Deck 16: International Operations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 16: International Operations

1

If the exchange rate for Canadian and U.S.dollars is 0.7382 to $1,this implies that 2 Canadian dollars can be purchased for $1.48 U.S.dollars.

True

2

Multinational corporations can be U.S.companies with operations in other countries.

True

3

The currency in which a company presents its financial statements is known as the:

A)Multinational currency

B)Price-level-adjusted currency

C)Specific currency

D)Reporting currency

E)Historical cost currency

A)Multinational currency

B)Price-level-adjusted currency

C)Specific currency

D)Reporting currency

E)Historical cost currency

D

4

If a U.S.Company's credit sale to an international customer allows payment to be made in a foreign currency,the same exchange rate must be used for the date of sale and the cash payment date.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

Kreighton Manufacturing purchased on credit £50,000 worth of production materials from a British company when the exchange rate was $1.97 per British pound.At the year-end balance sheet date,the exchange rate increased to $2.76.If the liability is still unpaid at that time,Kreighton must record a:

A)gain of $39,500.

B)loss of $39,500.

C)gain of $138,000.

D)loss of $138,000.

E)neither a gain nor loss.

A)gain of $39,500.

B)loss of $39,500.

C)gain of $138,000.

D)loss of $138,000.

E)neither a gain nor loss.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

If a U.S.company's credit sale to an international customer allows payment to be made in a foreign currency,the sale transaction is recorded using the exchange rate on the date of sale.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

The price of one currency stated in terms of another currency is called a foreign exchange rate.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

All of the following statements relating to accounting for international operations are true except:

A)Foreign exchange gains or losses can occur when accounting for international sales transactions.

B)Gains and losses from foreign exchange transactions are accumulated in the Fair Value Adjustment Account and are reported on the balance sheet.

C)Gains and losses from foreign exchange transactions are accumulated in the Foreign Exchange Gain (or Loss)account.

D)The balance in the Foreign Exchange Gain (or Loss)account is reported on the income statement.

E)Foreign exchange gains or losses can occur when accounting for international purchases transactions.

A)Foreign exchange gains or losses can occur when accounting for international sales transactions.

B)Gains and losses from foreign exchange transactions are accumulated in the Fair Value Adjustment Account and are reported on the balance sheet.

C)Gains and losses from foreign exchange transactions are accumulated in the Foreign Exchange Gain (or Loss)account.

D)The balance in the Foreign Exchange Gain (or Loss)account is reported on the income statement.

E)Foreign exchange gains or losses can occur when accounting for international purchases transactions.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

If the exchange rate for Canadian and U.S.dollars is 0.82777 to 1,this implies that 3 Canadian dollars will buy ________ worth of U.S.dollars.

A)$0.2759

B)$0.82777

C)$1.82777

D)$2.48

E)$1.00

A)$0.2759

B)$0.82777

C)$1.82777

D)$2.48

E)$1.00

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

The price of one currency stated in terms of another currency is called a(n):

A)Foreign exchange rate

B)Currency transaction

C)Historical exchange rate

D)International conversion rate

E)Currency rate

A)Foreign exchange rate

B)Currency transaction

C)Historical exchange rate

D)International conversion rate

E)Currency rate

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

On November 12,Higgins,Inc.,a U.S.Company,sold merchandise on credit to Kagome of Japan at a price of 1,500,000 yen.The exchange rate was $0.00837 per yen on the date of sale.On December 31,when Higgins prepared its financial statements,the exchange rate was $0.00843.Kagome paid in full on January 12,when the exchange rate was $0.00861.On December 31,Higgins should prepare the following journal entry:

A)Debit Sales $90; credit Foreign Exchange Gain $90.

B)Debit Foreign Exchange Loss $90; credit Sales $90.

C)Debit Accounts Receivable-Kagome $90; credit Foreign Exchange Gain $90.

D)Debit Foreign Exchange Loss $90; Accounts Receivable-Kagome $90.

E)No journal entry is required until the amount is collected.

A)Debit Sales $90; credit Foreign Exchange Gain $90.

B)Debit Foreign Exchange Loss $90; credit Sales $90.

C)Debit Accounts Receivable-Kagome $90; credit Foreign Exchange Gain $90.

D)Debit Foreign Exchange Loss $90; Accounts Receivable-Kagome $90.

E)No journal entry is required until the amount is collected.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

Foreign exchange rates fluctuate due to many factors including changing political and economic conditions.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

When a U.S.company makes a credit sale to an international customer and the sale terms are for payment in a foreign currency,the foreign exchange rate used to record the sale is the exchange rate:

A)Thirty days from the date of sale.

B)At the end of the seller's fiscal year.

C)At the end of the buyer's fiscal year.

D)On the date final payment is made.

E)On the date of the sale.

A)Thirty days from the date of sale.

B)At the end of the seller's fiscal year.

C)At the end of the buyer's fiscal year.

D)On the date final payment is made.

E)On the date of the sale.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

Maroon Company sold supplies in the amount of € 15,000 (euros)to a French company when the exchange rate was $1.15 per euro.At the time of payment,the exchange rate decreased to $1.12.Maroon must record a loss of $450.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

On June 18,Wyman Company (a U.S.Company)sold merchandise to the Nielsen Company of Denmark for €60,000 (Euros),with a payment due in 60 days.If the exchange rate was $1.35 per euro on the date of sale and $1.14 per euro on the date of payment,Wyman Company should recognize a foreign exchange gain or loss in the amount of:

A)$60,000 gain.

B)$60,000 loss.

C)$68,400 loss.

D)$12,600 gain.

E)$12,600 loss.

A)$60,000 gain.

B)$60,000 loss.

C)$68,400 loss.

D)$12,600 gain.

E)$12,600 loss.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

A U.S.company makes a sale to a foreign customer receivable in 30 days in the customer's currency.The sale would be recorded by the U.S.company on the date:

A)Of sale using a projected estimate of the U.S.dollar value at payment date.

B)Of sale using a 30-day average U.S.dollar value.

C)Of sale using the current dollar value.

D)Of sale using the foreign currency value.

E)When payment is received.

A)Of sale using a projected estimate of the U.S.dollar value at payment date.

B)Of sale using a 30-day average U.S.dollar value.

C)Of sale using the current dollar value.

D)Of sale using the foreign currency value.

E)When payment is received.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

Foreign exchange rates fluctuate due to changes in all but which of the following:

A)Political conditions.

B)Economic conditions.

C)Supply and demand for currencies.

D)Expectations of future events.

E)Whether the companies prepare financial statements under U.S.GAAP or IFRS.

A)Political conditions.

B)Economic conditions.

C)Supply and demand for currencies.

D)Expectations of future events.

E)Whether the companies prepare financial statements under U.S.GAAP or IFRS.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

Kim Manufacturing purchased on credit £20,000 worth of parts from a British company when the exchange rate was $1.66 per British pound.At the year-end balance sheet date,the exchange rate increased to $1.69.Kim must record a gain of $600.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

Marshall Company sold supplies in the amount of € 25,000 (euros)to a French company when the exchange rate was $1.21 per euro.At the time of payment,the exchange rate decreased to $0.82.Marshall must record a:

A)gain of $9,750.

B)gain of $20,500.

C)loss of $9,750.

D)loss of $20,500.

E)neither a gain nor loss.

A)gain of $9,750.

B)gain of $20,500.

C)loss of $9,750.

D)loss of $20,500.

E)neither a gain nor loss.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

To prepare consolidated financial statements when a U.S.parent company has an international subsidiary,the international subsidiary's financial statements must be translated into U.S.dollars.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

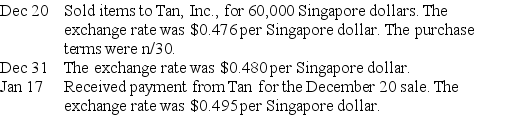

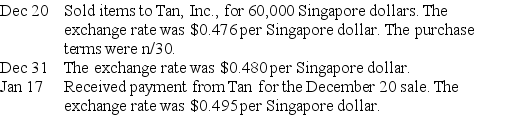

FreshFoods,Inc.sells American gourmet foods to merchandisers in Singapore.Prepare the journal entries for FreshFoods,to record the following transactions.Include any year-end adjustments.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

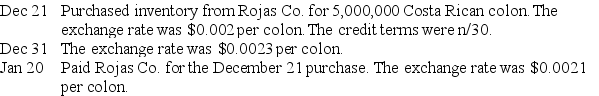

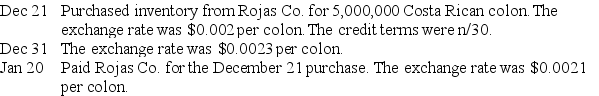

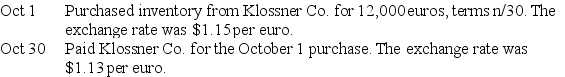

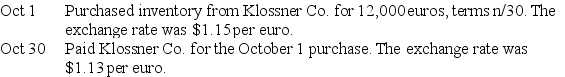

Arkansana Inc.imports inventory from Costa Rica.Prepare the journal entries for Arkansana to record the following transactions.Include any year-end adjustments.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

Rainier Importers purchases automotive parts from Austria.Prepare journal entries for the following transactions of Rainier.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

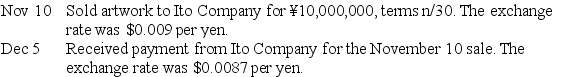

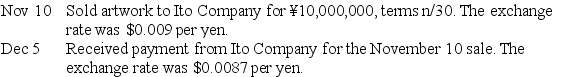

Silver Era Co.exports Southwestern artwork to Japan.Prepare journal entries for the following transactions.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

Explain how transactions (both sales and purchases)in a foreign currency are recorded and reported.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

Define the foreign exchange rate between two currencies.Explain its effect on business transactions conducted in a foreign currency.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

If a U.S.company makes a credit sale to a foreign company,the sales price must be translated into dollars as of the date of ________.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

On November 12,Higgins,Inc.,a U.S.Company,sold merchandise on credit to Kagome of Japan at a price of 1,500,000 yen.The exchange rate was $0.00837 on the date of sale.On December 31,when Higgins prepared its financial statements,the exchange rate was $0.00843.Kagome paid in full on January 12,when the exchange rate was $0.00861.On January 12,Higgins should prepare the following journal entry:

A)Debit Cash $12,915; credit Accounts Receivable-Kagome $12,555; credit Foreign Exchange Gain $360.

B)Debit Cash $12,555; debit Foreign Exchange Loss $360; credit Accounts Receivable-Kagome $12,915.

C)Debit Cash $12,915; credit Accounts Receivable-Kagome $12,645; credit Foreign Exchange Gain $90.

D)Debit Cash $12,645; debit Foreign Exchange Loss $90; credit Accounts Receivable-Kagome $12,915.

E)Debit Cash $12,915; credit Accounts Receivable-Kagome $12,645; credit Foreign Exchange Gain $270.

A)Debit Cash $12,915; credit Accounts Receivable-Kagome $12,555; credit Foreign Exchange Gain $360.

B)Debit Cash $12,555; debit Foreign Exchange Loss $360; credit Accounts Receivable-Kagome $12,915.

C)Debit Cash $12,915; credit Accounts Receivable-Kagome $12,645; credit Foreign Exchange Gain $90.

D)Debit Cash $12,645; debit Foreign Exchange Loss $90; credit Accounts Receivable-Kagome $12,915.

E)Debit Cash $12,915; credit Accounts Receivable-Kagome $12,645; credit Foreign Exchange Gain $270.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck