Deck 17: Corporations: Introduction and Operating Rules

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 17: Corporations: Introduction and Operating Rules

1

As a general rule, C corporations must use the cash method of accounting. However, under several exceptions to this rule (e.g., average annual gross receipts of $25 million or less for the most recent 3-year period), a C corporation can use the accrual method.

False

2

If a C corporation uses straight-line depreciation on real estate (§ 1250 property), no portion of a recognized gain on the sale of the property will be recaptured as ordinary income.

False

3

For tax years beginning before 2018, the corporate marginal income tax rates ranged from 15% to 39%, while the individual marginal income tax rates ranged from 10% to 39.6%.

True

4

Thrush Corporation, a calendar year C corporation, files it's 2018 Form 1120, which reports taxable income of $200,000 for the year. The corporation's tax is $61,250.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

The passive loss rules apply to closely held C corporations and to personal service corporations but not to Scorporations.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

A personal service corporation must use a calendar year, and is not permitted to use a fiscal year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

Albatross, a C corporation, had $140,000 net income from operations and a $25,000 short-term capital loss in the current year. Albatross Corporation's taxable income is $140,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

Because of the taxable income limitation, no dividends received deduction is allowed if a corporation has an NOL for the current taxable year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

In the current year, Oriole Corporation donated a painting worth $30,000 to the Texas Art Museum, a qualified public charity. The museum included the painting in its permanent collection. Oriole Corporation purchased the painting five years ago for $10,000. Oriole's charitable contribution deduction is $30,000 (ignoring the taxable income limitation).

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

Employment taxes apply to all entity forms of operating a business. As a result, employment taxes are a neutral factor in selecting the most tax effective form of operating a business.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

Peach Corporation had $210,000 of net active income, $45,000 of portfolio income, and a $230,000 passive loss during the current year. If Peach is a closely held C corporation that is not a PSC, it can deduct $210,000 of the passive loss in the year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

Heron Corporation, a calendar year C corporation, had an excess charitable contribution for 2017 of $5,000. In 2018, Heron made a further charitable contribution of $20,000. Heron's 2018 deduction is limited to $15,000 (10% of taxable income). The 2018 contribution must be applied first against the $15,000 limitation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

In the current year, Azul Corporation, a calendar year C corporation, received a dividend of $30,000 from Naranja Corporation. Azul owns 25% of the Naranja Corporation stock. Assuming it is not subject to the taxable income limitation, Azul's dividends received deduction is $19,500.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

The $1 million limitation on the deduction of executive compensation applies to compensation paid to a publicly traded corporation's principal executive officer, principal financial officer, and Board of Directors.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

In the current year, Crow Corporation, a C corporation, donated scientific property (basis of $30,000, fair market value of $50,000) to State University, a qualified charitable organization, to be used in research. Crow had held the property for four months as inventory. Crow Corporation may deduct $50,000 for the charitable contribution (ignoring the taxable income limitation).

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

Under the "check-the-box" Regulations, a two-owner LLC that fails to elect to be to treated as a corporation will be taxed as a sole proprietorship.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

Azure Corporation, a C corporation, had a long-term capital gain of $50,000 in the current year. The maximum amount of tax applicable to the capital gain is $7,500 ($50,000 × 15%).

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

A corporate net operating loss arising in 2018 for a calendar year C corporation can be carried back 2 years and forward 20 years to offset taxable income for those years.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

On December 20, 2018, the directors of Quail Corporation (an accrual basis, calendar year taxpayer) authorized a cash donation of $5,000 to the American Cancer Society, a qualified charity. The payment, which is made on April 11, 2019, may be claimed as a deduction for tax year 2018.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

On December 31, 2018, Lavender, Inc., an accrual basis C corporation, accrues a $50,000 bonus to Barry, its vice president and a 40% shareholder. Lavender pays the bonus to Barry, who is a cash basis taxpayer, on March 14, 2019. Lavender can deduct the bonus in 2019, the year in which it is included in Barry's gross income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

The accumulated earnings and personal holding company taxes are designed to prevent the accumulation of earnings within a corporation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

A calendar year C corporation can receive an automatic 9-month extension to file its corporate return (Form 1120) by timely filing a Form 7004 for the tax year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

On December 31, 2018, Flamingo, Inc., a calendar year, accrual method C corporation, accrues a bonus of $50,000 to its president (a cash basis taxpayer), who owns 75% of the corporation's outstanding stock. The $50,000 bonus is paid to the president on February 4, 2019. For Flamingo's 2018 Form 1120, the $50,000 bonus will be a subtraction item on Schedule M-1.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

Schedule M-1 is used to reconcile net income as computed for financial accounting purposes with taxable income reported on the corporation's income tax return.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

No dividends received deduction is allowed unless the corporation has held the stock for more than 90 days.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

Income that is included in net income per books but not included in taxable income is a subtraction item on Schedule M-1.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

The limitation on the deduction of business interest does not apply to noncorporate taxpayers.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

Lilac Corporation incurred $4,700 of legal and accounting fees associated with its incorporation. The $4,700 is deductible as startup expenditures on Lilac's tax return for the year in which it begins business.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

Katherine, the sole shareholder of Penguin Corporation, has the corporation pay her a salary of $300,000 in the current year. The Tax Court has held that $90,000 represents unreasonable compensation. Katherine has avoided double taxation only to the extent of $210,000 (the portion of the salary that is considered reasonable compensation).

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

For purposes of the estimated tax payment rules, a "large corporation" is defined as a corporation that had taxable income of $1 million or more in any of the three preceding years.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

Canary Corporation, a calendar year C corporation, received an $80,000 dividend from Stork Corporation. Canary owns 18% of the Stork Corporation stock. Assuming it is not subject to the taxable income limitation, Canary's dividends received deduction is $40,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

Schedule M-3 is similar to Schedule M-1 in that the form is designed to reconcile net income per books with taxable income. However, an objective of Schedule M-3 is more transparency between financial statements and tax returns than that provided by Schedule M-1.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

An expense that is deducted in computing net income per books but not deductible in computing taxable income is a subtraction item on Schedule M-1.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

The accumulated earnings and personal holding company taxes both can be avoided by distributing sufficient dividends.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

A corporation with $5 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

Schedule M-2 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

Hornbill Corporation, a cash basis and calendar year C corporation, was formed and began operations on May 1, 2018. Hornbill incurred the following expenses during its first year of operations (May 1 - December 31, 2018): temporary directors meeting expenses of $10,500, state of incorporation fee of $5,000, stock certificate printing expenses of $1,200, and legal fees for drafting corporate charter and bylaws of $7,500. Hornbill Corporation's 2018 deduction for organizational expenditures is $5,800.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

A corporation must file a Federal income tax return even if it has no taxable income for the year.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

A calendar year personal service corporation with taxable income of $100,000 in the current year will have a tax liability of $21,000.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

In general, all corporations that maintain inventory for sale to customers are required to use the accrual method of accounting for all income and expense items.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

Grebe Corporation, a closely held corporation that is not a PSC, had $75,000 of net active income, $60,000 of portfolio income, and a $105,000 passive activity loss during the year. How much of the passive activity loss can Grebe deduct in the current year?

A) $0

B) $60,000

C) $105,000

D) $135,000

E) None of the above

A) $0

B) $60,000

C) $105,000

D) $135,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

During the current year, Woodchuck, Inc., a closely held personal service corporation, has $115,000 of net active income, $40,000 of portfolio income, and $135,000 of passive activity loss. What is Woodchuck's taxable income for the current year?

A) $0

B) $20,000

C) $40,000

D) $155,000

E) None of the above

A) $0

B) $20,000

C) $40,000

D) $155,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

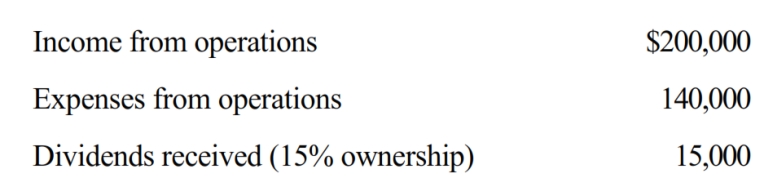

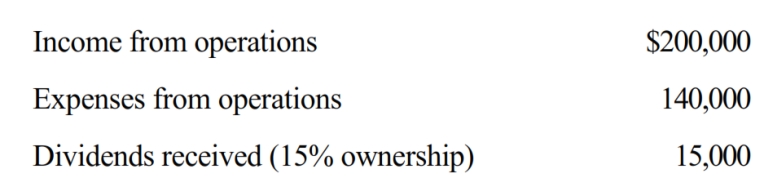

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000

B) $7,500

C) $6,750

D) $6,525

E) None of the above

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.A) $9,000

B) $7,500

C) $6,750

D) $6,525

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

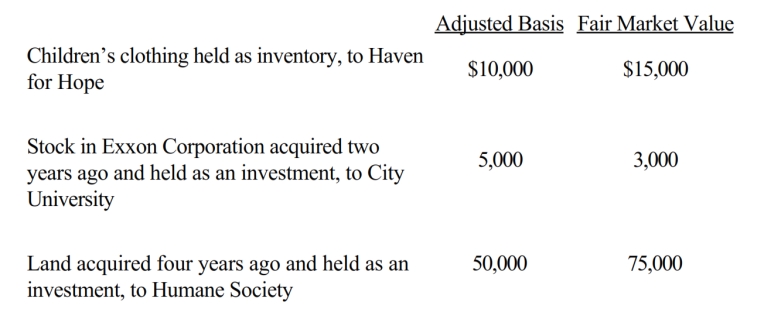

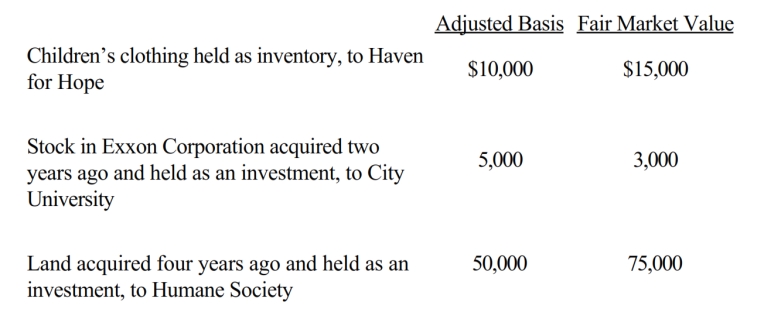

During the current year, Owl Corporation (a C corporation), a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

Canary Corporation, which sustained a $5,000 net short-term capital loss during the year, will enter $5,000 as an addition on Schedule M-1 of Form 1120.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

On December 31, 2018, Peregrine Corporation, an accrual method, calendar year taxpayer, accrued a performance bonus of $100,000 to Charles, a cash basis, calendar year taxpayer. Charles is president and sole shareholder of the corporation. When can Peregrine deduct the bonus?

A) In 2018, if the bonus was authorized by the Board of Directors and payment was made on or before April 15, 2019.

B) In 2019, if payment was made at any time during that year.

C) In 2018, if payment was made on or before April 15, 2019.

D) In 2019, but only if payment was made on or before April 15, 2019.

E) None of the above.

A) In 2018, if the bonus was authorized by the Board of Directors and payment was made on or before April 15, 2019.

B) In 2019, if payment was made at any time during that year.

C) In 2018, if payment was made on or before April 15, 2019.

D) In 2019, but only if payment was made on or before April 15, 2019.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

In the current year, Plum Corporation, a computer manufacturer, donated 100 laptop computers to a local university (a qualified educational organization). The computers were constructed by Plum earlier this year, and the university will use the computers for research and research training. Plum's basis in the computers is $35,000, and their fair market value is $120,000. What is Plum's deduction for the contribution of the computers (ignoring the taxable income limitation)?

A) $35,000

B) $70,000

C) $77,500

D) $85,000

E) $120,000

A) $35,000

B) $70,000

C) $77,500

D) $85,000

E) $120,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

In tax planning for charitable contributions, a current year's contribution might have to be deferred to a later year in order to deduct a contribution carryover amount.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

Grackle Corporation, a personal service corporation, had $230,000 of net active income, $40,000 of portfolio income, and a $250,000 passive activity loss during the year. How much is Grackle's taxable income?

A) $20,000

B) $40,000

C) $270,000

D) $520,000

E) None of the above

A) $20,000

B) $40,000

C) $270,000

D) $520,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

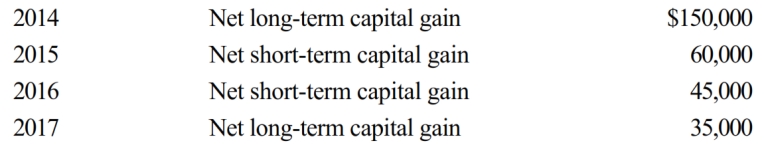

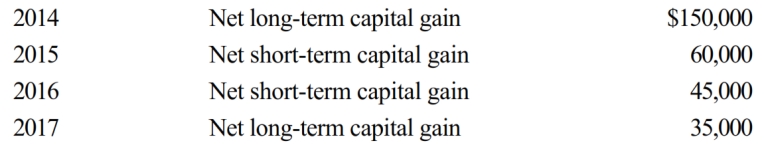

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2018. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2019.

Compute the amount of Carrot's capital loss carryover to 2019.

A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Compute the amount of Carrot's capital loss carryover to 2019.

Compute the amount of Carrot's capital loss carryover to 2019.A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

In 2018, Bluebird Corporation had net income from operations of $100,000. Further, Bluebird recognized a long-term capital gain of $30,000, and a short-term capital loss of $45,000. Which of the following statements is correct?

A) Bluebird Corporation will have taxable income in 2018 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years.

B) Bluebird Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a short-term capital loss.

C) Bluebird Corporation may deduct $33,000 of the capital loss in 2018 and may carry forward the remainder of the capital loss indefinitely to offset capital gains.

D) Bluebird Corporation will have taxable income in 2018 of $85,000.

E) None of the above.

A) Bluebird Corporation will have taxable income in 2018 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years.

B) Bluebird Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a short-term capital loss.

C) Bluebird Corporation may deduct $33,000 of the capital loss in 2018 and may carry forward the remainder of the capital loss indefinitely to offset capital gains.

D) Bluebird Corporation will have taxable income in 2018 of $85,000.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

Wanda is the Chief Executive Officer of Pink corporation, a publicly traded, calendar year corporation. For the current year, Wanda's compensation package consists of: Cash compensation $2.5 million

Nontaxable fringe benefits 250,000

Taxable fringe benefits 150,000

Bonus tied to company performance 2 million

How much of Wanda's compensation is deductible by Pink Corporation?

A) $1,000,000.

B) $1,250,000.

C) $3,250,000.

D) $4,900,000.

E) None of the above.

Nontaxable fringe benefits 250,000

Taxable fringe benefits 150,000

Bonus tied to company performance 2 million

How much of Wanda's compensation is deductible by Pink Corporation?

A) $1,000,000.

B) $1,250,000.

C) $3,250,000.

D) $4,900,000.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

Copper Corporation, a C corporation, had gross receipts of $25 million in 2015, $26 million in 2016, and $23 million in 2017. Gold Corporation, a personal service corporation (PSC), had gross receipts of $24 million in 2015, $27 million in 2016, and $25 million in 2017. Which of the corporations will be allowed to use the cash method of accounting in 2018?

A) Copper Corporation only.

B) Gold Corporation only.

C) Both Copper Corporation and Gold Corporation.

D) Neither Copper Corporation nor Gold Corporation.

E) None of the above.

A) Copper Corporation only.

B) Gold Corporation only.

C) Both Copper Corporation and Gold Corporation.

D) Neither Copper Corporation nor Gold Corporation.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

Ivory Corporation, a calendar year, accrual method C corporation, has two cash method, calendar year shareholders who are unrelated to each other. Craig owns 35% of the stock, and Oscar owns the remaining 65%. During 2018, Ivory paid a salary of $100,000 to each shareholder. On December 31, 2018, Ivory accrued a bonus of $25,000 to each shareholder. Assuming that the bonuses are paid to the shareholders on February 1, 2019, compute Ivory Corporation's 2018 deduction for the above amounts.

A) $250,000

B) $225,000

C) $200,000

D) $125,000

E) None of above

A) $250,000

B) $225,000

C) $200,000

D) $125,000

E) None of above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

Elk, a C corporation, has $370,000 operating income and $290,000 operating expenses during the current year. In addition, Elk has a $10,000 long-term capital gain and a $17,000 short-term capital loss. Elk's taxable income is:

A) $63,000.

B) $73,000.

C) $80,000.

D) $90,000.

E) None of the above.

A) $63,000.

B) $73,000.

C) $80,000.

D) $90,000.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

In the current year, Sunset Corporation (a C corporation) had operating income of $200,000 and operating expenses of $175,000. In addition, Sunset had a $30,000 long-term capital gain, a $52,000 short-term capital loss, and $5,000 tax-exempt interest income. What is Sunset Corporation's taxable income for the year?

A) $0

B) $3,000

C) $22,000

D) $30,000

E) None of the above

A) $0

B) $3,000

C) $22,000

D) $30,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

Saleh, an accountant, is the sole shareholder of Turquoise Corporation, a C corporation. Turquoise is a personal service corporation with a fiscal year ending September 30 (pursuant to a § 444 election). The corporation paid Saleh a salary of $330,000 during its fiscal year ending September 30, 2018. How much salary must Turquoise pay Saleh during the period October 1 through December 31, 2018, if the corporation is to continue to use its fiscal year without negative tax effects?

A) $0

B) $27,500

C) $82,500

D) $247,500

E) None of the above

A) $0

B) $27,500

C) $82,500

D) $247,500

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

Beige Corporation, a C corporation, purchases a warehouse on August 1, 2002, for $1 million. Straight-line depreciation is taken in the amount of $411,750 before the property is sold on June 12, 2018, for $1.2 million. What is the amount and character of the gain recognized by Beige on the sale of the realty?

A) Ordinary income of $0 and § 1231 gain of $611,750.

B) Ordinary income of $411,750 and § 1231 gain of $200,000.

C) Ordinary income of $82,350 and § 1231 gain of $529,400.

D) Ordinary income of $117,650 and § 1231 gain of $494,100.

E) None of the above.

A) Ordinary income of $0 and § 1231 gain of $611,750.

B) Ordinary income of $411,750 and § 1231 gain of $200,000.

C) Ordinary income of $82,350 and § 1231 gain of $529,400.

D) Ordinary income of $117,650 and § 1231 gain of $494,100.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

Patrick, an attorney, is the sole shareholder of Gander Corporation, a C corporation. Gander is a personal service corporation with a fiscal year ending November 30 (pursuant to a § 444 election). The corporation paid Patrick a salary of $180,000 during its fiscal year ending November 30, 2018. How much salary must Gander pay Patrick during the period December 1 through December 31, 2018, to permit the corporation to continue to use its fiscal year without negative tax effects?

A) $0

B) $30,000

C) $165,000

D) $180,000

E) None of the above

A) $0

B) $30,000

C) $165,000

D) $180,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

During the current year, Violet, Inc., a closely held corporation (not a PSC), has $55,000 of passive activity loss, $80,000 of net active income, and $20,000 of portfolio income. How much is Violet's taxable income for the current year?

A) $20,000

B) $45,000

C) $80,000

D) $100,000

E) None of the above

A) $20,000

B) $45,000

C) $80,000

D) $100,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is incorrect regarding the taxation of C corporations for tax years beginning after 2017?

A) NOLs are subject to a 2 year carryback and 20 year carryforward period.

B) Taxable income of a personal service corporation is taxed at a flat rate of 21%.

C) A tax return must be filed whether or not the corporation has taxable income.

D) The alternative minimum tax does not apply.

E) None of the above.

A) NOLs are subject to a 2 year carryback and 20 year carryforward period.

B) Taxable income of a personal service corporation is taxed at a flat rate of 21%.

C) A tax return must be filed whether or not the corporation has taxable income.

D) The alternative minimum tax does not apply.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is incorrect regarding the dividends received deduction?

A) A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B) The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C) If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D) The taxable income limitation does not apply if the normal deduction (i.e., 50% or 65% of dividends) results in a net operating loss for the corporation.

E) None of the above.

A) A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B) The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C) If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D) The taxable income limitation does not apply if the normal deduction (i.e., 50% or 65% of dividends) results in a net operating loss for the corporation.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

In the current year, Red Corporation (a calendar year C corporation), which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of $40,000. Red takes a dividends received deduction of $20,000. Which of the following statements is correct?

A) Red owns 80% of Blue Corporation.

B) Red owns 20% or more, but less than 80% of Blue Corporation.

C) Red owns 80% or more of Blue Corporation.

D) Red owns less than 20% of Blue Corporation.

E) None of the above.

A) Red owns 80% of Blue Corporation.

B) Red owns 20% or more, but less than 80% of Blue Corporation.

C) Red owns 80% or more of Blue Corporation.

D) Red owns less than 20% of Blue Corporation.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

During the current year, Jay Corporation, a calendar year personal service C corporation, had operating income of income of $300,000, operating expenses of $200,000, a short-term capital gain of $5,000, and a long-term capital loss of $35,000. How much is Jay's income tax liability for the year?

A) $14,700.

B) $21,000.

C) $22,250.

D) $35,000.

E) None of the above.

A) $14,700.

B) $21,000.

C) $22,250.

D) $35,000.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

Luis is the sole shareholder of a regular C corporation, and Eduardo owns a proprietorship. In the current year, both businesses make a profit of $80,000 and each owner withdraws $50,000 from his business. With respect to this information, which of the following statements is incorrect?

A) Eduardo must report $80,000 of income on his return.

B) Luis must report $80,000 of income on his return.

C) Eduardo's proprietorship is not required to pay income tax on $80,000.

D) Luis's corporation must pay income tax on $80,000.

E) None of the above.

A) Eduardo must report $80,000 of income on his return.

B) Luis must report $80,000 of income on his return.

C) Eduardo's proprietorship is not required to pay income tax on $80,000.

D) Luis's corporation must pay income tax on $80,000.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

Eagle Corporation, a calendar year C corporation, owns stock in Hawk Corporation and has taxable income of $100,000 for the year before considering the dividends received deduction. In the current year, Hawk Corporation pays Eagle a dividend of $130,000, which was considered in calculating the $100,000. What amount of dividends received deduction may Eagle claim if it owns 15% of Hawk's stock?

A) $0

B) $50,000

C) $65,000

D) $84,500

E) None of the above

A) $0

B) $50,000

C) $65,000

D) $84,500

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

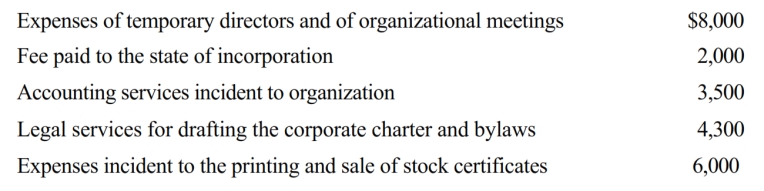

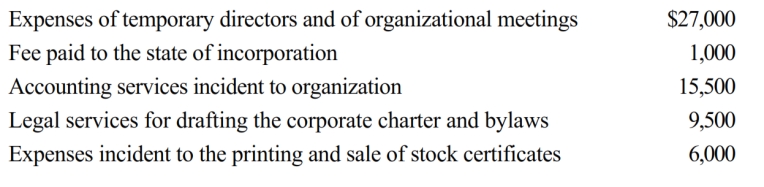

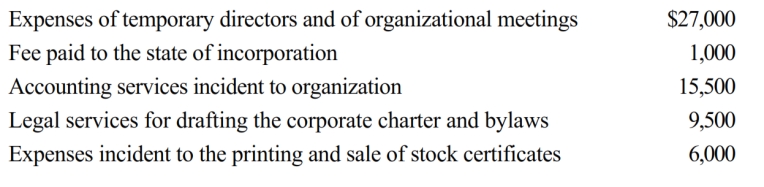

Opal Corporation, an accrual method, calendar year taxpayer, was formed and began operations on July 1, 2018. The following expenses were incurred during the first tax year (July 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

A) $593.

B) $460.

C) $5,427.

D) $5,627.

E) None of the above.

Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?A) $593.

B) $460.

C) $5,427.

D) $5,627.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

Rodney, the sole shareholder of Orange Corporation, an accrual method, calendar year corporation, loaned the corporation a substantial amount of money on January 1, 2018. Orange Corporation accrued $45,000 of interest expense on the loan on December 31, 2018. Orange pays the interest to Rodney, a cash basis taxpayer, on January 1, 2019. Based on these facts:

A) Orange Corporation will be allowed to deduct the interest expense in 2018 and Rodney will be required to report the interest income in 2019.

B) Orange Corporation will be allowed to deduct the interest expense in 2019 and Rodney will be required to report the interest income in 2018.

C) Orange Corporation will be allowed to deduct the interest expense in 2018and Rodney will be required to report the interest income in 2018.

D) Orange Corporation will be allowed to deduct the interest expense in 2019 and Rodney will be required to report the interest income in 2019.

E) None of the above.

A) Orange Corporation will be allowed to deduct the interest expense in 2018 and Rodney will be required to report the interest income in 2019.

B) Orange Corporation will be allowed to deduct the interest expense in 2019 and Rodney will be required to report the interest income in 2018.

C) Orange Corporation will be allowed to deduct the interest expense in 2018and Rodney will be required to report the interest income in 2018.

D) Orange Corporation will be allowed to deduct the interest expense in 2019 and Rodney will be required to report the interest income in 2019.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income. Which of the following items is a subtraction on Schedule M-1?

A) Book depreciation in excess of tax depreciation.

B) Excess of capital losses over capital gains.

C) Proceeds on key employee life insurance.

D) Income subject to tax but not recorded on the books.

E) None of the above.

A) Book depreciation in excess of tax depreciation.

B) Excess of capital losses over capital gains.

C) Proceeds on key employee life insurance.

D) Income subject to tax but not recorded on the books.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Nancy Smith is the sole shareholder and employee of White Corporation, a calendar year C corporation that is engaged exclusively in accounting services. During the current year, White has operating income of $320,000 and operating expenses (excluding salary) of $150,000. Further, White Corporation pays Nancy a salary of $100,000. The salary is reasonable in amount and Nancy is in the 32% marginal tax bracket irrespective of any income from White. Assuming that White Corporation distributes all after-tax income as dividends, how much total combined income tax do White and Nancy pay in the current year? (Ignore any employment tax considerations.)

A) $40,295

B) $54,995

C) $63,325

D) $64,396

E) None of the above

A) $40,295

B) $54,995

C) $63,325

D) $64,396

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

Orange Corporation, a calendar year C corporation, owns stock in White Corporation and has net operating income of $400,000 for the current year. White Corporation pays Orange a dividend of $60,000. What amount of dividends received deduction may Orange claim if it owns 45% of White stock (assuming Orange's dividends received deduction is not limited by its taxable income)?

A) $30,000

B) $39,000

C) $42,000

D) $60,000

E) None of the above

A) $30,000

B) $39,000

C) $42,000

D) $60,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

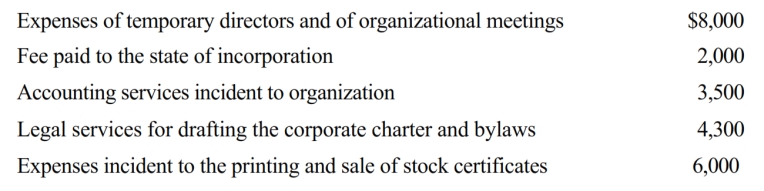

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2018. The following expenses were incurred during the first tax year (April 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

In working with Schedule M-2 (analysis of unappropriated retained earnings per books) of Form 1120, which of the following is an addition to beginning retained earnings?

A) Cash dividends.

B) Net loss per books.

C) Property dividends.

D) Net income per books.

E) None of the above.

A) Cash dividends.

B) Net loss per books.

C) Property dividends.

D) Net income per books.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

During the current year, Sparrow Corporation, a calendar year C corporation, had operating income of $425,000, operating expenses of $280,000, a short-term capital loss of $10,000, and a long-term capital gain of $25,000. How much is Sparrow's income tax liability for the year?

A) $32,700

B) $33,600

C) $45,650

D) $62,400

E) None of the above

A) $32,700

B) $33,600

C) $45,650

D) $62,400

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

In the current year, Crimson, Inc., a calendar C corporation, has income from operations of $180,000 and operating deductions of $225,000. Crimson also had $30,000 of dividends from a 15% stock ownership in a domestic corporation. Which of the following statements is correct with respect to Crimson for the current year?

A) Crimson's NOL is $15,000.

B) A dividends received deduction is not allowed in computing Crimson's NOL.

C) The NOL is carried back 3 years and forward 10 years by Crimson.

D) Crimson's dividends received deduction is $15,000.

E) None of the above.

A) Crimson's NOL is $15,000.

B) A dividends received deduction is not allowed in computing Crimson's NOL.

C) The NOL is carried back 3 years and forward 10 years by Crimson.

D) Crimson's dividends received deduction is $15,000.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

Copper Corporation, a calendar year C corporation, owns stock in Bronze Corporation and has net operating income of $900,000 for the current year. Bronze Corporation pays Copper a dividend of $150,000. What amount of dividends received deduction may Copper claim if it owns 85% of Bronze stock (assuming Copper's dividends received deduction is not limited by its taxable income)?

A) $75,000

B) $97,500

C) $120,000

D) $150,000

E) None of the above

A) $75,000

B) $97,500

C) $120,000

D) $150,000

E) None of the above

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income. Which of the following items is an addition on Schedule M-1?

A) Tax depreciation in excess of book depreciation.

B) Proceeds of life insurance paid on death of key employee.

C) Excess of capital losses over capital gains.

D) Tax-exempt interest.

E) None of the above.

A) Tax depreciation in excess of book depreciation.

B) Proceeds of life insurance paid on death of key employee.

C) Excess of capital losses over capital gains.

D) Tax-exempt interest.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Robin Corporation, a calendar year C corporation, had taxable income of $700,000, $1.2 million, and $1 million for 2016, 2017, and 2018, respectively. Robin has taxable income of $1.8 million for 2018. The minimum 2019 estimated tax installment payments for Robin are:

A) April 15, 2019, $52,500? June 17, 2019, $52,500? September 16, 2019, $52,500? December 16, 2019, $52,500.

B) April 15, 2019, $52,500? June 17, 2019, $94,500? September 16, 2019, $94,500? December 16, 2019, $94,500.

C) April 15, 2019, $94,500? June 17, 2019, $94,500? September 16, 2019, $94,500? December 16, 2019, $94,500.

D) April 15, 2019, $52,500? June 17, 2019, $136,500? September 16, 2019, $94,500? December 16, 2019, $94,500.

E) None of the above.

A) April 15, 2019, $52,500? June 17, 2019, $52,500? September 16, 2019, $52,500? December 16, 2019, $52,500.

B) April 15, 2019, $52,500? June 17, 2019, $94,500? September 16, 2019, $94,500? December 16, 2019, $94,500.

C) April 15, 2019, $94,500? June 17, 2019, $94,500? September 16, 2019, $94,500? December 16, 2019, $94,500.

D) April 15, 2019, $52,500? June 17, 2019, $136,500? September 16, 2019, $94,500? December 16, 2019, $94,500.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is correct regarding the taxation of C corporations?

A) Schedule M-2 is used to reconcile net income computed for financial accounting purposes with taxable income reported on the corporation's tax return.

B) The corporate return is filed on Form 1120S.

C) Corporations can receive an automatic extension of nine months for filing the corporate return by filing Form 7004 by the due date for the return.

D) A corporation with total assets of $7.5 million or more is required to file Schedule M-3.

E) None of the above.

A) Schedule M-2 is used to reconcile net income computed for financial accounting purposes with taxable income reported on the corporation's tax return.

B) The corporate return is filed on Form 1120S.

C) Corporations can receive an automatic extension of nine months for filing the corporate return by filing Form 7004 by the due date for the return.

D) A corporation with total assets of $7.5 million or more is required to file Schedule M-3.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

For tax years ending after 2017, which of the following statements is incorrect with respect to the treatment of a net operating loss by a calendar year C corporation?

A) The deduction for any carryover year of the NOL is limited to 80% of taxable income (determined without regard to the NOL deduction).

B) A corporation may claim a dividends received deduction in computing an NOL.

C) An NOL is generally carried back 2 years and forward 20 years.

D) Unlike individuals, corporations do not adjust their NOLs for net capital losses or nonbusiness deductions.

E) None of the above.

A) The deduction for any carryover year of the NOL is limited to 80% of taxable income (determined without regard to the NOL deduction).

B) A corporation may claim a dividends received deduction in computing an NOL.

C) An NOL is generally carried back 2 years and forward 20 years.

D) Unlike individuals, corporations do not adjust their NOLs for net capital losses or nonbusiness deductions.

E) None of the above.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck