Deck 4: Supply and Demand: Applications and Extensions

Question

Question

Question

Question

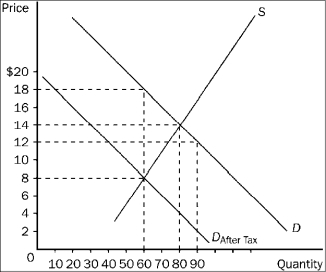

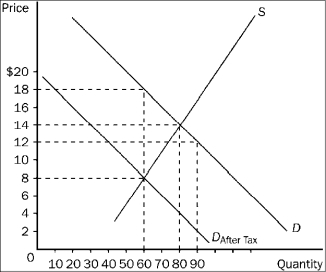

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/254

Play

Full screen (f)

Deck 4: Supply and Demand: Applications and Extensions

1

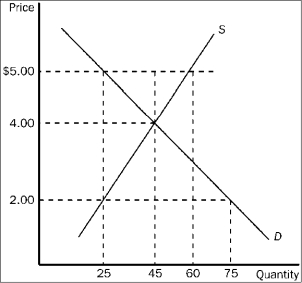

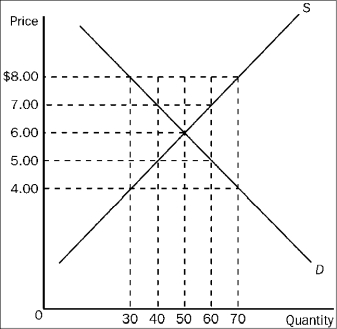

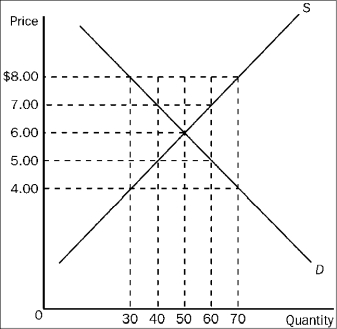

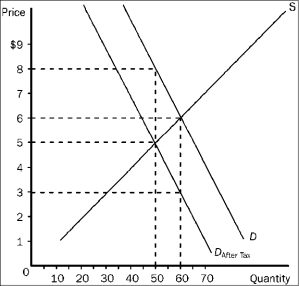

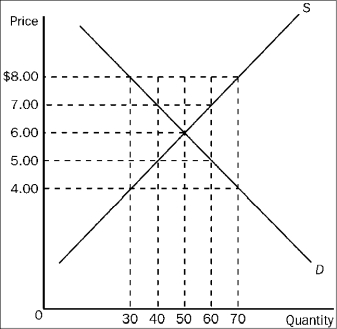

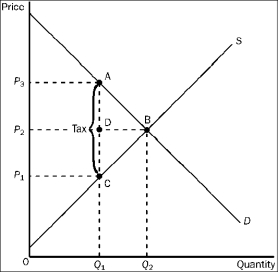

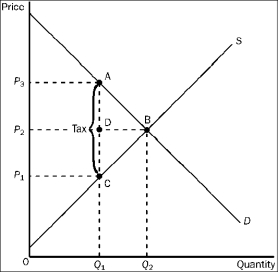

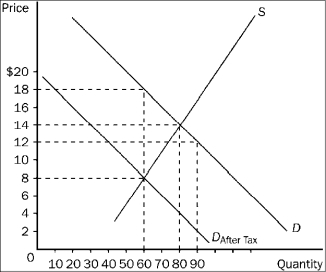

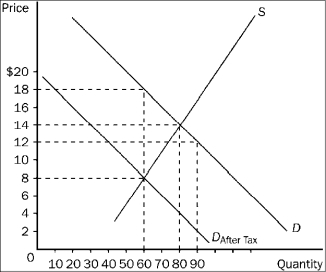

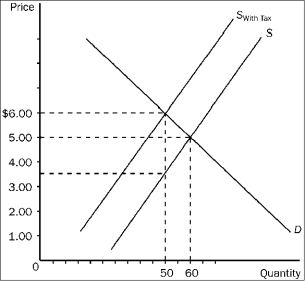

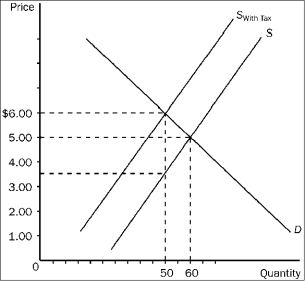

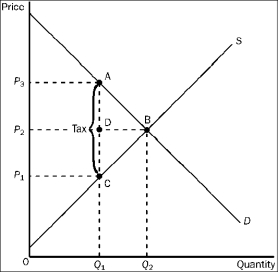

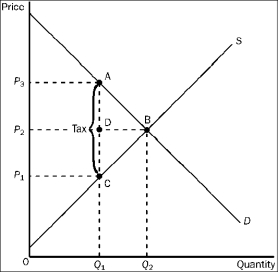

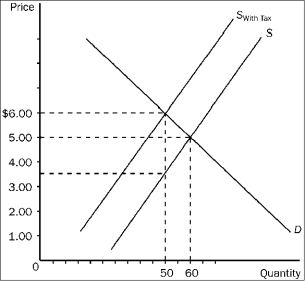

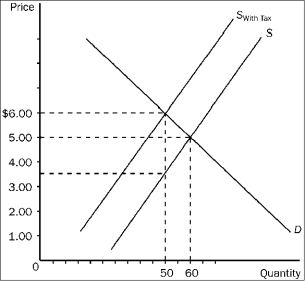

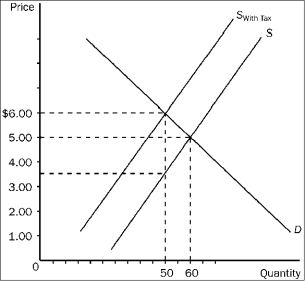

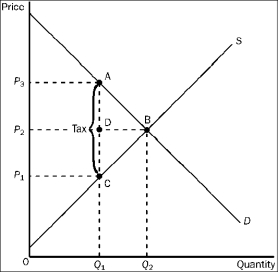

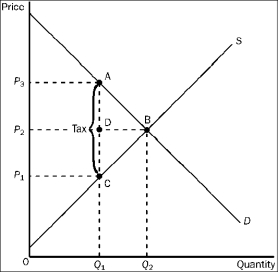

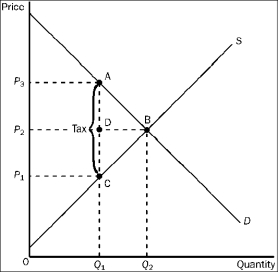

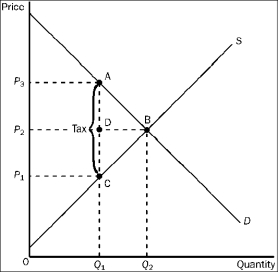

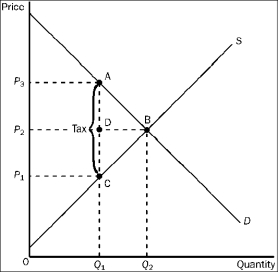

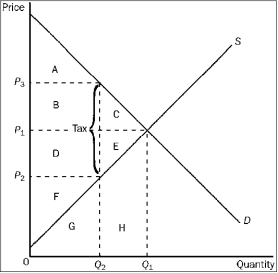

Figure 4-18

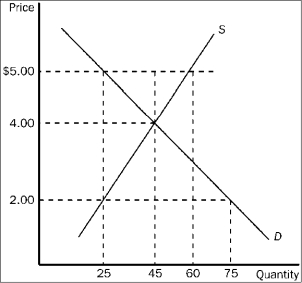

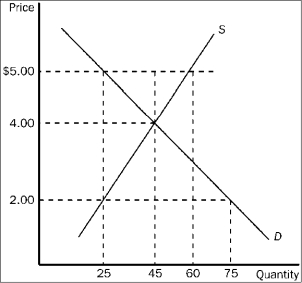

Refer to Figure 4-18. The price of the good would continue to serve as the rationing mechanism if

A)a price ceiling of $4.00 were imposed.

B)a price ceiling of $5.00 were imposed.

C)a price floor of $3.00 were imposed.

D)All of the above are correct.

Refer to Figure 4-18. The price of the good would continue to serve as the rationing mechanism if

A)a price ceiling of $4.00 were imposed.

B)a price ceiling of $5.00 were imposed.

C)a price floor of $3.00 were imposed.

D)All of the above are correct.

All of the above are correct.

2

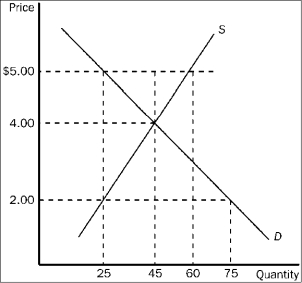

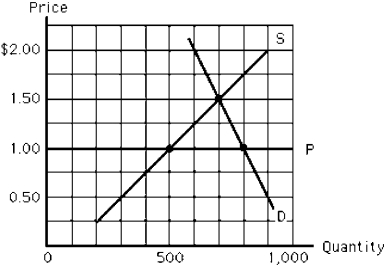

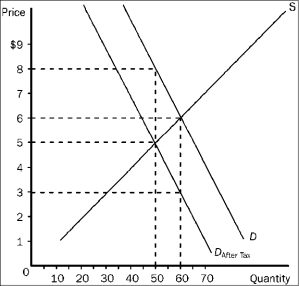

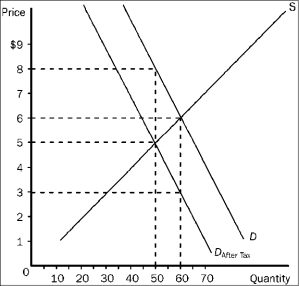

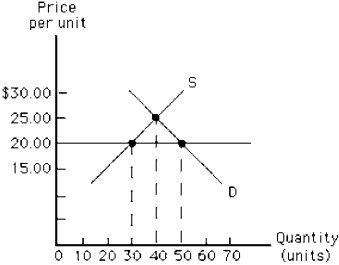

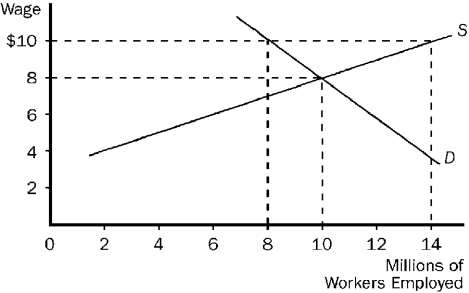

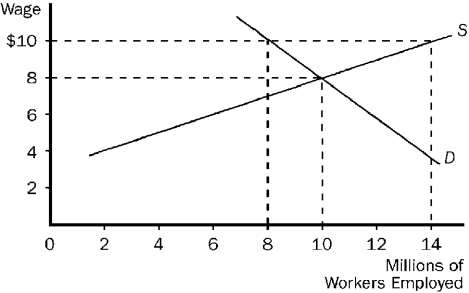

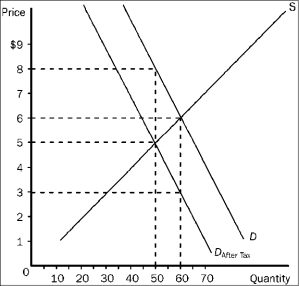

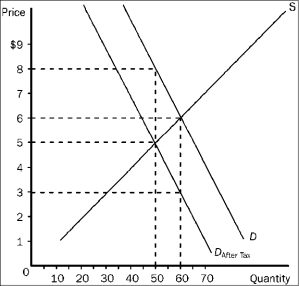

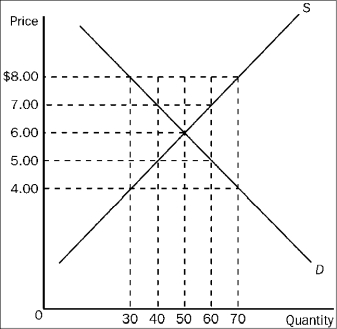

Figure 4-17

Refer to Figure 4-17. Suppose a price ceiling of $4.50 is imposed. As a result,

A)there is a shortage of 15 units of the good.

B)the demand curve will shift to the left so as to now pass through the point (Q = 35, P = $4.50).

C)the situation is very much like the one created by a binding minimum wage.

D)the quantity of the good that is bought and sold is the same as it would have been had a price floor of $7.50 been imposed.

Refer to Figure 4-17. Suppose a price ceiling of $4.50 is imposed. As a result,

A)there is a shortage of 15 units of the good.

B)the demand curve will shift to the left so as to now pass through the point (Q = 35, P = $4.50).

C)the situation is very much like the one created by a binding minimum wage.

D)the quantity of the good that is bought and sold is the same as it would have been had a price floor of $7.50 been imposed.

the quantity of the good that is bought and sold is the same as it would have been had a price floor of $7.50 been imposed.

3

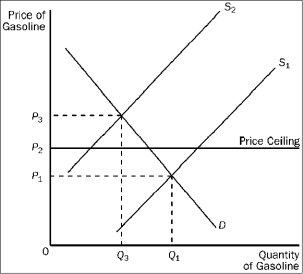

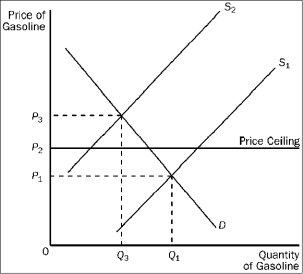

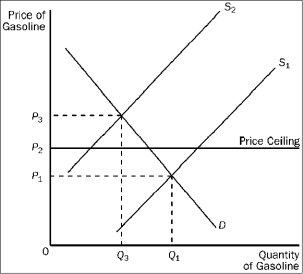

Figure 4-19

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2, the resulting quantity of gasoline that is bought and sold is

A)less than Q3.

B)Q3

C)between Q1 and Q3.

D)at least Q1.

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2, the resulting quantity of gasoline that is bought and sold is

A)less than Q3.

B)Q3

C)between Q1 and Q3.

D)at least Q1.

less than Q3.

4

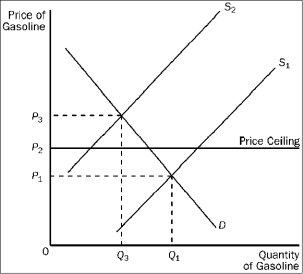

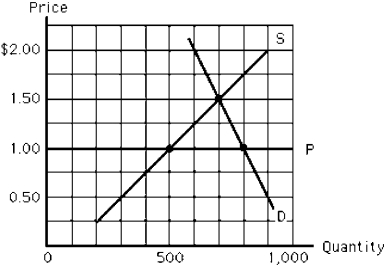

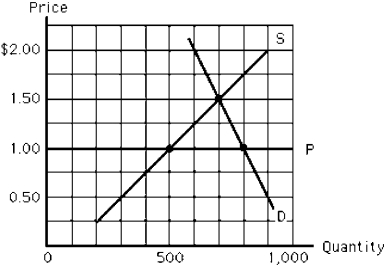

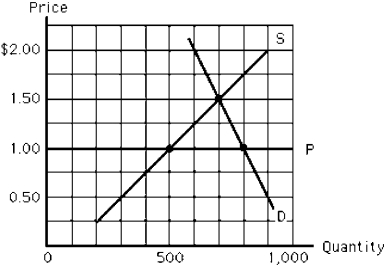

Figure 4-14

In Figure 4-14, which of the following is true at the price ceiling, P?

A)The excess quantity supplied equals 300 gallons.

B)The excess quantity demanded equals 300 gallons.

C)The excess quantity supplied equals 500 gallons.

D)The excess quantity demanded equals 800 gallons.

E)Sales will be equal to 800 gallons.

In Figure 4-14, which of the following is true at the price ceiling, P?

A)The excess quantity supplied equals 300 gallons.

B)The excess quantity demanded equals 300 gallons.

C)The excess quantity supplied equals 500 gallons.

D)The excess quantity demanded equals 800 gallons.

E)Sales will be equal to 800 gallons.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

5

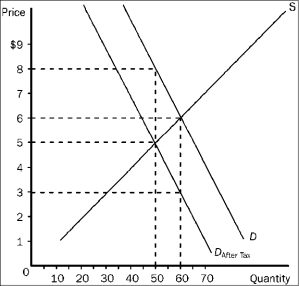

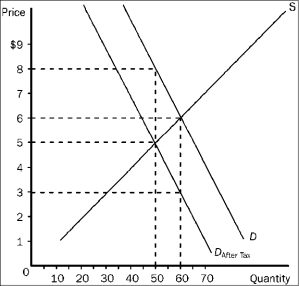

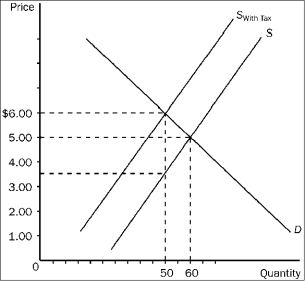

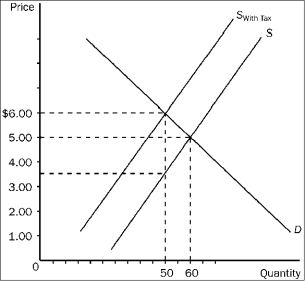

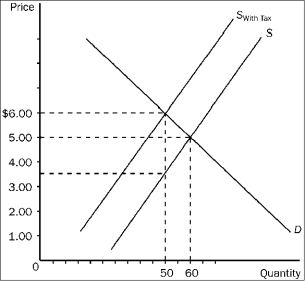

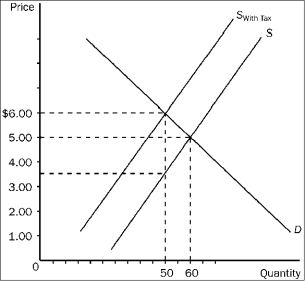

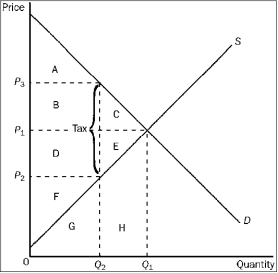

Figure 4-20

Refer to Figure 4-20. As the figure is drawn, who sends the tax payments to the government?

A)the buyers

B)the sellers

C)A portion of the tax payments is sent by the buyers and the remaining portion is sent by the sellers.

D)The question of who sends the tax payments cannot be determined from the figure.

Refer to Figure 4-20. As the figure is drawn, who sends the tax payments to the government?

A)the buyers

B)the sellers

C)A portion of the tax payments is sent by the buyers and the remaining portion is sent by the sellers.

D)The question of who sends the tax payments cannot be determined from the figure.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

6

Figure 4-17

Refer to Figure 4-17. If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

A)shortage of 20 units.

B)shortage of 10 units.

C)surplus of 20 units.

D)surplus of 10 units.

Refer to Figure 4-17. If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

A)shortage of 20 units.

B)shortage of 10 units.

C)surplus of 20 units.

D)surplus of 10 units.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

7

Figure 4-17

Refer to Figure 4-17. Suppose a price floor of $7.00 is imposed. As a result,

A)buyers' total expenditure on the good decreases by $20.00.

B)the supply curve will shift to the left so as to now pass through the point (Q = 40, P = $7.00).

C)the quantity of the good demanded decreases by 20 units.

D)the price of the good continues to serve as the rationing mechanism.

Refer to Figure 4-17. Suppose a price floor of $7.00 is imposed. As a result,

A)buyers' total expenditure on the good decreases by $20.00.

B)the supply curve will shift to the left so as to now pass through the point (Q = 40, P = $7.00).

C)the quantity of the good demanded decreases by 20 units.

D)the price of the good continues to serve as the rationing mechanism.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

8

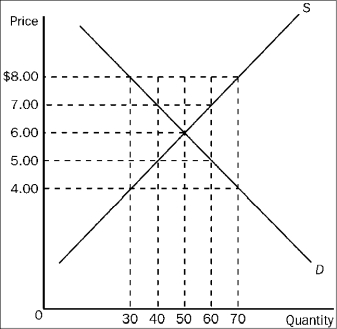

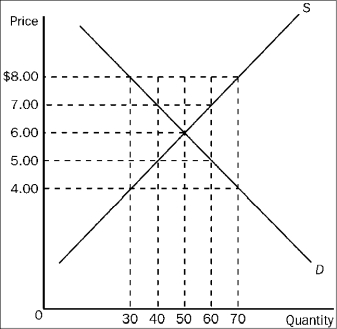

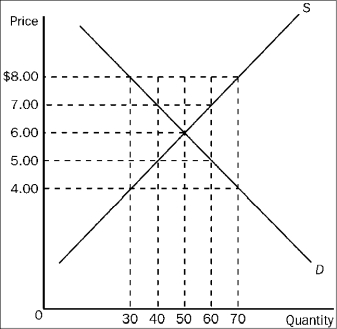

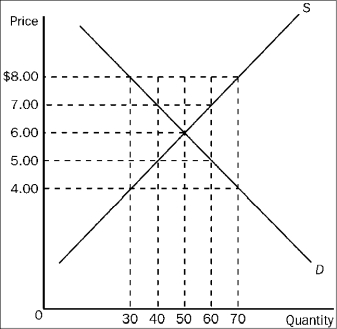

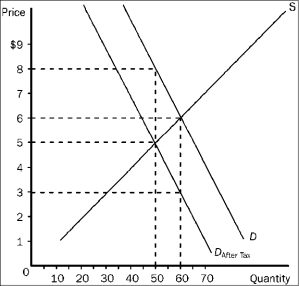

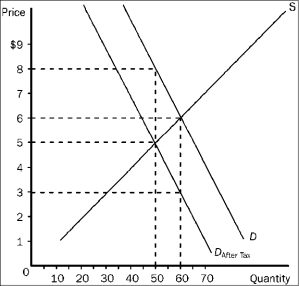

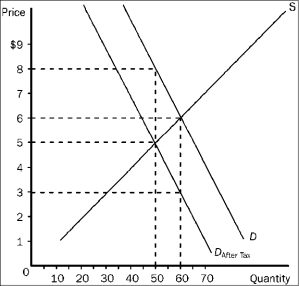

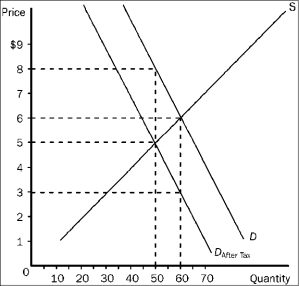

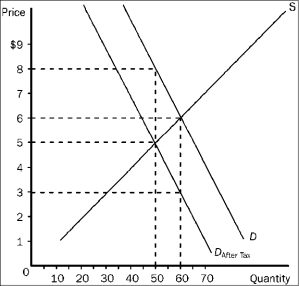

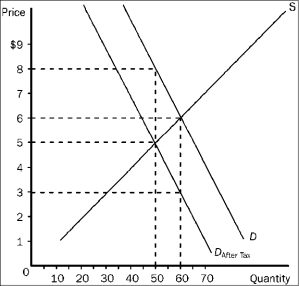

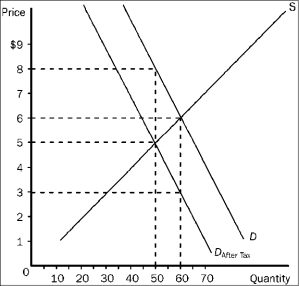

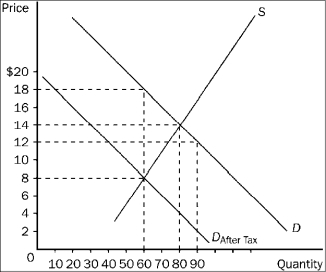

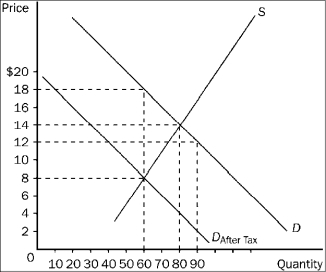

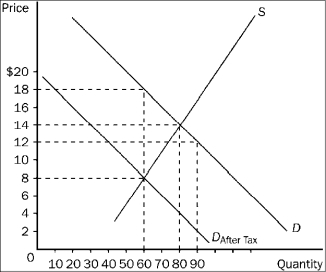

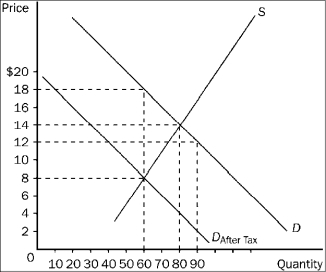

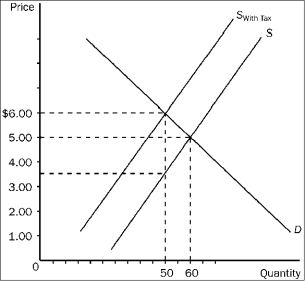

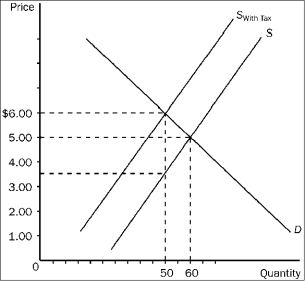

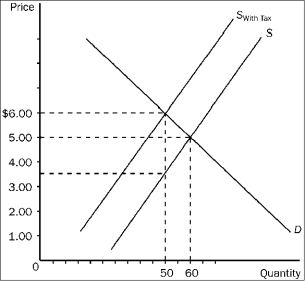

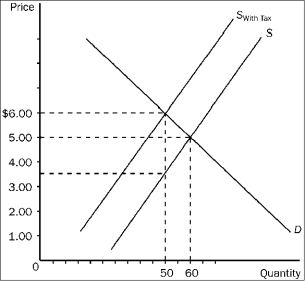

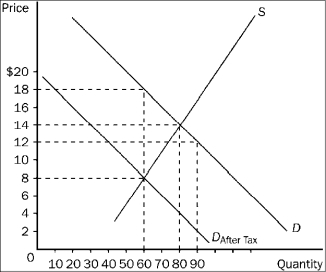

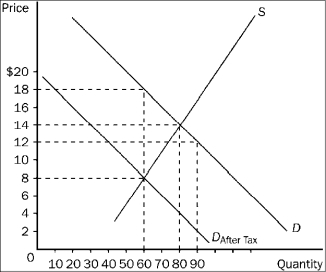

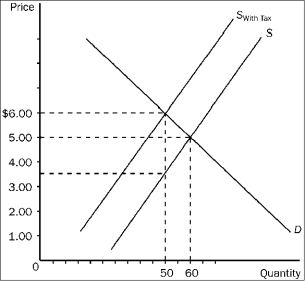

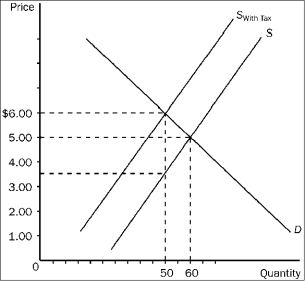

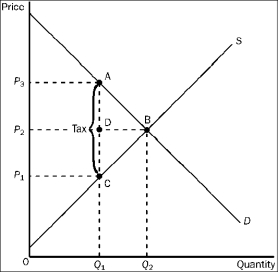

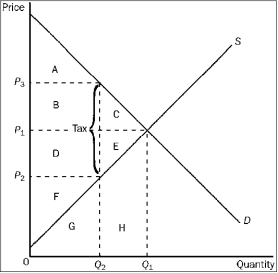

Figure 4-20

Refer to Figure 4-20. The amount of the tax per unit is

A)$1.

B)$2.

C)$3.

D)$5.

Refer to Figure 4-20. The amount of the tax per unit is

A)$1.

B)$2.

C)$3.

D)$5.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

9

Figure 4-20

Refer to Figure 4-20. The burden of the tax on buyers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

Refer to Figure 4-20. The burden of the tax on buyers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

10

Figure 4-20

Refer to Figure 4-20. The equilibrium price in the market before the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Refer to Figure 4-20. The equilibrium price in the market before the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

11

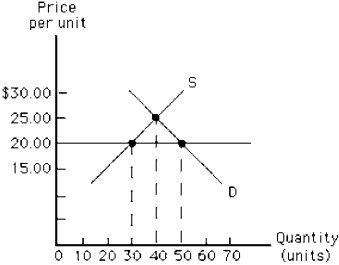

Figure 4-15

In Figure 4-15, suppose a price floor is established at $20.00. What is the result?

A)a shortage of 10 units

B)a surplus of 10 units

C)a shortage of 20 units

D)a surplus of 20 units

E)there is no change from the situation that exists at the equilibrium price

In Figure 4-15, suppose a price floor is established at $20.00. What is the result?

A)a shortage of 10 units

B)a surplus of 10 units

C)a shortage of 20 units

D)a surplus of 20 units

E)there is no change from the situation that exists at the equilibrium price

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

12

Figure 4-18

Refer to Figure 4-18. In this market, which of the following price controls would be binding?

A)a price ceiling of $2.00, and it would cause a shortage

B)a price ceiling of $5.00, and it would cause a surplus

C)a price floor of $2.00, and it would cause a shortage

D)All of the above are correct.

Refer to Figure 4-18. In this market, which of the following price controls would be binding?

A)a price ceiling of $2.00, and it would cause a shortage

B)a price ceiling of $5.00, and it would cause a surplus

C)a price floor of $2.00, and it would cause a shortage

D)All of the above are correct.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

13

Figure 4-16

Refer to Figure 4-16. Some policymakers have argued that the government should establish a "living wage." A living wage would provide workers a reasonable standard of living in their city or region. If a living wage of $10 per hour is established in the market pictured here, we would expect

A)employment will increase to 14 million.

B)employment will decrease to 8 million.

C)the wage will actually rise to $20 per hour.

D)there will be a surplus of 14 million workers.

Refer to Figure 4-16. Some policymakers have argued that the government should establish a "living wage." A living wage would provide workers a reasonable standard of living in their city or region. If a living wage of $10 per hour is established in the market pictured here, we would expect

A)employment will increase to 14 million.

B)employment will decrease to 8 million.

C)the wage will actually rise to $20 per hour.

D)there will be a surplus of 14 million workers.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

14

Figure 4-20

Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

15

Figure 4-20

Refer to Figure 4-20. The price that buyers pay after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Refer to Figure 4-20. The price that buyers pay after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

16

Figure 4-18

Refer to Figure 4-18. If the government imposes a price ceiling of $2.00 in this market, the result is a

A)surplus of 30 units of the good.

B)shortage of 20 units of the good.

C)shortage of 30 units of the good.

D)shortage of 50 units of the good.

Refer to Figure 4-18. If the government imposes a price ceiling of $2.00 in this market, the result is a

A)surplus of 30 units of the good.

B)shortage of 20 units of the good.

C)shortage of 30 units of the good.

D)shortage of 50 units of the good.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

17

Figure 4-14

Figure 4-14 depicts the milk market. The horizontal line, P, represents a price ceiling imposed by the government. Which of the following is true?

A)In equilibrium, the quantity demanded is 800 gallons.

B)At the ceiling price, there is a surplus.

C)The quantity demanded at the price ceiling will equal the quantity supplied.

D)The equilibrium price would be $1 per unit without the price ceiling.

E)The quantity sold will be 500 gallons.

Figure 4-14 depicts the milk market. The horizontal line, P, represents a price ceiling imposed by the government. Which of the following is true?

A)In equilibrium, the quantity demanded is 800 gallons.

B)At the ceiling price, there is a surplus.

C)The quantity demanded at the price ceiling will equal the quantity supplied.

D)The equilibrium price would be $1 per unit without the price ceiling.

E)The quantity sold will be 500 gallons.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

18

Figure 4-19

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2,

A)the price will increase to P3.

B)a surplus will occur at the new market price of P2.

C)the market price will stay at P1 due to the price ceiling.

D)a shortage will occur at the price ceiling of P2.

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S1 to S2,

A)the price will increase to P3.

B)a surplus will occur at the new market price of P2.

C)the market price will stay at P1 due to the price ceiling.

D)a shortage will occur at the price ceiling of P2.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

19

Figure 4-17

Refer to Figure 4-17. Which of the following price controls would cause a shortage of 10 units of the good?

A)a price ceiling of $5.50

B)a price floor of $5.50

C)a price ceiling of $6.50

D)a price floor of $6.50

Refer to Figure 4-17. Which of the following price controls would cause a shortage of 10 units of the good?

A)a price ceiling of $5.50

B)a price floor of $5.50

C)a price ceiling of $6.50

D)a price floor of $6.50

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

20

Figure 4-20

Refer to Figure 4-20. The burden of the tax on sellers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

Refer to Figure 4-20. The burden of the tax on sellers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

21

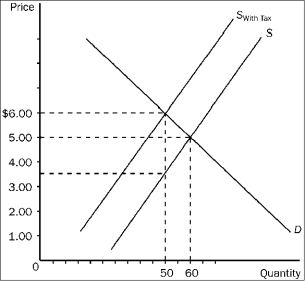

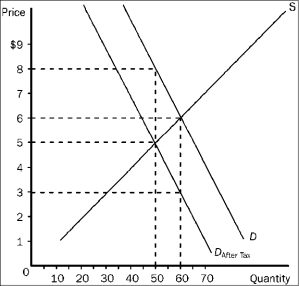

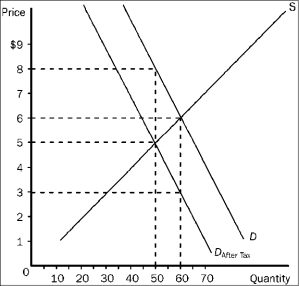

Figure 4-21

Refer to Figure 4-21. How much tax revenue does this tax produce for the government?

A)$480

B)$600

C)$800

D)$1,080

Refer to Figure 4-21. How much tax revenue does this tax produce for the government?

A)$480

B)$600

C)$800

D)$1,080

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

22

Figure 4-21

Refer to Figure 4-21. The per-unit burden of the tax is

A)$4 on buyers and $4 on sellers.

B)$5 on buyers and $5 on sellers.

C)$4 on buyers and $6 on sellers.

D)$6 on buyers and $4 on sellers.

Refer to Figure 4-21. The per-unit burden of the tax is

A)$4 on buyers and $4 on sellers.

B)$5 on buyers and $5 on sellers.

C)$4 on buyers and $6 on sellers.

D)$6 on buyers and $4 on sellers.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

23

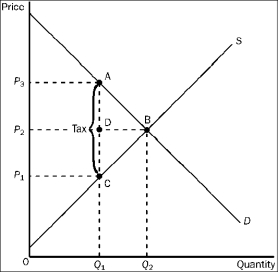

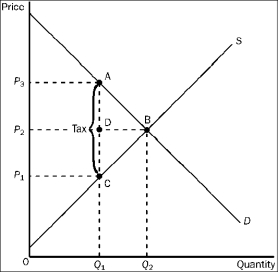

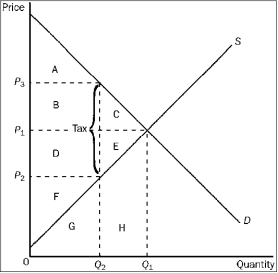

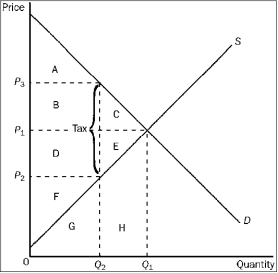

Figure 4-24

Refer to Figure 4-24. The equilibrium price before the tax is imposed is

A)P1.

B)P2.

C)P3.

D)None of the above is correct.

Refer to Figure 4-24. The equilibrium price before the tax is imposed is

A)P1.

B)P2.

C)P3.

D)None of the above is correct.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

24

Figure 4-22

Refer to Figure 4-22. Buyers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

Refer to Figure 4-22. Buyers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

25

Figure 4-21

Refer to Figure 4-21. The price paid by buyers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

Refer to Figure 4-21. The price paid by buyers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

26

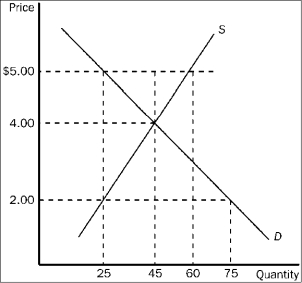

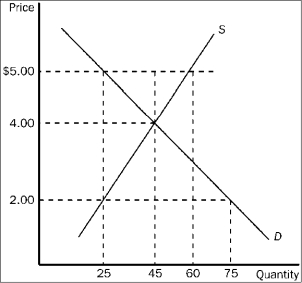

Figure 4-22

Refer to Figure 4-22. The equilibrium price in the market before the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Refer to Figure 4-22. The equilibrium price in the market before the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

27

Figure 4-22

Refer to Figure 4-22. The amount of the tax per unit is

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.50.

Refer to Figure 4-22. The amount of the tax per unit is

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.50.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

28

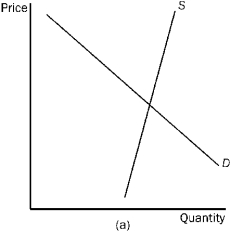

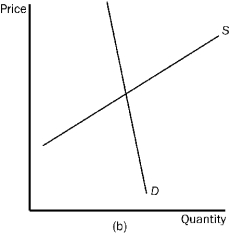

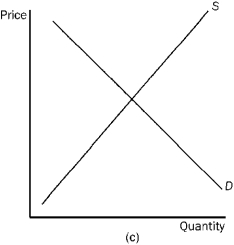

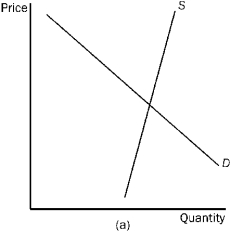

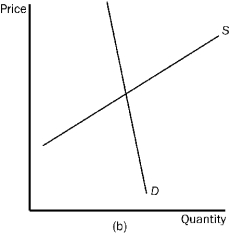

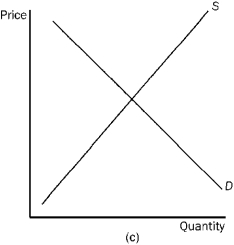

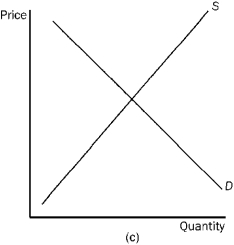

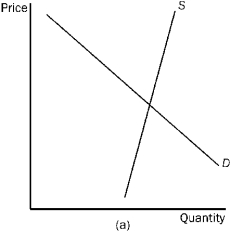

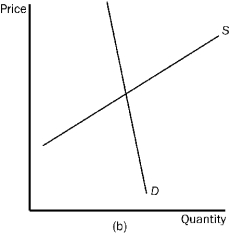

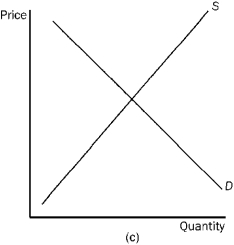

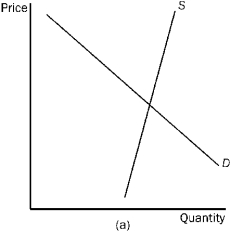

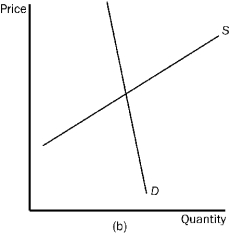

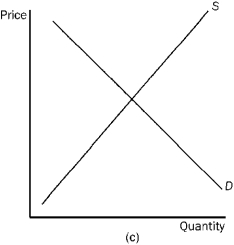

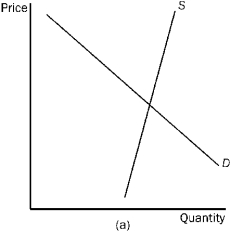

Figure 4-23

Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

29

Figure 4-24

Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

30

Figure 4-22

Refer to Figure 4-22. The price paid by buyers after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Refer to Figure 4-22. The price paid by buyers after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

31

Figure 4-22

Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

A) the burden on buyers will be larger than in the case illustrated in Figure 4-22.

B) the burden on sellers will be smaller than in the case illustrated in Figure 4-22.

C) a downward shift of the demand curve replaces the upward shift of the supply curve.

D) All of the above are correct.

Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

A) the burden on buyers will be larger than in the case illustrated in Figure 4-22.

B) the burden on sellers will be smaller than in the case illustrated in Figure 4-22.

C) a downward shift of the demand curve replaces the upward shift of the supply curve.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

32

Figure 4-22

Refer to Figure 4-22. From this tax the government will collect a total of

A)$125.00.

B)$175.00.

C)$200.00.

D)$250.00.

Refer to Figure 4-22. From this tax the government will collect a total of

A)$125.00.

B)$175.00.

C)$200.00.

D)$250.00.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

33

Figure 4-21

Refer to Figure 4-21. The price received by sellers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

Refer to Figure 4-21. The price received by sellers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

34

Figure 4-20

Refer to Figure 4-20. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. Now, relative to the case depicted in the figure,

A)the burden on buyers will be larger and the burden on sellers will be smaller.

B)the burden on buyers will be smaller and the burden on sellers will be larger.

C)the burden on buyers will be the same and the burden on sellers will be the same.

D)The relative burdens in the two cases cannot be determined without further information.

Refer to Figure 4-20. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. Now, relative to the case depicted in the figure,

A)the burden on buyers will be larger and the burden on sellers will be smaller.

B)the burden on buyers will be smaller and the burden on sellers will be larger.

C)the burden on buyers will be the same and the burden on sellers will be the same.

D)The relative burdens in the two cases cannot be determined without further information.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

35

Figure 4-22

Refer to Figure 4-22. Sellers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

Refer to Figure 4-22. Sellers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

36

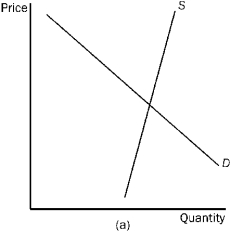

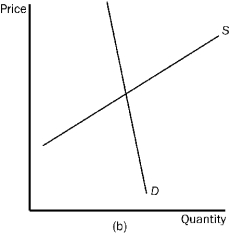

Figure 4-23

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

37

Figure 4-23

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the buyer?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the buyer?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

38

Figure 4-21

Refer to Figure 4-21. The amount of the tax per unit is

A)$10.

B)$6.

C)$4.

D)$2.

Refer to Figure 4-21. The amount of the tax per unit is

A)$10.

B)$6.

C)$4.

D)$2.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

39

Figure 4-24

Refer to Figure 4-24. The price that buyers pay after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Refer to Figure 4-24. The price that buyers pay after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

40

Figure 4-22

Refer to Figure 4-22. The effective price sellers receive after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Refer to Figure 4-22. The effective price sellers receive after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

41

An effective minimum wage

A)imposes a price ceiling on the wages of various categories of low-skill workers.

B)increases the demand for low-skill workers.

C)makes it easier for low skill workers to find jobs.

D)increases the earnings of some low-skill workers while reducing the employment and training opportunities available to others.

A)imposes a price ceiling on the wages of various categories of low-skill workers.

B)increases the demand for low-skill workers.

C)makes it easier for low skill workers to find jobs.

D)increases the earnings of some low-skill workers while reducing the employment and training opportunities available to others.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

42

When the price of a good is legally set below the equilibrium level, a shortage often results. This shortage

A)is a temporary failure of the market mechanism.

B)is the result of a shift in demand.

C)is the result of a shift in supply.

D)occurs because the price ceiling prevents the market mechanism from establishing an equilibrium price.

A)is a temporary failure of the market mechanism.

B)is the result of a shift in demand.

C)is the result of a shift in supply.

D)occurs because the price ceiling prevents the market mechanism from establishing an equilibrium price.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

43

Figure 4-24

-Refer to Figure 4-24. The amount of the tax on each unit of the good is

A)P3 - P1.

B)P3 -P2.

C)P2- P1.

D)Q2 - Q1.

-Refer to Figure 4-24. The amount of the tax on each unit of the good is

A)P3 - P1.

B)P3 -P2.

C)P2- P1.

D)Q2 - Q1.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements regarding black markets is true?

A)The reliability of products sold in black markets is generally higher than the reliability of products sold in legal markets.

B)The prices of goods in black markets are generally lower than the prices of similar products in legal markets.

C)The laws of supply and demand do not affect the prices of goods exchanged in black markets.

D)The rate of violence is higher in black markets than in legal markets.

A)The reliability of products sold in black markets is generally higher than the reliability of products sold in legal markets.

B)The prices of goods in black markets are generally lower than the prices of similar products in legal markets.

C)The laws of supply and demand do not affect the prices of goods exchanged in black markets.

D)The rate of violence is higher in black markets than in legal markets.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

45

A black market is

A)a market that operates outside the legal system, either by selling illegal goods or by selling goods at illegal prices.

B)a market where goods and services can be obtained at lower prices.

C)a government-mandated market where controls are placed on prices.

D)a market where exchanges are made using bartering.

A)a market that operates outside the legal system, either by selling illegal goods or by selling goods at illegal prices.

B)a market where goods and services can be obtained at lower prices.

C)a government-mandated market where controls are placed on prices.

D)a market where exchanges are made using bartering.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

46

The "incidence of a tax" is the term used to indicate

A)the responsibility for collecting the tax.

B)who actually bears the tax burden.

C)who the tax is initially levied on.

D)the regressive rate structure of the tax.

A)the responsibility for collecting the tax.

B)who actually bears the tax burden.

C)who the tax is initially levied on.

D)the regressive rate structure of the tax.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

47

If the Federal government enacts a new excise tax of $1.50 per case of soda. Which of the following is most likely to occur?

A)Consumers of soda will pay a higher price and buy a larger quantity.

B)Consumers of soda will pay a higher price, which will increase the profits of soda companies, inducing them to sell a larger quantity.

C)Consumers of soda will pay a higher price and buy a smaller quantity.

D)Consumers of soda will buy less bottled water.

A)Consumers of soda will pay a higher price and buy a larger quantity.

B)Consumers of soda will pay a higher price, which will increase the profits of soda companies, inducing them to sell a larger quantity.

C)Consumers of soda will pay a higher price and buy a smaller quantity.

D)Consumers of soda will buy less bottled water.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

48

When a government subsidy is granted to the buyers of a product, sellers can end up capturing some of the benefit because

A)the market price of the product will fall in response to the subsidy.

B)the market price of the product will rise in response to the subsidy.

C)the market price of the product will not change in response to the subsidy.

D)producers will reduce the supply of the product.

A)the market price of the product will fall in response to the subsidy.

B)the market price of the product will rise in response to the subsidy.

C)the market price of the product will not change in response to the subsidy.

D)producers will reduce the supply of the product.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

49

If Olivia's income increases from $40,000 to $50,000 and her tax liability increases from $6,000 to $9,000, which of the following is true?

A)Her marginal tax rate is 18 percent in this range.

B)Her marginal tax rate is 30 percent in this range.

C)Her average tax rate was 22.5 percent when her income was $40,000.

D)The tax structure must be regressive in the range between $40,000 and $50,000.

A)Her marginal tax rate is 18 percent in this range.

B)Her marginal tax rate is 30 percent in this range.

C)Her average tax rate was 22.5 percent when her income was $40,000.

D)The tax structure must be regressive in the range between $40,000 and $50,000.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

50

The Laffer Curve indicates that

A)when tax rates are high, a rate reduction may lead to an increase in tax revenue.

B)when tax rates are low, an increase in tax rates will generally lead to a reduction in tax revenues.

C)an increase in tax rates will always lead to an increase in tax revenues.

D)the deadweight losses resulting from taxation are small at the tax rate that maximizes the revenues derived by the government.

A)when tax rates are high, a rate reduction may lead to an increase in tax revenue.

B)when tax rates are low, an increase in tax rates will generally lead to a reduction in tax revenues.

C)an increase in tax rates will always lead to an increase in tax revenues.

D)the deadweight losses resulting from taxation are small at the tax rate that maximizes the revenues derived by the government.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

51

The market pricing system corrects an excess supply by

A)raising the product price and increasing producer profits.

B)lowering the product price and decreasing producer profits.

C)raising the product price and decreasing producer profits.

D)lowering the product price and increasing producer profits.

A)raising the product price and increasing producer profits.

B)lowering the product price and decreasing producer profits.

C)raising the product price and decreasing producer profits.

D)lowering the product price and increasing producer profits.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

52

Black markets that operate outside the legal system are often characterized by

A)low profits for suppliers.

B)lower opportunity costs for suppliers and buyers.

C)decreased prices.

D)the use of violence as a means of settling disputes.

A)low profits for suppliers.

B)lower opportunity costs for suppliers and buyers.

C)decreased prices.

D)the use of violence as a means of settling disputes.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

53

If political officials want to minimize the excess burden accompanying a tax, they should set the tax at a rate

A)that will maximize the revenue derived from the tax.

B)slightly above the rate that will maximize the revenue derived from the tax.

C)well below the rate that will maximize the revenue derived from the tax.

D)that is the highest that could possibly be imposed.

A)that will maximize the revenue derived from the tax.

B)slightly above the rate that will maximize the revenue derived from the tax.

C)well below the rate that will maximize the revenue derived from the tax.

D)that is the highest that could possibly be imposed.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

54

Figure 4-24

-Refer to Figure 4-24. The per unit burden of the tax on buyers is

A)P3 - P1.

B)P3 - P2.

C)P2- P1.

D)Q2 - Q1.

-Refer to Figure 4-24. The per unit burden of the tax on buyers is

A)P3 - P1.

B)P3 - P2.

C)P2- P1.

D)Q2 - Q1.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose the U.S. government banned the sale and production of cigarettes. Which of the following would be most likely to occur?

A)No one would smoke anymore.

B)The amount of violence involved in the buying and selling of cigarettes would increase.

C)The price of cigarettes would decrease.

D)The supply for cigarettes would become elastic.

A)No one would smoke anymore.

B)The amount of violence involved in the buying and selling of cigarettes would increase.

C)The price of cigarettes would decrease.

D)The supply for cigarettes would become elastic.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

56

Figure 4-24

-Refer to Figure 4-24. The per-unit burden of the tax on sellers is

A)P3 -P1.

B)P3 - P2.

C)P2 - P1.

D)Q2 - Q1.

-Refer to Figure 4-24. The per-unit burden of the tax on sellers is

A)P3 -P1.

B)P3 - P2.

C)P2 - P1.

D)Q2 - Q1.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

57

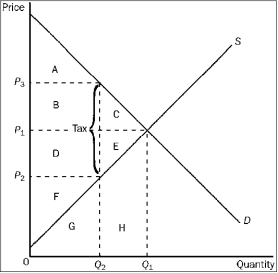

Figure 4-25

Refer to Figure 4-25. The equilibrium price before the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Refer to Figure 4-25. The equilibrium price before the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

58

Figure 4-25

Refer to Figure 4-25. The price that buyers pay after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Refer to Figure 4-25. The price that buyers pay after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose that the minimum wage was increased to $10 per hour. Which of the following would be most likely to result from the minimum wage increase?

A)an increase in the employment of low-skill workers previously employed at wage rates of less than $10 per hour

B)an increase in the number of jobs providing low-skill workers with on-the-job training

C)a reduction in the number of teenagers unemployed

D)an increase in the demand for high-skill workers providing services that are a good substitute for those whose wages were pushed up by the higher minimum wage

A)an increase in the employment of low-skill workers previously employed at wage rates of less than $10 per hour

B)an increase in the number of jobs providing low-skill workers with on-the-job training

C)a reduction in the number of teenagers unemployed

D)an increase in the demand for high-skill workers providing services that are a good substitute for those whose wages were pushed up by the higher minimum wage

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

60

Figure 4-25

Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

A)P1.

B)P2.

C)P3.

D)impossible to determine from the figure.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

61

Bill the butcher is upset because the government plans to tax beef $.10 a pound. "I hate paying taxes," he says. "Because of this, I'm raising all my beef prices by $.10 a pound. The consumers will bear this burden, not me." Do you see anything wrong with this way of thinking? Explain.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

62

Lowincomesville is a poor town. The mayor has decided to impose a law to cut all rental rates on apartments in half and to fix them at this level. Will this help the poor? Why or why not? Be sure to distinguish between the short run and the long run.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

63

Government programs such as Medicare substantially subsidize health care purchases by some consumers in the U.S. economy. Who benefits from these subsidies? How do they affect the price of health care? If you are not a recipient of this program, are you made better or worse off by the subsidy? Explain.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose the U.S. Government banned the sale and production of cigarettes. What are likely effects of this action on the market for cigarettes?

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

65

The City of Greenville needs to raise revenue. Alderman Black has proposed a $10 tax on red cars in the city, currently numbering 2,000. Mayor White, who wants more than $20,000 in revenue, proposes taxing these cars at $100 each. Councilwoman Bluestone goes even farther, suggesting a $1,000 per red car tax, arguing that her proposal will raise $2 million. If maximizing tax revenue is the only consideration, which proposal should pass? Why?

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

66

Other things constant, as the price of a resource increases,

A)the quantity of the resource demanded falls.

B)the quantity of the resource supplied falls.

C)the price of the product the resource helps to produce falls.

D)there is less of an incentive for users of the resource to find substitute resources.

A)the quantity of the resource demanded falls.

B)the quantity of the resource supplied falls.

C)the price of the product the resource helps to produce falls.

D)there is less of an incentive for users of the resource to find substitute resources.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

67

If there was an increase in the excise tax imposed on guitar suppliers, what would be the effect on the equilibrium price and quantity of guitars?

A)Price increases; quantity decreases

B)Price decreases; quantity decreases

C)Price increases; quantity increases

D)Price decreases; quantity increases

A)Price increases; quantity decreases

B)Price decreases; quantity decreases

C)Price increases; quantity increases

D)Price decreases; quantity increases

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is the most likely result of an increase in the minimum wage?

A)an increase in the employment of unskilled workers

B)a decrease in the number of workers seeking minimum wage jobs

C)an increase in the demand for unskilled workers

D)a decrease in the employment of unskilled workers

A)an increase in the employment of unskilled workers

B)a decrease in the number of workers seeking minimum wage jobs

C)an increase in the demand for unskilled workers

D)a decrease in the employment of unskilled workers

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

69

The more elastic the supply of a product, the more likely it is that the

A)burden of a tax on the product will fall on sellers.

B)burden of a tax on the product will fall on buyers.

C)burden of a tax on the product will fall equally on both buyers and sellers.

D)deadweight loss of the tax will be smaller.

A)burden of a tax on the product will fall on sellers.

B)burden of a tax on the product will fall on buyers.

C)burden of a tax on the product will fall equally on both buyers and sellers.

D)deadweight loss of the tax will be smaller.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

70

When a price floor is above the equilibrium price,

A)quantity demanded will exceed quantity supplied, so there will be a shortage.

B)quantity supplied will exceed quantity demanded, so there will be a surplus.

C)the market will be in equilibrium.

D)This is a trick question because price floors are generally set below the equilibrium price.

A)quantity demanded will exceed quantity supplied, so there will be a shortage.

B)quantity supplied will exceed quantity demanded, so there will be a surplus.

C)the market will be in equilibrium.

D)This is a trick question because price floors are generally set below the equilibrium price.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

71

The Laffer curve illustrates the concept that

A)an increase in marginal tax rates will always cause tax revenues to increase.

B)an increase in marginal tax rates will always cause tax revenues to decrease.

C)when marginal tax rates are quite high, a decrease in the tax rate may cause tax revenues to increase.

D)when marginal taxes are quite low, an increase in the tax rate will probably cause tax revenues to decline.

A)an increase in marginal tax rates will always cause tax revenues to increase.

B)an increase in marginal tax rates will always cause tax revenues to decrease.

C)when marginal tax rates are quite high, a decrease in the tax rate may cause tax revenues to increase.

D)when marginal taxes are quite low, an increase in the tax rate will probably cause tax revenues to decline.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

72

Ava states, "If raising the minimum wage to $10 an hour is good, like Senator Largess suggests, then raising it to $20 an hour would be twice as good." Is Ava correct? Why or why not?

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

73

Other things constant, a decrease in the demand for hair dryers will

A)increase the price of hair dryers.

B)increase the quantity supplied of hair dryers.

C)increase the demand for hair dryer manufacturing workers.

D)decrease the demand for hair dryer manufacturing workers.

A)increase the price of hair dryers.

B)increase the quantity supplied of hair dryers.

C)increase the demand for hair dryer manufacturing workers.

D)decrease the demand for hair dryer manufacturing workers.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

74

When a government subsidy is granted to the sellers of a product, buyers can end up capturing some of the benefit because

A)the market price of the product will fall in response to the subsidy.

B)the market price of the product will rise in response to the subsidy.

C)the market price of the product will not change in response to the subsidy.

D)producers will reduce the supply of the product.

A)the market price of the product will fall in response to the subsidy.

B)the market price of the product will rise in response to the subsidy.

C)the market price of the product will not change in response to the subsidy.

D)producers will reduce the supply of the product.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is a major disadvantage of setting the price of a good below equilibrium and using waiting in line rather than price to ration the good?

A)Compared to price rationing, waiting in line is unfair since it is easier for those with higher incomes to wait in line.

B)Waiting in line imposes a cost on the consumer; paying higher prices does not.

C)Both waiting in line and higher prices are costly to consumers, but unlike the payment of a higher price, waiting in line does not provide suppliers with an incentive to expand future output.

D)Waiting in line benefits consumers at the expense of producers.

A)Compared to price rationing, waiting in line is unfair since it is easier for those with higher incomes to wait in line.

B)Waiting in line imposes a cost on the consumer; paying higher prices does not.

C)Both waiting in line and higher prices are costly to consumers, but unlike the payment of a higher price, waiting in line does not provide suppliers with an incentive to expand future output.

D)Waiting in line benefits consumers at the expense of producers.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

76

Rent control applies to about two-thirds of the private rental housing in New York City. Economic theory suggests that the below-equilibrium prices established by rent controls would

A)create a surplus of rental housing.

B)promote a rapid increase in the future supply of housing.

C)result in poor service and quality deterioration of many rental units.

D)lead to a reduction in housing discrimination against minorities.

A)create a surplus of rental housing.

B)promote a rapid increase in the future supply of housing.

C)result in poor service and quality deterioration of many rental units.

D)lead to a reduction in housing discrimination against minorities.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

77

If the demand for a good is highly inelastic, a tax on the good

A)places the burden of the tax equally on buyers and sellers

B)permits sellers to pass most of the cost increase resulting from the tax on to the consumers of the product

C)reduces the profits earned by sellers since they must write the check to pay the tax

D)makes the demand more inelastic

E)makes the demand more elastic

A)places the burden of the tax equally on buyers and sellers

B)permits sellers to pass most of the cost increase resulting from the tax on to the consumers of the product

C)reduces the profits earned by sellers since they must write the check to pay the tax

D)makes the demand more inelastic

E)makes the demand more elastic

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

78

The more elastic the supply of a product, the more likely it is that the burden of a tax will

A)fall on sellers.

B)fall on buyers.

C)fall equally on both buyers and sellers.

D)be borne by the public sector, and not by market participants.

A)fall on sellers.

B)fall on buyers.

C)fall equally on both buyers and sellers.

D)be borne by the public sector, and not by market participants.

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

79

The state of Florida is considering putting an excise tax on either good X or good Y. An economist discovers the supply of good X is more elastic than the supply of good Y, while the demand elasticities are identical. Which good should Florida tax in order to minimize the deadweight loss of the tax?

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck

80

Suppose the United Auto Workers union obtains a substantial wage increase for auto workers. How will this affect the market for automobiles?

Unlock Deck

Unlock for access to all 254 flashcards in this deck.

Unlock Deck

k this deck