Deck 19: Pensions and Other Employee Future Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

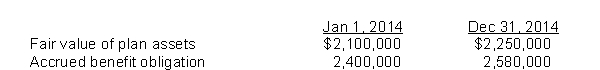

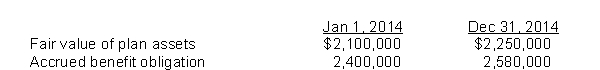

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 19: Pensions and Other Employee Future Benefits

1

The defined benefit obligation is always decreased by

A)benefits paid to retirees.

B)past service costs.

C)benefits paid to retirees and interest costs.

D)past service costs and interest costs.

A)benefits paid to retirees.

B)past service costs.

C)benefits paid to retirees and interest costs.

D)past service costs and interest costs.

A

2

The defined benefit obligation is always increased by

A)current service cost and payments to retirees.

B)current service cost and interest cost.

C)interest cost and actuarial gains.

D)current service cost and past service costs.

A)current service cost and payments to retirees.

B)current service cost and interest cost.

C)interest cost and actuarial gains.

D)current service cost and past service costs.

B

3

An experience gain or loss (adjustment)is

A)additional contributions made to the pension fund by the employer.

B)additional contributions made to the pension fund by the employees.

C)reduced payments made to retirees.

D)the difference between what has occurred and the previous actuarial assumptions.

A)additional contributions made to the pension fund by the employer.

B)additional contributions made to the pension fund by the employees.

C)reduced payments made to retirees.

D)the difference between what has occurred and the previous actuarial assumptions.

D

4

For defined benefit plans, the attribution period for employees is the time between

A)the hire date and the vesting date.

B)the vesting date and the date the employee becomes eligible for full benefits.

C)the hire date and the date the employee becomes eligible for full benefits.

D)the hire date and the date the employee reaches 65.

A)the hire date and the vesting date.

B)the vesting date and the date the employee becomes eligible for full benefits.

C)the hire date and the date the employee becomes eligible for full benefits.

D)the hire date and the date the employee reaches 65.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

Under IFRS, the defined benefit obligation for accounting purposes is

A)the present value of vested and non-vested benefits earned to the statement of financial position date, with the benefits measured using employees' future salary levels.

B)the present value of vested and non-vested benefits earned to the statement of financial position date, with the benefits measured using employees' current salary levels.

C)the present value of vested benefits only earned to the statement of financial position date, with the benefits measured using employees' future salary levels.

D)the present value of non-vested benefits only earned to the statement of financial position date, with the benefits measured using employees' future salary levels.

A)the present value of vested and non-vested benefits earned to the statement of financial position date, with the benefits measured using employees' future salary levels.

B)the present value of vested and non-vested benefits earned to the statement of financial position date, with the benefits measured using employees' current salary levels.

C)the present value of vested benefits only earned to the statement of financial position date, with the benefits measured using employees' future salary levels.

D)the present value of non-vested benefits only earned to the statement of financial position date, with the benefits measured using employees' future salary levels.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

The objective of accounting for defined benefit plans is to

A)calculate the actual amounts employees will receive at retirement.

B)recognize the appropriate expense and liability over the accounting periods in which the related services are provided by the employees.

C)calculate the current service cost.

D)determine which employees' rights have vested.

A)calculate the actual amounts employees will receive at retirement.

B)recognize the appropriate expense and liability over the accounting periods in which the related services are provided by the employees.

C)calculate the current service cost.

D)determine which employees' rights have vested.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

In a defined contribution plan, a formula is used that

A)defines the benefits that the employee will receive at retirement.

B)ensures that pension expense and the cash funding amount will be different.

C)requires an employer to contribute a certain sum each period based on the formula.

D)ensures that employers are not at risk to make sure funds are available at retirement.

A)defines the benefits that the employee will receive at retirement.

B)ensures that pension expense and the cash funding amount will be different.

C)requires an employer to contribute a certain sum each period based on the formula.

D)ensures that employers are not at risk to make sure funds are available at retirement.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

The obligation for a defined contribution plan is calculated by

A)discounting the benefit the employee will receive at retirement.

B)add up contributions made plus interest earned less any benefits paid out.

C)the cumulative contributions made to the pension plan.

D)the amount the employer is obligated to contribute for the period.

A)discounting the benefit the employee will receive at retirement.

B)add up contributions made plus interest earned less any benefits paid out.

C)the cumulative contributions made to the pension plan.

D)the amount the employer is obligated to contribute for the period.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

Examples of post-employment benefits that are provided after employment but before retirement include all EXCEPT

A)long-term disability income benefits.

B)pension plan.

C)long-term severance benefits.

D)continuation of benefits such as health care.

A)long-term disability income benefits.

B)pension plan.

C)long-term severance benefits.

D)continuation of benefits such as health care.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

Employee future benefits do NOT include

A)post-employment pension plans.

B)long-term severance benefits.

C)regular vacation pay.

D)unrestricted sabbatical leaves.

A)post-employment pension plans.

B)long-term severance benefits.

C)regular vacation pay.

D)unrestricted sabbatical leaves.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

The relationship between the amount funded and the amount reported for pension expense is that

A)pension expense must always equal the amount funded.

B)pension expense will be less than the amount funded.

C)pension expense will be more than the amount funded.

D)pension expense may be greater than, equal to, or less than the amount funded.

A)pension expense must always equal the amount funded.

B)pension expense will be less than the amount funded.

C)pension expense will be more than the amount funded.

D)pension expense may be greater than, equal to, or less than the amount funded.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

In pension accounting, the actuary's main purpose is to

A)make predictions about mortality rates and employee turnover.

B)calculate the current pension cost.

C)calculate the interest cost of the pension plan.

D)ensure the employer has established an appropriate funding pattern to meet its pension obligations.

A)make predictions about mortality rates and employee turnover.

B)calculate the current pension cost.

C)calculate the interest cost of the pension plan.

D)ensure the employer has established an appropriate funding pattern to meet its pension obligations.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

Which statement is INCORRECT regarding vested benefits?

A)They usually require a certain minimum number of years of service.

B)The employee is entitled to receive such benefits even if s/he is fired.

C)They are not contingent upon additional service under the plan.

D)They are lost when the employee is terminated.

A)They usually require a certain minimum number of years of service.

B)The employee is entitled to receive such benefits even if s/he is fired.

C)They are not contingent upon additional service under the plan.

D)They are lost when the employee is terminated.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

Accounting problems for all pension plans may include all the following EXCEPT

A)determining the level of individual premiums.

B)reporting the status and effects of the plan in the financial statements.

C)allocating the cost of the plan to the proper periods.

D)measuring the amount of pension obligation.

A)determining the level of individual premiums.

B)reporting the status and effects of the plan in the financial statements.

C)allocating the cost of the plan to the proper periods.

D)measuring the amount of pension obligation.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

All of the following are methods of measuring the pension obligation EXCEPT

A)vested benefit method.

B)accumulated benefit method.

C)total benefit method.

D)projected benefit method.

A)vested benefit method.

B)accumulated benefit method.

C)total benefit method.

D)projected benefit method.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

For ASPE and IFRS, the past service costs are

A)recognized immediately in expense.

B)deferred and amortized over the life of the pension.

C)not included in expenses.

D)restated in the year they are applicable to.

A)recognized immediately in expense.

B)deferred and amortized over the life of the pension.

C)not included in expenses.

D)restated in the year they are applicable to.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

In a defined benefit plan, a formula is used that

A)requires that the benefit of gain or the risk of loss from the assets contributed to the pension plan be borne by the employee.

B)defines the benefits that the employee will receive at retirement.

C)requires that pension expense and the cash funding amount to be the same.

D)defines the contribution the employer is to make; no promise is made concerning the ultimate benefits to be paid out to the employees.

A)requires that the benefit of gain or the risk of loss from the assets contributed to the pension plan be borne by the employee.

B)defines the benefits that the employee will receive at retirement.

C)requires that pension expense and the cash funding amount to be the same.

D)defines the contribution the employer is to make; no promise is made concerning the ultimate benefits to be paid out to the employees.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

In Canada, employer-sponsored pension plans are

A)increasingly defined contribution.

B)increasingly defined benefit.

C)decreasingly defined contribution.

D)staying relatively the same.

A)increasingly defined contribution.

B)increasingly defined benefit.

C)decreasingly defined contribution.

D)staying relatively the same.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

Categories of employee future benefit plans include

A)future earnings plan.

B)defined pension plan.

C)defined contribution plan.

D)health and benefits plan.

A)future earnings plan.

B)defined pension plan.

C)defined contribution plan.

D)health and benefits plan.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

In a defined benefit plan, for the employer, the term "funding" refers to

A)being responsible for the assets of the pension plan.

B)determining the defined benefit obligation.

C)making periodic contributions to a funding agency to ensure that funds are available to meet retirees' claims.

D)calculating the amount to report for pension expense.

A)being responsible for the assets of the pension plan.

B)determining the defined benefit obligation.

C)making periodic contributions to a funding agency to ensure that funds are available to meet retirees' claims.

D)calculating the amount to report for pension expense.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

All past service costs are expensed.The rationale for doing this is that

A)they are usually immaterial.

B)they relate to non-vested services, so there is no justification for deferring their recognition to future periods.

C)they relate to past services, so there is no justification for deferring their recognition to future periods.

D)CRA will not allow them to be deferred.

A)they are usually immaterial.

B)they relate to non-vested services, so there is no justification for deferring their recognition to future periods.

C)they relate to past services, so there is no justification for deferring their recognition to future periods.

D)CRA will not allow them to be deferred.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

Post-employment benefits may include all of the following EXCEPT

A)dental care.

B)severance pay to laid-off employees.

C)legal and tax services.

D)tuition assistance.

A)dental care.

B)severance pay to laid-off employees.

C)legal and tax services.

D)tuition assistance.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

All of the following increase the value of plan assets EXCEPT

A)opening balance of plan assets.

B)employer contributions.

C)actual returns.

D)benefits paid to retirees.

A)opening balance of plan assets.

B)employer contributions.

C)actual returns.

D)benefits paid to retirees.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

Under IFRS, a net defined benefit asset is reported when

A)the defined benefit obligation exceeds the fair value of pension plan assets.

B)the fair value of pension plan assets exceeds the defined benefit obligation.

C)the pension expense for the period is the same as the contributions made to the pension plan for the same period.

D)the vested benefits exceed the fair value of pension plan assets.

A)the defined benefit obligation exceeds the fair value of pension plan assets.

B)the fair value of pension plan assets exceeds the defined benefit obligation.

C)the pension expense for the period is the same as the contributions made to the pension plan for the same period.

D)the vested benefits exceed the fair value of pension plan assets.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is INCORRECT?

A)Most pension plan employers report their pension assets or liabilities in the appropriate long-term classifications.

B)An employer with two or more defined benefit plans is required to measure the benefit cost of each plan separately.

C)IFRS specifies how the components of pension benefit costs are to be reported on the income statement.

D)Underlying assumptions, such as how the expected return on plan assets is determined, are required to be disclosed.

A)Most pension plan employers report their pension assets or liabilities in the appropriate long-term classifications.

B)An employer with two or more defined benefit plans is required to measure the benefit cost of each plan separately.

C)IFRS specifies how the components of pension benefit costs are to be reported on the income statement.

D)Underlying assumptions, such as how the expected return on plan assets is determined, are required to be disclosed.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

When the plan assets of a pension plan are greater than the defined benefit obligation, the pension plan is

A)overstated.

B)understated.

C)overfunded.

D)underfunded.

A)overstated.

B)understated.

C)overfunded.

D)underfunded.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

An advantage of the immediate recognition approach is that

A)the Net Defined Benefit Liability/Asset account reflects the actual funded status of the pension plan.

B)unrecognized past service costs are deferred and amortized over future periods.

C)it averages out the pension expense from year to year.

D)it does not recognize actuarial gains and losses.

A)the Net Defined Benefit Liability/Asset account reflects the actual funded status of the pension plan.

B)unrecognized past service costs are deferred and amortized over future periods.

C)it averages out the pension expense from year to year.

D)it does not recognize actuarial gains and losses.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

The return on plan assets

A)is the change in the fair value of the plan assets during the year.

B)includes interest, dividends, and gains or losses from the sale of investments.

C)is the actual rate of return times the fair value of the plan assets at the beginning of the period.

D)does not include unrealized gains and/or losses on the assets in the plan.

A)is the change in the fair value of the plan assets during the year.

B)includes interest, dividends, and gains or losses from the sale of investments.

C)is the actual rate of return times the fair value of the plan assets at the beginning of the period.

D)does not include unrealized gains and/or losses on the assets in the plan.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

Under IFRS, any difference between the pension expense and the payments into the fund should be reflected in

A)a contra account to the net defined benefit liability/asset.

B)an accrued actuarial liability.

C)the net defined benefit liability/asset.

D)a note to the financial statements only.

A)a contra account to the net defined benefit liability/asset.

B)an accrued actuarial liability.

C)the net defined benefit liability/asset.

D)a note to the financial statements only.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

The interest cost included in the annual pension cost recorded by an employer sponsoring a defined benefit pension plan represents the

A)difference between the expected and actual return on plan assets.

B)increase in the defined benefit obligation due to the passage of time.

C)increase in the fair value of plan assets due to the passage of time.

D)interest earned on the plan assets for the year.

A)difference between the expected and actual return on plan assets.

B)increase in the defined benefit obligation due to the passage of time.

C)increase in the fair value of plan assets due to the passage of time.

D)interest earned on the plan assets for the year.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

Pension plan assets include

A)contributions made by the employer and the employees in a contributory pension plan.

B)plan assets under the control of the employer.

C)only assets reported on the employer's statement of financial position as the net defined benefit liability/asset.

D)contribution by the employer/employees, less the actual return, plus benefits paid to retirees.

A)contributions made by the employer and the employees in a contributory pension plan.

B)plan assets under the control of the employer.

C)only assets reported on the employer's statement of financial position as the net defined benefit liability/asset.

D)contribution by the employer/employees, less the actual return, plus benefits paid to retirees.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

Under IFRS, the defined benefit obligation is adjusted to its most recent actuarial valuation, and the adjustment flows through

A)other comprehensive income.

B)net income.

C)either other comprehensive income or net income.

D)retained earnings.

A)other comprehensive income.

B)net income.

C)either other comprehensive income or net income.

D)retained earnings.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

Any past service costs should be included in the

A)pension expense of current and future periods.

B)pension expense of past periods.

C)pension expense of the current period.

D)plan assets.

A)pension expense of current and future periods.

B)pension expense of past periods.

C)pension expense of the current period.

D)plan assets.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

A difference between IFRS and ASPE's recognition of the defined benefit cost components is

A)gains and losses from remeasurement of the net defined benefit liability or asset are reported in Net Income under ASPE.

B)gains and losses from remeasurement of the net defined benefit liability or asset are reported in Net Income under IFRS.

C)ASPE can use the defer and amortize approach.

D)IFRS can use the defer and amortize approach.

A)gains and losses from remeasurement of the net defined benefit liability or asset are reported in Net Income under ASPE.

B)gains and losses from remeasurement of the net defined benefit liability or asset are reported in Net Income under IFRS.

C)ASPE can use the defer and amortize approach.

D)IFRS can use the defer and amortize approach.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

The items included in pension expense are

A)service cost, net interest or finance cost, actuarial gains or losses.

B)service cost, net interest or finance cost, past service costs, actuarial gains or losses.

C).service cost, net interest or finance cost, remeasurement gain or loss on plan assets, past service costs, actuarial gains or losses.

D)service cost, remeasurement gain or loss on plan assets, actuarial gains or losses.

A)service cost, net interest or finance cost, actuarial gains or losses.

B)service cost, net interest or finance cost, past service costs, actuarial gains or losses.

C).service cost, net interest or finance cost, remeasurement gain or loss on plan assets, past service costs, actuarial gains or losses.

D)service cost, remeasurement gain or loss on plan assets, actuarial gains or losses.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

Under IFRS,

A)there is a general ledger account called net defined benefit liability/asset.

B)there is a general ledger account called defined benefit obligation.

C)there is a general ledger account called Pension Fund Assets.

D)Pension Expense is included in other comprehensive Income.

A)there is a general ledger account called net defined benefit liability/asset.

B)there is a general ledger account called defined benefit obligation.

C)there is a general ledger account called Pension Fund Assets.

D)Pension Expense is included in other comprehensive Income.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

When a pension plan is underfunded

A)it has more assets than liabilities.

B)it has more liabilities than assets.

C)it has higher net income.

D)it has lower net income.

A)it has more assets than liabilities.

B)it has more liabilities than assets.

C)it has higher net income.

D)it has lower net income.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

Who assumes the economic risk for defined benefit pension plans?

A)actuarials

B)trustees

C)employees

D)employers

A)actuarials

B)trustees

C)employees

D)employers

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

The difference between the defined benefit obligation and the pension assets' fair value at any point in time is known as the plan's

A)return on plan assets.

B)surplus or deficit.

C)experience gain or loss.

D)actual return.

A)return on plan assets.

B)surplus or deficit.

C)experience gain or loss.

D)actual return.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

Magritte Inc.provides a defined benefit pension plan for its employees (for which the corporation uses IFRS).At December 31, 2017, the fair value of the plan assets is less than the defined benefit obligation.In its statement of financial position at December 31, 2017, Magritte should report a net defined benefit liability/asset of the

A)excess of the defined benefit obligation over the fair value of the plan assets.

B)excess of the plan assets over the defined benefit obligation.

C)defined benefit obligation.

D)fair value of the plan assets.

A)excess of the defined benefit obligation over the fair value of the plan assets.

B)excess of the plan assets over the defined benefit obligation.

C)defined benefit obligation.

D)fair value of the plan assets.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

41

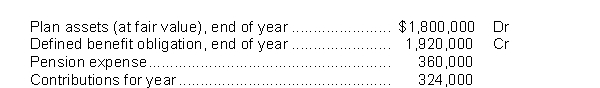

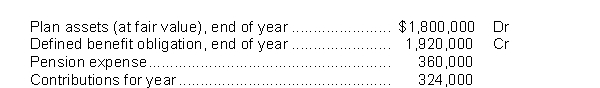

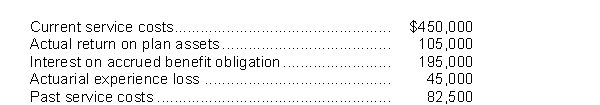

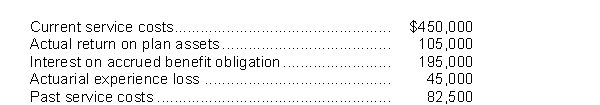

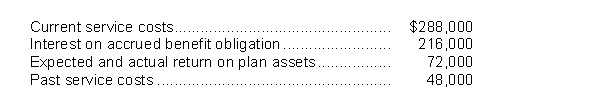

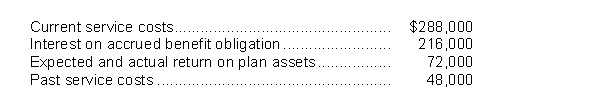

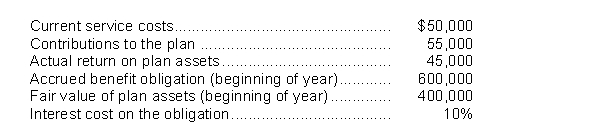

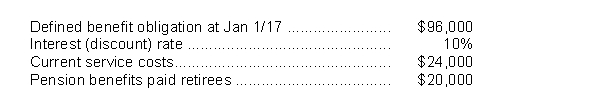

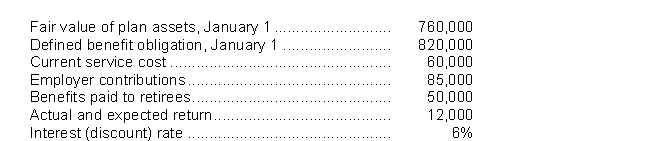

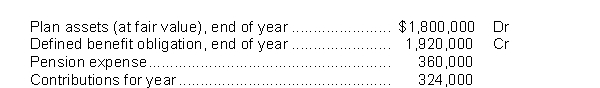

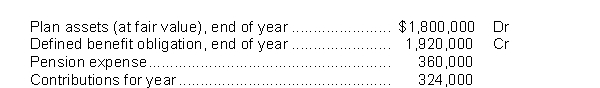

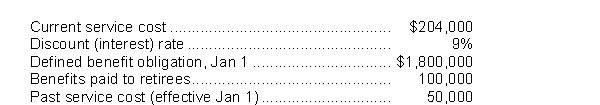

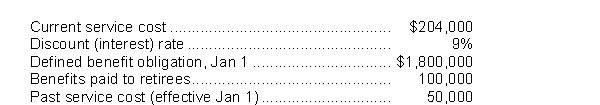

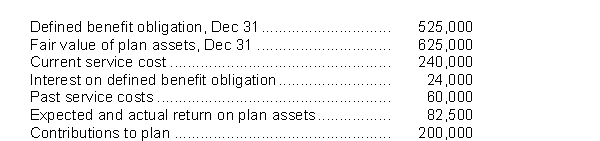

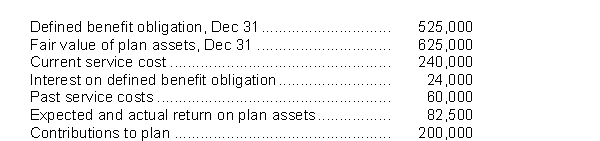

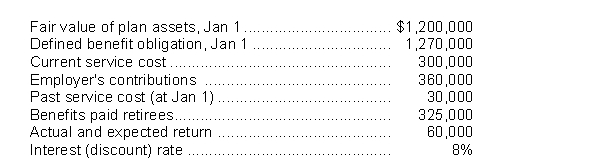

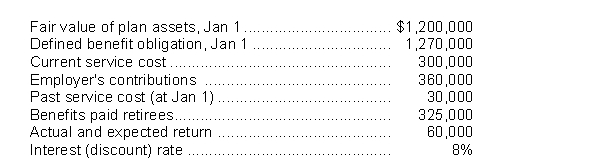

Use the following information for questions.

The following information is available for Figgy Enterprises Ltd.for calendar 2017.The corporation uses IFRS.

The pension expense to be reported for 2017 is

A)$360,000.

B)$346,000.

C)$324,000.

D)$120,000.

The following information is available for Figgy Enterprises Ltd.for calendar 2017.The corporation uses IFRS.

The pension expense to be reported for 2017 is

A)$360,000.

B)$346,000.

C)$324,000.

D)$120,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

Under ASPE, which of the following disclosures of post-employment benefits would NOT be required?

A)a description of each type of plan

B)the effective date of the most recent actuarial report

C)the year-end surplus or deficit, including the fair value of the plan assets and defined benefit obligation

D)the risks associated with the defined benefit plan

A)a description of each type of plan

B)the effective date of the most recent actuarial report

C)the year-end surplus or deficit, including the fair value of the plan assets and defined benefit obligation

D)the risks associated with the defined benefit plan

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

At the end of 2017, Lime Inc.has determined the following adjusted information related to its defined benefit pension plan  The corporation uses IFRS.Assume the net defined benefit liability/asset account at January 1, 2017 was nil.If the contribution to plan assets in 2017 is $410,000, the pension expense for 2017 is

The corporation uses IFRS.Assume the net defined benefit liability/asset account at January 1, 2017 was nil.If the contribution to plan assets in 2017 is $410,000, the pension expense for 2017 is

A)$100,000.

B)$310,000.

C)$410,000.

D)$510,000.

The corporation uses IFRS.Assume the net defined benefit liability/asset account at January 1, 2017 was nil.If the contribution to plan assets in 2017 is $410,000, the pension expense for 2017 is

The corporation uses IFRS.Assume the net defined benefit liability/asset account at January 1, 2017 was nil.If the contribution to plan assets in 2017 is $410,000, the pension expense for 2017 isA)$100,000.

B)$310,000.

C)$410,000.

D)$510,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

At January 1, 2017, Van Gogh Corp.'s defined benefit pension plan, under IFRS, had a defined benefit obligation of $100,000, while the fair value of the plan assets was $120,000.During 2017, the plan's current service cost was $150,000; past service costs were $80,000; Van Gogh contributed $110,000 to the plan; the actual and expected return on the plan assets was $9,000; and benefits paid to retirees were $95,000.What is the fair value of the plan assets at December 31, 2017?

A)$239,000

B)$205,000

C)$144,000

D)$135,000

A)$239,000

B)$205,000

C)$144,000

D)$135,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

Presented below is pension information related to Cantaloupe Ltd.for the calendar year 2017.The corporation uses ASPE.  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$757,500.

B)$697,500.

C)$667,500.

D)$577,500.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$757,500.

B)$697,500.

C)$667,500.

D)$577,500.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

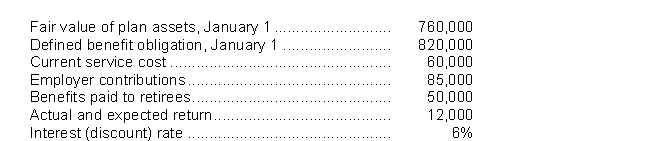

Presented below is information related to Kiwi Ltd.for calendar 2017.The corporation uses IFRS.  The fair value of the plan assets at December 31, 2017 is

The fair value of the plan assets at December 31, 2017 is

A)$785,000.

B)$805,000.

C)$819,000.

D)$875,000.

The fair value of the plan assets at December 31, 2017 is

The fair value of the plan assets at December 31, 2017 isA)$785,000.

B)$805,000.

C)$819,000.

D)$875,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

Under IFRS all of the following are reported in OCI, EXCEPT

A)remeasurement changes.

B)actuarial gains.

C)actuarial losses.

D)past service costs.

A)remeasurement changes.

B)actuarial gains.

C)actuarial losses.

D)past service costs.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following disclosures of post-employment benefits would NOT be required?

A)the cost of post-employment benefits during the period

B)a description of the accounting and funding policies followed

C)the amount of the actuarial liability for short-term benefits such as paternity leave

D)the assumptions and rates used in calculating the benefit obligation

A)the cost of post-employment benefits during the period

B)a description of the accounting and funding policies followed

C)the amount of the actuarial liability for short-term benefits such as paternity leave

D)the assumptions and rates used in calculating the benefit obligation

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

Presented below is pension information related to Apple Inc.for the calendar year 2017.The corporation uses the immediate recognition approach.  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$432,000.

B)$480,000.

C)$576,000.

D)$648,000.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$432,000.

B)$480,000.

C)$576,000.

D)$648,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

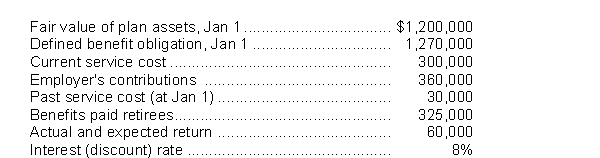

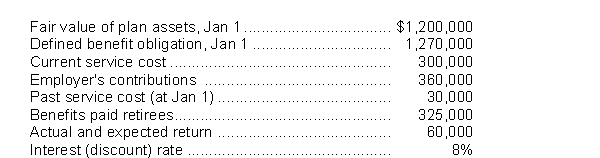

Bateman Corp.provides a defined benefit pension plan for its employees, and uses the IFRS.The trustee administering the plan provided the following information for the year ended December 31, 2017:  The fair value of the plan assets at December 31, 2017 would be

The fair value of the plan assets at December 31, 2017 would be

A)$1,235,000.

B)$1,295,000.

C)$1,335,000.

D)$1,535,000.

The fair value of the plan assets at December 31, 2017 would be

The fair value of the plan assets at December 31, 2017 would beA)$1,235,000.

B)$1,295,000.

C)$1,335,000.

D)$1,535,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

Presented below is pension information related to Banana Inc.for the calendar year 2017.The corporation uses ASPE.  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$110,000.

B)$ 70,000.

C)$ 65,000.

D)$ 50,000.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$110,000.

B)$ 70,000.

C)$ 65,000.

D)$ 50,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

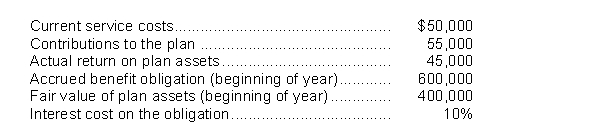

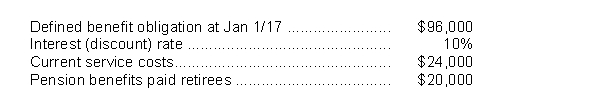

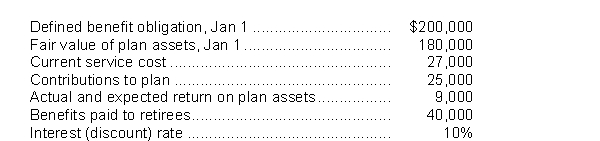

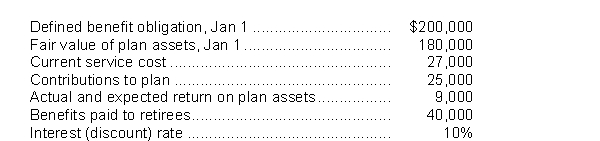

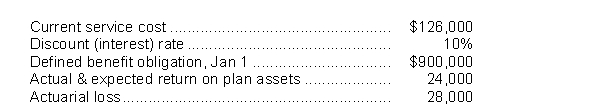

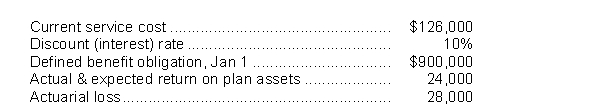

The following information pertains to Rembrandt Inc.'s pension plan for calendar 2017:  The corporation uses IFRS.If no change in actuarial estimates occurred during 2017, Rembrandt's defined benefit obligation at December 31, 2017 would be

The corporation uses IFRS.If no change in actuarial estimates occurred during 2017, Rembrandt's defined benefit obligation at December 31, 2017 would be

A)$85,600.

B)$100,000.

C)$105,600.

D)$109,600.

The corporation uses IFRS.If no change in actuarial estimates occurred during 2017, Rembrandt's defined benefit obligation at December 31, 2017 would be

The corporation uses IFRS.If no change in actuarial estimates occurred during 2017, Rembrandt's defined benefit obligation at December 31, 2017 would beA)$85,600.

B)$100,000.

C)$105,600.

D)$109,600.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

Under IFRS for employee future benefits besides pension plans, remeasurements of the net defined benefit

A)should be reflected in OCU.

B)should not be recorded.

C)do not need to be remeasured.

D)should be reflected in income.

A)should be reflected in OCU.

B)should not be recorded.

C)do not need to be remeasured.

D)should be reflected in income.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

How should employers recognize employee benefit plans that do NOT accumulate?

A)Recognize the liability and cost over the life of the employee.

B)Recognize the liability and cost over the length of service.

C)Recognize the liability and cost when the event occurs to obligate the company to provide the benefit.

D)They don't need to recognize them.

A)Recognize the liability and cost over the life of the employee.

B)Recognize the liability and cost over the length of service.

C)Recognize the liability and cost when the event occurs to obligate the company to provide the benefit.

D)They don't need to recognize them.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

Raphael Inc.provides a defined benefit plan for its employees, and reports using ASPE.The pension plan administrator for Raphael Inc.provided the following information for the year ended December 31, 2017  The fair value of the plan assets at December 31, 2017 would be

The fair value of the plan assets at December 31, 2017 would be

A)$807,000.

B)$867,000.

C)$907,000.

D)$967,000.

The fair value of the plan assets at December 31, 2017 would be

The fair value of the plan assets at December 31, 2017 would beA)$807,000.

B)$867,000.

C)$907,000.

D)$967,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

Presented below is information related to Peach Corporation's defined benefit pension plan for calendar 2017.The corporation uses IFRS.  The fair value of the plan assets at December 31, 2017 is

The fair value of the plan assets at December 31, 2017 is

A)$187,000.

B)$174,000.

C)$165,000.

D)$149,000.

The fair value of the plan assets at December 31, 2017 is

The fair value of the plan assets at December 31, 2017 isA)$187,000.

B)$174,000.

C)$165,000.

D)$149,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

The major difference in accounting for pensions under ASPE and IFRS is

A)ASPE allows two approaches for accounting, immediate recognition approach and the deferral and amortization approach and IFRS only allows the immediate recognition approach.

B)IFRS requires use of an actuarial and ASPE does not for calculation pension plans.

C)ASPE includes the entire pension expense in net income and IFRS includes actuarial gains and losses as well as remeasurements in OCI.

D)IFRS includes the entire pension expense in net income and ASPE includes actuarial gains and losses as well as remeasurements in OCI.

A)ASPE allows two approaches for accounting, immediate recognition approach and the deferral and amortization approach and IFRS only allows the immediate recognition approach.

B)IFRS requires use of an actuarial and ASPE does not for calculation pension plans.

C)ASPE includes the entire pension expense in net income and IFRS includes actuarial gains and losses as well as remeasurements in OCI.

D)IFRS includes the entire pension expense in net income and ASPE includes actuarial gains and losses as well as remeasurements in OCI.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following pieces of disclosure information would analysts NOT focus on?

A)the name of the actuarial company that performed the calculations

B)major assumptions used in the calculation of the defined benefit obligation

C)the surplus or deficit of the plan

D)the company's future cash requirements

A)the name of the actuarial company that performed the calculations

B)major assumptions used in the calculation of the defined benefit obligation

C)the surplus or deficit of the plan

D)the company's future cash requirements

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

Regarding post-employment health-care benefits,

A)they are generally funded.

B)they are well-defined and level in dollar amount.

C)the beneficiary is the retiree, spouse, and other dependents.

D)benefits are payable monthly.

A)they are generally funded.

B)they are well-defined and level in dollar amount.

C)the beneficiary is the retiree, spouse, and other dependents.

D)benefits are payable monthly.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

Accrued post-employment benefit obligations are

A)recorded at their present value.

B)recorded in the same manner as pension benefit obligations.

C)not recognized in the financial statements.

D)disclosed in the notes to the financial statements only.

A)recorded at their present value.

B)recorded in the same manner as pension benefit obligations.

C)not recognized in the financial statements.

D)disclosed in the notes to the financial statements only.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

Use the following information for questions.

The following information is available for Figgy Enterprises Ltd.for calendar 2017.The corporation uses IFRS.

The net defined benefit liability/asset that should be reported at December 31, 2017 is

A)$120,000 asset.

B)$120,000 liability.

C)$204,000 asset.

D)$360,000 liability.

The following information is available for Figgy Enterprises Ltd.for calendar 2017.The corporation uses IFRS.

The net defined benefit liability/asset that should be reported at December 31, 2017 is

A)$120,000 asset.

B)$120,000 liability.

C)$204,000 asset.

D)$360,000 liability.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

Presented below is information related to Peach Corporation's defined benefit pension plan for calendar 2017.The corporation uses IFRS.  The balance of the defined benefit obligation at December 31, 2017 is

The balance of the defined benefit obligation at December 31, 2017 is

A)$185,000.

B)$187,000.

C)$207,000.

D)$245,000.

The balance of the defined benefit obligation at December 31, 2017 is

The balance of the defined benefit obligation at December 31, 2017 isA)$185,000.

B)$187,000.

C)$207,000.

D)$245,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

Presented below is pension information related to Squash Corp.for the calendar year 2017.The corporation uses IFRS.  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$266,000.

B)$366,000.

C)$416,000.

D)$420,500.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$266,000.

B)$366,000.

C)$416,000.

D)$420,500.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

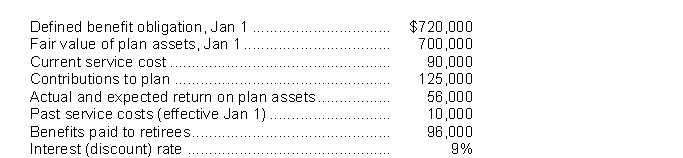

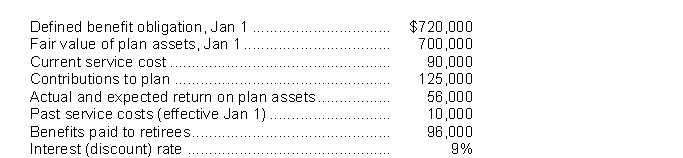

Use the following information for questions.

Presented below is information related to Kiwi Ltd.for calendar 2017.The corporation uses IFRS.

The balance of the defined benefit obligation at December 31, 2017 is

A)$724,000.

B)$779,700.

C)$778,800.

D)$789,700.

Presented below is information related to Kiwi Ltd.for calendar 2017.The corporation uses IFRS.

The balance of the defined benefit obligation at December 31, 2017 is

A)$724,000.

B)$779,700.

C)$778,800.

D)$789,700.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following information for questions.

Maggie Moo, age 40, begins employment with Farm Corporation on January 1, 2017 at a starting salary of $40,000.It is expected that Maggie will work for the company for 25 years, retiring on December 31, 2041, when Maggie is 65 years old.It is expected that her salary at retirement will be $140,000.Further assume that mortality tables indicate the life expectancy of someone age 65 in 2041 is 12 years.

Farm Corporation sponsors a defined benefit pension plan with the following formula

Annual pension benefit on retirement = 3% of salary for each year of service, or 3% final salary x years of service.

Assume a discount rate of 6%

Determine the current service cost for Maggie Moo at December 31, 2017.

A)$4,200

B)$8,212.66

C)$8,696.69

D)$35,212.12

Maggie Moo, age 40, begins employment with Farm Corporation on January 1, 2017 at a starting salary of $40,000.It is expected that Maggie will work for the company for 25 years, retiring on December 31, 2041, when Maggie is 65 years old.It is expected that her salary at retirement will be $140,000.Further assume that mortality tables indicate the life expectancy of someone age 65 in 2041 is 12 years.

Farm Corporation sponsors a defined benefit pension plan with the following formula

Annual pension benefit on retirement = 3% of salary for each year of service, or 3% final salary x years of service.

Assume a discount rate of 6%

Determine the current service cost for Maggie Moo at December 31, 2017.

A)$4,200

B)$8,212.66

C)$8,696.69

D)$35,212.12

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

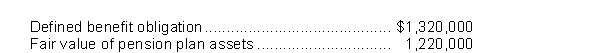

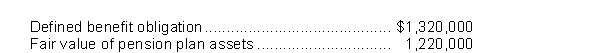

Presented below is pension information related to Mango Ltd.at December 31, 2017.The corporation uses IFRS.  The amount to be reported as the net defined benefit liability at December 31, 2017 is

The amount to be reported as the net defined benefit liability at December 31, 2017 is

A)$1,100,000.

B)$1,000,000.

C)$900,000.

D)$700,000.

The amount to be reported as the net defined benefit liability at December 31, 2017 is

The amount to be reported as the net defined benefit liability at December 31, 2017 isA)$1,100,000.

B)$1,000,000.

C)$900,000.

D)$700,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

Thomson Corp.provides a defined benefit pension plan for its employees, and uses IFRS to account for it.The corporation's actuary has provided the following information for the year ended December 31, 2017:  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$241,500.

B)$324,000.

C)$406,500.

D)$524,000.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$241,500.

B)$324,000.

C)$406,500.

D)$524,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

Presented below is pension information related to Watermelon Corp.for the calendar year 2017.The corporation uses IFRS.  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$220,000.

B)$192,000.

C)$164,000.

D)$130,000.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$220,000.

B)$192,000.

C)$164,000.

D)$130,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information for questions.

Presented below is information related to Kiwi Ltd.for calendar 2017.The corporation uses IFRS.

The pension expense to be reported for 2017 is

A)$140,000.

B)$109,700.

C)$108,800.

D)$ 60,000.

Presented below is information related to Kiwi Ltd.for calendar 2017.The corporation uses IFRS.

The pension expense to be reported for 2017 is

A)$140,000.

B)$109,700.

C)$108,800.

D)$ 60,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

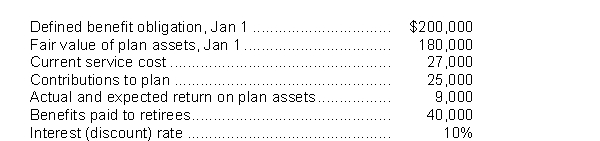

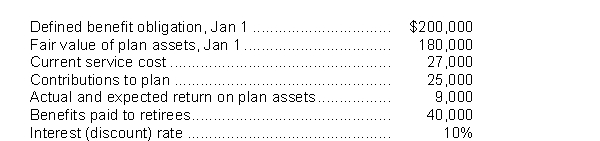

Daikon Ltd.received the following information from its pension plan trustee concerning their defined benefit pension plan for calendar 2017.The corporation uses ASPE.  For 2017, the current service cost is $180,000.The interest rate on the liability is 10% and the actual rate of return on plan assets is 9%.The pension expense to be reported for 2017 is

For 2017, the current service cost is $180,000.The interest rate on the liability is 10% and the actual rate of return on plan assets is 9%.The pension expense to be reported for 2017 is

A)$265,500.

B)$231,000.

C)$216,000.

D)$180,000.

For 2017, the current service cost is $180,000.The interest rate on the liability is 10% and the actual rate of return on plan assets is 9%.The pension expense to be reported for 2017 is

For 2017, the current service cost is $180,000.The interest rate on the liability is 10% and the actual rate of return on plan assets is 9%.The pension expense to be reported for 2017 isA)$265,500.

B)$231,000.

C)$216,000.

D)$180,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

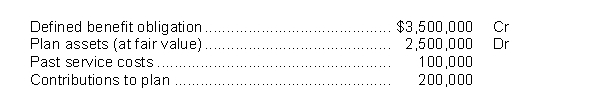

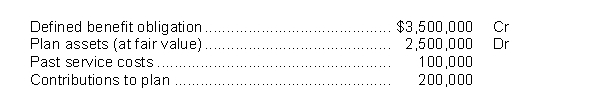

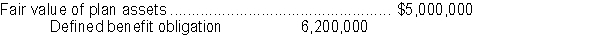

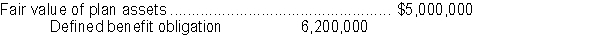

At December 31, 2017, the following information was provided by the defined benefit pension plan administrator for Leonardo Corp.:  The corporation uses IFRS.What is the net defined benefit liability/asset account that should be shown on Leonardo's December 31, 2017 statement of financial position?

The corporation uses IFRS.What is the net defined benefit liability/asset account that should be shown on Leonardo's December 31, 2017 statement of financial position?

A)$1,200,000 liability

B)$1,200,000 asset

C)$6,200,000 liability

D)$5,000,000 asset

The corporation uses IFRS.What is the net defined benefit liability/asset account that should be shown on Leonardo's December 31, 2017 statement of financial position?

The corporation uses IFRS.What is the net defined benefit liability/asset account that should be shown on Leonardo's December 31, 2017 statement of financial position?A)$1,200,000 liability

B)$1,200,000 asset

C)$6,200,000 liability

D)$5,000,000 asset

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

72

Bateman Corp.provides a defined benefit pension plan for its employees, and IFRS to account for it.The trustee administering the plan provided the following information for the year ended December 31, 2017:  The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 is

A)$270,000.

B)$366,000.

C)$374,000.

D)$434,000.

The pension expense to be reported for 2017 is

The pension expense to be reported for 2017 isA)$270,000.

B)$366,000.

C)$374,000.

D)$434,000.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck