Deck 6: Deductions and Losses: In General

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/156

Play

Full screen (f)

Deck 6: Deductions and Losses: In General

1

Isabella owns two business entities. She may be able to use the cash method for one and the accrual method for the other.

True

2

Generally, a closely-held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

False

3

Aaron, a shareholder-employee of Pigeon, Inc., receives a $300,000 salary. The IRS classifies $100,000 of this amount as unreasonable compensation. The effect of this reclassification is to decrease Aaron's gross income by $100,000 and increase Pigeon's gross income by $100,000.

False

4

The portion of a shareholder-employee's salary that is classified as unreasonable has no effect on the amount of a shareholder-employee's gross income, but results in an increase in the taxable income of the corporation.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

5

Mitch is in the 24% tax bracket. He may receive a different tax benefit for a $2,000 expenditure that is classified as a deduction from AGI than he will receive for a $2,000 expenditure that is classified as a deduction for AGI.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

6

Deductions are allowed unless a specific provision in the tax law provides otherwise.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

7

In 2018, unreimbursed employment related expenses are classified as deductions for AGI.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

8

Section 212 expenses that are related to rent and royalty income are deductions for AGI.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

9

Depending on the nature of the expenditure, expenses incurred in a trade or business may be deductible for or from AGI.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

10

Alice incurs qualified moving expenses of $12,000 in 2018. If she is not reimbursed by her employer, the deduction is classified as a deduction for AGI.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

11

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance and all events tests.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

12

The income of a sole proprietorship is reported on Schedule C (Profit or Loss from Business).

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

13

The Code does not specifically define what constitutes a trade or business.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

14

None of the prepaid rent paid on September 1 by a calendar year cash basis taxpayer for the next 18 months is deductible in the current period.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

15

Investment related expenses, such as paying a fee to an investment manager, generally are deductions from adjusted gross income in 2018.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

16

An expense need not be recurring in order to be "ordinary."

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

17

Only under limited circumstances can a loss on the sale of a personal use asset be deducted.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

18

A taxpayer's note or promise to pay satisfies the "actually paid" requirement for the cash basis method of accounting.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

19

Under the "twelve month rule" for the current period deduction of prepaid expenses of cash basis taxpayers, the asset must expire or be consumed by the end of the tax year following the year of payment.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

20

The cash method can always be used by a corporation even if inventory and cost of goods sold are a significant income producing factor in the business.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

21

The cost of legal advice associated with the preparation of an individual's Federal income tax return that is paid in 2018 is not deductible because it is a personal expense.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

22

Ordinary and necessary business expenses, other than cost of goods sold, of an illegal drug trafficking business do not reduce taxable income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

23

Legal expenses incurred in connection with rental property are deductions from AGI.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

24

Two-thirds of treble damage payments under the antitrust law are not deductible.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

25

All domestic bribes (i.e., to a U.S. official) are disallowed as deductions.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

26

Jacques, who is not a U.S. citizen, makes a contribution to the campaign of a candidate for governor. Cassie, a U.S. citizen, also makes a contribution to the same campaign fund. If contributions by noncitizens are illegal under state law, the contribution by Cassie is deductible, while that by Jacques is not.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

27

In determining whether an activity should be classified as a business or as a hobby, the satisfaction of the presumption (i.e., profit in at least 3 out of 5 years) ensures treatment as a business.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

28

The legal cost of having a will prepared is not deductible.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

29

For a taxpayer who is engaged in a trade or business, the cost of investigating a business in the same field is deductible only if the taxpayer acquires the business.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

30

The amount of the addition to the reserve for bad debts for an accrual method taxpayer is allowed as a deduction for tax purposes, but is not allowed for a cash method taxpayer.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

31

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense. If the same amount is paid to the CEO of IBM, only $1 million is deductible.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

32

A hobby activity results in all of the hobby income being included in AGI and no deductions being allowed for hobby related expenses.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

33

If a taxpayer operates an illegal business, no deductions are permitted.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

34

If a taxpayer can satisfy the three-out-of-five year presumption test associated with hobby losses, then expenses from the activity can be deducted in excess of the gross income from the activity.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

35

Investigation of a business unrelated to one's present business never results in a current period deduction of the entire amount if the amount of the investigation expenses exceeds $5,000.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

36

If property taxes and home mortgage interest expense are related to a hobby, the excess amount of these items over the hobby income cannot be deducted even if the taxpayer itemizes deductions.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

37

Susan is a sales representative for a U.S. weapons manufacturer. She makes a $100,000 "grease" payment to a U.S. government official associated with a weapons purchase by the U.S. Army. She makes a similar payment to a Saudi Arabian government official associated with a similar sale. Neither of these payments is deductible by Susan's employer.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

38

If an activity involves horses, a profit in at least two of seven consecutive years meets the presumptive rule of § 183.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

39

Fines and penalties paid for violations of the law (e.g., illegal dumping of hazardous waste) are deductible only if they relate to a trade or business.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

40

Legal fees incurred in connection with a criminal defense are not deductible even if the crime is associated with a trade or business.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

41

If a vacation home is rented for less than 15 days during a year, the only expenses that can be deducted are mortgage interest, property taxes, and personal casualty losses.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

42

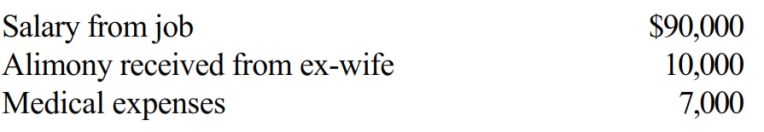

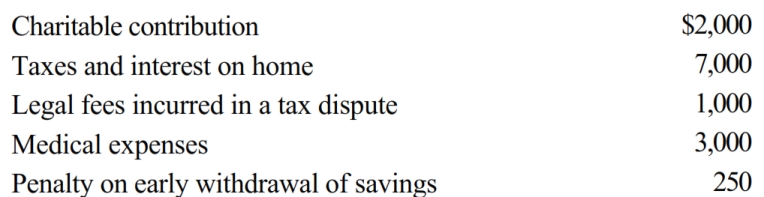

Sammy, a calendar year cash basis taxpayer who is age 66, has the following transactions in 2018:

Based on this information, Sammy has:

A) AGI of $90,000.

B) AGI of $95,000.

C) AGI of $99,500.

D) Deduction for medical expenses of $0.

E) None of the above.

Based on this information, Sammy has:

A) AGI of $90,000.

B) AGI of $95,000.

C) AGI of $99,500.

D) Deduction for medical expenses of $0.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

43

LD Partnership, a cash basis taxpayer, purchases land and a building for $200,000 with $150,000 of the cost being allocated to the building. The gross receipts of the partnership are less than $100,000. LD must capitalize the $50,000 paid for the land, but can deduct the $150,000 paid for the building in the current tax year.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

44

Marge sells land to her adult son, Jason, for its $20,000 appraised value. Her adjusted basis for the land is $25,000.

Marge's recognized loss is $5,000 and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 recognized gain of Marge).

Marge's recognized loss is $5,000 and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 recognized gain of Marge).

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

45

Martha rents part of her personal residence in the summer for 3 weeks for $3,000. Anne rents all of her personal residence for one week in December for $2,500. Anne is not required to include the $2,500 in her gross income whereas Martha is required to include the $3,000 in her gross income.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

46

Beulah's personal residence has an adjusted basis of $450,000 and a fair market value of $390,000. Beulah converts the property to rental use this year. The vacation home rules that limit the amount of the deduction to the rental income will apply and the adjusted basis for depreciation is $390,000.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

47

If a vacation home is classified as primarily rental use, a deduction for all of the rental expenses is allowed.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

48

If a vacation home is classified as primarily personal use, part of the maintenance and utility expenses can be allocated and deducted as a rental expense.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

49

Trade or business expenses of a self-employed taxpayer should be treated as:

A) Deductible for AGI on Schedule E.

B) A deduction from AGI.

C) Deductible for AGI on Schedule C.

D) An itemized deduction if not reimbursed.

E) None of the above.

A) Deductible for AGI on Schedule E.

B) A deduction from AGI.

C) Deductible for AGI on Schedule C.

D) An itemized deduction if not reimbursed.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

50

For purposes of the § 267 loss disallowance provision, a taxpayer's aunt is a related party.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

51

An advance payment received in June 2018 by an accrual basis and calendar year taxpayer for services to be provided over a 36-month period can be spread over four tax years.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

52

Walt wants to give his daughter $1,800 for Christmas. As an alternative, she suggests that he pay the property taxes on her residence. If Ralph pays the property taxes, he can deduct them.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

53

A vacation home at the beach which is rented for 200 days and used personally for 16 days is classified in the personal/rental use category.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

54

The portion of property tax on a vacation home that is attributable to personal use is an itemized deduction.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

55

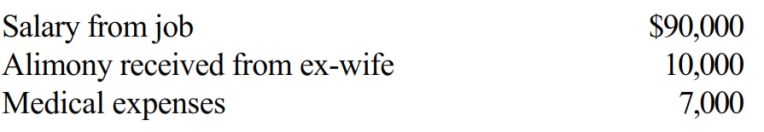

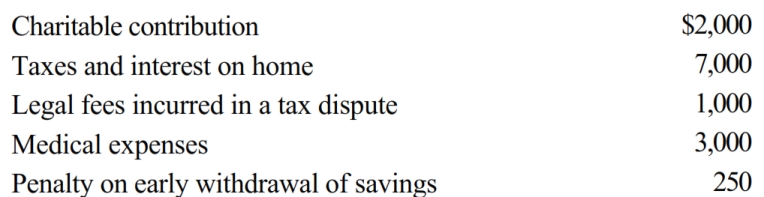

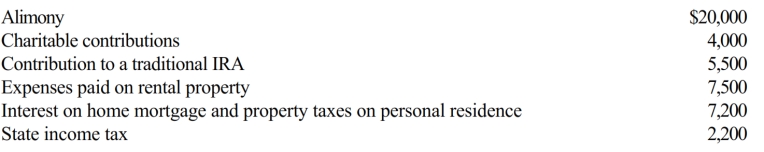

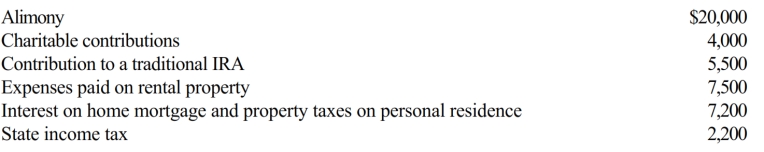

Marsha is single, had gross income of $50,000, and incurred the following expenses:

Her AGI is:

A) $39,750.

B) $49,750.

C) $40,000.

D) $39,750.

E) None of the above.

Her AGI is:

A) $39,750.

B) $49,750.

C) $40,000.

D) $39,750.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

56

Purchased goodwill must be capitalized, but can be amortized over a 60-month period.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

57

If a vacation home is a personal/rental residence, no maintenance and utility expenses can be claimed as a deduction.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

58

If a publicly-traded corporation hires a new CEO in 2018 and she earns $12,000,000 from a performance-based compensation plan, the corporation can deduct the entire $12,000,000.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

59

If a vacation home is classified as primarily personal use (i.e., rented for fewer than 15 days), none of the related expenses can be deducted.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

60

Al is single, age 60, and has gross income of $140,000. His deductible expenses are as follows:

What is Al's AGI?

A) $94,100.

B) $103,000.

C) $107,000.

D) $127,000.

E) None of the above.

What is Al's AGI?

A) $94,100.

B) $103,000.

C) $107,000.

D) $127,000.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is incorrect?

A) Alimony is a deduction for AGI.

B) The expenses associated with royalty property are a deduction from AGI.

C) Contributions to a traditional IRA are a deduction for AGI.

D) Property taxes on taxpayer's personal residence are a deduction from AGI

E) All of the above are correct.

A) Alimony is a deduction for AGI.

B) The expenses associated with royalty property are a deduction from AGI.

C) Contributions to a traditional IRA are a deduction for AGI.

D) Property taxes on taxpayer's personal residence are a deduction from AGI

E) All of the above are correct.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is a deduction for AGI?

A) Contribution to a traditional IRA.

B) Roof repairs to a personal use home.

C) Safe deposit box rental fee in which stock certificates are stored.

D) Property tax on personal residence.

E) All of the above.

A) Contribution to a traditional IRA.

B) Roof repairs to a personal use home.

C) Safe deposit box rental fee in which stock certificates are stored.

D) Property tax on personal residence.

E) All of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

63

Terry and Jim are both involved in operating illegal businesses. Terry operates a gambling business and Jim operates a drug running business. Both businesses have gross revenues of $500,000. The businesses incur the following expenses.

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following may be deductible in 2018?

A) Bribes that relate to a U.S. business.

B) Fines paid for violations of the law.

C) Interest on a loan used in a hobby.

D) All of the above.

E) None of the above.

A) Bribes that relate to a U.S. business.

B) Fines paid for violations of the law.

C) Interest on a loan used in a hobby.

D) All of the above.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

65

Benita incurred a business expense on December 10, 2018, which she charged on her bank credit card. She paid the credit card statement which included the charge on January 5, 2019. Which of the following is correct?

A) If Benita is a cash method taxpayer, she cannot deduct the expense until 2019.

B) If Benita is an accrual method taxpayer, she can deduct the expense in 2018.

C) If Benita uses the accrual method, she can choose to deduct the expense in either 2018 or 2019.

D) Only b. and c. are correct.

E) a., b., and c. are correct.

A) If Benita is a cash method taxpayer, she cannot deduct the expense until 2019.

B) If Benita is an accrual method taxpayer, she can deduct the expense in 2018.

C) If Benita uses the accrual method, she can choose to deduct the expense in either 2018 or 2019.

D) Only b. and c. are correct.

E) a., b., and c. are correct.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following are deductions for AGI?

A) Mortgage interest on a personal residence.

B) Property taxes on a personal residence.

C) Mortgage interest on a building used in a business.

D) Fines and penalties incurred in a trade or business.

E) None of the above.

A) Mortgage interest on a personal residence.

B) Property taxes on a personal residence.

C) Mortgage interest on a building used in a business.

D) Fines and penalties incurred in a trade or business.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

67

Andrew, who operates a laundry business, incurred the following expenses during the year.

? Parking ticket of $250 for one of his delivery vans that parked illegally.

? Parking ticket of $75 when he parked illegally while attending a rock concert in Tulsa.

? DUI ticket of $500 while returning from the rock concert.

? Attorney's fee of $600 associated with the DUI ticket.

What amount can Andrew deduct for these expenses?

A) $0.

B) $250.

C) $600.

D) $1,425.

E) None of the above.

? Parking ticket of $250 for one of his delivery vans that parked illegally.

? Parking ticket of $75 when he parked illegally while attending a rock concert in Tulsa.

? DUI ticket of $500 while returning from the rock concert.

? Attorney's fee of $600 associated with the DUI ticket.

What amount can Andrew deduct for these expenses?

A) $0.

B) $250.

C) $600.

D) $1,425.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following legal expenses are deductible for AGI in 2018?

A) Incurred in connection with a trade or business.

B) Incurred in connection with rental or royalty property held for the production of income.

C) Incurred for tax advice relative to the preparation of an individual's income tax return.

D) Only a. and b. qualify.

E) a., b., and c. qualify.

A) Incurred in connection with a trade or business.

B) Incurred in connection with rental or royalty property held for the production of income.

C) Incurred for tax advice relative to the preparation of an individual's income tax return.

D) Only a. and b. qualify.

E) a., b., and c. qualify.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

69

Payments by a cash basis taxpayer of capital expenditures:

A) Must be expensed at the time of payment.

B) Must be expensed by the end of the first year after the asset is acquired.

C) Must be deducted over the actual or statutory life of the asset.

D) Can be deducted in the year the taxpayer chooses.

E) None of the above.

A) Must be expensed at the time of payment.

B) Must be expensed by the end of the first year after the asset is acquired.

C) Must be deducted over the actual or statutory life of the asset.

D) Can be deducted in the year the taxpayer chooses.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

70

During 2017, the first year of operations, Silver, Inc., pays salaries of $175,000. At the end of the year, employees have earned salaries of $20,000, which are not paid by Silver until early in 2018. What is the amount of the deduction for salary expense?

A) If Silver uses the cash method, $175,000 in 2017 and $0 in 2018.

B) If Silver uses the cash method, $0 in 2017 and $195,000 in 2018.

C) If Silver uses the accrual method, $175,000 in 2017 and $20,000 in 2018.

D) If Silver uses the accrual method, $195,000 in 2017 and $0 in 2018.

E) None of the above is correct.

A) If Silver uses the cash method, $175,000 in 2017 and $0 in 2018.

B) If Silver uses the cash method, $0 in 2017 and $195,000 in 2018.

C) If Silver uses the accrual method, $175,000 in 2017 and $20,000 in 2018.

D) If Silver uses the accrual method, $195,000 in 2017 and $0 in 2018.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

71

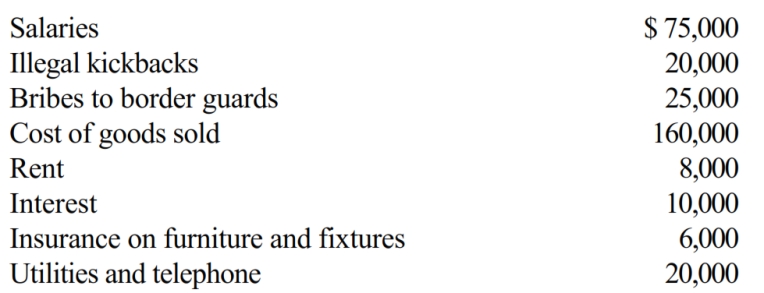

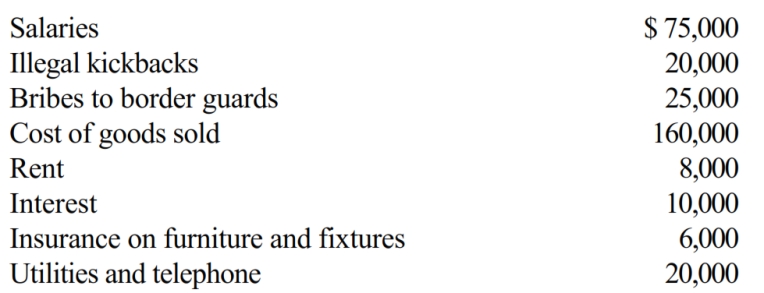

Tom operates an illegal drug-running operation and incurred the following expenses:

Which of the above amounts reduces his taxable income?

A) $0.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of the above.

Which of the above amounts reduces his taxable income?

A) $0.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

72

Paula is the sole shareholder of Violet, Inc. For 2018, she receives from Violet a salary of $300,000 and dividends of $100,000. Violet's taxable income for 2018 is $500,000. On audit, the IRS treats $100,000 of Paula's salary as unreasonable. Which of the following statements is correct?

A) Paula's gross income will increase by $100,000 as a result of the IRS adjustment.

B) Violet's taxable income will not be affected by the IRS adjustment.

C) Paula's gross income will decrease by $100,000 as a result of the IRS adjustment.

D) Violet's taxable income will decrease by $100,000 as a result of the IRS adjustment.

E) None of the above is correct.

A) Paula's gross income will increase by $100,000 as a result of the IRS adjustment.

B) Violet's taxable income will not be affected by the IRS adjustment.

C) Paula's gross income will decrease by $100,000 as a result of the IRS adjustment.

D) Violet's taxable income will decrease by $100,000 as a result of the IRS adjustment.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

73

Petal, Inc. is an accrual basis taxpayer. Petal uses the aging approach to calculate the reserve for bad debts. During 2018, the following occur associated with bad debts.

The amount of the deduction for bad debt expense for Petal for 2018 is:

A) $10,000.

B) $12,000.

C) $22,000.

D) $140,000.

E) None of the above.

The amount of the deduction for bad debt expense for Petal for 2018 is:

A) $10,000.

B) $12,000.

C) $22,000.

D) $140,000.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

74

Tommy, an automobile mechanic employed by an auto dealership, is considering opening a fast food franchise. If Tommy decides not to acquire the fast food franchise, any investigation expenses are:

A) A deduction for AGI.

B) A deduction from AGI, subject to the 2 percent floor.

C) A deduction from AGI, not subject to the 2 percent floor.

D) Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E) Not deductible.

A) A deduction for AGI.

B) A deduction from AGI, subject to the 2 percent floor.

C) A deduction from AGI, not subject to the 2 percent floor.

D) Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E) Not deductible.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is a required test for the deduction of a business expense?

A) Ordinary

B) Necessary

C) Reasonable

D) All of the above

E) None of the above

A) Ordinary

B) Necessary

C) Reasonable

D) All of the above

E) None of the above

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following can be claimed as a deduction for AGI?

A) Personal casualty losses.

B) Investment interest expenses.

C) Medical expenses.

D) Property taxes on personal use real estate.

E) None of the above.

A) Personal casualty losses.

B) Investment interest expenses.

C) Medical expenses.

D) Property taxes on personal use real estate.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is not a "trade or business" expense?

A) Interest on business indebtedness.

B) Property taxes on business property.

C) Parking ticket paid on business auto.

D) Depreciation on business property.

E) All of the above are "trade or business" expenses.

A) Interest on business indebtedness.

B) Property taxes on business property.

C) Parking ticket paid on business auto.

D) Depreciation on business property.

E) All of the above are "trade or business" expenses.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is correct?

A) A personal casualty loss incurred from a Presidentially declared disaster is classified as a deduction from AGI.

B) Real estate taxes on a taxpayer's personal residence are classified as deductions from AGI.

C) An expense associated with rental property is classified as a deduction for AGI.

D) Only a. and b. are correct.

E) a., b., and c., are correct.

A) A personal casualty loss incurred from a Presidentially declared disaster is classified as a deduction from AGI.

B) Real estate taxes on a taxpayer's personal residence are classified as deductions from AGI.

C) An expense associated with rental property is classified as a deduction for AGI.

D) Only a. and b. are correct.

E) a., b., and c., are correct.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

79

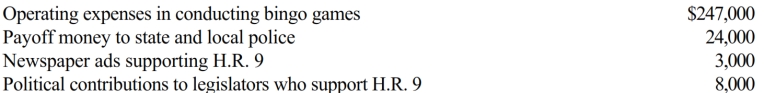

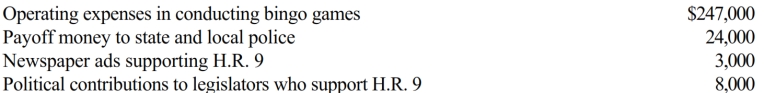

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2018, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2018, Rex had the following expenses:

Of these expenditures, Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Of these expenditures, Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck

80

For a president of a publicly held corporation hired in 2018, which of the following are not subject to the $1 million limit on executive compensation?

A) Contribution to medical insurance plan.

B) Contribution to pension plan.

C) Premiums on group term life insurance of $50,000.

D) Only b. and c. are not subject to the limit.

E) a., b., and c., are not subject to the limit.

A) Contribution to medical insurance plan.

B) Contribution to pension plan.

C) Premiums on group term life insurance of $50,000.

D) Only b. and c. are not subject to the limit.

E) a., b., and c., are not subject to the limit.

Unlock Deck

Unlock for access to all 156 flashcards in this deck.

Unlock Deck

k this deck