Deck 6: The Acquisition, Use, and Disposal of Depreciable Property

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/6

Play

Full screen (f)

Deck 6: The Acquisition, Use, and Disposal of Depreciable Property

1

Green Gardens Inc. purchased a piece of Class 8 machinery in 20x0. The cost of the machine was $5,000. In 20x2, the machine was sold for proceeds of $2,000 and there were no other purchases or disposals during the year. The UCC in the Class 8 pool was $5,500 at the beginning of 20x2. What is the UCC of this class at the end of 20x2? (Assume 20x2 is 2019.)

A) $700

B)$2,800

C) $3,500

D) $4,800

A) $700

B)$2,800

C) $3,500

D) $4,800

B

2

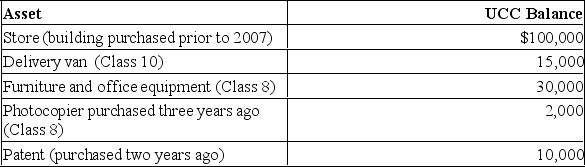

Angela Smith has owned and operated The Stationary Store for fifteen years. The company's year-end is December 31st.

Assets owned prior to 20x0 and their UCC balances on January 1, 20x0 are listed below:

Additional information for 20x0:

Additional information for 20x0:

Angela purchased $2,000 worth of small tools (each costing under $500).

The delivery van was sold for $12,000. The original cost was $20,000. A second-hand van was purchased in the year for $16,000.

$15,000 was paid for an air conditioning system in the building, which was added to the cost of the standard Class 1 pool.

Angela sold the photocopier for $1,500 in the year, and will replace it in January, 20x1 with a second-hand model valued at $1,700.

Angela amortizes the patent in Class 44.

The business acquired a franchise on March 1st of 20x0 costing $55,000. The franchise has a limited legal life of 20 years. (Ignore leap year effects.)

Required:

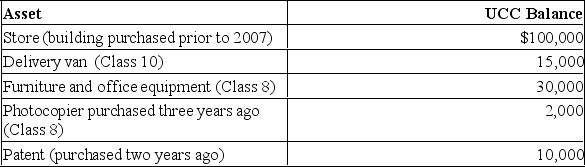

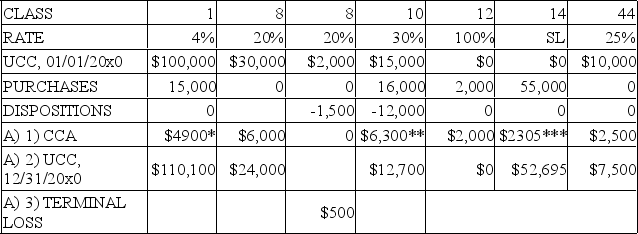

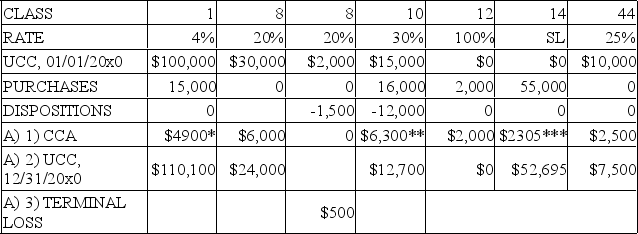

A) Calculate the following:

(Assume 20x0 is 2019.)

1) the total CCA that Angela will be able to claim in 20x0;

2) the UCC balances as of December 31, 20x0;

3) any recapture and/or terminal loss that occurred during the year.

B) What would the tax effect have been for the original photocopier if Angela had purchased the new photocopier during 20x0?

Assets owned prior to 20x0 and their UCC balances on January 1, 20x0 are listed below:

Additional information for 20x0:

Additional information for 20x0:Angela purchased $2,000 worth of small tools (each costing under $500).

The delivery van was sold for $12,000. The original cost was $20,000. A second-hand van was purchased in the year for $16,000.

$15,000 was paid for an air conditioning system in the building, which was added to the cost of the standard Class 1 pool.

Angela sold the photocopier for $1,500 in the year, and will replace it in January, 20x1 with a second-hand model valued at $1,700.

Angela amortizes the patent in Class 44.

The business acquired a franchise on March 1st of 20x0 costing $55,000. The franchise has a limited legal life of 20 years. (Ignore leap year effects.)

Required:

A) Calculate the following:

(Assume 20x0 is 2019.)

1) the total CCA that Angela will be able to claim in 20x0;

2) the UCC balances as of December 31, 20x0;

3) any recapture and/or terminal loss that occurred during the year.

B) What would the tax effect have been for the original photocopier if Angela had purchased the new photocopier during 20x0?

A)  *(100,000 * .04) + (15,000 * .04 * 1.5) = 4,900 **(15,000 * .3) + [(16,000 - 12,000) * .3 * 1.5) = 6,300 ***$55,000 * 306/(365 * 20) = 2,305

*(100,000 * .04) + (15,000 * .04 * 1.5) = 4,900 **(15,000 * .3) + [(16,000 - 12,000) * .3 * 1.5) = 6,300 ***$55,000 * 306/(365 * 20) = 2,305

B) The tax effect for the original copier would have been the same since photocopiers are afforded special treatment and may be placed in their own class provided they cost more than $1,000 (based on a specified time period). (The new copier would have recognized CCA of $510 if purchased in 20x0.)

*(100,000 * .04) + (15,000 * .04 * 1.5) = 4,900 **(15,000 * .3) + [(16,000 - 12,000) * .3 * 1.5) = 6,300 ***$55,000 * 306/(365 * 20) = 2,305

*(100,000 * .04) + (15,000 * .04 * 1.5) = 4,900 **(15,000 * .3) + [(16,000 - 12,000) * .3 * 1.5) = 6,300 ***$55,000 * 306/(365 * 20) = 2,305 B) The tax effect for the original copier would have been the same since photocopiers are afforded special treatment and may be placed in their own class provided they cost more than $1,000 (based on a specified time period). (The new copier would have recognized CCA of $510 if purchased in 20x0.)

3

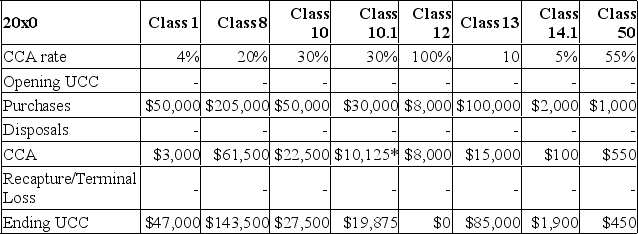

Tom's Tool Rentals began operations in 20x0. All income in the company classifies as 'business income'. The following information pertains to transactions in 20x0.

--Tom signed an 8-year lease for a building when he began the business. The building is in an excellent location and is estimated to be worth $500,000. Tom has an option to renew the lease for an additional 2 years. Tom spent $100,000 in 20x0 on improvements to the leased building at the beginning of the year.

--Tom purchased land and a building adjacent to his business for $120,000 in 20x0 (after March 18, 2007). The building was valued at $50,000, and is used as a storage facility. Tom has chosen to take 4% CCA on the building.

--Tom's inventory of rental tools is valued at $200,000. All of the tools were purchased in 20x0 and are required to be placed in Class 8 by the CRA.

--Tom purchased several small tools in 20x0 that he uses to maintain his rental tools. The total cost of these tools was $8,000, and each tool cost under $500.

--A delivery van costing a total of $50,000 was purchased in 20x0, to be used solely in the business.

--Tom furnished the reception area of his business at a cost of $5000 with Class 8 assets.

--A computer was purchased for tracking sales and inventory. The computer cost $1,000.

--Incorporation costs for the business were $5,000.

--Tom purchased a $42,000 passenger vehicle to be used for the business. In 20x0, the car was driven 20,000 km. 15,000 km were for business. (The car was used exclusively for business in the following years.)

--The business was very successful in the first year so Tom chose to use all of the CCA that was available to him in 20x0.

--Tom is an HST registrant.

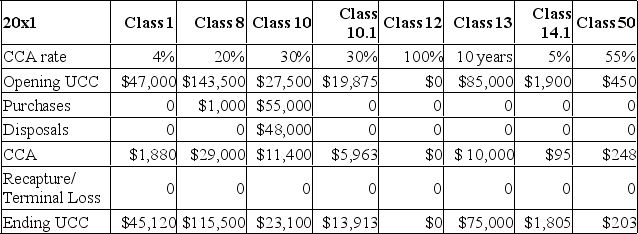

The following transactions occurred in 20x1:

--Tom sold the delivery truck for $48,000, and immediately purchased a newer and larger model for $55,000.

--New shelving was purchased for the reception area, at a cost of $1,000.

--Maximum CCA was claimed for the year.

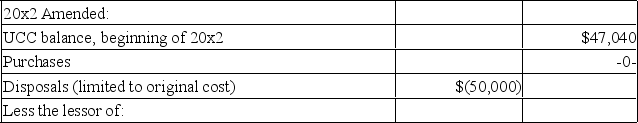

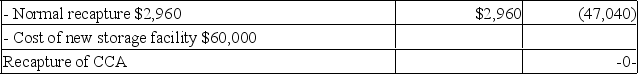

In 20x2 the storage facility was destroyed in a fire. The market value of the building, which was insured, was $55,000. A new building was built one year after the fire at a cost of $60,000.

Required:

A) Calculate the capital cost allowance per class claimed by the company in 20x0 and 20x1. (Round all answers.)

B) Show the amended recapture calculation to be filed pertaining to the storage building in the year the new building will be built.

--Tom signed an 8-year lease for a building when he began the business. The building is in an excellent location and is estimated to be worth $500,000. Tom has an option to renew the lease for an additional 2 years. Tom spent $100,000 in 20x0 on improvements to the leased building at the beginning of the year.

--Tom purchased land and a building adjacent to his business for $120,000 in 20x0 (after March 18, 2007). The building was valued at $50,000, and is used as a storage facility. Tom has chosen to take 4% CCA on the building.

--Tom's inventory of rental tools is valued at $200,000. All of the tools were purchased in 20x0 and are required to be placed in Class 8 by the CRA.

--Tom purchased several small tools in 20x0 that he uses to maintain his rental tools. The total cost of these tools was $8,000, and each tool cost under $500.

--A delivery van costing a total of $50,000 was purchased in 20x0, to be used solely in the business.

--Tom furnished the reception area of his business at a cost of $5000 with Class 8 assets.

--A computer was purchased for tracking sales and inventory. The computer cost $1,000.

--Incorporation costs for the business were $5,000.

--Tom purchased a $42,000 passenger vehicle to be used for the business. In 20x0, the car was driven 20,000 km. 15,000 km were for business. (The car was used exclusively for business in the following years.)

--The business was very successful in the first year so Tom chose to use all of the CCA that was available to him in 20x0.

--Tom is an HST registrant.

The following transactions occurred in 20x1:

--Tom sold the delivery truck for $48,000, and immediately purchased a newer and larger model for $55,000.

--New shelving was purchased for the reception area, at a cost of $1,000.

--Maximum CCA was claimed for the year.

In 20x2 the storage facility was destroyed in a fire. The market value of the building, which was insured, was $55,000. A new building was built one year after the fire at a cost of $60,000.

Required:

A) Calculate the capital cost allowance per class claimed by the company in 20x0 and 20x1. (Round all answers.)

B) Show the amended recapture calculation to be filed pertaining to the storage building in the year the new building will be built.

*$30,000 (HST registrant - no tax included for CCA) * .3 * 1.5 * 15,000/20,000

*$30,000 (HST registrant - no tax included for CCA) * .3 * 1.5 * 15,000/20,000

4

ABC Corp. leased an office and paid $20,000 for leasehold improvements in January of this year. This cost included drywall, new carpets, and all new lighting fixtures. The term of the lease is 2 years plus an option to renew for 2 more years.

Required:

Calculate the maximum CCA that ABC Corp. will be allowed to deduct this year.

Required:

Calculate the maximum CCA that ABC Corp. will be allowed to deduct this year.

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck

5

(Adapted from "Problem Eleven" from Chapter Six of previous editions of the textbook)

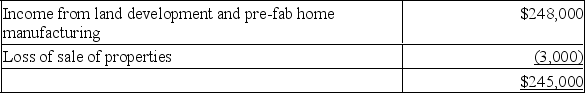

Alpha Ltd. is a Canadian-controlled private corporation operating a small land-development business. In June 20x2, the company acquired a license to manufacture pre-fab homes and began operations immediately. Financial information for the 20x2 taxation year is outlined below:

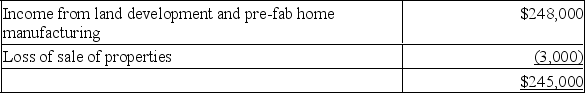

Alpha's profit before income taxes for the year ended November 30, 20x2, was $245,000, as follows:

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

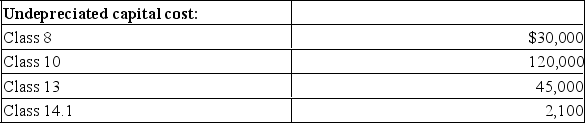

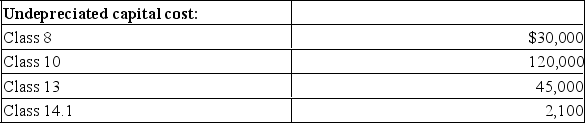

The 20x1 corporate tax return shows the following UCC balances:

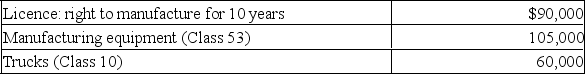

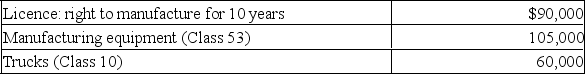

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Accounting amortization in 20x2 amounted to $60,000.

Accounting amortization in 20x2 amounted to $60,000.

Alpha normally acquires raw land, which it then develops into building lots for resale to individuals or housing contractors. In 20x2, it sold part of its undeveloped land inventory to another developer for $400,000. The sale realized a profit of $80,000, which is included in the land-development income above. The proceeds consisted of $40,000 in cash, with the balance payable in five annual instalments beginning in 20x3.

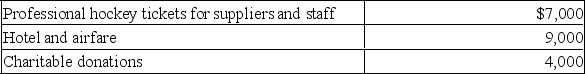

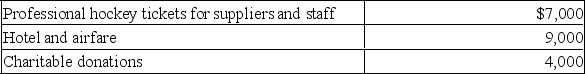

Travel and entertainment expense includes the following:

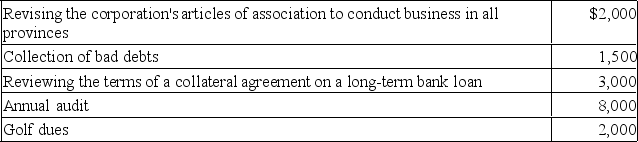

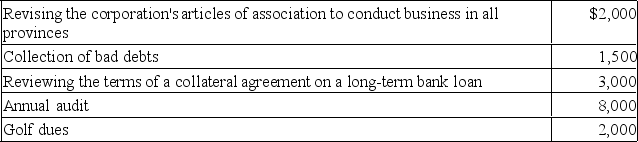

Legal and accounting expense includes the following:

Legal and accounting expense includes the following:

Required:

Required:

Calculate Alpha's net income for tax purposes for the 20x2 taxation year. (Assume 20x2 is 2019.)

Alpha Ltd. is a Canadian-controlled private corporation operating a small land-development business. In June 20x2, the company acquired a license to manufacture pre-fab homes and began operations immediately. Financial information for the 20x2 taxation year is outlined below:

Alpha's profit before income taxes for the year ended November 30, 20x2, was $245,000, as follows:

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.The 20x1 corporate tax return shows the following UCC balances:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following: Accounting amortization in 20x2 amounted to $60,000.

Accounting amortization in 20x2 amounted to $60,000.Alpha normally acquires raw land, which it then develops into building lots for resale to individuals or housing contractors. In 20x2, it sold part of its undeveloped land inventory to another developer for $400,000. The sale realized a profit of $80,000, which is included in the land-development income above. The proceeds consisted of $40,000 in cash, with the balance payable in five annual instalments beginning in 20x3.

Travel and entertainment expense includes the following:

Legal and accounting expense includes the following:

Legal and accounting expense includes the following: Required:

Required:Calculate Alpha's net income for tax purposes for the 20x2 taxation year. (Assume 20x2 is 2019.)

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following situations would not be permitted to defer the recognition of any recapture that might arise from the disposition of an asset?

A) A building that was used for income earning purposes was destroyed in a fire. Insurance proceeds were received which generated recapture. A new building was built one and a half years later.

B) A half-ton truck that belonged to a construction company was stolen in 20x0. Insurance proceeds were received which generated recapture. The truck was replaced in 20x1.

C) A customized half-ton truck that belonged to a construction company was sold in 20x0. The proceeds from the sale generated recapture. A new customized truck was purchased fourteen months later in order to carry out the duties of a large contract awarded to the company.

D) A building that was used for income earning purposes was sold in December 20x0. The proceeds from the sale generated recapture. A new building was purchased in April 20x1. The company's fiscal year-end is December 31st.

A) A building that was used for income earning purposes was destroyed in a fire. Insurance proceeds were received which generated recapture. A new building was built one and a half years later.

B) A half-ton truck that belonged to a construction company was stolen in 20x0. Insurance proceeds were received which generated recapture. The truck was replaced in 20x1.

C) A customized half-ton truck that belonged to a construction company was sold in 20x0. The proceeds from the sale generated recapture. A new customized truck was purchased fourteen months later in order to carry out the duties of a large contract awarded to the company.

D) A building that was used for income earning purposes was sold in December 20x0. The proceeds from the sale generated recapture. A new building was purchased in April 20x1. The company's fiscal year-end is December 31st.

Unlock Deck

Unlock for access to all 6 flashcards in this deck.

Unlock Deck

k this deck