Deck 3: Budgeting, Budgetary Accounting, and Budgetary Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/36

Play

Full screen (f)

Deck 3: Budgeting, Budgetary Accounting, and Budgetary Reporting

1

Managers may ration expenditure authority into either monthly or quarterly expenditure ceilings. This would be an example of

A) An allotment.

B) An allocation.

C) A ration.

D) An appropriation.

A) An allotment.

B) An allocation.

C) A ration.

D) An appropriation.

A

2

A budgetary comparison schedule is required to include all of the following columns except

A) The original budget.

B) Actual on the GAAP basis.

C) Final revised budget.

D) Actual on the budgetary basis.

A) The original budget.

B) Actual on the GAAP basis.

C) Final revised budget.

D) Actual on the budgetary basis.

B

3

The basis of accounting for a governmental fund budget should be?

A) Cash basis.

B) Accrual basis.

C) Modified accrual basis.

D) Determined by the entity's governing body or by law or regulation.

A) Cash basis.

B) Accrual basis.

C) Modified accrual basis.

D) Determined by the entity's governing body or by law or regulation.

D

4

A city's General Fund general ledger includes accounts called Estimated Revenues, Appropriations, and Encumbrances. This indicates that the city

A) Formally integrates its budget into its accounts.

B) Uses a cash plus encumbrances basis of accounting.

C) Maintains its accounts on an accrual basis.

D) Erroneously reports encumbrances as expenditures.

A) Formally integrates its budget into its accounts.

B) Uses a cash plus encumbrances basis of accounting.

C) Maintains its accounts on an accrual basis.

D) Erroneously reports encumbrances as expenditures.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements regarding revenue subsidiary ledgers is false?

A) The number of revenue subsidiary ledger accounts necessary is at the discretion of management.

B) The number of revenue subsidiary ledger accounts used is limited by the number of broad revenue categories (e.g., taxes, licenses and permits, intergovernmental) that a governmental entity reports.

C) Entries to revenue subsidiary ledger accounts may be made at any time during a fiscal period.

D) Revenue subsidiary ledgers are never required.

A) The number of revenue subsidiary ledger accounts necessary is at the discretion of management.

B) The number of revenue subsidiary ledger accounts used is limited by the number of broad revenue categories (e.g., taxes, licenses and permits, intergovernmental) that a governmental entity reports.

C) Entries to revenue subsidiary ledger accounts may be made at any time during a fiscal period.

D) Revenue subsidiary ledgers are never required.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

6

The purpose of encumbrance accounting is to

A) Manage a government's cash flows.

B) Avoid expenditures exceeding appropriations.

C) Replace expense accounting in governments.

D) Prevent government waste.

A) Manage a government's cash flows.

B) Avoid expenditures exceeding appropriations.

C) Replace expense accounting in governments.

D) Prevent government waste.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

7

A general budget is often a term used to describe a budget for all of the following except

A) A General Fund.

B) A Special Revenue Fund.

C) An Enterprise Fund.

D) A Debt Service Fund.

A) A General Fund.

B) A Special Revenue Fund.

C) An Enterprise Fund.

D) A Debt Service Fund.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

8

As part of the state and local government accounting and reporting model, a budgetary comparison statement or schedule for the General Fund should be presented as

A) A basic financial statement or required supplementary information.

B) In the other information section of the CAFR.

C) A note to the financial statements.

D) Budgetary reporting is optional for governments.

A) A basic financial statement or required supplementary information.

B) In the other information section of the CAFR.

C) A note to the financial statements.

D) Budgetary reporting is optional for governments.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following amounts are included in a governmental fund's encumbrances account?

A) Outstanding vouchers payable amounts.

B) Excess amounts of purchase orders over actual expenditures.

C) Outstanding purchase order amounts.

D) Actual expenditure amounts.

A) Outstanding vouchers payable amounts.

B) Excess amounts of purchase orders over actual expenditures.

C) Outstanding purchase order amounts.

D) Actual expenditure amounts.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

10

What general ledger account is not needed for an expenditures subsidiary ledger?

A) Appropriations.

B) Expenditures.

C) Encumbrances.

D) Encumbrances Outstanding.

A) Appropriations.

B) Expenditures.

C) Encumbrances.

D) Encumbrances Outstanding.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

11

The most widely used approach to budgeting operating expenditures is

A) Zero-base.

B) Performance approach.

C) Object-of-expenditure.

D) Program and planning-programming-budgeting.

A) Zero-base.

B) Performance approach.

C) Object-of-expenditure.

D) Program and planning-programming-budgeting.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

12

Common functional categories of expenditures in governmental funds include all of the following except

A) Public Safety.

B) Health and Sanitation.

C) Highways and Streets.

D) Utilities.

A) Public Safety.

B) Health and Sanitation.

C) Highways and Streets.

D) Utilities.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

13

The "Unencumbered Balance" in an expenditure subsidiary ledger represents

A) Appropriations less expenditures.

B) Appropriations less encumbrances.

C) Appropriations less expenditures and encumbrances.

D) Estimated revenues less appropriations.

A) Appropriations less expenditures.

B) Appropriations less encumbrances.

C) Appropriations less expenditures and encumbrances.

D) Estimated revenues less appropriations.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

14

Legal authority to expend resources is adopted by a city council in the budgeting process. These legal authorizations are called

A) Appropriations.

B) Authorizations.

C) Encumbrances.

D) Expenditures.

A) Appropriations.

B) Authorizations.

C) Encumbrances.

D) Expenditures.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

15

When goods that have already been approved for purchase are received but have not yet been paid for, which of the following local government accounts should be increased? Encumbrances Expenditures

A) Yes Yes

B) Yes No

C) No No

D) No Yes

A) Yes Yes

B) Yes No

C) No No

D) No Yes

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following does not represent a common approach to budgeting expenditures?

A) Zero-base budgeting.

B) Object-of-expenditure budgeting.

C) Program budgeting.

D) Marginal increase budgeting.

A) Zero-base budgeting.

B) Object-of-expenditure budgeting.

C) Program budgeting.

D) Marginal increase budgeting.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

17

Under an encumbrance system, which account is debited when a purchase order is issued?

A) Expenditures.

B) Appropriations.

C) Encumbrances.

D) Encumbrances Outstanding.

A) Expenditures.

B) Appropriations.

C) Encumbrances.

D) Encumbrances Outstanding.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

18

The encumbrances method of budgetary reporting

A) Is never allowed by GAAP.

B) Never results in an outstanding encumbrance.

C) Is where outstanding encumbrances are considered to be budgetary expenditures.

D) Is always required by GAAP.

A) Is never allowed by GAAP.

B) Never results in an outstanding encumbrance.

C) Is where outstanding encumbrances are considered to be budgetary expenditures.

D) Is always required by GAAP.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the statements regarding the accounting for encumbrances is false?

A) The budgetary entry to record an encumbrance would be a debit to Encumbrances Outstanding and a credit to Encumbrances.

B) The budgetary entry to record an encumbrance would be a debit to Encumbrances and a credit to Encumbrances Outstanding.

C) If the actual cost of a purchase exceeds the amount of the original encumbrance, the original encumbrance is still reversed at the original amount.

D) The recording of an encumbrance is considered to be a budgetary entry.

A) The budgetary entry to record an encumbrance would be a debit to Encumbrances Outstanding and a credit to Encumbrances.

B) The budgetary entry to record an encumbrance would be a debit to Encumbrances and a credit to Encumbrances Outstanding.

C) If the actual cost of a purchase exceeds the amount of the original encumbrance, the original encumbrance is still reversed at the original amount.

D) The recording of an encumbrance is considered to be a budgetary entry.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

20

As part of a government's basic financial statements and required supplementary information, a budgetary comparison schedule is required for which funds?

A) All governmental funds.

B) All governmental funds with legally adopted annual budgets.

C) General Fund only.

D) General Fund and each major Special Revenue Fund that has a legally adopted annual budget.

A) All governmental funds.

B) All governmental funds with legally adopted annual budgets.

C) General Fund only.

D) General Fund and each major Special Revenue Fund that has a legally adopted annual budget.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

21

The presentation of a governmental fund budgetary comparison statement or schedule may be part of the

A) Basic financial statements and include the General Fund and certain Special Revenue Funds.

B) Basic financial statements and include the General Fund only.

C) Required supplementary information and include all governmental funds with a legally adopted budget.

D) Required supplementary information and include the General Fund only.

A) Basic financial statements and include the General Fund and certain Special Revenue Funds.

B) Basic financial statements and include the General Fund only.

C) Required supplementary information and include all governmental funds with a legally adopted budget.

D) Required supplementary information and include the General Fund only.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

22

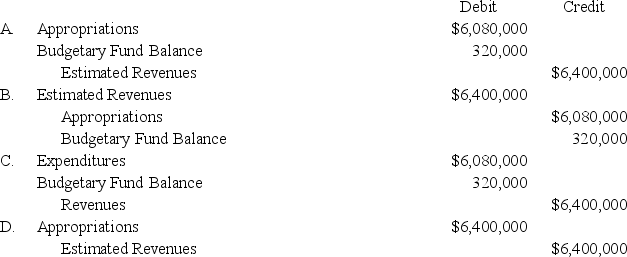

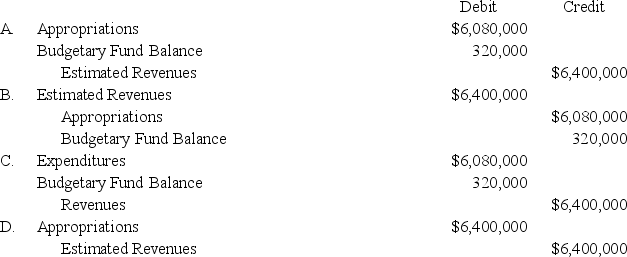

Which of the following budgetary entries would the town of Geneva make upon adoption of its Special Revenue Fund Budget for the year? Assume the following: Estimated Revenues $6,400,000

Appropriations 6,080,000

Appropriations 6,080,000

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

23

The Town of Red Herring issued $60,000 of purchase orders. Assume that when all orders were received, the actual cost was $59,000. How much would be recorded as expenditures when the purchase orders were issued?

A) $60,000

B) $59,000

C) $1,000

D) $0

A) $60,000

B) $59,000

C) $1,000

D) $0

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

24

The following information pertains to the Scott County General Fund:

The change in Scott County's General Fund fund balance for the year is a

A) $1,600,000 decrease.

B) $1,000,000 decrease.

C) $600,000 decrease.

D) $400,000 increase.

The change in Scott County's General Fund fund balance for the year is a

A) $1,600,000 decrease.

B) $1,000,000 decrease.

C) $600,000 decrease.

D) $400,000 increase.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

25

The Town of Red Herring issued $60,000 of purchase orders. Assume that when all orders were received, the actual cost was $59,000. How much would be recorded as expenditures when the goods are received?

A) $60,000.

B) $59,000.

C) $1,000.

D) $0.

A) $60,000.

B) $59,000.

C) $1,000.

D) $0.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

26

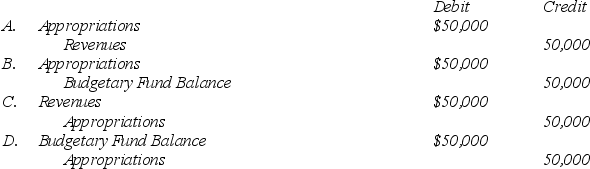

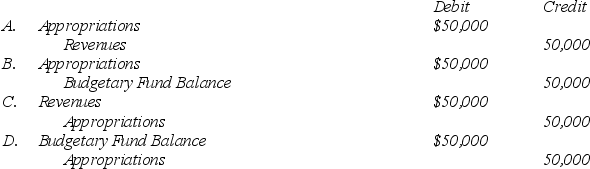

During the year, Nathan Township amended their General Fund budget to reflect an increase in appropriations of $50,000 to be funded by an appropriation of existing fund balance. What would the necessary be to reflect this amendment?

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

27

A city ordered uniforms with an expected cost of $6,000 for policemen. This amount is encumbered. The uniforms are received with an invoice of $5,900. The entries to record the receipt of the uniforms should include a credit to

A) Encumbrances of $6,000.

B) Encumbrances Outstanding of $6,000.

C) Encumbrances of $5,900.

D) Appropriations of $100.

A) Encumbrances of $6,000.

B) Encumbrances Outstanding of $6,000.

C) Encumbrances of $5,900.

D) Appropriations of $100.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

28

The Town of Red Herring issued $60,000 of purchase orders and recorded the encumbrance. Assume that when all orders were received, the actual cost was $59,000. What would be the net change in the unencumbered balance when the goods are received?

A) $60,000 increase.

B) $1,000 increase.

C) $1,000 decrease.

D) $59,000 decrease.

A) $60,000 increase.

B) $1,000 increase.

C) $1,000 decrease.

D) $59,000 decrease.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

29

A governmental fund budgetary comparison statement or schedule should

A) Be prepared on the same basis the budget was enacted.

B) Always be prepared on a GAAP basis.

C) Always be prepared on a cash basis.

D) Be prepared only for the General Fund.

A) Be prepared on the same basis the budget was enacted.

B) Always be prepared on a GAAP basis.

C) Always be prepared on a cash basis.

D) Be prepared only for the General Fund.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a common revenue source in a governmental fund budget?

A) Property taxes.

B) Other financing sources.

C) Charges for services.

D) Investment income or interest.

A) Property taxes.

B) Other financing sources.

C) Charges for services.

D) Investment income or interest.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

31

A city ordered uniforms with an expected cost of $6,000 for policemen. This amount is encumbered. The uniforms are received with an invoice of $5,900. The entries to record the receipt of the uniforms should include a debit to

A) Encumbrances of $6,000.

B) Encumbrances Outstanding of $5,900.

C) Encumbrances Outstanding of $6,000.

D) Appropriations of $100.

A) Encumbrances of $6,000.

B) Encumbrances Outstanding of $5,900.

C) Encumbrances Outstanding of $6,000.

D) Appropriations of $100.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

32

If a government uses a Budgetary Fund Balance account, the account balance

A) Will equal the difference between actual expenditures and appropriations at any point in time.

B) Will be the planned increase or decrease in fund balance at any point in time.

C) Will equal the difference between actual revenues and budgeted revenues at any point in time.

D) Will equal the difference between actual revenues and actual expenditures and encumbrances for the year.

A) Will equal the difference between actual expenditures and appropriations at any point in time.

B) Will be the planned increase or decrease in fund balance at any point in time.

C) Will equal the difference between actual revenues and budgeted revenues at any point in time.

D) Will equal the difference between actual revenues and actual expenditures and encumbrances for the year.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

33

A city ordered uniforms with an expected cost of $6,000 for policemen. The credit required to record this transaction is

A) Appropriations.

B) Encumbrances.

C) Vouchers payable.

D) Encumbrances Outstanding.

A) Appropriations.

B) Encumbrances.

C) Vouchers payable.

D) Encumbrances Outstanding.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

34

The following information pertains to the Richardson County General Fund:

The change in Richardson County's General Fund fund balance for the year is a

A) $2,600,000 decrease.

B) $2,675,000 decrease.

C) $2,925,000 decrease.

D) $3,600,000 decrease.

The change in Richardson County's General Fund fund balance for the year is a

A) $2,600,000 decrease.

B) $2,675,000 decrease.

C) $2,925,000 decrease.

D) $3,600,000 decrease.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

35

When preparing a budgetary comparison statement for a General Fund, which column is optional?

A) Final amended budget.

B) Original budget.

C) Variance comparing the final budget to the actual amounts on a budgetary basis.

D) Actual amounts on a budgetary basis.

A) Final amended budget.

B) Original budget.

C) Variance comparing the final budget to the actual amounts on a budgetary basis.

D) Actual amounts on a budgetary basis.

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck

36

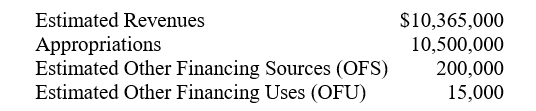

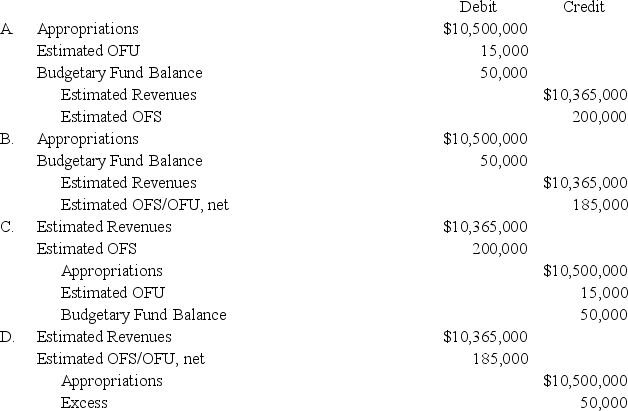

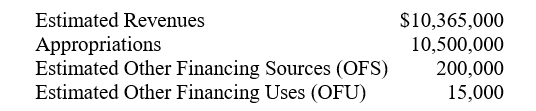

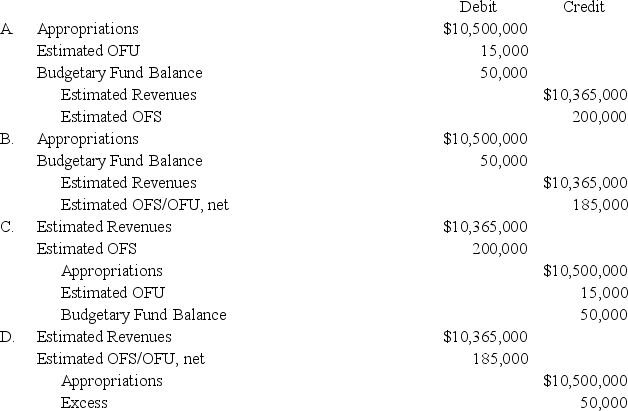

Which of the following budgetary entries would the township of Brussels make upon adoption of its General Fund budget for the year? Assume the following:

Unlock Deck

Unlock for access to all 36 flashcards in this deck.

Unlock Deck

k this deck