Deck 12: Nonrecognition Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/118

Play

Full screen (f)

Deck 12: Nonrecognition Transactions

1

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Realized gain

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Realized gain

E

2

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Coke-Cola bonds for General Foods bonds.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Coke-Cola bonds for General Foods bonds.

B

3

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Land held as an investment for land used in a business.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Land held as an investment for land used in a business.

A

4

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Farm land for an office building and its land.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Farm land for an office building and its land.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Land in London,England for land in San Francisco,California.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Land in London,England for land in San Francisco,California.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

A personal residence for a vacation home.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

A personal residence for a vacation home.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Office copier for an office fax machine.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Office copier for an office fax machine.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

8

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Principal residence

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Principal residence

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

9

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Boot

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Boot

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Personal residence for an apartment building.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Personal residence for an apartment building.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Computer for delivery truck.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Computer for delivery truck.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

12

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Involuntary conversion

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Involuntary conversion

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

13

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Wherewithal-to-pay

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Wherewithal-to-pay

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

An airplane for a duplex apartment.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

An airplane for a duplex apartment.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

15

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Third-party exchange

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Third-party exchange

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Inventory for inventory.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Inventory for inventory.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

A business use automobile for a personal use automobile.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

A business use automobile for a personal use automobile.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

18

Match each statement with the correct term below.

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Like-kind property

a.Losses are never deferred.

b.Can be within the same NAICS Code.

c.Not considered like-kind property.

d.A taxpayer can have only one at a time.

e.The maximum amount that can be recognized on a like-kind exchange.

f.This type of exchange must be completed within 180 days of first property transfer.

g.The concept upon which the ability to defer gains on certain nontaxable transactions relies.

Like-kind property

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Office building for office equipment.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Office building for office equipment.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Inventory for office supplies.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Inventory for office supplies.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

21

The basis of replacement property in a nonrecognition transaction is the adjusted basis of the property received less any deferred gain.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Microsoft common stock for Merrill Lynch common stock.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Microsoft common stock for Merrill Lynch common stock.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

23

An involuntary conversion occurs whenever a loss (but not a gain)is realized from a transaction that occurs against the taxpayer's will.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

24

In general,qualified replacement property for an involuntary conversion must be purchased within one year after the close of the tax year in which the involuntary conversion occurred.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

25

The recognition of a loss realized on an involuntary conversion is mandatory.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

A Cadillac automobile used 100% for business for a Ford Mustang automobile used 100% for business.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

A Cadillac automobile used 100% for business for a Ford Mustang automobile used 100% for business.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

27

The holding period of an asset received in a like-kind exchange includes the holding period of the transferred asset.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

28

When two qualified assets are exchanged and their fair market values are not equal,additional nonqualifying property referred to as "boot" can be used to equalize the transaction without disqualifying the nonrecognition transaction.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

29

Ed and Elise got married during the year and they each sold their homes to buy a new house for them to live in.As long as they file a joint return they can each claim a $250,000 exclusion.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

30

Nancy purchased her houseboat six years ago for $35,000.She has lived in the houseboat since she purchased it.A friend has offered $62,000 for the houseboat.If she sells it,she will be able to exclude the gain.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

31

Simon exchanged his Mustang for Michael's Econovan so that he could go hunting.The exchange does not qualify as a like-kind exchange since the assets are personal.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

32

The deferral of a gain realized on an involuntary conversion is mandatory.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

33

For related parties to qualify for a like-kind exchange,the property received must be held for six months.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following can be income deferral transactions?

I)Sale of municipal bonds.

II)Involuntary conversions of property.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Sale of municipal bonds.

II)Involuntary conversions of property.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

35

Taxpayers are allowed to structure transactions through third parties that qualify as exchanges if they meet certain time requirements for identifying properties and closing the transaction.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following qualify as a like-kind exchange?

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Land held as an investment for an office building and land used in a business.

a.qualifies as a like-kind exchange

b.does not qualify as a like-kind exchange

Land held as an investment for an office building and land used in a business.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

37

The mechanism for effecting a deferral in a nonrecognition transaction is an adjustment of the replacement asset's basis.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

38

A gain on a like-kind exchange is always recognized to the extent of any boot received.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

39

Classification of a nonrecognition transaction as a continuation of an investment requires a qualified replacement asset.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following can be income deferral transactions?

I)Exchanges of like-kind property.

II)Involuntary conversions of property.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Exchanges of like-kind property.

II)Involuntary conversions of property.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

41

Rationale for nonrecognition of property transactions exists because of which concept(s)of taxation?

I)Wherewithal-to-Pay Concept.

II)Constructive receipt Doctrine.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Wherewithal-to-Pay Concept.

II)Constructive receipt Doctrine.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

42

Wendell owns 115 acres of land with a fair market value of $57,000.He purchased the land as an investment for $35,000 in 1993.Wendell trades the land for a 122-acre parcel adjacent to other property he owns.The 122 acres has a value of $57,000,and the exchange qualifies for like-kind deferral treatment.What is Wendell's recognized gain on the exchange?

A)$ - 0 -

B)$22,000

C)$35,000

D)$57,000

E)$79,000

A)$ - 0 -

B)$22,000

C)$35,000

D)$57,000

E)$79,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

43

For a transaction to qualify as a third-party exchange,

I)The exchange must be completed within 1 year of the first exchange.

II)The property exchanged must be identified within 45 days of the first exchange.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The exchange must be completed within 1 year of the first exchange.

II)The property exchanged must be identified within 45 days of the first exchange.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

44

Karen owns a commercial office building with a fair market value of $140,000.She purchased the building as an investment for $102,000 in 2003.She has claimed $18,000 in depreciation deductions.Karen trades the building for an apartment complex.The apartment complex has a value of $140,000,and the exchange qualifies for like-kind deferral treatment.What is Karen's basis in the apartment complex?

A)$ - 0 -

B)$ 58,000

C)$ 84,000

D)$140,000

E)$198,000

A)$ - 0 -

B)$ 58,000

C)$ 84,000

D)$140,000

E)$198,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

45

The general mechanism used to defer gains and losses from a transaction includes certain adjustments to the fair market value of the replacement property.These adjustments include

I)adding boot received.

II)subtracting deferred gains.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)adding boot received.

II)subtracting deferred gains.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following exchanges of property are like-kind exchanges?

I)Common stock of Intel traded for preferred stock of Intel.

II)Principal residence traded for 20 acres of undeveloped investment land.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Common stock of Intel traded for preferred stock of Intel.

II)Principal residence traded for 20 acres of undeveloped investment land.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following qualifies as a like-kind exchange of property?

I)Commercial retail building and its land for an office building and its land.

II)Louisiana Oil,Inc.common stock for Louisiana Oil,Inc.corporate bonds.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Commercial retail building and its land for an office building and its land.

II)Louisiana Oil,Inc.common stock for Louisiana Oil,Inc.corporate bonds.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

48

Commonalties of nonrecognition transactions include that

I)deferring a loss is mandatory on like-kind exchanges.

II)deferring a loss is mandatory on involuntary conversions.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)deferring a loss is mandatory on like-kind exchanges.

II)deferring a loss is mandatory on involuntary conversions.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

49

Willie owns 115 acres of land with a fair market value of $57,000.He purchased the land as an investment for $35,000 in 1993.Willie trades the land for a 122-acre parcel adjacent to other property he owns.The 122 acres has a value of $57,000,and the exchange qualifies for like-kind deferral treatment.What is Willie's basis in the new parcel of land?

A)$ - 0 -

B)$17,000

C)$35,000

D)$57,000

E)$74,000

A)$ - 0 -

B)$17,000

C)$35,000

D)$57,000

E)$74,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

50

Randy owns 115 acres of land with a fair market value of $57,000.He purchased the land as an investment for $35,000 in 1993.Randy trades the land for a 122-acre parcel adjacent to other property he owns.The 122 acres has a value of $57,000,and the exchange qualifies for like-kind deferral treatment.What is Randy's realized gain on the exchange?

A)$ - 0 -

B)$22,000

C)$35,000

D)$57,000

E)$79,000

A)$ - 0 -

B)$22,000

C)$35,000

D)$57,000

E)$79,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the tax concept(s)allow for the deferral of gains on nonrecognition transactions?

I)Capital Recovery Concept.

II)Ability to Pay Concept.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Capital Recovery Concept.

II)Ability to Pay Concept.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

52

Commonalties of nonrecognition transactions include that

I)gains on all transactions must be recognized when the taxpayer has the wherewithal-to-pay.

II)tax attributes carryover from the original asset to the replacement asset.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)gains on all transactions must be recognized when the taxpayer has the wherewithal-to-pay.

II)tax attributes carryover from the original asset to the replacement asset.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

53

Rationale for nonrecognition includes which of the following?

I)A refinement of the realization concept,which postpones recognition of appreciation in value until the taxpayer disposes of a property,or its replacement.

II)Under the Substance-over-form doctrine,new property acquired in a transaction is viewed as a continuation of the original investment.

III)The taxpayer lacks wherewithal to pay the tax on a realized gain because the amount realized on the transaction is reinvested in the replacement asset.

A)Only II is correct.

B)Only I is correct.

C)II and III are correct.

D)I, II, and III are correct.

E)Only III is correct.

I)A refinement of the realization concept,which postpones recognition of appreciation in value until the taxpayer disposes of a property,or its replacement.

II)Under the Substance-over-form doctrine,new property acquired in a transaction is viewed as a continuation of the original investment.

III)The taxpayer lacks wherewithal to pay the tax on a realized gain because the amount realized on the transaction is reinvested in the replacement asset.

A)Only II is correct.

B)Only I is correct.

C)II and III are correct.

D)I, II, and III are correct.

E)Only III is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

54

Under the like-kind exchange rules,when like-kind property is traded for like-kind property,a loss on a trade-in is:

A)recognized and treated as a capital loss.

B)recognized and treated as an ordinary loss.

C)not recognized and increases the basis of the replacement property.

D)not recognized and decreases the basis of the replacement property.

E)none of the above.

A)recognized and treated as a capital loss.

B)recognized and treated as an ordinary loss.

C)not recognized and increases the basis of the replacement property.

D)not recognized and decreases the basis of the replacement property.

E)none of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

55

Fran owns a commercial office building with a fair market value of $850,000.She purchased the building as an investment for $815,000 in 2006.She has deducted $115,000 in depreciation.Fran trades the building for an apartment complex.The apartment complex has a value of $850,000,and the exchange qualifies for like-kind deferral treatment.What is Fran's recognized gain on the exchange?

A)$ - 0 -

B)$ 35,000

C)$115,000

D)$150,000

E)$850,000

A)$ - 0 -

B)$ 35,000

C)$115,000

D)$150,000

E)$850,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following qualifies as a like-kind exchange of property?

I)Inventory for inventory.

II)Office equipment for a delivery van.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Inventory for inventory.

II)Office equipment for a delivery van.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

57

A fire destroyed Jimmy's Teeshirt Shop.The business had an adjusted basis of $500,000 and a fair market value of $600,000 before the fire.Jimmy received $550,000 from the insurance company and opened a new Teeshirt Shop with the proceeds.

I)Jimmy has a realized gain of $50,000.

II)Jimmy has a recognized gain of $50,000.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Jimmy has a realized gain of $50,000.

II)Jimmy has a recognized gain of $50,000.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

58

The general mechanism used to defer gains and losses from a transaction includes certain adjustments to the basis of the replacement property.These adjustments include

I)subtracting deferred losses.

II)adding deferred gains.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)subtracting deferred losses.

II)adding deferred gains.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following exchanges of property are like-kind exchanges?

I)Convenience store owner trades several cases of potato chips for a cash register.

II)A completely rented apartment building traded for a parts supply warehouse to use in business.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Convenience store owner trades several cases of potato chips for a cash register.

II)A completely rented apartment building traded for a parts supply warehouse to use in business.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

60

Gain deferral is fundamental to the nonrecognition transactions.In which of the following is gain deferral mandatory?

I)Involuntary conversion of business real estate.

II)Like-kind exchange of business real estate.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Involuntary conversion of business real estate.

II)Like-kind exchange of business real estate.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

61

Rosilyn trades her old business-use luxury car with an adjusted basis of $13,000 and an outstanding loan liability balance of $2,000 for a new business-use economy car valued at $9,000 plus $3,000 cash from Bob's Auto Sales and Loan Company.Bob assumes Rosilyn's loan balance.What is Rosilyn's amount realized on the transaction?

A)$ 3,000

B)$ 9,000

C)$12,000

D)$13,000

E)$14,000

A)$ 3,000

B)$ 9,000

C)$12,000

D)$13,000

E)$14,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

62

Rebecca trades in her four-wheel drive truck for a new one.Rebecca's truck cost $20,000 and has an $8,000 basis on the date of the trade-in.The price of the new truck is $27,000 and the dealer gives Rebecca a $10,000 trade in allowance on her old truck.She uses the trucks in her business.What is Rebecca's basis in the new truck?

A)$ 8,000

B)$18,000

C)$25,000

D)$27,000

E)$29,000

A)$ 8,000

B)$18,000

C)$25,000

D)$27,000

E)$29,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

63

Rosilyn trades her old business-use car with an adjusted basis of $13,000 and an outstanding loan liability balance of $2,000 for a new business-use car valued at $9,000 plus $3,000 cash from Bob's Auto Sales and Loan Company.Bob assumes Rosilyn's loan balance.What is Rosilyn's basis in her new car?

A)$ - 0 -

B)$ 9,000

C)$11,000

D)$12,000

E)$14,000

A)$ - 0 -

B)$ 9,000

C)$11,000

D)$12,000

E)$14,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

64

No taxable gain or loss is recognized on a like-kind exchange of an investment asset for a similar asset that will be held for investment if both assets consist of

A)Partnership interests.

B)Convertible debentures.

C)Mortgage notes

D)Rental real estate located in different states.

E)Common stock of companies in the same industry.

A)Partnership interests.

B)Convertible debentures.

C)Mortgage notes

D)Rental real estate located in different states.

E)Common stock of companies in the same industry.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

65

Norman exchanges a machine he uses in his pool construction business for a used machine worth $6,000 to use in the same business.He purchased the machine 3 years ago for $22,000 and has taken depreciation of $9,000 on the machine.In the exchange,Norman also receives $3,000 of cash.As a result of the exchange,

I)Norman's basis in the acquired machine is $10,000.

II)Norman recognizes a loss of $3,000 on the exchange.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Norman's basis in the acquired machine is $10,000.

II)Norman recognizes a loss of $3,000 on the exchange.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

66

Norman exchanges a machine he uses in his pool construction business for a used machine worth $6,000 to use in the same business.He purchased the machine 3 years ago for $22,000 and had taken depreciation of $9,000 on the machine.In the exchange,Norman also receives $3,000 of cash.As a result of the exchange,

I)Norman realizes a loss of $4,000 on the exchange.

II)Norman's basis in the acquired machine is $13,000.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Norman realizes a loss of $4,000 on the exchange.

II)Norman's basis in the acquired machine is $13,000.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

67

Justin trades an office building located in Michigan to John for an apartment complex located in North Carolina.Details of the two properties:

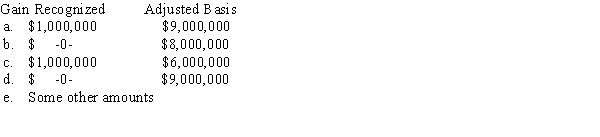

In addition,John pays Justin $3,000,000 cash as part of this transaction.What is the gain (loss)recognized by John in this transaction and what is his basis in the Michigan property?

In addition,John pays Justin $3,000,000 cash as part of this transaction.What is the gain (loss)recognized by John in this transaction and what is his basis in the Michigan property?

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following qualifies as a like-kind exchange of property?

I)Registered trademark for a copyright.

II)A 2009 Chevy,business-use automobile for a 2010 Ford,business-use automobile

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Registered trademark for a copyright.

II)A 2009 Chevy,business-use automobile for a 2010 Ford,business-use automobile

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

69

Rosilyn trades her old business-use car with an adjusted basis of $13,000 and an outstanding loan liability balance of $2,000 for a new business-use car valued at $9,000 plus $3,000 cash from Bob's Auto Sales and Loan Company.Bob assumes Rosilyn's loan balance.How much boot does Rosilyn receive in the transaction?

A)$ - 0 -

B)$1,000

C)$2,000

D)$3,000

E)$5,000

A)$ - 0 -

B)$1,000

C)$2,000

D)$3,000

E)$5,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

70

Robert trades an office building located in Tennessee to John for an apartment complex located in New Jersey.Details of the two properties:

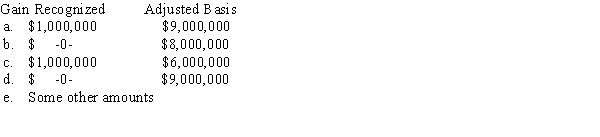

In addition,John pays Robert $3,000,000 cash as part of this transaction.What is the gain (loss)recognized by Robert in this transaction and what is his basis in the New Jersey property?

In addition,John pays Robert $3,000,000 cash as part of this transaction.What is the gain (loss)recognized by Robert in this transaction and what is his basis in the New Jersey property?

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

71

Lindsey exchanges investment real estate parcels with Donna.Lindsay's adjusted basis in the property is $400,000,and it is encumbered by a mortgage liability of $200,000.Donna assumes the mortgage.Donna's property is appraised at $1,000,000 and is subject to a $100,000 liability.Lindsey assumes the liability.If no cash is exchanged,what is Lindsey's basis in the new real estate?

A)$ - 0 -

B)$100,000

C)$200,000

D)$400,000

E)$600,000

A)$ - 0 -

B)$100,000

C)$200,000

D)$400,000

E)$600,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

72

Roscoe receives real estate appraised at $200,000 and cash of $10,000 from Cathy in exchange for Roscoe's investment realty with a basis of $170,000.Roscoe plans to hold the new realty for investment.What is the amount realized for the property given up by Roscoe?

A)$160,000

B)$170,000

C)$190,000

D)$200,000

E)$210,000

A)$160,000

B)$170,000

C)$190,000

D)$200,000

E)$210,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

73

Roscoe receives real estate appraised at $200,000 and cash of $10,000 from Cathy in exchange for his investment realty with a basis of $170,000.Roscoe plans to hold the new realty for investment.What is his recognized gain?

A)$ - 0 -

B)$10,000

C)$20,000

D)$30,000

E)$40,000

A)$ - 0 -

B)$10,000

C)$20,000

D)$30,000

E)$40,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

74

Grant exchanges an old pizza oven from his business for a new oven.In addition to the old oven,which had a basis of $10,000,Grant pays $4,000 cash and takes out a loan on the new oven for $6,000.The new oven is valued at $22,000.What is Grant's basis in the new oven?

A)$12,000

B)$16,000

C)$20,000

D)$22,000

E)$32,000

A)$12,000

B)$16,000

C)$20,000

D)$22,000

E)$32,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

75

Lindsey exchanges investment real estate parcels with Donna.Her adjusted basis in the property is $400,000,and it is encumbered by a mortgage liability of $200,000.Donna assumes the mortgage.Donna's property is appraised at $1,000,000 and is subject to a $100,000 liability.Lindsey assumes the liability.If no cash is exchanged,what is the amount of gain recognized by Lindsey?

A)$ - 0 -

B)$100,000

C)$200,000

D)$500,000

E)$900,000

A)$ - 0 -

B)$100,000

C)$200,000

D)$500,000

E)$900,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

76

Rosilyn trades her old business-use car with an adjusted basis of $13,000 and an outstanding loan liability balance of $2,000 for a new business-use car valued at $9,000 plus $3,000 cash from Bob's Auto Sales and Loan Company.Bob assumes Rosilyn's loan balance.What is Rosilyn's recognized gain on the transaction?

A)$ - 0 -

B)$1,000

C)$2,000

D)$3,000

E)$5,000

A)$ - 0 -

B)$1,000

C)$2,000

D)$3,000

E)$5,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

77

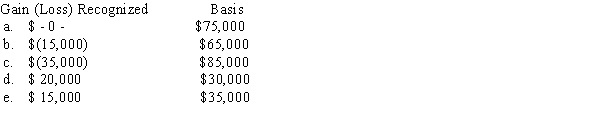

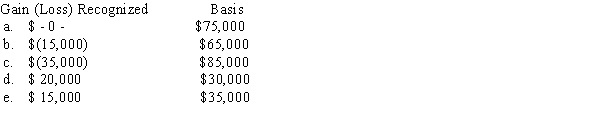

Matthew exchanges an investment apartment building for a parcel of land.The apartment building has a fair market value of $80,000 and an adjusted basis of $95,000.The land's value is $60,000.Matthew receives $20,000 cash in the exchange.What is Matthew's recognized gain or (loss)on the exchange and his basis in the land?

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

78

Grant exchanges an old pizza oven from his business for a new oven.In addition to the old oven,which has a basis of $10,000,Grant pays $4,000 cash and takes out a loan on the new oven for $6,000.The new oven is valued at $22,000.What is Grant's recognized gain or loss due on this transaction?

A)$ - 0 -

B)$ 2,000

C)$12,000

D)$16,000

E)$22,000

A)$ - 0 -

B)$ 2,000

C)$12,000

D)$16,000

E)$22,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

79

Rosilyn trades her old business-use car with an adjusted basis of $13,000 and an outstanding loan liability balance of $2,000 for a new business-use car valued at $9,000 plus $3,000 cash from Bob's Auto Sales and Loan Company.Bob assumes Rosilyn's loan balance.What is Rosilyn's realized gain on the transaction?

A)$ - 0 -

B)$1,000

C)$2,000

D)$3,000

E)$5,000

A)$ - 0 -

B)$1,000

C)$2,000

D)$3,000

E)$5,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

80

Roscoe receives real estate appraised at $200,000 and cash of $10,000 from Cathy in exchange for Roscoe's investment realty with a basis of $170,000.What is his basis in the new real estate?

A)$160,000

B)$170,000

C)$180,000

D)$200,000

E)$210,000

A)$160,000

B)$170,000

C)$180,000

D)$200,000

E)$210,000

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck