Deck 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/58

Play

Full screen (f)

Deck 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds

1

Debt Service funds account for

A)revenue bonds.

B)payment of principal and interest on general obligation debt.

C)arbitrage.

D)monies irrevocably set aside for an in-substance defeasance.

A)revenue bonds.

B)payment of principal and interest on general obligation debt.

C)arbitrage.

D)monies irrevocably set aside for an in-substance defeasance.

B

The primary purpose of Debt Service funds is to account for financial resources accumulated to cover the payment of principal and interest on general government obligations.

The primary purpose of Debt Service funds is to account for financial resources accumulated to cover the payment of principal and interest on general government obligations.

2

In a Special Revenue fund:

A)projects are permitted to expand beyond the original authorization if the resources exist.

B)sufficient revenue should exist to fund the activities, but funds should not accumulate beyond reasonable needs.

C)budgetary control accounts are not used.

D)None of the above.

A)projects are permitted to expand beyond the original authorization if the resources exist.

B)sufficient revenue should exist to fund the activities, but funds should not accumulate beyond reasonable needs.

C)budgetary control accounts are not used.

D)None of the above.

B

In a special revenue fund, the accounting must be designed to permit close scrutiny of activities. If resources are greater than anticipated, the project is not permitted to expand beyond the original authorization, nor is money permitted to accumulate beyond reasonable needs. However, sufficient resources should be generated to permit the activity. The desired control may be accomplished by using the same accounting procedures as those used by the general fund. Annual budgets are prepared for each special revenue fund and are required to be integrated into the accounting system by using the appropriate budgetary control accounts and their related subsidiary records.

In a special revenue fund, the accounting must be designed to permit close scrutiny of activities. If resources are greater than anticipated, the project is not permitted to expand beyond the original authorization, nor is money permitted to accumulate beyond reasonable needs. However, sufficient resources should be generated to permit the activity. The desired control may be accomplished by using the same accounting procedures as those used by the general fund. Annual budgets are prepared for each special revenue fund and are required to be integrated into the accounting system by using the appropriate budgetary control accounts and their related subsidiary records.

3

In a Debt Service fund:

A)expenditures for interest and principal are recognized when they are due.

B)expenditures for interest are recognized as incurred.

C)long-term debt is reduced by principal payments.

D)funds transferred from the General Fund to cover debt payments are recorded as revenue.

A)expenditures for interest and principal are recognized when they are due.

B)expenditures for interest are recognized as incurred.

C)long-term debt is reduced by principal payments.

D)funds transferred from the General Fund to cover debt payments are recorded as revenue.

A

The modified accrual method recognizes expenditures for principal and interest payments when they are due.

The modified accrual method recognizes expenditures for principal and interest payments when they are due.

4

At the inception of the City of Covedale's motor pool, $1,000,000 was transferred from the General Fund as beginning capital. The entry in the Internal Service Fund included a credit to:

A)Revenue.

B)Capital.

C)Interfund Transfer In.

D)Net Assets.

A)Revenue.

B)Capital.

C)Interfund Transfer In.

D)Net Assets.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

5

Service-type special assessments:

A)result in a single charge to the property tax bill.

B)are usually accounted for in the fund type that best reflects the nature of the transaction.

C)cover operating activities.

D)All of the above.

A)result in a single charge to the property tax bill.

B)are usually accounted for in the fund type that best reflects the nature of the transaction.

C)cover operating activities.

D)All of the above.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

6

Capital improvements which are financed by special assessment debt for which the government is obligated in some manner would be recorded in the General Fixed Assets Account Group as a(n)

A)debit to Expenditures.

B)debit to Assets for the portion owned by the government.

C)investment in General Fixed Assets--Capital Project Funds.

D)Bonds Payable.

A)debit to Expenditures.

B)debit to Assets for the portion owned by the government.

C)investment in General Fixed Assets--Capital Project Funds.

D)Bonds Payable.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

7

A government may decide to do an advance refunding of long-term debt to remove legal impairments or lower the effective interest rate. If the refunding does not pay off the old debt, but simply sets aside monies irrevocably with a trustee to pay it as it comes due, it is a(n)

A)duplicate borrowing.

B)defeasance of debt

C)transaction to only disclose in the footnotes.

D)trust to record in the nonexpendable trust fund.

A)duplicate borrowing.

B)defeasance of debt

C)transaction to only disclose in the footnotes.

D)trust to record in the nonexpendable trust fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

8

When a city plans to build a fire station by issuing long-term debt, it could obtain money to start construction before the bonds are sold by

A)selling old fire trucks.

B)borrowing from the pension trust fund.

C)issuing Bond Anticipation Notes.

D)issuing Tax Anticipation Notes.

A)selling old fire trucks.

B)borrowing from the pension trust fund.

C)issuing Bond Anticipation Notes.

D)issuing Tax Anticipation Notes.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following funds or account groups would be affected by a transfer of property tax receipts to pay bond principal and interest payments? The bonds were issued several years ago to fund the construction of a new library.

A)Capital Project Fund

B)Library Fund

C)Debt Service Fund

D)General Fixed Asset Account Group

A)Capital Project Fund

B)Library Fund

C)Debt Service Fund

D)General Fixed Asset Account Group

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

10

An enterprise fund should be used to account for

A)a free city-run swimming pool paid for with property tax.

B)a city-run water utility serving the general public.

C)any activity which the city plans to sell to external users for a fee either now or in the future.

D)Both b and c are correct.

A)a free city-run swimming pool paid for with property tax.

B)a city-run water utility serving the general public.

C)any activity which the city plans to sell to external users for a fee either now or in the future.

D)Both b and c are correct.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

11

Permanent Funds are established to

A)account for general operating activities

B)account for public purpose trust for which only the earnings are expendable for a specific purpose

C)record earnings and principal expended for public purpose trusts for specific purposes

D)account for private purpose trusts

A)account for general operating activities

B)account for public purpose trust for which only the earnings are expendable for a specific purpose

C)record earnings and principal expended for public purpose trusts for specific purposes

D)account for private purpose trusts

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

12

Revenue in a Capital Projects Fund includes all but:

A)special assessments.

B)federal grants.

C)proceeds from the sale of general obligation bonds.

D)interest from temporary investments.

A)special assessments.

B)federal grants.

C)proceeds from the sale of general obligation bonds.

D)interest from temporary investments.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

13

Capital improvement special assessments:

A)may include contributions from property owners.

B)are accounted for through a capital projects fund.

C)may include debt accounted for in an agency fund if the government has no obligation for it.

D)All of the above.

A)may include contributions from property owners.

B)are accounted for through a capital projects fund.

C)may include debt accounted for in an agency fund if the government has no obligation for it.

D)All of the above.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

14

On December 1, $125,000 was deposited with a fiscal agent for payment on bonds payable in the amount of $90,000 and interest payable for $35,000 due maturing on the last day of December. This will require a debit of

A)$125,000 to the Expenditure account in the General Fund.

B)$35,000 to the Expenditure account in the General Fund.

C)$125,000 to the Other Financing Uses--Transfers Out account in the General Fund.

D)$35,000 to the Expenditure account in the Debt Service Fund.

A)$125,000 to the Expenditure account in the General Fund.

B)$35,000 to the Expenditure account in the General Fund.

C)$125,000 to the Other Financing Uses--Transfers Out account in the General Fund.

D)$35,000 to the Expenditure account in the Debt Service Fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

15

Capital projects expected to take several years to complete and involve large amounts of money

A)operate under an annual budget, including expected revenues and estimated expenditures for the current fiscal year.

B)operate under an annual budget, including expected revenues and estimated expenditures for the entire project life.

C)budget for estimated expenditures only and only for the current fiscal period.

D)do not utilize any annual budgeting entries.

A)operate under an annual budget, including expected revenues and estimated expenditures for the current fiscal year.

B)operate under an annual budget, including expected revenues and estimated expenditures for the entire project life.

C)budget for estimated expenditures only and only for the current fiscal period.

D)do not utilize any annual budgeting entries.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

16

In a Capital Projects Fund, when a contract is signed with a contractor to construct a fixed asset, the amount of the contract is:

A)debited to Expenditures.

B)credited to Contracts Payable.

C)debited to Encumbrances.

D)credited to Other Financing Sources.

A)debited to Expenditures.

B)credited to Contracts Payable.

C)debited to Encumbrances.

D)credited to Other Financing Sources.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

17

Utilizing serial bonds to raise long term resources is preferred in debt service funds because:

A)the face value becomes due at one time at a more distant maturity date.

B)serial bonds do not require a substantial accumulation of money in a sinking fund.

C)it assists in the budgeting process.

D)the primary function is to account for fixed asset acquisitions.

A)the face value becomes due at one time at a more distant maturity date.

B)serial bonds do not require a substantial accumulation of money in a sinking fund.

C)it assists in the budgeting process.

D)the primary function is to account for fixed asset acquisitions.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following fund types have accounting principles most closely related to those of the General Fund?

A)Pension Trust

B)Enterprise

C)Agency

D)Special Revenues

A)Pension Trust

B)Enterprise

C)Agency

D)Special Revenues

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

19

The basis of accounting for the Public Purpose Trust is the

A)accrual basis.

B)cash basis.

C)modified accrual basis.

D)modified cash basis.

A)accrual basis.

B)cash basis.

C)modified accrual basis.

D)modified cash basis.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following activities would not be accounted for in a Special Revenue Fund?

A)hotel taxes restricted for tourism expenditures

B)lottery proceeds restricted for property tax relief

C)interest earned on temporary investments of long term bond proceeds

D)park fees restricted to cover a small portion of park upkeep and maintenance

A)hotel taxes restricted for tourism expenditures

B)lottery proceeds restricted for property tax relief

C)interest earned on temporary investments of long term bond proceeds

D)park fees restricted to cover a small portion of park upkeep and maintenance

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

21

The entry in the General Fund to record the reimbursement from a capital projects fund for legal services paid by the General Fund on its behalf would include:

A)a debit to Expenditures.

B)a credit to Other Financing Sources.

C)a credit to Expenditures.

D)a credit to Revenues.

A)a debit to Expenditures.

B)a credit to Other Financing Sources.

C)a credit to Expenditures.

D)a credit to Revenues.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

22

For the Statement of Cash Flows for an Proprietary Fund:

A)the direct or indirect method may be used

B)cash flows from investing activities include fixed asset acquisitions

C)a reconciliation of net operating income to net cash flow from operating activities is required when the direct method is used

D)interest paid and interest earned are included in cash flows from operating activities

A)the direct or indirect method may be used

B)cash flows from investing activities include fixed asset acquisitions

C)a reconciliation of net operating income to net cash flow from operating activities is required when the direct method is used

D)interest paid and interest earned are included in cash flows from operating activities

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

23

The entry in the General Fund to record the purchase of water for City Hall from the city's Water Utility Enterprise Fund would include a debit to:

A)Utilities Expense.

B)Other Financing Uses.

C)Expenditures.

D)Encumbrances.

A)Utilities Expense.

B)Other Financing Uses.

C)Expenditures.

D)Encumbrances.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

24

The financial statements of fiduciary funds:

A)include a Statement of Cash Flow.

B)are prepared using the modified accrual method of accounting.

C)do not include Fund Balances.

D)do not require any additional disclosures in the Notes to the Financial Statements.

A)include a Statement of Cash Flow.

B)are prepared using the modified accrual method of accounting.

C)do not include Fund Balances.

D)do not require any additional disclosures in the Notes to the Financial Statements.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

25

A redemption of the final serial of general obligation bonds, including a deficiency covered by the general fund, would affect which funds and/or account groups?

A)General, Debt Service, General Long-Term Debt Account Group

B)Debt Service, General Long-Term Debt Account Group, Agency Fund

C)General, Debt Service

D)General, Debt Service, General Long-Term Debt Account Group, Capital Projects

A)General, Debt Service, General Long-Term Debt Account Group

B)Debt Service, General Long-Term Debt Account Group, Agency Fund

C)General, Debt Service

D)General, Debt Service, General Long-Term Debt Account Group, Capital Projects

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

26

If a county collects taxes on behalf of the city and school district, it would record the taxes in the

A)General Fund.

B)Special Revenue Fund.

C)Agency Fund.

D)Trust Fund.

A)General Fund.

B)Special Revenue Fund.

C)Agency Fund.

D)Trust Fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not a classification of net assets of proprietary funds?

A)Unrestricted

B)Restricted

C)Assigned

D)Invested in capital assets, net of related debt

A)Unrestricted

B)Restricted

C)Assigned

D)Invested in capital assets, net of related debt

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

28

Interfund transactions include all of the following except for:

A)one fund's reimbursement of another for supplies paid on its behalf

B)interfund operating transfers between government funds for services provided and used and recorded as revenues and expenditures/expenses

C)interfund loan transfers classified as Due to/from other Funds

D)interfund non-reciprocal transfers between government funds recorded as interfund transfers appearing after non-operating revenues

A)one fund's reimbursement of another for supplies paid on its behalf

B)interfund operating transfers between government funds for services provided and used and recorded as revenues and expenditures/expenses

C)interfund loan transfers classified as Due to/from other Funds

D)interfund non-reciprocal transfers between government funds recorded as interfund transfers appearing after non-operating revenues

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

29

A government may use agency funds to account for all but the following:

A)taxes that are collected that are restricted for a special purpose

B)employee withholdings

C)taxes collected on behalf of other governmental units

D)capital projects undertaken by a government for which special assessment bonds were issued, but for which it has no responsibility in the case of nonpayment

A)taxes that are collected that are restricted for a special purpose

B)employee withholdings

C)taxes collected on behalf of other governmental units

D)capital projects undertaken by a government for which special assessment bonds were issued, but for which it has no responsibility in the case of nonpayment

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

30

The activities of a central motor pool that supplies and services vehicles for the use of municipal employees on official business should be accounted for in a(n)?

A)General Fund

B)Agency Fund

C)Internal Service Fund

D)Special Revenue Fund

A)General Fund

B)Agency Fund

C)Internal Service Fund

D)Special Revenue Fund

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

31

The best fund in which to account for the interest and dividends from an endowment to purchase library books would be a(n)

A)Private-Purpose Trust Fund

B)Agency Fund.

C)Endowment Fund.

D)Nonexpendable Trust Fund.

A)Private-Purpose Trust Fund

B)Agency Fund.

C)Endowment Fund.

D)Nonexpendable Trust Fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

32

In the Statement of Cash Flows for an Proprietary Fund, the receipt of an operating grant would be included in cash flows from:

A)operating activities.

B)noncapital financing activities.

C)capital and related financing activities.

D)investing activities.

A)operating activities.

B)noncapital financing activities.

C)capital and related financing activities.

D)investing activities.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not a typical year-end statement for an Enterprise Fund?

A)Balance Sheet

B)Statement of Revenue, Expenses and Changes in Net Assets

C)Statement of Cash Flows

D)All of these financial statements would be used at year end by an Enterprise Fund.

A)Balance Sheet

B)Statement of Revenue, Expenses and Changes in Net Assets

C)Statement of Cash Flows

D)All of these financial statements would be used at year end by an Enterprise Fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

34

Internal Service funds:

A)have restricted assets.

B)use budgetary accounting.

C)must recover their costs, including depreciation, or be subsidized.

D)record expenditures for resources used.

A)have restricted assets.

B)use budgetary accounting.

C)must recover their costs, including depreciation, or be subsidized.

D)record expenditures for resources used.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

35

When a landfill operation is accounted for in an Enterprise Fund:

A)the costs to close the landfill are recognized when incurred.

B)post-closure monitoring is recognized when the landfill is closed.

C)a portion of the estimate for closure cost and post-closure monitoring is recognized during each year the landfill is in operation.

D)an estimate for closure cost and post-closure monitoring is recognized when the landfill is opened.

A)the costs to close the landfill are recognized when incurred.

B)post-closure monitoring is recognized when the landfill is closed.

C)a portion of the estimate for closure cost and post-closure monitoring is recognized during each year the landfill is in operation.

D)an estimate for closure cost and post-closure monitoring is recognized when the landfill is opened.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

36

The entry in the General Fund to record the an operating subsidy paid to the city's Water Utility Enterprise Fund for which it does not expect repayment would include a debit to:

A)Utilities Expense.

B)Other Financing Uses.

C)Expenditures.

D)Encumbrances.

A)Utilities Expense.

B)Other Financing Uses.

C)Expenditures.

D)Encumbrances.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

37

In the Statement of Cash Flows for an Proprietary Fund, the acquisition of a fixed asset would be included in cash flows from:

A)operating activities.

B)noncapital financing activities.

C)capital and related financing activities.

D)investing activities.

A)operating activities.

B)noncapital financing activities.

C)capital and related financing activities.

D)investing activities.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following terms best describes the accounting methods used to account for a city's Pension Trust Fund?

A)Cash basis

B)Modified cash basis

C)Accrual basis

D)Modified accrual basis

A)Cash basis

B)Modified cash basis

C)Accrual basis

D)Modified accrual basis

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

39

If general obligation debt is refunded to lower the interest rate and the proceeds are irrevocably placed with an escrow agent or trustee to pay off the old debt as it comes due, the government must

A)provide a general description of the transaction in the newspaper.

B)calculate the economic gain or Balance--Employer Contributions.

C)adjust the GLTDAG for the increase or decrease in the amount of long-term debt.

D)Both b and c are correct.

A)provide a general description of the transaction in the newspaper.

B)calculate the economic gain or Balance--Employer Contributions.

C)adjust the GLTDAG for the increase or decrease in the amount of long-term debt.

D)Both b and c are correct.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

40

The main difference between an agency fund and a trust fund is:

A)an agency fund may not have a balance at the end of the period

B)agency funds account for assets invested to produce earnings for a designated purpose

C)agency funds account for assets, liabilities, and changes in net assets of external participants in an investment pool

D)agency funds account for contributions to retirement plans

A)an agency fund may not have a balance at the end of the period

B)agency funds account for assets invested to produce earnings for a designated purpose

C)agency funds account for assets, liabilities, and changes in net assets of external participants in an investment pool

D)agency funds account for contributions to retirement plans

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

41

On 1-1-01, the City of Midville received $100,000 from a citizen, who specifies the principal amount should remain intact. Earnings on the principal are to be used for park beautification projects and upkeep.

Required:

Record the following events in the appropriate Permanent Fund and Special Revenue Fund, as necessary.

a.The deposit is made of the cash received.

b.The cash is invested in marketable securities.

c.Total interest accrued on investments for the year is $8,000; A liability is established in the permanent fund for what is owed to special revenue fund.

d.The interest is collected and transferred to the appropriate special revenue fund.

e.Park Operating expenses are $2,500; $5,500 is spent on new park benches.Required:Using this information, make the necessary entries in all other affected funds or groups and identify the fund for each event. If no other fund or group is affected, so note. Closing entries are not required.

Required:

Record the following events in the appropriate Permanent Fund and Special Revenue Fund, as necessary.

a.The deposit is made of the cash received.

b.The cash is invested in marketable securities.

c.Total interest accrued on investments for the year is $8,000; A liability is established in the permanent fund for what is owed to special revenue fund.

d.The interest is collected and transferred to the appropriate special revenue fund.

e.Park Operating expenses are $2,500; $5,500 is spent on new park benches.Required:Using this information, make the necessary entries in all other affected funds or groups and identify the fund for each event. If no other fund or group is affected, so note. Closing entries are not required.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

42

The City of Newport operates its own solid waste landfill and charges fees to users who dump solid waste in the landfill. When should estimated costs for closure and post-closure care be accounted for?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

43

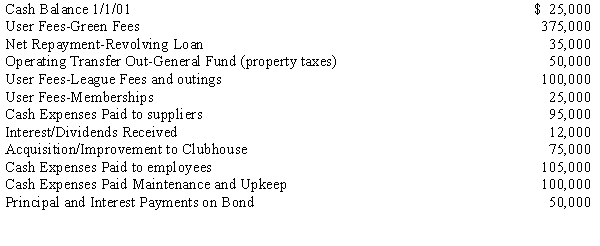

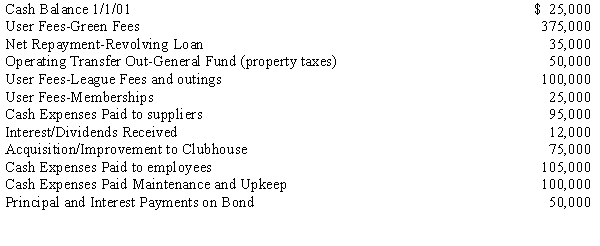

Given the following information for the City of Youngstown Municipal Golf Course:

Prepare a cash flow statement for this enterprise fund.

Prepare a cash flow statement for this enterprise fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

44

Consider the following transactions:

a.The Cline County Tax Agency Fund was established to account for the county's responsibility of collecting Brent City and Cline County property taxes. The levies for 20X1 were $800,000 for the County General Fund and $400,000 for the City General Fund.

b.Collections were $750,000 (in proportion to levies).

c.The county is entitled to a fee of 1% of taxes collected for Brent City; the net amount due is sent to the city. Liabilities to all funds and units were recorded to date.

d.All moneys collected to date were released to each government unit.Required:Prepare the general journal entries required to record the following transactions in Cline County Tax Agency Fund.

a.The Cline County Tax Agency Fund was established to account for the county's responsibility of collecting Brent City and Cline County property taxes. The levies for 20X1 were $800,000 for the County General Fund and $400,000 for the City General Fund.

b.Collections were $750,000 (in proportion to levies).

c.The county is entitled to a fee of 1% of taxes collected for Brent City; the net amount due is sent to the city. Liabilities to all funds and units were recorded to date.

d.All moneys collected to date were released to each government unit.Required:Prepare the general journal entries required to record the following transactions in Cline County Tax Agency Fund.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

45

Consider the following events:

a.A portion of the property tax levied was directly earmarked for, and previously recorded in, the Debt Service fund. Of these property taxes, $6,600 was previously reclassified as delinquent. From the delinquent taxes, $5,000 is now collected, with the balance considered uncollectible. An allowance for uncollectible delinquent of $2,000 existed.

b.Previously deferred property taxes amounting to $50,000 will be subjected to collection during the current year. A 4% allowance is to be created to cover uncollectible amounts.

c.The state has remitted $45,000 as the municipality's portion of a shared sales tax. No receivable had previously been recorded. The amount is to be used for debt service and is to be recorded directly in that fund.

d.The General Fund transferred $80,000 to the Debt Service Fund, $70,000 for serial bond principal retirement, and $10,000 for interest payment.

e.A check for $110,000 is sent by the Debt Service Fund to the fiscal agent who handles the principal and interest payments. The amount covers $70,000 for matured bond principal and $40,000 for interest due.f. The fiscal agent later reports that all payments for matured principal and interest mentioned in item e above have been made.Required:Prepare the journal entries that would be made in a municipality's Debt Service Fund for each of the following events:

a.A portion of the property tax levied was directly earmarked for, and previously recorded in, the Debt Service fund. Of these property taxes, $6,600 was previously reclassified as delinquent. From the delinquent taxes, $5,000 is now collected, with the balance considered uncollectible. An allowance for uncollectible delinquent of $2,000 existed.

b.Previously deferred property taxes amounting to $50,000 will be subjected to collection during the current year. A 4% allowance is to be created to cover uncollectible amounts.

c.The state has remitted $45,000 as the municipality's portion of a shared sales tax. No receivable had previously been recorded. The amount is to be used for debt service and is to be recorded directly in that fund.

d.The General Fund transferred $80,000 to the Debt Service Fund, $70,000 for serial bond principal retirement, and $10,000 for interest payment.

e.A check for $110,000 is sent by the Debt Service Fund to the fiscal agent who handles the principal and interest payments. The amount covers $70,000 for matured bond principal and $40,000 for interest due.f. The fiscal agent later reports that all payments for matured principal and interest mentioned in item e above have been made.Required:Prepare the journal entries that would be made in a municipality's Debt Service Fund for each of the following events:

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

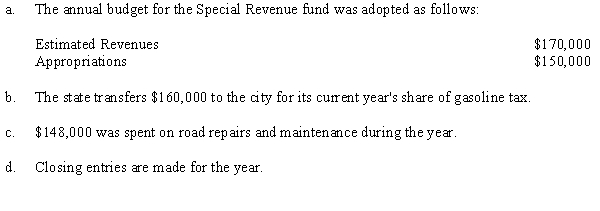

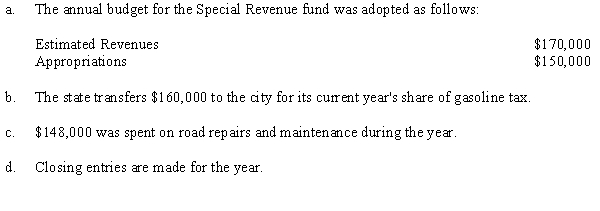

46

The following summary events are for the Village of Carsonville:

Required:

Prepare the journal entries necessary to record these events in the Special Revenue Fund. The fund was established to record the city's share of state gasoline tax, which is used for street maintenance.

Required:

Prepare the journal entries necessary to record these events in the Special Revenue Fund. The fund was established to record the city's share of state gasoline tax, which is used for street maintenance.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

47

Consider the following transactions:

a.The city government approved a $1,500,000 addition to the library to be financed by a $1,000,000 general obligation bond issue and a $500,000 state grant. The city anticipated that the proceeds from both the bond sale and the grant would be received in 20X1. It is also estimated that 40% of the project will be completed by year end.

b.The bonds are sold at 101. The bond premium is transferred to the debt service fund to be used for interest.

c.The grant is approved by the state for payment.

d.A contract for the project is signed to build the addition for $1,440,000.

e.The architect's bill is received for $15,000 and paid without an encumbrance.f. One-half of the grant is received from the state. g. A progress billing for $576,000 is received from the contractor. h. The closing entries for 20X1 are made.Required:Make the necessary journal entries to record the transactions in the Capital Project Fund of Chatham during 20X1. Budgetary accounts are used.

a.The city government approved a $1,500,000 addition to the library to be financed by a $1,000,000 general obligation bond issue and a $500,000 state grant. The city anticipated that the proceeds from both the bond sale and the grant would be received in 20X1. It is also estimated that 40% of the project will be completed by year end.

b.The bonds are sold at 101. The bond premium is transferred to the debt service fund to be used for interest.

c.The grant is approved by the state for payment.

d.A contract for the project is signed to build the addition for $1,440,000.

e.The architect's bill is received for $15,000 and paid without an encumbrance.f. One-half of the grant is received from the state. g. A progress billing for $576,000 is received from the contractor. h. The closing entries for 20X1 are made.Required:Make the necessary journal entries to record the transactions in the Capital Project Fund of Chatham during 20X1. Budgetary accounts are used.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

48

On July 1, 20X5, Rhodes City approved the construction of a new library costing $8,000,000. The project was to be financed with a $4,000,000 general obligation bond issue and a matching state grant.

Required:

Record the following events in the Capital Project Fund for Rhodes City during 20X5.

a.The city estimated that approximately one-fourth of the contract price would be paid for in the current fiscal year and that the bond issue will be sold this year. The project should be completed and the matching grant received next year.

b.The bonds are sold at 102 and premium to be used for future principal payment, forwarded to the Debt Service Fund.

c.A contract was signed to construct the library at a cost of $7,900,000 with a retained percentage of 10% until final inspection at completion.

d.The contractor submits a $1,000,000 progress billing.

e.The books are closed at year end.

Required:

Record the following events in the Capital Project Fund for Rhodes City during 20X5.

a.The city estimated that approximately one-fourth of the contract price would be paid for in the current fiscal year and that the bond issue will be sold this year. The project should be completed and the matching grant received next year.

b.The bonds are sold at 102 and premium to be used for future principal payment, forwarded to the Debt Service Fund.

c.A contract was signed to construct the library at a cost of $7,900,000 with a retained percentage of 10% until final inspection at completion.

d.The contractor submits a $1,000,000 progress billing.

e.The books are closed at year end.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

49

The City of Light Falls operates a centralized garage and charges the other departments on a per-mile basis for the purchase and maintenance of most city-owned vehicles.

Required:

Make journal entries to record the following selection of transactions concerning the motor pool during the following year:

a.Salaries of $360,000 were paid during the year.

b.A bill from the Water and Sewer Enterprise Fund for $8,000 was received and paid.

c.Eight new vehicles costing $24,000 each were purchased for cash.

d.Billing to other city funds were as follows:General Fund$550,000Utility Fund130,000Special Revenue Fund20,000

e.All of the billings in (d) except $50,000 from the Utility Fund were paid.f. Depreciation expense on the motor pool assets was $225,000 for the year.

Required:

Make journal entries to record the following selection of transactions concerning the motor pool during the following year:

a.Salaries of $360,000 were paid during the year.

b.A bill from the Water and Sewer Enterprise Fund for $8,000 was received and paid.

c.Eight new vehicles costing $24,000 each were purchased for cash.

d.Billing to other city funds were as follows:General Fund$550,000Utility Fund130,000Special Revenue Fund20,000

e.All of the billings in (d) except $50,000 from the Utility Fund were paid.f. Depreciation expense on the motor pool assets was $225,000 for the year.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

50

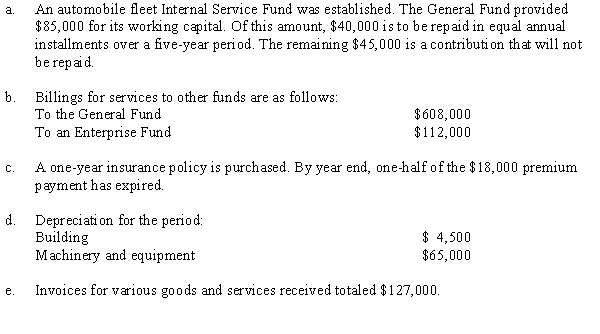

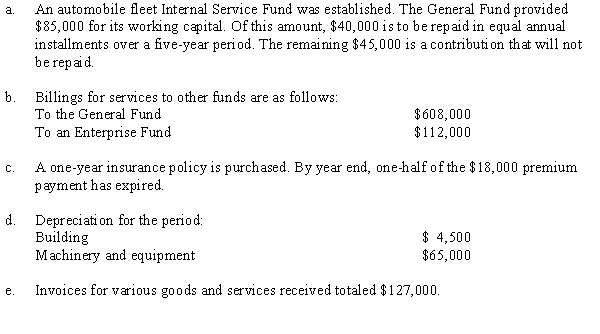

The following selected events occurred in Hershey City's Internal Service Fund for its automobile fleet:

Required:

Omitting explanations, prepare journal entries for all funds and groups affected, using the following format:

Required:

Omitting explanations, prepare journal entries for all funds and groups affected, using the following format:

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

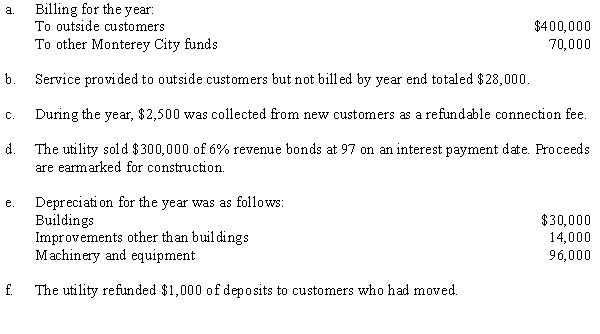

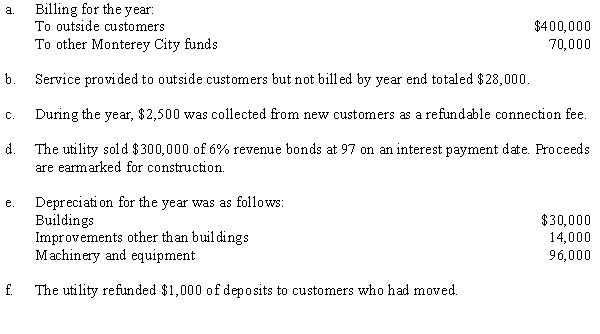

51

The following are selected activities for the Monterey City Natural Gas Company, a governmental entity:

Required:

Prepare journal entries to record the activities.

Required:

Prepare journal entries to record the activities.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

52

A Nonexpendable Trust Fund was established to help pay for Little League baseball. A total of $100,000 was donated to Babe City. The earnings, not the principal, from the donation could be used to fund baseball.

Required:

Make the entries and identify the fund into which the following transactions should be made:

a.The donation is received and invested immediately in a mutual stock fund.

b.Cash dividends of $8,500 were received from the mutual fund and made available for spending.

c.During the first baseball season, $8,300 was spent from the fund.

d.The closing entries were made.

Required:

Make the entries and identify the fund into which the following transactions should be made:

a.The donation is received and invested immediately in a mutual stock fund.

b.Cash dividends of $8,500 were received from the mutual fund and made available for spending.

c.During the first baseball season, $8,300 was spent from the fund.

d.The closing entries were made.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

53

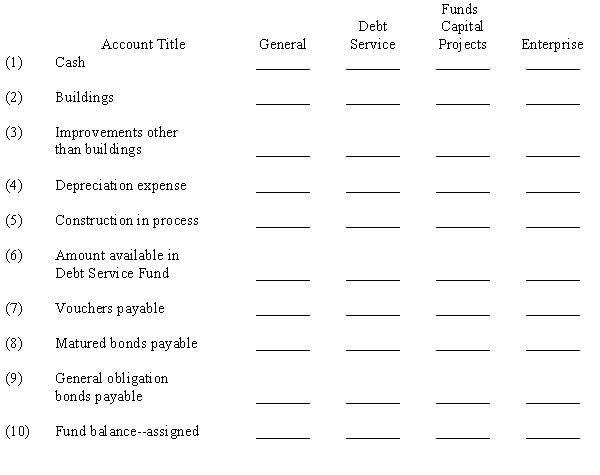

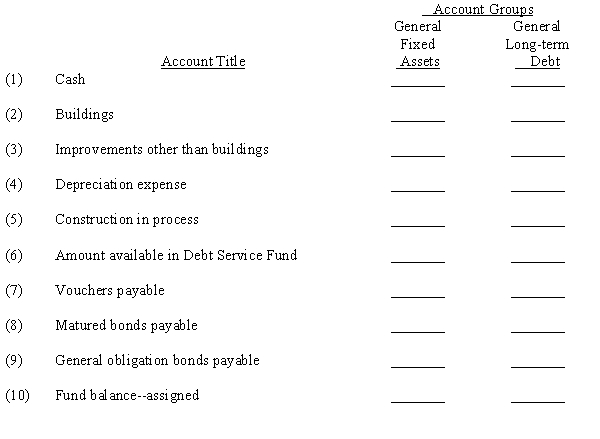

Place a check mark in the appropriate column to indicate in which of the following funds and accounts groups the given accounts would commonly be found:

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

54

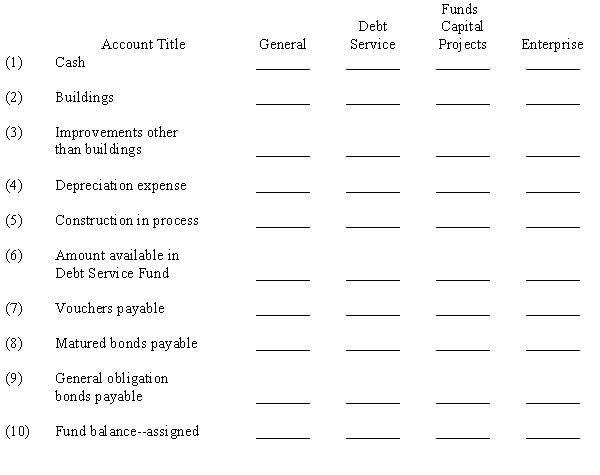

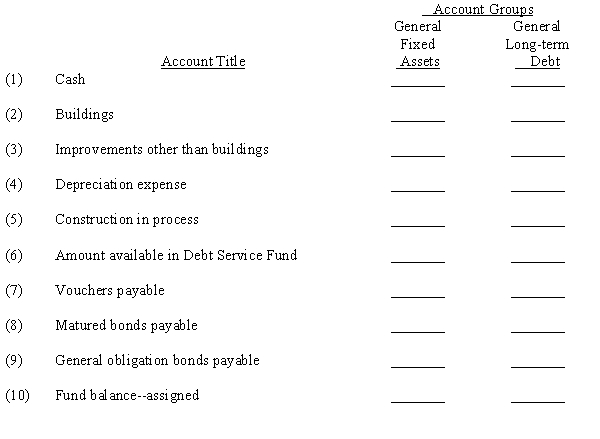

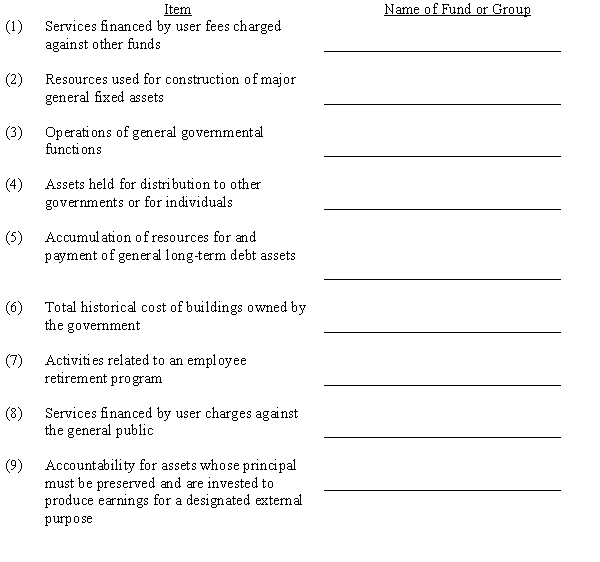

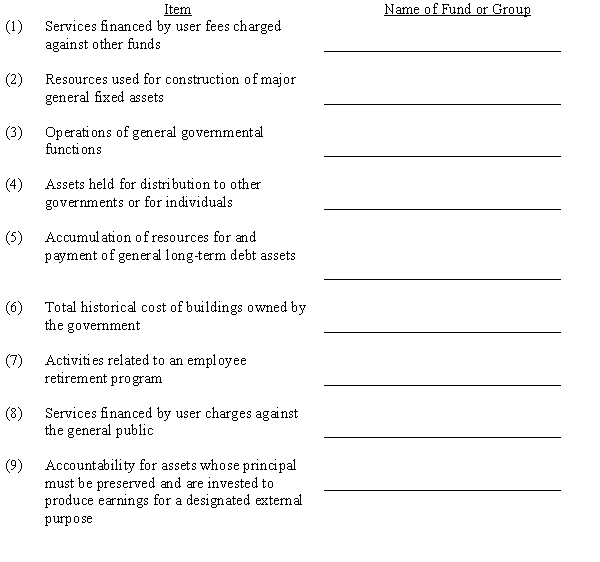

In the space provided, fill in the name of the one fund or account group in which each of the following items is most likely to be recorded.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

55

Rankin City established a Central Printing and Reproductions Fund during the fiscal year ending 6/30/05. Transactions affecting the fund are as follows:

a.The fund was established with a $100,000 contribution from the General Fund on 7/1/04. The transfer will be recorded as Contributed Capital for the fund.

b.Equipment costing $30,000 was acquired on 7/3/04. The equipment is assigned a 10 year life, no salvage. It will be paid at a future date.

c.Supplies costing $65,000 were acquired. A physical inventory was taken on 6/30/05 of the supplies, the count showed supplies valued at $11,000. The voucher will be paid at a later date.

d.Various operating expenses were incurred for a total of $67,000. Of that amount, $7,000 represented charges from the city's electric utility (an enterprise fund). All the vouchers were then paid. The payments for the equipment and supplies acquisition are also made.

e.Total billings to the city's various departments were $125,000. Of this amount, $9,000 pertained to services performed for the city's electric utility (enterprise fund).f. Cash was collected on the above billings in full.Required:Make the necessary journal entries for fiscal year 2004-2005 (ending 6/30/05) for Rankin City's Internal Service Fund including any year end adjusting entries. Closing entries are not required.

a.The fund was established with a $100,000 contribution from the General Fund on 7/1/04. The transfer will be recorded as Contributed Capital for the fund.

b.Equipment costing $30,000 was acquired on 7/3/04. The equipment is assigned a 10 year life, no salvage. It will be paid at a future date.

c.Supplies costing $65,000 were acquired. A physical inventory was taken on 6/30/05 of the supplies, the count showed supplies valued at $11,000. The voucher will be paid at a later date.

d.Various operating expenses were incurred for a total of $67,000. Of that amount, $7,000 represented charges from the city's electric utility (an enterprise fund). All the vouchers were then paid. The payments for the equipment and supplies acquisition are also made.

e.Total billings to the city's various departments were $125,000. Of this amount, $9,000 pertained to services performed for the city's electric utility (enterprise fund).f. Cash was collected on the above billings in full.Required:Make the necessary journal entries for fiscal year 2004-2005 (ending 6/30/05) for Rankin City's Internal Service Fund including any year end adjusting entries. Closing entries are not required.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

56

What reporting is required for the accounting for employee Pension Trust Funds.

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

57

The City of Warwick authorized a project to modernize its street lighting.

a.The project will take approximately nine months to complete and will cost $290,000. The project will be financed by a $60,000 grant from the federal government and a $15,000 transfer from the General Fund. In addition, the city will issue $125,000 of special assessment serial bonds. Special assessments of $180,000, to be collected in two equal installments due November 1 each year, will be levied. The first installment is to go directly to the Capital Projects Fund. The remaining installment will be used to repay the related bond issue. The city desires that budgetary accounts be established for the project.

b.A construction contract for $265,000 is signed. The amount is encumbered.

c.The installment assessments of $180,000 are levied.

d.All but $1,000 of the first installment is collected.

e.Serial bonds are sold at a face value of $125,000 on an interest payment date.f. The transfer from the General Fund and the grant from the federal government are received.Required:Prepare journal entries in a Capital Projects Fund for the above events:

a.The project will take approximately nine months to complete and will cost $290,000. The project will be financed by a $60,000 grant from the federal government and a $15,000 transfer from the General Fund. In addition, the city will issue $125,000 of special assessment serial bonds. Special assessments of $180,000, to be collected in two equal installments due November 1 each year, will be levied. The first installment is to go directly to the Capital Projects Fund. The remaining installment will be used to repay the related bond issue. The city desires that budgetary accounts be established for the project.

b.A construction contract for $265,000 is signed. The amount is encumbered.

c.The installment assessments of $180,000 are levied.

d.All but $1,000 of the first installment is collected.

e.Serial bonds are sold at a face value of $125,000 on an interest payment date.f. The transfer from the General Fund and the grant from the federal government are received.Required:Prepare journal entries in a Capital Projects Fund for the above events:

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck

58

What is escheat property and how do we account for it?

Unlock Deck

Unlock for access to all 58 flashcards in this deck.

Unlock Deck

k this deck