Deck 23: Business Valuations

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/7

Play

Full screen (f)

Deck 23: Business Valuations

1

The contingent business value method determines the valuation of a business based on which of the following:

A) The likelihood of the sale taking place

B)The occurrence of events following the sale

C) The fair market value of the assets at the time of sale

D) The current profits of the business

A) The likelihood of the sale taking place

B)The occurrence of events following the sale

C) The fair market value of the assets at the time of sale

D) The current profits of the business

B

2

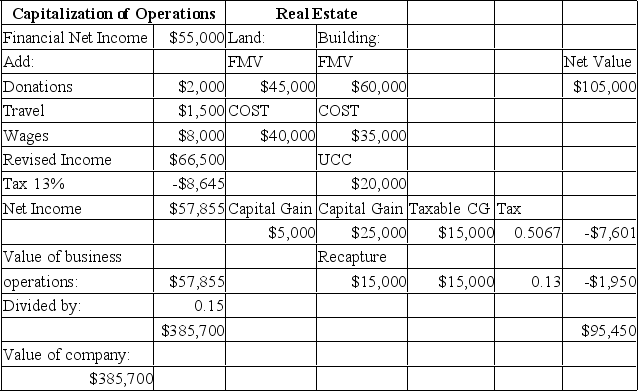

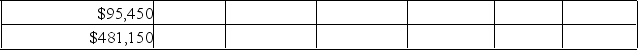

The Food Hut Inc. is for sale, and the sole shareholder, Andy, is trying to determine the value of the company. The business has annual pre-tax financial profits of $55,000. The following items will be omitted in arriving at the business value as they will not pertain to the prospective buyer's objectives: donations of $2,000, personal travel of $1,500, and part-time wages to Andy's son, Phil, of $8,000.

The store is run from a small building which has a fair market value of $105,000 (land = $45,000 and building = $60,000). The property was originally purchased for $75,000 (land = $40,000 and building = $35,000). The UCC on the building is $20,000. There is no mortgage remaining on the property.

Businesses similar to The Food Hut Inc. are generating a 15% rate of return.

Andy is selling the operations of the business using the earnings method, and the small store and land will be sold using the asset approach.

The corporate tax rate is 13% for active business income, and 50 2/3% on specified investment business income.

Required:

Calculate the total value of the sale of The Food Hut Inc. Show all calculations.

The store is run from a small building which has a fair market value of $105,000 (land = $45,000 and building = $60,000). The property was originally purchased for $75,000 (land = $40,000 and building = $35,000). The UCC on the building is $20,000. There is no mortgage remaining on the property.

Businesses similar to The Food Hut Inc. are generating a 15% rate of return.

Andy is selling the operations of the business using the earnings method, and the small store and land will be sold using the asset approach.

The corporate tax rate is 13% for active business income, and 50 2/3% on specified investment business income.

Required:

Calculate the total value of the sale of The Food Hut Inc. Show all calculations.

3

The value of a going-concern business is influenced primarily by its

A) length of time in business.

B) shareholders' personal wealth.

C)Income-earning potential.

D) location.

A) length of time in business.

B) shareholders' personal wealth.

C)Income-earning potential.

D) location.

C

4

Graeme owns a profitable small CCPC, ABC Co. that he started five years ago, which generated $75,000 in pre-tax profits this year. He is considering selling the company to a potential buyer, Steve, and the two are trying to determine an appropriate value. Graeme believes the profits will increase steadily in the future, while Steve is a bit more cautious in his predictions as he is aware of a strong competitor coming to town. Graeme believes that a capitalization rate of 20% is reasonable, while Steve believes that 40% would be more realistic for this type of sale. Graeme would like to use the after-tax profits from this year in the valuation. Steve would like to see the pre-tax profits reduced by 10% to reflect a potential decline in revenues. The corporate tax rate is 13%.

Required:

Calculate the difference in the two valuations that Graeme and Steve are considering for the sale of ABC Co. using the earnings method.

Required:

Calculate the difference in the two valuations that Graeme and Steve are considering for the sale of ABC Co. using the earnings method.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

5

Small Co. is for sale. The company has recognized $50,000 in profits every year since it began three years ago. The industry has a capitalization rate of 25%. What is the value of Small Co.?

A) $50,000

B) $150,000

C)$200,000

D) $600,000

A) $50,000

B) $150,000

C)$200,000

D) $600,000

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

6

Business Co. is a CCPC with annual profits of $120,000. The corporate tax rate is 13%.

Required:

Calculate 1) the business value and 2) the earnings multiple if the capitalization rate is:

a) 30%

b) 20%

c) 10%

Required:

Calculate 1) the business value and 2) the earnings multiple if the capitalization rate is:

a) 30%

b) 20%

c) 10%

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

7

Based on the premise of the capitalization of earning method, if a business for sale is low risk with good growth potential, the value will be based on which of the following?

A) A high capitalization rate and a low earnings multiplier

B)A low capitalization rate and a high earnings multiplier

C) A high capitalization rate and a high earnings multiplier

D) A low capitalization rate and a low earnings multiplier

A) A high capitalization rate and a low earnings multiplier

B)A low capitalization rate and a high earnings multiplier

C) A high capitalization rate and a high earnings multiplier

D) A low capitalization rate and a low earnings multiplier

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck