes to other countries -Consider This: This is the national debt.Deficits can feed into this,but the two are not synonymous.

B)the difference when expenditures exceed revenues

C)the cost of social services the government offers

D)the money the government has left to spend at the end of the year

The federal budget: An overview

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Tables 1.1 and 7.1.

Note: Data are estimates for fiscal year 2017.

Based on the graph,what is a budget deficit?

A)the amount the nation owes to other countries -Consider This: This is the national debt.Deficits can feed into this,but the two are not synonymous.

B)the difference when expenditures exceed revenues

C)the cost of social services the government offers

D)the money the government has left to spend at the end of the year

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

What are tax expenditures?

A)yearly appropriations of funds by the president and Congress -Consider This: While these may seem like expenditures,in the language of government funding,these deal with specific types of losses.

B)revenue losses from special exemptions,exclusions,or deductions

C)the financial resources of the government

D)federal policies allocating tax burdens and benefits

A)yearly appropriations of funds by the president and Congress -Consider This: While these may seem like expenditures,in the language of government funding,these deal with specific types of losses.

B)revenue losses from special exemptions,exclusions,or deductions

C)the financial resources of the government

D)federal policies allocating tax burdens and benefits

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.”

--Amendment XVI, U.S. Constitution, 1913

-Which of the following pays the taxes permitted by this amendment?

A)federal and state governments

B)corporations and individuals

C)universities and churches -Consider This: Non-profit organizations are typically exempt from paying a variety of taxes.

D)all U.S.citizens

--Amendment XVI, U.S. Constitution, 1913

-Which of the following pays the taxes permitted by this amendment?

A)federal and state governments

B)corporations and individuals

C)universities and churches -Consider This: Non-profit organizations are typically exempt from paying a variety of taxes.

D)all U.S.citizens

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

Questions 10 and 11 refer to the following graph.

Trends in social service spending Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Government Printing Office,2016),Table 3.1.

Based on the graph,which of the following led to an increase in social services spending?

A)higher birthrates -Consider This: More births mean more contributors-eventually.Social services spending more often implies to the elderly and the sick.

B)rising life expectancy

C)increased social insurance taxes

D)the growing size of the working population

Trends in social service spending

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Table 3.1.

Based on the graph,which of the following led to an increase in social services spending?

A)higher birthrates -Consider This: More births mean more contributors-eventually.Social services spending more often implies to the elderly and the sick.

B)rising life expectancy

C)increased social insurance taxes

D)the growing size of the working population

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

The federal budget: An overview  Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,

D.C.: U.S.Government Printing Office,2016),Tables 1.1 and 7.1.

Note: Data are estimates for fiscal year 2017.

-When does a balanced budget occur?

A)appropriations are equal to authorizations

B)government spending is equal to the sum of all tax expenditures

C)the national debt is zero -Consider This: It is possible to actually borrow to ensure that there is no deficit or surplus.Over time,this will lead to a debt or to unhappy citizens,but it does work for a temporary stopgap measure.

D)there is no budget deficit

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,

Source: Budget of the United States Government,Fiscal Year 2017: Historical Tables (Washington,D.C.: U.S.Government Printing Office,2016),Tables 1.1 and 7.1.

Note: Data are estimates for fiscal year 2017.

-When does a balanced budget occur?

A)appropriations are equal to authorizations

B)government spending is equal to the sum of all tax expenditures

C)the national debt is zero -Consider This: It is possible to actually borrow to ensure that there is no deficit or surplus.Over time,this will lead to a debt or to unhappy citizens,but it does work for a temporary stopgap measure.

D)there is no budget deficit

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

“The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.”

--Amendment XVI, U.S. Constitution, 1913

-Which of the following statements about income taxes is most accurate?

A)Tax rates are fixed and remain the same in perpetuity.-Consider This: Tax rates have changed several times over the years,as Congress approves new tax bills.

B)The government should expect all people to pay taxes at the same rate.

C)Only the wealthy are expected to pay taxes in the U.S.

D)The government could not fund critical programs with a uniform tax rate.

--Amendment XVI, U.S. Constitution, 1913

-Which of the following statements about income taxes is most accurate?

A)Tax rates are fixed and remain the same in perpetuity.-Consider This: Tax rates have changed several times over the years,as Congress approves new tax bills.

B)The government should expect all people to pay taxes at the same rate.

C)Only the wealthy are expected to pay taxes in the U.S.

D)The government could not fund critical programs with a uniform tax rate.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

Which is an example of intragovernmental debt?

A)money borrowed from foreign governments -Consider This: Intragovernmental debt looks at transactions between domestic governments.Involving foreign governments adds external actors.

B)money the government has borrowed from Social Security revenue for general spending

C)money borrowed from private corporations that purchase government bonds

D)money borrowed from citizens who purchase government bonds

A)money borrowed from foreign governments -Consider This: Intragovernmental debt looks at transactions between domestic governments.Involving foreign governments adds external actors.

B)money the government has borrowed from Social Security revenue for general spending

C)money borrowed from private corporations that purchase government bonds

D)money borrowed from citizens who purchase government bonds

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following best supports Allan Meltzer and Scott Richard's argument that government grows in a democracy because of the equality of suffrage?

A)Working- and middle-class voters will support more generous Social Security and Medicare benefits.

B)Economically disadvantaged voters will support increased defense spending.-Consider This: According to Meltzer and Richard,the economically disadvantaged would vote for social programs that help them-not defense.

C)Wealthy voters will support progressive taxation.

D)Veterans will support reducing the influence of the military-industrial complex.

A)Working- and middle-class voters will support more generous Social Security and Medicare benefits.

B)Economically disadvantaged voters will support increased defense spending.-Consider This: According to Meltzer and Richard,the economically disadvantaged would vote for social programs that help them-not defense.

C)Wealthy voters will support progressive taxation.

D)Veterans will support reducing the influence of the military-industrial complex.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

23

What is incrementalism?

A)the tendency for budgets to increase modestly from year to year

B)income tax rates that increase in increments as income increases -Consider This: While incrementalism does focus on modest increases,it is not specific to income taxes.

C)congressional resolutions that prohibit spending increases except in times of emergency

D)the tendency for the national debt to increase in large increments every year

A)the tendency for budgets to increase modestly from year to year

B)income tax rates that increase in increments as income increases -Consider This: While incrementalism does focus on modest increases,it is not specific to income taxes.

C)congressional resolutions that prohibit spending increases except in times of emergency

D)the tendency for the national debt to increase in large increments every year

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following best describes the executive branch's role in the budget process before the Budget and Accounting Act of 1921?

A)The president proposed an executive budget to the secretary of the treasury.-Consider This: While the secretary of the treasury collected requests before 1921,the president did not get the first crack at setting spending levels and budgets.

B)Executive branch agencies sent budget requests to the secretary of the treasury.

C)The Office of Management and Budget proposed an executive budget to Congress.

D)The Government Accounting Office proposed an executive budget to Congress.

A)The president proposed an executive budget to the secretary of the treasury.-Consider This: While the secretary of the treasury collected requests before 1921,the president did not get the first crack at setting spending levels and budgets.

B)Executive branch agencies sent budget requests to the secretary of the treasury.

C)The Office of Management and Budget proposed an executive budget to Congress.

D)The Government Accounting Office proposed an executive budget to Congress.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following illustrates American citizens' usual attitude toward the budget?

A)Americans want to decrease taxes,decrease spending,and balance the budget.

B)Americans want to increase taxes,decrease spending,and balance the budget.

C)Americans want to keep taxes low,maintain or increase spending,and balance the budget.

D)Americans want to keep taxes low,decrease spending,and run a budget surplus.-Consider This: Despite wanting low taxers,most Americans still desire to see an increase in government spending.

A)Americans want to decrease taxes,decrease spending,and balance the budget.

B)Americans want to increase taxes,decrease spending,and balance the budget.

C)Americans want to keep taxes low,maintain or increase spending,and balance the budget.

D)Americans want to keep taxes low,decrease spending,and run a budget surplus.-Consider This: Despite wanting low taxers,most Americans still desire to see an increase in government spending.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

What was the average Social Security check for retired workers in 2016?

A)$121

B)$523

C)$1,341

D)$3,523 -Consider This: While retirees would like to receive this amount,they actually gain roughly a third of it currently.

A)$121

B)$523

C)$1,341

D)$3,523 -Consider This: While retirees would like to receive this amount,they actually gain roughly a third of it currently.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is a tax expenditure?

A)appropriations bills

B)authorization bills

C)lower tax rates for stock and real estate profits

D)estate taxes -Consider This: Estate taxes are actually tax revenues since money comes into government when they are applied.

A)appropriations bills

B)authorization bills

C)lower tax rates for stock and real estate profits

D)estate taxes -Consider This: Estate taxes are actually tax revenues since money comes into government when they are applied.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

Which is an act of Congress that establishes or changes a government program?

A)authorization bill

B)appropriations bill -Consider This: Appropriations bills involve funding programs,not the creation or alteration of existing programs.

C)continuing resolution

D)budget resolution

A)authorization bill

B)appropriations bill -Consider This: Appropriations bills involve funding programs,not the creation or alteration of existing programs.

C)continuing resolution

D)budget resolution

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is an accurate statement about the American Opportunity Credit and the Lifetime Learning Credit?

A)They are education credits you can deduct from your taxable income.-Consider This: While these are education credits,they do not alter your determined taxable income.Instead,they are applied through a different mechanism.

B)They are education credits you can subtract in full from your federal income tax.

C)They are credits earned through job training programs that can be applied toward degrees at any public university.

D)They are credits earned through life experiences that can be applied toward degrees at any public university.

A)They are education credits you can deduct from your taxable income.-Consider This: While these are education credits,they do not alter your determined taxable income.Instead,they are applied through a different mechanism.

B)They are education credits you can subtract in full from your federal income tax.

C)They are credits earned through job training programs that can be applied toward degrees at any public university.

D)They are credits earned through life experiences that can be applied toward degrees at any public university.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

With which of the following did the rise of the national security state begin?

A)the Civil War

B)World War I

C)the Cold War

D)the September 11,2001,terrorist attacks -Consider This: The September 11th attack would have led to a national security state-if it did no already exist from a previous conflict with the Soviet Union.

A)the Civil War

B)World War I

C)the Cold War

D)the September 11,2001,terrorist attacks -Consider This: The September 11th attack would have led to a national security state-if it did no already exist from a previous conflict with the Soviet Union.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

Which is an act of Congress that attempts to bind Congress to a total expenditure level for all programs in a given year?

A)authorization bill

B)appropriations bill -Consider This: Appropriations bills involve funding programs,not overall expenditure levels.

C)continuing resolution

D)budget resolution

A)authorization bill

B)appropriations bill -Consider This: Appropriations bills involve funding programs,not overall expenditure levels.

C)continuing resolution

D)budget resolution

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is an excise tax?

A)tax levied on corporate income

B)tax levied on personal income

C)tax levied on the consumption of a certain good

D)tax levied on the top 2 percent of income earners -Consider This: While this would cause income taxes to be even more progressive,it would not be an excise tax since it doesn't focus on consumption of goods.

A)tax levied on corporate income

B)tax levied on personal income

C)tax levied on the consumption of a certain good

D)tax levied on the top 2 percent of income earners -Consider This: While this would cause income taxes to be even more progressive,it would not be an excise tax since it doesn't focus on consumption of goods.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following most accurately describes the federal capital budget?

A)It is used to pay for Social Security.

B)It is used for infrastructure projects,such as roads and bridges.-Consider This: Capital budgets are used to pay for infrastructure projects,but the federal government handles these projects differently than state and local governments.

C)It is used to fund tax expenditures.

D)The federal government does not have a capital budget.

A)It is used to pay for Social Security.

B)It is used for infrastructure projects,such as roads and bridges.-Consider This: Capital budgets are used to pay for infrastructure projects,but the federal government handles these projects differently than state and local governments.

C)It is used to fund tax expenditures.

D)The federal government does not have a capital budget.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

Which is an act of Congress that funds programs established by authorization bills?

A)joint proclamation

B)appropriations bill

C)budget resolution -Consider This: Budget resolutions look at overall spending levels rather than authorizing the funding of specific programs.

D)omnibus bill

A)joint proclamation

B)appropriations bill

C)budget resolution -Consider This: Budget resolutions look at overall spending levels rather than authorizing the funding of specific programs.

D)omnibus bill

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

Which is a tax expenditure given primarily to college students?

A)American Opportunity Credit

B)private student loans -Consider This: Private transactions between lenders and borrowers do not count as tax expenditures.

C)private scholarships

D)research grants

A)American Opportunity Credit

B)private student loans -Consider This: Private transactions between lenders and borrowers do not count as tax expenditures.

C)private scholarships

D)research grants

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is a law that limits how much the federal government may borrow?

A)debt ceiling

B)capital budget

C)tax expenditure

D)budget resolution -Consider This: Budget resolutions may talk about spending and borrowing levels,but they do not explicitly include limitations on the ability for government to borrow.

A)debt ceiling

B)capital budget

C)tax expenditure

D)budget resolution -Consider This: Budget resolutions may talk about spending and borrowing levels,but they do not explicitly include limitations on the ability for government to borrow.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following investors hold the majority of the federal government's public debt?

A)foreign investors

B)citizen investors

C)corporate investors

D)financial institutions -Consider This: Banks hold parts of the federal debt,but non-Americans actually control much of the nation's public debt today.

A)foreign investors

B)citizen investors

C)corporate investors

D)financial institutions -Consider This: Banks hold parts of the federal debt,but non-Americans actually control much of the nation's public debt today.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

What is the national debt?

A)all of the money Congress has spent

B)all of the money the federal government has borrowed and has not yet repaid

C)the sum of all tax expenditures minus the sum of all tax receipts

D)the sum of all tax receipts minus the sum of all tax expenditures -Consider This: Receipts minus expenditures tells us about deficit levels but does not describe in any way the national debt.

A)all of the money Congress has spent

B)all of the money the federal government has borrowed and has not yet repaid

C)the sum of all tax expenditures minus the sum of all tax receipts

D)the sum of all tax receipts minus the sum of all tax expenditures -Consider This: Receipts minus expenditures tells us about deficit levels but does not describe in any way the national debt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

What is the largest tax expenditure in the United States?

A)deduction of mortgage interest on owner-occupied houses

B)deferral of income from controlled foreign corporations -Consider This: While this is a tax expenditure,the amount involved does not compare to other areas where taxpayers benefit.

C)exclusion of employer contributions to health care and insurance

D)exclusion for interest earned on state and local government bonds

A)deduction of mortgage interest on owner-occupied houses

B)deferral of income from controlled foreign corporations -Consider This: While this is a tax expenditure,the amount involved does not compare to other areas where taxpayers benefit.

C)exclusion of employer contributions to health care and insurance

D)exclusion for interest earned on state and local government bonds

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following reports directly to the president?

A)Government Accountability Office (GAO)-Consider This: While the GAO plays a critical role in the budget process,they are not an agency that directly reports to the president.It is strategically designed to be independent.

B)Appropriations Committees and subcommittees

C)Budget Committees and subcommittees

D)Office of Management and Budget (OMB)

A)Government Accountability Office (GAO)-Consider This: While the GAO plays a critical role in the budget process,they are not an agency that directly reports to the president.It is strategically designed to be independent.

B)Appropriations Committees and subcommittees

C)Budget Committees and subcommittees

D)Office of Management and Budget (OMB)

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is the role of the Government Accountability Office (GAO)?

A)to monitor what agencies do with their budgets

B)to make the budget for Congress [The GAO focuses its energy on checking to assure appropriated money is used-and used within the intended context.

C)to propose new bills to implement the president's agenda

D)to write tax codes based on yearly changes in law

A)to monitor what agencies do with their budgets

B)to make the budget for Congress [The GAO focuses its energy on checking to assure appropriated money is used-and used within the intended context.

C)to propose new bills to implement the president's agenda

D)to write tax codes based on yearly changes in law

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

How might democracy distort budgeting?

A)The income tax is a progressive tax.-Consider This: While the income tax is intentionally progressive,this does not necessarily distort budgeting since revenues remain the same-it just impacts who pays what percentage to meet the budget number.

B)Politicians spend public funds to win votes.

C)Funds are borrowed from foreign governments.

D)Congress approves taxes and appropriations.

A)The income tax is a progressive tax.-Consider This: While the income tax is intentionally progressive,this does not necessarily distort budgeting since revenues remain the same-it just impacts who pays what percentage to meet the budget number.

B)Politicians spend public funds to win votes.

C)Funds are borrowed from foreign governments.

D)Congress approves taxes and appropriations.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

43

Why did the United States keep a large permanent military after World War II?

A)Treaties would not allow an extensive demilitarization.

B)The large veteran population supported peacetime military service.

C)Defense contractors successfully lobbied for an increase in contracts.-Consider This: Defense contractors have a large say in current military operations,but this was not the case in the aftermath of World War II.

D)The Cold War began shortly after World War II ended.

A)Treaties would not allow an extensive demilitarization.

B)The large veteran population supported peacetime military service.

C)Defense contractors successfully lobbied for an increase in contracts.-Consider This: Defense contractors have a large say in current military operations,but this was not the case in the aftermath of World War II.

D)The Cold War began shortly after World War II ended.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following concerns did Congress passed the Budget and Accounting Act to alleviate?

A)retiring the debt from World War I

B)communist influence in the budget process

C)corporate funds going to political campaigns -Consider This: Funding of campaigns has been a more recent phenomenon.In 1921,the United States was still trying to recover from a successful military effort.

D)the viability of the Social Security program

A)retiring the debt from World War I

B)communist influence in the budget process

C)corporate funds going to political campaigns -Consider This: Funding of campaigns has been a more recent phenomenon.In 1921,the United States was still trying to recover from a successful military effort.

D)the viability of the Social Security program

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is the role of the Congressional Budget Office?

A)to monitor what agencies do with their budgets -Consider This: This would be under the purview of the Government Accountability Office.The CBO works more closely with Congress and its committees.

B)to write tax codes based on yearly changes in law

C)to propose new bills following the president's agenda

D)to advise Congress on consequences of its budget decisions

A)to monitor what agencies do with their budgets -Consider This: This would be under the purview of the Government Accountability Office.The CBO works more closely with Congress and its committees.

B)to write tax codes based on yearly changes in law

C)to propose new bills following the president's agenda

D)to advise Congress on consequences of its budget decisions

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

46

What does the federal government do when it is unable to cover its expenditures?

A)sells bonds

B)indexes taxes to the cost of living

C)changes the tax code -Consider This: Changing the tax code could work if citizens were asked to increase payments.Instead,the government has determined an appropriate channel is to sell bonds,which is easy to do given the low risk of default.

D)invests in pork projects

A)sells bonds

B)indexes taxes to the cost of living

C)changes the tax code -Consider This: Changing the tax code could work if citizens were asked to increase payments.Instead,the government has determined an appropriate channel is to sell bonds,which is easy to do given the low risk of default.

D)invests in pork projects

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following have resulted in policymaking in the United States that could be considered the "politics of scarcity"?

A)tax cuts

B)pork barrel projects

C)subsidies -Consider This: Instead of offering subsidies,recent changes have been more direct in eliminating the amount of tax that must be paid.

D)tax expenditures

A)tax cuts

B)pork barrel projects

C)subsidies -Consider This: Instead of offering subsidies,recent changes have been more direct in eliminating the amount of tax that must be paid.

D)tax expenditures

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck