Deck 13: The Canadian-Controlled Private Corporation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/9

Play

Full screen (f)

Deck 13: The Canadian-Controlled Private Corporation

1

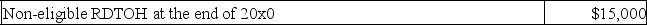

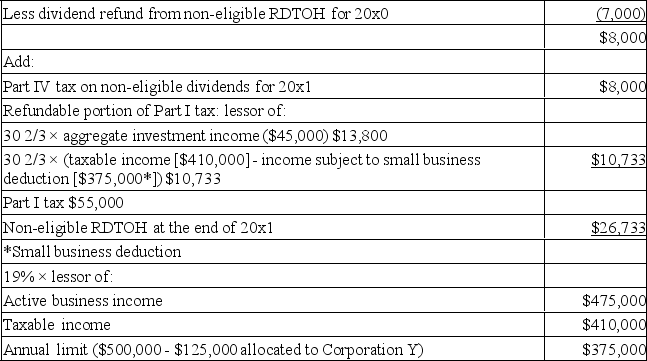

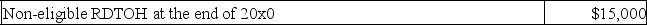

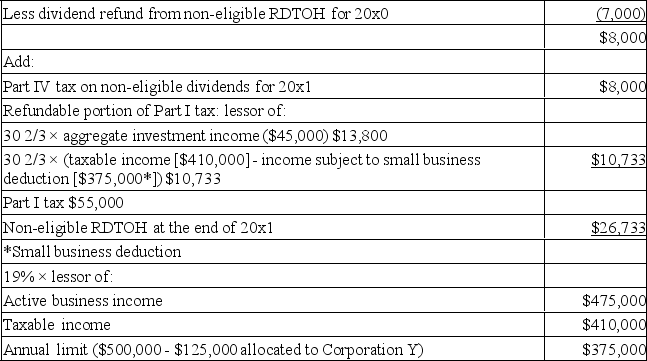

Corporation X had a non-eligible RDTOH balance of $15,000 at the end of 20x0, and the dividend refund from non-eligible RDTOH to the company in 20x0 was $7,000. The company's Part IV tax on non-eligible dividends for 20x1 is $8,000. The company's active business income is $475,000 and its taxable income is $410,000. Corporation Y (which is associated with Corporation X) was allocated $125,000 of the small business deduction in 20x1. (Corporation Y only has active business income.) Corporation X has investment income which remained at $45,000 in both 20x0 and 20x1. The total taxable capital of the two corporations is less than $10 million. Part I tax for 20x1 was $55,000. What is Corporation X's non-eligible RDTOH balance at the end of 20x1? (Round all numbers)

A) $8,000

B) $16,000 $26,733

D) $65,623

A) $8,000

B) $16,000 $26,733

D) $65,623

C

2

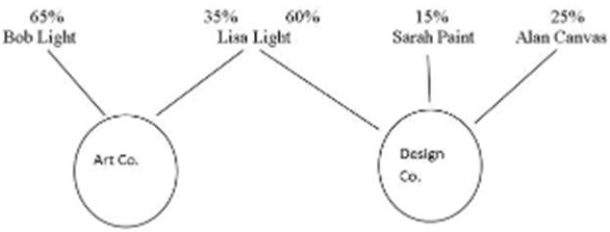

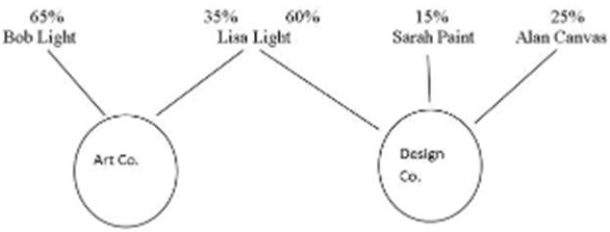

The following diagram depicts the ownership structure of two CCPCs. Bob Light is Lisa Light's son. Sarah Paint and Alan Canvas are not related to Bob and Lisa or to one another. All of the shares held are common shares.

In 20xx, Art Co. earned $700,000 of active business income and Design Co. earned $500,000 of active business income. Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000. Art Co. reported $100,000 of adjusted aggregate investment income in the previous year. Design Co. did not report any investment income. The two companies have decided that Design Co. will not use any of the small business deduction in 20xx. The combined taxable capital of the two corporations is less than $10 million.

Required:

A) Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B) Calculate the amount available for the small business deduction to Art Co. in 20xx.

In 20xx, Art Co. earned $700,000 of active business income and Design Co. earned $500,000 of active business income. Art Co.'s taxable income was $750,000 and Design Co.'s taxable income was $500,000. Art Co. reported $100,000 of adjusted aggregate investment income in the previous year. Design Co. did not report any investment income. The two companies have decided that Design Co. will not use any of the small business deduction in 20xx. The combined taxable capital of the two corporations is less than $10 million.

Required:

A) Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B) Calculate the amount available for the small business deduction to Art Co. in 20xx.

A) The two corporations are associated as defined by paragraph 256(1)(c) of the ITA. Each corporation is controlled by one person, and the two people are related, and one of the people, Lisa Light, owns not less than 25% of the shares of either corporation. B) $500,000 - [($100,000 - $50,000) * $5] = $250,000

3

Which of the following scenarios does not describe two associated corporations (in a de jure context)? (There is no specified corporate income in any of the scenarios.)

A) Blue Corp. owns 90% of the shares of White Corp.

B) Yellow Corp. is wholly owned by Mrs. Smith. Her son, James, owns 65% of the shares of Green Corp. Mrs. Smith owns the remaining 35% of the shares.

C) Kelly Booker owns 100% of the shares of Read Co. His mother and father each own 30% of the shares of Write Co. A friend, Mr. Words, owns 10% of Write Co., and Kelly owns the remaining shares.

A) Blue Corp. owns 90% of the shares of White Corp.

B) Yellow Corp. is wholly owned by Mrs. Smith. Her son, James, owns 65% of the shares of Green Corp. Mrs. Smith owns the remaining 35% of the shares.

C) Kelly Booker owns 100% of the shares of Read Co. His mother and father each own 30% of the shares of Write Co. A friend, Mr. Words, owns 10% of Write Co., and Kelly owns the remaining shares.

D

4

Which of the following types of corporate income are subject to the special refundable tax of 10 2/3%, and a tax reduction of 30 2/3% upon distribution of the income to shareholders?

A) Business income and net property income.

B) Specified investment business income and dividend income. Specified investment business income and taxable capital gains.

D) Dividend income and net taxable capital gains.

A) Business income and net property income.

B) Specified investment business income and dividend income. Specified investment business income and taxable capital gains.

D) Dividend income and net taxable capital gains.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

5

There are several benefits to incorporating a business. Which of the following is NOT a benefit of incorporating?

A) The small business deduction provides a tax reduction on the first $500,000 of active business income. Dividends paid to shareholders are deductible business expenses.

C) There is greater flexibility to bring family members on board as owners.

D) The owner/employee may participate in a registered pension plan through the corporation.

A) The small business deduction provides a tax reduction on the first $500,000 of active business income. Dividends paid to shareholders are deductible business expenses.

C) There is greater flexibility to bring family members on board as owners.

D) The owner/employee may participate in a registered pension plan through the corporation.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

6

Private Co. received a $5,000 eligible dividend from Public Co., which is a non-connected corporation. Which of the following applies?

A) The dividends can be reinvested by Private Co. on a tax-free basis.

B) The dividend will be subject to Part I tax. The dividend will be subject to Part IV tax at rate of 38 1/3%.

D) Receipt of the dividend will result in an immediate dividend refund for Private Co.

A) The dividends can be reinvested by Private Co. on a tax-free basis.

B) The dividend will be subject to Part I tax. The dividend will be subject to Part IV tax at rate of 38 1/3%.

D) Receipt of the dividend will result in an immediate dividend refund for Private Co.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

7

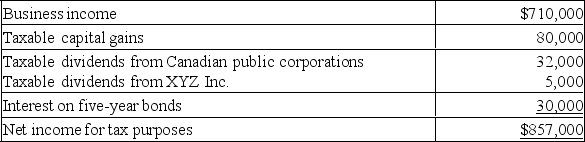

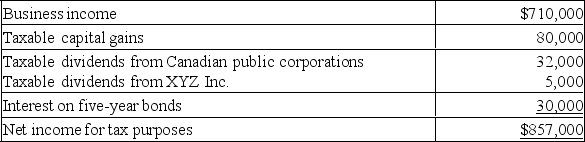

ABC Corporation ("ABC") is a Canadian-controlled private corporation and has correctly calculated its net income for tax purposes to be $857,000 for the year ending December 31, 2019, as shown below:

ABC owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income.

ABC owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income.

Additional information:

- ABC made charitable donations of $45,000 during the year

- Net capital losses were $35,000 as of January 1, 2019

- Non-capital losses were $50,000 as of January 1, 2019

- At the end of the previous year, ABC had a balance in its non-eligible refundable dividend tax on hand (RDTOH) account of $18,000 and GRIP of $2,000. XYZ received a dividend refund of $1,917 from its non-eligible RDTOH when it paid its dividend of $5,000 to ABC.

- ABC calculated a dividend refund of $3,000 for the previous year, based on dividends paid in the previous year.

- Eligible dividends of $90,000 and capital dividends of $70,000 were paid by ABC on December 31, 2019. Dividends equal to the GRIP balance were designated as eligible dividends.

- For 2018, the taxable capital of ABC and XYZ, combined, was below $10,000,000. As well, the combined adjusted aggregate investment income was below $50,000.

Required:

a) Determine ABC's federal income tax payable for its 2019 fiscal year

b) Determine ABC's refundable dividend tax on hand balances at the end of 2019

c) Determine ABC's dividend refund for 2019

ABC owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income.

ABC owns 100% of the shares of XYZ. For the current year, XYZ claimed the small-business deduction on $80,000 of its active business income.Additional information:

- ABC made charitable donations of $45,000 during the year

- Net capital losses were $35,000 as of January 1, 2019

- Non-capital losses were $50,000 as of January 1, 2019

- At the end of the previous year, ABC had a balance in its non-eligible refundable dividend tax on hand (RDTOH) account of $18,000 and GRIP of $2,000. XYZ received a dividend refund of $1,917 from its non-eligible RDTOH when it paid its dividend of $5,000 to ABC.

- ABC calculated a dividend refund of $3,000 for the previous year, based on dividends paid in the previous year.

- Eligible dividends of $90,000 and capital dividends of $70,000 were paid by ABC on December 31, 2019. Dividends equal to the GRIP balance were designated as eligible dividends.

- For 2018, the taxable capital of ABC and XYZ, combined, was below $10,000,000. As well, the combined adjusted aggregate investment income was below $50,000.

Required:

a) Determine ABC's federal income tax payable for its 2019 fiscal year

b) Determine ABC's refundable dividend tax on hand balances at the end of 2019

c) Determine ABC's dividend refund for 2019

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

8

Chartered Tours Inc. (CTI) reported a net income for tax purposes of $800,000 in 20xx. (CTI operates in a province which has a provincial tax reduction on income earned from manufacturing and processing.)

During 20xx, CTI:

a) made a contribution of $25,000 to eligible charities;

b) received $30,000 in non-eligible dividends from a connected taxable Canadian corporation;

c) recognized manufacturing and processing profits of $250,000; and

d) had active business income of $770,000.

For tax purposes, CTI is associated with Rocky Mountain Hikers Inc. (RMHI). RMHI used $310,000 of the small business deduction for its active business income in 20xx.

The non-eligible dividends were received from ABC Co. CTI owns 20% of ABC Co. ABC Co. received a dividend refund of $20,000 as a result of paying taxable dividends.

The ending balances in CTI's GRIP and non-eligible RDTOH accounts were nil in the previous year.

(None of the above is subject to rules pertaining to specified corporate income, excessive income from passive investments, or taxable capital in excess of $10 million.)

Required:

Calculate the following federal amounts for 20xx:

a) CTI's taxable income

b) CTI's small business deduction

c) The M & P deduction available to CTI

d) CTI's general rate reduction

e) Part IV tax on non-eligible dividends

f) The balance in CTI's GRIP account at the end of 20xx

During 20xx, CTI:

a) made a contribution of $25,000 to eligible charities;

b) received $30,000 in non-eligible dividends from a connected taxable Canadian corporation;

c) recognized manufacturing and processing profits of $250,000; and

d) had active business income of $770,000.

For tax purposes, CTI is associated with Rocky Mountain Hikers Inc. (RMHI). RMHI used $310,000 of the small business deduction for its active business income in 20xx.

The non-eligible dividends were received from ABC Co. CTI owns 20% of ABC Co. ABC Co. received a dividend refund of $20,000 as a result of paying taxable dividends.

The ending balances in CTI's GRIP and non-eligible RDTOH accounts were nil in the previous year.

(None of the above is subject to rules pertaining to specified corporate income, excessive income from passive investments, or taxable capital in excess of $10 million.)

Required:

Calculate the following federal amounts for 20xx:

a) CTI's taxable income

b) CTI's small business deduction

c) The M & P deduction available to CTI

d) CTI's general rate reduction

e) Part IV tax on non-eligible dividends

f) The balance in CTI's GRIP account at the end of 20xx

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

9

Bean Co. is a Canadian-controlled private corporation with a December 31 year-end. The company reported a net income of $200,000 on its financial statements in 20x7. Of this amount, $15,000 was from non-eligible dividend income received from a taxable Canadian corporation. The remaining income was from active business.

Additional information:

The non-eligible dividends were received from Grow Ltd., a connected Canadian-controlled private corporation. Grow has only one class of shares, and the total amount of non-eligible dividends paid in 20x1 was $50,000 which resulted in a non-eligible dividend refund of $9,000.

Bean Co. had a balance in its non-eligible RDTOH account of $3,000 at the end of 20x0. The company did not receive a dividend refund in 20x0.

Bean Co. is associated with Pea Co. Pea Co. used $220,000 of the small business deduction limit on its 20x1 tax return.

Bean Co.'s 20x1 profits include a donation expense of $1,000.

Amortization of $30,000 was expensed on Bean Co.'s income statement in 20x1. CCA has been correctly calculated at $28,500 for 20x1 and has not been transferred from the tax accounts to the financial statements. Bean Co. utilizes the maximum CCA deduction each year.

Bean Co. paid dividends totaling $5,000 during 20x1.

(None of the above is subject to rules pertaining to specified corporate income, excessive income from passive investments, or taxable capital in excess of $10 million.)

Required:

A) Calculate Bean Co.'s 20x1 net income for tax purposes.

B) Calculate Bean Co.'s 20x1 taxable income.

C) Calculate the small-business deduction for Bean Co. for 20x1 (using the rules applicable for 2019). Identify the values for Bean Co.'s active business income, taxable income, and annual limit amount in your answer.

D) Calculate Bean Co.'s 20x1 Part IV tax on non-eligible dividends and dividend refund from non-eligible RDTOH, if applicable.

Additional information:

The non-eligible dividends were received from Grow Ltd., a connected Canadian-controlled private corporation. Grow has only one class of shares, and the total amount of non-eligible dividends paid in 20x1 was $50,000 which resulted in a non-eligible dividend refund of $9,000.

Bean Co. had a balance in its non-eligible RDTOH account of $3,000 at the end of 20x0. The company did not receive a dividend refund in 20x0.

Bean Co. is associated with Pea Co. Pea Co. used $220,000 of the small business deduction limit on its 20x1 tax return.

Bean Co.'s 20x1 profits include a donation expense of $1,000.

Amortization of $30,000 was expensed on Bean Co.'s income statement in 20x1. CCA has been correctly calculated at $28,500 for 20x1 and has not been transferred from the tax accounts to the financial statements. Bean Co. utilizes the maximum CCA deduction each year.

Bean Co. paid dividends totaling $5,000 during 20x1.

(None of the above is subject to rules pertaining to specified corporate income, excessive income from passive investments, or taxable capital in excess of $10 million.)

Required:

A) Calculate Bean Co.'s 20x1 net income for tax purposes.

B) Calculate Bean Co.'s 20x1 taxable income.

C) Calculate the small-business deduction for Bean Co. for 20x1 (using the rules applicable for 2019). Identify the values for Bean Co.'s active business income, taxable income, and annual limit amount in your answer.

D) Calculate Bean Co.'s 20x1 Part IV tax on non-eligible dividends and dividend refund from non-eligible RDTOH, if applicable.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck