Deck 9: Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/193

Play

Full screen (f)

Deck 9: Liabilities

1

Current liabilities are expected to be paid within one year or the operating cycle, whichever is shorter.

False

2

All of the following are reported as current liabilities EXCEPT:

A)unearned revenues for services to be provided in 16 months.

B)sales tax payable.

C)accounts payable.

D)bonds payable due in 6 months.

A)unearned revenues for services to be provided in 16 months.

B)sales tax payable.

C)accounts payable.

D)bonds payable due in 6 months.

A

3

Employee compensation is the major expense for most service companies.

True

4

Purchasing inventory on account results in an accounts receivable.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

5

A potential obligation that depends on the future outcome of past events is a contingent liability.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

6

The journal entry to record salaries earned by employees will debit:

A)Salary Expense and credit Salary Payable for net pay.

B)Salary Expense and credit Salary Payable for gross pay.

C)Salary Expense for gross pay, credit FICA Tax Payable, credit Employee Income Tax Payable and credit Salary Payable for net pay.

D)Salary Expense for net pay, debit FICA Tax Payable, debit Employee Income Tax Payable, and credit Salary Payable for gross pay.

A)Salary Expense and credit Salary Payable for net pay.

B)Salary Expense and credit Salary Payable for gross pay.

C)Salary Expense for gross pay, credit FICA Tax Payable, credit Employee Income Tax Payable and credit Salary Payable for net pay.

D)Salary Expense for net pay, debit FICA Tax Payable, debit Employee Income Tax Payable, and credit Salary Payable for gross pay.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

7

On November 1, 2017, a company signed a promissory note. The interest and principal are due on July 1, 2018. What accounts relating to the note payable will be reported on the financial statements for the fiscal year ending December 31, 2017?

A)Short-term notes payable will be reported on the balance sheet and interest payable will be reported on the income statement.

B)Interest receivable will be reported on the balance sheet.

C)Short-term notes payable and interest payable will be reported on the balance sheet.

D)Short-term notes payable, interest payable and interest expense will be reported on the balance sheet.

A)Short-term notes payable will be reported on the balance sheet and interest payable will be reported on the income statement.

B)Interest receivable will be reported on the balance sheet.

C)Short-term notes payable and interest payable will be reported on the balance sheet.

D)Short-term notes payable, interest payable and interest expense will be reported on the balance sheet.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

8

All contingent liabilities should be reported as liabilities on the financial statements, even those that are unlikely to occur.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

9

Unearned revenues should be classified as Other revenues on the income statement.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

10

Interest expense on a note payable is only recorded at maturity.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

11

When accruing interest expense on a short-term note payable, the Interest Payable account will decrease.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

12

The current portion of a long-term note payable refers to the amount of interest on a note payable that must be paid in the current year.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

13

At the end of the year, a company makes a journal entry to accrue the interest expense on a short-term note payable. As a result of this transaction:

A)current liabilities increase and current assets increase.

B)current liabilities increase and stockholders' equity increases.

C)current liabilities decrease and stockholders' equity decreases.

D)current liabilities increase and stockholders' equity decreases.

A)current liabilities increase and current assets increase.

B)current liabilities increase and stockholders' equity increases.

C)current liabilities decrease and stockholders' equity decreases.

D)current liabilities increase and stockholders' equity decreases.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

14

Vacation pay and income taxes are examples of expenses that must be estimated.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

15

A note payable may require the borrower to accrue interest expense and interest payable at the end of the accounting period.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

16

The balance of the Unearned Revenue account becomes zero when a company has earned all of the revenue it had collected in advance.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

17

A contingent liability should be disclosed in the notes to the financial statements if there is a reasonable possibility that a loss (or expense)will occur.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

18

Accounts payable turnover is an important measure of liquidity for a retail business.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

19

When a business receives cash from customers before earning the revenue, the ________ account is credited.

A)Accounts Receivable

B)Sales Tax Payable

C)Accounts Payable

D)Unearned Revenue

A)Accounts Receivable

B)Sales Tax Payable

C)Accounts Payable

D)Unearned Revenue

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

20

At the end of each year, a company must reclassify from long-term debt to a current liability the amount of its long-term debt that is due next year.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

21

Nationwide Magazine sells 63,000 subscriptions on account in March. The subscription price is $14 each. The subscriptions start in April. The journal entry in March would include a:

A)debit to Unearned Subscription Revenue for $882,000.

B)debit to prepaid subscriptions for $882,000.

C)credit to Cash for $882,000.

D)credit to Unearned Subscription Revenue for $882,000.

A)debit to Unearned Subscription Revenue for $882,000.

B)debit to prepaid subscriptions for $882,000.

C)credit to Cash for $882,000.

D)credit to Unearned Subscription Revenue for $882,000.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

22

The journal entry to record accrued interest on a short-term note payable includes a debit to:

A)Interest Payable and a credit to Cash.

B)Interest Expense and a credit to Cash.

C)Interest Expense and a credit to Interest Payable.

D)Interest Payable and a credit to Notes Payable.

A)Interest Payable and a credit to Cash.

B)Interest Expense and a credit to Cash.

C)Interest Expense and a credit to Interest Payable.

D)Interest Payable and a credit to Notes Payable.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following liability accounts is usually NOT an accrued liability:

A)Interest Payable.

B)Wages Payable.

C)Taxes Payable.

D)Notes Payable.

A)Interest Payable.

B)Wages Payable.

C)Taxes Payable.

D)Notes Payable.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

24

Monthly sales are $530,000. Warranty costs are estimated at 6% of monthly sales. Warranties are honored with replacement products. No defective products are returned during the month. At the end of the month, the company should record a journal entry with a credit to:

A)Estimated Warranty Payable for $31,800.

B)Warranty Expense for $31,800.

C)Sales for $31,800.

D)Inventory for $31,800.

A)Estimated Warranty Payable for $31,800.

B)Warranty Expense for $31,800.

C)Sales for $31,800.

D)Inventory for $31,800.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

25

Mike's Pharmacy sold inventory with a selling price of $2800 to customers for cash. They also collected sales taxes of $500. The journal entry to record this information includes a:

A)debit to Cash of $3300.

B)debit to Sales Tax Expense $500.

C)credit to Sales $3300.

D)debit to Sales Tax Payable $500.

A)debit to Cash of $3300.

B)debit to Sales Tax Expense $500.

C)credit to Sales $3300.

D)debit to Sales Tax Payable $500.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

26

Wisconsin Bank lends Local Furniture Company $140,000 on November 1. Local Furniture Company signs a $140,000, 3%, 4-month note. The fiscal year end of Local Furniture Company is December 31. The journal entry made by Local Furniture Company on December 31 is:

A)debit Interest Expense and credit Interest Payable for $700

B)debit Interest Payable and credit Interest Expense for $700

C)debit Interest Expense and credit Cash for $700

D)debit Interest Payable and credit Cash for $700

A)debit Interest Expense and credit Interest Payable for $700

B)debit Interest Payable and credit Interest Expense for $700

C)debit Interest Expense and credit Cash for $700

D)debit Interest Payable and credit Cash for $700

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

27

Sales taxes collected from customers are sent to the state at the end of each month. What journal entry is prepared?

A)debit Accounts Receivable and credit Sales

B)debit Sales Tax Payable and credit Sales

C)debit Accounts Payable and credit Cash

D)debit Sales Taxes Payable and credit Cash

A)debit Accounts Receivable and credit Sales

B)debit Sales Tax Payable and credit Sales

C)debit Accounts Payable and credit Cash

D)debit Sales Taxes Payable and credit Cash

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

28

Mariano Corporation sells 12,000 units of inventory during the first year of operations for $700 each. Mariano provides a one-year warranty on parts. It is estimated that 4% of the units will be defective and that repair costs are estimated to be $70 per unit. In the year of sale, warranty contracts are honored on 70 units for a total cost of $4900. What amount will be reported as Estimated Warranty Liability at the end of the year?

A)$4900

B)$13,720

C)$28,700

D)$33,600

A)$4900

B)$13,720

C)$28,700

D)$33,600

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

29

Illinois Bank lends Lisle Furniture Company $70,000 on December 1. Lisle Furniture Company signs a $70,000, 6%, 4-month note. The total cash paid at maturity of the note is: (Round your final answer to the nearest dollar.)

A)$70,000.

B)$71,400.

C)$72,100.

D)$74,200.

A)$70,000.

B)$71,400.

C)$72,100.

D)$74,200.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

30

Unearned Service Revenue relating to services, to be provided in one month, is reported on the balance sheet as:

A)a revenue account.

B)a current liability.

C)a component of stockholders' equity.

D)a long-term liability.

A)a revenue account.

B)a current liability.

C)a component of stockholders' equity.

D)a long-term liability.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

31

Aisha Company paid $1,500 cash to replace a wheel on equipment sold under a two-year warranty in the prior year. The entry to record the payment will debit:

A)Warranty Expense and credit Cash.

B)Repair Expense and credit Cash.

C)Estimated Warranty Payable and credit Cash.

D)Operating Expense and credit Cash.

A)Warranty Expense and credit Cash.

B)Repair Expense and credit Cash.

C)Estimated Warranty Payable and credit Cash.

D)Operating Expense and credit Cash.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

32

Kathy's Corner Store has total cash sales for the month of $38,000 excluding sales taxes. If the sales tax rate is 8%, which journal entry is needed? (Ignore Cost of Goods Sold.)

A)debit Cash $41,040, credit Sales Revenue $41,040

B)debit Cash $38,000 and credit Sales Revenue $38,000

C)debit Cash $34,960, debit Sales Tax Receivable for $3040 and credit Sales Revenue for $38,000

D)debit Cash $41,040, credit Sales Revenue $38,000 and credit Sales Tax Payable $3040

A)debit Cash $41,040, credit Sales Revenue $41,040

B)debit Cash $38,000 and credit Sales Revenue $38,000

C)debit Cash $34,960, debit Sales Tax Receivable for $3040 and credit Sales Revenue for $38,000

D)debit Cash $41,040, credit Sales Revenue $38,000 and credit Sales Tax Payable $3040

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

33

Failure to record an accrued liability for wages earned by employees causes a company to:

A)understate net income.

B)overstate assets.

C)overstate liabilities.

D)overstate stockholders' equity.

A)understate net income.

B)overstate assets.

C)overstate liabilities.

D)overstate stockholders' equity.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

34

Michigan Bank lends Detroit Furniture Company $80,000 on December 1. Detroit Furniture Company signs a $80,000, 6%, 4-month note. The total cash paid for interest (only)at maturity of the note is: (Round your final answer to the nearest dollar.)

A)$800

B)$1600

C)$3200

D)$4800

A)$800

B)$1600

C)$3200

D)$4800

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

35

Madison Bank lends Neenah Paper Company $110,000 on January 1, 2017. Neenah signs a $110,000, 10%, 6-month note. The journal entry made by Neenah on January 1, 2017 will debit:

A)Cash for $99,000 and credit Note Payable for $99,000.

B)Interest Expense for $11,000 and credit Cash for $11,000.

C)Cash for $110,000 and credit Notes Payable for $110,000.

D)Interest Expense for $11,000 and credit Interest Payable for $11,000.

A)Cash for $99,000 and credit Note Payable for $99,000.

B)Interest Expense for $11,000 and credit Cash for $11,000.

C)Cash for $110,000 and credit Notes Payable for $110,000.

D)Interest Expense for $11,000 and credit Interest Payable for $11,000.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

36

Notes payable due in six months are reported as:

A)a reduction to notes receivable on the balance sheet.

B)current assets on the balance sheet.

C)current liabilities on the balance sheet.

D)long-term liabilities on the balance sheet.

A)a reduction to notes receivable on the balance sheet.

B)current assets on the balance sheet.

C)current liabilities on the balance sheet.

D)long-term liabilities on the balance sheet.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

37

Total wages employees earned for the payroll period are called ________. The amount of wages the employees take home is the ________.

A)gross pay; withholding amount

B)gross pay; net pay

C)net pay; gross pay

D)net pay; taxes withheld amount

A)gross pay; withholding amount

B)gross pay; net pay

C)net pay; gross pay

D)net pay; taxes withheld amount

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

38

On December 31, 2017, Estimated Warranty Payable is reported on the balance sheet for White and Decker Company. The liability pertains to products sold, in 2017, with five year warranties. The Estimated Warranty Payable should be reported on the balance sheet at December 31, 2017 as a:

A)part of stockholders' equity.

B)long-term liability only.

C)current liability only.

D)current liability and a long-term liability.

A)part of stockholders' equity.

B)long-term liability only.

C)current liability only.

D)current liability and a long-term liability.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

39

The accounting principle that requires a company to record warranty expense in the same period that it records sales revenue is the:

A)going concern principle.

B)expense recognition principle.

C)conservatism principle.

D)consistency principle.

A)going concern principle.

B)expense recognition principle.

C)conservatism principle.

D)consistency principle.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

40

Montana Company sold merchandise with a retail price of $34,000 for cash. Montana Company is required to collect 6% state sales tax. The total cash received from customers was:

A)$2040.

B)$31,960.

C)$34,000.

D)$36,040.

A)$2040.

B)$31,960.

C)$34,000.

D)$36,040.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

41

A company reports Cost of Goods Sold of $420,000, Ending Inventory of $52,000, Beginning Inventory of $50,000, Ending Accounts Payable of $51,000 and Beginning Accounts Payable of $35,000. What is the days' payable outstanding? (Round any intermediary calculations to two decimal places and your final answer to the nearest day.)

A)37 days

B)40 days

C)44 days

D)45 days

A)37 days

B)40 days

C)44 days

D)45 days

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

42

At January 1, 2017, the Estimated Warranty Payable is $1100. During 2017, the company recorded Warranty Expense of $19,500. During 2017, the company replaced defective products in accordance with product warranties at a cost of $12,000. What is the Estimated Warranty Payable at December 31, 2017?

A)$7500

B)$8600

C)$20,600

D)$19,500

A)$7500

B)$8600

C)$20,600

D)$19,500

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

43

On December 31, 2016, a note payable of $180,000 has installments of $45,000 due yearly, beginning on December 31, 2017. On December 31, 2016, how will the note payable be reported on the balance sheet?

A)$135,000 current liability and $45,000 long-term liability

B)$180,000 long-term liability

C)$180,000 current liability

D)$45,000 current liability and $135,000 long-term liability

A)$135,000 current liability and $45,000 long-term liability

B)$180,000 long-term liability

C)$180,000 current liability

D)$45,000 current liability and $135,000 long-term liability

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

44

A company has a lawsuit pending with regard to patent infringement. The amount of the loss can be estimated and has a probable chance of occurrence. What journal entry is required?

A)debit Lawsuit Loss and credit Cash

B)debit Estimated Lawsuit Loss and credit Cash

C)debit Cash and credit Estimated Lawsuit Liability

D)debit Estimated Lawsuit Loss and credit Estimated Lawsuit Liability

A)debit Lawsuit Loss and credit Cash

B)debit Estimated Lawsuit Loss and credit Cash

C)debit Cash and credit Estimated Lawsuit Liability

D)debit Estimated Lawsuit Loss and credit Estimated Lawsuit Liability

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

45

Davies Accessories Company entered into the following transactions relating to notes payable:

August 1 Purchased inventory costing $42,000 by signing an 8-month, 5% note payable.

October 1 Purchased inventory costing $15,000 by signing a 1-year, 6% note payable.

Required:

Prepare journal entries to record the above transactions. Also, prepare journal entries needed on December 31, the company's fiscal year end. Omit explanations.

August 1 Purchased inventory costing $42,000 by signing an 8-month, 5% note payable.

October 1 Purchased inventory costing $15,000 by signing a 1-year, 6% note payable.

Required:

Prepare journal entries to record the above transactions. Also, prepare journal entries needed on December 31, the company's fiscal year end. Omit explanations.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

46

What is the accounts payable turnover?

A)a measure of liquidity

B)a measure of the number of times a year a company is able to pay its accounts payable

C)purchases on account from suppliers divided by average accounts payable

D)all of the above

A)a measure of liquidity

B)a measure of the number of times a year a company is able to pay its accounts payable

C)purchases on account from suppliers divided by average accounts payable

D)all of the above

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

47

On December 1, 2017, Goliath Corporation borrowed $120,000 on a three month, 10% note. Goliath Corporation's year end is December 31.

Required:

1. Prepare the journal entries in 2017 and 2018 for Goliath Corporation. Omit explanations.

2. At December 31, 2017, what is reported on the balance sheet?

Required:

1. Prepare the journal entries in 2017 and 2018 for Goliath Corporation. Omit explanations.

2. At December 31, 2017, what is reported on the balance sheet?

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

48

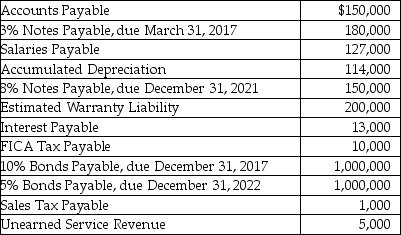

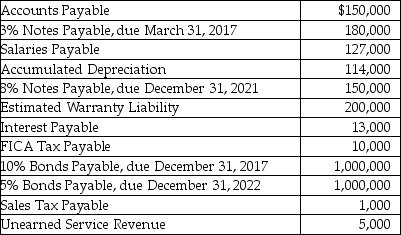

At December 31, 2016, Lansing Company's general ledger shows the following balances after posting adjusting entries:

Additional information:

Additional information:

1. $50,000 of the 8% note due December 31, 2021 is due on December 31, 2017.

2. The Estimated Warranty Liability relates to a multiple year product warranty. One-half of the liability will be honored in 2017, and one-half in 2018.

3. The Unearned Service Revenue pertains to a service contract to be performed in 2018.

Required:

Prepare the liability section of Lansing Company's balance sheet at December 31, 2016.

Additional information:

Additional information:1. $50,000 of the 8% note due December 31, 2021 is due on December 31, 2017.

2. The Estimated Warranty Liability relates to a multiple year product warranty. One-half of the liability will be honored in 2017, and one-half in 2018.

3. The Unearned Service Revenue pertains to a service contract to be performed in 2018.

Required:

Prepare the liability section of Lansing Company's balance sheet at December 31, 2016.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

49

A company reports Cost of Goods Sold of $390,000, Ending Inventory of $49,000, Beginning Inventory of $47,000, Ending Accounts Payable of $48,000 and Beginning Accounts Payable of $27,000. What is the accounts payable turnover? (Round your final answer to two decimal places.)

A)8.17

B)8.13

C)10.40

D)10.45

A)8.17

B)8.13

C)10.40

D)10.45

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

50

A company has days' payable outstanding of 70 days. If credit terms of purchases are 2/10, net 30, is the company paying accounts payable on a timely basis?

A)Yes, days' payable outstanding exceeds the net period of 30 days.

B)Yes, days' payable outstanding exceeds the discount period of 10 days and the net period of 30 days.

C)No, days' payable outstanding exceeds the discount period of 10 days and the net period of 30 days.

D)There is not enough information to make an assessment.

A)Yes, days' payable outstanding exceeds the net period of 30 days.

B)Yes, days' payable outstanding exceeds the discount period of 10 days and the net period of 30 days.

C)No, days' payable outstanding exceeds the discount period of 10 days and the net period of 30 days.

D)There is not enough information to make an assessment.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

51

The international accounting standard for loss contingencies:

A)contains the same language and requirements as the U.S. standard.

B)defines the term contingency as a probable obligation that arises from a past event.

C)states that contingencies can, by definition, only be disclosed in the financial statement footnotes.

D)never allows a provision to be recorded.

A)contains the same language and requirements as the U.S. standard.

B)defines the term contingency as a probable obligation that arises from a past event.

C)states that contingencies can, by definition, only be disclosed in the financial statement footnotes.

D)never allows a provision to be recorded.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements regarding contractual commitments is INCORRECT?

A)Even though contractual commitments are slightly different, the disclosures fall into the same category as contingencies.

B)Commitments represent contractual promises a company has made to enter into transactions in the future and thus obligate the company to commit resources toward a certain purpose.

C)It would not be proper to accrue commitments because the transactions have not yet occurred as of the balance-sheet date.

D)All contractual commitments must be disclosed, regardless of whether there will be a substantial impact on the company's financial statements in future years.

A)Even though contractual commitments are slightly different, the disclosures fall into the same category as contingencies.

B)Commitments represent contractual promises a company has made to enter into transactions in the future and thus obligate the company to commit resources toward a certain purpose.

C)It would not be proper to accrue commitments because the transactions have not yet occurred as of the balance-sheet date.

D)All contractual commitments must be disclosed, regardless of whether there will be a substantial impact on the company's financial statements in future years.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

53

A company reports Cost of Goods Sold of $325,000, Ending Inventory of $125,000, Beginning Inventory of $40,000, Ending Accounts Payable of $95,000 and Beginning Accounts Payable of $55,000. What is the accounts payable turnover? (Round your final answer to two decimal places.)

A)4.32

B)4.33

C)3.42

D)5.47

A)4.32

B)4.33

C)3.42

D)5.47

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

54

Hoover Company signs a four month promissory note for $270,000 on January 31, 2016. The company is required to pay $67,500 on the note each month. The first payment is on February 1, 2016, and the final payment is on May 1, 2016. How will this note be reported on the balance sheet at January 31, 2016?

A)long-term liability, $270,000

B)long-term liability, $202,500

C)current liability, $67,500; long-term liability, $202,500

D)current liability, $270,000

A)long-term liability, $270,000

B)long-term liability, $202,500

C)current liability, $67,500; long-term liability, $202,500

D)current liability, $270,000

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

55

The following information is available for a retail store for the month of February:

1. Wahlberg Computers sells computers for $2,500 each on account. On February 1, Wahlberg sold 20 computers. The cost of each computer sold was $1,000. The store uses the perpetual inventory system.

2. It is estimated that the warranty expense is 5% of gross sales. A journal entry is prepared February 1.

3. During February, Wahlberg replaced two computers due to product warranty complaints for products purchased in a prior month.

4. A customer fell in the store and is seeking $100,000 in damages. Wahlberg's attorney believes the case is frivolous because the customer has similar lawsuits pending against other retail stores.

5. A customer is suing Wahlberg Computers for $100,000 because the customer's computer purchased from Wahlberg Computers started a fire and destroyed the customer's residence. Wahlberg's attorney believes the customer will probably win the case and receive $100,000.

Required: Prepare the journal entries to record the transactions above. Omit explanations.

1. Wahlberg Computers sells computers for $2,500 each on account. On February 1, Wahlberg sold 20 computers. The cost of each computer sold was $1,000. The store uses the perpetual inventory system.

2. It is estimated that the warranty expense is 5% of gross sales. A journal entry is prepared February 1.

3. During February, Wahlberg replaced two computers due to product warranty complaints for products purchased in a prior month.

4. A customer fell in the store and is seeking $100,000 in damages. Wahlberg's attorney believes the case is frivolous because the customer has similar lawsuits pending against other retail stores.

5. A customer is suing Wahlberg Computers for $100,000 because the customer's computer purchased from Wahlberg Computers started a fire and destroyed the customer's residence. Wahlberg's attorney believes the customer will probably win the case and receive $100,000.

Required: Prepare the journal entries to record the transactions above. Omit explanations.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

56

Potential liabilities that depend on future events arising out of past events are called:

A)long-term liabilities.

B)estimated liabilities.

C)contingent liabilities.

D)current liabilities.

A)long-term liabilities.

B)estimated liabilities.

C)contingent liabilities.

D)current liabilities.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

57

Devin's Animal Shop has the following information for the pay period of March 15 to March 31:

Gross payroll $20,000

FICA tax rate 7%

Federal income tax withheld 15%

Required:

Prepare the journal entry to record the accrued payroll on March 31 and the journal entry to remit the payroll taxes to the government on April 15. Omit explanations. Do not record employer payroll taxes.

Gross payroll $20,000

FICA tax rate 7%

Federal income tax withheld 15%

Required:

Prepare the journal entry to record the accrued payroll on March 31 and the journal entry to remit the payroll taxes to the government on April 15. Omit explanations. Do not record employer payroll taxes.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

58

A company reports Cost of Goods Sold of $275,000, Ending Inventory of $120,000, Beginning Inventory of $15,000, Ending Accounts Payable of $110,000 and Beginning Accounts Payable of $80,000. What is the days' payable outstanding? (Round any intermediary calculations to two decimal places and your final answer to the nearest day.)

A)91 days

B)106 days

C)84 days

D)146 days

A)91 days

B)106 days

C)84 days

D)146 days

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

59

Company A has an accounts payable turnover of 9.5. Company B has an accounts payable turnover of 7.3. Which company is more liquid?

A)Company A is more liquid.

B)Company B is more liquid.

C)Both are equally liquid.

D)None of the above are correct.

A)Company A is more liquid.

B)Company B is more liquid.

C)Both are equally liquid.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

60

A company has a pending lawsuit that has a remote possibility of being settled in favor of the plaintiff who is a former employee. What should the company do?

A)Nothing.

B)Make a disclosure in a financial statement footnote.

C)Prepare a journal entry.

D)Make a note to the financial statements and prepare a journal entry.

A)Nothing.

B)Make a disclosure in a financial statement footnote.

C)Prepare a journal entry.

D)Make a note to the financial statements and prepare a journal entry.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

61

If bonds are issued at a discount, the issuing corporation will pay an amount greater than the face amount of the bonds on the maturity date.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

62

If the market interest rate is greater than the stated interest rate on bonds, bonds will sell:

A)at face value.

B)at a discount.

C)at a premium.

D)at the stated interest rate.

A)at face value.

B)at a discount.

C)at a premium.

D)at the stated interest rate.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

63

If the market interest rate is greater than the stated interest rate, the bonds will sell at a discount.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

64

If bonds are issued at a discount, it means that the:

A)market interest rate is higher than the stated interest rate.

B)market interest rate is lower than the stated interest rate.

C)financial strength of the issuer is weak.

D)bond is convertible.

A)market interest rate is higher than the stated interest rate.

B)market interest rate is lower than the stated interest rate.

C)financial strength of the issuer is weak.

D)bond is convertible.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

65

The stated interest rate is always equal to the market interest rate on the date the bonds are issued.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

66

If $120,000 face value bonds are issued at 104, the proceeds received will be $104,000.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

67

Bonds that are secured by real estate are called:

A)term bonds.

B)secured bonds.

C)mortgage bonds.

D)B and C.

A)term bonds.

B)secured bonds.

C)mortgage bonds.

D)B and C.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

68

Premium on bonds payable is a contra account to bonds payable.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

69

The carrying value of bonds decreases over the term of the bonds if the bonds were issued at a discount.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

70

The account Premium on Bonds Payable increases the issuer's liabilities.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

71

Bonds which are backed only by the good faith of the borrower are referred to as:

A)junk bonds.

B)uncertified bonds.

C)debenture bonds.

D)callable bonds.

A)junk bonds.

B)uncertified bonds.

C)debenture bonds.

D)callable bonds.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

72

If the stated interest rate on a bond is 8% and the market interest rate is 7%, the bond will be issued at a price above the par value of the bond.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

73

Corporations borrow large amounts of money by issuing (selling)bonds to the public.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

74

At maturity, the premium on bonds payable will have been amortized to zero, and the bonds' carrying value will be the face value of the bond.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

75

If $500,000, 6% bonds are issued on January 1 and pay interest semiannually, the amount of the interest payment on July 1 will be $15,000.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

76

Bonds in a particular issue which mature in installments over a period of time are called:

A)serial bonds.

B)term bonds.

C)callable bonds.

D)convertible bonds.

A)serial bonds.

B)term bonds.

C)callable bonds.

D)convertible bonds.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

77

The carrying amount of bonds is calculated by adding the balance of the Discount on Bonds Payable account to the balance in the Bonds Payable account.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

78

At maturity, the carrying amount of bonds should equal the face value of the bonds.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

79

The straight-line amortization method keeps interest expense at the same dollar amount for each interest payment over the bond's life.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck

80

If bonds are issued at a premium, the carrying value of the bonds will be greater than the face value of the bonds for all interest periods prior to the bond's maturity date.

Unlock Deck

Unlock for access to all 193 flashcards in this deck.

Unlock Deck

k this deck