Deck 3: Demand, Supply, and the Market Process

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/408

Play

Full screen (f)

Deck 3: Demand, Supply, and the Market Process

1

Since 1802, the average annual compound return for stock holdings, adjusted for inflation, has been approximately

A) 2 percent.

B) 7 percent.

C) 15 percent.

D) 30 percent.

A) 2 percent.

B) 7 percent.

C) 15 percent.

D) 30 percent.

7 percent.

2

Which of the following is true of investments?

A) The stock market helps channel the savings of individuals into business activities that create wealth.

B) Individual investors can reduce their risk by holding a large share of their wealth in the form of the stock ownership of a single company.

C) Historically, the long-term real rate of return of stocks has generally been less than that of bonds.

D) Mutual funds that have done well in the past are more likely to outperform the market average in the future.

A) The stock market helps channel the savings of individuals into business activities that create wealth.

B) Individual investors can reduce their risk by holding a large share of their wealth in the form of the stock ownership of a single company.

C) Historically, the long-term real rate of return of stocks has generally been less than that of bonds.

D) Mutual funds that have done well in the past are more likely to outperform the market average in the future.

The stock market helps channel the savings of individuals into business activities that create wealth.

3

Which of the following is true of stocks?

A) Stock ownership is risky because the investor can never be sure what return they will earn or what the value of their stock holdings will be in the future.

B) The riskiness of stocks is one reason why their average rate of return has been higher than investments like bonds that guarantee a specified nominal amount in the future.

C) Both a and b are true.

D) Neither a nor b is true.

A) Stock ownership is risky because the investor can never be sure what return they will earn or what the value of their stock holdings will be in the future.

B) The riskiness of stocks is one reason why their average rate of return has been higher than investments like bonds that guarantee a specified nominal amount in the future.

C) Both a and b are true.

D) Neither a nor b is true.

Both a and b are true.

4

During the last sixty years, the broad stock market (Standard and Poor's 500 Index) yielded an average annual nominal rate of return of approximately ____ and real rate of return of approximately ____.

A) 5 percent; 2 percent

B) 10 percent; 7 percent

C) 17 percent; 9 percent

D) 9 percent; 17 percent

A) 5 percent; 2 percent

B) 10 percent; 7 percent

C) 17 percent; 9 percent

D) 9 percent; 17 percent

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following about stocks and bonds is true?

A) Bond owners are entitled to the fraction of the firm's future revenues represented by their ownership shares.

B) As long as the organization issuing the bond is solvent, the bondholder can count on the funds being repaid with interest.

C) Stocks provide businesses, governments, and other organizations with a convenient way to borrow money.

D) All of the above are true.

A) Bond owners are entitled to the fraction of the firm's future revenues represented by their ownership shares.

B) As long as the organization issuing the bond is solvent, the bondholder can count on the funds being repaid with interest.

C) Stocks provide businesses, governments, and other organizations with a convenient way to borrow money.

D) All of the above are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is true?

A) Most stockholders own stock because they want to participate in the daily decision making of the firms that they own.

B) The shareholders of a large well-established firm can be reasonably sure that they will earn a real rate of return of about 7 percent in the future.

C) The potential losses of shareholders are limited to the amount of their investment.

D) Ownership of a corporate bond provides the bondholder with an ownership right to a fraction of the firm's future profits.

A) Most stockholders own stock because they want to participate in the daily decision making of the firms that they own.

B) The shareholders of a large well-established firm can be reasonably sure that they will earn a real rate of return of about 7 percent in the future.

C) The potential losses of shareholders are limited to the amount of their investment.

D) Ownership of a corporate bond provides the bondholder with an ownership right to a fraction of the firm's future profits.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

7

The market for new issues of stock is called the

A) primary market.

B) secondary market.

C) The New York Stock Exchange (NYSE).

D) The Chicago Board of Trade.

A) primary market.

B) secondary market.

C) The New York Stock Exchange (NYSE).

D) The Chicago Board of Trade.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

8

Historically, which of the following has had the highest average annual rate of return?

A) corporate bonds

B) money market mutual funds

C) corporate stocks

D) U.S. Treasury bonds

A) corporate bonds

B) money market mutual funds

C) corporate stocks

D) U.S. Treasury bonds

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

9

Currently, about ____ of U.S. households own stock, either directly or through an equity mutual fund.

A) 10 percent

B) 20 percent

C) 50 percent

D) 80 percent

A) 10 percent

B) 20 percent

C) 50 percent

D) 80 percent

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

10

During the last two centuries, after adjustment for inflation,

A) corporate bonds have yielded a real return of approximately 7 percent annually, compared to a real return of about 3 percent for corporate stocks.

B) corporate stocks have yielded a real return of approximately 7 percent annually, compared to a real return of about 3 percent for bonds.

C) both corporate stocks and bonds have yielded a real rate of return of about 3 percent.

D) both corporate stocks and bonds have yielded a real rate of return of about 7 percent.

A) corporate bonds have yielded a real return of approximately 7 percent annually, compared to a real return of about 3 percent for corporate stocks.

B) corporate stocks have yielded a real return of approximately 7 percent annually, compared to a real return of about 3 percent for bonds.

C) both corporate stocks and bonds have yielded a real rate of return of about 3 percent.

D) both corporate stocks and bonds have yielded a real rate of return of about 7 percent.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is true about investments?

A) Most stockholders own stock because they want to run the business.

B) The shareholders of a large well-established firm can be reasonably sure that they will earn a real rate of return of about 7 percent in the future.

C) Ownership of a corporate bond provides the bondholder with an ownership right to a fraction of the firm's future profits.

D) Stock ownership makes it possible for investors to own a fractional share of a firm's future profits even if they do not participate in the operation of the firm.

A) Most stockholders own stock because they want to run the business.

B) The shareholders of a large well-established firm can be reasonably sure that they will earn a real rate of return of about 7 percent in the future.

C) Ownership of a corporate bond provides the bondholder with an ownership right to a fraction of the firm's future profits.

D) Stock ownership makes it possible for investors to own a fractional share of a firm's future profits even if they do not participate in the operation of the firm.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following indicates why the role of vigilant investors and investment fund managers is important for the efficient operation of an economy?

A) These investors generally serve on the boards of directors of corporations.

B) These investors tend to buy and sell stocks in a way that rewards good management.

C) These investors help allocate capital efficiently among firms and among investment projects.

D) Both b and c are true.

A) These investors generally serve on the boards of directors of corporations.

B) These investors tend to buy and sell stocks in a way that rewards good management.

C) These investors help allocate capital efficiently among firms and among investment projects.

D) Both b and c are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

13

Stock market analysts often argue that lower interest rates are good for the stock market. Does this argument make sense?

A) No; lower interest rates will tend to slow down the economy, and this will be bad for the stock market.

B) Yes; the lower rates of interest will increase the value of future income (and capital gains), and stock prices will rise to reflect this factor.

C) No; the lower rates of interest will reduce the value of future income (and capital gains), and this will cause stock prices to fall.

D) Yes; the lower interest rates will cause inflation, and inflation is generally good for the stock market.

A) No; lower interest rates will tend to slow down the economy, and this will be bad for the stock market.

B) Yes; the lower rates of interest will increase the value of future income (and capital gains), and stock prices will rise to reflect this factor.

C) No; the lower rates of interest will reduce the value of future income (and capital gains), and this will cause stock prices to fall.

D) Yes; the lower interest rates will cause inflation, and inflation is generally good for the stock market.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following about stock is true?

A) The stock market provides investors with an opportunity to own a fractional share of the firm's future profits.

B) A new stock issue is often an excellent way for a firm to raise funds for future expansion.

C) Changes in stock prices provide information about what investors think of various business decisions.

D) All of the above are true.

A) The stock market provides investors with an opportunity to own a fractional share of the firm's future profits.

B) A new stock issue is often an excellent way for a firm to raise funds for future expansion.

C) Changes in stock prices provide information about what investors think of various business decisions.

D) All of the above are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is an advantage of an indexed equity mutual fund relative to a managed equity fund?

A) Indexed funds generally have better stock pickers.

B) Indexed funds engage in more detailed research.

C) Indexed funds have lower operating costs because they engage in less stock trading.

D) Indexed funds earn a significantly higher rate of return than a broad portfolio that represents the entire stock market.

A) Indexed funds generally have better stock pickers.

B) Indexed funds engage in more detailed research.

C) Indexed funds have lower operating costs because they engage in less stock trading.

D) Indexed funds earn a significantly higher rate of return than a broad portfolio that represents the entire stock market.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

16

The random walk theory of stock prices indicates that

A) if they are willing to do a little research, even beginning investors will be able to pick the stocks that will increase most in price in the future.

B) managed mutual funds will persistently earn a higher rate of return than indexed funds.

C) current stock prices already reflect information about factors influencing future stock prices that can be forecast with any degree of accuracy.

D) stock market investors can expect to earn a steady real rate of return of about 7 percent annually.

A) if they are willing to do a little research, even beginning investors will be able to pick the stocks that will increase most in price in the future.

B) managed mutual funds will persistently earn a higher rate of return than indexed funds.

C) current stock prices already reflect information about factors influencing future stock prices that can be forecast with any degree of accuracy.

D) stock market investors can expect to earn a steady real rate of return of about 7 percent annually.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

17

Compared to other investments such as bonds, historically a diverse set of stocks held over a lengthy time period (for example, 30 or 40 years) has yielded a

A) low average real rate of return, and the variation in that return has been extremely high.

B) high average real rate of return, and the variation in that return has been relatively small.

C) low average real rate of return, and the variation in that return has been relatively small.

D) high average real rate of return, and the variation in that return has been extremely high.

A) low average real rate of return, and the variation in that return has been extremely high.

B) high average real rate of return, and the variation in that return has been relatively small.

C) low average real rate of return, and the variation in that return has been relatively small.

D) high average real rate of return, and the variation in that return has been extremely high.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following about stock prices is true?

A) The buyer of a firm's stock is purchasing a fractional share in the firm's future net revenues.

B) When investors believe that a business decision by the management of a firm will increase the firm's future earnings, the price of the firm's stock will tend to rise.

C) Changing stock prices provide the board of directors and managers of a firm with a strong incentive to make good decisions and undertake productive projects.

D) All of the above are true.

A) The buyer of a firm's stock is purchasing a fractional share in the firm's future net revenues.

B) When investors believe that a business decision by the management of a firm will increase the firm's future earnings, the price of the firm's stock will tend to rise.

C) Changing stock prices provide the board of directors and managers of a firm with a strong incentive to make good decisions and undertake productive projects.

D) All of the above are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is a risk that investors undertake when purchasing stocks?

A) An individual stock can rise and fall unpredictably.

B) Nearly all stocks in the stock market may rise or fall together, when expectations about the entire economy change.

C) Both a and b are true.

D) Neither a nor b is true.

A) An individual stock can rise and fall unpredictably.

B) Nearly all stocks in the stock market may rise or fall together, when expectations about the entire economy change.

C) Both a and b are true.

D) Neither a nor b is true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

20

Regarding stocks and bonds, which of the following is true?

A) Bond owners are entitled to the fraction of the firm's future revenues represented by their ownership shares.

B) As long as the organization issuing the stock is solvent, the stockholder can count on the funds being repaid with interest.

C) Bonds provide businesses, governments, and other organizations with a convenient way to borrow money.

D) All of the above are true.

A) Bond owners are entitled to the fraction of the firm's future revenues represented by their ownership shares.

B) As long as the organization issuing the stock is solvent, the stockholder can count on the funds being repaid with interest.

C) Bonds provide businesses, governments, and other organizations with a convenient way to borrow money.

D) All of the above are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following would tend to increase the value of a future stream of income?

A) an increase in the rate of inflation

B) an increase in the interest rate

C) a reduction in the interest rate

D) a reduction in the size of the expected future income

A) an increase in the rate of inflation

B) an increase in the interest rate

C) a reduction in the interest rate

D) a reduction in the size of the expected future income

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

22

Since 1802, the American stock market has yielded an average annual real return (the return adjusted for inflation) of approximately

A) 3 percent.

B) 5 percent.

C) 7 percent

D) 11 percent.

A) 3 percent.

B) 5 percent.

C) 7 percent

D) 11 percent.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following would be most likely to push stock prices higher?

A) higher interest rates and the expectation of larger future corporate profits

B) higher interest rates and the expectation of smaller future corporate profits

C) lower interest rates and the expectation of larger future corporate profits

D) lower interest rates and the expectation of smaller future corporate profits

A) higher interest rates and the expectation of larger future corporate profits

B) higher interest rates and the expectation of smaller future corporate profits

C) lower interest rates and the expectation of larger future corporate profits

D) lower interest rates and the expectation of smaller future corporate profits

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

24

If the interest rate were 10 percent, how much would people be willing to pay for a stock that was certain to yield a $2 per share stream of net earnings continuously in the future?

A) $2

B) $10

C) $20

D) $100

A) $2

B) $10

C) $20

D) $100

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

25

During the 1970s, the price/earnings ratio of stocks in the S&P 500 was relatively low. This low P/E ratio was

A) surprising because the inflation rate was high during the 1970s.

B) not surprising because interest rates were low during the inflationary 1970s.

C) not surprising because interest rates were high during the inflationary 1970s.

D) surprising because the inflation rate was low during the 1970s.

A) surprising because the inflation rate was high during the 1970s.

B) not surprising because interest rates were low during the inflationary 1970s.

C) not surprising because interest rates were high during the inflationary 1970s.

D) surprising because the inflation rate was low during the 1970s.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

26

Consider a stock with a 50 percent probability of zero net earnings and a 50 percent probability of net earnings equal to $20 per share each year continuously in the future. Furthermore, assume that people are risk averse. That is, they will have to be compensated for uncertainty accompanying variation in their future wealth. If the interest rate were 5 percent, how much would people be willing to pay for a share of this stock?

A) $10

B) $200

C) less than $200

D) more than $200

E) $400

A) $10

B) $200

C) less than $200

D) more than $200

E) $400

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

27

The stock price of a firm is primarily a reflection of the

A) firm's current net earnings per share.

B) firm's expected future net earnings per share.

C) discounted value of the firm's expected future net earnings per share.

D) firm's current net earnings per share multiplied by the interest rate.

E) book value of the firm.

A) firm's current net earnings per share.

B) firm's expected future net earnings per share.

C) discounted value of the firm's expected future net earnings per share.

D) firm's current net earnings per share multiplied by the interest rate.

E) book value of the firm.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

28

If the interest rate were 5 percent, how much would people be willing to pay for a stock that was certain to yield a $10 per share stream of net earnings continuously in the future?

A) $10

B) $20

C) $200

D) $400

E) $2,000

A) $10

B) $20

C) $200

D) $400

E) $2,000

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

29

A firm's stock price will be higher when the interest rate is ____ and the value of the firm's expected future profits are ____.

A) lower; larger

B) lower; smaller

C) higher; larger

D) higher; smaller

A) lower; larger

B) lower; smaller

C) higher; larger

D) higher; smaller

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

30

The random walk theory indicates that

A) investors can make money by purchasing stocks that are widely expected to earn substantial profits in the future.

B) while changes in the prices of specific stocks are difficult to predict, experts are able to forecast the future direction of broad stock market indexes with a high degree of accuracy.

C) changes in stock prices are driven by surprise occurrences that are difficult for anyone to predict accurately.

D) managed mutual funds will persistently outperform indexed funds.

A) investors can make money by purchasing stocks that are widely expected to earn substantial profits in the future.

B) while changes in the prices of specific stocks are difficult to predict, experts are able to forecast the future direction of broad stock market indexes with a high degree of accuracy.

C) changes in stock prices are driven by surprise occurrences that are difficult for anyone to predict accurately.

D) managed mutual funds will persistently outperform indexed funds.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose that monetary policy becomes more expansionary, and as a result, the future rate of inflation is higher. Will this be good for the stock market?

A) Yes; the inflation will lead to higher wages, and this will be good for both the economy and the stock market.

B) No; the inflation will lead to higher nominal interest rates, and this will reduce the present value of the future net earnings derived from stocks.

C) Yes; the inflation rate will reduce the long-run rate of unemployment, and this will be good for the stock market.

D) No; the expansionary monetary policy will lead to lower real interest rates, and this is generally bad for both the economy and the stock market.

A) Yes; the inflation will lead to higher wages, and this will be good for both the economy and the stock market.

B) No; the inflation will lead to higher nominal interest rates, and this will reduce the present value of the future net earnings derived from stocks.

C) Yes; the inflation rate will reduce the long-run rate of unemployment, and this will be good for the stock market.

D) No; the expansionary monetary policy will lead to lower real interest rates, and this is generally bad for both the economy and the stock market.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following would be most likely to cause the price/earnings ratio of stocks to rise?

A) the expectation of a recession in the near future

B) the expectation of inflation in the near future

C) higher interest rates

D) lower interest rates

A) the expectation of a recession in the near future

B) the expectation of inflation in the near future

C) higher interest rates

D) lower interest rates

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

33

To the extent that current profits are directly related to future profits, a high price/earnings ratio would indicate that stocks are

A) inexpensive.

B) expensive.

C) going to increase in value in the future.

D) most likely to fall in value if interest rates decline.

A) inexpensive.

B) expensive.

C) going to increase in value in the future.

D) most likely to fall in value if interest rates decline.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

34

The theory that stock prices reflect all available information and that the future movement of stock prices is unpredictable is called the

A) random walk theory.

B) inefficient market theory.

C) technical analysis theory.

D) charting theory.

A) random walk theory.

B) inefficient market theory.

C) technical analysis theory.

D) charting theory.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is true of stock prices?

A) An increase in the interest rate will tend to increase stock prices.

B) A reduction in the interest rate will tend to increase stock prices.

C) An increase in the inflation rate will tend to increase stock prices.

D) There is no reason to believe that changes in interest rates will influence stock prices.

A) An increase in the interest rate will tend to increase stock prices.

B) A reduction in the interest rate will tend to increase stock prices.

C) An increase in the inflation rate will tend to increase stock prices.

D) There is no reason to believe that changes in interest rates will influence stock prices.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

36

Stock analysts often argue that lower interest rates are good for the stock market. Does this argument make sense?

A) No; lower interest rates will tend to slow down the economy and this will be bad for the stock market.

B) Yes; the lower rates of interest will increase the value of future income (and capital gains) and stock prices will rise to reflect this factor.

C) No; the lower rates of interest will reduce the value of future income (and capital gains) and this will cause stock prices to fall.

D) Yes; the lower interest rates will cause inflation and inflation is generally good for the stock market.

A) No; lower interest rates will tend to slow down the economy and this will be bad for the stock market.

B) Yes; the lower rates of interest will increase the value of future income (and capital gains) and stock prices will rise to reflect this factor.

C) No; the lower rates of interest will reduce the value of future income (and capital gains) and this will cause stock prices to fall.

D) Yes; the lower interest rates will cause inflation and inflation is generally good for the stock market.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

37

During 1982-1997, stock prices increased substantially. Which of the following helped to boost stock prices during this period?

A) higher interest rates and rapid growth of corporate profits

B) lower interest rates and rapid growth of corporate profits

C) higher interest rates and slow growth of corporate profits

D) lower interest rates and slow growth of corporate profits

A) higher interest rates and rapid growth of corporate profits

B) lower interest rates and rapid growth of corporate profits

C) higher interest rates and slow growth of corporate profits

D) lower interest rates and slow growth of corporate profits

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

38

Investors are often willing to pay positive prices for shares of firms that have never earned a profit because the investors

A) do not know the firms have never earned a profit.

B) expect the firms to have positive net earnings in the future.

C) expect that interest rates will rise in the future.

D) expect that higher rates of inflation will push stock prices higher in the future.

A) do not know the firms have never earned a profit.

B) expect the firms to have positive net earnings in the future.

C) expect that interest rates will rise in the future.

D) expect that higher rates of inflation will push stock prices higher in the future.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

39

The present value of $1 million to be received in the future will

A) increase if the interest rate rises.

B) increase if the payment is received at a more distant time in the future.

C) be greater than $1 million.

D) increase if the interest rate were to fall from 8 percent to 4 percent.

A) increase if the interest rate rises.

B) increase if the payment is received at a more distant time in the future.

C) be greater than $1 million.

D) increase if the interest rate were to fall from 8 percent to 4 percent.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

40

If the interest rate were 12.5 percent, how much would people be willing to pay for a stock that was certain to yield a $20 per share stream of net earnings continuously in the future?

A) $20

B) $25

C) $160

D) $250

A) $20

B) $25

C) $160

D) $250

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

41

If Apple Computer Corporation constitutes a sizeable share of your current stock holdings, the purchase of which of the following stocks would provide you with the greatest reduction in risk?

A) Hewlett-Packard

B) IBM

C) Dell Computer Corporation

D) Wal-Mart

A) Hewlett-Packard

B) IBM

C) Dell Computer Corporation

D) Wal-Mart

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

42

If an investor's primary stock holding is currently Exxon Mobil, the purchase of which of the following stocks would provide the investor with the largest reduction in risk?

A) BP / Amoco.

B) Shell Oil Corporation.

C) General Motors.

D) Texaco.

A) BP / Amoco.

B) Shell Oil Corporation.

C) General Motors.

D) Texaco.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following about investments is true?

A) People who invest in the stock market are virtually certain to make money.

B) Investors in the stock market can reduce their risk if they hold shares of specific stocks for only short periods of time.

C) The risk of stock market investments can be reduced through the holding of a diverse portfolio of unrelated stocks over long periods of time.

D) In the long run, corporate bonds can be expected to yield a higher real rate of return than ownership of stocks.

A) People who invest in the stock market are virtually certain to make money.

B) Investors in the stock market can reduce their risk if they hold shares of specific stocks for only short periods of time.

C) The risk of stock market investments can be reduced through the holding of a diverse portfolio of unrelated stocks over long periods of time.

D) In the long run, corporate bonds can be expected to yield a higher real rate of return than ownership of stocks.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following provides the strongest argument for young people making regular payments into a retirement program that invests these funds in a diverse set of stocks?

A) The prices of stocks tend to fluctuate more than the prices of bonds.

B) Over short periods of time, variation in the real rate of return of stocks is greater than bonds.

C) When held over lengthy periods like 30 or 40 years, historically, the rate of return on stocks has been both higher and less variable than that of bonds.

D) Lower interest rates will lead to higher bond prices.

A) The prices of stocks tend to fluctuate more than the prices of bonds.

B) Over short periods of time, variation in the real rate of return of stocks is greater than bonds.

C) When held over lengthy periods like 30 or 40 years, historically, the rate of return on stocks has been both higher and less variable than that of bonds.

D) Lower interest rates will lead to higher bond prices.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following would be the best strategy for a long-term investor wanting to earn an attractive rate of return?

A) Pick stocks that have done well in the past.

B) Buy shares of an equity mutual fund indexed to the S&P 500.

C) Purchase shares of a money market mutual fund.

D) Buy shares of an actively managed equity mutual fund.

A) Pick stocks that have done well in the past.

B) Buy shares of an equity mutual fund indexed to the S&P 500.

C) Purchase shares of a money market mutual fund.

D) Buy shares of an actively managed equity mutual fund.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

46

Historically, when a diverse set of stocks is held over a lengthy time period, stocks have yielded a ____ rate of return, and the variation in the rate of return has been ____.

A) low; low

B) low; high

C) high; low

D) high; high

A) low; low

B) low; high

C) high; low

D) high; high

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following will tend to result in the least variation in the expected real rate of return from the ownership of stocks?

A) ownership of a single stock for a short period of time

B) ownership of a single stock over a lengthy period of time

C) ownership of stocks from a specific sector (for example, the automobile industry) over a lengthy period of time

D) ownership of a diverse set of stocks (the Standard & Poor's 500, for example) over a lengthy period of time

A) ownership of a single stock for a short period of time

B) ownership of a single stock over a lengthy period of time

C) ownership of stocks from a specific sector (for example, the automobile industry) over a lengthy period of time

D) ownership of a diverse set of stocks (the Standard & Poor's 500, for example) over a lengthy period of time

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following about the stock market is true?

A) Investment in the stock market is a relatively foolproof method for an investor to earn a high rate of return during the next five years.

B) Current stock prices already reflect information that is known with a high degree of certainty.

C) Experts are able to predict changes in the direction of the broad stock market indexes with a high degree of accuracy.

D) While changes in the prices of specific stocks are difficult to predict, it is relatively easy to predict the future direction of the broad stock market.

E) Both c and d are true.

A) Investment in the stock market is a relatively foolproof method for an investor to earn a high rate of return during the next five years.

B) Current stock prices already reflect information that is known with a high degree of certainty.

C) Experts are able to predict changes in the direction of the broad stock market indexes with a high degree of accuracy.

D) While changes in the prices of specific stocks are difficult to predict, it is relatively easy to predict the future direction of the broad stock market.

E) Both c and d are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is an implication of the random walk theory?

A) Experts will be able to make money by picking and choosing the best stocks.

B) There is a systematic pattern to the movement of prices in the stock market.

C) Stock market investors can expect to earn a fairly steady real rate of return of about 7 percent annually.

D) Even experts will be unable to predict the future movement of stock prices with any degree of accuracy.

A) Experts will be able to make money by picking and choosing the best stocks.

B) There is a systematic pattern to the movement of prices in the stock market.

C) Stock market investors can expect to earn a fairly steady real rate of return of about 7 percent annually.

D) Even experts will be unable to predict the future movement of stock prices with any degree of accuracy.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following has enhanced the ability of investors, without any special business skills, to benefit from the ownership of corporate America?

A) the increased availability of mutual funds that make it possible for even small investors to purchase a diverse stock portfolio at a low cost

B) an increased tendency of small investors to buy and sell stock frequently, using stock tips from investment experts

C) the virtual disappearance of business failures among corporations with publicly traded stock shares

D) all of the above

A) the increased availability of mutual funds that make it possible for even small investors to purchase a diverse stock portfolio at a low cost

B) an increased tendency of small investors to buy and sell stock frequently, using stock tips from investment experts

C) the virtual disappearance of business failures among corporations with publicly traded stock shares

D) all of the above

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following will reduce the risk accompanying equity (stock) investments?

A) the purchase of shares of a mutual fund that holds the stocks of many diverse corporations

B) the purchasing and holding of equities over a lengthy period of time

C) the purchase of shares in firms doing business in a wider variety of industries and markets

D) all of the above

A) the purchase of shares of a mutual fund that holds the stocks of many diverse corporations

B) the purchasing and holding of equities over a lengthy period of time

C) the purchase of shares in firms doing business in a wider variety of industries and markets

D) all of the above

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following makes it possible for even a small investor to hold a diverse set of stocks and still keep the cost of purchasing additional stock holdings low?

A) A real world savings account.

B) An equity (stock) mutual fund.

C) A bond mutual fund.

D) A checking account at a local bank.

A) A real world savings account.

B) An equity (stock) mutual fund.

C) A bond mutual fund.

D) A checking account at a local bank.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is an implication of the random walk theory?

A) Experts will be able to make money by picking and choosing the best stocks.

B) There is a systematic pattern to the movement of prices in the stock market.

C) Stock market investors can expect to earn a fairly steady real rate of return of about 7 percent annually.

D) Even experts will be unable to predict the future movement of stock prices with any degree of accuracy.

A) Experts will be able to make money by picking and choosing the best stocks.

B) There is a systematic pattern to the movement of prices in the stock market.

C) Stock market investors can expect to earn a fairly steady real rate of return of about 7 percent annually.

D) Even experts will be unable to predict the future movement of stock prices with any degree of accuracy.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following provides young people with a strong incentive to make regular payments into a retirement program and invest these funds in a diverse set of stocks?

A) The prices of stocks tend to fluctuate more than the prices of bonds.

B) Over short periods of time, variation in the real rate of return of stocks is greater than bonds.

C) When held over lengthy periods like 30 or 40 years, historically the rate of return on stocks has been both higher and less variable than that of bonds.

D) Lower interest rates will lead to higher bond prices.

A) The prices of stocks tend to fluctuate more than the prices of bonds.

B) Over short periods of time, variation in the real rate of return of stocks is greater than bonds.

C) When held over lengthy periods like 30 or 40 years, historically the rate of return on stocks has been both higher and less variable than that of bonds.

D) Lower interest rates will lead to higher bond prices.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

55

Which person is more likely to have more wealth upon retirement?

A) A person who has invested 5 percent of their income into an equity mutual fund beginning at age 22.

B) A employee who bought some of their company's stock beginning at age 30.

C) A person who has invested 5 percent of their income into a stock portfolio beginning at age 50.

D) A person who has invested 5 percent of their income into government bonds beginning at age 22.

A) A person who has invested 5 percent of their income into an equity mutual fund beginning at age 22.

B) A employee who bought some of their company's stock beginning at age 30.

C) A person who has invested 5 percent of their income into a stock portfolio beginning at age 50.

D) A person who has invested 5 percent of their income into government bonds beginning at age 22.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

56

Investment in a broad portfolio of stocks is most attractive for

A) short-term investors.

B) long-term investors.

C) investors seeking a steady rate of return.

D) investors who will need the funds for other purposes in about 10 years.

A) short-term investors.

B) long-term investors.

C) investors seeking a steady rate of return.

D) investors who will need the funds for other purposes in about 10 years.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

57

The variation in the rate of return one can expect from ownership of stocks will generally be smaller if

A) all of the funds are invested in a specific sector of the economy such as the automobile industry.

B) a diverse set of stocks is held over a lengthy period of time such as 30 or 40 years.

C) all of the funds are invested in a single stock.

D) the funds are invested for a relatively short period of time.

A) all of the funds are invested in a specific sector of the economy such as the automobile industry.

B) a diverse set of stocks is held over a lengthy period of time such as 30 or 40 years.

C) all of the funds are invested in a single stock.

D) the funds are invested for a relatively short period of time.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

58

The random walk theory implies that stock prices

A) go down, then up, and then down again.

B) follow systematic trends.

C) can be forecast accurately by experts who are knowledgeable about how the stock market works.

D) will change as the result of unexpected factors that are virtually impossible to forecast accurately.

A) go down, then up, and then down again.

B) follow systematic trends.

C) can be forecast accurately by experts who are knowledgeable about how the stock market works.

D) will change as the result of unexpected factors that are virtually impossible to forecast accurately.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

59

Buying shares of corporate stock tends to be more risky when

A) the stock of a single corporation is purchased.

B) the stock may have to be sold within a few months.

C) all stocks bought are in the same industry.

D) all of the above are true.

A) the stock of a single corporation is purchased.

B) the stock may have to be sold within a few months.

C) all stocks bought are in the same industry.

D) all of the above are true.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

60

The random walk theory implies that stock prices

A) go down, then up, and then down again.

B) go up and then down in a predictable pattern.

C) follow systematic trends.

D) are unpredictable based on past trends.

A) go down, then up, and then down again.

B) go up and then down in a predictable pattern.

C) follow systematic trends.

D) are unpredictable based on past trends.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

61

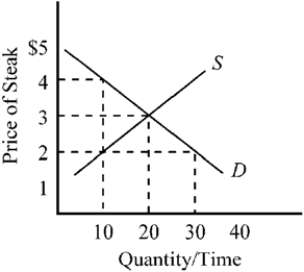

Figure 3-1

Which of the following is true regarding the market for steak shown in Figure 3-1?

A) If the price of steak were $2 per pound, producers would want to supply less steak than consumers would want to buy.

B) If the price of steak were $4 per pound, producers would want to supply more steak than consumers would want to buy.

C) If the price of steak were $3 per pound, producers would want to supply the same amount of steak that consumers would want to buy.

D) All of the above are true regarding the market for steak shown in the figure.

Which of the following is true regarding the market for steak shown in Figure 3-1?

A) If the price of steak were $2 per pound, producers would want to supply less steak than consumers would want to buy.

B) If the price of steak were $4 per pound, producers would want to supply more steak than consumers would want to buy.

C) If the price of steak were $3 per pound, producers would want to supply the same amount of steak that consumers would want to buy.

D) All of the above are true regarding the market for steak shown in the figure.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

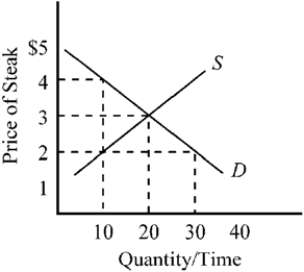

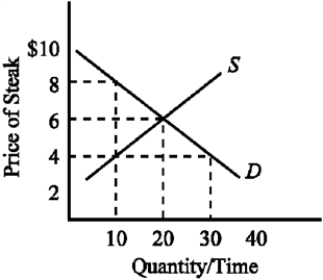

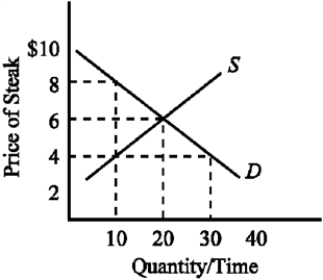

62

Figure 3-2

Given the supply and demand conditions illustrated in Figure 3-2, the equilibrium price of steak is

A) $2 per pound.

B) $4 per pound.

C) $6 per pound.

D) $8 per pound.

Given the supply and demand conditions illustrated in Figure 3-2, the equilibrium price of steak is

A) $2 per pound.

B) $4 per pound.

C) $6 per pound.

D) $8 per pound.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

63

Many personal finance magazines such as Money and Smart Money routinely give advice as to which stocks to buy. Should you take their advice?

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

64

An indexed equity mutual fund

A) is directly tied to either the consumer price index or the GDP deflator.

B) is a fund that hires a manager who will try to pick the stocks that will increase most in value in the future.

C) merely holds stocks in the same proportion as they exist in a broad stock market index like the Standard & Poor's 500.

D) will have high operating costs because these funds engage in a substantial amount of stock trading.

A) is directly tied to either the consumer price index or the GDP deflator.

B) is a fund that hires a manager who will try to pick the stocks that will increase most in value in the future.

C) merely holds stocks in the same proportion as they exist in a broad stock market index like the Standard & Poor's 500.

D) will have high operating costs because these funds engage in a substantial amount of stock trading.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

65

Assume that corn and soybeans are alternatives that could be grown by most farmers. An increase in the price of corn will

A) increase the supply of corn.

B) increase the supply of soybeans.

C) decrease the supply of soybeans.

D) decrease the supply of corn.

E) have no effect on the supplies of corn and soybeans.

A) increase the supply of corn.

B) increase the supply of soybeans.

C) decrease the supply of soybeans.

D) decrease the supply of corn.

E) have no effect on the supplies of corn and soybeans.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

66

Does it ever make sense to purchase a stock that has never paid a dividend? Explain.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

67

"A reduction in gasoline prices caused the demand for gasoline to increase. The lower gas prices also led to an increase in demand for large cars, causing their prices to rise." These statements

A) are essentially correct.

B) contain one error; the lower gasoline prices would cause an increase in the quantity demanded of gasoline, not an increase in demand.

C) contain one error; the lower gasoline prices would increase the quantity demanded of large cars, not the demand.

D) contain two errors; the lower gasoline prices would cause the quantity of gasoline demanded (rather than the demand) to increase, and the lower gasoline price would cause an increase in quantity demanded (rather than the demand) for large cars.

A) are essentially correct.

B) contain one error; the lower gasoline prices would cause an increase in the quantity demanded of gasoline, not an increase in demand.

C) contain one error; the lower gasoline prices would increase the quantity demanded of large cars, not the demand.

D) contain two errors; the lower gasoline prices would cause the quantity of gasoline demanded (rather than the demand) to increase, and the lower gasoline price would cause an increase in quantity demanded (rather than the demand) for large cars.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

68

When the market for a good is in equilibrium,

A) consumer surplus will equal producer surplus.

B) the total value created for consumers will equal the total cost of production for business firms.

C) all units valued more highly than the opportunity cost of production will be supplied.

D) all units that have value will be produced, regardless of their cost of production.

A) consumer surplus will equal producer surplus.

B) the total value created for consumers will equal the total cost of production for business firms.

C) all units valued more highly than the opportunity cost of production will be supplied.

D) all units that have value will be produced, regardless of their cost of production.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

69

Producers are willing to offer greater quantities for sale at higher prices because

A) they have the incentive to pay the increasing opportunity cost of resources necessary to attract them from alternative uses

B) they will decrease their profits by expanding production at higher prices

C) the government orders them to do so

D) lower prices attract new firms, which have higher costs of production

E) they hire superior quality, higher-priced resources as production expands

A) they have the incentive to pay the increasing opportunity cost of resources necessary to attract them from alternative uses

B) they will decrease their profits by expanding production at higher prices

C) the government orders them to do so

D) lower prices attract new firms, which have higher costs of production

E) they hire superior quality, higher-priced resources as production expands

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following would most likely increase the demand for peanut butter?

A) a decrease in the price of jelly, a good that is often used with peanut butter

B) the discovery that excessive consumption of peanut butter is harmful to one's health

C) crop failures that raise the price of peanuts

D) the invention of a new product that consumers think is a good substitute for peanut butter

A) a decrease in the price of jelly, a good that is often used with peanut butter

B) the discovery that excessive consumption of peanut butter is harmful to one's health

C) crop failures that raise the price of peanuts

D) the invention of a new product that consumers think is a good substitute for peanut butter

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following investments is characterized by low risk, low fees, and high historic returns when held over a lengthy time period?

A) A managed mutual fund that has performed well during the past two or three years.

B) A portfolio of technology stocks.

C) A mutual fund that holds stocks in the same proportion as a broad stock market index such as the S&P 500.

D) A mutual fund invested in medium-term bonds issued by the U.S. Treasury.

A) A managed mutual fund that has performed well during the past two or three years.

B) A portfolio of technology stocks.

C) A mutual fund that holds stocks in the same proportion as a broad stock market index such as the S&P 500.

D) A mutual fund invested in medium-term bonds issued by the U.S. Treasury.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

72

Jane is a 22-year-old college graduate. She has just started working at a job that pays her $75,000 per year. Since you have had an economics course, Jane asks you for advice on where to invest the money she is saving for her retirement. What do you recommend?

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

73

The invisible hand principle indicates that competitive markets can help promote the efficient use of resources

A) only if buyers and sellers really care, personally, about economic efficiency.

B) even when each market participant cares only about their own self interest rather than about the overall efficiency of resource use.

C) even if business firms fail to produce goods efficiently.

D) if, and only if, businesses recognize their social obligation to keep costs low and use resources wisely.

A) only if buyers and sellers really care, personally, about economic efficiency.

B) even when each market participant cares only about their own self interest rather than about the overall efficiency of resource use.

C) even if business firms fail to produce goods efficiently.

D) if, and only if, businesses recognize their social obligation to keep costs low and use resources wisely.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is true?

A) Managed equity funds that have yielded attractive returns during the last 5 or 10 years can generally be counted on to yield similar returns in the future.

B) Managed funds generally outperform indexed equity mutual funds.

C) An investment strategy that yielded a high rate of return in the past will often yield below-average returns in the future.

D) Indexed equity mutual funds are usually tied directly to either the Consumer Price Index or the GDP deflator.

A) Managed equity funds that have yielded attractive returns during the last 5 or 10 years can generally be counted on to yield similar returns in the future.

B) Managed funds generally outperform indexed equity mutual funds.

C) An investment strategy that yielded a high rate of return in the past will often yield below-average returns in the future.

D) Indexed equity mutual funds are usually tied directly to either the Consumer Price Index or the GDP deflator.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

75

If cable TV service and satellite TV service are substitutes,

A) a decrease in the price of cable will decrease the demand for satellite TV.

B) an increase in the price of cable will decrease the demand for satellite TV.

C) an increase in the price of cable will generally have no effect on the demand for satellite TV.

D) an increase in the price of cable will shift the demand curve for satellite TV to the left.

A) a decrease in the price of cable will decrease the demand for satellite TV.

B) an increase in the price of cable will decrease the demand for satellite TV.

C) an increase in the price of cable will generally have no effect on the demand for satellite TV.

D) an increase in the price of cable will shift the demand curve for satellite TV to the left.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

76

"My broker studies the stock market and the management of specific firms. When he advises me to buy, I listen because he is an expert." Analyze this view.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

77

If DeShawn only pays $25,000 to purchase a new car even though he would have been willing to pay as much as $35,000 for the car, this indicates that

A) DeShawn is an irrational consumer.

B) The seller earned a $10,000 profit on the sale of the car.

C) DeShawn reaped $10,000 of consumer surplus from the transaction.

D) The seller received $10,000 worth of producer surplus on the transaction.

A) DeShawn is an irrational consumer.

B) The seller earned a $10,000 profit on the sale of the car.

C) DeShawn reaped $10,000 of consumer surplus from the transaction.

D) The seller received $10,000 worth of producer surplus on the transaction.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

78

A cold spell in Florida extensively reduced the orange crop, and as a result, California oranges commanded a higher price. Which of the following statements best explains the situation?

A) The supply of Florida oranges fell, causing the supply of California oranges to increase as well as their price.

B) The supply of Florida oranges fell, causing the supply of California oranges to decrease and their price to increase.

C) The supply of Florida oranges fell, causing their price to increase and the demand for California oranges to increase.

D) The demand for Florida oranges was reduced by the freeze, causing an increase in the price of California oranges and a greater demand for them.

A) The supply of Florida oranges fell, causing the supply of California oranges to increase as well as their price.

B) The supply of Florida oranges fell, causing the supply of California oranges to decrease and their price to increase.

C) The supply of Florida oranges fell, causing their price to increase and the demand for California oranges to increase.

D) The demand for Florida oranges was reduced by the freeze, causing an increase in the price of California oranges and a greater demand for them.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is true of equity funds?

A) Managed equity funds generally outperform indexed equity mutual funds.

B) Managed equity funds merely hold stocks in the same proportion they are represented in a broad stock market index such as the Standard & Poor's 500.

C) Indexed equity funds generally have lower management and operating costs than managed funds.

D) Indexed equity funds generally engage in more stock trading than managed funds.

A) Managed equity funds generally outperform indexed equity mutual funds.

B) Managed equity funds merely hold stocks in the same proportion they are represented in a broad stock market index such as the Standard & Poor's 500.

C) Indexed equity funds generally have lower management and operating costs than managed funds.

D) Indexed equity funds generally engage in more stock trading than managed funds.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck

80

The number of people willing to buy tickets to the Super Bowl is invariably greater than the number of tickets (and seats) available. This is evidence that the price of the tickets is

A) higher than the equilibrium price.

B) equal to the equilibrium price since the number of tickets bought equals the number sold.

C) lower than the equilibrium price.

D) higher than the equilibrium price when the demand is inelastic but lower when the demand is elastic.

A) higher than the equilibrium price.

B) equal to the equilibrium price since the number of tickets bought equals the number sold.

C) lower than the equilibrium price.

D) higher than the equilibrium price when the demand is inelastic but lower when the demand is elastic.

Unlock Deck

Unlock for access to all 408 flashcards in this deck.

Unlock Deck

k this deck