Deck 10: Arguments for and Against Protection

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 10: Arguments for and Against Protection

1

Which of the following is true of the specificity rule?

A)The specificity rule suggests that tariffs should be imposed only on specific products.

B)According to the specificity rule, government policy should target as closely as possible the source of the distortion that separates private and social benefits (or costs).

C)The specificity rule posits that tariff imposed on a good favors only the interests of a specific group within a country.

D)According to the specificity rule, only specific industries should be allowed to participate in government lobbying.

A)The specificity rule suggests that tariffs should be imposed only on specific products.

B)According to the specificity rule, government policy should target as closely as possible the source of the distortion that separates private and social benefits (or costs).

C)The specificity rule posits that tariff imposed on a good favors only the interests of a specific group within a country.

D)According to the specificity rule, only specific industries should be allowed to participate in government lobbying.

B

2

In a "first-best" world:

A)each economy is self-sufficient enough not to indulge in free trade.

B)free trade is economically efficient.

C)free trade benefits only the consumers of the importing country.

D)free trade benefits only the exporting nations.

A)each economy is self-sufficient enough not to indulge in free trade.

B)free trade is economically efficient.

C)free trade benefits only the consumers of the importing country.

D)free trade benefits only the exporting nations.

B

3

Which of the following statements reflects a situation in which there are external benefits?

A)John paints his house and cleans his paintbrushes in the stream.

B)John pays 5 percent of his income as taxes.

C)John's decision to get vaccinated for smallpox reduces the chances that his neighbor Pete will get smallpox.

D)John sells his car to his neighbor Pete at half the first-hand price.

A)John paints his house and cleans his paintbrushes in the stream.

B)John pays 5 percent of his income as taxes.

C)John's decision to get vaccinated for smallpox reduces the chances that his neighbor Pete will get smallpox.

D)John sells his car to his neighbor Pete at half the first-hand price.

C

4

Suppose manufacturing of paper results in substantial ground-water pollution. One possible policy that can be used to fix this externality is:

A)to subsidize the production of paper by the domestic firms.

B)to impose tax on the production of paper.

C)to raise tariff barriers on paper imports.

D)to provide tax benefits to the firms exporting paper.

A)to subsidize the production of paper by the domestic firms.

B)to impose tax on the production of paper.

C)to raise tariff barriers on paper imports.

D)to provide tax benefits to the firms exporting paper.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose that the training, skills, and attitudes received by employees in the computer gaming development industry have positive spillover effects as workers leave the industry and move to other jobs. The specificity rule suggests that the best way to achieve more employment in this industry is to:

A)impose a tariff on the importation of computer games.

B)remove all sales taxes from the purchases of computer games.

C)give computer game developing firms a subsidy tied to their level of employment.

D)tax production of computer games.

A)impose a tariff on the importation of computer games.

B)remove all sales taxes from the purchases of computer games.

C)give computer game developing firms a subsidy tied to their level of employment.

D)tax production of computer games.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

If Social Marginal Benefit (SMB) > Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Cost (SMC), it implies that:

A)too much is supplied.

B)not enough of a good is being demanded.

C)the socially optimal amount is supplied.

D)the buyers are not maximizing utility.

A)too much is supplied.

B)not enough of a good is being demanded.

C)the socially optimal amount is supplied.

D)the buyers are not maximizing utility.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following refers to the net effects on parties who are not directly involved in a transaction?

A)Invisible hand

B)Incentive distortions

C)Consumption effect

D)Externality

A)Invisible hand

B)Incentive distortions

C)Consumption effect

D)Externality

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

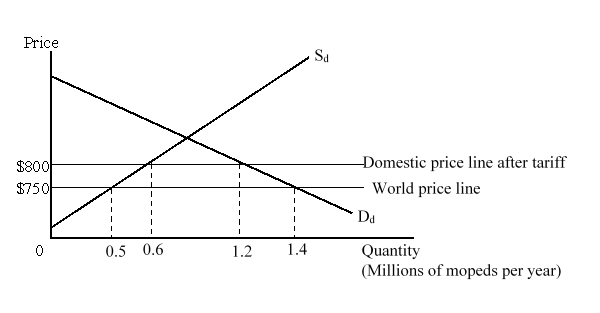

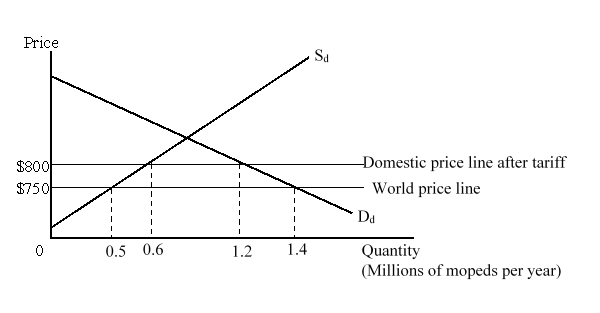

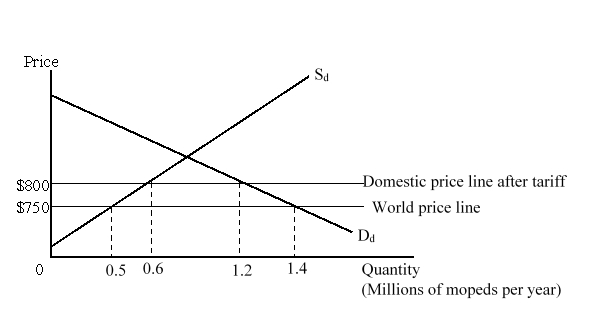

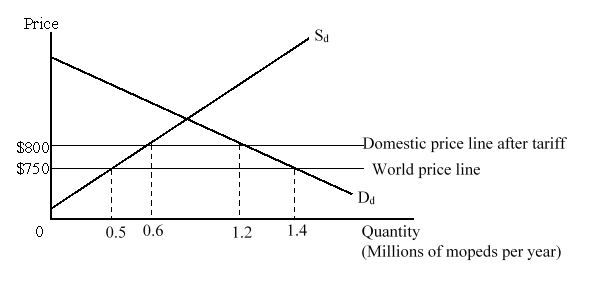

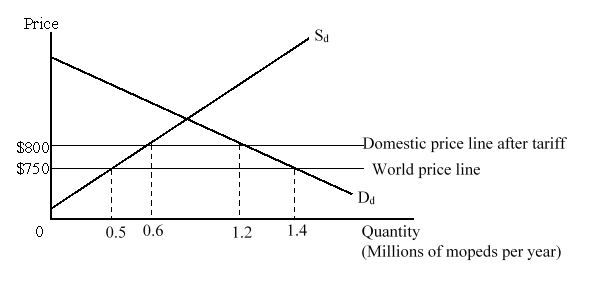

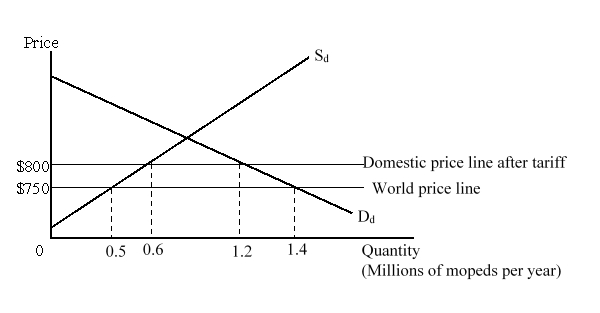

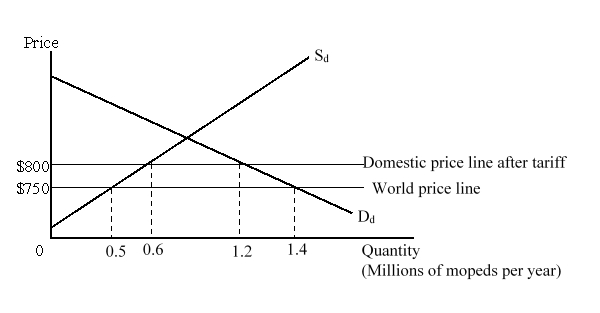

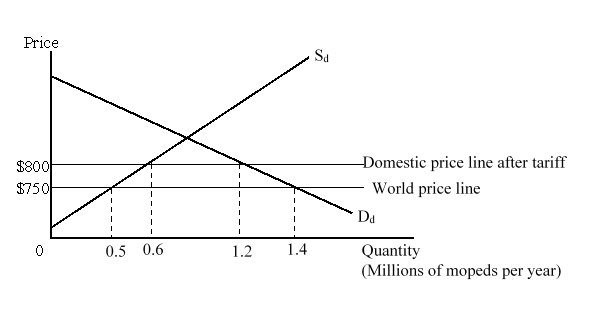

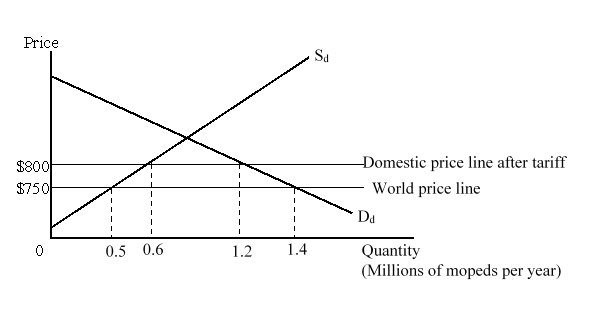

The figure given below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds respectively.  Calculate the welfare loss arising from the production effect of the tariff.

Calculate the welfare loss arising from the production effect of the tariff.

A)$14 million

B)$2.5 million

C)$5 million

D)$7.5 million

Calculate the welfare loss arising from the production effect of the tariff.

Calculate the welfare loss arising from the production effect of the tariff.A)$14 million

B)$2.5 million

C)$5 million

D)$7.5 million

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements reflects a situation in which there are external costs?

A)Suzanne invites her neighbors to a party on her birthday.

B)Suzanne paints her house and landscapes her yard.Her newly beautified house and yard help her neighbors to sell their house for more than the asking price.

C)Suzanne pays for a professional fireworks show for her family.Her neighbors also enjoy the show.

D)Suzanne dumps her household garbage around the corner of the street.

A)Suzanne invites her neighbors to a party on her birthday.

B)Suzanne paints her house and landscapes her yard.Her newly beautified house and yard help her neighbors to sell their house for more than the asking price.

C)Suzanne pays for a professional fireworks show for her family.Her neighbors also enjoy the show.

D)Suzanne dumps her household garbage around the corner of the street.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

If there is something extra bad about local consumption of a product, then a tariff can be good for the country because:

A)the tariff makes all residents richer.

B)the tariff brings down the domestic price of the product.

C)the tariff leads to higher domestic price for the product.

D)the tariff revenue is invested in the production of substitute products.

A)the tariff makes all residents richer.

B)the tariff brings down the domestic price of the product.

C)the tariff leads to higher domestic price for the product.

D)the tariff revenue is invested in the production of substitute products.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is valid for a "first-best" world?

A)Social Marginal Benefit (SMB) > Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Cost (SMC)

B)Social Marginal Cost (SMC) > Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Benefit (SMB)

C)Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Cost (SMC) = Social Marginal Benefit (SMB)

D)Social Marginal Benefit (SMB) > Social Marginal Cost (SMC)

A)Social Marginal Benefit (SMB) > Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Cost (SMC)

B)Social Marginal Cost (SMC) > Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Benefit (SMB)

C)Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Cost (SMC) = Social Marginal Benefit (SMB)

D)Social Marginal Benefit (SMB) > Social Marginal Cost (SMC)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is a plausible solution to a distortion?

A)By centralizing the privately owned enterprises

B)By shutting down any industry which is contributing to atmospheric pollution

C)By imposing a tax or subsidy on the activity if the social marginal cost or the social marginal benefit exceeds the market price

D)By imposing an importation ban on manufactured goods

A)By centralizing the privately owned enterprises

B)By shutting down any industry which is contributing to atmospheric pollution

C)By imposing a tax or subsidy on the activity if the social marginal cost or the social marginal benefit exceeds the market price

D)By imposing an importation ban on manufactured goods

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

The tax-or-subsidy approach for solving externality problems was developed by:

A)Arthur Pigou.

B)Ronald Coase.

C)Eli Heckscher.

D)Bertil Ohlin.

A)Arthur Pigou.

B)Ronald Coase.

C)Eli Heckscher.

D)Bertil Ohlin.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose that the domestic production of computer games creates enjoyment for those who play the games. Domestic production of computer games also results in knowledge spillovers that positively impact many other industries. One possible policy that could be employed to encourage increased production of computer games by domestic firms is:

A)to impose tariffs on computer game imports.

B)to tax the production of computer games.

C)to tax the consumption of computer games.

D)to eliminate all restrictions on the importation of computer games.

A)to impose tariffs on computer game imports.

B)to tax the production of computer games.

C)to tax the consumption of computer games.

D)to eliminate all restrictions on the importation of computer games.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

The _____ states that it is usually more efficient to use the government policy tool that acts as directly as possible on the source of the distortion separating private and social benefits or costs.

A)Pigou effect

B)spillover effect

C)sudden-damage effect

D)specificity rule

A)Pigou effect

B)spillover effect

C)sudden-damage effect

D)specificity rule

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

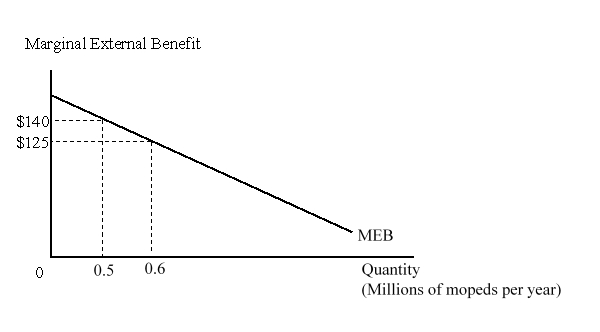

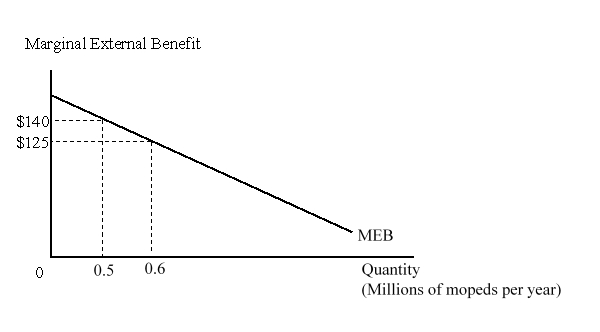

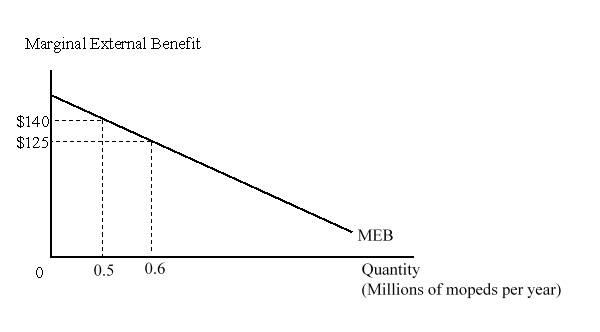

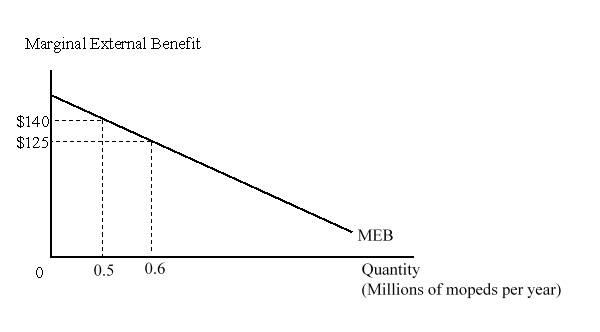

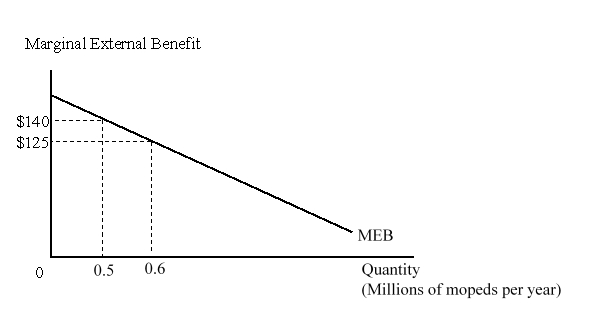

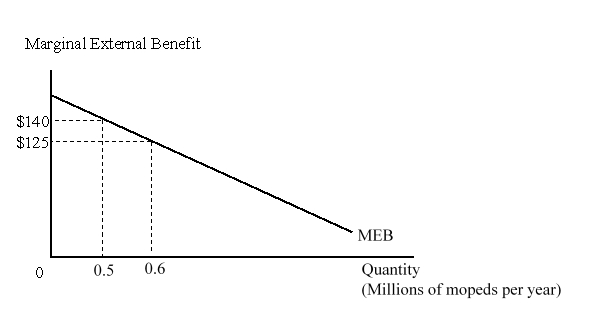

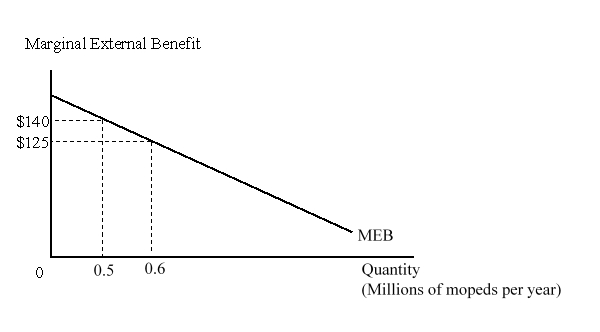

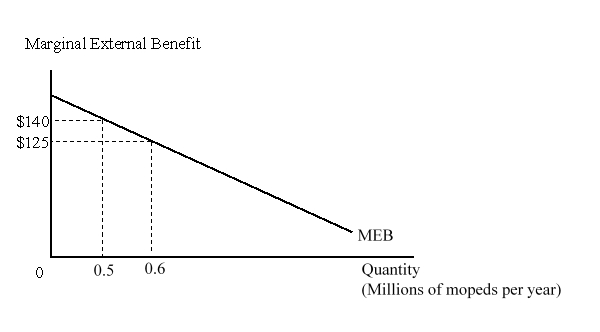

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  The increase in external benefits to the nation of the increased production of mopeds because of the tariff is:

The increase in external benefits to the nation of the increased production of mopeds because of the tariff is:

A)$13.25 million.

B)$2.5 million.

C)$5 million.

D)$7.5 million.

The increase in external benefits to the nation of the increased production of mopeds because of the tariff is:

The increase in external benefits to the nation of the increased production of mopeds because of the tariff is:A)$13.25 million.

B)$2.5 million.

C)$5 million.

D)$7.5 million.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

In a "second-best" world:

A)tariffs are economically optimal.

B)private actions are dictated by government agencies.

C)social marginal cost of a transaction equals social marginal benefit.

D)private actions do not lead to the best possible outcomes for society.

A)tariffs are economically optimal.

B)private actions are dictated by government agencies.

C)social marginal cost of a transaction equals social marginal benefit.

D)private actions do not lead to the best possible outcomes for society.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is an expected effect of a tariff or a nontariff barrier (NTB) on a product?

A)A decrease in the domestic production of the product

B)An increase in the employment of labor and other resources used in the import-competing industry in the tariff imposing country

C)An increase in domestic consumption of the imported product

D)A decrease in government revenue

A)A decrease in the domestic production of the product

B)An increase in the employment of labor and other resources used in the import-competing industry in the tariff imposing country

C)An increase in domestic consumption of the imported product

D)A decrease in government revenue

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

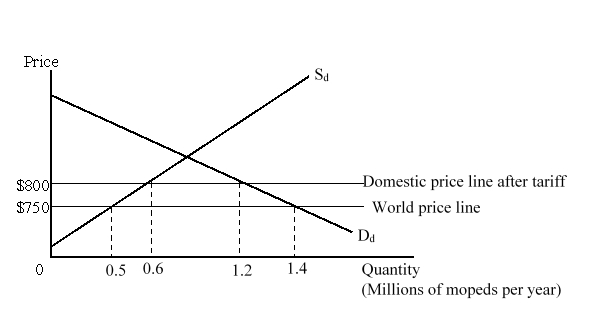

The figure given below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds respectively.  Calculate the welfare loss arising from the consumption effect of the tariff.

Calculate the welfare loss arising from the consumption effect of the tariff.

A)$14 million

B)$2.5 million

C)$5 million

D)$7.5 million

Calculate the welfare loss arising from the consumption effect of the tariff.

Calculate the welfare loss arising from the consumption effect of the tariff.A)$14 million

B)$2.5 million

C)$5 million

D)$7.5 million

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

If Social Marginal Cost (SMC) > Price (P) = Buyer's Private Marginal Benefit (MB) = Seller's Private Marginal Cost (MC) = Social Marginal Benefit (SMB), it implies that:

A)a commodity is oversupplied.

B)there is an excess demand for a commodity.

C)the socially optimal amount of a good is supplied.

D)firms are not maximizing profits.

A)a commodity is oversupplied.

B)there is an excess demand for a commodity.

C)the socially optimal amount of a good is supplied.

D)firms are not maximizing profits.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following asserts that temporary protection from international competition is needed for a nascent industry that initially has high costs?

A)The developing government argument

B)The infant industry argument

C)The dying industry argument

D)The optimal tariff argument

A)The developing government argument

B)The infant industry argument

C)The dying industry argument

D)The optimal tariff argument

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following asserts that import-competing firms that are struggling to stay in business should be provided protection in order to maintain jobs and continue domestic production?

A)The developing government argument

B)The infant industry argument

C)The dying industry argument

D)The optimal tariff argument

A)The developing government argument

B)The infant industry argument

C)The dying industry argument

D)The optimal tariff argument

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

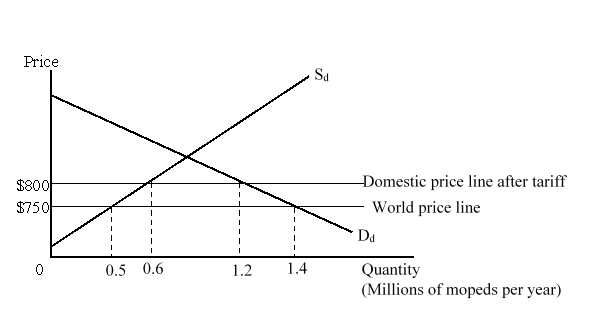

The figure given below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds respectively.  If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic production will increase by:

If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic production will increase by:

A)100,000 units.

B)600,000 units.

C)700,000 units.

D)1,200,000 units.

If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic production will increase by:

If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic production will increase by:A)100,000 units.

B)600,000 units.

C)700,000 units.

D)1,200,000 units.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

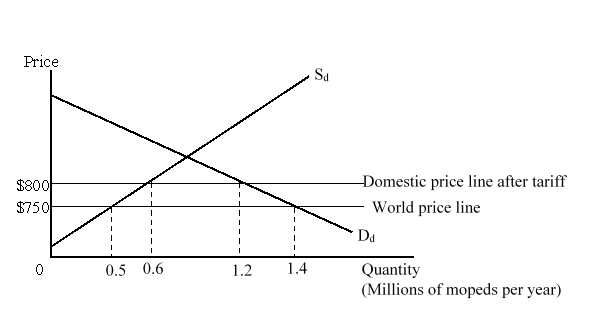

The figure given below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds respectively.  The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic consumption of mopeds would:

If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic consumption of mopeds would:

A)increase by 100,000 units.

B)decrease by 200,000 units.

C)decrease by 600,000 units.

D)remain unchanged.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic consumption of mopeds would:

If there is initially free trade, and then a $50 per unit subsidy is given to the domestic producers of mopeds, domestic consumption of mopeds would:A)increase by 100,000 units.

B)decrease by 200,000 units.

C)decrease by 600,000 units.

D)remain unchanged.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

The figure given below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds respectively.  The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  The overall impact of the tariff on the nation would be:

The overall impact of the tariff on the nation would be:

A)a loss of $15 million.

B)a loss of $20.75 million.

C)a gain of $13.25 million.

D)a gain of $5.75 million.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  The overall impact of the tariff on the nation would be:

The overall impact of the tariff on the nation would be:A)a loss of $15 million.

B)a loss of $20.75 million.

C)a gain of $13.25 million.

D)a gain of $5.75 million.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

The figure given below shows the national market for mopeds in a country. Dd and Sd are the domestic demand and supply curves of mopeds respectively.  The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  What will be the impact on the national well-being if, instead of imposing a tariff of $50 per unit, the government provides a subsidy of $50 per unit to the domestic manufacturers of mopeds?

What will be the impact on the national well-being if, instead of imposing a tariff of $50 per unit, the government provides a subsidy of $50 per unit to the domestic manufacturers of mopeds?

A)The national welfare will increase by $5 million.

B)The national welfare will decline by $2.5 million.

C)The national welfare will increase by $10.75 million.

D)The national welfare will decline by $5 million.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.

The figure given below shows the marginal external benefit curve (MEB) of the country from the production of domestic mopeds.  What will be the impact on the national well-being if, instead of imposing a tariff of $50 per unit, the government provides a subsidy of $50 per unit to the domestic manufacturers of mopeds?

What will be the impact on the national well-being if, instead of imposing a tariff of $50 per unit, the government provides a subsidy of $50 per unit to the domestic manufacturers of mopeds?A)The national welfare will increase by $5 million.

B)The national welfare will decline by $2.5 million.

C)The national welfare will increase by $10.75 million.

D)The national welfare will decline by $5 million.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

The import tariff rates are typically higher on final consumption goods than on intermediate goods and raw materials sold to manufacturing firms. This tendency is known as:

A)the tariff escalation pattern.

B)the terms of trade effect.

C)the spillover effect.

D)the sudden-damage effect.

A)the tariff escalation pattern.

B)the terms of trade effect.

C)the spillover effect.

D)the sudden-damage effect.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Under which of the following situations will the infant industry argument for protection stand to be valid?

A)New firms are unable to obtain funds from the financial owing to inherent imperfections in the banking system.

B)The benefits from the early business investments accrue to the firms making these early investments.

C)Firms that produce important military hardware cannot be established without government support.

D)The more a country exports, the more the price of its exports fall relative to its imports.

A)New firms are unable to obtain funds from the financial owing to inherent imperfections in the banking system.

B)The benefits from the early business investments accrue to the firms making these early investments.

C)Firms that produce important military hardware cannot be established without government support.

D)The more a country exports, the more the price of its exports fall relative to its imports.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Whenever the benefits of group effort fall on every member of a large dispersed group, regardless of individual contributions, there can be a:

A)sudden-damage effect.

B)spillover effect

C)free-rider problem.

D)negative externality.

A)sudden-damage effect.

B)spillover effect

C)free-rider problem.

D)negative externality.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

According to the developing government argument, tariffs imposed by a developing country:

A)may benefit the country because they represent an efficient mechanism for collecting revenue, but will harm the world.

B)can benefit the country by creating net social gains.

C)will be as inefficient as tariffs imposed by developed countries.

D)are likely to represent only a very small fraction of government revenues because the volume of imports in developing countries is relatively small.

A)may benefit the country because they represent an efficient mechanism for collecting revenue, but will harm the world.

B)can benefit the country by creating net social gains.

C)will be as inefficient as tariffs imposed by developed countries.

D)are likely to represent only a very small fraction of government revenues because the volume of imports in developing countries is relatively small.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

The United States produces some of the electronic components used as inputs in its fighter planes. But due to the limited number of companies that produce these items, it is forced to import these parts from Japan as well. There is concern that in the case of a prolonged war, these important imports may not be available. Fearing that the air force may be unable to fulfill its tasks in the case of a prolonged war, the specificity rule suggests that the United States should:

A)ban the importation of these electronics parts in order to protect jobs in this industry.

B)impose tariffs on the imports of these electronic parts.

C)subsidize the domestic production of these electronics parts.

D)impose high taxes on the production of these electronic parts.

A)ban the importation of these electronics parts in order to protect jobs in this industry.

B)impose tariffs on the imports of these electronic parts.

C)subsidize the domestic production of these electronics parts.

D)impose high taxes on the production of these electronic parts.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is true?

A)If new firms are struggling to obtain funds from underdeveloped financial markets, the most efficient policy solution would be to offer a production subsidy to these firms.

B)If the government's goal is to induce early production even when the new firms are not cost-competitive by world standards, a barrier to the import of a substitute of the product produced by these firms would be an ideal policy.

C)If young firms are struggling to retain their trained workers, then government should offer a subsidy to offset the costs of training workers.

D)If the domestic firms do not supply anything at the world price, the government should lower the import barriers to boost domestic production.

A)If new firms are struggling to obtain funds from underdeveloped financial markets, the most efficient policy solution would be to offer a production subsidy to these firms.

B)If the government's goal is to induce early production even when the new firms are not cost-competitive by world standards, a barrier to the import of a substitute of the product produced by these firms would be an ideal policy.

C)If young firms are struggling to retain their trained workers, then government should offer a subsidy to offset the costs of training workers.

D)If the domestic firms do not supply anything at the world price, the government should lower the import barriers to boost domestic production.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

The French highly value domestic production of traditional French cheese made by high-cost, traditional production methods. According to the specificity rule, the most efficient policy tool to protect this traditional industry would be:

A)to provide a production subsidy to the domestic firms.

B)to impose an import tariff on cheeses produced in other countries.

C)to impose an import ban on cheeses produced in other countries.

D)to eliminate all barriers on cheese imports since no protectionist policy would be efficient.

A)to provide a production subsidy to the domestic firms.

B)to impose an import tariff on cheeses produced in other countries.

C)to impose an import ban on cheeses produced in other countries.

D)to eliminate all barriers on cheese imports since no protectionist policy would be efficient.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

What is most likely to happen when firms in an import-competing infant industry are offered subsidies?

A)The firms will suffer from diseconomies of scale.

B)The firms will be able to sustain only if they charge a higher price than the foreign firms.

C)The firms will be able to charge a price equal to the world price and still earn a profit.

D)The firms will face a perfectly inelastic demand curve.

A)The firms will suffer from diseconomies of scale.

B)The firms will be able to sustain only if they charge a higher price than the foreign firms.

C)The firms will be able to charge a price equal to the world price and still earn a profit.

D)The firms will face a perfectly inelastic demand curve.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Instead of placing a tariff on the imports of steel, a government has decided to offer steel workers trade adjustment assistance which will allow them to pre-qualify for unemployment benefits. Such a policy is consistent with:

A)the dying industry argument.

B)the specificity rule.

C)the infant industry argument.

D)the national pride argument.

A)the dying industry argument.

B)the specificity rule.

C)the infant industry argument.

D)the national pride argument.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

In the U.S., the trade adjustment assistance:

A)provides workers who have been displaced from import-competing firms with an unemployment compensation for at least 24 months.

B)provides subsidies to firms who produce exportable commodities.

C)provides incentives for workers to search for new jobs outside the import-competing industry before they lose their jobs in these industries.

D)is often criticized on the ground that it leads to a huge drain of government funds.

A)provides workers who have been displaced from import-competing firms with an unemployment compensation for at least 24 months.

B)provides subsidies to firms who produce exportable commodities.

C)provides incentives for workers to search for new jobs outside the import-competing industry before they lose their jobs in these industries.

D)is often criticized on the ground that it leads to a huge drain of government funds.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Direct democracy makes tariffs less likely to be voted into law because:

A)the size of the individual losses would be larger than the individual gains from any potential protectionist measure.

B)domestic producers threatened by increased imports will lobby against the trade agreements entered into by the countries.

C)each person does not vote on the basis of his/her direct interest as a winner or loser from protection.

D)the number of people who are hurt by protectionist measures exceeds the number of people who gain from protectionist measures.

A)the size of the individual losses would be larger than the individual gains from any potential protectionist measure.

B)domestic producers threatened by increased imports will lobby against the trade agreements entered into by the countries.

C)each person does not vote on the basis of his/her direct interest as a winner or loser from protection.

D)the number of people who are hurt by protectionist measures exceeds the number of people who gain from protectionist measures.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is incorrect?

A)In a first-best world, import-competing firms that are struggling to stay in business would be allowed to go out of business and workers would find jobs in other industries.

B)If we want to help workers who lose jobs when a domestic industry shrinks, the specificity rule suggests that the government should provide subsidies to those workers to relocate to areas where jobs are available.

C)According to the protectionists, the most efficient policy to save jobs in the import-competing industries is to impose barriers on imports.

D)In a first-best world, if rising import competition is driving domestic producers out of business, the government must intervene to protect the domestic firms.

A)In a first-best world, import-competing firms that are struggling to stay in business would be allowed to go out of business and workers would find jobs in other industries.

B)If we want to help workers who lose jobs when a domestic industry shrinks, the specificity rule suggests that the government should provide subsidies to those workers to relocate to areas where jobs are available.

C)According to the protectionists, the most efficient policy to save jobs in the import-competing industries is to impose barriers on imports.

D)In a first-best world, if rising import competition is driving domestic producers out of business, the government must intervene to protect the domestic firms.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following arguments for protection is derived from the fact that funding of public goods in some countries is difficult given little or no means to collect income or sales taxes?

A)The developing government argument

B)The infant industry argument

C)The dying industry argument.

D)The national defense argument.

A)The developing government argument

B)The infant industry argument

C)The dying industry argument.

D)The national defense argument.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Tariffs are more likely to be imposed when:

A)the lobbying efforts of the consumer advocacy groups are much stronger than those of the producers.

B)the average gain per proponent far exceeds the average cost per opponent.

C)the number of people who are hurt by protectionist measures exceeds the number of people who gain from protectionist measures.

D)import-competing producers are unorganized.

A)the lobbying efforts of the consumer advocacy groups are much stronger than those of the producers.

B)the average gain per proponent far exceeds the average cost per opponent.

C)the number of people who are hurt by protectionist measures exceeds the number of people who gain from protectionist measures.

D)import-competing producers are unorganized.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

If additional domestic production will lead to positive spillover effects, then an import tariff that increases domestic production would better adhere to the specificity rule than would a government subsidy to domestic production.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

While trade restrictions do provide gains to certain segments in the economy, such restrictions will always lower national welfare.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

The national defense argument advocates the use of import barriers on goods that would be important in the case of a military emergency.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Arthur Pigou put forward the idea that positive and negative externalities can be resolved by creating new private property institutions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

The United States could begin building a new type of flat panel 3-dimensional television (FP3D). However, Japanese firms have been producing such televisions for a couple of years and are already low-cost, high-quality producers. Should the United States impose temporary protection in the form of a tariff on this product to protect the domestic industry until it is mature enough to compete with the Japanese producers? Why or why not?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Tariffs and quotas are one-size-fits-all measures that work as tools to internalize external effects.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

"It is good to protect domestic production for a nation as a whole and not just for workers and firms receiving protection." Give three scenarios to justify this statement.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Import tariffs are efficient second-best policy solutions for many developing countries where government revenue is difficult to obtain by other means such as an income or sales tax.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Monopoly power can create distortions because a powerful seller can raise price and profits by restricting output.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

In second-best world, private actions will lead to the best possible outcomes for the society.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

What is the dying industry argument for establishing barriers to imports? What are its merits and weaknesses? What measure(s) is/are more efficient than an import tariff if the intention is to help workers who would be displaced from a dying industry? Why? What measure(s) is/are more efficient than an import tariff if maintaining current production levels is the goal of government policy?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose Russia can produce automobiles relatively cheaply, but they have poor gas mileage and create a great deal of air pollution. The U.S. government, concerned about the quality of air, would like to see fewer Russian automobiles and more cleaner-running American automobiles on the road.

a.What is the nature of the market failure that would justify the U.S.government taking some action against the importation of Russian automobiles?

b.Explain why imposing a tariff is a second best policy to employ in this case and what policy choice would be more efficient.

a.What is the nature of the market failure that would justify the U.S.government taking some action against the importation of Russian automobiles?

b.Explain why imposing a tariff is a second best policy to employ in this case and what policy choice would be more efficient.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose a recent study shows that in country A, consumers pay an average of about $169,000 per job per year maintained by import protection. Given that these employees earned much less than $169,000 per year, it would be much cheaper to simply pay these workers not to work and impose no import restrictions. Why do you think that, in spite of the fact that there is a net welfare loss, the government of country A has maintained these barriers?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

External effects from a transaction indicate that there is a misalignment between private and social benefits or costs.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Government loans are more efficient than production subsidies if a young industry faces financial markets that are unwilling to provide funding to the industry due to the high risk.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

Too much of a good is produced if some external benefits of producing or consuming it are ignored by the private decision makers.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose the government of a small country has to frame a policy which would promote the level of domestic production or employment of import-competing industries. It is left with a choice of either imposing a tariff on the foreign goods or providing production subsidies to the domestic firms. Which policy will the government choose and why? Explain with a diagram. Is there a particular principle that can guide the government's decision? If so, name and state it.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

In a first-best world, for any commodity, the price of the commodity, the private marginal benefit, the private marginal cost of producing it, the social marginal benefit, and the social marginal cost are all equal at the margin.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

If it is desirable to enhance the incomes of factors used intensively in the import-competing industry, then a tariff would actually lower national welfare.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

The infant industry argument is valid if the present value of the stream of national benefits is less than the present value of the stream of national costs.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck