Deck 17: An Introduction to Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 17: An Introduction to Options

1

Holders of calls do not receive the cash dividendspaid to the company's stockholders.

True

2

A covered call is constructed by buying the stock and selling the call.

True

3

The strike price of an option is fixed when the option is issued.

True

4

Arbitrage determines the maximum price of an option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

The maximum potential profit on a covered call is the time premium paid for the stock.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

Call options, unlike warrants, may be written byindividuals.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

An option's intrinsic value exceeds the option's price.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

Arbitrage is the act of simultaneously buying andselling in two markets to take advantage of price differentials.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

The intrinsic value of an option to buy stock (i.e., a call option) is the difference between the price of the stock and the per share exercise price of the option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

As the price of a stock rises, the time premium paid for an option to buy stock increases.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

Calls are options to sell stock at a specified pricewithin a specified time period.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

If the price of an option to buy stock were to sellfor less than its strike price, an opportunity for arbitrage exists.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

The time period to expiration for call options is usually for less than a year.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

The price of an option is generally less than the option's intrinsic value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

Because of arbitrage, an option should not sell forless than its intrinsic value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

Investors and speculators rarely, if ever, have an opportunity to establish an arbitrage position.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

Since options offer potential leverage, they tend tosell for a time premium.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

Because of the small cash outlay to buy an option, these securities are considered to be conservative investments.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

A warrant is an option issued by a corporation to buyits stock at a specified price within a specified time period.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

The time premium paid for an option reduces the option's potential leverage.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

Writing covered call options is more risky than writing naked call options

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

The intrinsic value of a put establishes the put'smaximum price.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

The buyer of a call option wants the price of the stock to rise.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

An investor may reduce risk by simultaneously purchasing a stock and a put option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

When a call option is exercised, new stock is issued.F.23. The intrinsic value of a call option is the strike price minus the stock's price.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

The value of a put is inversely related to the value ofthe underlying stock.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

If the price of a stock rises, the writer of a putoption profits.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

In addition to put and call options on individual stocks, there are also options on the market as a whole (i.e., an index).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

Calls tend to sell for a time premium that exceeds the stock's price.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

The price of a call option is often more volatile than the price of the underlying stock.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

A writer of a naked call option will lose money if the price of the stock declines.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

The intrinsic value of a put is the price of the stockminus the put's strike price.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

There is no limit to the potential loss from buying a call option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

The writer of a covered call cannot lose money if the price of the stock rises.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

Selling a covered call option is comparable to selling a stock short.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

A put is an option to sell stock at a specified pricewithin a specified time period.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

The profits (gains) on option trading are exempt from federal income taxation.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

The writer of a call option does not receive any dividends paid by the firm.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

The CBOE is a secondary market for put and call options.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

While individuals can write call options, they can onlybuy put options.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

If an investor constructs a covered call,

A) there is no limit to the potential profit

B) risk is increased

C) risk is reduced

D) the term of the position is increased

A) there is no limit to the potential profit

B) risk is increased

C) risk is reduced

D) the term of the position is increased

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

If an investor anticipates that interest rates will increase, that individual should sell an option to buy Treasury bonds

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

A call is an option to

A) sell stock at a specified price

B) buy stock at a specified price

C) deliver stock at a specified price

D) deliver bonds at a specified price

A) sell stock at a specified price

B) buy stock at a specified price

C) deliver stock at a specified price

D) deliver bonds at a specified price

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

Warrants are issued by

A) individuals

B) firms

C) governments

D) investor

A) individuals

B) firms

C) governments

D) investor

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

The most the investor who sells a naked stock indexoption can lose is the cost of the option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

Warrants and calls do not have

A) an expiration date

B) a specified exercise price

C) the right to receive dividends

D) a strike price

A) an expiration date

B) a specified exercise price

C) the right to receive dividends

D) a strike price

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

A portfolio manager with a position in many stocks may hedge the portfolio by purchasing a stock index call option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

The intrinsic value of an option sets

A) the minimum price of an option

B) the maximum price of an option

C) neither an option's minimum nor its maximum price

D) both the maximum and the minimum price of an option

A) the minimum price of an option

B) the maximum price of an option

C) neither an option's minimum nor its maximum price

D) both the maximum and the minimum price of an option

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

The most the individual who buys a put option can loseis the cost of the option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

If an investor is bearish, he or she should not buya stock index call option.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

Options to buy stock offer

A) potential leverage

B) potential income

C) safety of principal

D) liquidity

A) potential leverage

B) potential income

C) safety of principal

D) liquidity

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

In-the-money stock index options are not exercised.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

Buying a stock index option reduces systematic risk.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

Options sell for a time premium over their intrinsicvalue because

A) they earn dividends

B) they are debt obligations

C) they offer potential leverage

D) they are long-term investments

A) they earn dividends

B) they are debt obligations

C) they offer potential leverage

D) they are long-term investments

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

Because of arbitrage, the price of an option

A) exceeds its intrinsic value

B) is less than its intrinsic value

C) cannot be less than its intrinsic value

D) cannot be greater than its intrinsic value

A) exceeds its intrinsic value

B) is less than its intrinsic value

C) cannot be less than its intrinsic value

D) cannot be greater than its intrinsic value

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

The intrinsic value of an option to buy stock is

A) its price

B) its strike price

C) the difference between the stock's price and the option's strike price

D) the difference between the option's strike price and the option's price

A) its price

B) its strike price

C) the difference between the stock's price and the option's strike price

D) the difference between the option's strike price and the option's price

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

Stock index options permit investors to establish aposition in the market without having to select individual stocks.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

The intrinsic value of an option to buy stock rises as

A) the strike price increases and the price of the stock declines

B) the strike price increases and the price of the stock rises

C) the strike price decreases and the price of the stock declines

D) the strike price decreases and the price of the stock rises

A) the strike price increases and the price of the stock declines

B) the strike price increases and the price of the stock rises

C) the strike price decreases and the price of the stock declines

D) the strike price decreases and the price of the stock rises

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

If the investor buys a stock index put, the individualwill profit if the market rises.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

The time premium paid for an option to buy stockis affected by

A) the length of time to expiration

B) the firm's credit rating

C) the existence of a rights offering

D) the firm's financial statements

A) the length of time to expiration

B) the firm's credit rating

C) the existence of a rights offering

D) the firm's financial statements

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

A warrant is the option to buy one share of stock at $40. It expires after one year and currently sells for $10. The price of the stock is $32. What is the maximum possible profit if an investor buys one share of stock and shorts one warrant What is the range of stock prices that yields a profit on this position

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

A call option is similar to a warrant except

A) the strike price is fixed

B) it may be issued by individual investors

C) it is not marketable (saleable)

D) it receives dividend payments

A) the strike price is fixed

B) it may be issued by individual investors

C) it is not marketable (saleable)

D) it receives dividend payments

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

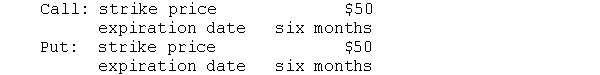

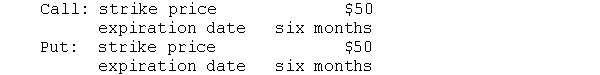

A put and a call have the following terms:  The price of the stock is currently $55. The price of the call and put are, respectively, $9 and $1. What will be the profit from buying the call or buying the put if, after six months, the price of the stock is $40, $50, or $60

The price of the stock is currently $55. The price of the call and put are, respectively, $9 and $1. What will be the profit from buying the call or buying the put if, after six months, the price of the stock is $40, $50, or $60

The price of the stock is currently $55. The price of the call and put are, respectively, $9 and $1. What will be the profit from buying the call or buying the put if, after six months, the price of the stock is $40, $50, or $60

The price of the stock is currently $55. The price of the call and put are, respectively, $9 and $1. What will be the profit from buying the call or buying the put if, after six months, the price of the stock is $40, $50, or $60

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

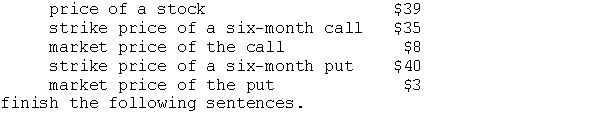

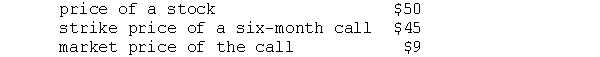

Given the following information,

a. The intrinsic value of the call is _________.

b. The intrinsic value of the put is _________.

c. The time premium paid for the call is _________.

d. The time premium paid for the put is _________.

At the expiration of the options (i.e., after six months have lapsed), the price of the stock is $45.

e. The profit (loss) from buying the call is _______.

a. The intrinsic value of the call is _________.

b. The intrinsic value of the put is _________.

c. The time premium paid for the call is _________.

d. The time premium paid for the put is _________.

At the expiration of the options (i.e., after six months have lapsed), the price of the stock is $45.

e. The profit (loss) from buying the call is _______.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is premised on lower stock prices

A) buying a stock index call

B) buying a stock index put

C) buying a stock and selling a call

D) buying a stock and selling a put

A) buying a stock index call

B) buying a stock index put

C) buying a stock and selling a call

D) buying a stock and selling a put

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

The writer of a naked call option wants

A) the prices of the stock and the call to rise

B) the prices of the stock and the call to fall

C) the prices of the stock to fall and the call to rise

D) the prices of the stock to rise and the call to remain stable

A) the prices of the stock and the call to rise

B) the prices of the stock and the call to fall

C) the prices of the stock to fall and the call to rise

D) the prices of the stock to rise and the call to remain stable

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

The value of a put rises as the price of

A) stock rises

B) a call falls

C) stock falls

D) a call rises

A) stock rises

B) a call falls

C) stock falls

D) a call rises

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following assumes higher stock prices 1. buying a stock index call2. buying a stock index put3. selling a stock index call4. selling a stock index put

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

PROBLEMS

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

PROBLEMS

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

One reason for writing and selling a covered calloption is

A) potential leverage

B) safety of principal

C) income received

D) liquidity

A) potential leverage

B) safety of principal

C) income received

D) liquidity

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

The CBOE is1. a secondary market in put and call options2. a division of the SEC that regulated option trading3. the first organized options exchange

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

If the price of a stock rises substantially,the investor who wrote a covered call1. earns a modest profit2. sustains a modest loss3. lost an opportunity for a large profit

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) only 3

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) only 3

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

A put is an option to

A) buy stock

B) receive stock

C) sell stock

D) receive dividends

A) buy stock

B) receive stock

C) sell stock

D) receive dividends

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

What are the intrinsic values and time premiums of the following call options if the price of the underlying stock is $35 What are the profits and losses to the buyers and the writers if the stock sells for $31 at the options' expiration

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

Stock index options1. permit the investor to short the market insteadof individual stocks2. require delivery of an index of stocks3. limit the buyer's potential loss to the cost ofthe option

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

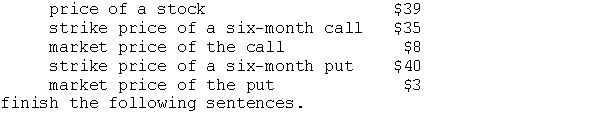

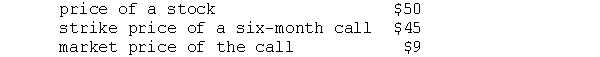

Given the following information,finish the following sentences:

a. The intrinsic value of the call is _________.

b. The time premium paid for the call is ________.

c. If an investor established a covered call position, the amount invested is _________.

d. The most the buyer of the call can lose is ________.

e. The maximum amount the seller of the call naked can lose is ________.

a. The intrinsic value of the call is _________.

b. The time premium paid for the call is ________.

c. If an investor established a covered call position, the amount invested is _________.

d. The most the buyer of the call can lose is ________.

e. The maximum amount the seller of the call naked can lose is ________.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

Call options offer buyers

A) potential leverage

B) liquidity

C) income

D) safety of principal

A) potential leverage

B) liquidity

C) income

D) safety of principal

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

The price of a call depends on1. the strike price2. the price of the underlying stock3. the term (i.e., life) of the call

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

What are the following call options' intrinsic values and time premiums if the price of the underlying stock is $55

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

The intrinsic value of a put depends on1. the strike price2. the price of the stock3. the term on the put

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of the above

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

A writer of a call option closes the position by

A) purchasing the stock

B) selling the stock

C) purchasing the option

D) selling the option

A) purchasing the stock

B) selling the stock

C) purchasing the option

D) selling the option

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck