Deck 16: Partnership Liquidation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/45

Play

Full screen (f)

Deck 16: Partnership Liquidation

1

Which of the following statements is correct?

1)Personal creditors have first claim on partnership assets.

2)Partnership creditors have first claim on partnership assets.

3)Partnership creditors have first claim on personal assets.

A)1

B)2

C)3

D)Both 2 and 3

1)Personal creditors have first claim on partnership assets.

2)Partnership creditors have first claim on partnership assets.

3)Partnership creditors have first claim on personal assets.

A)1

B)2

C)3

D)Both 2 and 3

B

2

Shrek, Donkey, and Fiona are partners in SDF and share profits and losses in the ratio of 5:3:2, respectively.The partnership has cash of $10,000 and noncash assets of $90,000 when they decide to liquidate.Liabilities at the time of liquidation are $40,000, including a note payable to Fiona of $5,000.The partner capital accounts are Shrek $40,000, Donkey $ 15,000 and Fiona $5,000.The non-cash assets of the partnership were sold for $26,000.The liabilities other than the note payable to Fiona are paid.Fiona is personally insolvent.Shrek and Donkey and not insolvent.Under the circumstances:

A)Shrek will receive a distribution in liquidation of $8,000.

B)Fiona will be required to contribute $2,800 to the partnership.

C)Shrek will receive a distribution in liquidation of $6,250.

D)Donkey will be required to contribute $4,200 to the partnership.

A)Shrek will receive a distribution in liquidation of $8,000.

B)Fiona will be required to contribute $2,800 to the partnership.

C)Shrek will receive a distribution in liquidation of $6,250.

D)Donkey will be required to contribute $4,200 to the partnership.

C

3

If a partner with a debit capital balance during liquidation is personally solvent, the

A)partner must invest additional assets in the partnership.

B)partner's debit balance will be allocated to the other partners.

C)other partners will give the partner enough cash to absorb the debit balance.

D)partnership will loan the partner enough cash to absorb the debit balance. 8.

A)partner must invest additional assets in the partnership.

B)partner's debit balance will be allocated to the other partners.

C)other partners will give the partner enough cash to absorb the debit balance.

D)partnership will loan the partner enough cash to absorb the debit balance. 8.

A

4

The partnership of Mick, Keith, and Charlie has been dissolved and is in the process of liquidation.On July 1, 2014, just before the second cash distribution, the assets and equities of the partnership along with residual profit sharing ratios were as follows: Assume that the available cash is distributed immediately, except for a $25,000 contingency fund that is withheld pending complete liquidation of the partnership.How much cash should be paid to each of the partners?

Mick Keith Charlie

A)$87,500 $52,500 $35,000

B)12,500 7,500 10,000

C)- 0 - 25,000 - 0 -

D)- 0 - 15,000 10,000

Mick Keith Charlie

A)$87,500 $52,500 $35,000

B)12,500 7,500 10,000

C)- 0 - 25,000 - 0 -

D)- 0 - 15,000 10,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

5

The first step in preparing an advance cash distribution plan is to

A)determine the order in which partners are to participate in cash distributions.

B)compute the amount of cash each partner is to receive as it becomes available for distribution.

C)allocate any gains (losses) to the partners in their profit-sharing ratio.

D)determine the net capital interest of each partner.

A)determine the order in which partners are to participate in cash distributions.

B)compute the amount of cash each partner is to receive as it becomes available for distribution.

C)allocate any gains (losses) to the partners in their profit-sharing ratio.

D)determine the net capital interest of each partner.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

6

X, Y, and Z have capital balances of $90,000, $60,000, and $30,000, respectively.Profits are allocated 35% to X, 35% to Y, and 30% to Z.The partners have decided to dissolve and liquidate the partnership.After paying all creditors, the amount available for distribution is $60,000.X, Y, and Z are all personally solvent.Under the circumstances, Z will

A)receive $18,000.

B)receive $30,000.

C)personally have to contribute an additional $6,000.

D)personally have to contribute an additional $36,000.

A)receive $18,000.

B)receive $30,000.

C)personally have to contribute an additional $6,000.

D)personally have to contribute an additional $36,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

7

The ABC partnership has the following capital accounts on its books at December 31, 2014: All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $400,000, the partners should receive as a final payment:

A)A, $304,000; B, $176,000; C, $80,000

B)A, $256,000; B, $144,000; C, $-0-

C)A, $304,000; B, $176,000; C, $-0-

D)A, $120,000; B, $80,000; C, $200,000

A)A, $304,000; B, $176,000; C, $80,000

B)A, $256,000; B, $144,000; C, $-0-

C)A, $304,000; B, $176,000; C, $-0-

D)A, $120,000; B, $80,000; C, $200,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

8

Gilligan, Skipper, and Professor are partners with a profit and loss ratio of 4:3:3.The partnership was liquidated and, prior to the liquidation process, the partnership balance sheet was as follows: \begin{array}{c} \text { GILLIIGAN, SKIPPER, AND PROFESSOR}\\ \text { Balance Sheet}\\ \text { January 1, 2014}\\\\\\begin{array}{lll} \text { Assets}\\ \text { Cash}&\$60,000\\ \text { Other assets}&540,000\\&\underline{\quad\quad}\\ \text { Total Assets}&\$600,000\end{array}\begin{array}{lll}\text {Liabilities and Equity}\\\text {Gilligan, Capital}&\$216,000\\\text {Skipper, Capital}&240,000\\\text {Professor, Capital}&144,000\\\text {Total Liabilities \& Equities}&\$600,000\end{array}\end{array}

After the partnership was liquidated and the cash was distributed, Skipper received $96,000 in cash in full settlement of his interest.

The liquidation loss must have been:

A)$360,000

B)$144,000

C)$504,000

D)$480,000

After the partnership was liquidated and the cash was distributed, Skipper received $96,000 in cash in full settlement of his interest.

The liquidation loss must have been:

A)$360,000

B)$144,000

C)$504,000

D)$480,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

9

Under the Uniform Partnership Act

A)partnership creditors have first claim (Rank I) against the assets of an insolvent partnership.

B)personal creditors of an individual partner have first claim (Rank I) against the personal assets of all partners.

C)partners with credit capital balances share (Rank I) the personal assets of an insolvent partner that has a debit capital balance with personal creditors of that partner.

D)personal creditors of the partners of an insolvent partnership share partnership assets on a pro rata basis (Rank I) with partnership creditors.

A)partnership creditors have first claim (Rank I) against the assets of an insolvent partnership.

B)personal creditors of an individual partner have first claim (Rank I) against the personal assets of all partners.

C)partners with credit capital balances share (Rank I) the personal assets of an insolvent partner that has a debit capital balance with personal creditors of that partner.

D)personal creditors of the partners of an insolvent partnership share partnership assets on a pro rata basis (Rank I) with partnership creditors.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

10

In a partnership liquidation, the final cash distribution to the partners should be made in accordance with the:

A)partners' profit and loss sharing ratio.

B)balances of the partners' capital accounts.

C)ratio of the capital contributions by the partners.

D)ratio of capital contributions less withdrawals by the partners.

A)partners' profit and loss sharing ratio.

B)balances of the partners' capital accounts.

C)ratio of the capital contributions by the partners.

D)ratio of capital contributions less withdrawals by the partners.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

11

In an advance plan for installment distributions of cash to partners of a liquidating partnership, each partner's loss absorption potential is computed by

A)dividing each partner's capital account balance by the percentage of that partner's capital account balance to total partners' capital.

B)multiplying each partner's capital account balance by the percentage of that partner's capital account balance to total partners' capital.

C)dividing the total of each partner's capital account less receivables from the partner plus payables to the partner by the partner's profit and loss percentage.

D)some other method.

A)dividing each partner's capital account balance by the percentage of that partner's capital account balance to total partners' capital.

B)multiplying each partner's capital account balance by the percentage of that partner's capital account balance to total partners' capital.

C)dividing the total of each partner's capital account less receivables from the partner plus payables to the partner by the partner's profit and loss percentage.

D)some other method.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

12

A schedule prepared each time cash is to be distributed is called a(n)

A)advance cash distribution schedule.

B)marshaling of assets schedule.

C)loss absorption potential schedule.

D)safe payment schedule.

A)advance cash distribution schedule.

B)marshaling of assets schedule.

C)loss absorption potential schedule.

D)safe payment schedule.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

13

During the liquidation of the partnership of Karr, Rice, and Long.Karr accepts, in partial settlement of his interest, a machine with a cost to the partnership of $150,000, accumulated depreciation of $70,000, and a current fair value of $110,000.The partners share net income and loss equally.The net debit to Karr's account (including any gain or loss on disposal of the machine) is

A)$90,000.

B)$100,000.

C)$110,000.

D)$150,000.

A)$90,000.

B)$100,000.

C)$110,000.

D)$150,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

14

An advance cash distribution plan is prepared

A)each time cash is distributed to partners in an installment liquidation.

B)each time a partnership asset is sold in an installment liquidation.

C)to determine the order and amount of cash each partner will receive as it becomes available for distribution.

D)none of these.

A)each time cash is distributed to partners in an installment liquidation.

B)each time a partnership asset is sold in an installment liquidation.

C)to determine the order and amount of cash each partner will receive as it becomes available for distribution.

D)none of these.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

15

The summarized balances of the accounts of MNO partnership on December 31, 2014, are as follows: The agreed upon profit/loss ratio is 50:40:10, respectively.Using the information given above, which one of the following amounts, if any, is the loss absorption potential of partner N as of December 31, 2014?

A)$20,000

B)$35,000

C)$75,000

D)$120,000

A)$20,000

B)$35,000

C)$75,000

D)$120,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

16

The first step in the liquidation process is to

A)convert noncash assets into cash.

B)pay partnership creditors

C)compute any net income (loss) up to the date of dissolution.

D)allocate any gains or losses to the partners.

A)convert noncash assets into cash.

B)pay partnership creditors

C)compute any net income (loss) up to the date of dissolution.

D)allocate any gains or losses to the partners.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

17

Offsetting a partner's loan balance against his debit capital balance is referred to as the

A)marshaling of assets.

B)right of offset.

C)allocation of assets.

D)liquidation of assets.

A)marshaling of assets.

B)right of offset.

C)allocation of assets.

D)liquidation of assets.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

18

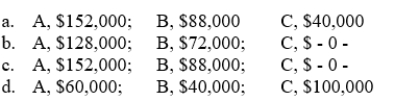

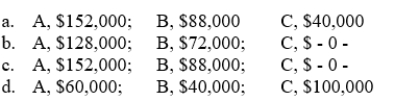

The partnership of Mick, Keith, and Charlie has been dissolved and is in the process of liquidation.On July 1, 2014, just before the second cash distribution, the assets and equities of the partnership along with residual profit sharing ratios were as follows: Assume that Mick takes equipment with a fair value of $40,000 and a book value of $50,000 in partial satisfaction of his equity in the partnership.If all the $200,000 cash is then distributed, the partners should receive:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

19

The partnership of Larry, Moe, and Curly shares profits and losses 60%, 30%, and 10%, respectively.On January 1, 2014, the partners voted to dissolve the partnership, at which time the assets, liabilities, and capital balances were as follows: All of the partners are personally insolvent.

Assume that all noncash assets are sold for $840,000 and all available cash is distributed in final liquidation of the partnership.Cash should be distributed to the partners as follows

A)Larry, $744,000; Moe, $372,000; Curly, $124,000.

B)Larry, $440,000; Moe, $380,000; Curly, $200,000.

C)Larry, $224,000; Moe, $272,000; Curly, $164,000.

D)Larry, $396,000; Moe, $198,000; Curly, $66,000.

Assume that all noncash assets are sold for $840,000 and all available cash is distributed in final liquidation of the partnership.Cash should be distributed to the partners as follows

A)Larry, $744,000; Moe, $372,000; Curly, $124,000.

B)Larry, $440,000; Moe, $380,000; Curly, $200,000.

C)Larry, $224,000; Moe, $272,000; Curly, $164,000.

D)Larry, $396,000; Moe, $198,000; Curly, $66,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

20

The partnership of Peter, Paul, and Mary share profits and losses in the ratio of 4:4:2, respectively.The partners voted to dissolve the partnership when its assets, liabilities, and capital were as follows: The partnership will be liquidated over a prolonged period of time.As cash is available, it will be distributed to the partners.The first sale of noncash assets having a book value of $600,000 realized $475,000.How much cash should be distributed to each partner after this sale?

A)Peter, $90,000; Paul, $140,000; Mary, $295,000

B)Peter, $210,000; Paul, $290,000; Mary, $145,000

C)Peter, $290,000; Paul, $210,000; Mary, $105,000

D)Peter, $150,000; Paul, $175,000; Mary, $200,000

A)Peter, $90,000; Paul, $140,000; Mary, $295,000

B)Peter, $210,000; Paul, $290,000; Mary, $145,000

C)Peter, $290,000; Paul, $210,000; Mary, $105,000

D)Peter, $150,000; Paul, $175,000; Mary, $200,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

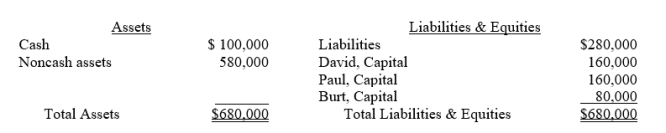

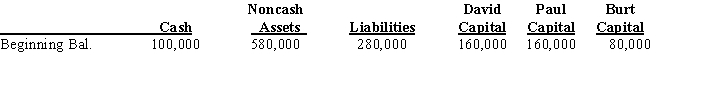

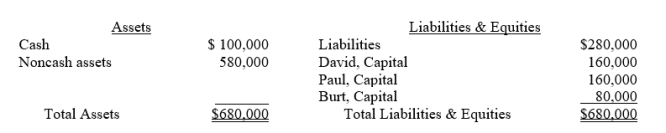

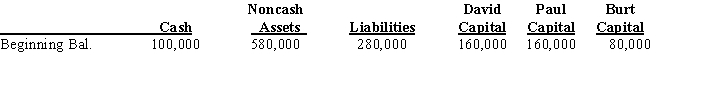

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively.Immediately prior to liquidation, the following balance sheet was prepared:

Required:

Assuming the noncash assets are sold for $160,000, determine the amount of cash to be distributed to each partner assuming all partners are personally solvent.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.

Required:

Assuming the noncash assets are sold for $160,000, determine the amount of cash to be distributed to each partner assuming all partners are personally solvent.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

22

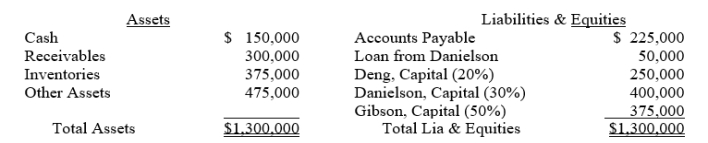

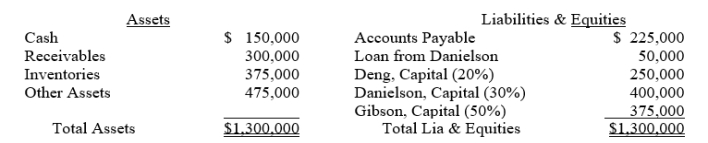

The December 31, 2013, balance sheet of the Deng, Danielson, and Gibson partnership, along with the partners' residual profit and loss sharing ratios, is summarized as follows:

The partners agree to liquidate their partnership as soon as possible after January 1, 2014 and to distribute all cash as it becomes available.

Required:

Prepare an advance cash distribution plan to show how cash will be distributed as it becomes available.

The partners agree to liquidate their partnership as soon as possible after January 1, 2014 and to distribute all cash as it becomes available.

Required:

Prepare an advance cash distribution plan to show how cash will be distributed as it becomes available.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

23

To what extent can personal creditors seek re-covery from partnership assets?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

24

Lennon, Newman, and Ott operate the LNO Partnership.The partnership agreement provides that the partners share profits in the ratio of 40:40:20, respectively.Unable to satisfy the firm's debts, the partners decide to liquidate.Account balances just prior to the start of the liquidation process are as follows:

During the first month of liquidation, other assets with a book value of $150,000 are sold for $165,000, and creditors are paid.In the following month unrecorded liabilities of $12,000 are discovered and assets carried on the books at a cost of $90,000 are sold for $36,000.During the third month the remaining other assets are sold for $42,000 and all available cash is distributed.

Required:

Prepare a schedule of partnership realization and liquidation.A safe distribution of cash is to be made at the end of the second and third months.The partners agreed to hold $30,000 in cash in reserve to provide for possible liquidation expenses and/or unrecorded liabilities.All of the partners are personally insolvent.

During the first month of liquidation, other assets with a book value of $150,000 are sold for $165,000, and creditors are paid.In the following month unrecorded liabilities of $12,000 are discovered and assets carried on the books at a cost of $90,000 are sold for $36,000.During the third month the remaining other assets are sold for $42,000 and all available cash is distributed.

Required:

Prepare a schedule of partnership realization and liquidation.A safe distribution of cash is to be made at the end of the second and third months.The partners agreed to hold $30,000 in cash in reserve to provide for possible liquidation expenses and/or unrecorded liabilities.All of the partners are personally insolvent.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

The trial balance for the ABC Partnership is as follows just before liquidation:

Partners share profits a 50:30:20 ratio.

Required:

Prepare an advance cash distribution plan showing how available cash would be distributed.

Partners share profits a 50:30:20 ratio.

Required:

Prepare an advance cash distribution plan showing how available cash would be distributed.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

26

Why does a debit balance in a partners' capital account create in the UPA order of payment for a partnership liquidation?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

27

The summarized balances of the accounts of RST partnership on December 31, 2014, are as follows:

The agreed upon profit/loss ratio is 50:40:10, respectively.Using the information given above, which one of the following amounts, if any, is the loss absorption potential of partner S as of December 31, 2014?

A)$60,000

B)$70,000

C)$150,000

D)$240,000

The agreed upon profit/loss ratio is 50:40:10, respectively.Using the information given above, which one of the following amounts, if any, is the loss absorption potential of partner S as of December 31, 2014?

A)$60,000

B)$70,000

C)$150,000

D)$240,000

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

28

The partnership of Stan, Kenney, and Cartman has been dissolved and is in the process of liquidation.On July 1, 2014, just before the second cash distribution, the assets and equities of the partnership along with residual profit sharing ratios were as follows:

Assume that the available cash is distributed immediately, except for a $10,000 contingency fund that is withheld pending complete liquidation of the partnership.How much cash should be paid to each of the partners?

A)

B)

C)

D)

Assume that the available cash is distributed immediately, except for a $10,000 contingency fund that is withheld pending complete liquidation of the partnership.How much cash should be paid to each of the partners?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

29

A trial balance for the DEF partnership just prior to liquidation is given below:

The partners share income and loss on the following basis:

Dugan 50%

Elston 30%

Flynn 20%

Required:

Prepare an advance cash distribution plan for the partners.

The partners share income and loss on the following basis:

Dugan 50%

Elston 30%

Flynn 20%

Required:

Prepare an advance cash distribution plan for the partners.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

30

Is it important to maintain separate accounts for a partner's outstanding loan and capital ac-counts? Explain why or why not.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

31

The ABC partnership has the following capital accounts on its books at December 31, 2014:  All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $150,000, the partners should receive as a final payment:

All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $150,000, the partners should receive as a final payment:

All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $150,000, the partners should receive as a final payment:

All liabilities have been liquidated and the cash balance is zero.None of the partners have personal assets in excess of his personal liabilities.The partners share profits and losses in the ratio of 3:2:5.If the noncash assets are sold for $150,000, the partners should receive as a final payment:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

32

The Uniform Partnership Act specifies specific steps in distributing available partnership assets in liquidation.Describe the steps used to distribute partnership assets during the liquidation process.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

33

In what manner should the final cash distribution be made in partnership liquidation?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

What is "marshaling of assets"?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

Due to the fact that the partnership had been unprofitable for the past several years, A, B, C, and D decided to liquidate their partnership.The partners share profits and losses in the ratio of 40:30:20:10, respectively.The following balance sheet was prepared immediately before the liquidation process began:

The personal status of each partner is as follows:

The partnership's other assets are sold for $100,000 cash.The partnership operates in a state which has adopted the Uniform Partnership Act.

Required:

A.Complete the following schedule of partnership realization and liquidation.Assume that a partner makes additional contributions to the partnership when appropriate based on their individual status.

B.Complete the following schedule to show the total amount that will be paid to the personal creditors.

A

B

C

D

The personal status of each partner is as follows:

The partnership's other assets are sold for $100,000 cash.The partnership operates in a state which has adopted the Uniform Partnership Act.

Required:

A.Complete the following schedule of partnership realization and liquidation.Assume that a partner makes additional contributions to the partnership when appropriate based on their individual status.

B.Complete the following schedule to show the total amount that will be paid to the personal creditors.

A

B

C

D

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

36

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively.Immediately prior to liquidation, the following balance sheet was prepared:

Required:

Assuming the noncash assets are sold for $300,000, determine the amount of cash to be distributed to each partner.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.No cash is available from any of the three partners.

Required:

Assuming the noncash assets are sold for $300,000, determine the amount of cash to be distributed to each partner.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.No cash is available from any of the three partners.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

During a liquidation, at which point may cash be distributed to any of the partners?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

38

Discuss the possible outcomes in the situation where the equity interest of one partner is inadequate to absorb realization losses.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

39

The NOR Partnership is being liquidated.A balance sheet prepared prior to liquidation is presented below:

Nutt, Ohm, and Rice share profits and losses in a 40:40:20 ratio.All partners are personally insolvent.

Required:

A.Prepare the journal entries necessary to record the distribution of the available cash.

B.Prepare the journal entries necessary to record the completion of the liquidation process, assuming the other assets are sold for $120,000.

Nutt, Ohm, and Rice share profits and losses in a 40:40:20 ratio.All partners are personally insolvent.

Required:

A.Prepare the journal entries necessary to record the distribution of the available cash.

B.Prepare the journal entries necessary to record the completion of the liquidation process, assuming the other assets are sold for $120,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

40

Why are realization gains or losses allocated to partners in their profit and loss ratios?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

41

Discuss the three basic assumptions necessary for calculating a safe cash distribution.How is this safe cash distribution computed?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

42

What is the objective of the procedures used for the preparation of an advance cash distribution plan?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

43

In an installment liquidation, why should the partners view each cash distribution as if it were the final distribution?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

44

How are unexpected costs such as liquidation expenses, disposal costs, or unrecorded liabilities covered in the safe distribution schedule?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

45

What is the "loss absorption potential"?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck