Deck 23: Other Measurement and Disclosure Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/37

Play

Full screen (f)

Deck 23: Other Measurement and Disclosure Issues

1

Errors and irregularities are defined as intentional distortions of facts.Yes or No?

C

2

Problems with interim reporting include

A)how to record depreciation.

B)inventory valuation.

C)how to present a change in accounting policy/principle.

D)revenue recognition.

A)how to record depreciation.

B)inventory valuation.

C)how to present a change in accounting policy/principle.

D)revenue recognition.

C

3

Which of the following subsequent events (post-statement of financial position events)would generally require disclosure in the financial statement notes, but NOT adjustment of the accounts?

A)retirement of the company president

B)settlement of a lawsuit when the event that gave rise to the action occurred prior to the statement of financial position date

C)strike by the company's unionized workers

D)issue of a significant number of common shares

A)retirement of the company president

B)settlement of a lawsuit when the event that gave rise to the action occurred prior to the statement of financial position date

C)strike by the company's unionized workers

D)issue of a significant number of common shares

D

4

According to IFRS, an operating segment is a reportable segment if

A)its operating profit is 10% or more of the combined operating profit of profitable segments only.

B)its operating loss is 10% or more of the combined operating losses of segments that incurred an operating loss.

C)the absolute amount of its operating profit or loss is 10% or more of the greater, in absolute amount, of (a)the combined reported operating profit of all operating segments that incurred a loss, of (b)the combined reported profit of all operating segments that did report a profit.

D)the absolute amount of its reported profit or loss is 10% or more of the greater, in absolute amount, of (a)the combined reported operating profit of all operating segments that did not incur a loss, or (b)the combined reported loss of all operating segments that did report a loss.

A)its operating profit is 10% or more of the combined operating profit of profitable segments only.

B)its operating loss is 10% or more of the combined operating losses of segments that incurred an operating loss.

C)the absolute amount of its operating profit or loss is 10% or more of the greater, in absolute amount, of (a)the combined reported operating profit of all operating segments that incurred a loss, of (b)the combined reported profit of all operating segments that did report a profit.

D)the absolute amount of its reported profit or loss is 10% or more of the greater, in absolute amount, of (a)the combined reported operating profit of all operating segments that did not incur a loss, or (b)the combined reported loss of all operating segments that did report a loss.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

5

For interim reporting, IFRS does NOT require a

A)comprehensive income statement.

B)statement of shareholders' equity.

C)statement of cash flows.

D)detailed statement of financial position.

A)comprehensive income statement.

B)statement of shareholders' equity.

C)statement of cash flows.

D)detailed statement of financial position.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

6

According to IFRS, a segment of a business is to be reported separately when its reporting revenue (including both sales to external customers and intersegment sales or transfers)exceeds 10% of the

A)total domestic sales only.

B)combined revenues of all the enterprise's operating segments.

C)combined revenues of all the enterprise's profitable operating segments.

D)combined net income of all the enterprise's profitable operating segments.

A)total domestic sales only.

B)combined revenues of all the enterprise's operating segments.

C)combined revenues of all the enterprise's profitable operating segments.

D)combined net income of all the enterprise's profitable operating segments.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

7

Reasons for increased disclosure requirements do NOT include

A)the current government trend toward reducing income taxes.

B)the necessity for timely information.

C)the complexity of the business environment.

D)accounting as a control and monitoring device.

A)the current government trend toward reducing income taxes.

B)the necessity for timely information.

C)the complexity of the business environment.

D)accounting as a control and monitoring device.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following facts concerning property, plant and equipment should be included in the Summary of Significant Accounting Policies?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

9

Regarding related-party transactions,

A)transactions between related parties are usually presumed to take place at arms length.

B)related parties do not include members of the immediate family of company management.

C)both IFRS and ASPE deal only with disclosure requirements for such transactions.

D)ASPE requires that some related-party transactions be remeasured.

A)transactions between related parties are usually presumed to take place at arms length.

B)related parties do not include members of the immediate family of company management.

C)both IFRS and ASPE deal only with disclosure requirements for such transactions.

D)ASPE requires that some related-party transactions be remeasured.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

10

Gooseberry Corp.is a multidivisional corporation that has both intersegment sales and sales to external customers.Gooseberry should report segmented financial information for each division meeting which of the following IFRS criteria?

A)segment profit or loss is 10% or more of consolidated profit or loss

B)segment profit or loss is 10% or more of combined profit or loss of all company segments

C)segment revenue is 10% or more of combined revenue of all the company segments

D)segment revenue is 10% or more of consolidated net income

A)segment profit or loss is 10% or more of consolidated profit or loss

B)segment profit or loss is 10% or more of combined profit or loss of all company segments

C)segment revenue is 10% or more of combined revenue of all the company segments

D)segment revenue is 10% or more of consolidated net income

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

11

When an auditor expresses an unqualified opinion about a company's financial statements, it means that the financial statements

A)are free from error.

B)present fairly the financial position, results of operations, and cash flows in accordance with GAAP.

C)indicate that the company is doing well and would make a good investment.

D)contain exceptions due to a departure from GAAP.

A)are free from error.

B)present fairly the financial position, results of operations, and cash flows in accordance with GAAP.

C)indicate that the company is doing well and would make a good investment.

D)contain exceptions due to a departure from GAAP.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

12

Although ASPE does NOT offer guidance for reporting segmented information, IFRS requires that

A)financial statements include selected information on a single basis of segmentation.

B)financial statements include selected information on multiple bases of segmentation.

C)financial statements disclose results for every segment, regardless of how many there are.

D)management segment the enterprise on a geographical basis only.

A)financial statements include selected information on a single basis of segmentation.

B)financial statements include selected information on multiple bases of segmentation.

C)financial statements disclose results for every segment, regardless of how many there are.

D)management segment the enterprise on a geographical basis only.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following does NOT need be disclosed in a Summary of Significant Accounting Policies?

A)inventory valuation method(s)

B)revenue recognition method(s)

C)depreciation and amortization method(s)

D)claims of shareholders

A)inventory valuation method(s)

B)revenue recognition method(s)

C)depreciation and amortization method(s)

D)claims of shareholders

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following items found in an annual report is NOT subject to GAAP?

A)financial statements

B)management discussion and analysis

C)inventory methods

D)accounting policies

A)financial statements

B)management discussion and analysis

C)inventory methods

D)accounting policies

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

15

IFRS requires that all of the following information about each reportable segment must be provided EXCEPT

A)total liabilities.

B)interest revenue.

C)cost of goods sold.

D)income tax expense or benefit.

A)total liabilities.

B)interest revenue.

C)cost of goods sold.

D)income tax expense or benefit.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

16

When using the discrete view to prepare interim statements, two exceptions that are permitted deal with the calculation of

A)depreciation and income tax expense.

B)income tax expense and employer's payroll tax expense.

C)depreciation and unearned revenue.

D)unearned revenue and employer's payroll tax expense.

A)depreciation and income tax expense.

B)income tax expense and employer's payroll tax expense.

C)depreciation and unearned revenue.

D)unearned revenue and employer's payroll tax expense.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

17

In which order of preference are a company's creditors paid in the event of bankruptcy?

A)Secured first, then preferred, then unsecured of the above

B)Preferred first, then secured, then unsecured

C)Secured first, then unsecured, then preferred

D)Any may be applied, according to agreements among the creditors.

A)Secured first, then preferred, then unsecured of the above

B)Preferred first, then secured, then unsecured

C)Secured first, then unsecured, then preferred

D)Any may be applied, according to agreements among the creditors.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following subsequent events (post-statement of financial position events)would require adjustment of the accounts before issuance of the financial statements?

A)major losses as a result of a fire in the company's plant

B)decline in the fair value of investments

C)loss on an account receivable (on the books at statement of financial position date)resulting from a customer's bankruptcy

D)lawsuit arising from a customer's injury due to a defective product

A)major losses as a result of a fire in the company's plant

B)decline in the fair value of investments

C)loss on an account receivable (on the books at statement of financial position date)resulting from a customer's bankruptcy

D)lawsuit arising from a customer's injury due to a defective product

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

19

Accounting issues involved for unincorporated businesses include

A)the definition of the economic entity.

B)who owns the issued shares.

C)segregating the salaries expense for the owner(s)from the salaries expense for the employees.

D)provision for income taxes.

A)the definition of the economic entity.

B)who owns the issued shares.

C)segregating the salaries expense for the owner(s)from the salaries expense for the employees.

D)provision for income taxes.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is INCORRECT regarding IFRS requirements for interim reporting?

A)Only a statement of financial position and statement of comprehensive income are required.

B)The same accounting policies should be used as for the annual statements.

C)When an accounting change is applied retrospectively, the enterprise must present a statement of financial position for the beginning of the earliest comparative period.

D)Condensed financial statements are permitted.

A)Only a statement of financial position and statement of comprehensive income are required.

B)The same accounting policies should be used as for the annual statements.

C)When an accounting change is applied retrospectively, the enterprise must present a statement of financial position for the beginning of the earliest comparative period.

D)Condensed financial statements are permitted.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

21

An auditor's adverse opinion

A)although very rare in the past, is frequently seen nowadays.

B)means the financial statements are prepared in accordance with GAAP.

C)is given when the auditor deems a qualified opinion is not justified.

D)means there are some minor exceptions due to a departure from GAAP.

A)although very rare in the past, is frequently seen nowadays.

B)means the financial statements are prepared in accordance with GAAP.

C)is given when the auditor deems a qualified opinion is not justified.

D)means there are some minor exceptions due to a departure from GAAP.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

22

The ratios that reflect financial strength are

A)liquidity and coverage ratios.

B)liquidity and profitability ratios.

C)profitability and activity ratios.

D)activity and coverage ratios.

A)liquidity and coverage ratios.

B)liquidity and profitability ratios.

C)profitability and activity ratios.

D)activity and coverage ratios.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

23

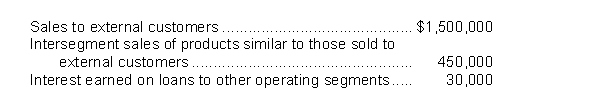

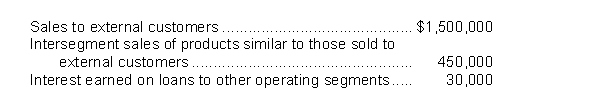

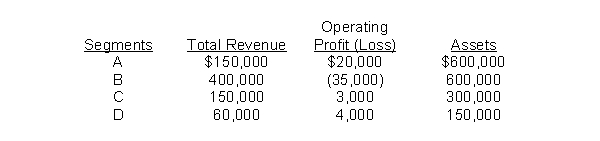

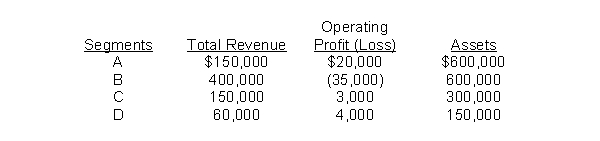

The following information pertains to Crabapple Corp.and its various divisions for the year ended December 31, 2017:  According to IFRS, Crabapple has a reportable segment if that segment's revenue equals or exceeds

According to IFRS, Crabapple has a reportable segment if that segment's revenue equals or exceeds

A)$198,000.

B)$195,000.

C)$153,000.

D)$150,000.

According to IFRS, Crabapple has a reportable segment if that segment's revenue equals or exceeds

According to IFRS, Crabapple has a reportable segment if that segment's revenue equals or exceedsA)$198,000.

B)$195,000.

C)$153,000.

D)$150,000.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

24

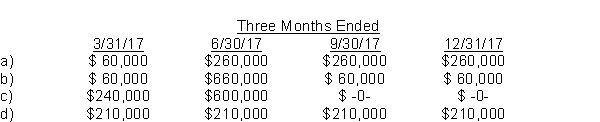

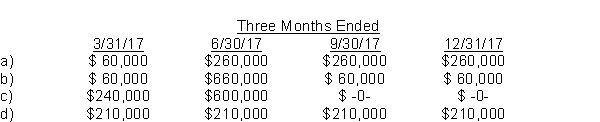

On January 15, 2017, Truro Corp.paid $240,000 in property taxes on its factory building for the calendar year 2017.In the first week of April 2017, the corporation made unanticipated repairs to its plant equipment at a cost of $600,000.These repairs will benefit operations for the remainder of 2017 only.How should these expenses be reflected in Truro's quarterly income statements?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

25

Peach Corp.has estimated that total depreciation expense for the 2017 calendar year will be $60,000, and that 2017 year-end bonuses to employees will be $120,000.In Peach's interim income statement for the six months ended June 30, 2017, what total expense relating to these two items should be reported?

A)$0

B)$30,000

C)$90,000

D)$180,000

A)$0

B)$30,000

C)$90,000

D)$180,000

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

26

When an auditor expresses a qualified opinion about a company's financial statements, it means that the financial statements

A)are free from error.

B)present fairly the financial position, results of operations, and cash flows in accordance with GAAP.

C)indicate that the company is doing well and would make a good investment.

D)contain exceptions due to a departure from GAAP.

A)are free from error.

B)present fairly the financial position, results of operations, and cash flows in accordance with GAAP.

C)indicate that the company is doing well and would make a good investment.

D)contain exceptions due to a departure from GAAP.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

27

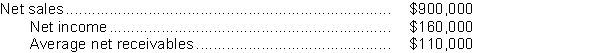

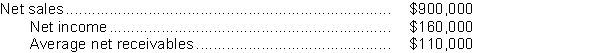

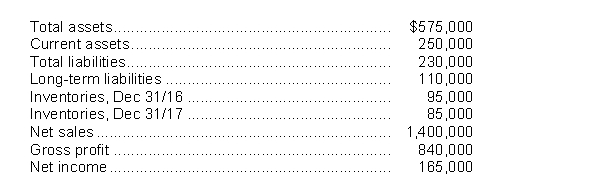

Prune Juice Corp.reported the following data on their 2017 financial statements:  To two decimals, the accounts receivable turnover for 2017 is

To two decimals, the accounts receivable turnover for 2017 is

A)5.63.

B)8.18.

C)12.22.

D)17.78.

To two decimals, the accounts receivable turnover for 2017 is

To two decimals, the accounts receivable turnover for 2017 isA)5.63.

B)8.18.

C)12.22.

D)17.78.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

28

Which statement is INCORRECT regarding guidance given by IFRS and ASPE?

A)IFRS provides guidance for interim reporting, while ASPE does not.

B)ASPE provides guidance for segmented reporting, while IFRS does not.

C)IFRS provides guidance for segmented reporting, while ASPE does not.

D)IFRS does not provide guidance for reporting on unincorporated businesses.

A)IFRS provides guidance for interim reporting, while ASPE does not.

B)ASPE provides guidance for segmented reporting, while IFRS does not.

C)IFRS provides guidance for segmented reporting, while ASPE does not.

D)IFRS does not provide guidance for reporting on unincorporated businesses.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is NOT a limitation of financial statement analysis?

A)Financial statements report on the past.

B)Ratio and trend analyses will help identify strengths and weaknesses of a company.

C)A single ratio, by itself, is not likely to be very useful.

D)Financial statement analysis is not likely to reveal why things are as they are.

A)Financial statements report on the past.

B)Ratio and trend analyses will help identify strengths and weaknesses of a company.

C)A single ratio, by itself, is not likely to be very useful.

D)Financial statement analysis is not likely to reveal why things are as they are.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

30

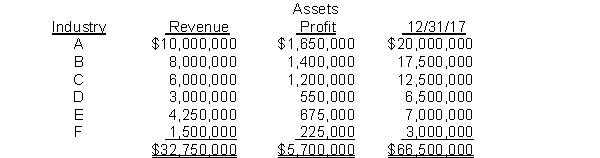

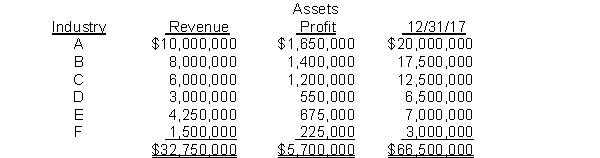

Melon Corp.is engaged in manufacturing operations in various industries.The following data pertain to the industries in which operations were conducted for the year ended December 31, 2017.  According to IFRS, how many reportable segments does Melon have?

According to IFRS, how many reportable segments does Melon have?

A)three

B)four

C)five

D)six

According to IFRS, how many reportable segments does Melon have?

According to IFRS, how many reportable segments does Melon have?A)three

B)four

C)five

D)six

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

31

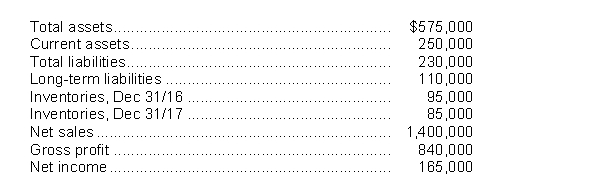

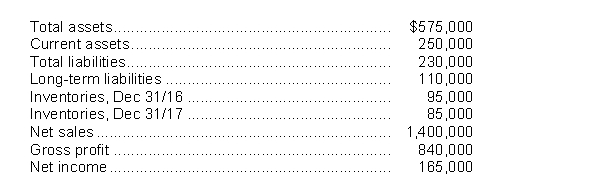

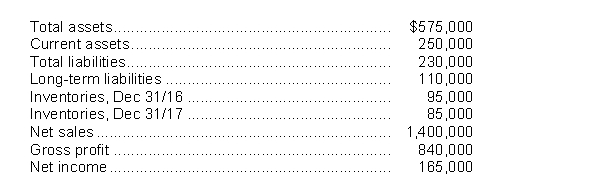

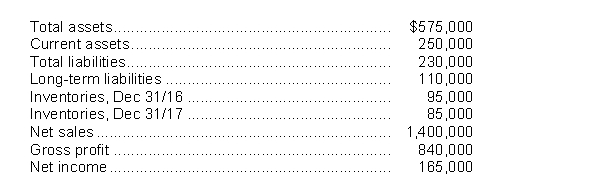

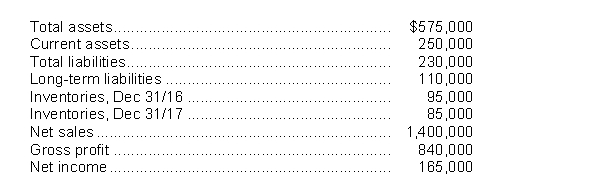

Use the following data to answer questions

Pear Corp.reported the following data for calendar 2017:

To two decimals, Pear Corp.'s inventory turnover for 2017 is

A)9.33.

B)6.59.

C)6.22.

D)1.60.

Pear Corp.reported the following data for calendar 2017:

To two decimals, Pear Corp.'s inventory turnover for 2017 is

A)9.33.

B)6.59.

C)6.22.

D)1.60.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

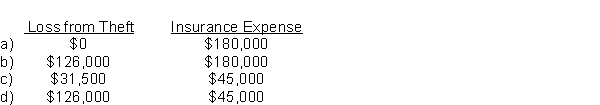

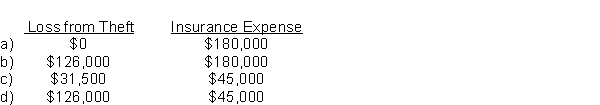

32

Raspberry Corp.had the following transactions during the quarter ended March 31, 2017:  What amount should be included in Raspberry's income statement for the quarter ended March 31, 2017?

What amount should be included in Raspberry's income statement for the quarter ended March 31, 2017?

What amount should be included in Raspberry's income statement for the quarter ended March 31, 2017?

What amount should be included in Raspberry's income statement for the quarter ended March 31, 2017?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

33

Presented below are four segments that have been identified by Plum Corp.:  According to IFRS, which segments would be considered reportable segments?

According to IFRS, which segments would be considered reportable segments?

A)Segments A, B, and C

B)Segments A, B, C, and D

C)Segments A and B

D)Segments A and D

According to IFRS, which segments would be considered reportable segments?

According to IFRS, which segments would be considered reportable segments?A)Segments A, B, and C

B)Segments A, B, C, and D

C)Segments A and B

D)Segments A and D

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

34

The ratios that assess management performance are

A)liquidity and coverage ratios.

B)liquidity and profitability ratios.

C)profitability and activity ratios.

D)activity and coverage ratios.

A)liquidity and coverage ratios.

B)liquidity and profitability ratios.

C)profitability and activity ratios.

D)activity and coverage ratios.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

35

In January 2017, Orange Ltd.estimated that its year-end bonuses to executives for calendar 2017 would be $640,000.In February 2017, $580,000 was paid in bonuses for the 2016 year-end.The estimate for 2017 is subject to year-end adjustment.How much bonus expense should be reflected in Orange's interim income statement for the three months ended March 31, 2017?

A)$640,000

B)$580,000

C)$160,000

D)$145,000

A)$640,000

B)$580,000

C)$160,000

D)$145,000

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

36

Use the following data to answer questions

Pear Corp.reported the following data for calendar 2017:

To two decimals, Pear Corp.'s current ratio for 2017 is

A)1.09.

B)2.08.

C)2.50.

D)5.23.

Pear Corp.reported the following data for calendar 2017:

To two decimals, Pear Corp.'s current ratio for 2017 is

A)1.09.

B)2.08.

C)2.50.

D)5.23.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following data to answer questions

Pear Corp.reported the following data for calendar 2017:

To two decimals, Pear Corp.'s profit margin on sales for 2017 is

A)6.43%.

B)8348%.

C)11.79%.

D)19.64%.

Pear Corp.reported the following data for calendar 2017:

To two decimals, Pear Corp.'s profit margin on sales for 2017 is

A)6.43%.

B)8348%.

C)11.79%.

D)19.64%.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck