Deck 3: The Corporate Income Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 3: The Corporate Income Tax

1

NOLs arising in tax years ending after 2017 carry over to subsequent tax years indefinitely.

True

2

Corporations may deduct the adjusted basis of inventory plus one- half of the excess of the property's FMV over its adjusted basis if the inventory is used for the care of the ill, needy, or infants.

True

3

A C corporation must use a calendar year as its tax year unless it has a substantial business purpose to use a fiscal year.

False

4

Identify which of the following statements is true.

A) The terms "regular corporation" and "C corporation" are synonymous.

B) A newly formed corporation must select its basic accounting method.

C) A corporation is a separate taxpaying entity that must file a tax return annually.

D) All of the above are true.

A) The terms "regular corporation" and "C corporation" are synonymous.

B) A newly formed corporation must select its basic accounting method.

C) A corporation is a separate taxpaying entity that must file a tax return annually.

D) All of the above are true.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

All of the taxable income of a personal service corporation is taxed at a flat 21% rate.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

If a controlling shareholder sells depreciable property to a controlled corporation and the property is depreciable by the purchaser, any gain on the sale is a 1231 gain.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

Identify which of the following is false.

A) Corporations that sell real property at a gain must report an additional 20% of the entire gain as ordinary income.

B) Section 291 reduces the amount of net Sec. 1231 gains that can be offset by corporate capital losses.

C) Section 291 recapture applies to Sec. 1250 property.

D) Corporations selling real property that previously had been depreciated using an accelerated method are subject to Sec. 291.

A) Corporations that sell real property at a gain must report an additional 20% of the entire gain as ordinary income.

B) Section 291 reduces the amount of net Sec. 1231 gains that can be offset by corporate capital losses.

C) Section 291 recapture applies to Sec. 1250 property.

D) Corporations selling real property that previously had been depreciated using an accelerated method are subject to Sec. 291.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Identify which of the following statements is false.

A) A corporation's first tax year may not cover a full 12- month period.

B) A corporation's fiscal year generally must end on the last day of the month.

C) A fiscal year may not end on December 31.

D) A new corporation can elect a fiscal year that runs from February 16 to February 15 of the following year.

A) A corporation's first tax year may not cover a full 12- month period.

B) A corporation's fiscal year generally must end on the last day of the month.

C) A fiscal year may not end on December 31.

D) A new corporation can elect a fiscal year that runs from February 16 to February 15 of the following year.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

Corporations may carry charitable contributions in excess of the income limitation forward for five years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

A new corporation may generally select one of the following accounting methods with the exception of

A) retail method.

B) cash method.

C) hybrid method.

D) accrual method.

A) retail method.

B) cash method.

C) hybrid method.

D) accrual method.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

Identify which of the following statements is false.

A) Casualty losses incurred by a corporation are deductible subject to a nondeductible floor similar to those applicable to individuals.

B) The passive loss rules do not apply to widely held C corporations.

C) Corporations may receive a deduction for dividends received from other corporations.

D) A corporation with annual gross receipts of $25,000,000 or less can use the accrual method to account for sales, cost of goods sold, inventories, accounts receivable and payable, and the cash method for other income and expenses.

A) Casualty losses incurred by a corporation are deductible subject to a nondeductible floor similar to those applicable to individuals.

B) The passive loss rules do not apply to widely held C corporations.

C) Corporations may receive a deduction for dividends received from other corporations.

D) A corporation with annual gross receipts of $25,000,000 or less can use the accrual method to account for sales, cost of goods sold, inventories, accounts receivable and payable, and the cash method for other income and expenses.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

Trail Corporation has gross profits on sales of $140,000 and deductible expenses of $180,000. In addition, Trail has a net capital gain of $60,000. Trail's taxable income is

A) $60,000.

B) $20,000.

C) a $20,000 loss.

D) a $40,000 loss.

A) $60,000.

B) $20,000.

C) a $20,000 loss.

D) a $40,000 loss.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

Identify which of the following statements is true.

A) At the election of a corporation, a net capital loss carryback can be forgone and carried forward only.

B) Corporate capital loss carrybacks can offset corporate ordinary income earned in previous years.

C) A corporate capital loss can be carried back three years, and then can be carried forward five years.

D) All of the above are false.

A) At the election of a corporation, a net capital loss carryback can be forgone and carried forward only.

B) Corporate capital loss carrybacks can offset corporate ordinary income earned in previous years.

C) A corporate capital loss can be carried back three years, and then can be carried forward five years.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

Corporations are permitted to deduct $3,000 in net capital losses annually.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

The dividends- received deduction is designed to reduce double taxation of corporate dividends payable to individual shareholders.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

Sparks Corporation receives a dividend of $100,000 from Jill Corporation, a C corporation. Sparks owns 70% of Jill Corporation stock. Sparks' dividends- received deduction is $65,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

Identify which of the following statements is true.

A) An S corporation must generally use a calendar year.

B) A corporation that is a member of an affiliated group filing a consolidated tax return may be allowed a tax year which is different from the group's parent.

C) A corporation's first year must cover a twelve- month period.

D) All of the above are false.

A) An S corporation must generally use a calendar year.

B) A corporation that is a member of an affiliated group filing a consolidated tax return may be allowed a tax year which is different from the group's parent.

C) A corporation's first year must cover a twelve- month period.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

Organizational expenses incurred after 2004 are amortized over five years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

Once a corporation has elected a taxable year, it can change the taxable year without IRS permission if

A) the corporation is not an S corporation.

B) the resulting short period has a net operating loss of $100,000 that the corporation wants to carry forward.

C) the corporation changed its taxable year seven years ago.

D) a corporation can change its taxable year without IRS permission in all of the above situations.

A) the corporation is not an S corporation.

B) the resulting short period has a net operating loss of $100,000 that the corporation wants to carry forward.

C) the corporation changed its taxable year seven years ago.

D) a corporation can change its taxable year without IRS permission in all of the above situations.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

Newco Corporation has asked you to help determine whether it should use the accrual method or the cash method of accounting. What are the tax issues involved in making this determination?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

In February of the current year, Brent Corporation donates computer equipment that it purchased six months ago to Eastside High School for use in its educational program. The donated property had a $20,000 adjusted basis to Brent and a $40,000 FMV. What is the amount of the gift?

A) $20,000

B) $30,000

C) $50,000

D) $35,000

A) $20,000

B) $30,000

C) $50,000

D) $35,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

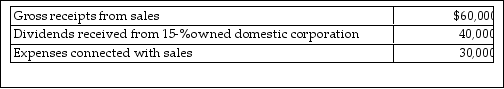

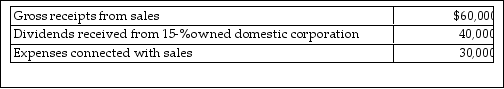

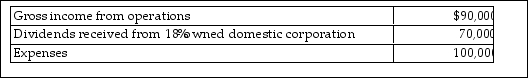

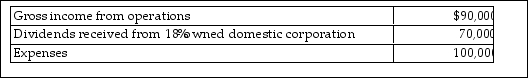

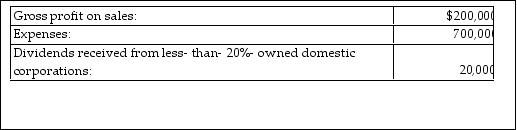

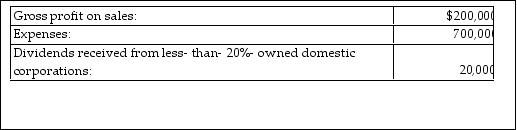

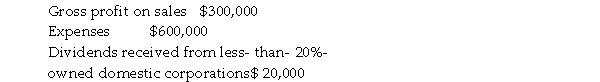

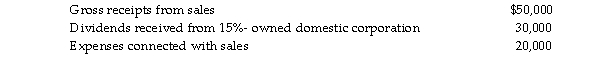

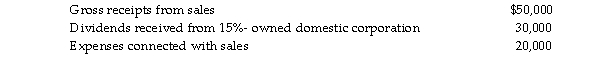

Island Corporation has the following income and expense items for the year:  The taxable income of Island Corporation is

The taxable income of Island Corporation is

A) $70,000.

B) $50,000.

C) $47,000.

D) $100,000.

The taxable income of Island Corporation is

The taxable income of Island Corporation isA) $70,000.

B) $50,000.

C) $47,000.

D) $100,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

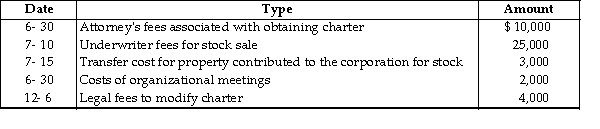

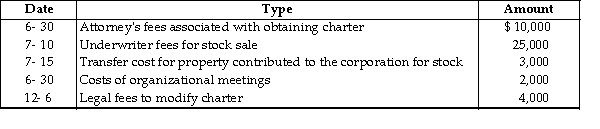

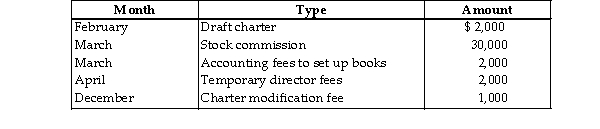

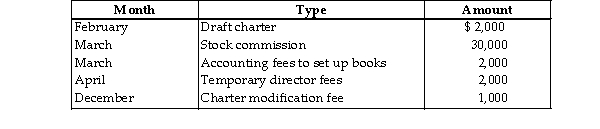

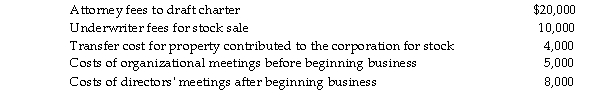

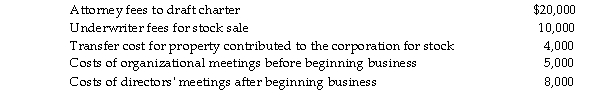

Edison Corporation is organized on July 31. The corporation starts business on August 10. The corporation adopts a November 30 fiscal year end. The following expenses are incurred during the year:  What is the maximum amount of organizational expenditures that can be deducted by the corporati its first tax year ending November 30?

What is the maximum amount of organizational expenditures that can be deducted by the corporati its first tax year ending November 30?

A) $800

B) $12,000

C) $5,156

D) $16,000

What is the maximum amount of organizational expenditures that can be deducted by the corporati its first tax year ending November 30?

What is the maximum amount of organizational expenditures that can be deducted by the corporati its first tax year ending November 30?A) $800

B) $12,000

C) $5,156

D) $16,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

Dallas Corporation, not a dealer in securities, realizes taxable income of $60,000 from the operation of its business. Additionally, in the same year, Dallas realizes a long- term capital loss of $10,000 from the sale of marketable securities. If the corporation realizes no other capital gains or losses, what is the proper treatment for the $10,000 long- term capital loss on the tax return?

A) Carry the $10,000 long- term capital loss back three years as a short- term capital loss, then forward five years.

B) Use $6,000 of the loss to reduce taxable income and carry $4,000 of the long- term capital loss forward for five years.

C) Use $10,000 of the long- term capital loss to reduce taxable income.

D) Use $3,000 of the loss to reduce taxable income and carry $7,000 of the long- term capital loss forward for five years.

A) Carry the $10,000 long- term capital loss back three years as a short- term capital loss, then forward five years.

B) Use $6,000 of the loss to reduce taxable income and carry $4,000 of the long- term capital loss forward for five years.

C) Use $10,000 of the long- term capital loss to reduce taxable income.

D) Use $3,000 of the loss to reduce taxable income and carry $7,000 of the long- term capital loss forward for five years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

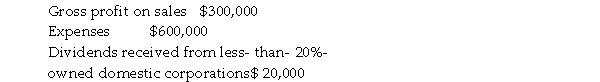

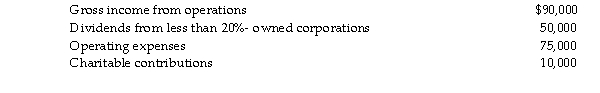

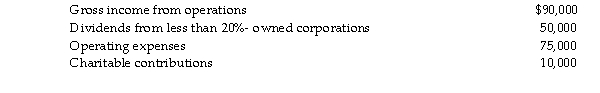

Maxwell Corporation reports the following results:  Maxwell's dividends- received deduction is

Maxwell's dividends- received deduction is

A) $35,000.

B) $70,000.

C) $56,000.

D) $30,000.

Maxwell's dividends- received deduction is

Maxwell's dividends- received deduction isA) $35,000.

B) $70,000.

C) $56,000.

D) $30,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

Green Corporation is incorporated on March 1 and begins business on June 1. Green's first tax year ends on October 31, i.e., a short year. Green incurs the following expenses during the year:  What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as pos

What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as pos

A) $36,000

B) $667

C) $500

D) $5,028

What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as pos

What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as posA) $36,000

B) $667

C) $500

D) $5,028

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

Identify which of the following statements is true.

A) The full 65% dividends- received deduction is available without restriction.

B) The dividends- received deduction is designed to reduce double taxation of corporate dividends.

C) If a corporation receives dividends eligible for the 65% dividends- received deduction and the 50% dividends- received deduction, the 50% dividends- received deduction reduces taxable income prior to the 65% deduction.

D) All of the above are false.

A) The full 65% dividends- received deduction is available without restriction.

B) The dividends- received deduction is designed to reduce double taxation of corporate dividends.

C) If a corporation receives dividends eligible for the 65% dividends- received deduction and the 50% dividends- received deduction, the 50% dividends- received deduction reduces taxable income prior to the 65% deduction.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

Identify which of the following statements is true.

A) Accrued compensation not paid within three and one- half months after the close of the corporation tax year is deducted in the year following the accrual.

B) Accrued compensation that is deductible in the year of accrual is considered to be part of an IRS deferred compensation plan.

C) A corporation that accrues compensation payable to an employee must pay the amount within two and one- half months after the close of the taxable year to deduct the amount in the year of the accrual.

D) All of the above are false.

A) Accrued compensation not paid within three and one- half months after the close of the corporation tax year is deducted in the year following the accrual.

B) Accrued compensation that is deductible in the year of accrual is considered to be part of an IRS deferred compensation plan.

C) A corporation that accrues compensation payable to an employee must pay the amount within two and one- half months after the close of the taxable year to deduct the amount in the year of the accrual.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

Booth Corporation sells a building classified as a residential rental property for $200,000. The MACRS straight- line depreciation taken is $20,000 and the adjusted basis of the building is $170,000. Booth Corporation must recognize ordinary income of

A) $20,000.

B) $4,000.

C) $0.

D) $30,000.

A) $20,000.

B) $4,000.

C) $0.

D) $30,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

Identify which of the following statements is true.

A) Unamortized organizational expenses cannot be deducted when the corporation is liquidated.

B) Organizational expenditures incurred by a corporation do not include the cost of accounting services necessary to create the corporation.

C) Organizational expenditures incurred by a corporation do not include the cost of printing stock.

D) All of the above are false.

A) Unamortized organizational expenses cannot be deducted when the corporation is liquidated.

B) Organizational expenditures incurred by a corporation do not include the cost of accounting services necessary to create the corporation.

C) Organizational expenditures incurred by a corporation do not include the cost of printing stock.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

Identify which of the following statements is false.

A) The 50% dividends- received deduction is limited to 50% of the taxable income of the corporation without regard to any NOL deduction, any capital loss carryback, and the dividends- received deduction itself unless the dividends- received deduction produces an NOL.

B) A corporate dividends- received deduction is not allowed for dividends received on stock held for 40 days.

C) Members of an affiliated group can claim a 90% dividends- received deduction for dividends received from other group members that is not subject to a taxable income limitation.

D) All of the above are false.

A) The 50% dividends- received deduction is limited to 50% of the taxable income of the corporation without regard to any NOL deduction, any capital loss carryback, and the dividends- received deduction itself unless the dividends- received deduction produces an NOL.

B) A corporate dividends- received deduction is not allowed for dividends received on stock held for 40 days.

C) Members of an affiliated group can claim a 90% dividends- received deduction for dividends received from other group members that is not subject to a taxable income limitation.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

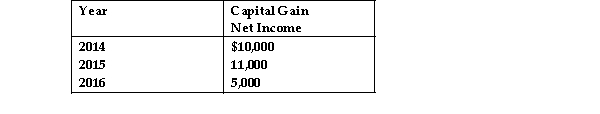

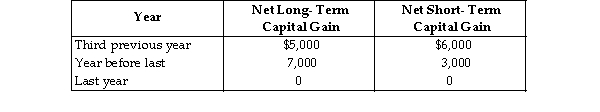

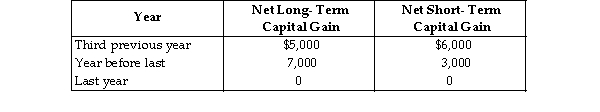

Evans Corporation has a $15,000 net capital loss in 2017. The corporation reported the following cap gain netting in income during the past three years. Identify which of the following statements is true

A) The loss is used to offset the $11,000 of the 2015 gains and then carried back to offset $4,000 of the year 2014 net gain.

B) The loss is used to offset $3,000 of 2014 , 2015 and 2016 capital gains, remaining amount carried forward at $3,000 a year until expired.

C) The loss is used to offset the year 2014 net gains, then $5,000 of the year 2015 net gains.

D) The loss is used to offset the gains from 2016 and then carried back to offset $10,000 of the gains in 2014.

A) The loss is used to offset the $11,000 of the 2015 gains and then carried back to offset $4,000 of the year 2014 net gain.

B) The loss is used to offset $3,000 of 2014 , 2015 and 2016 capital gains, remaining amount carried forward at $3,000 a year until expired.

C) The loss is used to offset the year 2014 net gains, then $5,000 of the year 2015 net gains.

D) The loss is used to offset the gains from 2016 and then carried back to offset $10,000 of the gains in 2014.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

Richards Corporation has taxable income of $280,000 calculated before the charitable contribution deduction and before its dividends- received deduction of $34,000. Richards makes cash contributions of $35,000 to charitable organizations. What is Richards Corporation's charitable contribution deduction for the current year?

A) $28,000

B) $35,000

C) $31,400

D) $24,600

A) $28,000

B) $35,000

C) $31,400

D) $24,600

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

Organizational expenditures include all of the following except for

A) expenses of organizational meetings.

B) legal costs incident to the creation of the corporation.

C) fees paid to the state of incorporation.

D) costs incurred when issuing stock.

A) expenses of organizational meetings.

B) legal costs incident to the creation of the corporation.

C) fees paid to the state of incorporation.

D) costs incurred when issuing stock.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

Money Corporation has the following income and expenses for the tax year:  What is Money's net operating loss?

What is Money's net operating loss?

A) $520,000

B) $494,000

C) $220,000

D) $490,000

What is Money's net operating loss?

What is Money's net operating loss?A) $520,000

B) $494,000

C) $220,000

D) $490,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

If a corporation's charitable contributions exceed the deduction limitation in a particular year, the excess

A) may be carried back to the third preceding year.

B) is not deductible in any future year.

C) is carried over indefinitely.

D) becomes a carryover to a maximum of five succeeding years.

A) may be carried back to the third preceding year.

B) is not deductible in any future year.

C) is carried over indefinitely.

D) becomes a carryover to a maximum of five succeeding years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

Blueboy Inc. contributes inventory to a qualified charity for use in feeding the needy. The inventory has a $70,000 FMV and a $30,000 adjusted basis. Blueboy Inc. can take a charitable contribution deduction of

A) $60,000.

B) $20,000.

C) $30,000.

D) $50,000.

A) $60,000.

B) $20,000.

C) $30,000.

D) $50,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

Garth Corporation donates inventory having an adjusted basis of $40,000 and an FMV of $150,000 to a qualified public charity. The inventory will be used by the charity to care for the ill. The maximum charitable contribution deduction before consideration of the 10% limitation is

A) $95,000.

B) $40,000.

C) $80,000.

D) $55,000.

A) $95,000.

B) $40,000.

C) $80,000.

D) $55,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

Identify which of the following statements is true.

A) The Twilight Corporation purchases inventory for $5,000. Its FMV on the date it is donated to the Blue- Gray Hospital for the care of the needy is $13,000. The maximum charitable contribution deduction available for the donation is $9,000.

B) Corporations' charitable deductions are limited to 20% of their adjusted taxable income.

C) "Ordinary income property" with regard to the charitable contribution deduction does not include property whose sale would have produced a short- term capital gain.

D) All of the above are false.

A) The Twilight Corporation purchases inventory for $5,000. Its FMV on the date it is donated to the Blue- Gray Hospital for the care of the needy is $13,000. The maximum charitable contribution deduction available for the donation is $9,000.

B) Corporations' charitable deductions are limited to 20% of their adjusted taxable income.

C) "Ordinary income property" with regard to the charitable contribution deduction does not include property whose sale would have produced a short- term capital gain.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

Identify which of the following statements is true.

A) When a corporation donates appreciated capital gain property to a charity, the amount of the contribution deduction generally equals the property's FMV.

B) When a corporation contributes appreciated property to a charity, the charitable contribution deduction is the property's FMV or adjusted basis, depending on the election made by the taxpayer.

C) When a corporation donates appreciated capital gain property to a private nonoperating foundation, the corporation's contribution is limited to the property's FMV minus the ordinary gain that would have resulted from the property's sale.

D) All of the above are false.

A) When a corporation donates appreciated capital gain property to a charity, the amount of the contribution deduction generally equals the property's FMV.

B) When a corporation contributes appreciated property to a charity, the charitable contribution deduction is the property's FMV or adjusted basis, depending on the election made by the taxpayer.

C) When a corporation donates appreciated capital gain property to a private nonoperating foundation, the corporation's contribution is limited to the property's FMV minus the ordinary gain that would have resulted from the property's sale.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

Two days before the ex- dividend date, Drexel Corporation buys 100 shares of Zebra Corporation stock (less than 1%) for $200,000. Drexel Corporation receives $10,000 of dividends from Zebra Corporation. Two weeks after the ex- dividend date, Drexel Corporation sells the Zebra Corporation stock for $190,000. Which of the following statements is correct?

A) Drexel Corporation cannot recognize a capital loss.

B) Drexel Corporation will be allowed a 50% dividends- received deduction when reporting the Zebra Corporation dividend.

C) Drexel Corporation cannot take a dividends- received deduction on the Zebra Corporation dividend.

D) Drexel Corporation will receive no dividends- received deduction because the stock was purchased ex- dividend.

A) Drexel Corporation cannot recognize a capital loss.

B) Drexel Corporation will be allowed a 50% dividends- received deduction when reporting the Zebra Corporation dividend.

C) Drexel Corporation cannot take a dividends- received deduction on the Zebra Corporation dividend.

D) Drexel Corporation will receive no dividends- received deduction because the stock was purchased ex- dividend.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

Identify which of the following statements is true.

A) If a corporation accrues an obligation to pay compensation, the corporation must make the payment by year- end to be able to deduct during the current year.

B) Any amount of net business interest disallowed due to limitation may be carried over indefinitely.

C) Net business interest is limited to 50% of adjusted taxable income.

D) Corporations can deduct up to $10,000 in capital losses per year.

A) If a corporation accrues an obligation to pay compensation, the corporation must make the payment by year- end to be able to deduct during the current year.

B) Any amount of net business interest disallowed due to limitation may be carried over indefinitely.

C) Net business interest is limited to 50% of adjusted taxable income.

D) Corporations can deduct up to $10,000 in capital losses per year.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

Prince Corporation donates inventory having an adjusted basis of $26,000 and an FMV of $40,000 to County Hospital, which is a qualified public charity. What is the amount of Prince's deduction?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

Bright Corporation purchased residential real estate five years ago for $450,000, of which $50,000 was allocated to the land and $400,000 was allocated to the building. Bright booked straight- line MACRS deductions of

$55,000 during the past five years. This year, Bright sells the property for $550,000, of which $100,000 is allocated to the land and $450,000 is allocated to the building. What is the amount and character of Bright's recognized gain or loss on the sale?

$55,000 during the past five years. This year, Bright sells the property for $550,000, of which $100,000 is allocated to the land and $450,000 is allocated to the building. What is the amount and character of Bright's recognized gain or loss on the sale?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

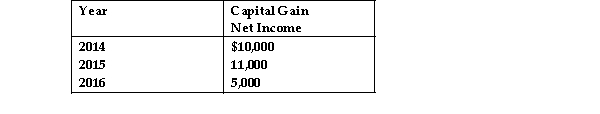

Lass Corporation reports a $25,000 net capital loss this year. The corporation reports the following net capital gains during the past three years.  Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, i available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, i available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, i available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss, i available as a carryforward.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

Walter, who owns all of the Ajax Corporation stock, purchases a truck from Ajax Corporation in January. The truck cost $12,000 and has a $10,000 adjusted basis. Walter pays the truck's $8,000 FMV. Later in the same year, Walter sells the truck to an unrelated party for $13,000. With respect to these transactions,

A) Ajax Corporation reports no loss and Walter reports a gain of $5,000.

B) Ajax Corporation reports a loss of $4,000 and Walter reports a gain of $5,000.

C) Ajax Corporation reports a loss of $2,000 and Walter reports a gain of $5,000.

D) Ajax Corporation reports no loss and Walter reports a gain of $3,000.

A) Ajax Corporation reports no loss and Walter reports a gain of $5,000.

B) Ajax Corporation reports a loss of $4,000 and Walter reports a gain of $5,000.

C) Ajax Corporation reports a loss of $2,000 and Walter reports a gain of $5,000.

D) Ajax Corporation reports no loss and Walter reports a gain of $3,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

Identify which of the following statements is true.

A) The charitable contribution deduction is computed after the dividends- received deduction.

B) The charitable contribution deduction is computed after the deduction for an NOL.

C) The NOL deduction claimed by a corporation must be taken after the dividends- received deduction.

D) All of the above are false.

A) The charitable contribution deduction is computed after the dividends- received deduction.

B) The charitable contribution deduction is computed after the deduction for an NOL.

C) The NOL deduction claimed by a corporation must be taken after the dividends- received deduction.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

Delux Corporation, a retail sales corporation, has a taxable income of $500,000. Delux Corporation's regular tax liability is

A) $158,250.

B) $175,000.

C) $105,000.

D) $162,200.

A) $158,250.

B) $175,000.

C) $105,000.

D) $162,200.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

Miller Corporation has gross income of $100,000, which includes $60,000 of dividends from a 10%- owned corporation. In addition, Miller has $80,000 of expenses. Miller's taxable income or loss is

A) $0.

B) ($10,000).

C) $20,000.

D) $6,000.

A) $0.

B) ($10,000).

C) $20,000.

D) $6,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

On December 10, 2018, Dell Corporation (a calendar- year taxpayer) accrues an obligation for a $100,000 bonus to Muriel, a sales representative who had had an outstanding year. Muriel owns no Dell Corporation stock. The bonus is paid on May 5, 2019. What is Dell's deduction for 2018? What is Dell's deduction for 2019?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

Chambers Corporation is a calendar year taxpayer using the accrual method of accounting. In 2018, its board of directors authorizes a $20,000 contribution to the Boy Scouts. Chambers pays the contribution on March 12, 2019. What is the maximum contribution allowed in 2018? What is the maximum contribution allowed in 2019?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

Identify which of the following statements is true.

A) In computing an NOL for the current year, a deduction is allowed for NOLs from previous years.

B) A corporate NOL can be carried back two years and forward 15 years.

C) An NOL incurred before 2018 carries forward 20 years and is not subject to the 80% of taxable income limitation.

D) All of the above are false.

A) In computing an NOL for the current year, a deduction is allowed for NOLs from previous years.

B) A corporate NOL can be carried back two years and forward 15 years.

C) An NOL incurred before 2018 carries forward 20 years and is not subject to the 80% of taxable income limitation.

D) All of the above are false.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

The following expenses are incurred by Salter Corporation when it is organized on July 1:  Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8. What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

Jackson Corporation, not a dealer in securities, realizes taxable income of $80,000 from the operation of its business. Additionally, Jackson Corporation realizes a $10,000 long- term capital loss from the sale of marketable securities. Explain the treatment of the loss on the corporate return for this and any other years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

Webster, who owns all the Bear Corporation stock, purchases a dump truck from Bear Corporation in January. The truck cost $12,000 and has a $10,000 adjusted basis at the time of the sale. Webster pays Bear the truck's $8,000 FMV. Later in the same year, Webster sells the dump truck to an unrelated party for $6,000. Webster can recognize a loss of

A) $4,000.

B) $5,000.

C) $2,000.

D) $3,000.

A) $4,000.

B) $5,000.

C) $2,000.

D) $3,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

Ryan Corporation sells a commercial building and land. The sales proceeds attributable to the building is

$145,000. When purchased, the building is allocated $75,000 of the purchase price. The firm has depreciated the building using the MACRS rules. The MACRS deductions taken total $60,000. What is the amount and character of Ryan's recognized gain?

$145,000. When purchased, the building is allocated $75,000 of the purchase price. The firm has depreciated the building using the MACRS rules. The MACRS deductions taken total $60,000. What is the amount and character of Ryan's recognized gain?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

Access Corporation, a large manufacturer, has a taxable income of $16,000,000. Access Corporation's tax is

A) $5,600,000.

B) $5,440,000.

C) $3,680,000.

D) $3,360,000.

A) $5,600,000.

B) $5,440,000.

C) $3,680,000.

D) $3,360,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

Baxter Corporation is a personal service corporation. Baxter Corporation has taxable income of $10,000. Baxter Corporation's tax is

A) $2,900.

B) $2,100.

C) $1,500.

D) $2,400.

A) $2,900.

B) $2,100.

C) $1,500.

D) $2,400.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

Identify which of the following statements is true.

A) Domestic Production Activities Deduction carry overs that originated from pre 2018 tax years are limited to 50% of taxable income until 2025.

B) Deductibility of business interest in a given year is limited to 80% of adjusted taxable income.

C) For expenses incurred after December 31, 2017, no deduction is allowed for any activities involving entertainment, amusement, or recreation, including expenses related to a facility used in connection with these activities.

D) The Dividends Received Deduction for individuals is limited to 50%.

A) Domestic Production Activities Deduction carry overs that originated from pre 2018 tax years are limited to 50% of taxable income until 2025.

B) Deductibility of business interest in a given year is limited to 80% of adjusted taxable income.

C) For expenses incurred after December 31, 2017, no deduction is allowed for any activities involving entertainment, amusement, or recreation, including expenses related to a facility used in connection with these activities.

D) The Dividends Received Deduction for individuals is limited to 50%.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

West Corporation purchases 50 shares (less than 1%) of Perch Corporation common stock on April 3. The ex- dividend date is April 4. West Corporation pays $50,000 for the stock and receives a dividend of $5,000 on the Perch stock. On May 1, West Corporation sells the Perch stock for

$45,000. West's taxable income before the dividends- received deduction is $4,000. West's dividends- received deduction is

A) $2,800.

B) $3,500.

C) $0.

D) $3,200.

$45,000. West's taxable income before the dividends- received deduction is $4,000. West's dividends- received deduction is

A) $2,800.

B) $3,500.

C) $0.

D) $3,200.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

How does the use of an NOL differ for individual and corporate taxpayers?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

Courtney Corporation had the following income and expenses for the tax year:  Courtney had taxable income for the past three years of:

Courtney had taxable income for the past three years of:  Determine the corporation's NOL for the current year.

Determine the corporation's NOL for the current year.

Courtney had taxable income for the past three years of:

Courtney had taxable income for the past three years of:  Determine the corporation's NOL for the current year.

Determine the corporation's NOL for the current year.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

Zerotech Corporation donates the following property to an elementary school:

• Computer printer purchased three years ago for $1,000. The printer has a $500 FMV and $0 adjusted basis on contribution date.

• Computer equipment acquired one year ago at a cost of $5,000. The equipment has an $8,000 FMV and $0 ad basis on contribution date.

• Computer software acquired two months ago at a cost of $10,000. The software will be used in a prekinderga program. Its FMV on the contribution date is $10,000 and it has an adjusted basis of $0.

a) Identify any donation qualifying for special treatment.

b) What is Zerotech's charitable contribution deduction?

• Computer printer purchased three years ago for $1,000. The printer has a $500 FMV and $0 adjusted basis on contribution date.

• Computer equipment acquired one year ago at a cost of $5,000. The equipment has an $8,000 FMV and $0 ad basis on contribution date.

• Computer software acquired two months ago at a cost of $10,000. The software will be used in a prekinderga program. Its FMV on the contribution date is $10,000 and it has an adjusted basis of $0.

a) Identify any donation qualifying for special treatment.

b) What is Zerotech's charitable contribution deduction?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

What are the various levels of stock ownership by corporate shareholders for the dividends- received deduction (DRD)? What is the DRD% for each level of ownership?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

Paul, who owns all the stock in Rodgers Corporation, purchases a truck from the corporation in January. The truck cost $11,000 and has an adjusted basis of $9,000. Paul pays Rodgers the truck's $7,000 FMV. Paul sells the truck later in the tax year to an unrelated party for $12,000. What is the amount and character of the income that Paul will report on this year's tax return?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

For corporations, what happens to excess charitable contributions?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

During the year, Soup Corporation contributes some of its inventory to a qualified charity for use in feeding the needy. The inventory has an FMV of $85,000 and an adjusted basis of $25,000. What is the amount of Soup Corporation's charitable contribution deduction for the donation of the inventory as determined without regard to the overall charitable contribution limitation?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

What are start- up expenditures?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

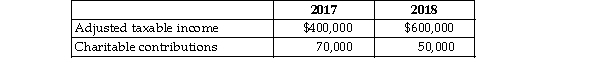

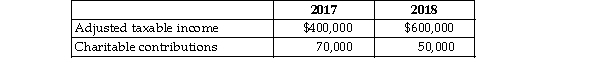

Bermuda Corporation reports the following results in 2017 and 2018:  What is Bermuda's contribution deduction in 2017 and 2018? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2017 and 2018? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2017 and 2018? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2017 and 2018? What is the disposition of any remaining amount?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

Cricket Corporation has a $50,000 NOL in the current year. Cricket does not have pre 2018 NOLs. Cricket expects its taxable income for next year to exceed $40,000. What issues should be considered with respect to the use of the NOL?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

Francine Corporation reports the following income and expense items for the tax year ending December 31:  What is Francine Corporation's taxable income?

What is Francine Corporation's taxable income?

What is Francine Corporation's taxable income?

What is Francine Corporation's taxable income?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

Dexter Corporation reports the following results for the current year:  In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income fo current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income fo current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income fo current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year. What is Dexter's taxable income fo current year?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

Little Corporation uses the accrual method of accounting. Little's sole shareholder, Renee, uses the cash method of accounting. Both taxpayers use the calendar year as their tax year. The corporation accrues a $25,000 interest payment to Renee on December 25, 2011 and makes the payment on March 10, 2012. What are the tax consequences of the transactions to both taxpayers in 2011 and 2012?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

Jackel, Inc. has the following information for the current tax year:  What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

How does the use of a net capital loss differ for individual and corporate taxpayers?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

When computing corporate taxable income, what is the proper sequencing of deductions?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

Westwind Corporation reports the following results for the current year:  What are Westwind's taxable income and regular tax liability before credits for the current year?

What are Westwind's taxable income and regular tax liability before credits for the current year?

What are Westwind's taxable income and regular tax liability before credits for the current year?

What are Westwind's taxable income and regular tax liability before credits for the current year?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

Quality Corporation, a regular corporation, has an opportunity to realize $50,000 of additional income in either the current year or next year. What tax issues need to be considered in determining when to realize the income?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

Vanda Corporation sold a truck with an adjusted basis of $50,000 to Barbara for $30,000. Vanessa owns 25% of the Vanda stock. What tax issues should Vanda and Vanessa consider with respect to the sale/purchase?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

What impact does an NOL carryforward have on the proper sequencing of deductions to compute corporate taxable income?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck