Deck 8: Debt Service Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 8: Debt Service Funds

1

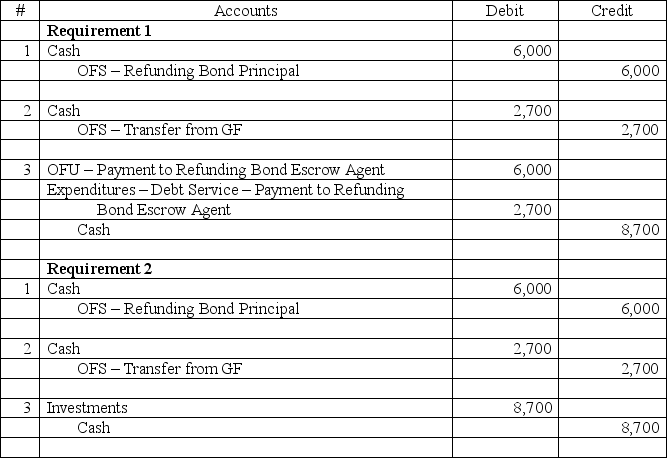

The City of Armona has decided to refinance $8,000 par value of general government, general obligation bonds outstanding. The bonds had a related unamortized bond premium of $200. The city issues $6,000 of refunding bonds and transfers $2,700 from the General Fund to the Debt Service Fund. The city paid $8,700 from the Debt Service Fund into an irrevocable trust to cover future payments on the original bonds. All amounts are in thousands of dollars.

1. Record the above transactions in the Debt Service Fund assuming the refinancing meets the conditions for treatment as a defeasance in substance.

2. Record the above transactions in the Debt Service Fund assuming the refinancing does not meet the conditions for treatment as a defeasance in substance.

3. For both requirements (1) and (2), indicate the effects of each transaction on the accounting equation of the Debt Service Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

1. Record the above transactions in the Debt Service Fund assuming the refinancing meets the conditions for treatment as a defeasance in substance.

2. Record the above transactions in the Debt Service Fund assuming the refinancing does not meet the conditions for treatment as a defeasance in substance.

3. For both requirements (1) and (2), indicate the effects of each transaction on the accounting equation of the Debt Service Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

Refunding

Investment (non-Refunding)

*Investments increase and cash decreases by equal amounts.

2

In order to recognize a debt service payment that comes due in the next fiscal year as an expenditure in the current fiscal year, which of the following conditions need not hold true?

A) The payment must come due early (not more than one month) in the next fiscal year.

B) Resources to make the payment need to have been raised in the current fiscal year to make the payment.

C) The resources dedicated for the payment must be held in the appropriate Debt Service Fund.

D) The payment must be for interest only; principal payments do not qualify for this early recognition.

A) The payment must come due early (not more than one month) in the next fiscal year.

B) Resources to make the payment need to have been raised in the current fiscal year to make the payment.

C) The resources dedicated for the payment must be held in the appropriate Debt Service Fund.

D) The payment must be for interest only; principal payments do not qualify for this early recognition.

D

3

Debt service expenditures on general long-term debt principal should be recognized in the period that the liability:

A) accrues, if paid.

B) accrues, whether or not paid.

C) is legally due, if paid.

D) is legally due, whether or not paid.

A) accrues, if paid.

B) accrues, whether or not paid.

C) is legally due, if paid.

D) is legally due, whether or not paid.

D

4

All of the following statements regarding a Debt Service Fund are true except

A) A Debt Service Fund is rarely used to account for all of a governmental entity's general obligation bond repayments.

B) Debt service on capital lease obligations is generally not accounted for in a Debt Service Fund.

C) A government may have several Debt Service Funds.

D) A government may use one Debt Service Fund to account for multiple general government debt issuances.

A) A Debt Service Fund is rarely used to account for all of a governmental entity's general obligation bond repayments.

B) Debt service on capital lease obligations is generally not accounted for in a Debt Service Fund.

C) A government may have several Debt Service Funds.

D) A government may use one Debt Service Fund to account for multiple general government debt issuances.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

Revenues in a Debt Service Fund are recognized when

A) They are collected in cash.

B) They are measurable and available.

C) They are measurable and earned.

D) Debt service payments are due.

A) They are collected in cash.

B) They are measurable and available.

C) They are measurable and earned.

D) Debt service payments are due.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

A government is required to use a Debt Service Fund in which of the following cases?

A) Capital leases.

B) When financial resources are being accumulated for long-term general government principal and interest maturing in future years.

C) Debt refunding.

D) All general obligation long-term debt.

A) Capital leases.

B) When financial resources are being accumulated for long-term general government principal and interest maturing in future years.

C) Debt refunding.

D) All general obligation long-term debt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

A special tax has been levied by the city council in a formal vote. This new revenue source has been set aside for debt service purposes in an ordinance separate from the ordinance that created the tax. This revenue source would most likely impact

A) Restricted fund balance.

B) Committed fund balance.

C) Assigned fund balance.

D) Unassigned fund balance.

A) Restricted fund balance.

B) Committed fund balance.

C) Assigned fund balance.

D) Unassigned fund balance.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

Principal and interest expenditures on general long-term debt should be recognized in the period

A) That the costs are incurred.

B) Prior to the year in which they are due, i.e., when they become short-term debt.

C) That they are legally due and payable.

D) That they are paid.

A) That the costs are incurred.

B) Prior to the year in which they are due, i.e., when they become short-term debt.

C) That they are legally due and payable.

D) That they are paid.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

Assume that a Debt Service Fund does not have nonspendable fund balance. Further, assume that total fund balance is less than the sum of restricted and committed levels of fund balance. This deficit should

A) Be reported as negative assigned fund balance.

B) Be reported as a negative unassigned fund balance.

C) Be reported as a negative nonspendable fund balance.

D) Be netted against the positive committed fund balance.

A) Be reported as negative assigned fund balance.

B) Be reported as a negative unassigned fund balance.

C) Be reported as a negative nonspendable fund balance.

D) Be netted against the positive committed fund balance.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following transactions would not be reported as expenditures in a Debt Service Fund?

A) Issuance costs incurred in a refunding bond issuance.

B) Payments to escrow agents with resources transferred from the General Fund.

C) Arbitrage rebate.

D) Repayment of BANs issued to finance a capital project.

A) Issuance costs incurred in a refunding bond issuance.

B) Payments to escrow agents with resources transferred from the General Fund.

C) Arbitrage rebate.

D) Repayment of BANs issued to finance a capital project.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

Each of the following are appropriate fund balance classifications for a Debt Service Fund except

A) Restricted.

B) Committed.

C) Assigned.

D) Designated.

A) Restricted.

B) Committed.

C) Assigned.

D) Designated.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

Debt Service Fund expenditures reported on the Statement of Revenues, Expenditures, and Changes in Fund Balance commonly exclude

A) Fiscal agent fees.

B) Interest expenditures.

C) Principal retirement expenditures.

D) Gains and losses on early retirement of debt.

A) Fiscal agent fees.

B) Interest expenditures.

C) Principal retirement expenditures.

D) Gains and losses on early retirement of debt.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

What measurement focus does a Debt Service Fund use?

A) Total financial resources.

B) Current financial resources

C) Economic resources

D) Cash resources

A) Total financial resources.

B) Current financial resources

C) Economic resources

D) Cash resources

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

Equity in a Debt Service Fund is known as

A) Restricted net position.

B) Fund balance.

C) Net investment in capital assets.

D) Unrestricted net position.

A) Restricted net position.

B) Fund balance.

C) Net investment in capital assets.

D) Unrestricted net position.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

The City of Dandridge has $8,000 par value of general government, general obligation bonds payable outstanding. The bonds have a call option at 102. The city has decided to call the bonds at their call date. The city uses a Debt Service Fund for all refunding transactions. All amounts are in thousands of dollars.

SITUATION A

1. The city issued $8,160 refunding bonds at par.

2. The city paid $8,160 to bondholders to retire the bonds at the call date.

SITUATION B

1. The city issued $4,000 of refunding bonds at par.

2. The city transferred $4,160 from the General Fund to the Debt Service Fund to provide the additional resources needed to call the bonds.

3. The city paid $8,160 to bondholders to retire the bonds at the call date.

1. Prepare the journal entries required in a Debt Service Fund to record these transactions, assuming the bond anticipation notes do not qualify for long-term debt treatment. If no entry is required, state "No entry required" and explain why.

2. Indicate the effects of each transaction on the accounting equation of the Debt Service Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

SITUATION A

1. The city issued $8,160 refunding bonds at par.

2. The city paid $8,160 to bondholders to retire the bonds at the call date.

SITUATION B

1. The city issued $4,000 of refunding bonds at par.

2. The city transferred $4,160 from the General Fund to the Debt Service Fund to provide the additional resources needed to call the bonds.

3. The city paid $8,160 to bondholders to retire the bonds at the call date.

1. Prepare the journal entries required in a Debt Service Fund to record these transactions, assuming the bond anticipation notes do not qualify for long-term debt treatment. If no entry is required, state "No entry required" and explain why.

2. Indicate the effects of each transaction on the accounting equation of the Debt Service Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

Listed below are selected transactions from a Loudon County Debt Service Fund (all amounts are in thousands of dollars).

1. The remaining funds of a Capital Projects Fund, $1,500, were transferred to the Debt Service Fund to be used in the repayment of debt and interest on that debt that was issued to finance and expansion of the county courthouse.

2. The county General Fund transferred $8,600 to the Debt Service Fund to provide financing for principal, interest, and fiscal agent fees for debt service transactions during the year. $6,000 of the transfer from the General Fund and all of the transfer from the CPF were invested.

3. The semi-annual payment of interest on bonds issued several years ago by a Capital Projects Fund came due and was paid. The outstanding principal of these 20-year, 4%, term bonds is $3,000. The unamortized discount on these bonds is $100. The bonds were issued 15 years ago on this date. The payment includes fiscal agent fees of $10.

4. The county has agreed to set up a small water treatment facility for the remote District 7, now that the local water supply has been polluted by a hog farm upstream. The cost of the facility, $2,500, is to be financed over 5 years by special assessments on the homeowners in that district, although the debt is guaranteed by the county. The assessment principal is paid annually, although the interest (4%) is paid semi-annually. The first interest payment is due in 6 months, with the first principal payment due in one year (60 days after year end). The water treatment facility will be operated as a general government activity.

5. The annual payment of serial bonds issued 10 years ago by the county came due. The amount owed is $1,250 in principal, $20 interest, and $5 in fiscal agent fees. The amount due was paid.

6. The county received interest on its investments, $85. In addition, investments that originally cost $4,000 were sold for $3,975. (See entry #2)

7. Another term bond issued 20 years ago by the county came due and was paid. The face amount and rate was $3,200 and 3%, respectively, and pays interest semi-annually. The fiscal agent fees were $60.

8. The semi-annual payment for interest on the outstanding special assessment bonds was paid when due. Also, $300 of assessments receivable has been collected for the principal payment due next year.

9. The regular semi-annual interest payment on the term bonds came due and was paid. (See entry #3)

10. A serial bond issued in the current year has its first annual payment of principal and interest due on the third day of the next fiscal year. As is required by the debt covenant and following the general procedures for all debt issues of the county, $1,200 ($1,000 for principal, $180 for interest, and $20 for fiscal agent fees) has been transferred from the General Fund to the Debt Service Fund to make this payment.

1. Record the above transactions in the Debt Service Fund.

2. Indicate the effects of each transaction on the accounting equation of the Debt Service Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

1. The remaining funds of a Capital Projects Fund, $1,500, were transferred to the Debt Service Fund to be used in the repayment of debt and interest on that debt that was issued to finance and expansion of the county courthouse.

2. The county General Fund transferred $8,600 to the Debt Service Fund to provide financing for principal, interest, and fiscal agent fees for debt service transactions during the year. $6,000 of the transfer from the General Fund and all of the transfer from the CPF were invested.

3. The semi-annual payment of interest on bonds issued several years ago by a Capital Projects Fund came due and was paid. The outstanding principal of these 20-year, 4%, term bonds is $3,000. The unamortized discount on these bonds is $100. The bonds were issued 15 years ago on this date. The payment includes fiscal agent fees of $10.

4. The county has agreed to set up a small water treatment facility for the remote District 7, now that the local water supply has been polluted by a hog farm upstream. The cost of the facility, $2,500, is to be financed over 5 years by special assessments on the homeowners in that district, although the debt is guaranteed by the county. The assessment principal is paid annually, although the interest (4%) is paid semi-annually. The first interest payment is due in 6 months, with the first principal payment due in one year (60 days after year end). The water treatment facility will be operated as a general government activity.

5. The annual payment of serial bonds issued 10 years ago by the county came due. The amount owed is $1,250 in principal, $20 interest, and $5 in fiscal agent fees. The amount due was paid.

6. The county received interest on its investments, $85. In addition, investments that originally cost $4,000 were sold for $3,975. (See entry #2)

7. Another term bond issued 20 years ago by the county came due and was paid. The face amount and rate was $3,200 and 3%, respectively, and pays interest semi-annually. The fiscal agent fees were $60.

8. The semi-annual payment for interest on the outstanding special assessment bonds was paid when due. Also, $300 of assessments receivable has been collected for the principal payment due next year.

9. The regular semi-annual interest payment on the term bonds came due and was paid. (See entry #3)

10. A serial bond issued in the current year has its first annual payment of principal and interest due on the third day of the next fiscal year. As is required by the debt covenant and following the general procedures for all debt issues of the county, $1,200 ($1,000 for principal, $180 for interest, and $20 for fiscal agent fees) has been transferred from the General Fund to the Debt Service Fund to make this payment.

1. Record the above transactions in the Debt Service Fund.

2. Indicate the effects of each transaction on the accounting equation of the Debt Service Fund and on the General Capital Assets and General Long-Term Liabilities accounts. If an element is not affected, put "NE" in the appropriate box.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

Calhoun County has a principal and interest payment due in the following fiscal year. However, the county Debt Service Fund has the cash necessary to make the payment in the current fiscal year. Assuming all other requirements have been met and the county plans to make the payment next year, at what point must the principal and interest payment come due in the next year to recognize the expenditure in the current fiscal year?

A) The principal and interest payment must be due before the end of the next fiscal year.

B) The principal and interest payment must come due not later than the end of the first quarter of next fiscal year.

C) The principal and interest payment must come due no later than the first 60 days of the next fiscal year.

D) The principal and interest payment must come due not later than one month into the next fiscal year.

A) The principal and interest payment must be due before the end of the next fiscal year.

B) The principal and interest payment must come due not later than the end of the first quarter of next fiscal year.

C) The principal and interest payment must come due no later than the first 60 days of the next fiscal year.

D) The principal and interest payment must come due not later than one month into the next fiscal year.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

The residual positive fund balance classification for a Debt Service Fund is

A) Unassigned.

B) Restricted.

C) Assigned

D) Committed.

A) Unassigned.

B) Restricted.

C) Assigned

D) Committed.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following types of transactions would not potentially be reported as expenditures in a Debt Service Fund?

A) Retirement of long-term debt principal.

B) Interest on long-term debt.

C) Discounts on refunding debt.

D) Bond issuance costs.

A) Retirement of long-term debt principal.

B) Interest on long-term debt.

C) Discounts on refunding debt.

D) Bond issuance costs.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

Assume that the fair market value of investments in a Debt Service Fund decreased by $25,000 as of the end of the fiscal year. What entry would be necessary to reflect this change?

A) Debit investment income and credit investments.

B) Debit interest expense and credit investments.

C) Debit interest expense and credit cash.

D) No entry is necessary since the investments have not actually been sold.

A) Debit investment income and credit investments.

B) Debit interest expense and credit investments.

C) Debit interest expense and credit cash.

D) No entry is necessary since the investments have not actually been sold.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

A government has $3,000,000 of 6%, 10-year general obligation bonds outstanding. The bonds were issued on July 2, 20X7 to finance construction of a general capital asset. Interest is payable semiannually on January 1 and July 1. What is the minimum amount of interest expenditures that the government would be permitted to report on the bonds for the year ended December 31, 20X7?

A) $0

B) $30,000

C) $90,000

D) $180,000

A) $0

B) $30,000

C) $90,000

D) $180,000

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

A Debt Service Fund should be used to account for debt service on special assessment indebtedness

A) Always.

B) Unless the government is not legally obligated for the debt.

C) If the government is obligated in some manner for the debt.

D) Never. A Special Assessment Fund should be used.

A) Always.

B) Unless the government is not legally obligated for the debt.

C) If the government is obligated in some manner for the debt.

D) Never. A Special Assessment Fund should be used.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

23

A Debt Service Fund retires bond principal during the year that is not related to a defeasance. The entry necessary to reflect the principal retirement would be

A) Debit bonds payable and credit cash.

B) Debit other financing use and credit cash.

C) Debit expenditures and credit cash.

D) Debit other financing source and credit cash.

A) Debit bonds payable and credit cash.

B) Debit other financing use and credit cash.

C) Debit expenditures and credit cash.

D) Debit other financing source and credit cash.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

A Debt Service Fund received a $100,000 payment from the General Fund to finance upcoming debt service payments. During the year, Debt Service Fund payments of $50,000 interest and $60,000 principal were made as they become due. The Debt Service Fund statement of revenues, expenditures, and changes in fund balance should report

A) An excess of revenues over expenditures of $50,000.

B) An excess of expenditures over revenues of $10,000.

C) An excess of expenditures over revenues of $50,000.

D) An excess of expenditures over revenues of $110,000.

A) An excess of revenues over expenditures of $50,000.

B) An excess of expenditures over revenues of $10,000.

C) An excess of expenditures over revenues of $50,000.

D) An excess of expenditures over revenues of $110,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

A government has $3,000,000 of 6%, 10-year general obligation bonds outstanding. The bonds were issued on July 2, 20X7 to finance construction of a general capital asset. Interest is payable semiannually on January 1 and July 1. What is the maximum amount of interest expenditures that the government would be permitted to report on the bonds for the year ended December 31, 20X7?

A) $0.

B) $30,000.

C) $90,000.

D) $180,000.

A) $0.

B) $30,000.

C) $90,000.

D) $180,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following financial statements is not presented for a Debt Service Fund?

A) A balance sheet.

B) A statement of cash flows.

C) A budget-to-actual statement.

D) A statement of revenues, expenditures, and changes in fund.

A) A balance sheet.

B) A statement of cash flows.

C) A budget-to-actual statement.

D) A statement of revenues, expenditures, and changes in fund.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

A government has $1,000,000 of 6%, 10-year general obligation bonds outstanding. The bonds were issued on August 15, 20X6 to finance construction of a general capital asset. Interest is payable semiannually on February 15 and August 15. What is the maximum amount of interest expenditures that the government would be permitted to report on the bonds for the year ended December 31, 20X6?

A) $0.

B) $22,500.

C) $30,000.

D) $60,000.

A) $0.

B) $22,500.

C) $30,000.

D) $60,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would not be a likely source of financial resources for a Debt Service Fund?

A) Property taxes.

B) Sales taxes.

C) Transfers from the General Fund.

D) Proceeds from the sale of capital assets.

A) Property taxes.

B) Sales taxes.

C) Transfers from the General Fund.

D) Proceeds from the sale of capital assets.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

In the year that a governmental entity enters into an advance refunding to legally defease outstanding debt, which of the following note disclosures would not be required?

A) The present value of the net debt service savings or cost of advance refunding transaction.

B) The amount of defeased debt that is still outstanding.

C) The difference between total of the remaining debt service requirements of the old defeased issue and the total debt service requirements of the new issue, adjusted for any additional cash received or paid.

D) General description of the transaction.

A) The present value of the net debt service savings or cost of advance refunding transaction.

B) The amount of defeased debt that is still outstanding.

C) The difference between total of the remaining debt service requirements of the old defeased issue and the total debt service requirements of the new issue, adjusted for any additional cash received or paid.

D) General description of the transaction.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

Debt Service Fund expenditures would include all of the following except

A) Fiscal agent fees.

B) Repayment of refunded bonds using resources transferred from the General Fund.

C) Principal retirement payments.

D) Discounts on refunding bonds.

A) Fiscal agent fees.

B) Repayment of refunded bonds using resources transferred from the General Fund.

C) Principal retirement payments.

D) Discounts on refunding bonds.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

If General Fund cash is transferred to a Debt Service Fund to provide resources to refund outstanding debt, the Debt Service Fund statement of revenues, expenditures, and changes in fund balance would report

A) An other financing source when the cash is received.

B) An other financing use when the cash is used to refund the outstanding debt.

C) A revenue.

D) A special item for the difference in the amount received and the amount paid.

A) An other financing source when the cash is received.

B) An other financing use when the cash is used to refund the outstanding debt.

C) A revenue.

D) A special item for the difference in the amount received and the amount paid.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

A Debt Service Fund received an annual payment from the General Fund to finance upcoming debt service payments. The amount received from the General Fund should be reported in the Debt Service Fund statement of revenues, expenditures, and changes in fund balance as

A) Other financing sources.

B) Revenues.

C) Proceeds from interfund loans.

D) Special item.

A) Other financing sources.

B) Revenues.

C) Proceeds from interfund loans.

D) Special item.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

In the fiscal year ended September 30, 20X9, debt service payments were made in January and July from the Debt Service Fund in the total amount of $25,000 ($10,000 principal, $15,000 interest). The sole financial resource for the debt service payments is the proceeds of a special debt service tax levy. The taxes are levied and collected in increments of about $27,000 and are due in June of each year. For the fiscal year ended September 30, 20X9, assuming $24,000 of taxes had been collected for this fiscal year, the expenditures reported in the Debt Service Fund would be

A) $10,000.

B) $15,000.

C) $24,000.

D) $25,000.

A) $10,000.

B) $15,000.

C) $24,000.

D) $25,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

If cash from the General Fund is transferred to a Debt Service Fund, the entry in the Debt Service Fund would

A) Debit cash and credit revenues.

B) Debit cash and credit other financing sources.

C) Debit cash and credit accounts receivable.

D) Debit cash and credit fund balance.

A) Debit cash and credit revenues.

B) Debit cash and credit other financing sources.

C) Debit cash and credit accounts receivable.

D) Debit cash and credit fund balance.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

If a special tax is levied to finance debt service for a particular debt issue, the entry to record the levy in the Debt Service Fund would include

A) Debit Taxes Receivable and credit to Revenues.

B) Debit Taxes Receivable and credit to Other Financing Sources.

C) Debit Prepaid Assets and credit to Revenues.

D) Tax levies may not be reported in a Debt Service Fund.

A) Debit Taxes Receivable and credit to Revenues.

B) Debit Taxes Receivable and credit to Other Financing Sources.

C) Debit Prepaid Assets and credit to Revenues.

D) Tax levies may not be reported in a Debt Service Fund.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

A government retired $5,000,000 of outstanding general obligation bonds when due. The government used $3,000,000 of proceeds from new bonds issued to provide resources for retiring the old bonds. The other $2,000,000 had been accumulated from tax and interest revenues over the years that the old bonds were outstanding. The government should report this transaction in its Debt Service Fund as

A) Other financing uses of $5,000,000.

B) Expenditures of $5,000,000.

C) Other financing uses of $3,000,000 and expenditures of $2,000,000.

D) Other financing uses of $2,000,000 and expenditures of $3,000,000.

A) Other financing uses of $5,000,000.

B) Expenditures of $5,000,000.

C) Other financing uses of $3,000,000 and expenditures of $2,000,000.

D) Other financing uses of $2,000,000 and expenditures of $3,000,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

Assume that a county with a June 30 fiscal year end levied $900,000 in special assessments to finance debt service on a special assessment debt issuance. The levy date was January 20X1. The levy is to be paid by the property owners over a 10-year period beginning in January 20X2. The amount of revenue recognized by the county in the Debt Service Fund as of June 30, 20X1 would be

A) $900,000.

B) $90,000.

C) $0.

D) Tax and special assessment revenues are never recognized in a Debt Service Fund.

A) $900,000.

B) $90,000.

C) $0.

D) Tax and special assessment revenues are never recognized in a Debt Service Fund.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not usually a requirement of a Debt Service Fund (DSF) for a term bond issue?

A) The DSF should be used to accumulate the necessary funds to pay the term bonds when they come due.

B) The DSF makes periodic interest payment on the debt during its life.

C) The DSF will have funded reserves as required by the debt covenant.

D) A DSF that services a term bond issue is used to account for principal retirement only, with interest expenditures made directly from the General Fund.

A) The DSF should be used to accumulate the necessary funds to pay the term bonds when they come due.

B) The DSF makes periodic interest payment on the debt during its life.

C) The DSF will have funded reserves as required by the debt covenant.

D) A DSF that services a term bond issue is used to account for principal retirement only, with interest expenditures made directly from the General Fund.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

A government has $1,000,000 of 6%, 10-year general obligation bonds outstanding. The bonds were issued on November 1, 20X7 to finance construction of a general capital asset. Interest is payable semiannually on November 1 and May 1. The bonds also require an annual principal payment of $100,000 on May 1. What amount of debt service expenditures should the government report for the year ended December 31, 20X8?

A) $60,000.

B) $90,000.

C) $160,000.

D) $190,000.

A) $60,000.

B) $90,000.

C) $160,000.

D) $190,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

A government has $3,000,000 of 6%, 10-year general obligation bonds outstanding. The bonds were issued on November 1, 20X8 to finance construction of a general capital asset. Interest is payable semiannually on October 31 and April 30. What amount of debt service expenditures should the government report for the year ended December 31, 20X8?

A) $0.

B) $30,000.

C) $90,000.

D) $180,000.

A) $0.

B) $30,000.

C) $90,000.

D) $180,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

A government paid $6,000,000 into an irrevocable trust to be used to service $5,000,000 of outstanding general obligation bonds, but the transaction does not meet the defeasance in-substance criteria. The payment included $3,000,000 of proceeds from a new bond issue that was issued to provide resources for the old bond. The other $3,000,000 had been accumulated over previous years from taxes and interest earnings in the Debt Service Fund. The government should report this transaction in its Debt Service Fund as

A) Other financing uses of $6,000,000.

B) Expenditures of $6,000,000.

C) Other financing uses of $3,000,000 and expenditures of $3,000,000.

D) No expenditures or other financing uses should be reported.

A) Other financing uses of $6,000,000.

B) Expenditures of $6,000,000.

C) Other financing uses of $3,000,000 and expenditures of $3,000,000.

D) No expenditures or other financing uses should be reported.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

Apex County advance refunded $3,000,000 of outstanding bonds. $2,500,000 was financed with net refunding bond proceeds and the remaining $500,000 was transferred from the General Fund. The county incurred $35,000 of bond issuance costs when issuing the refunding bonds. Which of the following statements about the reporting of these transactions in the Debt Service Fund is not true? The Debt Service Fund financial statements would report

A) $2,500,000 of other financing uses.

B) Expenditures of $535,000.

C) Transfers in of $500,000.

D) Net other financing sources and uses of $500,000.

A) $2,500,000 of other financing uses.

B) Expenditures of $535,000.

C) Transfers in of $500,000.

D) Net other financing sources and uses of $500,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

43

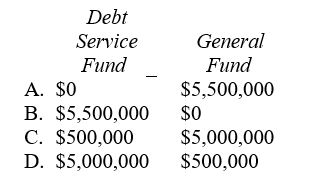

The Diné Nation-recognized by the United States Congress as a sovereign Native American nation-is accumulating financial resources that are legally restricted to service future principal and interest payments on general long-term debt. At June 30 of the current year, $5,000,000 and $500,000 have been accumulated for principal and interest payments, respectively. These restricted funds should be accounted for in the

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

The City of Newport issued $1,500,000 of general obligation refunding bonds at a 2% premium. Bond issuance costs of $15,000 were incurred. The proceeds, net of the premium and bond issue costs, are used in the same period to defease the outstanding bonds. Debt Service Fund Expenditures will be debited for

A) $15,000.

B) $30,000.

C) $1,455,000.

D) $1,470,000.

A) $15,000.

B) $30,000.

C) $1,455,000.

D) $1,470,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

Monica City paid $6,000,000 to its fiscal agent to be placed in an irrevocable trust to be used to service an outstanding $5,000,000 general obligation bond issue and those bonds are deemed defeased in-substance. The payment included $3,000,000 of proceeds from the issuance of new general obligation bonds and $3,000,000 that had been accumulated over the years to service the old debt. The city should report the payment to the fiscal agent in its Debt Service Fund as

A) Other financing uses of $6,000,000.

B) Expenditures of $6,000,000.

C) Other financing uses of $3,000,000 and expenditures of $3,000,000.

D) Other financing uses of $5,000,000 and expenditures of $1,000,000.

A) Other financing uses of $6,000,000.

B) Expenditures of $6,000,000.

C) Other financing uses of $3,000,000 and expenditures of $3,000,000.

D) Other financing uses of $5,000,000 and expenditures of $1,000,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

46

The Village of Bakersville issued $700,000 of refunding bonds at a 1% premium. Bond issuance costs were $10,000; $695,000 was used to retire the existing bonds. Other financing uses will be debited for

A) $7,000.

B) $10,000.

C) $683,000.

D) $695,000.

A) $7,000.

B) $10,000.

C) $683,000.

D) $695,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

The GASB Codification sets forth circumstances in which a state or local government is permitted to accrue expenditures related to unmatured principal and interest on general obligation long-term liabilities. Which of the following are those circumstances?

I. Dedicated financial resources to pay the maturing principal and interest have been accumulated in a Debt Service Fund by year end.

II. The debt service payment is due early next year (within 30 days).

III. The debt service payment is due early next year (within 60 days).

A) I only.

B) I and II.

C) I and III.

D) II only.

I. Dedicated financial resources to pay the maturing principal and interest have been accumulated in a Debt Service Fund by year end.

II. The debt service payment is due early next year (within 30 days).

III. The debt service payment is due early next year (within 60 days).

A) I only.

B) I and II.

C) I and III.

D) II only.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck