Deck 16: Property Transactions: Capital Gains and Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 16: Property Transactions: Capital Gains and Losses

1

The first step in the capital gain and loss netting process is to combine all capital gains and all capital losses.

False

2

For a capital gain or loss to be considered long-term, the asset must generally be held more than one year.

True

3

A personal automobile (i.e., one that is owned by the taxpayer and driven for personal purposes) is an example of a capital asset.

True

4

A long-term capital loss carryforward is treated as a short-term capital loss in the carryover year by an individual taxpayer.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

In order for real property to be considered ordinary income property (i.e., inventory rather than a capital asset), the taxpayer's livelihood must be derived primarily from buying and selling real estate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

Gain or loss resulting from lease cancellation payments is treated as ordinary income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Section 1244 applies to losses, but not gains, resulting from the sale or exchange of § 1244 stock; therefore, any gain on the disposition of such stock held for investment is subject to capital gain treatment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

The holding period of property acquired by gift that is sold at a gain is always treated as having a long-term holding period.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

A net short-term capital gain (NSTCG) with no further netting, or the excess of a net short-term capital gain over a net long-term capital loss (NSTCG - NLTCL) is treated just like ordinary income for tax computation purposes.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

The holding period of like-kind property acquired in a qualifying exchange begins on the date of the exchange.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Casualties and thefts involving personal-use property are treated as capital gains and losses if the gains exceed the losses from such events for a particular year.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

A net 15 percent capital gain of a noncorporate taxpayer that would otherwise fall into the 10 percent bracket for a lower-income individual will be taxed at 10 percent.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

A net 15 percent capital gain results when a noncorporate taxpayer has a 15 percent capital gain with no capital loss or a net 15 percent capital gain to the extent it exceeds net short-term capital losses.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Undeveloped vacant real estate held exclusively for speculation is treated as business property and does not qualify as a capital asset.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

The holding period of stock purchased and sold on a stock exchange begins and ends with the dates of settlement with the broker.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Capital losses in excess of the annual limitation for individuals are carried forward only.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

The gain or loss on the disposition of a sole proprietorship is capital gain or loss.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

An employer of the creator of a patent cannot be a "holder" of the patent, and therefore cannot qualify for long-term capital gain treatment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Both the date of acquisition and the date of sale are included in determining the holding period for a capital asset.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

The deduction for excess capital losses for individual taxpayers is limited to the lower of an absolute amount of (a) $3,000 or (b) the taxable income for the year, before the deduction.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

Original-issue discount on corporate bonds issued during the current year must be amortized over the life of the bond using the straight-line method.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following assets is not generally considered a capital asset?

A)A personal residence

B)A computer used in a trade or business

C)Chrysler Corporation stock held for investment

D)U.S.Government securities held for investment

A)A personal residence

B)A computer used in a trade or business

C)Chrysler Corporation stock held for investment

D)U.S.Government securities held for investment

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Market discount only occurs when there is a purchase of a bond after issue, not at original issue.The market discount is the excess of the discount in price over any unamortized original-issue discount.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

For the current year, a taxpayer had a short-term capital gain (STCG) of $5,000 and a short-term capital loss (STCL) of $1,000.The taxpayer also had a long-term capital gain (LTCG) of $3,000 and a long-term capital loss (LTCL) of $6,000.Based upon that information, which of the following is not true?

A)The taxpayer has a NSTCG of $4,000.

B)The taxpayer has a NLTCL of $3,000.

C)The taxpayer treats the net gain of $1,000 just like ordinary income.

D)The taxpayer cannot combine the NSTCG and NLTCL; therefore, the NSTCG is treated like ordinary income and the NLTCL is deductible as a net capital loss (NCL).

A)The taxpayer has a NSTCG of $4,000.

B)The taxpayer has a NLTCL of $3,000.

C)The taxpayer treats the net gain of $1,000 just like ordinary income.

D)The taxpayer cannot combine the NSTCG and NLTCL; therefore, the NSTCG is treated like ordinary income and the NLTCL is deductible as a net capital loss (NCL).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

In order for a corporation's stock to qualify as a qualified small business stock under § 1202, the corporation must be a C corporation and the gross assets at incorporation must be $20 million or less.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Dealers in securities hold stocks and bonds as inventory, not as any other class of asset.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

J purchased stock in X Corporation from C, one of the original shareholders.In C's hands, the shares were § 1244 stock.The stock will also be § 1244 stock to J.Both J and C are individuals.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

FGH, Inc.issued stock to individuals for $800,000 cash in 1980 and $400,000 in 1987.None of the stock currently qualifies as § 1244 stock since the paid-in capital of the corporation exceeds $1,000,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following netting processes does not result in a net capital loss (NCL)? (Assume that all results are positive numbers.)

A)NLTCG > NSTCL

B)NSTCL and NLTCL

C)NSTCL > NLTCG

D)NLTCL > NSTCG

A)NLTCG > NSTCL

B)NSTCL and NLTCL

C)NSTCL > NLTCG

D)NLTCL > NSTCG

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

When stock becomes worthless, the loss is ordinary because there is no "sale or exchange" as required for capital loss treatment.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

The purchase of an investment from a seller who agrees to buy the investment back at a speculative market price at the option of the buyer for three years is a conversion transaction.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

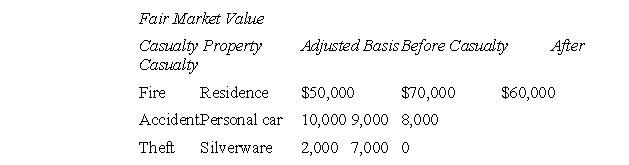

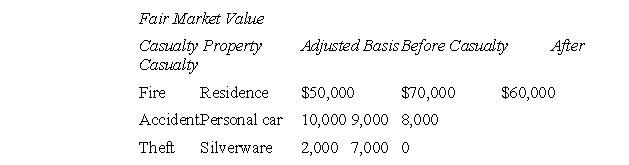

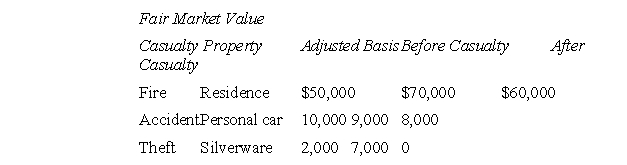

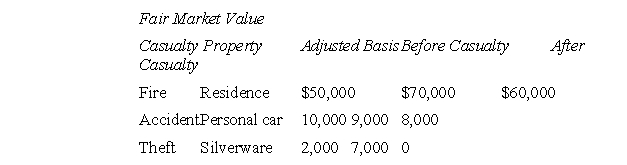

M had three separate casualties involving personal use property during the current year:  M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.Which of the following is not necessarily true concerning M's gains and losses?

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.Which of the following is not necessarily true concerning M's gains and losses?

A)M must report each separate gain or loss as a gain or loss from the sale or exchange of a capital asset.

B)M's personal casualty gain exceeds her personal casualty losses by $900.

C)If M's personal casualty losses had exceeded her gain, then only so much of the net loss as exceeds 10 percent of A.G.I.could have been taken as an itemized deduction.

D)M's personal casualty gains and/or losses are long-term.

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.Which of the following is not necessarily true concerning M's gains and losses?

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.Which of the following is not necessarily true concerning M's gains and losses?A)M must report each separate gain or loss as a gain or loss from the sale or exchange of a capital asset.

B)M's personal casualty gain exceeds her personal casualty losses by $900.

C)If M's personal casualty losses had exceeded her gain, then only so much of the net loss as exceeds 10 percent of A.G.I.could have been taken as an itemized deduction.

D)M's personal casualty gains and/or losses are long-term.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

The stock of a corporation involved in food processing cannot be qualified small business stock.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Options to purchase property are always treated as capital assets.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is not an important factor used to determine whether or not real estate is held primarily for sale?

A)Subdivision and improvement

B)Amount of gain or loss on sale

C)Purpose and manner of acquisition

D)Reason for and method of sale

A)Subdivision and improvement

B)Amount of gain or loss on sale

C)Purpose and manner of acquisition

D)Reason for and method of sale

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

K sold the following investments during the current year:  How much are K's net long-term capital gain or loss and net short-term capital gain or loss, respectively, if any?

How much are K's net long-term capital gain or loss and net short-term capital gain or loss, respectively, if any?

A)$0 and $2,500

B)$1,700 and $800

C)$1,900 and $600

D)$2,500 and $0

How much are K's net long-term capital gain or loss and net short-term capital gain or loss, respectively, if any?

How much are K's net long-term capital gain or loss and net short-term capital gain or loss, respectively, if any?A)$0 and $2,500

B)$1,700 and $800

C)$1,900 and $600

D)$2,500 and $0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

A taxpayer can defer gain on the sale of stock traded on a stock exchange if the proceeds are invested in a specialized small business investment company within 60 days.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following dispositions of property is not treated as a sale or exchange?

A)Securities becoming worthless

B)Transfer of property in satisfaction of debt

C)Abandonment of unencumbered property

D)Gain or loss from personal casualty or theft, if any gains exceed any losses

A)Securities becoming worthless

B)Transfer of property in satisfaction of debt

C)Abandonment of unencumbered property

D)Gain or loss from personal casualty or theft, if any gains exceed any losses

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

M had three separate casualties involving personal use property during the current year:  M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.What is M's deductible gain (or loss) on each casualty, respectively, before any percentage limit?

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.What is M's deductible gain (or loss) on each casualty, respectively, before any percentage limit?

A)$1,900 loss, $200 loss, $3,000 gain

B)$2,000 loss, $300 loss, $3,000 gain

C)$10,000 loss, $1,000 loss, $7,000 loss

D)$10,000 gain, $2,000 loss, $2,000 loss

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.What is M's deductible gain (or loss) on each casualty, respectively, before any percentage limit?

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.What is M's deductible gain (or loss) on each casualty, respectively, before any percentage limit?A)$1,900 loss, $200 loss, $3,000 gain

B)$2,000 loss, $300 loss, $3,000 gain

C)$10,000 loss, $1,000 loss, $7,000 loss

D)$10,000 gain, $2,000 loss, $2,000 loss

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not true of the netting process for capital gains and losses?

A)Short-term capital gains and losses are combined and result in either a net short-term capital gain (NSTCG) or a net short-term capital loss (NSTCL).

B)Long-term capital gains and losses are combined and result in either a net long-term capital gain (NLTCG) or a net long-term capital loss (NLTCL).

C)If a taxpayer has both a NSTCG and a NLTCG or both a NSTCL and a NLTCL, the results are netted in the second stage of the netting process.

D)If a taxpayer has either a NSTCG and a NLTCL or NSTCL and a NLTCG, the results are netted in the second stage of the netting process.

A)Short-term capital gains and losses are combined and result in either a net short-term capital gain (NSTCG) or a net short-term capital loss (NSTCL).

B)Long-term capital gains and losses are combined and result in either a net long-term capital gain (NLTCG) or a net long-term capital loss (NLTCL).

C)If a taxpayer has both a NSTCG and a NLTCG or both a NSTCL and a NLTCL, the results are netted in the second stage of the netting process.

D)If a taxpayer has either a NSTCG and a NLTCL or NSTCL and a NLTCG, the results are netted in the second stage of the netting process.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

W and Y are married and file a joint return each year.They owned 50 percent of the stock in a small business corporation with total paid-in capital of $550,000.During the current year, they sold their stock, which had a basis of $275,000, for $190,000.How is this sale treated on their return?

A)Ordinary deduction of $50,000 and long-term capital loss of $35,000

B)Ordinary deduction of $85,000

C)Short-term capital loss of $85,000

D)Long-term capital loss of $85,000

A)Ordinary deduction of $50,000 and long-term capital loss of $35,000

B)Ordinary deduction of $85,000

C)Short-term capital loss of $85,000

D)Long-term capital loss of $85,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

During the current year, F, an individual, had long-term capital losses of $2,000 and short-term capital losses of $1,500.If this is the first year F has experienced capital gains or losses, what amount of these losses may F deduct this year?

A)$1,750

B)$2,500

C)$3,000

D)$3,500

A)$1,750

B)$2,500

C)$3,000

D)$3,500

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following debt instruments are not excluded from original issue discount (OID) rules?

A)U.S.Savings Bonds

B)Issues not in security (bond) form

C)Bonds with maturity dates no more than one year after their dates of issue (unless held by accrual basis taxpayers)

D)Nonbusiness loans between individuals of $10,000 or less

A)U.S.Savings Bonds

B)Issues not in security (bond) form

C)Bonds with maturity dates no more than one year after their dates of issue (unless held by accrual basis taxpayers)

D)Nonbusiness loans between individuals of $10,000 or less

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

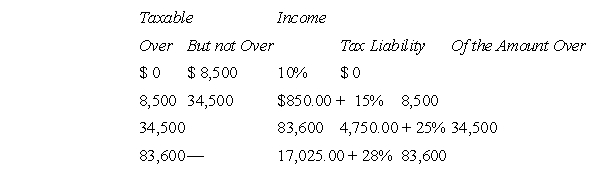

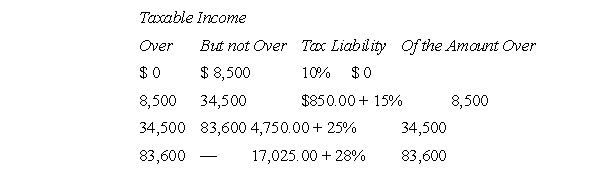

K is a single, calendar year, individual taxpayer.A net long-term (15 percent) capital gain of $10,000 is included in K's taxable income.The 2011 tax schedules for single taxpayers are as follows:  Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

A)If K's taxable income is $70,000, all of the net capital gain is taxed at 15 percent.

B)If K's taxable income is $20,000, all of the net capital gain is taxed at 0 percent.

C)If K's taxable income is $40,000, the net capital gain is taxed at the same rate as it would have been had it been ordinary income.

D)If K's taxable income is $37,000, the net capital gain is taxed partly at 15 percent and partly at 0 percent.

Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?

Which of the following is not true regarding the taxation of K's federal gross income tax for 2011?A)If K's taxable income is $70,000, all of the net capital gain is taxed at 15 percent.

B)If K's taxable income is $20,000, all of the net capital gain is taxed at 0 percent.

C)If K's taxable income is $40,000, the net capital gain is taxed at the same rate as it would have been had it been ordinary income.

D)If K's taxable income is $37,000, the net capital gain is taxed partly at 15 percent and partly at 0 percent.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

C had a long-term capital loss carryover to the current year of $4,000.For the current year, she had a short-term capital loss of $2,000 and a long-term capital gain of $1,000.What is C's capital loss deduction for the current year and her carryover to the next year?

A)$3,000 and no carryover

B)$2,500 and no carryover

C)$3,000 and $2,000 short-term loss carryover

D)$3,000 and $2,000 long-term loss carryover

A)$3,000 and no carryover

B)$2,500 and no carryover

C)$3,000 and $2,000 short-term loss carryover

D)$3,000 and $2,000 long-term loss carryover

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Dr.T recently called her tax adviser and indicated that one of her investments had turned sour and now was worthless.Assuming T has no other property transactions during the year, the best possible tax treatment could result from a $30,000 loss from holding which of the following?

A)A worthless bond

B)A worthless nonbusiness debt

C)A worthless share of § 1244 stock

D)Some combination of the above, because the treatment would be the same in both or all cases

A)A worthless bond

B)A worthless nonbusiness debt

C)A worthless share of § 1244 stock

D)Some combination of the above, because the treatment would be the same in both or all cases

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

E always had eyes for a deal.When B approached her about his idea of having his chain of pizza parlors deliver video tapes along with pizzas, E saw dollar signs.B needed financing, and E gave the corporation $10,000 in exchange for stock.A summary of the corporation's balance sheet after the exchange revealed the following: Despite some initial growth based on the idea, the pizza business fell on hard times due to heavy competition.This year E sold her stock at a $9,000 loss, her only property transaction (i.e., sales during the year).This year, E may deduct how much?

A)$0

B)$3,000

C)$9,000

D)$10,000

E)None of the above

A)$0

B)$3,000

C)$9,000

D)$10,000

E)None of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

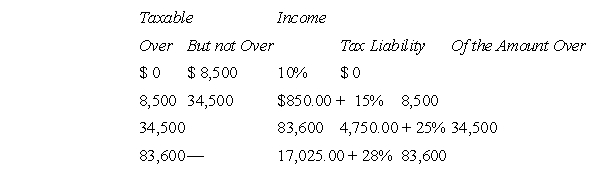

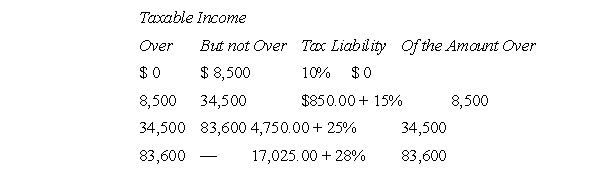

J is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $65,000, including a net short-term capital loss of $5,000 and a net long-term (15 percent) capital gain of $10,000.The 2011 tax schedules for single taxpayers are as follows:  J's federal gross income tax for 2011 is

J's federal gross income tax for 2011 is

A)$16,875

B)$13,000

C)$11,875

D)$11,375

J's federal gross income tax for 2011 is

J's federal gross income tax for 2011 isA)$16,875

B)$13,000

C)$11,875

D)$11,375

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Q, who is single, acquired § 1244 stock of XYZ Corporation several years ago for $150,000.During the current year, Q sold the XYZ stock for $20,000.Q also realized a $10,000 long-term capital gain during the year from a separate transaction.Q's taxable income, excluding both of these transactions, is $70,000 (after personal and dependency exemptions).Q's taxable income including these transactions is how much?

A)$0

B)$17,000

C)$20,000

D)$67,000

E)None of the above

A)$0

B)$17,000

C)$20,000

D)$67,000

E)None of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

K had short-term capital losses of $2,000 and long-term capital gains of $5,000 during the current year.By what amount is K's A.G.I.increased as a result of these transactions?

A)$2,000

B)$2,500

C)$3,000

D)$5,000

A)$2,000

B)$2,500

C)$3,000

D)$5,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

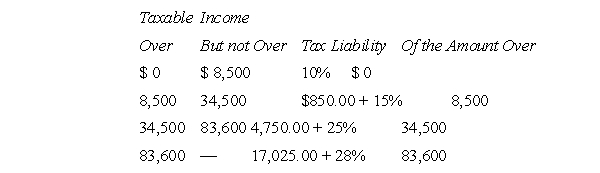

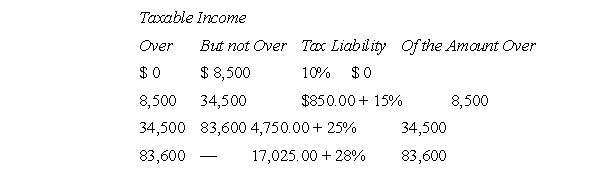

G is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $65,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $10,000.The 2011 tax schedules for single taxpayers are as follows:  G's federal gross income tax for 2011 is

G's federal gross income tax for 2011 is

A)$11,375

B)$9,875

C)$18,200

D)$12,375

G's federal gross income tax for 2011 is

G's federal gross income tax for 2011 isA)$11,375

B)$9,875

C)$18,200

D)$12,375

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

During the current year, J had long-term capital gains of $3,600 and short-term capital gains of $3,200.By what amount is J's A.G.I.increased?

A)$0

B)$3,200

C)$6,800

D)The increase in J's A.G.I.cannot be determined from the facts given.

A)$0

B)$3,200

C)$6,800

D)The increase in J's A.G.I.cannot be determined from the facts given.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

D purchased an option to acquire 3 acres of real estate for investment for $15,000 on or before March 15, 20X4.The option cost $2,000.Which of the following is NOT true?

A)If D allows the option to lapse, she has a long-term capital loss of $2,000 in the year 20X4.

B)If D exercises the option on March 15, 20X1, the real estate has a basis of $17,000.

C)If D sells the option for $1,500, she may not deduct the loss.

D)The option is a capital asset to D since the land would be a capital asset if it were held.

A)If D allows the option to lapse, she has a long-term capital loss of $2,000 in the year 20X4.

B)If D exercises the option on March 15, 20X1, the real estate has a basis of $17,000.

C)If D sells the option for $1,500, she may not deduct the loss.

D)The option is a capital asset to D since the land would be a capital asset if it were held.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

The de minimis amount of discount for a 10-year bond with a face value of $10,000 is how much?

A)$0

B)$200

C)$250

D)$2,000

A)$0

B)$200

C)$250

D)$2,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

J and K, who file jointly, started a small business in 1985 by investing $225,000 cash.Their basis in their corporate stock remained at $225,000 until it became worthless during the current year.They have no other gains and losses for the year.How much may they deduct and what is the character of their loss?

A)$50,000 ordinary loss, $3,000 capital loss deduction, $172,000 long-term capital loss carryover

B)$100,000 ordinary loss and no capital loss deduction or carryover

C)$100,000 ordinary loss, $3,000 capital loss deduction, and $122,000 long-term capital loss carryover

D)$225,000 ordinary loss

A)$50,000 ordinary loss, $3,000 capital loss deduction, $172,000 long-term capital loss carryover

B)$100,000 ordinary loss and no capital loss deduction or carryover

C)$100,000 ordinary loss, $3,000 capital loss deduction, and $122,000 long-term capital loss carryover

D)$225,000 ordinary loss

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

On July 1, 19X7, T, an investor, purchased a newly issued corporate bond with a face value of $10,000 bearing 10 percent interest for a term of 30 years for $9,500.The bond pays interest semi- annually on December 31 and June 30.During 19X7 T received an interest payment of $1,000.Assume the bond's semi-annual yield to maturity is 10.6 percent.The original issue discount will increase T's interest income of $500 by how much in 19X7?

A)$0

B)$3.50

C)$5

D)$8.33

A)$0

B)$3.50

C)$5

D)$8.33

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

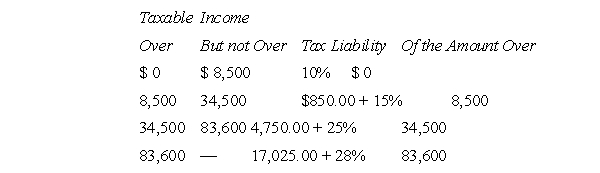

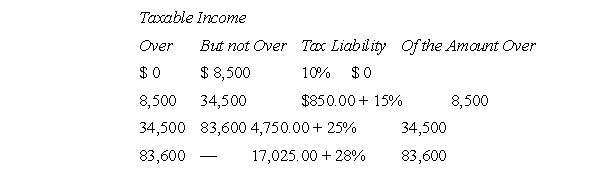

H is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $70,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $30,000.The 2011 tax schedules for single taxpayers are as follows:  H's federal gross income tax for 2011 is

H's federal gross income tax for 2011 is

A)$14,000

B)$10,625

C)$18,125

D)$13,625

H's federal gross income tax for 2011 is

H's federal gross income tax for 2011 isA)$14,000

B)$10,625

C)$18,125

D)$13,625

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not required for a patent to qualify for long-term capital gain treatment?

A)The transferor must be a holder; holders include the creator of the patentable technology and certain transferees.

B)All substantial rights to the patent must be sold.

C)The price must be a fixed price.

D)All of the above listed conditions are required.

A)The transferor must be a holder; holders include the creator of the patentable technology and certain transferees.

B)All substantial rights to the patent must be sold.

C)The price must be a fixed price.

D)All of the above listed conditions are required.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

The importance of stock being designated § 1244 stock is which of the following?

A)Any loss on the stock is deductible as an ordinary loss.

B)It can be sold by the shareholder at a premium because of the availability of the ordinary loss deduction to the new owner.

C)The first $50,000 of each year's loss ($100,000 on a joint return) on the stock may be deducted as an ordinary loss.

D)More than one but less than all of the above are true.

E)All of the above are true.

A)Any loss on the stock is deductible as an ordinary loss.

B)It can be sold by the shareholder at a premium because of the availability of the ordinary loss deduction to the new owner.

C)The first $50,000 of each year's loss ($100,000 on a joint return) on the stock may be deducted as an ordinary loss.

D)More than one but less than all of the above are true.

E)All of the above are true.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Which one of the following is not true of securities held by dealers in securities?

A)Securities are generally held as inventory, with any gains or losses on their disposition being ordinary in nature.

B)A dealer may designate a particular lot as held for investment, but the designation must be made on the day the lot is acquired.

C)Once a lot is designated as an investment, losses on its disposition cannot be treated as ordinary.

D)A dealer can receive capital gain treatment on lots of stock held as inventory if they are held for more than two years.

A)Securities are generally held as inventory, with any gains or losses on their disposition being ordinary in nature.

B)A dealer may designate a particular lot as held for investment, but the designation must be made on the day the lot is acquired.

C)Once a lot is designated as an investment, losses on its disposition cannot be treated as ordinary.

D)A dealer can receive capital gain treatment on lots of stock held as inventory if they are held for more than two years.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck