Deck 9: Business Income,deductions,and Accounting Methods

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/99

Play

Full screen (f)

Deck 9: Business Income,deductions,and Accounting Methods

1

Ralph borrowed $4 million and used the proceeds in his Internet business.The interest on this debt is not subject to an interest limitation if Ralph's business has average annual gross receipts of $26 million or less for the prior three taxable years.

True

2

A business generally adopts a fiscal or calendar year by using that year-end on the first tax return for the business.

True

3

The Internal Revenue Code authorizes deductions for trade or business activities if the expenditure is "ordinary and necessary."

True

4

Business activities are distinguished from personal activities in that business activities are motivated by the pursuit of profits.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

5

A business can deduct the cost of uniforms supplied to employees.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

6

Although expenses associated with illegal activities are not deductible,political contributions can be deducted as long as the donation is not made to a candidate for public office.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

7

Illegal bribes and kickbacks are not deductible as business expenses but fines imposed by a governmental unit are deductible as long as the fines are incurred in the ordinary course of business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

8

A fiscal tax year can end on the last day of any month other than December.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

9

Only half the cost of a business meal is deductible even if the meal is extravagant.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

10

Taxpayers must maintain written contemporaneous records of business purpose when traveling in order to claim a deduction for the expenditures.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

11

A short tax year can end on any day of any month other than December.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

12

Adjusted taxable income for calculating the business interest limitation is defined as taxable income of the taxpayer computed without regard to any item of income,gain,deduction,or loss that is not properly allocable to a trade or business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

13

When a taxpayer borrows money and invests the loan proceeds in municipal bonds,the interest paid by the taxpayer on the debt will not be deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

14

Reasonable in amount means that expenditures can be exorbitant as long as the activity is motivated by profit.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

15

The test for whether an expenditure is reasonable in amount is whether the expenditure was for an "arm's length" amount.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

16

The deduction for business interest expense is limited to the sum of (1)business interest income and (2)30 percent of the adjusted taxable income of the taxpayer for the taxable year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

17

The phase "ordinary and necessary" has been defined to mean that an expense must be essential and indispensable to the conduct of a business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

18

A loss deduction from a casualty of a business asset is only available if the asset is completely destroyed.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

19

All taxpayers must account for taxable income using a calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

20

Sole proprietorships must use the same tax year as the proprietor of the business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is likely to be a fully deductible business expense?

A)Salaries in excess of the industry average paid to attract talented employees.

B)The cost of employee uniforms that can be adapted to ordinary personal wear.

C)A speeding fine paid by a trucker who was delivering a rush order.

D)The cost of a three-year subscription to a business publication.

E)None of the choices are likely to be deductible.

A)Salaries in excess of the industry average paid to attract talented employees.

B)The cost of employee uniforms that can be adapted to ordinary personal wear.

C)A speeding fine paid by a trucker who was delivering a rush order.

D)The cost of a three-year subscription to a business publication.

E)None of the choices are likely to be deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following business expense deductions is most likely to be unreasonable in amount?

A)Compensation paid to the taxpayer's spouse in excess of salary payments to other employees.

B)Amounts paid to a subsidiary corporation for services where the amount is in excess of the cost of comparable services by competing corporations.

C)Cost of a meal with a former client when there is no possibility of any future benefits from a relation with that client.

D)All of the choices are likely to be unreasonable in amount.

E)None of the choices are likely to be unreasonable in amount.

A)Compensation paid to the taxpayer's spouse in excess of salary payments to other employees.

B)Amounts paid to a subsidiary corporation for services where the amount is in excess of the cost of comparable services by competing corporations.

C)Cost of a meal with a former client when there is no possibility of any future benefits from a relation with that client.

D)All of the choices are likely to be unreasonable in amount.

E)None of the choices are likely to be unreasonable in amount.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

23

Dick pays insurance premiums for his employees.What type of insurance premium is not deductible as compensation paid to the employee?

A)Health insurance with benefits payable to the employee.

B)Whole life insurance with benefits payable to the employee's dependents.

C)Group-term life insurance with benefits payable to the employee's dependents.

D)Key-employee life insurance with benefits payable to Dick.

E)All of the choices are deductible by Dick.

A)Health insurance with benefits payable to the employee.

B)Whole life insurance with benefits payable to the employee's dependents.

C)Group-term life insurance with benefits payable to the employee's dependents.

D)Key-employee life insurance with benefits payable to Dick.

E)All of the choices are deductible by Dick.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

24

This year Clark leased a car to drive between his office and various work sites.Clark carefully recorded that he drove the car 23,000 miles this year and paid $7,200 of operating expenses ($2,700 for gas,oil,and repairs,and $4,500 for lease payments).What amount of these expenses may Clark deduct as business expenses?

A)$7,200

B)Clark cannot deduct these costs because taxpayers must use the mileage method to determine any transportation deduction.

C)$4,500

D)$2,700

E)Clark is not entitled to any deduction if he used the car for any personal trips.

A)$7,200

B)Clark cannot deduct these costs because taxpayers must use the mileage method to determine any transportation deduction.

C)$4,500

D)$2,700

E)Clark is not entitled to any deduction if he used the car for any personal trips.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

25

Uniform capitalization of indirect inventory costs is required for most very large taxpayers.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

26

The full-inclusion method requires cash-basis taxpayers to include prepayments for goods or services into realized income.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following expenditures is NOT likely to be allowed as a current deduction for a landscaping and nursery business?

A)Cost of fertilizer

B)Accounting fees

C)Cost of a greenhouse

D)Cost of uniforms for employees

E)A cash settlement for trade name infringement

A)Cost of fertilizer

B)Accounting fees

C)Cost of a greenhouse

D)Cost of uniforms for employees

E)A cash settlement for trade name infringement

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

28

Individual proprietors report their business income and deductions on:

A)Form 1065.

B)Form 1120S.

C)Schedule C.

D)Schedule A.

E)Form 1041.

A)Form 1065.

B)Form 1120S.

C)Schedule C.

D)Schedule A.

E)Form 1041.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is an explanation for why insurance premiums on a key employee are not deductible?

A)A deduction for the insurance premium would offset taxable income without the potential for the proceeds generating taxable income.

B)The federal government does not want to subsidize insurance companies.

C)It is impractical to trace insurance premiums to the receipt of proceeds.

D)Congress presumes that all expenses are not deductible unless specifically allowed in the Internal Revenue Code.

E)This rule was grandfathered from a time when the Internal Revenue Code disallowed all insurance premiums deductions.

A)A deduction for the insurance premium would offset taxable income without the potential for the proceeds generating taxable income.

B)The federal government does not want to subsidize insurance companies.

C)It is impractical to trace insurance premiums to the receipt of proceeds.

D)Congress presumes that all expenses are not deductible unless specifically allowed in the Internal Revenue Code.

E)This rule was grandfathered from a time when the Internal Revenue Code disallowed all insurance premiums deductions.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

30

In order to deduct a portion of the cost of a business meal,which of the following conditions must be met?

A)A client (not a supplier or vendor)must be present at the meal.

B)The taxpayer or an employee must be present at the meal.

C)The meal must occur on the taxpayer's business premises.

D)None of these choices is a condition for the deduction.

E)All of the choices are conditions for a deduction.

A)A client (not a supplier or vendor)must be present at the meal.

B)The taxpayer or an employee must be present at the meal.

C)The meal must occur on the taxpayer's business premises.

D)None of these choices is a condition for the deduction.

E)All of the choices are conditions for a deduction.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

31

According to the Internal Revenue Code §162,deductible trade or business expenses must be which one of the following?

A)Incurred for the production of investment income

B)Ordinary and necessary

C)Minimized

D)Appropriate and measurable

E)Personal and justifiable

A)Incurred for the production of investment income

B)Ordinary and necessary

C)Minimized

D)Appropriate and measurable

E)Personal and justifiable

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

32

Even a cash-method taxpayer must consistently use accounting methods that "clearly reflect income" for tax purposes.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is a true statement?

A)Interest expense is not deductible if the loan is used to purchase municipal bonds.

B)Insurance premiums are not deductible if paid for "key-employee" life insurance.

C)One-half of the cost of business meals is not deductible.

D)All of these choices are true.

E)None of the choices are true.

A)Interest expense is not deductible if the loan is used to purchase municipal bonds.

B)Insurance premiums are not deductible if paid for "key-employee" life insurance.

C)One-half of the cost of business meals is not deductible.

D)All of these choices are true.

E)None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is a true statement?

A)Meals are never deductible as a business expense.

B)An employer can only deduct half of any meals provided to employees as compensation.

C)The cost of business meals must be reasonable.

D)A taxpayer can only deduct a meal for a client if business is discussed during the meal.

E)None of the choices are true.

A)Meals are never deductible as a business expense.

B)An employer can only deduct half of any meals provided to employees as compensation.

C)The cost of business meals must be reasonable.

D)A taxpayer can only deduct a meal for a client if business is discussed during the meal.

E)None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

35

Paris operates a talent agency as a sole proprietorship,and this year she incurred the following expenses in operating her talent agency.What is the total deductible amount of these expenditures? $1,000 dinner and theater with a film producer where no business was discussed

$500 lunch with sister Nicky where no business was discussed

$700 business dinner with a client but Paris forgot to keep any records (oops!)

$900 tickets to the opera with a client following a business meeting

A)$450.

B)$900.

C)$1,100.

D)$1,200.

E)$0.

$500 lunch with sister Nicky where no business was discussed

$700 business dinner with a client but Paris forgot to keep any records (oops!)

$900 tickets to the opera with a client following a business meeting

A)$450.

B)$900.

C)$1,100.

D)$1,200.

E)$0.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

36

The all-events test for income determines the period in which income will be recognized for tax purposes.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

37

The IRS would most likely apply the arm's length transaction test to determine which of the following?

A)Whether an expenditure is related to a business activity.

B)Whether an expenditure will be likely to produce income.

C)Timeliness of an expenditure.

D)Reasonableness of an expenditure.

E)All of the choices are correct.

A)Whether an expenditure is related to a business activity.

B)Whether an expenditure will be likely to produce income.

C)Timeliness of an expenditure.

D)Reasonableness of an expenditure.

E)All of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

38

The 12-month rule allows taxpayers to deduct the entire amount of certain prepaid business expenses.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

39

Holly took a prospective client to dinner,and after agreeing to a business deal,they went to the theater.Holly paid $290 for the meal and separately paid $250 for the theater tickets,amounts that were reasonable under the circumstances.What amount of these expenditures can Holly deduct as a business expense?

A)$540

B)$270

C)$145

D)$125

E)None-the meals and entertainment are not deductible except during travel.

A)$540

B)$270

C)$145

D)$125

E)None-the meals and entertainment are not deductible except during travel.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following expenditures is most likely to be deductible for a construction business?

A)A fine for a zoning violation.

B)A tax underpayment penalty.

C)An "under the table" payment to a government representative to obtain a better price for raw materials.

D)A contribution to the mayor's political campaign fund.

E)An arm's length payment to a related party for emergency repairs of a sewage line.

A)A fine for a zoning violation.

B)A tax underpayment penalty.

C)An "under the table" payment to a government representative to obtain a better price for raw materials.

D)A contribution to the mayor's political campaign fund.

E)An arm's length payment to a related party for emergency repairs of a sewage line.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

41

Riley operates a plumbing business,and this year the three-year-old van he used in the business was destroyed in a traffic accident.The van was originally purchased for $20,000 and the adjusted basis was $5,800 at the time of the accident.Although the van was worth $6,000 at the time of accident,insurance only paid Riley $1,200 for the loss.What is the amount of Riley's casualty loss deduction?

A)$6,000.

B)$14,000.

C)$5,800.

D)$4,600.

E)$5,300.

A)$6,000.

B)$14,000.

C)$5,800.

D)$4,600.

E)$5,300.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following types of transactions may not be accounted for using the cash method for small proprietorships?

A)Sales of inventory

B)Services

C)Sales of securities by an investor

D)Payments of debt

E)All of the choices can be accounted for using the cash method.

A)Sales of inventory

B)Services

C)Sales of securities by an investor

D)Payments of debt

E)All of the choices can be accounted for using the cash method.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

43

Clyde operates a sole proprietorship using the cash method.This year Clyde made the following expenditures: $480 to U.S.Bank for 12 months of interest accruing on a business loan from September 1 of this year through August 31 of next year even though only $160 of interest accrued this year.

$600 for 12 months of property insurance beginning on July 1 of this year.

What is the maximum amount Clyde can deduct this year?

A)$760

B)$600

C)$480

D)$160

E)$360

$600 for 12 months of property insurance beginning on July 1 of this year.

What is the maximum amount Clyde can deduct this year?

A)$760

B)$600

C)$480

D)$160

E)$360

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

44

Bill operates a proprietorship using the cash method of accounting,and this year he received the following payments:

-$100 in cash from a customer for services rendered this year

-a promise from a customer to pay $200 for services rendered this year

-tickets to a football game worth $250 as payment for services performed last year

-a check for $170 for services rendered this year that Bill forgot to cash

How much income should Bill realize on Schedule C?

A)$100

B)$300

C)$350

D)$270

E)$520

-$100 in cash from a customer for services rendered this year

-a promise from a customer to pay $200 for services rendered this year

-tickets to a football game worth $250 as payment for services performed last year

-a check for $170 for services rendered this year that Bill forgot to cash

How much income should Bill realize on Schedule C?

A)$100

B)$300

C)$350

D)$270

E)$520

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

45

Don operates a taxi business,and this year one of his taxis was damaged in a traffic accident.The taxi was originally purchased for $32,000 and the adjusted basis was $2,000 at the time of the accident.The taxi was repaired at a cost of $2,500 and insurance reimbursed Don $700 of this cost.What is the amount of Don's casualty loss deduction?

A)$1,300.

B)$2,500.

C)$1,800.

D)$2,000.

E)Don is not eligible for a casualty loss deduction.

A)$1,300.

B)$2,500.

C)$1,800.

D)$2,000.

E)Don is not eligible for a casualty loss deduction.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

46

George operates a business that generated revenues of $50 million and allocable taxable income of $1.25 million.Included in the computation of allocable taxable income were deductible expenses of $240,000 of business interest and $250,000 of depreciation.What is the maximum business interest deduction that George will be eligible to claim this year?

A)$375,000

B)$522,200

C)$1,500,000

D)$300,000

E)$228,000

A)$375,000

B)$522,200

C)$1,500,000

D)$300,000

E)$228,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

47

John is a self-employed computer consultant who lives and works in Dallas.John paid for the following activities in conjunction with his business.Which of the following expenditures is not deductible in any amount? 1.Dinner with a potential client where the client's business was discussed.

2)A trip to Houston to negotiate a contract.

3)A seminar in Houston on new developments in the software industry.

4)A trip to New York to visit a school chum who is also interested in computers.

A)1 only.

B)2 only.

C)3 only.

D)4 only.

E)None of the choices are correct.

2)A trip to Houston to negotiate a contract.

3)A seminar in Houston on new developments in the software industry.

4)A trip to New York to visit a school chum who is also interested in computers.

A)1 only.

B)2 only.

C)3 only.

D)4 only.

E)None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

48

Jim operates his business on the accrual method and this year he received $4,000 for services that he intends to provide to his clients next year.Under what circumstances can Jim defer the recognition of the $4,000 of income until next year?

A)Jim can defer the recognition of the income if he absolutely promises not to provide the services until next year.

B)Jim must defer the recognition of the income until the income is earned.

C)Jim can defer the recognition of the income if he has requested that the client not pay for the services until the services are provided.

D)Jim can elect to defer the recognition of the income if the income is not recognized for financial accounting purposes.

E)Jim can never defer the recognition of the prepayments of income.

A)Jim can defer the recognition of the income if he absolutely promises not to provide the services until next year.

B)Jim must defer the recognition of the income until the income is earned.

C)Jim can defer the recognition of the income if he has requested that the client not pay for the services until the services are provided.

D)Jim can elect to defer the recognition of the income if the income is not recognized for financial accounting purposes.

E)Jim can never defer the recognition of the prepayments of income.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

49

Ronald is a cash-method taxpayer who made the following expenditures this year.Which expenditure is completely deductible in this period as a business expense?

A)$4,000 for rent on his office,which covers the next 24 months.

B)$3,000 for a new watch for the mayor to keep "good relations" with city hall.

C)$2,500 for professional hockey tickets distributed to a customer to generate "goodwill" for his business.

D)$55 to collect an account receivable from a customer who has failed to pay for services rendered.

E)None of the choices are completely deductible.

A)$4,000 for rent on his office,which covers the next 24 months.

B)$3,000 for a new watch for the mayor to keep "good relations" with city hall.

C)$2,500 for professional hockey tickets distributed to a customer to generate "goodwill" for his business.

D)$55 to collect an account receivable from a customer who has failed to pay for services rendered.

E)None of the choices are completely deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is a true statement about the limitation on business interest deductions?

A)Interest disallowed by this limitation is carried back three years and then forward five years.

B)The limitation is calculated as a percentage of the taxpayer's total taxable income.

C)This limitation is not imposed on businesses with average annual gross receipts of $26 million or less for the prior three taxable years.

D)All of the choices are false.

E)All of the choices are true.

A)Interest disallowed by this limitation is carried back three years and then forward five years.

B)The limitation is calculated as a percentage of the taxpayer's total taxable income.

C)This limitation is not imposed on businesses with average annual gross receipts of $26 million or less for the prior three taxable years.

D)All of the choices are false.

E)All of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

51

Ed is a self-employed heart surgeon who lives in Michigan and has incurred the following reasonable expenses.How much can Ed deduct? $1,000 in airfare to repair investment rental property in Colorado.

$500 in meals while attending a medical convention in New York.

$300 for tuition for an investment seminar,"How to pick stocks."

$100 for tickets to a football game with hospital administrators to celebrate successful negotiation of a surgical contract earlier in the day.

The correct answer is ________.

A)$1,250 "for AGI"

B)$1,300 "for AGI" and $300 "from AGI"

C)$480 "for AGI"

D)$80 "for AGI" and $1,300 "from AGI"

E)None of the choices are correct.

$500 in meals while attending a medical convention in New York.

$300 for tuition for an investment seminar,"How to pick stocks."

$100 for tickets to a football game with hospital administrators to celebrate successful negotiation of a surgical contract earlier in the day.

The correct answer is ________.

A)$1,250 "for AGI"

B)$1,300 "for AGI" and $300 "from AGI"

C)$480 "for AGI"

D)$80 "for AGI" and $1,300 "from AGI"

E)None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following expenditures is completely deductible?

A)$1,000 spent on compensating your brother for a personal expense.

B)$50 spent on meals while traveling on business.

C)$2,000 spent by the employer on reimbursing an employee for entertainment.

D)All of these expenses are fully deductible.

E)None of these expenses can be deducted in full.

A)$1,000 spent on compensating your brother for a personal expense.

B)$50 spent on meals while traveling on business.

C)$2,000 spent by the employer on reimbursing an employee for entertainment.

D)All of these expenses are fully deductible.

E)None of these expenses can be deducted in full.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

53

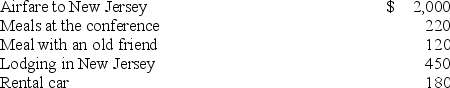

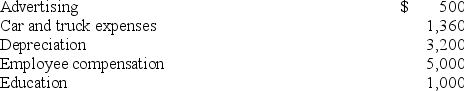

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey.After Shelley attended the conference,she had dinner with an old friend who lived nearby.Shelly documented her expenditures (described below).What amount can Shelley deduct?

A)$2,850.

B)$2,740.

C)$1,850 if Shelley itemizes the deductions.

D)All of these expenses are deductible but only if Shelley attends a conference in Texas.

E)None of the expenses are deductible because Shelly visited her friend.

A)$2,850.

B)$2,740.

C)$1,850 if Shelley itemizes the deductions.

D)All of these expenses are deductible but only if Shelley attends a conference in Texas.

E)None of the expenses are deductible because Shelly visited her friend.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

54

When does the all-events test under the accrual method require the recognition of income from the sale of goods?

A)when the title of the goods passes to the buyer.

B)when the business receives payment.

C)when payment is due from the buyer.

D)the earliest of the other three dates.

E)None of the choices are correct.

A)when the title of the goods passes to the buyer.

B)when the business receives payment.

C)when payment is due from the buyer.

D)the earliest of the other three dates.

E)None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is a true statement?

A)Meals,lodging,and incidental expenditures are deductible if the taxpayer is away from home overnight while traveling.

B)Meals are deductible for an employee who is forced to work during the lunch hour.

C)When a taxpayer travels solely for business purposes,only half of the costs of travel are deductible.

D)If travel has both business and personal aspects,the cost of transportation is always deductible but the deductibility of lodging depends upon whether business is conducted that day.

E)None of the choices are true because business travel is not deductible.

A)Meals,lodging,and incidental expenditures are deductible if the taxpayer is away from home overnight while traveling.

B)Meals are deductible for an employee who is forced to work during the lunch hour.

C)When a taxpayer travels solely for business purposes,only half of the costs of travel are deductible.

D)If travel has both business and personal aspects,the cost of transportation is always deductible but the deductibility of lodging depends upon whether business is conducted that day.

E)None of the choices are true because business travel is not deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

56

Adjusted taxable income is defined as follows for purposes of the business interest limitation:

A)taxable income allocable to the business computed without regard to interest income; depreciation,amortization,or depletion; interest expense; and net operating loss deductions.

B)30 percent of revenue after deducting depreciation and interest expense.

C)Taxable income allocable to debt invested in the business.

D)Interest income after deducting 30 percent of all deductible expenses.

E)None of the choices are correct.

A)taxable income allocable to the business computed without regard to interest income; depreciation,amortization,or depletion; interest expense; and net operating loss deductions.

B)30 percent of revenue after deducting depreciation and interest expense.

C)Taxable income allocable to debt invested in the business.

D)Interest income after deducting 30 percent of all deductible expenses.

E)None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

57

Colbert operates a catering service on the accrual method.In November of year 1 Colbert received a payment of $9,000 for 18 months of catering services to be rendered from December 1st of year 1 through May 31st of year 3.When must Colbert recognize the income if his accounting methods are selected to minimize income recognition?

A)$500 is recognized in year 1,$6,000 in year 2,and $2,500 in year 3.

B)$500 is recognized in year 1 and $8,500 in year 2.

C)$9,000 is recognized in year 3.

D)$2,500 is recognized in year 1 and $6,500 in year 2.

E)$9,000 is recognized in year 1.

A)$500 is recognized in year 1,$6,000 in year 2,and $2,500 in year 3.

B)$500 is recognized in year 1 and $8,500 in year 2.

C)$9,000 is recognized in year 3.

D)$2,500 is recognized in year 1 and $6,500 in year 2.

E)$9,000 is recognized in year 1.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

58

Beth operates a plumbing firm.In August of last year she signed a contract to provide plumbing services for a renovation.Beth began the work that August and finished the work in December of last year.However,Beth didn't bill the client until January of this year and she didn't receive the payment until March when she received payment in full.When should Beth recognize income under the accrual method of accounting?

A)In August of last year

B)In December of last year

C)In January of this year

D)In March of this year

E)In April of this year

A)In August of last year

B)In December of last year

C)In January of this year

D)In March of this year

E)In April of this year

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is a true statement about travel that has both business and personal aspects?

A)Transportation costs are always fully deductible.

B)Meals are not deductible for this type of travel.

C)Only half of the cost of meals and transportation is deductible.

D)The deduction for the cost of lodging and incidental expenditures is limited to those amounts incurred during the business portion of the travel.

E)None of the choices are correct.

A)Transportation costs are always fully deductible.

B)Meals are not deductible for this type of travel.

C)Only half of the cost of meals and transportation is deductible.

D)The deduction for the cost of lodging and incidental expenditures is limited to those amounts incurred during the business portion of the travel.

E)None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following cannot be selected as a valid tax year-end?

A)December 31st

B)January 31st

C)The last Friday of the last week of June.

D)December 15th

E)A tax year can end on any of these days

A)December 31st

B)January 31st

C)The last Friday of the last week of June.

D)December 15th

E)A tax year can end on any of these days

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

61

Todd operates a business using the cash basis of accounting.At the end of last year,Todd was granted permission to switch his sales on account to the accrual method.Last year Todd made $420,000 of sales on account and $64,000 was uncollected at the end of the year.What is Todd's §481 adjustment for this year?

A)Increase income by $420,000

B)Increase income by $16,000

C)Increase expenses by $64,000

D)Increase expenses by $420,000

E)Todd has no §481 adjustment this year.

A)Increase income by $420,000

B)Increase income by $16,000

C)Increase expenses by $64,000

D)Increase expenses by $420,000

E)Todd has no §481 adjustment this year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

62

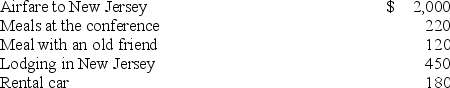

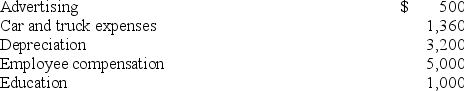

Smith operates a roof repair business.This year Smith's business generated cash receipts of $32,000 and Smith made the following expenditures associated with his business:

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is a true statement about impermissible accounting methods?

A)An impermissible method is adopted by using the method to report results for two consecutive years.

B)An impermissible method may never be used by a taxpayer.

C)Cash-method accounting is an impermissible method for partnerships and Subchapter S- electing corporations.

D)There is no accounting method that is impermissible.

E)None of the choices are true.

A)An impermissible method is adopted by using the method to report results for two consecutive years.

B)An impermissible method may never be used by a taxpayer.

C)Cash-method accounting is an impermissible method for partnerships and Subchapter S- electing corporations.

D)There is no accounting method that is impermissible.

E)None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is a true statement about accounting for business activities?

A)An overall accounting method can only be adopted with the permission of the commissioner.

B)An overall accounting method is initially adopted on the first return filed for the business.

C)The cash method can only be adopted by individual taxpayers.

D)The accrual method can only be adopted by corporate taxpayers.

E)None of the choices are true.

A)An overall accounting method can only be adopted with the permission of the commissioner.

B)An overall accounting method is initially adopted on the first return filed for the business.

C)The cash method can only be adopted by individual taxpayers.

D)The accrual method can only be adopted by corporate taxpayers.

E)None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

65

Big Homes Corporation is an accrual-method calendar-year taxpayer that manufactures and sells modular homes.This year for the first time Big Homes was forced to offer a rebate on the purchase of new homes.At year-end,Big Homes had paid $12,000 in rebates and was liable for an additional $7,500 in rebates to buyers.What amount of the rebates,if any,can Big Homes deduct this year?

A)$12,000 because rebates are payment liabilities.

B)$19,500 because Big Homes is an accrual-method taxpayer.

C)$19,500 if this amount is not material,Big Homes expects to continue the practice of offering rebates in future years,and Big Homes expects to pay the accrued rebates before filing its tax return for this year.

D)$12,000 because the $7,500 liability is not fixed and determinable.

E)Big Homes is not entitled to a deduction because rebates are against public policy.

A)$12,000 because rebates are payment liabilities.

B)$19,500 because Big Homes is an accrual-method taxpayer.

C)$19,500 if this amount is not material,Big Homes expects to continue the practice of offering rebates in future years,and Big Homes expects to pay the accrued rebates before filing its tax return for this year.

D)$12,000 because the $7,500 liability is not fixed and determinable.

E)Big Homes is not entitled to a deduction because rebates are against public policy.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

66

Manley operates a law practice on the accrual method and calendar year.At the beginning of the year Manley's firm had an allowance for doubtful accounts with a balance of $15,000.At the end of the year,Manley recorded bad debt expense of $23,000 and the balance of doubtful accounts had increased to $18,000.What is Manley's deduction for bad debt expense this year?

A)$23,000

B)$3,000

C)$26,000

D)$5,000

E)$20,000

A)$23,000

B)$3,000

C)$26,000

D)$5,000

E)$20,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is NOT considered a related party for the purpose of limitation on accruals to related parties?

A)Spouse when the taxpayer is an individual.

B)A partner when the taxpayer is a partnership.

C)Brother when the taxpayer is an individual.

D)A minority shareholder when the taxpayer is a corporation.

E)All of these are related parties.

A)Spouse when the taxpayer is an individual.

B)A partner when the taxpayer is a partnership.

C)Brother when the taxpayer is an individual.

D)A minority shareholder when the taxpayer is a corporation.

E)All of these are related parties.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following types of expenditures is not subject to capitalization under the UNICAP rules?

A)Selling expenditures

B)Cost of manufacturing labor

C)Compensation of managers who supervise production

D)Cost of raw materials

E)All of the choices are subject to capitalization under the UNICAP rules

A)Selling expenditures

B)Cost of manufacturing labor

C)Compensation of managers who supervise production

D)Cost of raw materials

E)All of the choices are subject to capitalization under the UNICAP rules

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

69

Bryon operates a consulting business and he usually works alone.However,during the summer Bryon will sometimes hire undergraduate students to collect data for his projects.This past summer Bryon hired Fred,the son of a prominent businessman,for a part-time summer job.The summer job usually pays about $17,000,but Bryon paid Fred $27,000 to gain favor with Fred's father.What amount of Fred's summer wages can Bryon deduct for tax purposes? Bryon is on the cash method and calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

70

Judy is a self-employed musician who performs for a variety of events.This year Judy was fined $250 by the city for violating the city's noise ordinance with a relatively loud performance.As a consequence,Judy contributed $1,000 to a campaign committee formed to recall the city's mayor.Judy normally hires three part-time employees to help her schedule events and transport equipment.Judy paid a total of $33,000 to her employees through June of this year.In June Judy fired her part-time employees and hired her husband to replace them.However,Judy paid him $55,000 rather than $33,000.Judy is on the cash method and calendar year,and she wants to know what amount of these expenditures is deductible as business expenses.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

71

Ajax Computer Company is an accrual-method calendar-year taxpayer.Ajax has never advertised in the national media prior to this year.In November of this year,however,Ajax paid $1 million for television advertising time during a "super" sporting event scheduled to take place in early February of next year.In addition,in November of this year the company paid $500,000 for a one-time advertising blitz during a professional golf tournament in April of next year.What amount of these payments,if any,can Ajax deduct this year?

A)$1 million

B)$500,000

C)$1.5 million

D)$1.5 million only if the professional golf tournament is played before April 15

E)No deduction can be claimed this year

A)$1 million

B)$500,000

C)$1.5 million

D)$1.5 million only if the professional golf tournament is played before April 15

E)No deduction can be claimed this year

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

72

Joe is a self-employed electrician who operates his business on the accrual method.This year Joe purchased a shop for his business,and for the first time at year-end he received a bill for $4,500 of property taxes on his shop.Joe didn't pay the taxes until after year-end but prior to filing his tax return.Which of the following is a true statement?

A)If he elects to treat the taxes as a recurring item,Joe can accrue and deduct $4,500 of taxes on the shop this year.

B)The taxes are a payment liability.

C)The taxes would not be deductible if Joe's business was on the cash method.

D)Unless Joe makes an election,the taxes are not deductible this year.

E)All of the choices are true.

A)If he elects to treat the taxes as a recurring item,Joe can accrue and deduct $4,500 of taxes on the shop this year.

B)The taxes are a payment liability.

C)The taxes would not be deductible if Joe's business was on the cash method.

D)Unless Joe makes an election,the taxes are not deductible this year.

E)All of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a payment liability?

A)Tort claims

B)Refunds

C)Insurance premiums

D)Real estate taxes

E)All of the choices are correct

A)Tort claims

B)Refunds

C)Insurance premiums

D)Real estate taxes

E)All of the choices are correct

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

74

Jones operates an upscale restaurant and he pays experienced cooks $35,000 per year.This year he hired his son as an apprentice cook.Jones agreed to pay his son $40,000 per year.Which of the following is a true statement about this transaction?

A)Jones will be allowed to deduct $40,000 only if his son eventually develops into an expert cook.

B)Jones will be allowed to accrue $40,000 only if he pays his son in cash.

C)Jones will be allowed to deduct $35,000 as compensation and another $5,000 can be deducted as an employee gift.

D)Jones is not entitled to any business deduction until the son is an experienced cook.

E)None of the choices are true.

A)Jones will be allowed to deduct $40,000 only if his son eventually develops into an expert cook.

B)Jones will be allowed to accrue $40,000 only if he pays his son in cash.

C)Jones will be allowed to deduct $35,000 as compensation and another $5,000 can be deducted as an employee gift.

D)Jones is not entitled to any business deduction until the son is an experienced cook.

E)None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

75

Mike started a calendar-year business on September 1st of this year by paying 12 months of rent on his shop at $1,000 per month.What is the maximum amount of rent that Mike can deduct this year under each type of accounting method?

A)$12,000 under the cash method and $12,000 under the accrual method.

B)$4,000 under the cash method and $12,000 under the accrual method.

C)$12,000 under the cash method and $4,000 under the accrual method.

D)$4,000 under the cash method and $4,000 under the accrual method.

E)$4,000 under the cash method and zero under the accrual method.

A)$12,000 under the cash method and $12,000 under the accrual method.

B)$4,000 under the cash method and $12,000 under the accrual method.

C)$12,000 under the cash method and $4,000 under the accrual method.

D)$4,000 under the cash method and $4,000 under the accrual method.

E)$4,000 under the cash method and zero under the accrual method.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is a true statement about a request for a change in accounting method?

A)Some requests are automatically granted.

B)Most requests require the permission of the commissioner.

C)Many requests require payment of a fee and a good business purpose for the change.

D)Form 3115 is typically required to be filed with a request for change in accounting method.

E)All of the choices are true.

A)Some requests are automatically granted.

B)Most requests require the permission of the commissioner.

C)Many requests require payment of a fee and a good business purpose for the change.

D)Form 3115 is typically required to be filed with a request for change in accounting method.

E)All of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

77

Crystal operates a business that provides typing and delivery services.This year Crystal spent $2,500 to purchase special shirts that identify her employees and provide some notoriety for her business.The shirts are especially colorful and include logos on the front pocket and the back.Besides salary payments,Crystal also compensates her employees by offering to pay whole life insurance premiums for any that want to provide insurance coverage for their beneficiaries.This year Crystal paid $5,000 in life insurance premiums.What amount of these payments can Crystal deduct? Crystal is on the cash method and calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

78

Kip started a wholesale store this year selling bulk peanut butter.In January of this year Kip purchased an initial five tubs of peanut butter for a total cost of $5,000.In July Kip purchased three tubs for a total cost of $6,000.Finally,in November Kip bought two tubs for a total cost of $1,000.Kip sold six tubs by year-end.What is Kip's ending inventory under the FIFO cost-flow method?

A)$12,000

B)$6,000

C)$5,000

D)$2,500

E)$1,000

A)$12,000

B)$6,000

C)$5,000

D)$2,500

E)$1,000

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

79

Werner is the president and CEO of Acme,Inc.,and this year he took a prospective client to dinner.During the dinner Werner and the client discussed a proposed contract for over $6 million as well as personal matters.After dinner Werner took the client to a football game and no business was discussed.Werner paid $1,220 for an expensive (but not extravagant)dinner and spent $600 for tickets to the game.What is the deductible amount of these expenses?

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

80

Brad operates a storage business on the accrual method.On July 1 Brad paid $48,000 for rent on his storage warehouse and $18,000 for insurance on the contents of the warehouse.The rent and insurance cover the next 12 months.What is Brad's deduction for the rent and insurance?

A)$48,000 for the rent and $18,000 for the insurance.

B)$24,000 for the rent and $18,000 for the insurance.

C)$24,000 for the rent and $9,000 for the insurance.

D)$48,000 for the rent and $9,000 for the insurance.

E)None of the choices are true.

A)$48,000 for the rent and $18,000 for the insurance.

B)$24,000 for the rent and $18,000 for the insurance.

C)$24,000 for the rent and $9,000 for the insurance.

D)$48,000 for the rent and $9,000 for the insurance.

E)None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck