Deck 7: Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

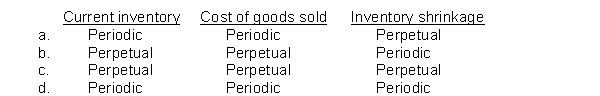

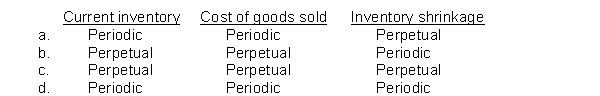

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 7: Inventory

1

All of the following are typical manufacturing costs except:

A)raw materials.

B)direct labour.

C)freight out

D)freight in

A)raw materials.

B)direct labour.

C)freight out

D)freight in

C

2

One way to estimate the cost of goods sold is to multiply the sales revenue for the period by the inventory turnover ratio.

False

3

The market in which a company sells its products is referred to as:

A)the wholesale market.

B)the retail market.

C)an input market.

D)an exit market.

A)the wholesale market.

B)the retail market.

C)an input market.

D)an exit market.

D

4

All of the following are manufacturing accounts except for:

A)Cost of goods available for sale

B)raw materials

C)finished goods

D)work in process

A)Cost of goods available for sale

B)raw materials

C)finished goods

D)work in process

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

If inventory is valued using a __________________system, then no profit is recognized when an inventory item is sold.

A)net realizable value

B)replacement cost

C)purchasing power

D)acquisition cost

A)net realizable value

B)replacement cost

C)purchasing power

D)acquisition cost

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

Perpetual inventory systems provide more timely information than periodic systems.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

If a company's inventory turnover ratio is 6.6 it takes them on average 55 days to sell their inventory.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

The LCM rule is usually applied to groups of similar items.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following risks are unique to inventory as an asset class?

A)Finding suppliers and obsolescence

B)Finding suppliers and estimating collection

C)Finding buyers and obsolescence

D)Finding buyers and estimating collection

A)Finding suppliers and obsolescence

B)Finding suppliers and estimating collection

C)Finding buyers and obsolescence

D)Finding buyers and estimating collection

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

The inventory turnover ratio is calculated as cost of goods sold divided by total inventory.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following should be included in the cost of inventory?

A)The cost of keeping the inventory records

B)Amortization on the inventory warehouse

C)The salesperson's commission.

D)Receiving and inspection costs

A)The cost of keeping the inventory records

B)Amortization on the inventory warehouse

C)The salesperson's commission.

D)Receiving and inspection costs

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is the correct flow of costs in a manufacturing operation?

A)Raw materials to finished goods

B)Raw materials to finished goods to work-in-process

C)Raw materials to work-in-process to finished goods

D)Direct materials to work-in-process to finished goods.

A)Raw materials to finished goods

B)Raw materials to finished goods to work-in-process

C)Raw materials to work-in-process to finished goods

D)Direct materials to work-in-process to finished goods.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not an inventory account in a manufacturing company?

A)Raw material

B)Work in process

C)Goods available for sale

D)Finished goods

A)Raw material

B)Work in process

C)Goods available for sale

D)Finished goods

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

Periodic inventory systems provide more relevant and timely information to managers for decision making purposes than perpetual inventory systems do.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

Perpetual inventory systems are incapable of identifying inventory shrinkage.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Net realizable value is also known as the:

A)replacement cost.

B)wholesale price.

C)exit price.

D)input price.

A)replacement cost.

B)wholesale price.

C)exit price.

D)input price.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Inventory sold as a result of liquidation or bankruptcy is:

A)reflective of the market value

B)subject to normal valuation and accounting procedures

C)in violation of the matching principle

D)in violation of the going concern principle

A)reflective of the market value

B)subject to normal valuation and accounting procedures

C)in violation of the matching principle

D)in violation of the going concern principle

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

Under the FIFO inventory assumption the cost of ending inventory and cost of goods sold will be the same under both the perpetual and periodic inventory systems.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

If prices were rising and a Canadian company wanted to report a smaller amount of profit for tax purposes, they should use the moving average cost flow assumption.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

The cost flow assumption used by a firm must match the physical flow of units through the firm.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

Use the following information to answer questions

Handel Inc.values its inventory on an LCM basis.The following data came from the 2011 inventory, which consisted of two items:

-The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value to the inventory as a whole would be:

A)$25,000

B)$26,000

C)$27,000

D)$28,000

Handel Inc.values its inventory on an LCM basis.The following data came from the 2011 inventory, which consisted of two items:

-The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value to the inventory as a whole would be:

A)$25,000

B)$26,000

C)$27,000

D)$28,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

IFRS standards require that a firm select the cost flow assumption that:

A)maximizes income.

B)provides the most conservative inventory cost.

C)most clearly reflects current income.

D)most closely matches the physical flow of inventory.

A)maximizes income.

B)provides the most conservative inventory cost.

C)most clearly reflects current income.

D)most closely matches the physical flow of inventory.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

The holding loss incurred from applying the LCM rule to inventory is:

A)not reflected on the balance sheet.

B)an adjustment to cost of goods sold.

C)not reflected on the income statement.

D)not considered a permanent loss.

A)not reflected on the balance sheet.

B)an adjustment to cost of goods sold.

C)not reflected on the income statement.

D)not considered a permanent loss.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

Under the direct method, the unrealized losses that result from the application of the LCM rule are often hidden in the:

A)selling expense.

B)inventory account.

C)cost of goods sold.

D)loss due to market decline of inventory.

A)selling expense.

B)inventory account.

C)cost of goods sold.

D)loss due to market decline of inventory.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is true under a periodic system:

A)A COGS expense is recognized each time a sale is made

B)The inventory account is not updated with each purchase.

C)Inventory shrinkage is easily identified.

D)This system can be costly to implement.

A)A COGS expense is recognized each time a sale is made

B)The inventory account is not updated with each purchase.

C)Inventory shrinkage is easily identified.

D)This system can be costly to implement.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following would be most likely to use the specific identification method?

A)shoe store

B)car dealership

C)grocery store

D)bookstore

A)shoe store

B)car dealership

C)grocery store

D)bookstore

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

The following amounts are always known under which inventory costing system?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

In a manufacturing process overhead costs are added to which inventory account?

A)Raw materials

B)Finished goods

C)Work-in-process

D)Cost of goods sold

A)Raw materials

B)Finished goods

C)Work-in-process

D)Cost of goods sold

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

When a periodic inventory system is used:

A)inventory shrinkage is impossible to calculate.

B)timely data is of utmost importance.

C)cost of goods sold is always known.

D)every inventory transaction is reflected in the inventory account.

A)inventory shrinkage is impossible to calculate.

B)timely data is of utmost importance.

C)cost of goods sold is always known.

D)every inventory transaction is reflected in the inventory account.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

When a company is evaluating whether or not to use a perpetual vs.a periodic inventory system the following statement is most accurate:

A)A perpetual inventory system provides far superior information and should be used at any cost.

B)A periodic system is inferior and should never be used if possible.

C)The cost of the system used should be measured against the benefits it provides.

D)Both systems are equally good.

A)A perpetual inventory system provides far superior information and should be used at any cost.

B)A periodic system is inferior and should never be used if possible.

C)The cost of the system used should be measured against the benefits it provides.

D)Both systems are equally good.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following cost flow assumptions would be most appropriate when the inventory units are unique or costly?

A)FIFO

B)Specific identification

C)Just-in-time

D)Moving average

A)FIFO

B)Specific identification

C)Just-in-time

D)Moving average

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information to answer questions

Handel Inc.values its inventory on an LCM basis.The following data came from the 2011 inventory, which consisted of two items:

-The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value on an item-by-item basis would be:

A)$25,000

B)$26,000

C)$27,000

D)$28,000

Handel Inc.values its inventory on an LCM basis.The following data came from the 2011 inventory, which consisted of two items:

-The appropriate carrying value for the entire inventory when applying the LCM rule using net realizable value on an item-by-item basis would be:

A)$25,000

B)$26,000

C)$27,000

D)$28,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following would most likely use a perpetual inventory system?

A)Hardware store

B)Shoe store

C)Car dealership

D)Bookstore

A)Hardware store

B)Shoe store

C)Car dealership

D)Bookstore

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

When applying the LCM using the direct method the following is true:

A)The inventory account remains at its original value

B)A contra account to inventory is used

C)COGS rises when ending inventory is reduced to market value

D)LCM can only be applied to individual items.

A)The inventory account remains at its original value

B)A contra account to inventory is used

C)COGS rises when ending inventory is reduced to market value

D)LCM can only be applied to individual items.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

Tommy Co.prepares its estimate of LCM using the net realizable value.Inventory item 101 cost $45 and its current replacement cost is $50.The item is currently selling in the market for $55 and selling costs are estimated to be $6.Tommy expects to earn a profit of $4 on the sale of this item.In its year-end financial statements, Tommy Co.should value this item at:

A)$50

B)$45

C)$49

D)$55

A)$50

B)$45

C)$49

D)$55

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements best describes net realizable value when applying the LCM rule?

A)Net realizable value is the selling price less the costs necessary to sell the item.

B)Net realizable value is the selling price plus the costs necessary to sell the item.

C)Net realizable value is the selling price plus the normal profit margin.

D)Net realizable value is the selling price less the normal profit margin.

A)Net realizable value is the selling price less the costs necessary to sell the item.

B)Net realizable value is the selling price plus the costs necessary to sell the item.

C)Net realizable value is the selling price plus the normal profit margin.

D)Net realizable value is the selling price less the normal profit margin.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

When using the LCM rule in Canada the market value is most commonly:

A)net present value.

B)selling price less profit margin.

C)replacement cost.

D)net realizable value.

A)net present value.

B)selling price less profit margin.

C)replacement cost.

D)net realizable value.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

When a perpetual inventory system is used:

A)a physical inventory count must be taken to determine cost of goods sold.

B)inventory shrinkage is difficult to determine.

C)the cost of each item sold must be known.

D)timeliness of data is sacrificed for lower costs of operation.

A)a physical inventory count must be taken to determine cost of goods sold.

B)inventory shrinkage is difficult to determine.

C)the cost of each item sold must be known.

D)timeliness of data is sacrificed for lower costs of operation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following would most likely use a periodic inventory system?

A)Car dealership

B)Jewelry store

C)Computer dealership

D)Hardware store

A)Car dealership

B)Jewelry store

C)Computer dealership

D)Hardware store

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

The bar scanners in a grocery store are most likely used to track:

A)only the costs of the items sold.

B)only the number of units sold.

C)both the price and the costs of the units sold.

D)both the costs and the numbers of units sold.

A)only the costs of the items sold.

B)only the number of units sold.

C)both the price and the costs of the units sold.

D)both the costs and the numbers of units sold.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information for questions:

Berenger Industries had the following activity with one of its inventory items during the current period:

-Using a perpetual inventory system and the FIFO cost flow assumption, the cost of goods sold was:

A)$975

B)$1,080

C)$1,175

D)$1,300

Berenger Industries had the following activity with one of its inventory items during the current period:

-Using a perpetual inventory system and the FIFO cost flow assumption, the cost of goods sold was:

A)$975

B)$1,080

C)$1,175

D)$1,300

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements about the FIFO cost assumption is true?

A)The same costs per unit are assigned to the ending inventory and the cost of goods sold.

B)Companies prefer to use FIFO because it lowers their tax liability.

C)In times of rising prices FIFO will produce a higher net income than moving average.

D)In time of rising prices FIFO produces an inventory cost per unit that is lower than the cost per unit of cost of goods sold.

A)The same costs per unit are assigned to the ending inventory and the cost of goods sold.

B)Companies prefer to use FIFO because it lowers their tax liability.

C)In times of rising prices FIFO will produce a higher net income than moving average.

D)In time of rising prices FIFO produces an inventory cost per unit that is lower than the cost per unit of cost of goods sold.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information for questions:

A company had the following inventory activity during January:

-If the company is using a perpetual system and the FIFO costing assumption, what is the ending inventory closest to?

A)$7,100

B)$7,350

C)$7,650

D)$7,920

A company had the following inventory activity during January:

-If the company is using a perpetual system and the FIFO costing assumption, what is the ending inventory closest to?

A)$7,100

B)$7,350

C)$7,650

D)$7,920

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information for questions:

A company had the following inventory activity during May:

-If the company uses a perpetual system and the FIFO cost flow assumption, what is the gross margin on the May 5 sale closest to?

A)$6,100

B)$8,100

C)$8,200

D)$8,550

A company had the following inventory activity during May:

-If the company uses a perpetual system and the FIFO cost flow assumption, what is the gross margin on the May 5 sale closest to?

A)$6,100

B)$8,100

C)$8,200

D)$8,550

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following cost flow assumptions would be most appropriate for costing an inventory of liquids stored in tanks?

A)Moving average

B)FIFO

C)Periodic

D)Perpetual

A)Moving average

B)FIFO

C)Periodic

D)Perpetual

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information for questions:

A company had the following inventory activity during January:

-The cost of goods available for sale was closest to:

A)$24,850

B)$25,500

C)$32,400

D)$32,850

A company had the following inventory activity during January:

-The cost of goods available for sale was closest to:

A)$24,850

B)$25,500

C)$32,400

D)$32,850

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

Effective inventory management would have one person place the order for new inventory, a second person check it against the purchase order when it arrives and a third person record the receipt of inventory in the accounting records.The purpose of this system is:

A)to reduce spoilage.

C)to guard against stock-outs.

D)to guard against internal theft and collusion.

E)to reduce storage costs.

A)to reduce spoilage.

C)to guard against stock-outs.

D)to guard against internal theft and collusion.

E)to reduce storage costs.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information for questions:

A company had the following inventory activity during January:

-If the company is using a perpetual system and the FIFO costing assumption, what is the cost of goods sold closest to?

A)$25,700

B)$25,500

C)$25,200

D)$25,930

A company had the following inventory activity during January:

-If the company is using a perpetual system and the FIFO costing assumption, what is the cost of goods sold closest to?

A)$25,700

B)$25,500

C)$25,200

D)$25,930

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements about the moving average cost assumption is true?

A)If prices are rising companies prefer it because it lowers their tax liability.

B)It is the most popular method in Canada.

C)In times of rising prices moving average will produce a higher net income than FIFO.

D)In time of rising prices moving average produces an inventory cost per unit that is higher than the cost per unit of cost of goods sold.

A)If prices are rising companies prefer it because it lowers their tax liability.

B)It is the most popular method in Canada.

C)In times of rising prices moving average will produce a higher net income than FIFO.

D)In time of rising prices moving average produces an inventory cost per unit that is higher than the cost per unit of cost of goods sold.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

Which cost flow assumption will produce the same results under both the periodic and perpetual inventory systems?

A)FIFO

B)Moving average

C)They both produce the same results.

D)They both produce different results.

A)FIFO

B)Moving average

C)They both produce the same results.

D)They both produce different results.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

Management incentives to overstate ending inventory include all of the following except:

A)increasing the current year's income.

B)increasing next year's income.

C)increasing the collateral value for a loan.

D)increasing the current ratio.

A)increasing the current year's income.

B)increasing next year's income.

C)increasing the collateral value for a loan.

D)increasing the current ratio.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

Use the following information for questions:

Berenger Industries had the following activity with one of its inventory items during the current period:

-Using a perpetual inventory system and the FIFO cost flow assumption, the ending inventory was valued at:

A)$500

B)$625

C)$720

D)$825

Berenger Industries had the following activity with one of its inventory items during the current period:

-Using a perpetual inventory system and the FIFO cost flow assumption, the ending inventory was valued at:

A)$500

B)$625

C)$720

D)$825

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

An inventory of grocery items where the shelves are stocked from the back would be similar to which cost flow assumption?

A)FIFO

B)Specific identification

C)Moving average

D)FISH

A)FIFO

B)Specific identification

C)Moving average

D)FISH

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

The acronym used to refer to ending inventory under the FIFO method is:

A)LISH

B)LISF

C)FISH

D)FISF

A)LISH

B)LISF

C)FISH

D)FISF

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following information for questions:

A company had the following inventory activity during January:

-If the company is using a perpetual system and the moving average costing assumption, what is the cost of goods sold closest to?

A)$24,380

B)$24,840

C)$25,459

D)$25,631

A company had the following inventory activity during January:

-If the company is using a perpetual system and the moving average costing assumption, what is the cost of goods sold closest to?

A)$24,380

B)$24,840

C)$25,459

D)$25,631

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

Use the following information for questions:

A company had the following inventory activity during May:

-If the company uses a perpetual system and the moving average cost flow assumption, what is the gross margin on the May 5 sale closest to?

A)$6,100

B)$8,100

C)$8,190

D)$8,550

A company had the following inventory activity during May:

-If the company uses a perpetual system and the moving average cost flow assumption, what is the gross margin on the May 5 sale closest to?

A)$6,100

B)$8,100

C)$8,190

D)$8,550

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

Use the following information for questions:

Berenger Industries had the following activity with one of its inventory items during the current period:

-Using a perpetual inventory system and the moving average cost flow assumption, the cost of goods sold for the October 11 sale was closest to:

A)$540

B)$420

C)$393

D)$370

Berenger Industries had the following activity with one of its inventory items during the current period:

-Using a perpetual inventory system and the moving average cost flow assumption, the cost of goods sold for the October 11 sale was closest to:

A)$540

B)$420

C)$393

D)$370

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

Use of the FIFO cost flow assumption means that:

A)the perpetual costing system is used.

B)the ending inventory contains the oldest costs.

C)the periodic costing system is used.

D)the ending inventory contains the most recent costs.

A)the perpetual costing system is used.

B)the ending inventory contains the oldest costs.

C)the periodic costing system is used.

D)the ending inventory contains the most recent costs.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

Use the following information for questions:

A company had the following inventory activity during January:

-If the company is using a perpetual system and the moving average costing assumption, what is the ending inventory closest to?

A)$8,470

B)$7,777

C)$7,560

D)$7,391

A company had the following inventory activity during January:

-If the company is using a perpetual system and the moving average costing assumption, what is the ending inventory closest to?

A)$8,470

B)$7,777

C)$7,560

D)$7,391

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

Use the following information for questions:

A company had the following inventory activity during May:

-If the company uses a perpetual system and the FIFO cost flow assumption, what is the gross margin for the month closest to:

A)$12,100

B)$16,200

C)$16,300

D)$17.100

A company had the following inventory activity during May:

-If the company uses a perpetual system and the FIFO cost flow assumption, what is the gross margin for the month closest to:

A)$12,100

B)$16,200

C)$16,300

D)$17.100

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

Francine Ltd.had beginning inventory of $10,000 and purchased $75,000 during 2011.The company had sales of $90,000 and has traditionally had a cost-to-sales ratio of 75%.Using the gross margin estimation method, the company estimates its ending inventory to be:

A)$67,500

B)$65,000

C)$17,500

D)$22,500

A)$67,500

B)$65,000

C)$17,500

D)$22,500

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

Jordan Company has a normal markup of 40%.Its cost-to-sales ratio is:

A)71.4%

B)67.5%

C)60%

D)Cannot be calculated

A)71.4%

B)67.5%

C)60%

D)Cannot be calculated

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

Blarney Ltd.had a fire at its warehouse and was trying to determine the cost of the inventory lost.For the year to date sales had been $525,000, opening inventory was $25,000, purchases to date were $198,000, the cost-to-sales ratio is normally 60%.Inventory not damaged in the fire was $18,000.What was the cost of the inventory damaged in the fire?

A)$110,000

B)$124,000

C)$160,000

D)$74,000

A)$110,000

B)$124,000

C)$160,000

D)$74,000

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

In 2011 Borger Inc.had beginning inventory of $106,000, purchases of $1,126,500, ending inventory of $116,000, accounts payable of $49,605, and sales of $2,147,250.Inventory turnover for 2011 was closest to:

A)9.625

B)10.06

C)10.15

D)10.53

A)9.625

B)10.06

C)10.15

D)10.53

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck