Deck 17: Property Transactions: Dispositions of Trade or Business Property

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/42

Play

Full screen (f)

Deck 17: Property Transactions: Dispositions of Trade or Business Property

1

Three rental houses held by a person who earns her living as a physician are not § 1231 property since the activity does not constitute a trade or business.

False

2

As a general rule, § 1250 (i.e., the partial recapture rule) applies to depreciable personalty but not realty.

False

3

In order for there to be depreciation recapture under either § 1245 or § 1250, the property must be held more than one year.

False

4

During the current year, Q sold a desk used in her business.The gain realized was $50 and the § 1245 recapture potential was $375.Q has ordinary gain of $50 and § 1231 gain of $325.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

5

The long-term holding period under § 1231 for cattle and horses is 12 months; for other livestock, 24 months.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

6

Nonresidential real property acquired during the years 1981 through 1986 is classified as § 1245 property if the taxpayer used the accelerated method of recovering cost.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

7

Unharvested crops sold along with land do not qualify for § 1231 treatment, and therefore produce ordinary income at the time of the sale.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

8

There is never any depreciation recapture on the sale of an asset when it is sold at a loss.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

9

Section 1250 is referred to as the partial recapture rule since only a portion of the depreciation allowed may be recaptured.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

10

As part of the § 1231 netting process, casualty and theft gains and losses involving business capital assets and § 1231 assets are combined.If a net gain results, each casualty or theft is treated separately as a casualty gain or loss.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

11

As a general rule, § 1245 (i.e., the full recapture rule) applies to depreciable personalty but not realty.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

12

Both land and a building used as rental property and held for more than one year are § 1231 assets.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

13

During the current year, X sold an office building that was purchased before 1981 and had been used in his business.Depreciation of $12,700 had been claimed.If the straight line method had been used, the depreciation expense would have been $8,500.W's § 1250 recapture potential is $4,200.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

14

If § 1245 property is sold on the installment basis, any depreciation recapture must be reported in the year of sale, even if the amount of money collected in that year is less than the recaptured amount.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

15

The gain or loss on the disposition of a machine used in a trade or business for one year or less is a short-term capital gain or loss.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

16

The portion of the gain on the sale of timber that qualifies for § 1231 treatment is only the difference between the fair market value at the beginning of the tax year of harvest and the adjusted basis of the timber.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

17

If the § 1231 netting process results in a loss, the taxpayer must look back to the prior five years to see if any net § 1231 gains were reported in those years.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

18

L sold a machine that had cost $6,000 during the current year for $3,200.The machine was used in her business for 21 months and was expensed under § 179.L must report ordinary income, rather than potential capital gain, of $3,200.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

19

W sold an automobile that had been used in his business during the current year.Depreciation of $6,700 had been claimed.If the straight line method had been used, the depreciation expense would have been $4,500.W's § 1245 recapture potential is $2,200.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

20

Section 1245 is referred to as the full recapture rule since all of the gain may be ordinary income.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

21

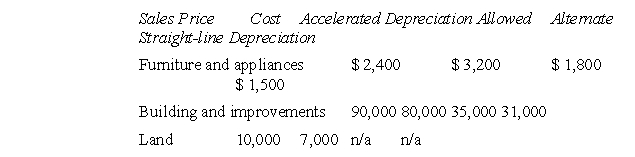

During the year, V sold an apartment purchased in 1980.Assume that V claimed all depreciation allowed.The sale is summarized as follows: Sales Price Cost Accelerated Depreciation Allowed Altemate Straigh-line Depreciation

Furniture and appliances

Building and improvements

Land 10,0007,000 How much ordinary income does V have under § 1245 and § 1250, respectively?

A)$300 and $0

B)$300 and $4,000

C)$1,000 and $0

D)$1,000 and $4,000

Furniture and appliances

Building and improvements

Land 10,0007,000 How much ordinary income does V have under § 1245 and § 1250, respectively?

A)$300 and $0

B)$300 and $4,000

C)$1,000 and $0

D)$1,000 and $4,000

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

22

If straight-line depreciation is used by an individual for real estate, no § 1250 recapture will be recognized if the property is sold at a gain.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

23

Five years ago, Wilson James purchased a photocopier with a five-year recovery period for use in his business for $8,000.He deducted depreciation totaling $7,078 in the five years.In the current year, after owning and using the machine 58 months, James sold it for $1,122.What are the amounts of his depreciation recapture and § 1231 gain, respectively?

A)$200; $0

B)$0; $200

C)$0; $0

D)$100; $100

A)$200; $0

B)$0; $200

C)$0; $0

D)$100; $100

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

24

The additional depreciation recapture for a corporation under § 291 is 20 percent of the § 1231 gain.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

25

N purchased a camera for use in his photography business for $1,200.Depreciation of $624 was allowed as a business deduction before the camera was sold.Which of the following is not true?

A)If the camera is sold for $550, § 1231 applies to the loss.

B)If the camera is sold for $1,000, § 1231 applies to the gain.

C)If the camera is sold for $1,300, §§ 1245 and 1231 apply to the gain.

D)All are true.

A)If the camera is sold for $550, § 1231 applies to the loss.

B)If the camera is sold for $1,000, § 1231 applies to the gain.

C)If the camera is sold for $1,300, §§ 1245 and 1231 apply to the gain.

D)All are true.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

26

Y suffered a theft of depreciable assets that were held for two years for use in her business.The assets were worth $1,000 and had a basis of $1,200.Y's only other property transaction resulted in a short- term capital loss of $2,500.What is the impact on Y's adjusted gross income?

A)$0

B)$3,700 reduction

C)$3,000 reduction

D)$3,500 reduction

A)$0

B)$3,700 reduction

C)$3,000 reduction

D)$3,500 reduction

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

27

C sold a house held for rental purposes for $40,000, recognizing § 1250 recapture of $3,000 and § 1231 gain of $5,000.Which of the following is not necessarily true?

A)The basis of the property was $32,000.

B)The depreciation allowed was $3,000 greater than straight-line depreciation would have been.

C)The total depreciation allowed was $8,000.

D)None of the above statements is necessarily true from these limited facts.

A)The basis of the property was $32,000.

B)The depreciation allowed was $3,000 greater than straight-line depreciation would have been.

C)The total depreciation allowed was $8,000.

D)None of the above statements is necessarily true from these limited facts.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

28

X sold a rental house at a small loss.The loss is a § 1250 loss.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

29

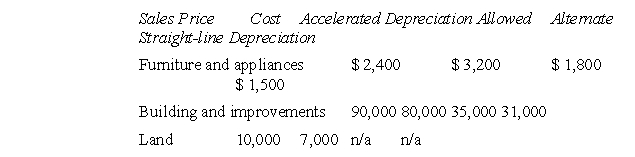

During the year, V sold an apartment purchased in 1980.Assume that V claimed all depreciation allowed.The sale is summarized as follows:  What is V's§ 1231 gain?

What is V's§ 1231 gain?

A)$44,000

B)$45,000

C)$48,000

D)$49,000

What is V's§ 1231 gain?

What is V's§ 1231 gain?A)$44,000

B)$45,000

C)$48,000

D)$49,000

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

30

Y sold a partially depreciated office building at a gain, all of which was § 1231 gain.The building was depreciated using an accelerated method.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

31

Z sold an office building at a gain, all of which was unrecaptured § 1250 gain.The building was sold for its original purchase price or less.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

32

R realized a gain of $10,000 on a fire that destroyed part of a warehouse.R also sold several assets during the current taxable year as follows: Business use equipment held three years $ 3,000 gain

Investment land held 15 years 12,000 gain

Travel trailer used for personal trips 4,000 loss

The depreciation allowed on the equipment was $6,500 and was calculated using the straight line method.Assuming R's taxable income is $70,000 before these transactions, what is his taxable income for the year (assuming these items do not affect any other deductions)?

A)$95,000, $25,000 of which is long-term capital gain

B)$91,000, $ 18,000 of which is long-term capital gain

C)$95,000, $22,000 of which is long-term capital gain

D)$95,000, $12,000 of which is long-term capital gain

Investment land held 15 years 12,000 gain

Travel trailer used for personal trips 4,000 loss

The depreciation allowed on the equipment was $6,500 and was calculated using the straight line method.Assuming R's taxable income is $70,000 before these transactions, what is his taxable income for the year (assuming these items do not affect any other deductions)?

A)$95,000, $25,000 of which is long-term capital gain

B)$91,000, $ 18,000 of which is long-term capital gain

C)$95,000, $22,000 of which is long-term capital gain

D)$95,000, $12,000 of which is long-term capital gain

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

33

Which one of the following is not generally considered § 1231 property?

A)Land held 13 months and used in a trade or business as a parking lot

B)Crops growing on farm land held 20 years

C)Cattle held 12 months and used in ranching

D)Equipment used in a printing business and held 15 months

A)Land held 13 months and used in a trade or business as a parking lot

B)Crops growing on farm land held 20 years

C)Cattle held 12 months and used in ranching

D)Equipment used in a printing business and held 15 months

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is statements is false regarding depreciation recapture under § 1250?

A)Depreciation recapture that existed at the death of the taxpayer carries over to the beneficiaries.

B)Recapture is generally not required upon the gift of § 1250 property.

C)In nontaxable transactions that do not trigger recapture under § 1250, the excess depreciation taken on the property prior to the nontaxable exchange carries over to the property received or purchased.

D)All of the above are false.

A)Depreciation recapture that existed at the death of the taxpayer carries over to the beneficiaries.

B)Recapture is generally not required upon the gift of § 1250 property.

C)In nontaxable transactions that do not trigger recapture under § 1250, the excess depreciation taken on the property prior to the nontaxable exchange carries over to the property received or purchased.

D)All of the above are false.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

35

The gains and losses from sales of capital assets for the current year by H are summarized as follows: Long-term gains

Short-term gains

Short-term losses Assuming H has a net § 1231 gain of $1,600 and depreciation recapture of $2,000, what is the increase in his A.G.I., if any, from these transactions?

A)$2,000

B)$5,800

C)$9,600

D)$7,800

Short-term gains

Short-term losses Assuming H has a net § 1231 gain of $1,600 and depreciation recapture of $2,000, what is the increase in his A.G.I., if any, from these transactions?

A)$2,000

B)$5,800

C)$9,600

D)$7,800

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following Code provisions or combinations of Code provisions cannot apply to the sale of a single asset?

A)Sections 1245 and 1231

B)Sections 1245 and 1250

C)Section 1250 only

D)Sections 291, 1250, and 1231

A)Sections 1245 and 1231

B)Sections 1245 and 1250

C)Section 1250 only

D)Sections 291, 1250, and 1231

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

37

H sold several business properties that were § 1231 property during the current year.His overall gain was $32,000 and he had depreciation recapture of $12,500.The only other § 1231 transactions H has had were in the two prior years.He had a net gain of $3,500 two years ago and a net loss of $12,000 last year.How are H's gains for the current year treated?

A)$12,500 ordinary gain; $19,500 long-term capital gain

B)$21,000 ordinary gain; $11,000 long-term capital gain

C)$24,500 ordinary gain; $ 7,500 long-term capital gain

D)$32,000 ordinary gain

A)$12,500 ordinary gain; $19,500 long-term capital gain

B)$21,000 ordinary gain; $11,000 long-term capital gain

C)$24,500 ordinary gain; $ 7,500 long-term capital gain

D)$32,000 ordinary gain

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

38

The gains and losses from sales of capital assets for the current year by G are summarized as follows: Long-term gains

Short-tem gains

Short-term losses G has § 1245 recapture of $1,500 from one transaction and a § 1231 loss of $1,000 from another.The net decrease in A.G.I, from these transactions is

A)$0

B)$2,500

C)$3,000

D)$3,500

Short-tem gains

Short-term losses G has § 1245 recapture of $1,500 from one transaction and a § 1231 loss of $1,000 from another.The net decrease in A.G.I, from these transactions is

A)$0

B)$2,500

C)$3,000

D)$3,500

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

39

G sold a file cabinet used in her business for $250.She had purchased it for $400 and deducted depreciation of $220.What is the amount and character of G's gain or loss recognized on this sale?

A)$70 ordinary income

B)$70 §1231 gain

C)$150 § 1231 loss

D)$220 ordinary income and $150 § 1231 loss

A)$70 ordinary income

B)$70 §1231 gain

C)$150 § 1231 loss

D)$220 ordinary income and $150 § 1231 loss

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

40

W sold some office furniture at a gain that was partly ordinary income and partly § 1231 gain.W sold the furniture for more than its original cost.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

41

X Corporation sold the following depreciable assets during the current year Building used in business, depreciated using straight line, held 15 years, cost = $50,000, basis = $30,000, gain = $40,000

Equipment used in business, depreciated using straight line, held five years, cost = $5,000, basis = $0, gain = $4,000

Land used in business, held 15 years

How much is total depreciation recapture for X Corporation for the year?

A)$44,000

B)$4,000

C)$0

D)$8,000

Equipment used in business, depreciated using straight line, held five years, cost = $5,000, basis = $0, gain = $4,000

Land used in business, held 15 years

How much is total depreciation recapture for X Corporation for the year?

A)$44,000

B)$4,000

C)$0

D)$8,000

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

42

K sold a building (held seven years and depreciated using an accelerated method) at a gain of $12,000 during the current year.The depreciation allowed was $45,000 and the straight line depreciation would have been $39,500.Which of the following is not true?

A)K has § 1250 recapture of $5,500.

B)K has unrecaptured § 1250 gain of $6,500.

C)K has § 1231 gain of $6,500.

D)K's § 1231 gain qualifies for the 15 percent capital gain rate.

A)K has § 1250 recapture of $5,500.

B)K has unrecaptured § 1250 gain of $6,500.

C)K has § 1231 gain of $6,500.

D)K's § 1231 gain qualifies for the 15 percent capital gain rate.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck