Deck 23: Internal and External Balance With Fixed Exchange Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 23: Internal and External Balance With Fixed Exchange Rates

1

If a country starts with a deficit in its official settlements balance, intervention to defend a fixed exchange rate will cause:

A)the money supply to expand and the economy to grow.

B)both the money supply and the economy to contract.

C)the money supply to grow and the economy to contract.

D)the money supply to contract and the economy to grow.

A)the money supply to expand and the economy to grow.

B)both the money supply and the economy to contract.

C)the money supply to grow and the economy to contract.

D)the money supply to contract and the economy to grow.

B

2

A(n) _____ in a country's money supply causes international capital _____.

A)expansion; outflows

B)expansion; inflows

C)contraction; outflows

D)contraction; stock to stabilize

A)expansion; outflows

B)expansion; inflows

C)contraction; outflows

D)contraction; stock to stabilize

A

3

Which of the following indicates taking an action to reverse the effect of official intervention on the domestic money supply?

A)Adjusting the country's interest rates

B)Implementing capital controls

C)Sterilization

D)Playing by the "rules of the game"

A)Adjusting the country's interest rates

B)Implementing capital controls

C)Sterilization

D)Playing by the "rules of the game"

C

4

Following an expansion of the money supply, a government committed to maintaining a fixed exchange rate must:

A)accept a surplus in its current account.

B)not use sterilized intervention.

C)increase its level of government expenditure and autonomous investments.

D)intervene in the foreign exchange market to sell foreign currency and buy domestic currency.

A)accept a surplus in its current account.

B)not use sterilized intervention.

C)increase its level of government expenditure and autonomous investments.

D)intervene in the foreign exchange market to sell foreign currency and buy domestic currency.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

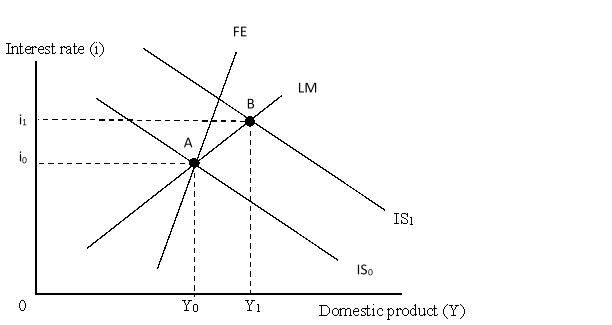

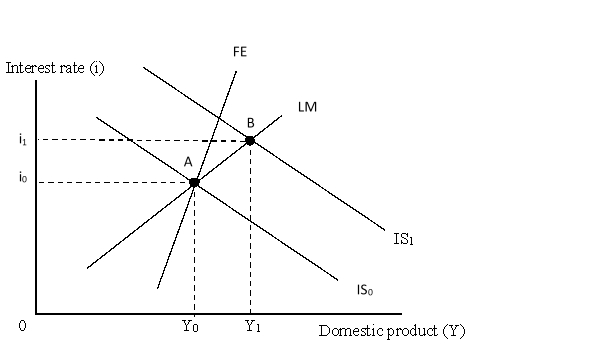

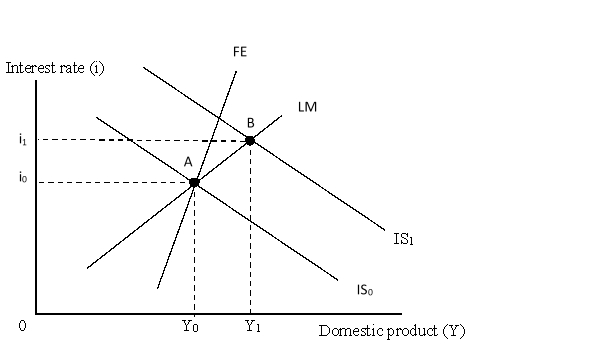

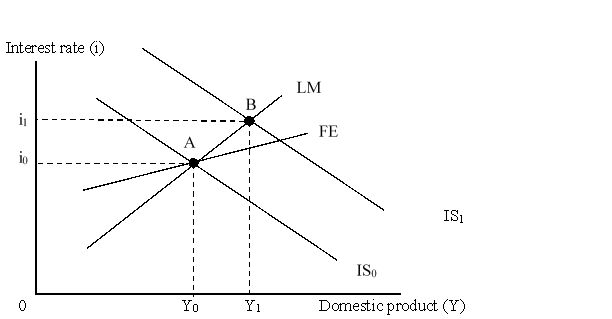

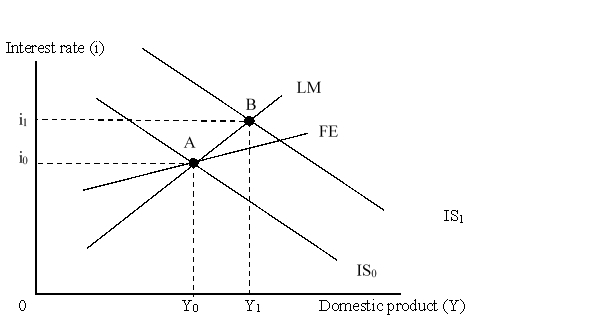

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy is at point A, a triple intersection. Here, the FE curve is steeper than the LM curve.  In order to maintain the fixed exchange rate, at point B monetary authorities must:

In order to maintain the fixed exchange rate, at point B monetary authorities must:

A)buy domestic government bonds.

B)sell domestic currency.

C)buy domestic currency.

D)sell domestic government bonds.

In order to maintain the fixed exchange rate, at point B monetary authorities must:

In order to maintain the fixed exchange rate, at point B monetary authorities must:A)buy domestic government bonds.

B)sell domestic currency.

C)buy domestic currency.

D)sell domestic government bonds.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following can be considered as domestic assets of a country's central bank?

A)Bank deposits at the central bank

B)The country's government bonds held by the central bank

C)Foreign currency assets held by the central bank

D)Currency issued by the central bank

A)Bank deposits at the central bank

B)The country's government bonds held by the central bank

C)Foreign currency assets held by the central bank

D)Currency issued by the central bank

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

Assuming no effect on exchange rates, which of the following is likely to happen if the money supply in a country contracts?

A)Decline in the international price competitiveness

B)Rise in the interest rates

C)Fall in the inflow of financial capital

D)Rise in the real spending

A)Decline in the international price competitiveness

B)Rise in the interest rates

C)Fall in the inflow of financial capital

D)Rise in the real spending

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

There are limits to the ability of monetary authorities to use sterilized intervention in the case of a deficit because:

A)the central bank may be unwilling to increase its holdings of foreign currency beyond a certain limit.

B)the pressure from foreign countries to allow the domestic currency to appreciate will lead to large losses.

C)the central bank's ability to constantly obtain foreign currency for the sterilized intervention is constrained.

D)the export level is fixed and it cannot be allowed to drop.

A)the central bank may be unwilling to increase its holdings of foreign currency beyond a certain limit.

B)the pressure from foreign countries to allow the domestic currency to appreciate will lead to large losses.

C)the central bank's ability to constantly obtain foreign currency for the sterilized intervention is constrained.

D)the export level is fixed and it cannot be allowed to drop.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

The sum of currency and bank deposits at the central bank is called:

A)the money supply.

B)domestic assets.

C)the monetary base.

D)fractional reserves.

A)the money supply.

B)domestic assets.

C)the monetary base.

D)fractional reserves.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT true with fixed exchange rates and perfect capital mobility?

A)Monetary policy is not effective in either the long-run or the short-run.

B)Sterilization is impossible.

C)Fiscal policy is very powerful.

D)Monetary policy is very powerful.

A)Monetary policy is not effective in either the long-run or the short-run.

B)Sterilization is impossible.

C)Fiscal policy is very powerful.

D)Monetary policy is very powerful.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

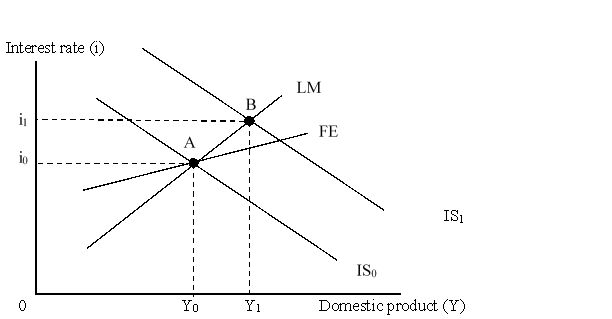

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy is at point A, a triple intersection. Here, the FE curve is steeper than the LM curve.  At point B, the economy is experiencing:

At point B, the economy is experiencing:

A)a deficit in the overall balance of payments.

B)a surplus in the overall balance of payments.

C)an overall balance of payments that is in equilibrium.

D)an expanding money supply.

At point B, the economy is experiencing:

At point B, the economy is experiencing:A)a deficit in the overall balance of payments.

B)a surplus in the overall balance of payments.

C)an overall balance of payments that is in equilibrium.

D)an expanding money supply.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

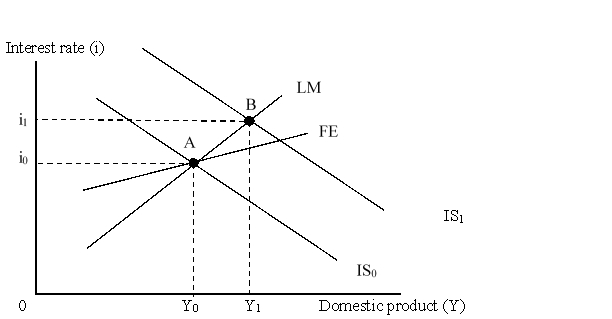

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy is at point A, a triple intersection. Here, the FE curve is steeper than the LM curve.  If monetary authorities are unable to sterilize, output will end up:

If monetary authorities are unable to sterilize, output will end up:

A)at Y1.

B)to the left of Y1.

C)To the right of Y1.

D)at Y0.

If monetary authorities are unable to sterilize, output will end up:

If monetary authorities are unable to sterilize, output will end up:A)at Y1.

B)to the left of Y1.

C)To the right of Y1.

D)at Y0.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

Consider a country that has an official settlements balance surplus and is experiencing upward pressure on the exchange rate value of its currency. Which of the following will NOT be true in this context?

A)The central bank of this country must intervene to buy foreign currency and sell domestic currency.

B)Its balance sheet will show an increase in official international reserve holdings.

C)Its balance sheet will show an increase in its liabilities.

D)For the regular bank that is involved in the intervention transaction, the central bank decreases the bank's deposits at the central bank.

A)The central bank of this country must intervene to buy foreign currency and sell domestic currency.

B)Its balance sheet will show an increase in official international reserve holdings.

C)Its balance sheet will show an increase in its liabilities.

D)For the regular bank that is involved in the intervention transaction, the central bank decreases the bank's deposits at the central bank.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

If international capital flows are not very responsive to interest rates, the initial impact of expansionary fiscal policy will:

A)result in a significant deterioration in the financial account.

B)result in a deficit in the overall balance of payments.

C)be totally ineffective.

D)lead to a current account surplus.

A)result in a significant deterioration in the financial account.

B)result in a deficit in the overall balance of payments.

C)be totally ineffective.

D)lead to a current account surplus.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

There are limits to the ability of monetary authorities to use sterilized intervention in the case of a surplus because:

A)the central bank may be unwilling to increase its holdings of foreign currency.

B)the pressure from foreign countries to allow the domestic currency to depreciate will lead to large losses.

C)the central bank's ability to constantly obtain foreign currency for the sterilized intervention is constrained.

D)the export level is fixed and it cannot be allowed to drop.

A)the central bank may be unwilling to increase its holdings of foreign currency.

B)the pressure from foreign countries to allow the domestic currency to depreciate will lead to large losses.

C)the central bank's ability to constantly obtain foreign currency for the sterilized intervention is constrained.

D)the export level is fixed and it cannot be allowed to drop.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

Monetary policy under a fixed exchange rate regime will be:

A)more effective than fiscal policy.

B)more powerful with high capital mobility than with low capital mobility.

C)likely to cause large and persistent deficits.

D)constrained and relatively ineffective.

A)more effective than fiscal policy.

B)more powerful with high capital mobility than with low capital mobility.

C)likely to cause large and persistent deficits.

D)constrained and relatively ineffective.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

The initial impact of _____ the money supply _____ the balance of payments.

A)expanding; worsens

B)expanding; improves

C)contracting; worsens

D)contracting; has no effect on

A)expanding; worsens

B)expanding; improves

C)contracting; worsens

D)contracting; has no effect on

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

Official intervention in the foreign exchange market to defend a fixed exchange rate when the value of the country's currency is under downward pressure causes:

A)international reserve holdings to rise.

B)a downward pressure on the country's interest rates.

C)an increase in the liabilities of the central bank.

D)the domestic money supply to fall.

A)international reserve holdings to rise.

B)a downward pressure on the country's interest rates.

C)an increase in the liabilities of the central bank.

D)the domestic money supply to fall.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

A(n) _____ in the money supply in a country _____ the domestic interest rates.

A)expansion; increases

B)expansion; decreases

C)contraction; decreases

D)contraction; has no impact on

A)expansion; increases

B)expansion; decreases

C)contraction; decreases

D)contraction; has no impact on

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

If international capital flows are highly responsive to interest rates, expansionary fiscal policy will:

A)lead to financial account surpluses.

B)lead to financial account deficits.

C)be totally ineffective.

D)lead to current account surpluses.

A)lead to financial account surpluses.

B)lead to financial account deficits.

C)be totally ineffective.

D)lead to current account surpluses.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

The combination of currency and bank deposits at the central bank is called the money supply.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

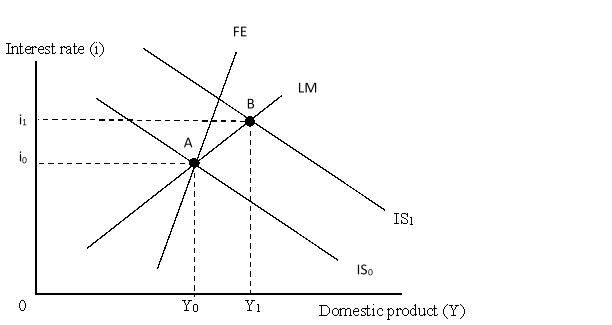

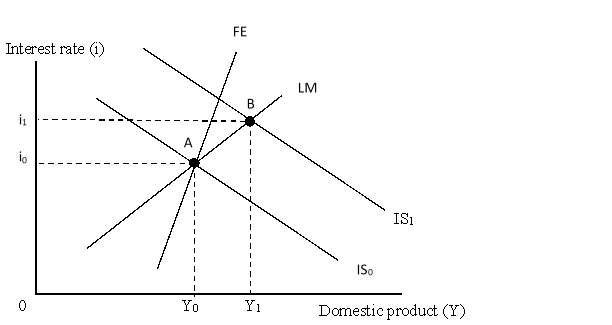

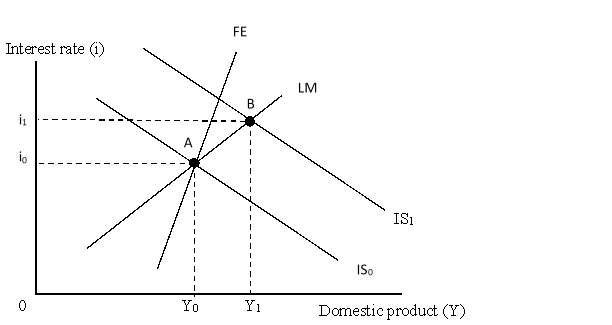

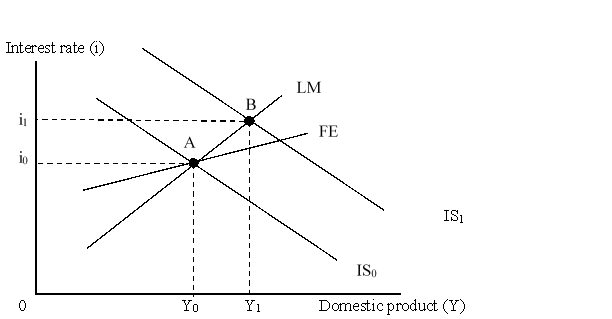

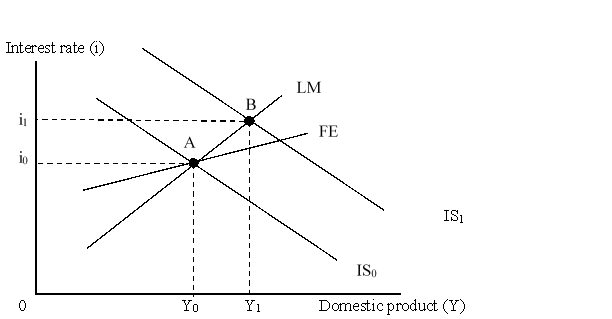

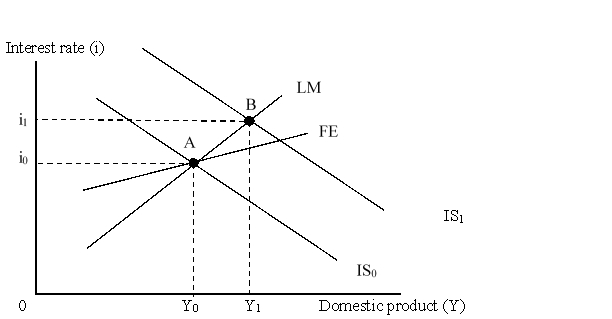

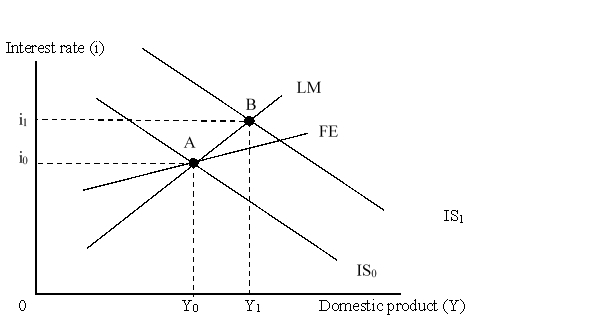

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy was at point A, a triple intersection. Here, the FE curve is flatter than the LM curve.  If monetary authorities are unable to sterilize, the interest rate will end up:

If monetary authorities are unable to sterilize, the interest rate will end up:

A)at i1.

B)above i1.

C)between i1 and i0.

D)at i0.

If monetary authorities are unable to sterilize, the interest rate will end up:

If monetary authorities are unable to sterilize, the interest rate will end up:A)at i1.

B)above i1.

C)between i1 and i0.

D)at i0.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

Assume that the exchange rates are fixed. When money demand is less sensitive to interest rate changes than are international capital flows, _____ policy will be _____ effective than when money demand is more sensitive to interest changes than are international capital flows.

A)expansionary fiscal; more

B)expansionary fiscal; less

C)expansionary monetary; more

D)sterilized intervention; more

A)expansionary fiscal; more

B)expansionary fiscal; less

C)expansionary monetary; more

D)sterilized intervention; more

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

Under perfect capital mobility and fixed exchange rates, expansionary _____ is a futile attempt because the _____.

A)fiscal policy; LM curve effectively is vertical.

B)monetary policy; LM curve effectively is the same as the FE curve.

C)fiscal policy; interest rate does not change.

D)monetary policy; IS curve will shift to the left.

A)fiscal policy; LM curve effectively is vertical.

B)monetary policy; LM curve effectively is the same as the FE curve.

C)fiscal policy; interest rate does not change.

D)monetary policy; IS curve will shift to the left.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy was at point A, a triple intersection. Here, the FE curve is flatter than the LM curve.  In order to maintain the fixed exchange rate, at point B monetary authorities must:

In order to maintain the fixed exchange rate, at point B monetary authorities must:

A)buy domestic government bonds.

B)sell domestic currency.

C)buy domestic currency.

D)sell domestic government bonds.

In order to maintain the fixed exchange rate, at point B monetary authorities must:

In order to maintain the fixed exchange rate, at point B monetary authorities must:A)buy domestic government bonds.

B)sell domestic currency.

C)buy domestic currency.

D)sell domestic government bonds.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

According to the assignment rule, which of the following policy mixes is appropriate for a country with high unemployment, a balance of payments deficit, and fixed exchange rates?

A)Contractionary fiscal policy and contractionary monetary policy

B)Contractionary fiscal policy and expansionary monetary policy

C)Expansionary fiscal policy and expansionary monetary policy

D)Expansionary fiscal policy and contractionary monetary policy

A)Contractionary fiscal policy and contractionary monetary policy

B)Contractionary fiscal policy and expansionary monetary policy

C)Expansionary fiscal policy and expansionary monetary policy

D)Expansionary fiscal policy and contractionary monetary policy

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy was at point A, a triple intersection. Here, the FE curve is flatter than the LM curve.  At point B, the economy is experiencing:

At point B, the economy is experiencing:

A)a decreasing money supply.

B)a surplus in the overall balance of payments.

C)an overall balance of payments that is in equilibrium.

D)a high rate of unemployment.

At point B, the economy is experiencing:

At point B, the economy is experiencing:A)a decreasing money supply.

B)a surplus in the overall balance of payments.

C)an overall balance of payments that is in equilibrium.

D)a high rate of unemployment.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

According to the assignment rule, which of the following policy mixes is appropriate for a country with high inflation, a balance of payments surplus, and fixed exchange rates?

A)Contractionary fiscal policy and contractionary monetary policy

B)Contractionary fiscal policy and expansionary monetary policy

C)Expansionary fiscal policy and expansionary monetary policy

D)Expansionary fiscal policy and contractionary monetary policy

A)Contractionary fiscal policy and contractionary monetary policy

B)Contractionary fiscal policy and expansionary monetary policy

C)Expansionary fiscal policy and expansionary monetary policy

D)Expansionary fiscal policy and contractionary monetary policy

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

Under perfect capital mobility and fixed exchange rates, expansionary _____ is especially effective because the _____.

A)fiscal policy; LM curve effectively is vertical.

B)monetary policy; LM curve effectively is the same as the FE curve.

C)fiscal policy; interest rate does not change.

D)monetary policy; interest rate does not change.

A)fiscal policy; LM curve effectively is vertical.

B)monetary policy; LM curve effectively is the same as the FE curve.

C)fiscal policy; interest rate does not change.

D)monetary policy; interest rate does not change.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

According to the assignment rule, which of the following policy mixes is appropriate for a country with high unemployment, a balance of payments surplus, and fixed exchange rates?

A)Expansionary fiscal policy and expansionary monetary policy

B)Expansionary fiscal policy and contractionary monetary policy

C)Contractionary fiscal policy and expansionary monetary policy

D)Contractionary fiscal policy and contractionary monetary policy

A)Expansionary fiscal policy and expansionary monetary policy

B)Expansionary fiscal policy and contractionary monetary policy

C)Contractionary fiscal policy and expansionary monetary policy

D)Contractionary fiscal policy and contractionary monetary policy

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

International capital-flow shocks to an economy with fixed exchange rates necessitates:

A)an offsetting fiscal policy.

B)devaluation or revaluation of the domestic currency.

C)international borrowing by the domestic government.

D)intervention in the foreign exchange market by the domestic monetary authorities.

A)an offsetting fiscal policy.

B)devaluation or revaluation of the domestic currency.

C)international borrowing by the domestic government.

D)intervention in the foreign exchange market by the domestic monetary authorities.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that the FE curve is flatter than the LM curve. A negative internal shock shifts the IS curve leftward. Under zero sterilization, which one of the following will happen next?

A)Because of the incipient balance of payments deficit, the LM curve will shift leftward

B)Because of the incipient balance of payments surplus, the LM curve will shift rightward

C)Because of the incipient balance of payments deficit, the IS curve will shift leftward

D)Because of the incipient balance of payments surplus, the IS curve will shift rightward

A)Because of the incipient balance of payments deficit, the LM curve will shift leftward

B)Because of the incipient balance of payments surplus, the LM curve will shift rightward

C)Because of the incipient balance of payments deficit, the IS curve will shift leftward

D)Because of the incipient balance of payments surplus, the IS curve will shift rightward

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is accurate?

A)Fiscal policy is not effective with fixed exchange rates in an environment of highly responsive international capital flows.

B)Fiscal policy is highly effective with fixed exchange rates and unresponsive international capital flows.

C)Fixed exchange rates greatly constrain a country's ability to pursue an independent monetary policy.

D)Contractionary monetary policy is effective under a fixed exchange rate regime.

A)Fiscal policy is not effective with fixed exchange rates in an environment of highly responsive international capital flows.

B)Fiscal policy is highly effective with fixed exchange rates and unresponsive international capital flows.

C)Fixed exchange rates greatly constrain a country's ability to pursue an independent monetary policy.

D)Contractionary monetary policy is effective under a fixed exchange rate regime.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

The J curve shows that:

A)devaluation is more likely to improve the trade balance in the short-run than in the long-run.

B)devaluation is more likely to improve the trade balance after a longer span of time has elapsed.

C)devaluation is likely to be unstable.

D)devaluation is unlikely to improve the trade balance in either the short-run or the long-run.

A)devaluation is more likely to improve the trade balance in the short-run than in the long-run.

B)devaluation is more likely to improve the trade balance after a longer span of time has elapsed.

C)devaluation is likely to be unstable.

D)devaluation is unlikely to improve the trade balance in either the short-run or the long-run.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

If a country with high unemployment, a balance of payments deficit, and fixed exchange rates decides to abandon it fixed exchange rate and allow its exchange rate to float, which among the following will be a probable effect?

A)Its currency will depreciate, increasing international competitiveness and leading to higher aggregate demand and an improvement in the current account.

B)Its currency will appreciate, increasing international competitiveness and leading to higher aggregate demand and an improvement in the current account.

C)Its currency will depreciate, decreasing international competitiveness and leading to lower aggregate demand and an improvement in the current account.

D)Its currency will appreciate, decreasing international competitiveness and leading to lower aggregate demand and a worsening of the current account.

A)Its currency will depreciate, increasing international competitiveness and leading to higher aggregate demand and an improvement in the current account.

B)Its currency will appreciate, increasing international competitiveness and leading to higher aggregate demand and an improvement in the current account.

C)Its currency will depreciate, decreasing international competitiveness and leading to lower aggregate demand and an improvement in the current account.

D)Its currency will appreciate, decreasing international competitiveness and leading to lower aggregate demand and a worsening of the current account.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

The figure below shows an IS-LM-FE model for an economy with fixed exchange rates. Initially the economy was at point A, a triple intersection. Here, the FE curve is flatter than the LM curve.  Assume that the economy was initially at point A. Which of the following would have moved the economy to point B?

Assume that the economy was initially at point A. Which of the following would have moved the economy to point B?

A)Expansionary monetary policy with sterilization

B)Expansionary monetary policy without sterilization

C)Expansionary fiscal policy with sterilization

D)Contractionary fiscal policy without sterilization

Assume that the economy was initially at point A. Which of the following would have moved the economy to point B?

Assume that the economy was initially at point A. Which of the following would have moved the economy to point B?A)Expansionary monetary policy with sterilization

B)Expansionary monetary policy without sterilization

C)Expansionary fiscal policy with sterilization

D)Contractionary fiscal policy without sterilization

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

According to the assignment rule, which of the following policy mixes is appropriate for a country with high inflation, a balance of payments deficit, and fixed exchange rates?

A)Expansionary fiscal policy and expansionary monetary policy

B)Expansionary fiscal policy and contractionary monetary policy

C)Contractionary fiscal policy and expansionary monetary policy

D)Contractionary fiscal policy and contractionary monetary policy

A)Expansionary fiscal policy and expansionary monetary policy

B)Expansionary fiscal policy and contractionary monetary policy

C)Contractionary fiscal policy and expansionary monetary policy

D)Contractionary fiscal policy and contractionary monetary policy

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

Assume that the FE curve is flatter than the LM curve. A negative external capital-flow shock shifts the FE curve left. Under zero sterilization, which one of the following will happen next?

A)Because of the incipient balance of payments deficit, LM curve will shift leftward

B)Because of the incipient balance of payments surplus, LM curve will shift rightward

C)Because of the incipient balance of payments deficit, IS curve will shift rightward

D)Because of the incipient balance of payments surplus, IS curve will shift leftward

A)Because of the incipient balance of payments deficit, LM curve will shift leftward

B)Because of the incipient balance of payments surplus, LM curve will shift rightward

C)Because of the incipient balance of payments deficit, IS curve will shift rightward

D)Because of the incipient balance of payments surplus, IS curve will shift leftward

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

Internal shocks to an economy with a fixed exchange rate will:

A)have the same types of impacts as monetary and fiscal policy changes.

B)have no impact on the domestic economy but will lead to external imbalances.

C)have no impact on both the country's internal balance and the country's balance of payments.

D)have no impact on the country's internal balance but will change the country's balance of payments.

A)have the same types of impacts as monetary and fiscal policy changes.

B)have no impact on the domestic economy but will lead to external imbalances.

C)have no impact on both the country's internal balance and the country's balance of payments.

D)have no impact on the country's internal balance but will change the country's balance of payments.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

International trade shocks:

A)have no impact on the countries under fixed exchange rate regimes.

B)are of equal concern to large industrialized countries and to developing countries that rely on exporting a few primary commodities.

C)include changes in a country's total exports that result from changes in foreign consumer tastes.

D)are magnified by the use of tariffs and non-tariff barriers.

A)have no impact on the countries under fixed exchange rate regimes.

B)are of equal concern to large industrialized countries and to developing countries that rely on exporting a few primary commodities.

C)include changes in a country's total exports that result from changes in foreign consumer tastes.

D)are magnified by the use of tariffs and non-tariff barriers.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

A monetary shock to an economy with a fixed exchange rate regime will have a smaller impact on the domestic economy than will a comparable domestic spending shock.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

A central bank can sterilize the increase in the money supply that results from an intervention to defend a fixed exchange rate by selling domestic government bonds.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

The assignment rule says that, with fixed exchange rates, fiscal policy should be used to stabilize the balance of payments and monetary policy should be used to stabilize the domestic economy.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

With perfect capital mobility, the LM and FE curves are both horizontal.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

For a country with a fixed exchange rate and no sterilization: When the FE curve is flatter than the LM curve, a negative domestic spending shock to the IS curve creates a balance of payments deficit, which then causes the LM curve to shift to the left.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

The key to the assignment rule is that one powerful government policy tool can be used to achieve both external balance and internal balance.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

"For countries with fixed exchange rates, payments deficits would be self-correcting, if only governments would stop doing their darnedest to prevent correction." Comment, and include how counterbalancing monetary policy (sterilization) can prevent self-adjustment from occurring.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

Describe the different types of internal shocks to an economy.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

According to the assignment rule, if a country has excessive inflation and a balance of payments surplus, it should ease monetary policy and tighten fiscal policy.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

According to the standard IS-LM-FE model, a country with a fixed exchange rate can attain both internal and external balance by using an appropriate mix of monetary and fiscal policies, without resorting to devaluation or revaluation.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

With fixed exchange rates, fiscal policy is more powerful with a high degree of capital mobility than with a low degree of capital mobility.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

Most countries are able to use sterilized interventions to run deficits and surpluses indefinitely.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

Why is a depreciation or devaluation of the nation's currency unable to eliminate a trade balance deficit when the country's demand for imports and the foreign demand for the country's exports are both highly inelastic?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

Consider a country with a fixed exchange rate that is experiencing a deficit in it overall payments balance. Show graphically (using IS-LM-FE) and explain how a change in domestic monetary policy could attempt to quickly eliminate the payments deficit. What could be a possible threat to the economy due to the policy change?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

A country begins with external balance (its official settlements balance is zero). Explain the effects of a shift by the country to an expansionary monetary policy on the balance of payments of the country. (Assume that the exchange rate is fixed, but do not consider any follow-on effects from defending the fixed rate.)

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

With fixed exchange rates, external capital flow shocks have little impact on a country's economy.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

For a country with a fixed exchange rate and no sterilization: When the FE curve is steeper than the LM curve, a negative domestic spending shock to the IS curve creates a balance of payments surplus, which then causes the LM curve to shift to the right.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

As long as the FE curve is vertical, internal and external balance can be achieved by using the appropriate mix of monetary and fiscal policy.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

The J-curve suggests a typical pattern for a country's trade balance after an abrupt depreciation or devaluation of the country's currency. What are the key factors behind this relationship? Explain.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck