Deck 16: Tax Deductions and Travel Expenses for Employees and Self-Employed Individuals

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/2235

Play

Full screen (f)

Deck 16: Tax Deductions and Travel Expenses for Employees and Self-Employed Individuals

1

Deferred compensation refers to methods of compensating employees based upon their current service where the benefits are deferred until future periods.

True

2

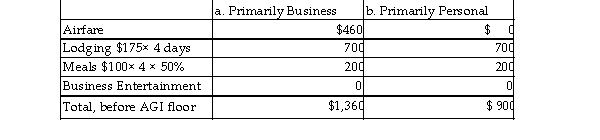

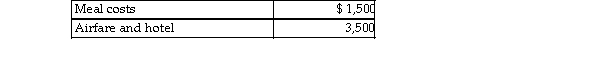

Richard, a self- employed business consultant, traveled from New Orleans to New York for both business and va He spent 4 days conducting business and some days vacationing. He incurred the following expenses:

Note that the plane fare is not deductible because he spent more time on vacation than on business. Busine entertainment is not deductible.

Note that the plane fare is not deductible because he spent more time on vacation than on business. Busine entertainment is not deductible.

3

Norman, a self- employed lawyer, traveled to San Francisco for four days on vacation, and while there spent another two days conducting business. Norman's plane fare for the trip was $500; meals cost $150 per day; hotels cost $300 per day; and a rental car cost $150 per day that was used for all six days. Norman may deduct

A) $1,200.

B) $1,217.

C) $0.

D) $1,050.

A) $1,200.

B) $1,217.

C) $0.

D) $1,050.

D

4

In which of the following situations is the individual more likely to be classified as an independent contractor rather than an employee?

A) a computer programmer who is instructed as to what projects to undertake, programming language and format, and hours of work

B) a nurse who travels to several different patients; she sets her own hours and is responsible for the delivery of nursing care and end result

C) a nurse who is directly supervised by doctors in an office

D) a teacher whose hours, classroom responsibilities, content and methods of instruction are established by the school

A) a computer programmer who is instructed as to what projects to undertake, programming language and format, and hours of work

B) a nurse who travels to several different patients; she sets her own hours and is responsible for the delivery of nursing care and end result

C) a nurse who is directly supervised by doctors in an office

D) a teacher whose hours, classroom responsibilities, content and methods of instruction are established by the school

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements regarding independent contractors and employees is true?

A) Independent contractors pay Social Security and Medicare tax of 15.3%.

B) Independent contractors and employees pay the same Social Security and Medicare tax rates.

C) Employees must pay unemployment taxes.

D) Independent contractors deduct their business expenses "from AGI."

A) Independent contractors pay Social Security and Medicare tax of 15.3%.

B) Independent contractors and employees pay the same Social Security and Medicare tax rates.

C) Employees must pay unemployment taxes.

D) Independent contractors deduct their business expenses "from AGI."

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

6

Travel expenses related to foreign conventions are disallowed unless the meeting is directly related to the taxpayer's business, and it is reasonable for the meeting to be held outside of North America.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

7

If a self- employed individual is not "away from home," expenses related to local transportation are never deductible.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

8

A worker is considered to be in travel status for temporary work assignments of two years or less.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

9

The key distinguishing factor for classifying a worker as either an employee or self- employed includes the right to control and direct the worker with respect to both the end result and the means to accomplish that end result.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

10

According to the IRS, a person's tax home is the location of the family residence regardless of the location of the taxpayer's principal place of work.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

11

All of the following individuals are allowed a deduction except:

A) Alison is an employee who is required to travel to company facilities throughout the United States in the conduct of her management responsibilities. She is not reimbursed by her employer.

B) Alan is self- employed and is away from home overnight on job- related business.

C) Cora owns her own CPA firm and travels from Lafayette, LA, to Washington, DC, to attend a tax conference.

D) Jennifer, who lives in Houston, is the owner or several apartment buildings in Salt Lake City and travels there to inspect and manage her investments.

A) Alison is an employee who is required to travel to company facilities throughout the United States in the conduct of her management responsibilities. She is not reimbursed by her employer.

B) Alan is self- employed and is away from home overnight on job- related business.

C) Cora owns her own CPA firm and travels from Lafayette, LA, to Washington, DC, to attend a tax conference.

D) Jennifer, who lives in Houston, is the owner or several apartment buildings in Salt Lake City and travels there to inspect and manage her investments.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

12

Jason, who lives in New Jersey, owns several apartment buildings in Baltimore. His travel expenses to Baltimore to inspect his property are tax deductible.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

13

Unreimbursed employee business expenses are deductions for AGI.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

14

An employee travels out of town as required by his job, and he is not reimbursed. The employee can deduct these work- related travel costs.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

15

A three- day investment conference is held in Las Vegas. Dr. Singh, a dentist, travels from Ohio to attend to improve his taxable investment portfolio performance. Ms. Gondin, a financial planner, travels from Seattle to attend the same conference to improve her skills in managing her clients' investment portfolios. The same standards of deductibility will apply to both attendees.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

16

Gwen, an independent consultant, traveled to New York City on a business trip. Gwen spent 4 days in business meetings and conferences and then spent 2 days sightseeing in the area. Gwen's plane fare for the trip was $250. Meals cost $160 per day. Hotels and other incidental expenses amounted to $250 per day. Gwen may deduct

A) $1,570.

B) $1,487.

C) $0.

D) $1,890.

A) $1,570.

B) $1,487.

C) $0.

D) $1,890.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

17

In determining whether a worker is considered to be in travel status for tax purposes, a general rule is that if a person is reassigned for an indefinite period, the individual's tax home shifts to the new location and the worker is not considered to be in travel status.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

18

If an individual is self- employed, business- related expenses are deductions for AGI.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

19

Tessa has planned a five- day trip to Miami with her husband. Before leaving, one of Tessa's partners asks her to take a morning meeting with a client while she is there. Tessa can now deduct the cost of the airfare for the trip.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

20

Charishma, a CPA, paid the following expenses in pursuing her profession in 2018: - Professional society dues - $450

- Tax and accounting journals - $250

How much of these expenses can be deducted if she is an employee of an accounting firm, and how much is ded she is a self- employed CPA? Ignore any potential limitations based on AGI.

A) Employee - $700; Self- employed - $0

B) Employee - $0; Self- employed - $0

C) Employee - $700; Self- employed - $700

D) Employee - $0; Self- employed - $700

- Tax and accounting journals - $250

How much of these expenses can be deducted if she is an employee of an accounting firm, and how much is ded she is a self- employed CPA? Ignore any potential limitations based on AGI.

A) Employee - $700; Self- employed - $0

B) Employee - $0; Self- employed - $0

C) Employee - $700; Self- employed - $700

D) Employee - $0; Self- employed - $700

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

21

Taxpayers may use the standard mileage rate method when five vehicles are used simultaneously for business.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

22

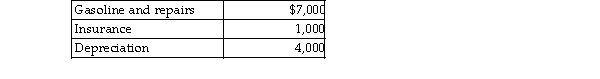

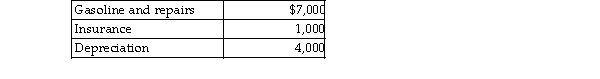

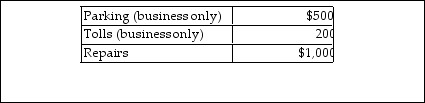

Rajiv, a self- employed consultant, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,00 commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What Rajiv's deduction for the use of the auto?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What Rajiv's deduction for the use of the auto?

A) $0

B) $12,000

C) $9,000

D) $7,000

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What Rajiv's deduction for the use of the auto?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What Rajiv's deduction for the use of the auto?A) $0

B) $12,000

C) $9,000

D) $7,000

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

23

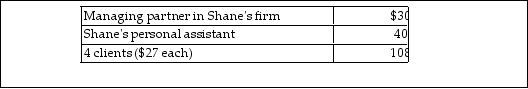

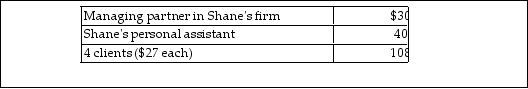

Shane, a partner in a law firm, makes the following gifts with their values noted:  What amount of the gifts is deductible?

What amount of the gifts is deductible?

A) $150

B) $125

C) $178

D) $75

What amount of the gifts is deductible?

What amount of the gifts is deductible?A) $150

B) $125

C) $178

D) $75

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

24

What factors are considered in determining whether an expense is a deductible travel expense?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

25

Rita, a self- employed CPA, incurred the following expenses during the year:  What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expens her tax return? Assume Rita maintains all appropriate documentation.

What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expens her tax return? Assume Rita maintains all appropriate documentation.

What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expens her tax return? Assume Rita maintains all appropriate documentation.

What is Rita's deduction for the year with respect to the above expenses and where will she deduct these expens her tax return? Assume Rita maintains all appropriate documentation.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

26

David acquired an automobile for $30,000 for use in his unincorporated business at the beginning of 2018 and used the standard mileage rate method in 2018. He plans to switch to the actual expense method for 2019. The automobile was used 25,000 miles in 2018. What is the amount of the adjusted basis of the automobile for purposes of computing depreciation in 2019?

A) $20,000

B) $16,625

C) $30,000

D) $23,750

A) $20,000

B) $16,625

C) $30,000

D) $23,750

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

27

Chuck, who is self- employed, is scheduled to fly from Minneapolis to London on a business trip. His flight schedule included a connection through New York City. When Chuck arrived in New York City, he learned that his flight to London had been cancelled due to a volcanic eruption in Iceland. All air travel to Europe was delayed for five days because of significant amounts of ash in the air, causing Chuck to incur costs for hotel and meals in New York City. Since Chuck had never been to New York City before, he spent the time sightseeing. What tax issues are present?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

28

A self- employed consultant takes a client to dinner to propose a new consulting engagement. Assuming appropriate documentation is maintained, the individual will receive a deduction for AGI for 50% of the meal cost.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

29

If an employee incurs travel expenditures and is fully reimbursed by the employer, neither the reimbursement nor the deduction is reported on the employee's tax return if reporting is pursuant to an accountable plan.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

30

A self- employed consultant takes a client to a major league football game to propose a new consulting engagement. Assuming appropriate documentation is maintained, the individual will receive a deduction for AGI for 50% of the ticket cost.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

31

Rui, the sole proprietor of a CPA firm, is responsible for a large client base. She often drives to meetings at two different clients' offices in a single day. Rui can deduct the transportation costs of driving to the various client meetings.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

32

Generally, 50% of the cost of business gifts is deductible up to $25 per donee per year for self- employed individuals.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

33

Commuting to and from a job location is a deductible expense.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

34

An employer adopts a per diem policy for hotel and meal travel reimbursements for employees, following the IRS tables. Employees will no longer have to submit any documentation.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

35

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be att by many potential customers. During the week of the convention, Steven incurs the following costs in attending conference and taking potential customers to lunch and dinner to discuss book sales.  Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

A) Reimbursement- include in income; unreimbursed expenses- deduct within itemized deductions, after 50% reduction for meal portion

B) Reimbursement- include in income; unreimbursed expenses- no deduction allowed

C) Reimbursement- exclude from income; unreimbursed expenses- deduct within itemized deductions, after 50% reduction for meal portion

D) Reimbursement- exclude from income; unreimbursed expenses- no deduction allowed

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?A) Reimbursement- include in income; unreimbursed expenses- deduct within itemized deductions, after 50% reduction for meal portion

B) Reimbursement- include in income; unreimbursed expenses- no deduction allowed

C) Reimbursement- exclude from income; unreimbursed expenses- deduct within itemized deductions, after 50% reduction for meal portion

D) Reimbursement- exclude from income; unreimbursed expenses- no deduction allowed

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

36

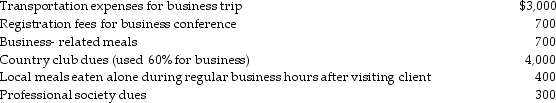

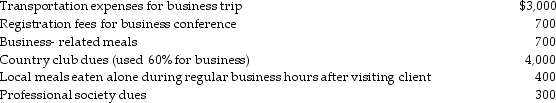

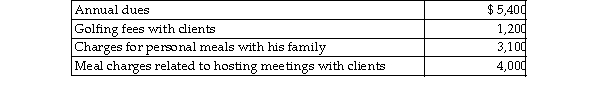

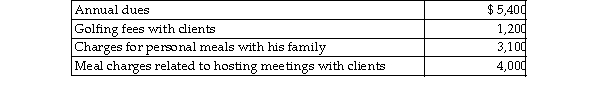

Joe is a self- employed tax attorney who frequently entertains his clients at his country club. Joe's club expenses i the following:  Assuming proper documentation is maintained, Joe may deduct

Assuming proper documentation is maintained, Joe may deduct

A) $5,300.

B) $4,000.

C) $2,000.

D) $2,600.

Assuming proper documentation is maintained, Joe may deduct

Assuming proper documentation is maintained, Joe may deductA) $5,300.

B) $4,000.

C) $2,000.

D) $2,600.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

37

A taxpayer goes out of town to a business convention. The 50% reduction applies to the cost of food, entertainment and transportation expenses.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

38

If the standard mileage rate is used in the first year, the actual expense method may not be used in future years.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

39

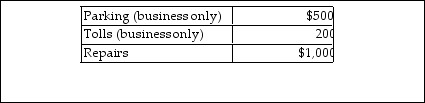

Chelsea, who is self- employed, drove her automobile a total of 20,000 business miles in 2018. This represents ab 75% of the auto's use. She has receipts as follows:  Chelsea uses the standard mileage rate method. She can deduct

Chelsea uses the standard mileage rate method. She can deduct

A) $12,600.

B) $10,900.

C) $11,600.

D) $11,425.

Chelsea uses the standard mileage rate method. She can deduct

Chelsea uses the standard mileage rate method. She can deductA) $12,600.

B) $10,900.

C) $11,600.

D) $11,425.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

40

Clarissa is a very successful self- employed real estate attorney. She spends $5,000 per year taking her clients out to dinner upon completion of a sale. Unfortunately, Clarissa is not a good recordkeeper and does not maintain receipts. However, such meals are standard practice in her field, and trade journals indicate that $5,000 is a reasonable amount for a successful high- end attorney. Clarissa will be allowed to deduct $2,500.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

41

Ovi is a sales representative for a local company. His sales territory crosses the state so he incurs substantial travel costs as a requirement of his job. Ovi maintains good records, and the travel costs total $3,000 for the year. His company provides him an expense allowance under a nonaccountable plan. How will Ovi treat the $2,000 partial reimbursement and the $3,000 of total business travel costs?

A) Reimbursement- exclude from income; travel costs- none are deductible

B) Reimbursement- include in income; travel costs- none are deductible

C) Reimbursement- include in income; travel costs- $2,000 are deductible and the $1,000 balance is not deductible

D) Reimbursement- include in income; travel costs- deduct the full $3,000

A) Reimbursement- exclude from income; travel costs- none are deductible

B) Reimbursement- include in income; travel costs- none are deductible

C) Reimbursement- include in income; travel costs- $2,000 are deductible and the $1,000 balance is not deductible

D) Reimbursement- include in income; travel costs- deduct the full $3,000

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

42

Fin is a self- employed tutor, regularly meeting with clients in a 100 square foot area of his home. Fin is terrible at keeping records. Without the records, he will be able to deduct $500 for a home office deduction for AGI.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

43

In- home office expenses for an office used by the taxpayer for administrative or management activities of the taxpayer's trade or business are never deductible.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

44

Educational expenses incurred by a self- employed CPA for courses necessary to meet continuing education requirements are fully deductible.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

45

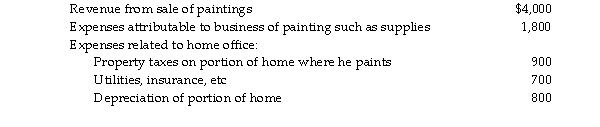

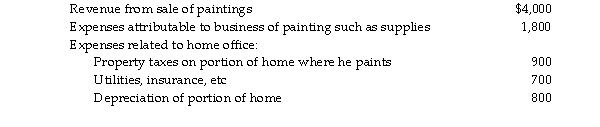

Dighi, an artist, uses a room in his home (250 square feet) as a studio exclusively to paint. The studio meets the requirements for a home office deduction. (Painting is considered his trade or business.) The following informati appears in Dighi's records:  a. What is the amount of Dighi's home office deduction if he is self- employed?

a. What is the amount of Dighi's home office deduction if he is self- employed?

b. If some amount is not allowed under the tax law, how is the disallowed amount treated?

c. Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How muc home office deduction, if any, will he be allowed?

a. What is the amount of Dighi's home office deduction if he is self- employed?

a. What is the amount of Dighi's home office deduction if he is self- employed?b. If some amount is not allowed under the tax law, how is the disallowed amount treated?

c. Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How muc home office deduction, if any, will he be allowed?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

46

All of the following may deduct education expenses except:

A) Hope is an independent business consultant who incurs expenses to pursue an MBA degree.

B) Richard is a self- employed dentist who incurs expenses to attend a convention on new techniques in oral surgery.

C) Marvin is a high school teacher who incurs expenses for education courses to meet new course requirements to maintain his job.

D) Paige is an self- employed accountant who incurs expenses to take advanced tax courses.

A) Hope is an independent business consultant who incurs expenses to pursue an MBA degree.

B) Richard is a self- employed dentist who incurs expenses to attend a convention on new techniques in oral surgery.

C) Marvin is a high school teacher who incurs expenses for education courses to meet new course requirements to maintain his job.

D) Paige is an self- employed accountant who incurs expenses to take advanced tax courses.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

47

In- home office expenses which are not deductible in the year in which the costs were incurred due to income limitations may be carried forward to subsequent years.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

48

Charles is a self- employed CPA who maintains a qualifying office in his home. Charles has $110,000 gross income from his practice and incurs $88,000 in salaries, supplies, computer services, etc. Charles's mortgage interest and real estate taxes allocable to the office total $10,000. Other expenses total $14,000 and consist of depreciation, utilities, insurance, and maintenance. What is Charles' total home office expense deduction?

A) $24,000

B) $14,000

C) $22,000

D) $10,000

A) $24,000

B) $14,000

C) $22,000

D) $10,000

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

49

A sole proprietor will not be allowed to deduct current home office expenses to the extent that they create or increase a loss from her business.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

50

Fiona is about to graduate college with a management degree. She has been offered a job as a sales representative for a pharmaceutical company. The job will require significant travel and entertainment expenses for which she will be given a salary supplement. What tax issues should Fiona consider in her decision?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

51

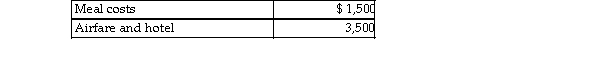

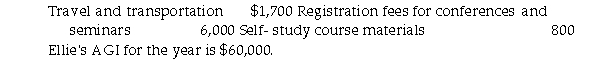

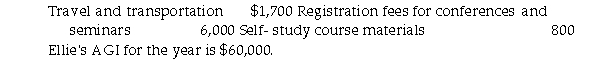

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:  a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by her employer, what are the amount of and the nat the deduction for these expenses (after limitations)?

a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?

a. If Ellie is self- employed, what are the amount of and the nature of the deduction for these expenses?b. If, instead, Ellie is an employee who is not reimbursed by her employer, what are the amount of and the nat the deduction for these expenses (after limitations)?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

52

Alex is a self- employed dentist who operates a qualifying office in his home. Alex has $180,000 gross income from his practice and $160,000 of expenses directly related to the business, i.e., non- home office expenses. Alex's allocable home office expenses for mortgage interest expenses and property taxes are $14,000 and other home office expenses are $9,000. What is Alex's total allowable home office deduction?

A) $20,000

B) $9,000

C) $23,000

D) $14,000

A) $20,000

B) $9,000

C) $23,000

D) $14,000

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

53

Pat is a sales representative for a publishing company. He travels extensively as part of his job. During the current year he spends $10,000 on business travel. The company reimburses him $5,000. Before consideration of the travel costs and the reimbursement, Pat earns AGI of $100,000, and he has itemized deductions of $13,000 due to mortgage interest and taxes. Pat is single, with no dependents. What is Pat's taxable income

a. assuming the employer maintains an accountable plan?

b. assuming the employer does not maintain an accountable plan?

a. assuming the employer maintains an accountable plan?

b. assuming the employer does not maintain an accountable plan?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

54

The following individuals maintained offices in their home: (1) Dr. Austin is a self- employed surgeon who performs surgery at four hospitals. He uses his home for administrative duties as he does not have an office in any of the hospitals.

(2) June, who is a self- employed plumber, earns her living in her customer's homes. She maintains an office at where she bills clients and does other paperwork related to her plumbing business.

(3) Cassie is an employed as a sales representative of Montgomery Products, an out- of- town company which not have a local office. She uses an extra room in her home to plan her sales calls, write up orders and store inven The use of this room in her home is a required part of the job., and this work is the only use of this room.

Who is entitled to a home office deduction?

A) Cassie and June

B) Dr. Austin and June

C) Dr Austin

D) All of the taxpayers are entitled to a deduction.

(2) June, who is a self- employed plumber, earns her living in her customer's homes. She maintains an office at where she bills clients and does other paperwork related to her plumbing business.

(3) Cassie is an employed as a sales representative of Montgomery Products, an out- of- town company which not have a local office. She uses an extra room in her home to plan her sales calls, write up orders and store inven The use of this room in her home is a required part of the job., and this work is the only use of this room.

Who is entitled to a home office deduction?

A) Cassie and June

B) Dr. Austin and June

C) Dr Austin

D) All of the taxpayers are entitled to a deduction.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

55

Louisa, an active duty U.S. Air Force pilot, receives orders to transfer from the Fort Benning (Georgia) base to the Fort Hood (Texas) base. It is a permanent transfer. John is a civilian employee of the U.S. Navy. He is transferred by the Navy from Norfolk (Virginia) to San Diego (California). Both individuals pay their own moving expenses. Regarding their ability to deduct the moving expenses,

A) Louisa will be allowed a deduction, but John cannot deduct his moving expenses.

B) John will be allowed a deduction, but Louisa cannot deduct her moving expenses.

C) both Louisa and John will be allowed a moving expense deduction.

D) neither Louisa, nor John, will be allowed a moving expense deduction.

A) Louisa will be allowed a deduction, but John cannot deduct his moving expenses.

B) John will be allowed a deduction, but Louisa cannot deduct her moving expenses.

C) both Louisa and John will be allowed a moving expense deduction.

D) neither Louisa, nor John, will be allowed a moving expense deduction.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

56

Gina is an instructor at State University in Birmingham. Her university has asked her if she would be interested in taking a temporary assignment at their Montgomery campus. In addition to her salary, the University would pay her living expenses while in Montgomery. What should Gina consider with regard to taxes in deciding whether or not to accept the offer?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

57

In- home office expenses are deductible if the office is used exclusively on a regular basis as the principal place of business for any trade or business of the taxpayer.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

58

Camellia, an accountant, accepts a new job located 1,000 miles away from her current job location. She has to pay a moving company plus the transportation costs for herself to move to the new location. The new employer does not pay moving costs. Camellia will be allowed a deduction for the work- related move.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

59

Camellia, an accountant, takes a new job located 1,000 miles away from her current job location. She has to pay a moving company plus the transportation costs for herself to move to the new location, totaling $6,000. After she submits all the receipts, the new employer reimburses her in full. Camellia will treat the reimbursement and the moving costs as follows:

A) reimbursement- include in income; moving expenses- no deduction allowed

B) reimbursement- include in income; moving expenses- deduct

C) reimbursement- exclude from income; moving expenses- no deduction allowed

D) reimbursement- exclude from income; moving expenses- deduct

A) reimbursement- include in income; moving expenses- no deduction allowed

B) reimbursement- include in income; moving expenses- deduct

C) reimbursement- exclude from income; moving expenses- no deduction allowed

D) reimbursement- exclude from income; moving expenses- deduct

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

60

Educational expenses incurred by a self- employed bookkeeper for courses necessary to sit for the CPA exam are fully deductible.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

61

Employees receiving nonqualified stock options recognize ordinary income at the grant date or exercise date if there is a readily ascertainable fair market value.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

62

In a defined contribution pension plan, fixed amounts are contributed based upon a specific formula and retirement benefits are based on the value of a participant's account at the time of retirement.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

63

A qualified pension plan requires that employer- provided benefits must be 100 percent vested after five years of service.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

64

Assuming AGI below the threshold, a contributor may make a deductible contribution to a Coverdell Education Savings Account for a qualified designated beneficiary of up to $2,000.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

65

In a contributory defined contribution pension plan, all of the following are true with the exception of

A) retirement benefits are a fixed amount based on the level of compensation earned by the employee during the working years.

B) amounts are contributed to the plan based upon a specific formula.

C) a separate account is established for each participant.

D) both the employee and employer can make contributions to the plan.

A) retirement benefits are a fixed amount based on the level of compensation earned by the employee during the working years.

B) amounts are contributed to the plan based upon a specific formula.

C) a separate account is established for each participant.

D) both the employee and employer can make contributions to the plan.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

66

Ross works for Houston Corporation, which has a contributory defined contribution pension plan. The employer's monthly contribution to the plan is 8 percent of each participating employee's monthly salary, while the employee contributes only 6 percent. Which of the following statements best describes the benefits of the plan?

A) While Ross is taxed on the employer's contributions to the plan, his own contributions are not taxed until he receives a distribution from the plan.

B) Ross may deduct his own contributions to the pension plan, and Ross reports income from the plan each year until he receives distributions from the plan.

C) Houston receives a deduction for its contributions to the plan when Ross receives a distribution from the plan.

D) The amounts contributed to the plan and the earnings on those contributions are not taxed to Ross until he retires or receives a distribution from the plan.

A) While Ross is taxed on the employer's contributions to the plan, his own contributions are not taxed until he receives a distribution from the plan.

B) Ross may deduct his own contributions to the pension plan, and Ross reports income from the plan each year until he receives distributions from the plan.

C) Houston receives a deduction for its contributions to the plan when Ross receives a distribution from the plan.

D) The amounts contributed to the plan and the earnings on those contributions are not taxed to Ross until he retires or receives a distribution from the plan.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

67

Hunter retired last year and will receive annuity payments for life from his employer's qualified retirement plan of $30,000 per year starting this year. During his years of employment, Hunter contributed $130,000 to the plan. Based on IRS tables, his life expectancy is 260 months. All of the contributions were on a pre- tax basis. This year, Hunter will include what amount in income?

A) $30,000

B) $24,000

C) $6,000

D) $0

A) $30,000

B) $24,000

C) $6,000

D) $0

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

68

SIMPLE retirement plans allow a higher level of employer contributions than do SEP IRAs.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

69

The maximum tax deductible contribution to a traditional IRA in 2018 is $5,500 ($6,500 for a taxpayer age 50 or over).

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

70

All taxpayers are allowed to contribute funds to Health Savings Accounts to supplement their health insurance.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

71

Characteristics of profit- sharing plans include all of the following with the exception of:

A) A predetermined formula is used to allocate employer contributions to individual employees and to establish benefit payments.

B) The company must make contributions to the plan if it has profits during the year.

C) Forfeitures of benefits under the plan may be reallocated to the remaining participants.

D) Annual employer contributions are not required, but substantial, recurring contributions must be made to satisfy the requirement that the plan be permanent.

A) A predetermined formula is used to allocate employer contributions to individual employees and to establish benefit payments.

B) The company must make contributions to the plan if it has profits during the year.

C) Forfeitures of benefits under the plan may be reallocated to the remaining participants.

D) Annual employer contributions are not required, but substantial, recurring contributions must be made to satisfy the requirement that the plan be permanent.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

72

When are home- office expenses deductible?

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

73

Sam retired last year and will receive annuity payments for life from his employer's qualified retirement plan of $30,000 per year starting this year. During his years of employment, Sam contributed $130,000 to the plan on an after- tax basis. Based on IRS tables, his life expectancy is 260 months. This year, Sam will include what amount in income?

A) 0

B) $24,000

C) $6,000

D) $30,000

A) 0

B) $24,000

C) $6,000

D) $30,000

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

74

A company maintains a qualified pension plan for all of its employees. The company can also establish a qualified profit- sharing plan for its management team.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

75

An employer contributing to a qualified retirement plan will be allowed a deduction when the employee recognizes the income at retirement or separation from service.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

76

Under a qualified pension plan, the employer's deduction is usually deferred until the employee recognizes income.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

77

A sole proprietor establishes a Keogh plan. The highest effective percentage of earned income she can contribute is 25 percent.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

78

Nonqualified deferred compensation plans can discriminate in favor of highly compensated executives.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

79

Corporations issuing incentive stock options receive a tax deduction for compensation expense.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck

80

There are several different types of qualified retirement plans. One common criteria across qualified retirement plans is that employers deduct the contributions and employees include the contributions in taxable income in the same period.

Unlock Deck

Unlock for access to all 2235 flashcards in this deck.

Unlock Deck

k this deck