Deck 18: Accounting for Private Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 18: Accounting for Private Not-For-Profit Organizations

1

In a not-for-profit organization, depreciation on capital assets is recognized on all but which of the following?

A)contributed assets.

B)building.

C)equipment.

D)historical treasures.

A)contributed assets.

B)building.

C)equipment.

D)historical treasures.

D

Land and individual works of art or historical treasures that have an extraordinarily long life are not depreciated.

Land and individual works of art or historical treasures that have an extraordinarily long life are not depreciated.

2

Which of the following is not true about accounting for investments that are included in permanently restricted net assets?

A)They should be reported at amortized cost or lower of cost or market.

B)Earnings are reported as unrestricted if the donors have not specified otherwise.

C)They are referred to as endowment investments.

D)There is no requirement to classify investments into trading, available for sale and held to maturity categories.

A)They should be reported at amortized cost or lower of cost or market.

B)Earnings are reported as unrestricted if the donors have not specified otherwise.

C)They are referred to as endowment investments.

D)There is no requirement to classify investments into trading, available for sale and held to maturity categories.

A

Investments held by a not-for-profit organization should be reported at fair value.

Investments held by a not-for-profit organization should be reported at fair value.

3

Which of the following would fall under the jurisdiction of the GASB rather than the FASB?

A)The American Cancer Society.

B)The Ohio State University.

C)The Metropolitan Museum of Art.

D)St. Jude's Children's Hospital.

A)The American Cancer Society.

B)The Ohio State University.

C)The Metropolitan Museum of Art.

D)St. Jude's Children's Hospital.

B

The Ohio State University is a public university, therefore, GASB would have jurisdiction over its accounting and financial reporting.

The Ohio State University is a public university, therefore, GASB would have jurisdiction over its accounting and financial reporting.

4

Which of the following is not a required characteristic of a private not-for-profit organization per the definition given by the AICPA?

A)no owners or shareholders

B)an operating purpose other than making a profit

C)an organization dedicated to service of the public good

D)Significant contributions from providers who do not expect reciprocal goods or services in return

A)no owners or shareholders

B)an operating purpose other than making a profit

C)an organization dedicated to service of the public good

D)Significant contributions from providers who do not expect reciprocal goods or services in return

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

A major corporation makes a donation of $10,000,000 to the local art museum foundation for the construction of a new art museum provided the community can match the $10,000,000 with other donations. This is an example of a(n):

A)Unconditional Pledge

B)Unrestricted Contribution

C)Conditional Pledge

D)Endowment

A)Unconditional Pledge

B)Unrestricted Contribution

C)Conditional Pledge

D)Endowment

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

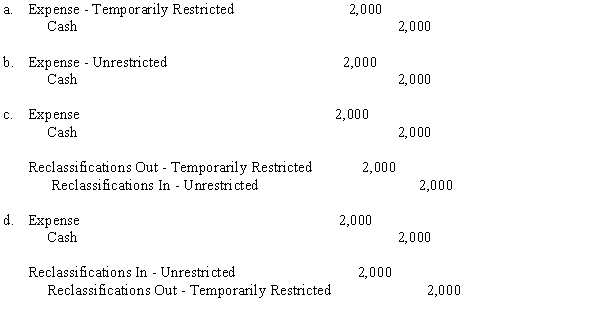

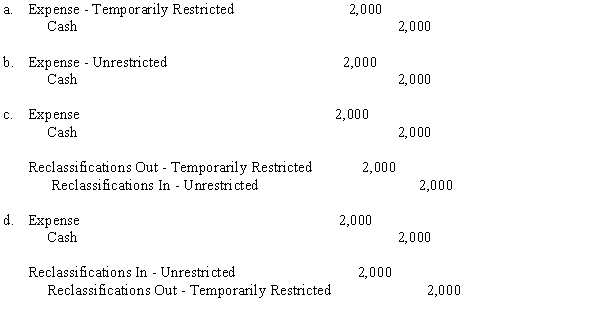

Rho Pi Phi Fraternity received a $2,000 donation from an alumnus who stipulated the funds be spent to provide a scholarship for a current member. The funds were spent as stipulated. The entry or entries to record the expense are:

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

Alice makes a cash gift which has no strings attached to a political party. It is recorded as:

A)An Endowment.

B)Revenue-Unrestricted Contribution.

C)Revenue-Temporarily Restricted Contribution.

D)An increase in the fund balance of the General Fund.

A)An Endowment.

B)Revenue-Unrestricted Contribution.

C)Revenue-Temporarily Restricted Contribution.

D)An increase in the fund balance of the General Fund.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

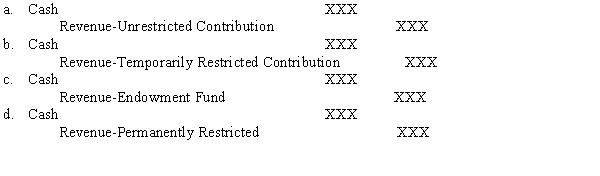

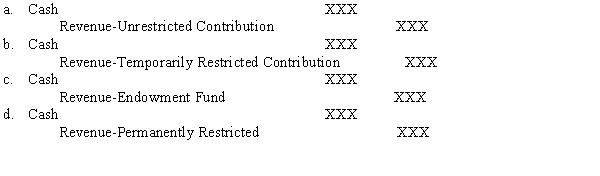

Atlee makes a cash gift to a not-for-profit local ballet company which is designated by the donor to buy costumes for a new ballet staging. It should be accounted for with the following journal entry:

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

A major corporation makes a donation of $10,000,000 to the local art museum foundation for the construction of a new art museum provided the community can match the $10,000,000 with other donations. At the time the donation is received, it should be recorded as:

A)Contribution Revenue - Temporarily Restricted

B)Contribution Revenue - Unrestricted with a corresponding entry to Provision for Uncollectible Contributions

C)Plant Fund Assets

D)Refundable Advance

A)Contribution Revenue - Temporarily Restricted

B)Contribution Revenue - Unrestricted with a corresponding entry to Provision for Uncollectible Contributions

C)Plant Fund Assets

D)Refundable Advance

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not true about multi-year pledges or pledges payable in the future?

A)The pledges are recorded as unrestricted if the donor has not stipulated any restrictions.

B)The pledges are recorded at their present value.

C)The pledges are treated as temporarily restricted revenue.

D)An allowance for doubtful contributions should be established based on historical expenses.

A)The pledges are recorded as unrestricted if the donor has not stipulated any restrictions.

B)The pledges are recorded at their present value.

C)The pledges are treated as temporarily restricted revenue.

D)An allowance for doubtful contributions should be established based on historical expenses.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

Donated services are recognized as a contribution if:

A)they create or enhance nonfinancial assets.

B)they require specialized skills and the individuals performing the donated service possess those skills.

C)the organization would otherwise purchase the service.

D)All of the above are correct.

A)they create or enhance nonfinancial assets.

B)they require specialized skills and the individuals performing the donated service possess those skills.

C)the organization would otherwise purchase the service.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

Contribution of a work of art to a museum for public exhibit would

A)be recognized as a contribution at fair market value.

B)be recognized as operating revenue based upon admission fees.

C)be recognized as an asset subject to depreciation.

D)not be recognized as a contribution.

A)be recognized as a contribution at fair market value.

B)be recognized as operating revenue based upon admission fees.

C)be recognized as an asset subject to depreciation.

D)not be recognized as a contribution.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

Government grants that require performance by the not-for-profit organization will be accounted for as:

A)Revenue-Unrestricted

B)Liabilities until earned, then Revenue-Unrestricted

C)Revenue-Temporarily Unrestricted

D)Endowments

A)Revenue-Unrestricted

B)Liabilities until earned, then Revenue-Unrestricted

C)Revenue-Temporarily Unrestricted

D)Endowments

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

Currently, which of the following has jurisdiction over accounting and financial reporting standards for voluntary health and welfare organizations?

A)The Governmental Accounting Standards Board

B)The Financial Accounting Standards Board

C)American Institute of Certified Public Accountants

D)The Not-for-Profit Accounting Board

A)The Governmental Accounting Standards Board

B)The Financial Accounting Standards Board

C)American Institute of Certified Public Accountants

D)The Not-for-Profit Accounting Board

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

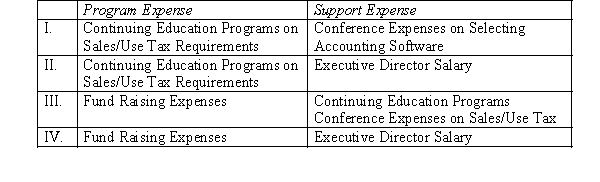

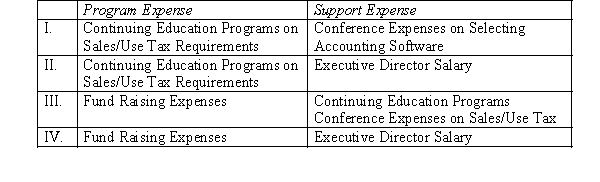

The local chapter of a CPA association, a not-for-profit organization, separate their expenses between program functions and support functions. Which of the following denote a proper classification of expenses?

A)I.

B)II.

C)III.

D)IV.

A)I.

B)II.

C)III.

D)IV.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

The Brown Museum of Art would need to recognize a contributed work of art as contribution revenue if it was:

A)displayed with its Impressionism Collection.

B)to be auctioned to raise funds to expand the gift shop.

C)used for its educational outreach program that teaches children to paint.

D)sold to purchase an item for its Modern Collection.

A)displayed with its Impressionism Collection.

B)to be auctioned to raise funds to expand the gift shop.

C)used for its educational outreach program that teaches children to paint.

D)sold to purchase an item for its Modern Collection.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

A temporary restriction expires when:

A)the stipulated time has elapsed.

B)the stipulated purpose has been fulfilled.

C)the useful life of donated assets has ended.

D)All of the above.

A)the stipulated time has elapsed.

B)the stipulated purpose has been fulfilled.

C)the useful life of donated assets has ended.

D)All of the above.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

A contribution made in 20X3 to a not-for-profit organization, which is restricted to usage to in the organization's 50th anniversary year in 20X5, is recorded as a credit to:

A)Contributions.

B)Revenue--unrestricted.

C)Revenue--temporarily restricted.

D)Revenue--permanently restricted.

A)Contributions.

B)Revenue--unrestricted.

C)Revenue--temporarily restricted.

D)Revenue--permanently restricted.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

Reclassifying net assets from temporarily restricted to unrestricted:

A)is done when the unrestricted net assets fall below a predetermined threshold.

B)matches the net assets to the expenses they support.

C)does not require a formal journal entry.

D)may be done at the organization's discretion when an expense is incurred for a purpose for which both restricted and unrestricted net assets are available.

A)is done when the unrestricted net assets fall below a predetermined threshold.

B)matches the net assets to the expenses they support.

C)does not require a formal journal entry.

D)may be done at the organization's discretion when an expense is incurred for a purpose for which both restricted and unrestricted net assets are available.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

On the financial statements of a not-for-profit organization, the term that refers to the accumulated excess of revenues over expenses is:

A)Retained surplus.

B)Fund balance.

C)Net assets.

D)Net equity.

A)Retained surplus.

B)Fund balance.

C)Net assets.

D)Net equity.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

Public support for a voluntary health and welfare organization includes:

A)news articles about the organization.

B)banners and promotional materials.

C)legacies and bequests.

D)celebrity endorsements.

A)news articles about the organization.

B)banners and promotional materials.

C)legacies and bequests.

D)celebrity endorsements.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

Voluntary health and welfare organizations prepare a Statement of Activities which displays program and supporting services costs. Program expenses for a cancer society would include:

A)fund-raising costs

B)chief executive officer salary

C)program costs of cancer research

D)brochures for prospective members

A)fund-raising costs

B)chief executive officer salary

C)program costs of cancer research

D)brochures for prospective members

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

Assume that investments in an Endowment Fund are being carried at market value. The annual net appreciation of investments should:

A)not be recognized until realized.

B)be recorded as investment revenue.

C)be recorded as deferred revenue.

D)be credited directly to the Endowment Fund Balance.

A)not be recognized until realized.

B)be recorded as investment revenue.

C)be recorded as deferred revenue.

D)be credited directly to the Endowment Fund Balance.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following items are considered special events support for a voluntary health and welfare organization?

A)bingo games and bake sales

B)a donated painting

C)donated stock in a publicly traded company

D)bequest of a building

A)bingo games and bake sales

B)a donated painting

C)donated stock in a publicly traded company

D)bequest of a building

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

The American Heart Association is having its annual Heart Ball. The ball is an on-going event and a major annual event for the association. Any promotional costs of the ball are considered:

A)Cost of Special Events

B)Operating Expenses

C)Fund Raising Expenses

D)None of the above

A)Cost of Special Events

B)Operating Expenses

C)Fund Raising Expenses

D)None of the above

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

Recently revised accounting standards for mergers and acquisitions of not-for-profit organizations:

A)require the recognition of goodwill for all acquisitions.

B)allows for a different methods of accounting for mergers than for acquisitions.

C)stipulate a new not-for-profit entity is created whenever there is a combination of two organizations.

D)allow the purchase method of accounting in certain situations.

A)require the recognition of goodwill for all acquisitions.

B)allows for a different methods of accounting for mergers than for acquisitions.

C)stipulate a new not-for-profit entity is created whenever there is a combination of two organizations.

D)allow the purchase method of accounting in certain situations.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

Hargett Heart Association has received donated services from several members of the community. The controller must determine which should be recorded as contribution revenue. The services and their values follow:

1) A retired biology professor conducted two small research projects, which resulted in the organization receiving a major grant, but did not accept a stipend for either. The stipend is usually $2,000 per project.

2) Local high school students participated in "Clean Up the Neighborhood" Day and provided 100 hours of labor trimming hedges and raking leaves on the property. The controller estimates the going rate for such work is $8 per hour.

3) An architect donated plans for a renovation to one of the research labs. The association paid $5,000 for plans for a similar renovation two years ago.

How much contribution revenue should be recognized from donated services?

A)$9,800

B)$9,000

C)$5,800

D)$5,000

1) A retired biology professor conducted two small research projects, which resulted in the organization receiving a major grant, but did not accept a stipend for either. The stipend is usually $2,000 per project.

2) Local high school students participated in "Clean Up the Neighborhood" Day and provided 100 hours of labor trimming hedges and raking leaves on the property. The controller estimates the going rate for such work is $8 per hour.

3) An architect donated plans for a renovation to one of the research labs. The association paid $5,000 for plans for a similar renovation two years ago.

How much contribution revenue should be recognized from donated services?

A)$9,800

B)$9,000

C)$5,800

D)$5,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would appear in the Custodian (Agency) Funds of a voluntary health and welfare organization?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

The Statement of Functional Expenses:

A)provides a comparison of actual expenses to budgeted amounts.

B)is required for all not-for-profit organizations.

C)serves as the operating statement for a voluntary health and welfare organization.

D)shows program, fundraising and management and general expenses by their natural categories.

A)provides a comparison of actual expenses to budgeted amounts.

B)is required for all not-for-profit organizations.

C)serves as the operating statement for a voluntary health and welfare organization.

D)shows program, fundraising and management and general expenses by their natural categories.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

A donation was received by a voluntary health and welfare organization specifically to care for indigent patients. Which of the following should be used to record the gift?

A)Unrestricted Net Assets

B)Public Support--Unrestricted Contribution

C)Public Support--Temporarily Restricted Contributions

D)Revenues--Unrestricted

A)Unrestricted Net Assets

B)Public Support--Unrestricted Contribution

C)Public Support--Temporarily Restricted Contributions

D)Revenues--Unrestricted

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

Depreciation Expense is recorded in which of the following funds for a voluntary health and welfare organization electing to use fund accounting?

A)Current Unrestricted Fund

B)Plant Fund

C)Depreciation is recorded in both the Current Unrestricted and Plant funds.

D)Depreciation is not normally recorded by health and welfare organizations.

A)Current Unrestricted Fund

B)Plant Fund

C)Depreciation is recorded in both the Current Unrestricted and Plant funds.

D)Depreciation is not normally recorded by health and welfare organizations.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following financial statements is not required when reporting for a voluntary health and welfare organization?

A)Statement of Financial Position

B)Statement of Support, Revenue, Expenses and Changes in Fund Balances

C)Statement of Functional Expenses

D)Statement of Cash Flows

A)Statement of Financial Position

B)Statement of Support, Revenue, Expenses and Changes in Fund Balances

C)Statement of Functional Expenses

D)Statement of Cash Flows

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

A donation was received by a voluntary health and welfare organization of materials to be used in providing services. How would these donated materials be recorded?

A)As inventory

B)As restricted contributions

C)As assets held for resale

D)As contributed services

A)As inventory

B)As restricted contributions

C)As assets held for resale

D)As contributed services

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following expenses would be considered a program service expense for the local cancer society?

A)salary of a home care nurse

B)salary of the local director

C)rent for the local office

D)printing costs for a fund-raising brochure

A)salary of a home care nurse

B)salary of the local director

C)rent for the local office

D)printing costs for a fund-raising brochure

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following organizations would be classified as a voluntary health and welfare organization?

A)the local ballet company

B)the Sierra Foundation, an environmental organization

C)a private elementary school

D)a synagogue

A)the local ballet company

B)the Sierra Foundation, an environmental organization

C)a private elementary school

D)a synagogue

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

A CPA donates her services to prepare the annual financial report for a voluntary health and welfare organization. The services should be recorded as:

A)revenues-unrestricted.

B)accounting expenses.

C)a footnote disclosure in the financial report.

D)both a and b are correct.

A)revenues-unrestricted.

B)accounting expenses.

C)a footnote disclosure in the financial report.

D)both a and b are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

What is the proper method of carrying investments by a voluntary health and welfare organization?

A)cost

B)lower of cost or market

C)either cost or market if applied consistently

D)market value measured as of the financial statement date

A)cost

B)lower of cost or market

C)either cost or market if applied consistently

D)market value measured as of the financial statement date

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

Not-for-profit organizations recognize expenses:

A)when the expenditures are made.

B)by their natural classifications.

C)as decreases in unrestricted net assets.

D)None of the above.

A)when the expenditures are made.

B)by their natural classifications.

C)as decreases in unrestricted net assets.

D)None of the above.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

A voluntary welfare organization is permitted to use building facilities rent free. This should be recorded as:

A)a footnote in the financial statements disclosing the rent-free arrangement.

B)a contribution.

C)rent expense at the fair market value.

D)both b and c are correct.

A)a footnote in the financial statements disclosing the rent-free arrangement.

B)a contribution.

C)rent expense at the fair market value.

D)both b and c are correct.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not a required external financial statement for a not-for-profit organization?

A)Statement of Financial Position

B)Statement of Cash Flows

C)Statement of Activities

D)Income Statement

A)Statement of Financial Position

B)Statement of Cash Flows

C)Statement of Activities

D)Income Statement

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

Rapitown Arts Council provides financial support to a number of independent fine-art projects in the city. Data concerning several events follow:

a.During 20X5, a fund-raising drive yielded $100,000 in cash and $25,000 in pledges.

b.Based on past experience, 10% of the pledges are estimated to be uncollectible.

c.A July 4 art fair yielded $20,000 in gross revenue. The proceeds of the fair are considered unrestricted. The cost of the program was $8,000, paid in cash.

d.$22,000 of the pledges mentioned in part (a) are collected during the year.

e.The following expenses were paid: Required:Make the necessary entries to record the transactions.

Required:Make the necessary entries to record the transactions.

a.During 20X5, a fund-raising drive yielded $100,000 in cash and $25,000 in pledges.

b.Based on past experience, 10% of the pledges are estimated to be uncollectible.

c.A July 4 art fair yielded $20,000 in gross revenue. The proceeds of the fair are considered unrestricted. The cost of the program was $8,000, paid in cash.

d.$22,000 of the pledges mentioned in part (a) are collected during the year.

e.The following expenses were paid:

Required:Make the necessary entries to record the transactions.

Required:Make the necessary entries to record the transactions.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

The following events affected the Rapitown Arts Council:

a.Contributions of $20,000, restricted for use in the children's art program, are received.

b.Stocks with a book value of $10,000 and a fair market value of $11,000 were donated. The proceeds from the sale of the stocks are to be used by the local drama group.

c.A famous author lectured to high school students in the children's art program. The cost was $3,000 and was paid by the contributions from part (a).

d.The stock donated in part (b) is sold for $11,500.Required:Make the necessary journal entries.

a.Contributions of $20,000, restricted for use in the children's art program, are received.

b.Stocks with a book value of $10,000 and a fair market value of $11,000 were donated. The proceeds from the sale of the stocks are to be used by the local drama group.

c.A famous author lectured to high school students in the children's art program. The cost was $3,000 and was paid by the contributions from part (a).

d.The stock donated in part (b) is sold for $11,500.Required:Make the necessary journal entries.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

South City Shelter is a voluntary health and welfare organization that provides emergency shelter and health care for the homeless, as well as educational programs. South City Shelter incurred the following transactions:

a.A computer with a book value of $500 (original cost, $2,800) was sold for $650.

b.Kitchen equipment with a book value of $1,100 (original cost, $3,500) was damaged in a fire and taken to the dump.

c.Total depreciation for the year was $60,000.

d.To close the depreciation expense, it was determined that 70% should be allocated to the Shelter Program, 15% to the Education Program, and 15% to the Health Care Program.Required:Make the necessary journal entries to reflect the events.

a.A computer with a book value of $500 (original cost, $2,800) was sold for $650.

b.Kitchen equipment with a book value of $1,100 (original cost, $3,500) was damaged in a fire and taken to the dump.

c.Total depreciation for the year was $60,000.

d.To close the depreciation expense, it was determined that 70% should be allocated to the Shelter Program, 15% to the Education Program, and 15% to the Health Care Program.Required:Make the necessary journal entries to reflect the events.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

Gains and losses, in other than the first year, from pooled investments are distributed to participating funds based on:

A)cost of contributed assets at the time of original pooling.

B)market value of contributed assets at the time of original pooling.

C)market value at the time of any additions or withdrawals.

D)market value at the previous valuation date.

A)cost of contributed assets at the time of original pooling.

B)market value of contributed assets at the time of original pooling.

C)market value at the time of any additions or withdrawals.

D)market value at the previous valuation date.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

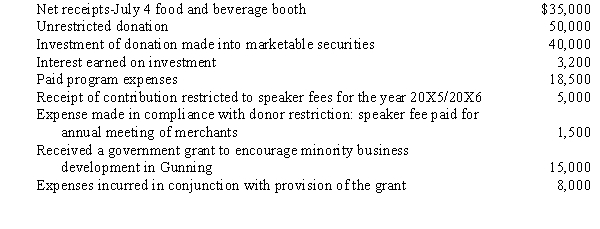

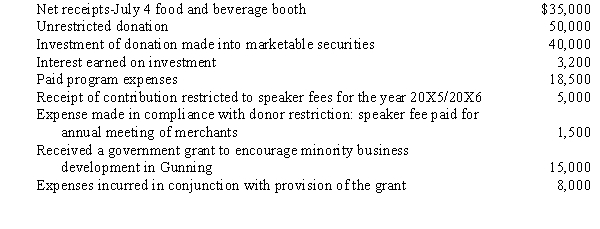

In the year 20X5, a group of merchants in the community of Gunning organized a merchant group, The Gunning Group, in an effort to work together to increase business to Gunning area merchants. Each of the 100 members pays dues of $200 per year for operations and fund raising. All dues were collected in 20X5. Other group activities for 20X5 were as follows:

Make the necessary entries to account for the above listed transactions.

Make the necessary entries to account for the above listed transactions.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

The following events are for South City Shelter, a voluntary health and welfare organization that provides emergency shelter and health care for the homeless, as well as educational programs:

a.A fund-raising program for a portable medical clinic yielded cash contributions of $50,000 and pledges of $100,000. In the past, 5% of pledges have been shown to be uncollectible.

b.A note for $100,000 was signed to finance the remaining cost of the clinic.

c.The mobile clinic and support materials were purchased for $240,000.

d.A note payment of $5,000 and $1,500 in interest was paid for the note in part (c).Required:Record the necessary journal entries.

a.A fund-raising program for a portable medical clinic yielded cash contributions of $50,000 and pledges of $100,000. In the past, 5% of pledges have been shown to be uncollectible.

b.A note for $100,000 was signed to finance the remaining cost of the clinic.

c.The mobile clinic and support materials were purchased for $240,000.

d.A note payment of $5,000 and $1,500 in interest was paid for the note in part (c).Required:Record the necessary journal entries.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

What are the two major categories of resources obtained by voluntary health and welfare organizations, and how do they differ?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

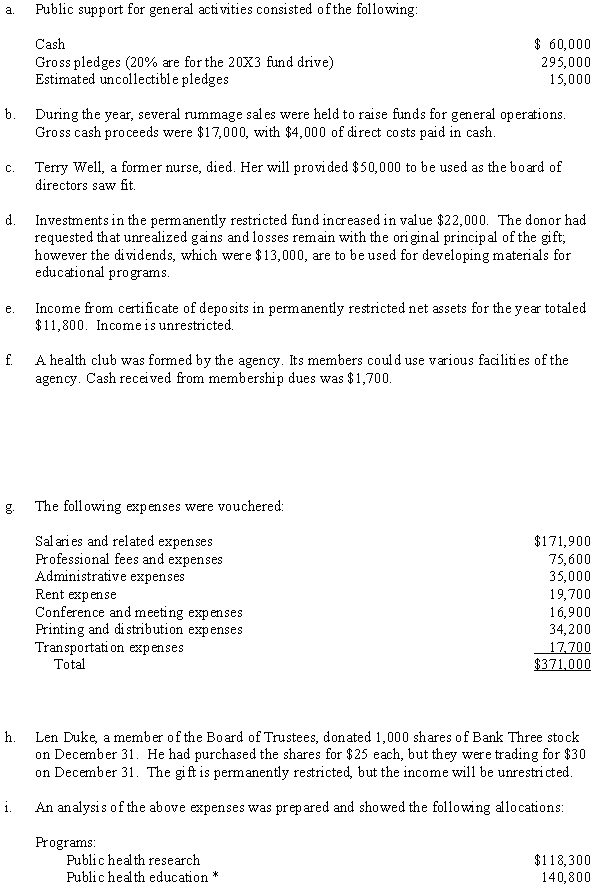

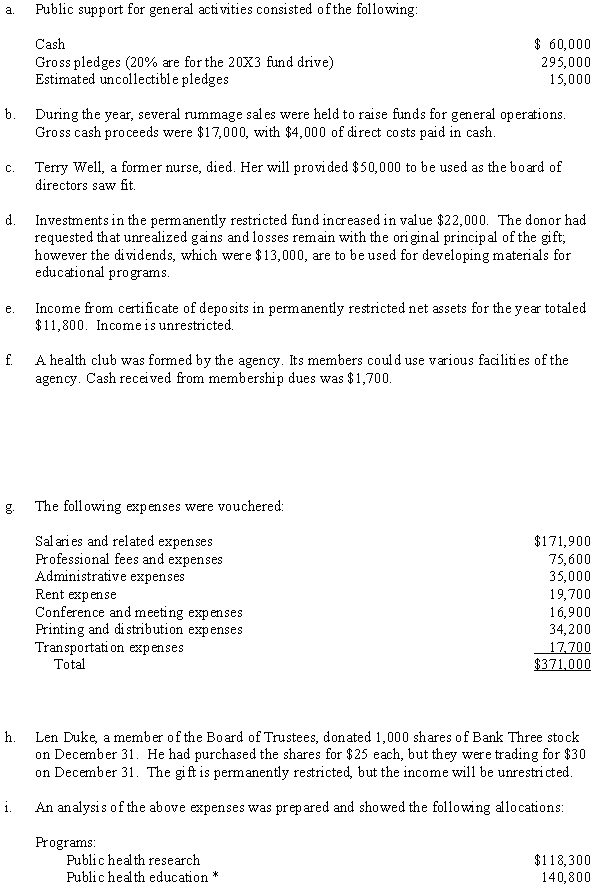

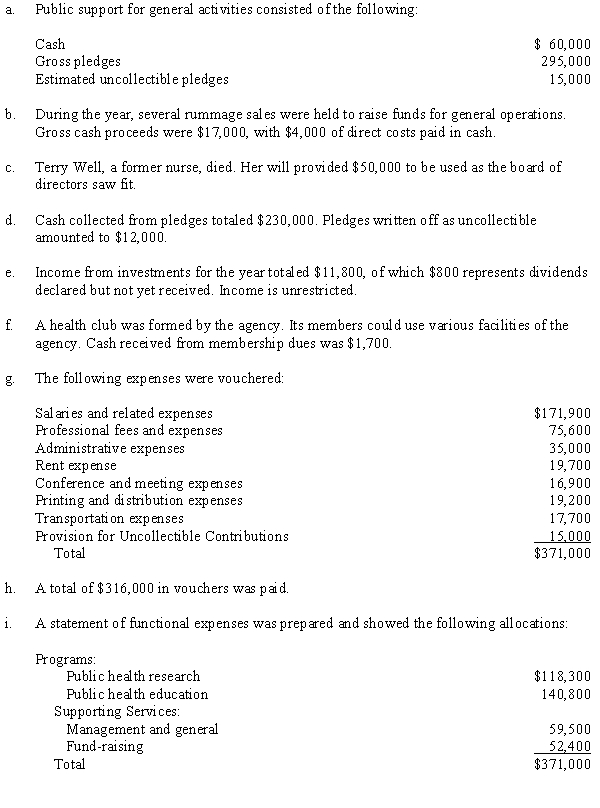

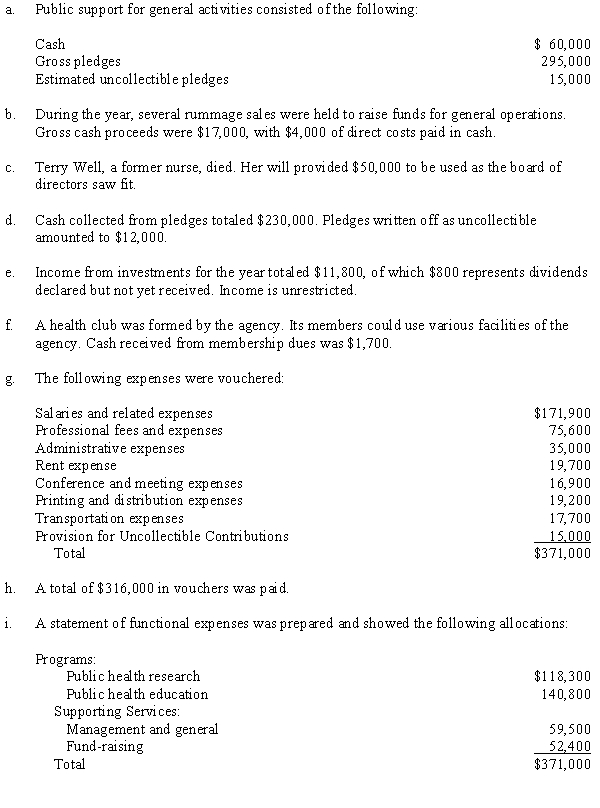

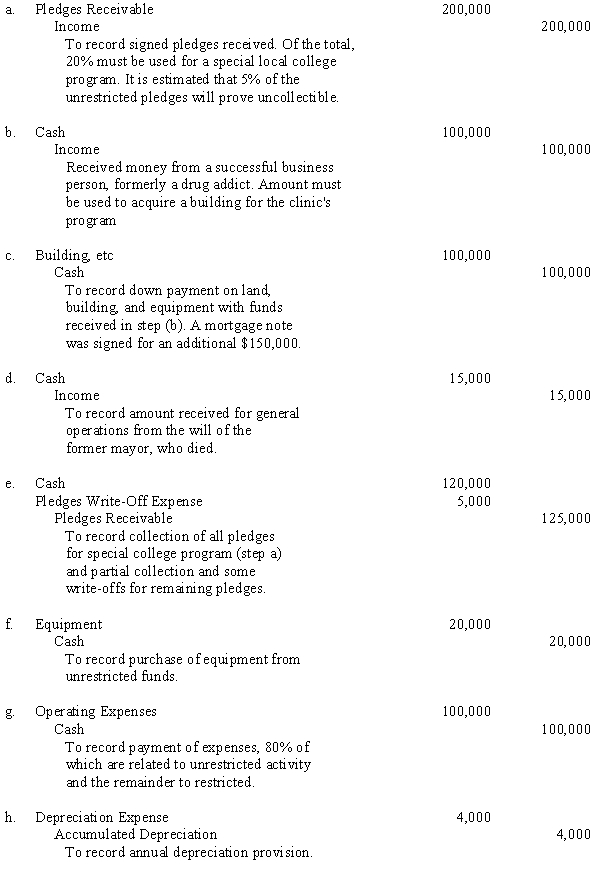

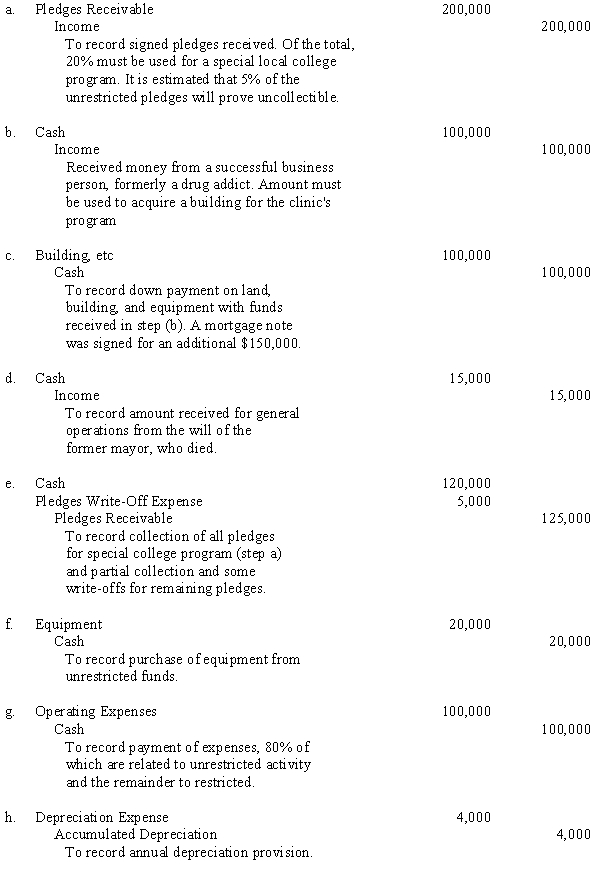

The Good Health Agency is a voluntary health and welfare organization that conducts two programs: public health research and public health education. Activities for the year ended December 31, 20X2 were as follows:

* including materials meeting conditions of the endowment gift in

d.j.Trish Dyer, CPA, performed the agency's audit on a pro bono basis. The value of the audit was estimated to be $4,000, and was accrued after the end of the year.k.The net assets at December 31, 20X1 were: Required:Prepare a statement of activities for Good Health Agency for the year ended December 31, 20X2.

Required:Prepare a statement of activities for Good Health Agency for the year ended December 31, 20X2.

* including materials meeting conditions of the endowment gift in

d.j.Trish Dyer, CPA, performed the agency's audit on a pro bono basis. The value of the audit was estimated to be $4,000, and was accrued after the end of the year.k.The net assets at December 31, 20X1 were:

Required:Prepare a statement of activities for Good Health Agency for the year ended December 31, 20X2.

Required:Prepare a statement of activities for Good Health Agency for the year ended December 31, 20X2.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

How do you differentiate between a voluntary health and welfare organization and another not-for-profit organization?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

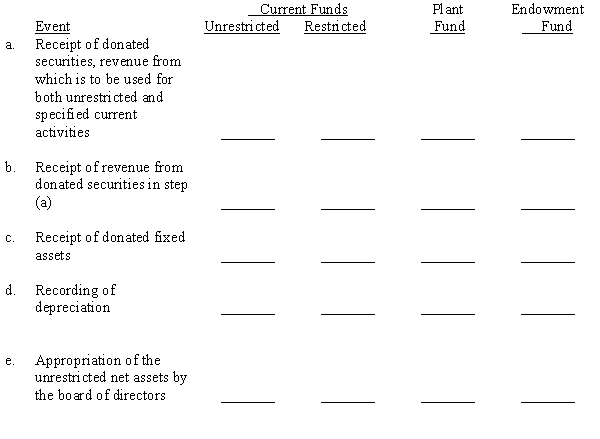

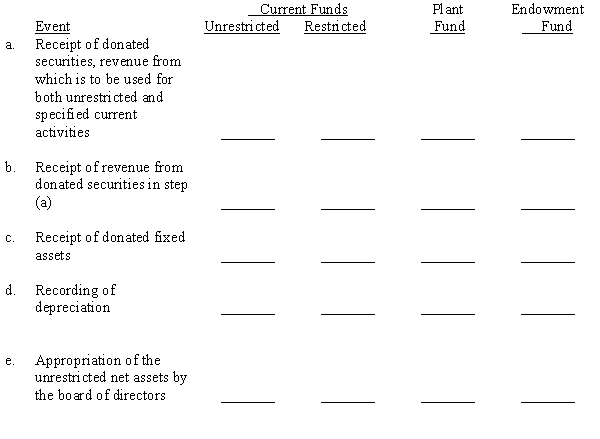

By placing a check mark in the appropriate column, indicate in which fund of a voluntary health and welfare organization the following events normally would be recorded. (Note: An event may require entries in more than one fund.)

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

The Good Health Agency is a voluntary health and welfare organization that conducts two programs: public health research and public health education.

Required:

Prepare journal entries for these events. Charge the respective services for their share of expenses.

Required:

Prepare journal entries for these events. Charge the respective services for their share of expenses.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

The Community Drug Clinic is a voluntary health and welfare organization that conducts two programs: drug abuse research and drug abuse education. An inexperienced accountant recorded the following entries:

Required:

Omitting explanations, prepare the correct entries, including the entry to assign expenses to programs and services. Assume that the incorrect entries of the previous accountant are reversed prior to your entries.

Required:

Omitting explanations, prepare the correct entries, including the entry to assign expenses to programs and services. Assume that the incorrect entries of the previous accountant are reversed prior to your entries.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

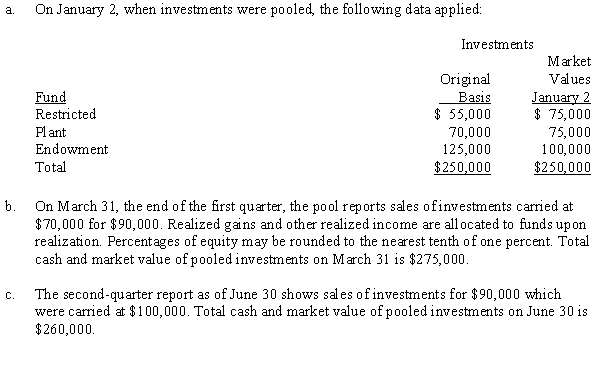

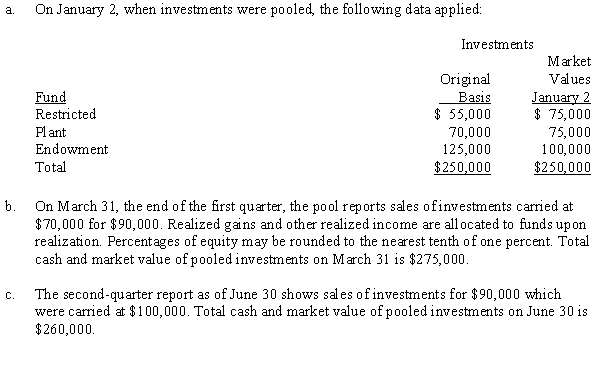

53

Senior Wellness Center is a voluntary health and welfare organization devoted to health education for the elderly. It has investments in its Restricted Fund, its Plant Fund, and its Endowment Fund. There are no restrictions on investment income or gains and losses in the endowment fund. On January 2, the organization decided to pool the investments of the three funds, and thereafter to maintain all investment account balances at market value.

Required:

Prepare a schedule of equities in pooled investments for the three funds at the end of the first two quarters.

Required:

Prepare a schedule of equities in pooled investments for the three funds at the end of the first two quarters.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

Describe the circumstances that must be true in order for donated, personal services to be recorded as revenue (contributions) in a not-for-profit organization.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

a. Describe the basic accounting for private not-for-profit groups promoted by the FASB including a brief description of the three net asset classes.

b. Indicate in which of the net asset classes the following transactions belong:

1. Donor makes a cash gift to not-for profit which must be invested and maintained in perpetuity

2. Income Earned on donation noted in item #1 is restricted to certain program expenditures

3. Gains/Losses, both realized and unrealized, on donation noted in item #1. Not stipulated in donor agreement or by the law

4. Expenses paid out for programs stipulated in donor agreement relating to donation made in item #1.

b. Indicate in which of the net asset classes the following transactions belong:

1. Donor makes a cash gift to not-for profit which must be invested and maintained in perpetuity

2. Income Earned on donation noted in item #1 is restricted to certain program expenditures

3. Gains/Losses, both realized and unrealized, on donation noted in item #1. Not stipulated in donor agreement or by the law

4. Expenses paid out for programs stipulated in donor agreement relating to donation made in item #1.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck