Deck 14: International Financial Reporting Standards

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 14: International Financial Reporting Standards

1

All of the following are among the most important reasons why accounting standards differ around the world except:

A)differences in the state of economic development

B)differences in taxation

C)differences in inflation

D)differences in code law in all countries around the world

A)differences in the state of economic development

B)differences in taxation

C)differences in inflation

D)differences in code law in all countries around the world

D

2

What is the name of the formalized commitment of the IASB and the FASB to converge U.S.and international accounting standards?

A)The Sarbanes-Oxley Act

B)The Norwalk Agreement

C)The IFRS Foundation

D)The Conceptual Framework

A)The Sarbanes-Oxley Act

B)The Norwalk Agreement

C)The IFRS Foundation

D)The Conceptual Framework

B

3

Which of the following inventory costing methods is prohibited under IFRS?

A)FIFO

B)Weighted-average

C)LIFO

D)Perpetual

A)FIFO

B)Weighted-average

C)LIFO

D)Perpetual

C

4

When analyzing foreign statements, all of the following are accurate positions of non-current liabilities listings except:

A)After current liabilities

B)Before current liabilities

C)After share capital

D)After total equity

A)After current liabilities

B)Before current liabilities

C)After share capital

D)After total equity

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Significant differences exist in terms on financial statements around the world.For example, another name for what we know as Capital Stock in the U.S.is:

A)Share Capital

B)Capital Reserves

C)Provisions for other Risks

D)Deferred Income

A)Share Capital

B)Capital Reserves

C)Provisions for other Risks

D)Deferred Income

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a commonly cited disadvantage of having a new unified set of accounting standards?

A)Acquiring foreign companies would become a more confusing proposition.

B)Corporations may find themselves more susceptible to lawsuits due to the principles-based system.

C)Time and money would not be saved in accessing capital markets abroad.

D)The SEC would be dissolved if international accounting standards were adopted.

A)Acquiring foreign companies would become a more confusing proposition.

B)Corporations may find themselves more susceptible to lawsuits due to the principles-based system.

C)Time and money would not be saved in accessing capital markets abroad.

D)The SEC would be dissolved if international accounting standards were adopted.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The group with primary responsibility for development of a single set of accounting standards around the world is the

A)FASB

B)SEC

C)IFRS

D)IASB

A)FASB

B)SEC

C)IFRS

D)IASB

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

On the reporting of liabilities where a range of values exists as a possible outcome, IFRS requires which of the following points to be recorded as a provision, if the outcome is probable?

A)Low end of the range.

B)High end of the range.

C)Midpoint of the range.

D)IFRS presents no specific guidance as to this point.

A)Low end of the range.

B)High end of the range.

C)Midpoint of the range.

D)IFRS presents no specific guidance as to this point.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

All of the following statements are true about inflation except:

A)The U.S.and Germany adjust their financial statements for inflation.

B)In recent years, inflation has been more rampant in Latin America and South America than the rest of the world.

C)The FASB developed rules for companies in the United States to use to adjust for inflation.

D)U.S.companies no longer present financial information adjusted for the effects of inflation.

A)The U.S.and Germany adjust their financial statements for inflation.

B)In recent years, inflation has been more rampant in Latin America and South America than the rest of the world.

C)The FASB developed rules for companies in the United States to use to adjust for inflation.

D)U.S.companies no longer present financial information adjusted for the effects of inflation.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Significant differences exist in terms on financial statements around the world.For example, another name for what we know as Contingent Liabilities in the U.S.is:

A)Share Capital

B)Capital Reserves

C)Provisions for Other Risks

D)Deferred Income

A)Share Capital

B)Capital Reserves

C)Provisions for Other Risks

D)Deferred Income

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Significant differences exist in terms on financial statements around the world.For example, another name for what we know as Additional Paid-In Capital in the U.S.is:

A)Share Capital

B)Capital Reserves

C)Provisions for Other Risks

D)Deferred Income

A)Share Capital

B)Capital Reserves

C)Provisions for Other Risks

D)Deferred Income

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

What is the name for the balance sheet under international accounting standards?

A)Assets and Equity Attributable to Shareholders

B)Statement of Financial Position

C)Statement of Balance

D)The Equitable Claims Statement

A)Assets and Equity Attributable to Shareholders

B)Statement of Financial Position

C)Statement of Balance

D)The Equitable Claims Statement

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

All of the following are advantages available to companies if a single set of accounting standards were used except:

A)A single set of worldwide accounting standards would have no effect on accounting fee costs.

B)A single set of standards would make it much easier to decide whether to acquire a foreign company.

C)A single set of worldwide accounting standards would facilitate comparisons for investment purposes.

D)A single set of worldwide accounting standards would make it easier to access foreign capital markets

A)A single set of worldwide accounting standards would have no effect on accounting fee costs.

B)A single set of standards would make it much easier to decide whether to acquire a foreign company.

C)A single set of worldwide accounting standards would facilitate comparisons for investment purposes.

D)A single set of worldwide accounting standards would make it easier to access foreign capital markets

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following countries do not use a common law system?

A)The United States

B)Germany

C)The United Kingdom

D)Both a and c are correct.

A)The United States

B)Germany

C)The United Kingdom

D)Both a and c are correct.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

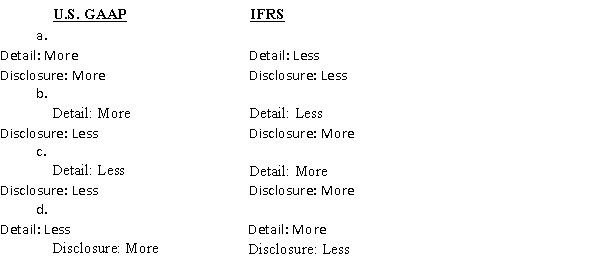

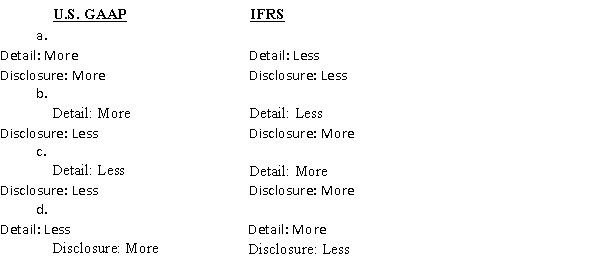

When comparing U.S.GAAP and IFRS, regarding the level of details in the standards and the level of disclosure required, which of the following is correct?

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is true regarding common law?

A)In common law countries, there are generally more statutes written into the laws.

B)In common law countries, there is less reliance on interpretation by the courts.

C)Because more details are written into U.S.law, FASB has shorter and more general accounting standards than most countries.

D)The common law system has its roots in the United Kingdom.

A)In common law countries, there are generally more statutes written into the laws.

B)In common law countries, there is less reliance on interpretation by the courts.

C)Because more details are written into U.S.law, FASB has shorter and more general accounting standards than most countries.

D)The common law system has its roots in the United Kingdom.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Which organization would have the ultimate responsibility of deciding if the advantages outweigh the disadvantages in the adoption of IFRS accounting standards in the U.S.?

A)FASB

B)SEC

C)IASB

D)AICPA

A)FASB

B)SEC

C)IASB

D)AICPA

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

During what year did the IASB and FASB reaffirm their commitment to achieving convergence of accounting standards in the U.S.?

A)2007

B)2009

C)2002

D)2008

A)2007

B)2009

C)2002

D)2008

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

The International Accounting Standards Committee was established in 1973 to develop worldwide standards.Which group replaced it in 2001?

A)FASB

B)IFRS

C)IASB

D)IIA

A)FASB

B)IFRS

C)IASB

D)IIA

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The benefits of a single set of accounting standards used around the world would include all of the following except:

A)They would eventually save companies considerable money in accounting fees.

B)They would prevent competitors from acquiring each other.

C)They would allow easier comparisons by analysts and investors.

D)They would facilitate access to foreign capital markets.

A)They would eventually save companies considerable money in accounting fees.

B)They would prevent competitors from acquiring each other.

C)They would allow easier comparisons by analysts and investors.

D)They would facilitate access to foreign capital markets.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

In countries, like Japan and much of Europe, fewer differences between the amount of income reported to stockholders and that reported to the taxing authorities exist than in the U.S.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Essentially, the entire statement of financial position is inverted compared to what is commonly seen in the United States.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

There is a standard format in various countries for the statement of financial position.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

The state of economic development can affect accounting standards.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Japan has a greater number of differences than the U.S.between the amount of income reported to stockholders and that reported to the taxing authorities.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following presents the proper ordering of assets, liabilities and equities on the statement of financial position used by some countries that is different from the U.S.?

A)current assets, long-term assets, current liabilities

B)inventories, trade-receivables, cash

C)assets, liabilities, equities

D)current liabilities, long-term liabilities, equities

A)current assets, long-term assets, current liabilities

B)inventories, trade-receivables, cash

C)assets, liabilities, equities

D)current liabilities, long-term liabilities, equities

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

While U.S.GAAP requires a complete set of financial statements, including a balance sheet, statement of stockholders' equity, income statement, and statement of cash flows, IFRS does not.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Regarding the valuation of operating assets, IFRS allows companies to use fair value.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Both U.S.GAAP and IFRS classify gains and losses that are both unusual in nature and infrequent in occurrence as extraordinary and present them in a separate section of the income statement.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Companies in Mexico had to begin using IFRS by 2012.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Under IFRS, if inventory is written down to a new lower market value, this cannot be reversed in later periods.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is a true statement about the terms used on the balance sheet?

A)U.S.GAAP requires a standard set of terms on the balance sheet.

B)IFRS requires a standard set of terms on the balance sheet.

C)Terminology is consistent across all countries.

D)Neither IFRS nor U.S.GAAP requires a standard set of terms on the balance sheet.

A)U.S.GAAP requires a standard set of terms on the balance sheet.

B)IFRS requires a standard set of terms on the balance sheet.

C)Terminology is consistent across all countries.

D)Neither IFRS nor U.S.GAAP requires a standard set of terms on the balance sheet.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

U.S.GAAP requires companies to present a balance sheet with classifications for current and long-term liabilities, while IFRS does not.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

According to the text, in economies like those that made up the former Soviet Union, accounting standards are relatively less complex due to the fact that they are just beginning to be developed.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

IFRS is now mandatory in all member states of the economic and political organization known as the European Union.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

The U.S.accounting standards are more principle-based than IFRS.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Both U.S.GAAP and IFRS apply the lower-of-cost-or market rule in a similar manner to inventory.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

No single explanation can be given for the divergence of accounting standards.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Ultimately, it will be the responsibility of the FASB in the U.S.to decide if the advantages of IFRS's outweigh the disadvantages.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

A single set of accounting standards could help a U.S.company save time and money in the acquisition of a German company.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck