Deck 6: Gross Income: Inclusions and Exclusions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 6: Gross Income: Inclusions and Exclusions

1

Workers at Saltmine, Inc., are required to take their lunch in the company cafeteria at the bottom of the mine for the employer's convenience.The per diem reimbursement they receive in their paycheck for the cost of meals is excluded from the worker's income.

False

2

A taxpayer buys a $2 raffle ticket at the neighborhood school carnival.He wins the third prize of $20.The income is excluded from gross income since it is less than $25.

False

3

Farmers are required to include in gross income fair market value of materials (e.g., seed corn) received from the government.

True

4

Assuming the existence of a written reciprocal agreement, employees of UFO Airlines who fly to Paris on otherwise empty seats on board another company's flight have no taxable income for the value of the transportation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

Any dividend declared, with the option of receiving cash or additional common stock, qualifies for the stock dividend exclusion if stock instead of cash is selected.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Conceptually, reimbursement for employee business travel is included in gross income but there normally is an offsetting deduction for A.GI.so the effect is usually a wash.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

A mother and her 19-year-old son live together in a state that declares persons to be adults at age 18.She receives $120 a month for child support and $80 for alimony.The entire $200 per month is included in gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

If an annuitant dies before recovering the entire investment in the annuity contract, the amount of the unrecovered investment is allowed as a deduction on the taxpayer's final tax return.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

The board of directors of Q Corporation votes to award the president of the company $5,000 in recognition of its appreciation for the president's hard work in securing a government contract.The president will pay no income tax on this bonus (award).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

The value of leasehold improvements made by the lessee is nontaxable to the lessor at the time made and at the time of lease termination unless they were made in lieu of rent.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

For child and dependent care assistance provided through an employer plan, an employer is allowed a deduction, and an employee is allowed an exclusion for gross income.The employee's exclusion is subject to an annual limit.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

H voluntarily pays W $200 a month for three months ($600) prior to their divorce and for five months after their divorce ($1,000).The divorce agreement requires that such payments be made until W's remarriage or death.They have no children.The entire $1,600 is included in the gross income of W.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Distributions of cash and other assets to shareholders by U.S.corporations in excess of their current and accumulated earnings and profits qualify as dividends, provided the shareholder's basis in the stock has been reduced to zero.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

The current tax law requires that the portion of social security tax paid by the employer be included in gross income by the employee, because it represents a benefit of value to be received in the future.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

T had $600 in state income tax withheld in 2011 and received a refund of $258 in 2012.T is single and always files Form 1040A.The refund is not included in gross income in 2012.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

When a mutual fund distributes dividends, the dividends are deductible by the fund and the undistributed income is taxable to the fund.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

In the calculation of gross income, income that is nontaxable in total is generally not reported on the tax return, while income that is partially taxable and partially nontaxable is generally reported on the return.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Insurance proceeds received to cover lost profits or overhead expenses in the event of fire damage to a grocery are included in gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

All interest from state and municipal bonds is excluded from gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

Proceeds received from an employer-provided group-term life insurance policy are included in gross income of the employee's widow.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

S purchased 200 shares of C, Inc., common stock on January 1, 2006 for $2,200.On December 15 of the current year, C, Inc., issued a 10 percent common stock dividend giving him 20 additional shares.D's basis in each share of common stock after the dividend is

A)$11

B)$10

C)$9

D)$8

A)$11

B)$10

C)$9

D)$8

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is a dividend for tax purposes?

A)The dividend check from a mutual insurance company

B)The dividend coupon from Health Food Co-op

C)The dividend check from Utility Power and Light preferred

D)The dividend entered in an account at Employee's Credit Union

A)The dividend check from a mutual insurance company

B)The dividend coupon from Health Food Co-op

C)The dividend check from Utility Power and Light preferred

D)The dividend entered in an account at Employee's Credit Union

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

H is a single, retired worker with $45,000 annual taxable income.H will begin to receive social security benefits this year that will only amount to $5,000 per year.His social security benefits will

A)Come to him tax-free since he paid tax on the amounts when they were included in his gross wages

B)Be partially taxed because of his high income bracket

C)Be denied him and redirected to a congressionally formed social security trust fund

D)Be denied him, but he will get a deduction against his taxable income for the full $5,000

A)Come to him tax-free since he paid tax on the amounts when they were included in his gross wages

B)Be partially taxed because of his high income bracket

C)Be denied him and redirected to a congressionally formed social security trust fund

D)Be denied him, but he will get a deduction against his taxable income for the full $5,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

In which of the following independent situations does the taxpayer have taxable income?

A)W lost a finger when a stamping press he was working with malfunctioned.His employer-provided accident insurance policy paid him $25,000

B)X received $10,000 of disability income during the year under an employer-financed disability plan

C)Y received $12,000 of disability income during the year.Y paid the $225 annual premium on the disability policy

D)Z, a spouse, received $40,000 in life insurance proceeds from the ABC Corporation due to the death of her husband

A)W lost a finger when a stamping press he was working with malfunctioned.His employer-provided accident insurance policy paid him $25,000

B)X received $10,000 of disability income during the year under an employer-financed disability plan

C)Y received $12,000 of disability income during the year.Y paid the $225 annual premium on the disability policy

D)Z, a spouse, received $40,000 in life insurance proceeds from the ABC Corporation due to the death of her husband

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

In the calculation of gross income, which of the following is not an example of nontaxable employee benefits?

A)Purchase discounts for all employees equal to the employer's gross profit percentage

B)Group-term life insurance for $100,000 of coverage

C)Parking provided in the company garage

D)Supper money for voluntarily working overtime

A)Purchase discounts for all employees equal to the employer's gross profit percentage

B)Group-term life insurance for $100,000 of coverage

C)Parking provided in the company garage

D)Supper money for voluntarily working overtime

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following employer awards is nontaxable to the employee?

A)A, Inc., pays E $400 in recognition of her 10 years of service to the company.

B)B, Inc., pays $375 for a watch that it awards to F in recognition of his four years of service to the company.

C)C, Inc., pays $400 for a watch that it awards to G in recognition of his safety achievements with the company.

D)All of the above awards are nontaxable.

A)A, Inc., pays E $400 in recognition of her 10 years of service to the company.

B)B, Inc., pays $375 for a watch that it awards to F in recognition of his four years of service to the company.

C)C, Inc., pays $400 for a watch that it awards to G in recognition of his safety achievements with the company.

D)All of the above awards are nontaxable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

An annuity has an annual compound interest rate of 9 percent.At this rate, the original investment will be doubled in approximately

A)10 years

B)8 years

C)5 years

D)4.75 years

A)10 years

B)8 years

C)5 years

D)4.75 years

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

B, who is single and 59 years old, purchased a single premium immediate annuity on January 1 of the current year for $12,000 that will pay him $100 every month for life beginning on January 15.Based on actuarial tables published by the IRS, his life expectancy multiple is 25.0.Assuming B lives 26 years, the amount included in his gross income for year 26 is

A)$1,200

B)$0

C)$720

D)$480

A)$1,200

B)$0

C)$720

D)$480

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

J is a 56-year-old executive who has worked for AM, Inc., since 1975.Her current contract with AM includes $100,000 of group-term life insurance.The taxable amount for each $1,000 of insurance protection, given J's age, is $5.16 annually.Assuming J is in the 28 percent marginal tax bracket, the after-tax cost of this policy to J in the current year is

A)$204.20

B)$102.00

C)$0.00

D)$72.24

A)$204.20

B)$102.00

C)$0.00

D)$72.24

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

D purchased all of the stock in SB, Inc., in 2006 for $76,000.On December 31 of the current year, SB, Inc., made a cash distribution of $135,000 to D.Assuming SB, Inc., has current E&P of $15,000 and accumulated E&P of $40,000, the distribution will be treated as

A)Taxable dividend of $135,000

B)Taxable dividend of $55,000 and nontaxable return of investment of $80,000

C)Taxable dividend of $55,000, nontaxable return of investment of $76,000, and a capital gain of $4,000

D)Taxable dividend of $55,000 and capital gain of $80,000

A)Taxable dividend of $135,000

B)Taxable dividend of $55,000 and nontaxable return of investment of $80,000

C)Taxable dividend of $55,000, nontaxable return of investment of $76,000, and a capital gain of $4,000

D)Taxable dividend of $55,000 and capital gain of $80,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

E, who is 68 years old and married, retired on July 1 of the current year.His current year income is shown below. Salary (prior to retirement)

Pension payments (all taxable) 14,000

Dividends

Tax-exempt bond interest

Social security benefits 5,000 Assume E has no deductions for adjusted gross income and that Mrs.E has no income.The amount of social security benefits that E must include in taxable income on a joint return for the current year is

A)$5,000

B)$0

C)$2,250

D)$2,500

Pension payments (all taxable) 14,000

Dividends

Tax-exempt bond interest

Social security benefits 5,000 Assume E has no deductions for adjusted gross income and that Mrs.E has no income.The amount of social security benefits that E must include in taxable income on a joint return for the current year is

A)$5,000

B)$0

C)$2,250

D)$2,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

A Corp.wants to throw something to its shareholders this year, but is cash poor.The board decides on a two-for-one stock dividend: common on common.The shareholders of record at the time of the dividend

A)Realize a taxable dividend equal in amount to the value of their pre-split shares

B)Have the value of their holdings doubled, taxation on which is postponed until the shares are sold

C)Double their shares, allocating the pre-split basis in the stock equally among the shares

D)Have nontaxable return of all their capital

A)Realize a taxable dividend equal in amount to the value of their pre-split shares

B)Have the value of their holdings doubled, taxation on which is postponed until the shares are sold

C)Double their shares, allocating the pre-split basis in the stock equally among the shares

D)Have nontaxable return of all their capital

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

A closely held C corporation purchased the $250,000 whole life insurance policy held by one of its officers, and named itself as beneficiary.The officer died in an airplane crash after the corporation had paid only $1,000 on her policy.If the deceased officer's basis in the policy was $10,000 at time of transfer to the corporation, the tax consequences to the corporation are

A)No taxable income

B)$240,000 taxable income

C)$250,000 taxable income

D)$239,000 taxable income

A)No taxable income

B)$240,000 taxable income

C)$250,000 taxable income

D)$239,000 taxable income

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

H owns 100 shares of A Corp.(or 1% of the stock), which he purchased two years ago for $30 each.A's net earnings this year were respectable-2 million-but their board decides to distribute $4 million.Assuming A Corp.had no AE&P before this year, how is the amount shareholder H receives reported on his individual return?

A)$40,000 of taxable dividend

B)$20,000 of taxable dividend; $17,000 capital gain; $3,000 nontaxable return of capital

C)$20,000 of taxable dividend; $20,000 capital gain

D)$37,000 capital gain; $3,000 nontaxable return of capital

A)$40,000 of taxable dividend

B)$20,000 of taxable dividend; $17,000 capital gain; $3,000 nontaxable return of capital

C)$20,000 of taxable dividend; $20,000 capital gain

D)$37,000 capital gain; $3,000 nontaxable return of capital

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

S purchased 200 shares of C, Inc., common stock on January 1, 2006 for $2,200.On December 15 of the current year, C, Inc., issued a 10 percent common stock dividend giving him 20 additional shares.The holding period for the 20 additional shares of C, Inc., begins on

A)January 1, 2006

B)December 15 of the current year

C)December 31 of the current year

D)None of the above

A)January 1, 2006

B)December 15 of the current year

C)December 31 of the current year

D)None of the above

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

T, Inc., pays $600 ($725 FMV) for a gold watch that is awarded to U for his 25 years of service to T.This is U's only award from T.The employer does not have a qualified plan for awards.The amount included in U's gross income and the amount deductible by T are, respectively,

A)$725 and $600

B)$600 and $600

C)$325 and $400

D)$200 and $325

E)$0 and $600

A)$725 and $600

B)$600 and $600

C)$325 and $400

D)$200 and $325

E)$0 and $600

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

B, who is single and 59 years old, purchased a single premium immediate annuity on January 1 of the current year for $12,000 that will pay him $100 every month for life beginning on January 15.Based on actuarial tables published by the IRS, his life expectancy multiple is 25.0.Assuming B lives just 20 years, the unrecovered amount allowed as a deduction on B's final tax return is

A)$0

B)$9,600

C)$720

D)$2,400

A)$0

B)$9,600

C)$720

D)$2,400

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

K purchased a single premium-deferred annuity 25 years ago for $6,000.Beginning in July of this year, he will receive $125 monthly for 20 years.The taxable amount in the current year is

A)$150

B)$600

C)$750

D)$1,500

A)$150

B)$600

C)$750

D)$1,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

R received cash income in the current year from the following investments: bank savings account interest, $43; municipal bond interest, $88; Canadian corporate stock dividend, $112; U.S.public utility stock dividend, $58; and corporate bond interest, $196.All amounts received on stock were paid from current earnings.The amount included in gross income of R is

A)$497

B)$439

C)$409

D)$351

A)$497

B)$439

C)$409

D)$351

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

W, who is married and files a joint return, had adjusted gross income last year of $50,000.The following is a list of W's itemized deductions for last year: Unreimbursed medical expenses before limitation

Charitable contributions

Interest paid on home mortgage

State and local property taxes 3,500 This year, W received $6,000 as reimbursement from his insurance company for his medical expenses in the prior year.How much of the reimbursement must W include in this year's gross income?

A)$0

B)$2,250

C)$6,000

D)$3,750

Charitable contributions

Interest paid on home mortgage

State and local property taxes 3,500 This year, W received $6,000 as reimbursement from his insurance company for his medical expenses in the prior year.How much of the reimbursement must W include in this year's gross income?

A)$0

B)$2,250

C)$6,000

D)$3,750

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

Alimony payments by H to W for the first three years after divorce are as follows: First year

Second year 60,000

Third year The recaptured amounts from the second and first years will be treated as follows in the third year:

A)H's gross income is increased by $52,500 and W's deduction for A.G.I.is increased by $52,500.

B)W's gross income is increased by $52,500 and H's deduction for A.G.I.is increased by $52,500.

C)H's gross income is increased by $52,500 and W's deduction from A.G.I.is increased by $52,500.

D)W's gross income is increased by $52,500 and H's deduction from A.G.I.is increased by $52,500.

Second year 60,000

Third year The recaptured amounts from the second and first years will be treated as follows in the third year:

A)H's gross income is increased by $52,500 and W's deduction for A.G.I.is increased by $52,500.

B)W's gross income is increased by $52,500 and H's deduction for A.G.I.is increased by $52,500.

C)H's gross income is increased by $52,500 and W's deduction from A.G.I.is increased by $52,500.

D)W's gross income is increased by $52,500 and H's deduction from A.G.I.is increased by $52,500.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

In a verbal agreement, W is to receive $150 per month for her maintenance and support (ending on her death or remarriage) and $250 for child support.The $250 payment is to stop when the child reaches age 18.During the current year, she received 12 payments of $400 each.The amount included in W's gross income is

A)$0

B)$2,400

C)$1,800

D)$4,800

A)$0

B)$2,400

C)$1,800

D)$4,800

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following would best improve the tax position of a divorcing husband who will be required to contribute toward the support of his ex-wife?

A)Pay her alimony

B)A large property settlement with the ex-wife

C)Voluntary cash payments to the ex-wife

D)Transfer assets to ex-wife before divorce or separation

A)Pay her alimony

B)A large property settlement with the ex-wife

C)Voluntary cash payments to the ex-wife

D)Transfer assets to ex-wife before divorce or separation

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

H and W are divorced.Pursuant to the divorce decree, H transferred stock with a FMV of $60,000 (basis to H of $25,000) to W.W's basis in the stock received is

A)$60,000

B)$25,000

C)$35,000

D)$0

A)$60,000

B)$25,000

C)$35,000

D)$0

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

During the summer, P is employed by a local charity as the director of a camp for handicapped children.She receives weekly benefits of $225 salary, lodging in a private cabin valued at $55, and meals in the dining hall worth $40.In case an emergency arises, P is required to be available at all times during the seven weeks of camp.The amount included in P's gross income is

A)$1,855

B)$1,960

C)$2,240

D)$1,575

A)$1,855

B)$1,960

C)$2,240

D)$1,575

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

Alimony payments by H to W for the first three years after divorce are as follows: First year

Second year 60,000

Third year The recapture amount in the third year from the second year is

A)$15,000

B)$30,000

C)$20,000

D)$10,000

Second year 60,000

Third year The recapture amount in the third year from the second year is

A)$15,000

B)$30,000

C)$20,000

D)$10,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following death benefits are wholly included in gross income?

A)$10,000 death benefit paid by the decedent's employer to the decedent's spouse

B)The Christmas bonus attributable to the decedent, but paid to the decedent's spouse

C)A $10,000 lump sum distribution from a qualified pension plan paid to the decedent's spouse

D)All of the above

A)$10,000 death benefit paid by the decedent's employer to the decedent's spouse

B)The Christmas bonus attributable to the decedent, but paid to the decedent's spouse

C)A $10,000 lump sum distribution from a qualified pension plan paid to the decedent's spouse

D)All of the above

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

S is selling a shoe repair shop this spring and is unsure how to word the sales agreement to his best advantage.The price he is to receive exceeds the fair market value (FMV) of all identifiable net assets.Also, the purchaser insists on a non-competition arrangement.S would be best served by

A)Allocating all amounts in excess of FMV to the non-competition clause

B)Allocating all amounts in excess of FMV to goodwill

C)Allocating 50 percent of excess amounts to the non-competition clause and 50 percent to goodwill

D)Allocating 25 percent of excess amounts to the non-competition clause and 75 percent to goodwill

A)Allocating all amounts in excess of FMV to the non-competition clause

B)Allocating all amounts in excess of FMV to goodwill

C)Allocating 50 percent of excess amounts to the non-competition clause and 50 percent to goodwill

D)Allocating 25 percent of excess amounts to the non-competition clause and 75 percent to goodwill

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

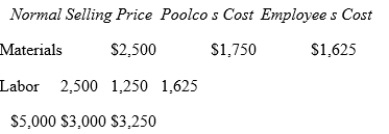

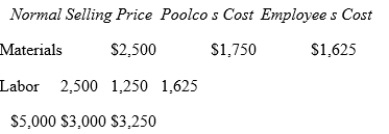

Poolco builds and installs swimming pools.The company will discount the price of a pool to its employees that choose to have one built.Given the information shown below, how much would an employee have to include as income if he took advantage of this discount?

A)$1,750

B)$750

C)$500

D)$0, because employee's cost exceeds Poolco's cost

A)$1,750

B)$750

C)$500

D)$0, because employee's cost exceeds Poolco's cost

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

H and W divorced six months ago.W is supposed to get H's Picasso painting, which he had bought for $20,000.At the time of transfer to W, the work of Picasso is valued at $100,000.Which of the following tax consequences would occur?

A)H has an $80,000 taxable gain.

B)W has an $80,000 taxable gain.

C)W has a $20,000 taxable gain.

D)There was no taxable income on this transfer.

A)H has an $80,000 taxable gain.

B)W has an $80,000 taxable gain.

C)W has a $20,000 taxable gain.

D)There was no taxable income on this transfer.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

For which of the following independent situations would the recipient be required to recognize taxable income?

A)Fire to a building resulted in a bookstore being closed for two months.An insurance company paid the proprietor of the bookstore $12,000 for lost profits during the two-month period.

B)As part of the sale price of a drug store, the seller received $12,000 for agreeing not to compete with the buyer in the same town.

C)On January 1 of the current year, X leased a building from Y.In lieu of paying Y rent of $1,000 per month, X made improvements to the building amounting to $12,000.

D)All of the above; each recipient is required to recognize $12,000 of taxable income.

A)Fire to a building resulted in a bookstore being closed for two months.An insurance company paid the proprietor of the bookstore $12,000 for lost profits during the two-month period.

B)As part of the sale price of a drug store, the seller received $12,000 for agreeing not to compete with the buyer in the same town.

C)On January 1 of the current year, X leased a building from Y.In lieu of paying Y rent of $1,000 per month, X made improvements to the building amounting to $12,000.

D)All of the above; each recipient is required to recognize $12,000 of taxable income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

D and M are divorcing.D loves his two children and agrees to support them with the amount of $500 per month, ending on the later of the child's 18th birthday or 22nd birthday, if the child pursues a full-time college education.He further agrees to pay his ex-wife $1,500 per month for her maintenance and support, ending on her death or remarriage.These agreements are contained in their divorce decree.D pays his ex-wife the $2,000 per month under the terms of the decree, using one check.How much of each $2,000 check is a nondeductible child support expense for D?

A)$2,000

B)$500

C)$0

D)Cannot figure amount without information on amount wife actually uses for child support

A)$2,000

B)$500

C)$0

D)Cannot figure amount without information on amount wife actually uses for child support

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

In which of the following independent situations does the taxpayer have taxable income?

A)Taxpayer L inherited land valued at $200,000 from the estate of his wealthy grandfather.

B)Taxpayer M, who manages a hotel, is required to live in the hotel for the employer's convenience and as a condition of employment.The value of the lodging, provided without charge, is equal to $500 per month.

C)Taxpayer N, who is an emergency room nurse, is required to eat in the hospital cafeteria to be available for emergencies.The meals are free to N.

D)Taxpayer O received $1,000 in interest on $15,000 that her aunt gave her last year.

A)Taxpayer L inherited land valued at $200,000 from the estate of his wealthy grandfather.

B)Taxpayer M, who manages a hotel, is required to live in the hotel for the employer's convenience and as a condition of employment.The value of the lodging, provided without charge, is equal to $500 per month.

C)Taxpayer N, who is an emergency room nurse, is required to eat in the hospital cafeteria to be available for emergencies.The meals are free to N.

D)Taxpayer O received $1,000 in interest on $15,000 that her aunt gave her last year.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

L, an undergraduate accounting major, received a $5,000 scholarship during the year.She used the money for the following school-related expenses: tuition $800, books $300, room and board $3,000, and supplies $100.How much of the scholarship is included in L's gross income?

A)$5,000

B)$4,200

C)$800

D)$3,800

A)$5,000

B)$4,200

C)$800

D)$3,800

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following represents taxable income to the recipient?

A)Scholarship used to pay tuition at a state university

B)Scholarship used to purchase books required for a course of study at a state university

C)Scholarship used to purchase equipment required for a course of study at a state university

D)Scholarship used to pay for room and board at a state university

A)Scholarship used to pay tuition at a state university

B)Scholarship used to purchase books required for a course of study at a state university

C)Scholarship used to purchase equipment required for a course of study at a state university

D)Scholarship used to pay for room and board at a state university

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Alimony payments by H to W for the first three years after divorce are as follows First year

Second year 60,000

Third year The recapture amount in the third year from the first year is

A)$30,000

B)$60,000

C)$45,000

D)$37,500

Second year 60,000

Third year The recapture amount in the third year from the first year is

A)$30,000

B)$60,000

C)$45,000

D)$37,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

A divorce decree states that H is to pay $600 per month as alimony and support of three minor children.The decree also provides that the payments will decrease by one-fourth: (1) if the former spouse dies or remarries, and (2) as each child reaches 21 years of age.The first payment was due November 1.H paid $400 in November and $550 in December.How are these payments allocated between child support and alimony?

A)$950.00 child support and zero alimony

B)$650.00 child support and $300.00 alimony

C)$900.00 child support and $50.00 alimony

D)$712.50 child support and $237.50 alimony

A)$950.00 child support and zero alimony

B)$650.00 child support and $300.00 alimony

C)$900.00 child support and $50.00 alimony

D)$712.50 child support and $237.50 alimony

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

M, Inc., operates a funeral home out of a nineteenth-century mansion.M, Inc., requires R to be on call 24 hours and provides the second floor of the mansion as an apartment.Rent expense for comparable accommodations would amount to $24,000 per year.R has taxable income on this perquisite of

A)$24,000

B)$12,000

C)$5,000

D)$0

A)$24,000

B)$12,000

C)$5,000

D)$0

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Sgt.C is transferred to a post in California.During the year, he received compensation from the U.S.Army valued as follows: active duty pay, $15,000; allowance for moving expenses, $1,400; re-enlistment bonus, $1,500; and meals and lodging, $6,000.Included in Sgt.C's gross income is

A)$23,900

B)$17,900

C)$16,500

D)$15,000

A)$23,900

B)$17,900

C)$16,500

D)$15,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following benefits provided by an employer to its employees is taxable?

A)Employees of the ABC Department Store are allowed a 15 percent discount (which does not exceed the employer's gross profit percentage) on the retail price of all merchandise purchased from the store.

B)Undergraduate tuition is waived by the XYZ University for dependent children of employees who are admitted to the school.

C)The MNO Airline provides free standby flights to its employees.

D)None of the above benefits are taxable.

A)Employees of the ABC Department Store are allowed a 15 percent discount (which does not exceed the employer's gross profit percentage) on the retail price of all merchandise purchased from the store.

B)Undergraduate tuition is waived by the XYZ University for dependent children of employees who are admitted to the school.

C)The MNO Airline provides free standby flights to its employees.

D)None of the above benefits are taxable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

Items that generally may be excluded by businesses from gross income are:

A)Debt cancellation (under bankruptcy proceedings), lease cancellation payments, and leasehold improvements (not in lieu of rent)

B)Lease cancellation payments, contributions to capital, and leasehold improvements (not in lieu of rent)

C)Debt cancellation (under bankruptcy proceedings), lease cancellation payments, and contributions to capital

D)Debt cancellation (under bankruptcy proceedings), contributions to capital, and leasehold improvements (not in lieu of rent)

A)Debt cancellation (under bankruptcy proceedings), lease cancellation payments, and leasehold improvements (not in lieu of rent)

B)Lease cancellation payments, contributions to capital, and leasehold improvements (not in lieu of rent)

C)Debt cancellation (under bankruptcy proceedings), lease cancellation payments, and contributions to capital

D)Debt cancellation (under bankruptcy proceedings), contributions to capital, and leasehold improvements (not in lieu of rent)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

L and M are married and file a joint return.Having no children of their own, they adopted a three year old "special needs" child.L and M incurred $10,000 in qualified adoption expenses such as adoption fees, attorney fees and court costs.The $10,000 was furnished to M under an adoption assistance program maintained by his employer.Assuming L and M's AGI for the current year amounts to $105,000 before considering adoption assistance, how much of the $10,000 payment must the couple include in their gross income?

A)$0

B)$10,000

C)$6,000

D)$8,500

A)$0

B)$10,000

C)$6,000

D)$8,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

A and B, who are married and file a joint return, have AGI for the current year of $32,000.In addition, they received tax-exempt interest income of $3,000 and Social Security benefits of $8,600.The Social Security benefits to be included in A and B's gross income for the current year is

A)$0

B)$3,650

C)$7,300

D)$4,300

A)$0

B)$3,650

C)$7,300

D)$4,300

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

A is employed in Chicago as a stewardess for AMX Airlines.The airline has a policy that allows employees to fly without charge on a standby basis only.In September, A flies from Chicago to Los Angeles to visit her father.The value of the ticket is $400.B is employed as a manager of the HMO Hotel in Chicago.HMO has a reciprocal agreement with the DEF Hotel in Boston that allows employees of both hotels to stay free of charge at either hotel provided space is available.In October, B spends two nights in Boston at the DEF Hotel.The value of the room for the two nights is $350.The tax consequences of these benefits are:

A)A can exclude the value of the airplane ticket from the gross income and B can exclude the value of the hotel room from gross income.

B)A must include the value of the airplane ticket in gross income but the value of the hotel room to B is tax-free.

C)B must include the value of the hotel room in gross income but the value of the airplane ticket to A is tax-free.

D)A must include the value of the airplane ticket in gross income and B must include the value of the hotel room in gross income.

A)A can exclude the value of the airplane ticket from the gross income and B can exclude the value of the hotel room from gross income.

B)A must include the value of the airplane ticket in gross income but the value of the hotel room to B is tax-free.

C)B must include the value of the hotel room in gross income but the value of the airplane ticket to A is tax-free.

D)A must include the value of the airplane ticket in gross income and B must include the value of the hotel room in gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

Hunter is deciding between purchasing General Motors Corporate bonds and State of Michigan bonds.In either case, Hunter will invest $10,000.The corporate bonds pay 15% annually.Assuming Hunter's marginal tax rate is 34%, he will be indifferent to choosing either option if the state bonds pay an annual rate of:

A)5.1%

B)9.9%

C)15%

D)19%

E)22.7%

A)5.1%

B)9.9%

C)15%

D)19%

E)22.7%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

During the current year, U made a $36,000 contribution to a 529 plan to help cover the cost of an undergraduate degree for D, her 15-year-old daughter.Assume three years later D elects to join the work force when she graduates from high school (rather than attend college) and the entire $45,000 accumulated in the 529 plan is distributed to U.How much is included in U's gross income?

A)$45,000

B)$36,000

C)$9,000

D)$0

A)$45,000

B)$36,000

C)$9,000

D)$0

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

During the current year, U made a $36,000 contribution to a 529 plan to help cover the cost of an undergraduate degree for D, her 15-year-old daughter.Assume that in the year D enrolls as a freshman at State University, the balance in the 529 plan has grown to $45,000.If D receives an $11,000 distribution to pay for her tuition, she may exclude from her gross income:

A)$11,000

B)$0

C)$8,800

D)$2,200

A)$11,000

B)$0

C)$8,800

D)$2,200

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following should not be included in taxable income for individuals?

A)Alimony

B)Child Support

C)Dividends from a corporation that is 100% owned by the taxpayer.

D)Interest from a checking account

E)Tips

A)Alimony

B)Child Support

C)Dividends from a corporation that is 100% owned by the taxpayer.

D)Interest from a checking account

E)Tips

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following types of interest income are taxable for Federal income tax purposes?

A)Interest on New York City School bonds

B)Interest on State of Michigan bonds

C)Interest on life insurance proceeds that the beneficiary elected to receive in installments over a 10-year period

D)None of the above is taxable.

A)Interest on New York City School bonds

B)Interest on State of Michigan bonds

C)Interest on life insurance proceeds that the beneficiary elected to receive in installments over a 10-year period

D)None of the above is taxable.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

C was recently diagnosed with a rare liver disorder and has been certified by his medical doctor, on June 1 of the current year, as terminally ill.C immediately resigned from his sales position with IBM and, on July 1 of the current year, sold his life insurance policy with a face value of $300,000 to a viatical "settlement provider" (VSP) for $240,000.Assuming C paid $30,000 in premiums, how much of the $240,000 proceeds must he include in his gross income for the current year?

A)$0

B)$300,000

C)$210,000

D)$240,000

A)$0

B)$300,000

C)$210,000

D)$240,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

A and B, who are married and file a joint return, have AGI for the current year of $42,000.In addition, they received tax-exempt interest income of $6,000 and Social Security benefits of $15,000.The Social Security benefits to be included in A and B's gross income for the current year is

A)$0

B)$7,500

C)$12,750

D)$11,750

A)$0

B)$7,500

C)$12,750

D)$11,750

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Refer to the facts in Question 82.If C dies 10 months later, how much must VSP include in its gross income assuming it paid additional premiums of $12,000 after purchasing the policy?

A)$0

B)$48,000

C)$300,000

D)$60,000

A)$0

B)$48,000

C)$300,000

D)$60,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

Alimony payments are to be paid by A to Z according to the following schedule: Year one Two Three

Amount What is the required recapture amount in year three from year one?

A)$17,500

B)$25,000

C)$3,000

D)$10,000

Amount What is the required recapture amount in year three from year one?

A)$17,500

B)$25,000

C)$3,000

D)$10,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

A flood forced A to live in a hotel for two months before she could return home.On average, it cost A $600 per month to live in her home.A's insurer paid out to A a total of $3,600: $1,800 for each of the two months to cover temporary living costs.A paid a corresponding $3,000 hotel bill.Of the $3,600 paid by the insurance company, how much, if any, is taxable to A?

A)$1,800

B)$3,600, reduced by the statutory multiplier

C)$600

D)$0

E)$2,400

A)$1,800

B)$3,600, reduced by the statutory multiplier

C)$600

D)$0

E)$2,400

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

G was injured when an elevator at his place of work fell three floors, permanently losing the use of his left hand.As a result, he received disability income of $700 per month for six months during the current year.G's employer paid 60 percent of the annual premium on the disability policy, and G paid the remainder.The amount included in G's gross income is

A)$0

B)$2,520

C)$4,200

D)$1,680

A)$0

B)$2,520

C)$4,200

D)$1,680

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following would not be a good purchase for someone seeking to defer taxable income?

A)Rare coins

B)Deferred life annuity

C)Six-month CDs compounded daily

D)A lot located near a recreational lake

A)Rare coins

B)Deferred life annuity

C)Six-month CDs compounded daily

D)A lot located near a recreational lake

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Employer P provides qualified parking with a fair market value of $250 per month to Employee D, but charges Employee D $45 per month.How much is includible in Employee D's gross income?

A)$250 per month

B)$205 per month

C)$45 per month

D)None of the above.The correct answer is $_________per month.

A)$250 per month

B)$205 per month

C)$45 per month

D)None of the above.The correct answer is $_________per month.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

H purchases a farm with an abandoned farmhouse on it.In the attic, he finds a mattress stuffed with $20,000 in old silver certificate bills.The tax consequences of this find are

A)Taxable income of $20,000 to the former owner of the mattress

B)Taxable income of $20,000 to H

C)No tax consequences at this time

D)Capital gain of $20,000

A)Taxable income of $20,000 to the former owner of the mattress

B)Taxable income of $20,000 to H

C)No tax consequences at this time

D)Capital gain of $20,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Alimony payments are to be paid by A to Z according to the following schedule: Year one Two Three

Amount What is the required recapture in year three from year two?

A)$0

B)$32,000

C)$22,000

D)$7,000

Amount What is the required recapture in year three from year two?

A)$0

B)$32,000

C)$22,000

D)$7,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

ABC Video sells VCRs and television sets.On July 1 of the current year, ABC sells a color T.V.to D, one of its sales clerks, for $400.The T.V.normally retails to customers for $600 and ABC's gross profit rate is 20%.J is an attorney for the JKL law firm.The firm pays J's annual dues to the American Bar Association.The tax consequences of these benefits are:

A)D can exclude the entire discount on the purchase of the T.V.from gross income and J can exclude the annual dues to the American Bar Association from gross income.

B)Although J is not required to include the payment of the dues in gross income, D must include $80 of the discount in gross income.

C)Although D is only required to include a portion of the purchase of the T.V.in gross income, J must include the annual dues paid to the American Bar Association in gross income.

D)D must include the entire discount on the purchase of the T.V.in gross income and J must include the annual dues to the American Bar Association in gross income.

A)D can exclude the entire discount on the purchase of the T.V.from gross income and J can exclude the annual dues to the American Bar Association from gross income.

B)Although J is not required to include the payment of the dues in gross income, D must include $80 of the discount in gross income.

C)Although D is only required to include a portion of the purchase of the T.V.in gross income, J must include the annual dues paid to the American Bar Association in gross income.

D)D must include the entire discount on the purchase of the T.V.in gross income and J must include the annual dues to the American Bar Association in gross income.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck